Abstract

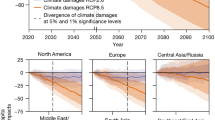

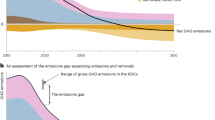

Several governments have tested formal index-based insurance to build climate resilience among smallholder farmers. Yet, adoption of such programmes has generated concerns that insurance may crowd out long-established informal risk transfer arrangements. Understanding this phenomenon requires new analytic approaches that capture dynamics of human social behaviour when facing risky events. Here we develop a modelling framework, based on evolutionary game theory and empirical data from Nepal and Ethiopia, to demonstrate that insurance may introduce a new social dilemma in farmer risk management strategies. We find that while socially optimal risk management is achieved when all farmers pursue a combination of formal and informal risk transfer, a community of self-interested agents is unable to maintain this co-existence under rising climate risks. We find that a combination of prosocial preferences—moderate altruism and solidarity—helps farmers overcome these concerns and achieve the social optimum. In our model, behavioural interventions that cue such preferences can reduce farmer expected losses by 26% and save approximately 5% of community agricultural income through reduced premium subsidies under climate risk levels likely to emerge in the coming decades.

This is a preview of subscription content, access via your institution

Access options

Access Nature and 54 other Nature Portfolio journals

Get Nature+, our best-value online-access subscription

$29.99 / 30 days

cancel any time

Subscribe to this journal

Receive 12 digital issues and online access to articles

$119.00 per year

only $9.92 per issue

Buy this article

- Purchase on Springer Link

- Instant access to full article PDF

Prices may be subject to local taxes which are calculated during checkout

Similar content being viewed by others

Data availability

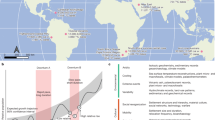

Data sources used to support this analysis include Chitwan Valley Family Study—Labour Outmigration, Agricultural Productivity and Food Security, Nepal (ICPSR 36755) (https://www.icpsr.umich.edu/web/DSDR/studies/36755/versions/V5); IBLI Borena Household Survey R1-4 Stata 13 data (https://data.ilri.org/portal/dataset/ibli-borena-r1/resource/41b75ad5-71cd-4d23-911c-dcce53bc68a7); and SPEI (https://spei.csic.es/database.html).

Code availability

The game theory model for this study was developed via Python 3 software and is available via a Zenodo repository at https://doi.org/10.5281/zenodo.8347265.

References

Howden, S. M. et al. Adapting agriculture to climate change. Proc. Natl Acad. Sci. USA 104, 19691–19696 (2007).

Hazell, P., Sberro-Kessler, R. & Varangis, P. When and How Should Agricultural Insurance Be Subsidized? Issues and Good Practices (International Labour Organization and International Finance Corporation, 2017).

Greatrex, H. et al. Scaling Up Index Insurance for Smallholder Farmers: Recent Evidence and Insights (CGIAR, 2015).

Schaefer, L. & Waters, E. Climate Risk Insurance for the Poor & Vulnerable: How to Effectively Implement the Pro-poor Focus of InsuResilience (Munich Climate Insurance Initiative, 2016).

Weingärtner, L., Caravani, A. & Suarez, P. The Role of Multilateral Climate Funds in Supporting Resilience and Adaptation Through Insurance Initiatives (Overseas Development Institute, 2018).

IPCC: Summary for Policymakers. In Climate Change 2022: Impacts, Adaptation and Vulnerability (eds Pörtner, H. O. et al.) (Cambridge Univ. Press, 2022).

Ellis, F. Household strategies and rural livelihood diversification. J. Dev. Stud. 35, 1–38 (1998).

Dercon, S. Income risks, coping strategies and safety nets. World Bank Res. Obs. 17, 141–166 (2002).

Fafchamps, M. & Gubert, F. The formation of risk sharing networks. J. Dev. Econ. 83, 326–350 (2007).

Lucas, R. E. & Stark, O. Motivations to remit: evidence from Botswana. J. Polit. Econ. 93, 901–918 (1985.

Stark, O. & Bloom, D. E. The new economics of labor migration. Am. Econ. Rev. 75, 173–178 (1985)

Dercon, S., Hill, R. V., Clarke, D., Outes-Leon, I. & Taffesse, A. S. Offering rainfall insurance to informal insurance groups: evidence from a field experiment in Ethiopia. J. Dev. Econ. 106, 132–143 (2014)

Takahashi, K., Barrett, C. B. & Ikegami, M. Does index insurance crowd in or crowd out informal risk sharing? Evidence from rural Ethiopia. Am. J. Agric. Econ. 101, 672–691 (2018).

Berg, E., Blake, M. & Morsink, K. Risk sharing and the demand for insurance: theory and experimental evidence from Ethiopia. J. Econ. Behav. Organ. 195, 236–256 (2022).

Muller, B., Johnson, L. & Kreuer, D. Maladaptive outcomes of climate insurance in agriculture. Glob. Environ. Change 46, 23–33 (2017).

Maharjan, S. & Maharjan, K. Roles and contributions of community seed banks in climate adaptation in Nepal. Dev. Pract. 28, 292–302 (2018).

Cárdenas, J.-C. et al. Fragility of the provision of local public goods to private and collective risks. Proc. Natl Acad. Sci. USA 114, 921–925 (2017).

Trærup, S. L. M. Informal networks and resilience to climate change impacts: a collective approach to index insurance. Glob. Environ. Change 22, 255–267 (2012).

Ali, W., Abdulai, A. & Mishra, A. K. Recent advances in the analyses of demand for agricultural insurance in developing and emerging countries. Annu. Rev. Resour. Econ. 12, 411–430 (2020).

Mobarak, A. M. & Rosenzweig, M. R. Informal risk sharing, index insurance and risk taking in developing countries. Am. Econ. Rev. 103, 375–380 (2013).

Will, M., Groeneveld, J., Frank, K. & Muller, B. Informal risk-sharing between smallholders may be threatened by formal insurance: lessons from a stylized agent-based model. PLoS ONE 16, e0248757 (2021).

Santos, F. P., Pacheco, J. M., Santos, F. C. & Levin, S. A. Dynamics of informal risk sharing in collective index insurance. Nat. Sustain. 4, 426–432 (2021).

Tavoni, A., Schlüter, M. & Levin, S. The survival of the conformist: social pressure and renewable resource management. J. Theor. Biol. 299, 152–161 (2012).

Axelrod, R. & Hamilton, W. D. The evolution of cooperation. Science 211, 1390–1396 (1981).

Levin, S. A. Public goods in relation to competition, cooperation and spite. Proc. Natl Acad. Sci. USA 111, 10838–10845 (2014).

Fehr, E. & Schurtenberger, I. Normative foundations of human cooperation. Nat. Hum. Behav. 2, 458–468 (2018).

Alger, I. & Weibull, J. W. Homo moralis—preference evolution under incomplete information and assortative matching. Econometrica 81, 2269–2302 (2013).

Alger, I. & Weibull, J. W. Evolution and Kantian morality. Games Econ. Behav. 98, 56–67 (2016).

Foster, A. D. & Rosenzweig, M. R. Imperfect commitment, altruism and the family: evidence from transfer behavior in low-income rural areas. Rev. Econ. Stat. 83, 389–407 (2001).

Lin, W., Liu, Y. & Meng, J. The crowding-out effect of formal insurance on informal risk sharing: an experimental study. Games Econ. Behav. 86, 184–211 (2014).

Waldman, K. B. et al. Agricultural decision making and climate uncertainty in developing countries. Environ. Res. Lett. 15, 113004 (2020).

Smith, J. M. The theory of games and the evolution of animal conflicts. J. Theor. Biol. 47, 209–221 (1974).

Lampe, I. & Wurtenberger, D. Loss aversion and the demand for index insurance. J. Econ. Behav. Organ. 180, 678–693 (2020).

Sagemuller, F. & Musshoff, O. Effects of household shocks on risk preferences and loss aversion: evidence from upland smallholders of South East Asia. J. Dev. Stud. 56, 2061–2078 (2020).

Ehret, S., Constantino, S. M., Weber, E. U., Efferson, C. & Vogt, S. Group identities can undermine social tipping after intervention. Nat. Hum. Behav. 6, 1669–1679 (2022).

Constantino, S. M. et al. Scaling up change: a critical review and practical guide to harnessing social norms for climate action. Psychol. Sci. Public Interest 23, 50–97 (2022).

Budhathoki, N. K., Lassa, J. A., Pun, S. & Zander, K. K. Farmers’ interest and willingness-to-pay for index-based crop insurance in the lowlands of Nepal. Land Use Policy 85, 1–10 (2019).

Miller, D. T. & Prentice, D. A. Changing norms to change behavior. Annu. Rev. Psychol. 67, 339–361 (2016).

Santos, F. P., Levin, S. A. & Vasconcelos, V. V. Biased perceptions explain collective action deadlocks and suggest new mechanisms to prompt cooperation. iScience 24, 102375 (2021).

Henrich, J. et al. ‘Economic man’ in cross-cultural perspective: behavioral experiments in 15 small-scale societies. Behav. Brain Sci. 28, 795–815 (2005).

Haerpfer, C. et al. (eds.) World Values Survey: Round Seven—Country-Pooled Datafile Version 5.0 (JD Systems Institute & WVSA Secretariat, 2022).

Nirmal, R. & Babu, S. C. When Implementation Goes Wrong: Lessons from Crop Insurance in India (International Food Policy Research Institute, 2021).

Hill, R. V. et al. Ex ante and ex post effects of hybrid index insurance in Bangladesh. J. Dev. Econ. 136, 1–17 (2019).

Gärtner, M., Andersson, D., Västfjäll, D. & Tinghög, G. Affect and prosocial behavior: the role of decision mode and individual processing style. Judgm. Decis. Mak. 17, 1–13 (2022).

Reeck, C., Gamma, K. & Weber, E. U. How we decide shapes what we choose: decision modes track consumer decisions that help decarbonize electricity generation. Theory Decis. 92, 731–758 (2022).

Bosetti, V., Dennig, F., Liu, N., Tavoni, M. & Weber, E. U. Forward-looking belief elicitation enhances intergenerational beneficence. Environ. Resour. Econ. 81, 743–761 (2022).

Adami, C., Schossau, J. & Hintze, A. Evolutionary game theory using agent-based methods. Phys. Life Rev. 19, 1–26 (2016).

Gaupp, F., Pflug, G., Hochrainer-Stigler, S., Hall, J. & Dadson, S. Dependency of crop production between global breadbaskets: a copula approach for the assessment of global and regional risk pools. Risk Anal. 37, 2212–2228 (2017).

Nepal Labour Migration Report (Government of Nepal, 2020).

Iskander, N. Does Skill Make Us Human? Migrant Workers in 21st-Century Qatar and Beyond (Princeton Univ. Press, 2021).

Choquette-Levy, N., Wildemeersch, M., Oppenheimer, M. & Levin, S. A. Risk transfer policies and climate-induced immobility among smallholder farmers. Nat. Clim. Change 11, 1046–1054 (2021).

Tversky, A. & Kahneman, D. Loss aversion in riskless choice: a reference-dependent model. Q. J. Econ. 106, 1039–1061 (1991).

Tilman, A. R., Dixit, A. K. & Levin, S. A. Localized prosocial preferences, public goods and common-pool resources. Proc. Natl Acad. Sci. USA 116, 5305–5310 (2018).

Ghimire, D. J., Axinn, W. G., Bhandari, P. B., Bhandari, H. & Thornton, R. Chitwan Valley Family Study: Labour Outmigration, Agricultural Productivity and Food Security, Nepal, 2015–2017 (ICPSR, 2019).

Ikegami, M. & Sheahan, M. Index Based Livestock Insurance (IBLI) Borena Household Survey (ILRI, 2014).

Vicente-Serrano, S. M. et al. Performance of drought indices for ecological, agricultural and hydrological applications. Earth Interact. 16, 1–27 (2012).

Katovich, E. & Sharma, A. Costs and Returns of Grain and Vegetable Crop Production in Nepal’s Mid-Western Development Region (US Agency for International Development, 2014).

Shrestha, M. Push and Pull: A Study of International Migration from Nepal (World Bank, 2017).

Mohan, S. Risk aversion and certification: evidence from the Nepali tea fields. World Dev. 129, 104903 (2020).

Fudenberg, D. & Imhof, L. A. Imitation processes with small mutations. J. Econ. Theory 131, 251–262 (2006).

Acknowledgements

N.C.L. acknowledges financial and organizational support from the Center for Policy Research on Energy and the Environment at Princeton University and the International Institute for Applied Systems Analysis, as well as financial support from the Social Sciences and Humanities Research Council of Canada (752-2020-077). M.W. acknowledges funding received from the Oxford Martin Programme on Systemic Resilience.

Author information

Authors and Affiliations

Contributions

N.C.L. and M.W. conceived of and developed an initial design for the study and drafted the initial manuscript. F.P.S., S.A.L., M.O. and E.U.W. proposed modifications incorporated in the final design. N.C.L. wrote the model code. N.C.L. and M.W. analysed model results. All authors contributed to drafting the final manuscript.

Corresponding authors

Ethics declarations

Competing interests

The authors declare no competing interests.

Peer review

Peer review information

Nature Sustainability thanks Marco Janssen, Olof Johansson-Stenman and the other, anonymous, reviewer(s) for their contribution to the peer review of this work.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary information

Supplementary Information

Supplementary Figs. 1–18, Tables 1–4 and background.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Choquette-Levy, N., Wildemeersch, M., Santos, F.P. et al. Prosocial preferences improve climate risk management in subsistence farming communities. Nat Sustain 7, 282–293 (2024). https://doi.org/10.1038/s41893-024-01272-3

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1038/s41893-024-01272-3