Negative U.S. Interest Rates?

Congress mandates the Federal Reserve to achieve price stability, maximum sustainable employment, and moderate long-term interest rates. The Fed, like other central banks, usually pursues these objectives by managing short-term interest rates. Short-term interest rates influence prices and economic activity through their effects on consumption, investment, and portfolio holdings.

Commercial banks keep deposits, a.k.a. reserves, at central banks to have a safe source of liquidity to satisfy withdrawals. The Financial Services Regulatory Relief Act of 2006 authorized the Fed to pay a market rate of interest on reserves. The starting date for such payments was later moved forward to 2008.

Central banks adjust short-term interest rates to respond to economic conditions. For example, high unemployment and/or undesirably low inflation call for low interest rates. In the unusually difficult circumstances following the Financial Crisis of 2007-2009 and the European debt crisis of 2010-2012, several central banks set negative interest rates on bank reserves. That is, several central banks have charged commercial banks a fee to keep these very safe and liquid assets. Figure 1 shows the time series of deposit rates—interest rates on bank reserves—paid by the Bank of Japan (BOJ), the European Central Bank (ECB), the Danish National Bank, the Swiss National Bank, and the Swedish Riksbank.

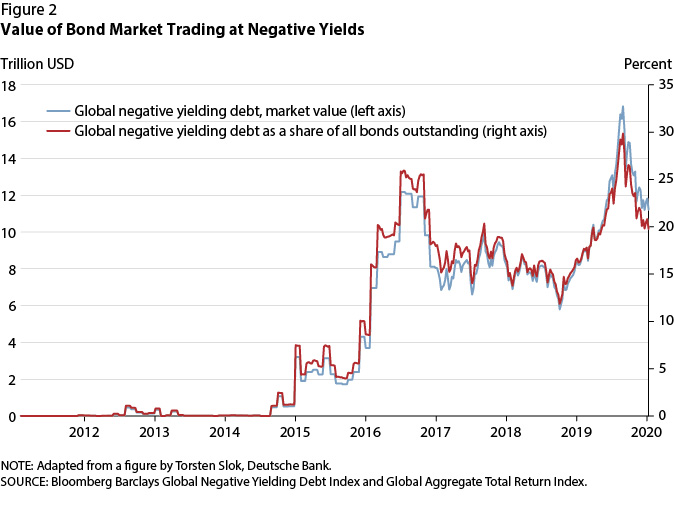

Negative deposit rates have many of the same effects as cuts in positive interest rates: Banks tend to make more and riskier loans or buy longer-term securities, thereby stimulating the economy (Jobst and Lin, 2016; Bech and Malkhozov, 2016; and Arteta et al., 2016).1 Figure 2 shows negative rates have spilled over into corporate and government yields. About $11 trillion of corporate, sovereign, and securitized bonds in 24 currency markets trades at negative yields, comprising about 20 percent of the value in these markets.

The reach of negative rates is limited, however, because commercial banks find it hard to charge negative rates to their retail depositors, who might choose to hold their wealth in cash. Commercial banks have been able to charge negative rates on deposits of other financial institutions or firms to a limited degree, but negative rates still tend to compress the margin between the rates at which banks lend and that at which they borrow, which reduces their profits. The effect on banks and related financial institutions has been a major factor in restraining use of negative interest rates.

The Federal Reserve did not introduce negative deposit rates even during its energetic, unconventional efforts to stimulate the economy in 2008-13. Why did the Fed eschew negative rates in those years? Former Chair Bernanke (2016) outlines several reasons: First, without experience with negative rates, Fed economists may have underestimated the extent to which rates could be pushed negative. A 2010 Federal Reserve Board memo (Burke et al., 2010) estimated that short rates couldn't be pushed below –30 to –35 basis points without provoking a widespread withdrawal of reserves from the Federal Reserve System. Several central banks, however, have pushed rates below –50 basis points.2 Second, according to former Chair Yellen, it is unclear whether the Federal Reserve can legally impose negative rates on reserve deposits (C-SPAN, 2016).3 Third, at that time there were concerns about the effect of negative rates on the health of money market mutual funds (MMFs). MMF losses might induce MMF investors to withdraw their deposits en masse and endanger the health of that part of the financial system.

When asked about potentially using negative interest rates in the future, Chair Powell (2019) responded: "I think we would look at using large-scale asset purchases and forward guidance. I do not think we'd be looking at using negative rates." Nevertheless, former Chair Bernanke (2020) has suggested that the Fed should not rule out resorting to negative rates if economic conditions warrant. He reasons that even the possibility of negative rates has a stimulative effect by keeping the expected path of short rates lower than it would otherwise be.4

Notes

1 Anticipation of negative-rate announcements makes it difficult to assess their impact on asset prices because their effects were "priced into the market" prior to the announcement. The BOJ's January 2016 negative-rate announcement was a surprising exception to this pattern, and it had clear effects on asset prices.

2 The Burke et al. (2010) estimate of a –30- to –35-basis-point practical limit might well have been reasonably accurate for the United States. Countries have very different financial systems.

3 In response to a question about the legality of negative rates, Yellen said, "I would say that remains a question that we still would need to investigate more thoroughly" (C-SPAN, 2016).

4 There are unabashed advocates for negative rates. Rogoff (2017) reasons that negative nominal interest rates are appropriate in times of recession with low inflation because goods markets need a substantially negative real rate of interest to properly adjust.

References

Arteta, Carlos; Kose, M. Ayhan; Stocker, Marc and Taskin, Temel. "Negative Interest Rate Policies: Sources and Implications." CAMA Working Paper 52/2016, Centre for Applied Macroeconomic Analysis, August 2016.

Bech, Morten L. and Malkhozov, Aytek. "How Have Central Banks Implemented Negative Policy Rates?" BIS Quarterly Review, March 2016, pp. 31-44.

Bernanke, Ben S. "What Tools Does the Fed Have Left? Part 1: Negative Interest Rates." Brookings Institution, March 18, 2016; https://www.brookings.edu/blog/ben-bernanke/2016/03/18/what-tools-does-the-fed-have-left-part-1-negative-interest-rates/.

Bernanke, Ben S. "The New Tools of Monetary Policy." American Economic Association Presidential Address, January 4, 2020.

Burke, Chris; Hilton, Spence; Judson, Ruth; Lewis, Kurt and Skeie, David. "Reducing the IOER Rate: An Analysis of Options." Federal Open Market Committee Note, August 5, 2010; https://www.federalreserve.gov/monetarypolicy/files/FOMC20100805memo05.pdf.

C-SPAN. Testimony by Fed Chair Janet Yellen before the House Financial Services Committee, Semi-annual Monetary Policy Report to Congress, Monetary Policy and the Economy video, February 10, 2016: see, especially, 54:00 – 54:12; https://www.c-span.org/video/?404386-1/federal-reserve-chair-janet-yellen-testimony-monetary-policy.

Jobst, Andreas, and Lin, Huidan. "Negative Interest Rate Policy (NIRP): Implications for Monetary Transmission and Bank Profitability in the Euro Area." IMF Working Paper 16/172, International Monetary Fund, August 2016; https://doi.org/10.5089/9781475524475.001.

Powell, Jerome. "Transcript of Chair Powell's Press Conference." Federal Open Market Committee, September 18, 2019; https://www.federalreserve.gov/mediacenter/files/FOMCpresconf20190918.pdf.

Rogoff, Kenneth. "Dealing with Monetary Paralysis at the Zero Bound." Journal of Economic Perspectives, Summer 2017, 31(3), pp. 47-66; https://doi.org/10.1257/jep.31.3.47.

© 2020, Federal Reserve Bank of St. Louis. The views expressed are those of the author(s) and do not necessarily reflect official positions of the Federal Reserve Bank of St. Louis or the Federal Reserve System.

follow @stlouisfed

follow @stlouisfed