Abstract

This paper provides an analysis of how thinking about the links between institutions and entrepreneurship has evolved over time. In its incipient phase, research largely viewed entrepreneurship as being independent of institutions and shaped solely by the personality attributes and characteristics of the entrepreneur. However, a reaction to the entrepreneur in isolation views entrepreneurship as being shaped and influenced by context. Institutions, public policy and culture are key components of the entrepreneurial context. Most recently, new thinking suggests that the causality can also be reversed, in that entrepreneurship may shape the institutions characterizing the context.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The scholarly research field of entrepreneurship is replete with a robust literature linking entrepreneurial activity to institutions. In explaining why entrepreneurship thrives in some contexts, yet struggles with other, the difference in institutions is typically among the first line of thinking offered (DeSoto, 2000).

However, this has not always been the case. Rather, in its incipience, the emergent field of entrepreneurship viewed entrepreneurship in almost total exclusion, void of influences from the external, including institutions. The most fundamental question in this emerging field was: why do some people become entrepreneurs, while others abstain? The answer was almost never about institutions. Rather, as the field of entrepreneurship gained considerable moment, it looked inward, within the entrepreneur themselves, for the answer. What made the entrepreneurship difference was posited to lie in the realm of personality characteristics, attitudes, propensities, proclivities and traits characterizing the personality. Entrepreneurs were largely viewed as being born and not made.

Times change and so has thinking about entrepreneurship. Most recently, research on entrepreneurship suggests that the causality between institutions and entrepreneurship is more nuanced. Just as institutions shape entrepreneurial activity, the institutions defining and characterizing any particular context tend to reflect underlying entrepreneurship.

The purpose of this paper is to explain, interpret and reflect upon how and why the relationship between institutions and entrepreneurship has evolved over time. The following section of this paper analyzes why in its early years, the field of entrepreneurship considered entrepreneurs to be independent of the institutional context. In the third section, the shift to viewing entrepreneurial activity as fundamentally shaped by the external context is analyzed. The impact of institutions on entrepreneurship has led to an articulation of the entrepreneurial ecosystem, which is the focus of the fourth section. The fifth section highlights a new strand of the entrepreneurship literature suggesting that the causality between institutions and entrepreneurship is not only in one direction. Rather, this strand analyzes how and why entrepreneurship shapes institutions. In the final section, a summary and conclusion are provided. In particular, this paper finds that the key to understanding entrepreneurship lies at least as much in the institutions shaping the context as it does in the entrepreneurs themselves.

2 The lonely entrepreneur

Research on what we today would characterize as entrepreneurship is squarely rooted in the second industrial era, when large-scale production, scale economies and firm size were the keys for efficiency and competitiveness. At the zenith of the second industrial age, entrepreneurship was largely viewed as extraneous and an inefficient business organization (Chandler, 1977, 1990). The entrepreneurs creating new companies were largely seen as social deviants unable to work within the eminently more efficient and productive large corporation (Whyte, 1956; Shapero, 1975, p. 83) put it, “The displaced, uncomfortable entrepreneur.” Thus, in its incipience, the emerging research on entrepreneurship focused primarily on the entrepreneur (McClelland, 1961; Brockhaus, 1982).

The analysis of entrepreneurs in the early days of the field of entrepreneurship tended to focus on those personality characteristics, traits, propensities, proclivities, attitudes that made entrepreneurs different from the norm (McClelland, 1961; Frese, 2009). In his seminal treatise, Risk, Uncertainty and Profit, Knight (1921) sharply distinguished between entrepreneurs and managers, launching the start of a research agenda to identify what makes entrepreneurs different. The answer provided by the incipient research field of entrepreneurship was their personality characteristics and traits (Pekkala et al., 2018; Stuetzer et al., 2015).

The assumption implicitly prevailing in the literature of that era was that well-adjusted and socialized people would obviously choose to work at the superior great legacy corporations, enjoying superior remuneration, benefits and status. Thus, the realm of the entrepreneur claimed the devious, social misfits and the unsalvageable. It became the main task of the budding literature on entrepreneurship to characterize and classify the band of renegades thought to be so prevalent among the entrepreneurs. Entrepreneurs were clearly born and not made.

Of course, this sweeping generalization about the state of thinking nearly a century ago comes with an important caveat – there were notable exceptions. For example, Oxenfeldt (1943) clearly viewed entrepreneurship as a response by individuals confronted with dismal labor market prospects, either unemployment or else meager wages. Still, the thinking at that time placed scholars such as Oxenfeldt (1943) in the minority, with their belief that entrepreneurship was perhaps less about their proclivities, propensities, and inclinations, and more about the external environment.

Whether a conclusion or assumption, the view that entrepreneurs are born and not made, clearly placed entrepreneurship in isolation, as an exogenous phenomenon. Entrepreneurship was a behavior that eluded the influence of institutions and other authoritative bodies. Rather, as the Noble Prize laureate, Robert Solow (1956), posited for technological change, it apparently falls like manna from heaven. Early research on entrepreneurs focused on their personality traits and characteristics, and what made them different from other actors in the economy. They were viewed as deviants from the norm and engaging in a type of behavior, entrepreneurship, that similarly deviated from the norm. The personality traits commonly associated with entrepreneurs were a high degree of autonomy, locus of control, self-efficacy, preference for risk, and need for achievement (McClelland, 1961; Müller & Gappisch, 2005; Obschonka et al., 2015).

The assumption that it was personality traits that made the entrepreneur meant that entrepreneurs were practically insensitive to or immune from not just institutions, but from their overall external context (Blanchflower & Oswald, 1998; Caliendo et al., 2009, 2014). The great English poet John Donne may have mused five centuries ago, “No man is an island, entire of itself; every man is a piece of the continent, a part of the main,” but this apparently was less true for entrepreneurs. They were set off, apart from the influences of institutions and context that imprinted the vast bulk of the “normal” population.

3 The entrepreneur in context

In his famous 1990 article, Baumol posits that the share of the population accounted for by entrepreneurs is not only fixed and exogenous, but that it is essentially identical across heterogeneous national, cultural and institutional contexts. What is not fixed, Baumol (1990) argues, is the manifestation of that entrepreneurship into either unproductive or productive activity. He seemingly suggests that it would be pointless to design policies and institutions to change the immutable propensity to become an entrepreneur within a population. Welter (2011) counters the view of the entrepreneur as immune from institutional influences. Rather, she posits that context shapes entrepreneurship. It may take a village to raise a child, but Welter (2011) and Welter et al. (2019), argue that it takes the right context to generate entrepreneurs.

By the early 1990s, armed with the startling empirical evidence from Birch (1981) that “four out of five jobs are created by small business,” public policy took little heed from the notion that entrepreneurship was essentially exogenous and beyond the research of institutions and policies. This may have reflected a rejection of the more extreme view that entrepreneurship is impervious to context. Certainly, Oxenfeldt (1943) view of entrepreneurship as a response to dismal opportunities emanating from labor markets is consistent with what is now known as defensive or necessity entrepreneurship.

In a rush to combat the most compelling economic problem of that era, rising unemployment combined with stagnant economic growth, public policy engaged in a plethora of policies deploying a broad range of instruments to spark entrepreneurship. As the President of the European Union, Romano Prodi, advocated in 2002, “Our lacunae in the field of entrepreneurship needs to be taken seriously because there is mounting evidence that the key to economic growth and productivity improvements lies in the entrepreneurial capacity of an economy.”

Scholarly research on entrepreneurship similarly shifted its view to place entrepreneurship in its context. For example, the view that entrepreneurship is endogenous to the context is central to the knowledge spillover theory of entrepreneurship. The primary, albeit not the only, contextual variable is knowledge. It is the existence or creation of new knowledge that generates divisive valuation of that knowledge across diverse decision-making actors within a legacy organization. As Arrow (1962) demonstrated, new ideas and knowledge are inherently shrouded in uncertainty about their expected outcome, and especially about their potential market value. He also emphasized the asymmetric nature of new knowledge, which when combined with high costs of transaction, results in persistent and unavoidable divergences in the valuation of new knowledge and ideas, based differential backgrounds, experiences and perspectives of decision-makers.

Thus, a high knowledge context generates greater heterogeneity in the potential value of outcomes emanating from those new ideas across different decision-makers within a legacy organization, resulting in the rejection by the decision-making hierarchy of some ideas actually deemed to be intrinsically valuable by others. Such divergences in the valuation of knowledge and new ideas leads to the opportunities to implement and commercialize them in the organizational context of a new firm startup, that is through entrepreneurship. The knowledge spillover theory of entrepreneurship posits not only that entrepreneurship provides a conduit for the spill over of knowledge from the organization creating it to the newly founded organization actually commercializing that knowledge through innovative activity, but also that the propensity to become an entrepreneur will be greater in a context rich in knowledge rather than in a context with a paucity of new knowledge and ideas (Audretsch, 1995).

Most notably, the knowledge spillover theory of entrepreneurship has remained relatively silent about the role of personality characteristics and attributes. Rather, the central focus is on the context, and in particular, the knowledge context. This does not mean that the traditional stalwarts driving entrepreneurship, personality traits and characteristics, do not matter. Rather, they may matter, but always within the knowledge context (Audretsch, 1995).

Knowledge, of course, and the propensity for legacy firms to commercialize that knowledge through innovative activity is shaped by institutions. Institutions, such as universities, research organizations, and other non-profit organizations directly undertake investments to create new knowledge and enhance human capital. They also provide the incentives to prioritize new knowledge and ideas, or to leave it untapped. National systems of innovation characterize why and how institutions within the country context create complementarities in generating new knowledge (Lundvall, 1992).

There are two types of incentives and policies – those prohibiting or impeding entrepreneurship and those enabling entrepreneurship (Audretsch, 2007). Both play an important role in the link between entrepreneurship and institutions. In terms of knowledge, examples impeding knowledge spillovers and entrepreneurship include exaggerated protection of intellectual property, constraints on researchers prohibiting or impeding their ability to become entrepreneurs and keeping the ownership of intellectual property centralized in bureaucratic decision-making organizations. Examples of institutions and policies conducive to entrepreneurship and knowledge spillovers include transparency in the protection of intellectual property rights, flexibility in allowing researchers and scientists to become entrepreneurs but still able to maintain their jobs in universities and scientific organizations, a rich array of translational organizations and mechanisms, the provision of networking functions, and the availability of financial organizations.

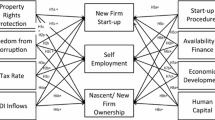

More generally, thinking in the entrepreneurship literature has become that institutions shape entrepreneurship (Bjørnskov & Foss, 2013, 2016). Institutions have the potential to completely eradicate entrepreneurship, as was the case under the rule of National Socialism in Germany in the 1930s, when the Führerprinzip, or principles of the Dictator Adolf Hitler, imposed a series of polices in the form of laws that stamped out entrepreneurship, including the 1933 Gesetz zum Schutze des Einzelhandels (Law to Protect Retailing), the 1933 Verordnung über den Abbau der selbständigen Handwerksbetriebe (Law to Regulate the Reduction of Self-Employed Craftsmen), the 1934 Gesetz zur Ordnung der nationalen Arbeit (transfer of the employment relationship from a contractual to a community relationship), 1934: Gesetz zur Vorbereitung des organischen Aufbaus des deutschen Wirtschaft (Organization of the commercial economy and setting goals under the leadership of the Reich Minister of Economic Affairs with the effect of narrowing the scope of decisions within firms), and the 1933 (Zwangskartellgesetz, (Law forcing companies to become a member of a legalized cartel) (Audretsch and Moog, 2022).

The anti-entrepreneurship institutions and policies under National Socialism in Germany in the 1930s eradicated entrepreneurial activity, as did similar policies and institutions in Eastern and Central Europe during the decades following the Second World War (Audretsch and Moog, 2022). Thus, there are a plethora of institutions and policies that have been observed to effectively impede and deter entrepreneurship.

By contrast, other institutions and policies are conducive to entrepreneurship. Such institutions and policies generally focus on the provision of key resources and factors for entrepreneurs, such as finance, human capital, skilled labor, key technologies, and more generally knowledge. For example, the Small Business Innovation Research (SBIR) program has been found to promote entrepreneurship through the provision of finance to enable entrepreneurs to traverse the “valley of death”, characterizing the phase of an entrepreneurial startup subsequent to the initial funding but prior to the actual stream of revenue accruing from innovative activity. Similarly, the Bayh-Dole Act, which transferred the intellectual property rights emanating from university research funded by the federal government from the government to the university, is widely viewed as providing key technological knowledge conducive to entrepreneurship (Audretsch, 2007).

In the context of Germany, the apprentice system has been viewed as a key source of skilled labor for the highly valued Mittelstand. Similarly, the Fraunhofer Institutes are an institution particular to Germany that have been shown to provide important technology and know-how to the Mittelstand (Audretsch & Lehmann, 2016).

Despite the plethora of compelling institutions and policies promoting entrepreneurship, influential research has concluded that they lead only to a Boulevard of Broken Dreams (Lerner, 2009), for example, concludes that institutions and policies to enhance entrepreneurial activity are largely a waste of public resources.

Still, the emergence of what has been characterized to constitute The Entrepreneurial Society (Audretsch, 2007) consists of institutions and policies that are congruent with an economy where entrepreneurship is the driving force underlying economic performance. According to this view, entrepreneurship is clearly endogenous and responds in a positive manner to the institutions and policies prevalent in any particular context (Boudreaux et al., 2019).

4 The entrepreneurship ecosystem

Interest in the entrepreneurial ecosystem came from two disparate directions. The first was from researchers and thought leaders in business and policy with a spatial or geographic focus on the economic performance of a place, such as a city, region, province or even an entire country (Li et al., 2022). As they became aware of the positive impact that institutions and policies can and do have on entrepreneurial activity, a new agenda emerged about how best to harness the positive impact of entrepreneurship for the strategic management of any particular place (Audretsch, 2015a, b). The answer that emerged is the entrepreneurial ecosystem.

At the same time, albeit from a very different intellectual direction, researchers interested in understanding the performance of entrepreneurs and their firms uncovered a direct link between entrepreneurial performance and the context, and in particular the institutions and policies characterizing that context. Entrepreneurship within the context of an entrepreneurial ecosystem was found to exhibit a superior economic performance relative to entrepreneurial counterparts not located within an entrepreneurial ecosystem.

Thus, while the former was primarily concerned about the economic performance of the place, ranging from city to region and province, the latter was mainly focused on the economic performance of the entrepreneur and her firm. However, both the spatial or geographic perspective and entrepreneur perspective converged. The regions need vital entrepreneurs to deliver a strong regional economic performance, just as the entrepreneur needs a vital region to deliver a strong entrepreneurial performance. This vitality resulted from the same source – the entrepreneurial ecosystem.

The entrepreneurial ecosystem consists of the resources and factors needed to provide a catalyst for innovation. Institutions and policy generally play a key role in the entrepreneurial ecosystem in the same manner as they do more generally in the more general context that is conducive to entrepreneurship. The literature is replete with identifying the specific actors, organizations, interactions, and more generally, institutions and policies characterizing the entrepreneurial ecosystem. However, different types of entrepreneurships emanate from different types of inputs. The different characterizations of culture reflecting a particular place identified by Hofstede (1981) are differentially conducive to or inhibit entrepreneurial activity. Thus, there is no prescribed algorithm for an entrepreneurial ecosystem. Thus, each entrepreneurial ecosystem offers a unique configuration of inputs and resources, with institutions and policies shaping them behind the scenes. What successful entrepreneurial ecosystems have in common is their ability to generate entrepreneurship. Where they differ is in the details and specifics characterizing each particular entrepreneurial ecosystem. To paraphrase Leo Tolstoy’s famous insight about families, each unsuccessful entrepreneurial ecosystem may be essentially the same, while each successful entrepreneurial ecosystem is special in its own way.

5 Reverse causality

The literature linking institutions to entrepreneurship is virtually unanimous in that the causality runs in one direction – entrepreneurship is endogenously shaped by the institutions and policies. Thus, institutions and policies have at least the potential to be designed to enhance entrepreneurial activity. According to this view, the institutions are exogenous, and the ensuing entrepreneurship is endogenous (Audretsch, 2007).

Endogenous entrepreneurship responding to exogenous institutions and policy is inherent in the model of the entrepreneurial ecosystem and its attendant literature. The various institutions and policies comprising an entrepreneurial system are designed and implemented with the goal of endogenously inducing more entrepreneurship. Institutions such as finance, education, training, technology transfer, knowledge creation and infrastructure are not a response to entrepreneurship but rather the need to provide a catalyst for enhancing entrepreneurship. An entrepreneurial ecosystem exhibiting a robust entrepreneurial response and performance is deemed to be compelling and successful. By contrast, an entrepreneurial ecosystem unable to generate more than a paucity of entrepreneurship is considered to be inadequate and unsuccessful.

However, the view that institutions and policy are exogenous and that the behavior and practices of business and the overall population is exogenous has been challenged by several key strands of literature. Most notably, in his seminal book, The Logic of Collective Action, Olson (1965) posited that institutions and policy will endogenously respond to the collective action by a set of economic actors sharing a common interest. Such a group has an incentive to incur the costs of communicating, arriving on a mutual understanding and strategy to engage in a collective action to achieve their mutually agreed upon goals.

More generally, a vast and robust literature has emerged analyzing the myriad ways that business organizations, and in particular large, dominant corporations possessing vast market power, can influence government policy. For example, the regulatory capture theory posits that power firms in the private sector can exert undue influence on the government agencies and institutions with a legal mandate to regulate them, resulting in the capture of institutions and public policy by private interests. Similarly, the theory of rent seeking posits that large, private companies invest the requisite resources to protect their legacy interests, thereby thwarting the independence and autonomy of institutions and public policy (Olson, 1982).

Perhaps because of their inherent paucity of power, size and influence, virtually the entire literature probing the links between institutions and entrepreneurship assumes that the former influences the latter, and not the other way around (Audretsch and Fiedler, 2022). However, a growing literature suggests that, despite their lack of resources, revenues, and influence, entrepreneurship may influence the institutions and public policies in a particular context. An important difference between the emerging strand of literature positing that institutions and policy endogenously responds to entrepreneurship and the earlier literature on rent-seeking and collective action, is that the latter requires a concentration of large and few actors or organizations. By contrast, the transmission of entrepreneurial interests to influencing institutions and power is generally not through large, concentrated actors and organizations in possession of market power, but rather through a completely different conduit – soft power (Audretsch and Fiedler, 2022). This is because the competitive advantage of entrepreneurs and the workforce employed at entrepreneurial firms typically revolves around creativity and the propensity to innovation and think out of the box, or at least deviate from the status quo (Audretsch, 2007). Such characteristics of entrepreneurs and their employees emanate from autonomy, independence and an absence of pressure to conform or adhere to authority. Thus, an entrepreneurial region or society will tend to engage in collective action to endogenously influence institutions and policies to generate a context conducive to independent thinking and autonomy, which facilitates.

Audretsch and Moog (2022) show how entrepreneurship shapes important institutions in a particular context. In particular, they posit that one of the most fundamental political institutions, the extent of democracy, is influenced by the prevalence of entrepreneurship and values congruent with entrepreneurial activity. Their study finds that entrepreneurship is conducive to democracy. By contrast, a paucity of entrepreneurship can render a context more vulnerable to a totalitarian political system.

Audretsch and Fiedler (2022) analyze the role of power in entrepreneurship to shed light on how entrepreneurs with a paucity of hard power in the form of market dominance, size and influence can have a profound influence on institutions. Rather than possessing hard power, entrepreneurs can instead leverage soft power in the form of resonating with the sympathies and values of the underlying population. It is the soft power of entrepreneurship that ultimately is commensurate with the same values underlying democratic institutions. As Elert and Henrekson (2017), institutions are inherently slow to adapt to societal changes, creating opportunities for entrepreneurs to serve as agents of change.

Thus, a promising area for future research may lie in probing what has previously assumed not to exist – ways in which institutions can be and are shaped by entrepreneurship. The extant literature in political economy and public management, which has generally been shaped by the compelling theories of collective action and rent-seeking, concluded that a concentration of large and dominant interests is a prerequisite for engaging in collective action as a catalyst for endogenously influencing institutions and policy. However, it may be that, by leveraging soft power, entrepreneurship can have a similar endogenous impact on institutions and policies, not because it represents a few highly dominant and powerful organizations or individuals, but exactly the opposite – because it is diffused, small and vulnerable.

6 Conclusions

Entrepreneurship has been posited to deliver solutions to the most compelling problems of any particular Zeitalter, or era. A generation ago, this meant generating the desperately needed jobs at a time when the leading developed countries of Europe and North America were devastated by chronic high unemployment. As it became apparent that these countries and their leading companies were confronted by a competitiveness crisis, emanating from a paucity of innovation, entrepreneurship again provided the solution. More recently, entrepreneurship has been found to contribute to economic growth, social inclusion, and a sustainable environment.

The point of this paper has been to draw from a rich literature to point out that the entrepreneurs cannot and do not do it alone. Rather, entrepreneurship, when it thrives, reflects a context replete with rich institutions and policies providing access to the requisite resources, factors and inputs conducive to entrepreneurial activity. As the critics highlighting the futility of entrepreneurship policy emphasize, this does not suggest the existence of an algorithm with a guarantee for flourishing entrepreneurial activity. Rather the links between institutions and entrepreneurship are nuanced and highly context specific. What may work in one context may lead only to frustration in another. Still, an institutional void is likely to result in an entrepreneurial wasteland, with the desired performance and outcomes remaining elusive and unrealized.

Most recently, the stirring of a new perspective suggests that perhaps the causal link between institutions and entrepreneurship does not run just one way. It may be, as an incipient literature is finding, that entrepreneurship plays a key role in shaping the very institutions characterizing the institutional context. Future research may find that, in fact, entrepreneurship is at the very heart of an institutional context for a democratic and sustainable society.

References

Arrow, K. (1962). Economic Welfare and the allocation of Resources for Invention. In R. R. Nelson (Ed.), The rate and direction of inventive activity. Princeton: Princeton University Press.

Audretsch, D. B. (1995). Innovation and Industry Evolution. Cambridge: MIT Press.

Audretsch, D. B. (2007). The Entrepreneurial Society. New York: Oxford University Press.

Audretsch, D. B. & Lehmann, E. (2016). The seven secrets of Germany. Oxford: Oxford University Press.

Audretsch, D. B. (2015). Everything in its place: Entrepreneurship and the strategic management of cities, regions and countries. New York: Oxford University Press.

Audretsch, D. B. & Petra Moog (2022). Entrepreneurship and democracy. Entrepreneurship Theory and Practice, 46(2), 368–392.

Audretsch, D. B., Antje, A., & Fiedler (2022). Power and entrepreneurship. Small Business Economics. https://doi.org/10.1007/s11187-022-00660-3.

Baumol, W. (1990). Entrepreneurship: Productive, unproductive, and destructive. Journal of Political Economy, 98, 893–921.

Birch, D. (1981). “Who Creates Jobs?” The National Interest, Fall, 3–14.

Bjørnskov, C., & Foss, N. (2013). How strategic entrepreneurship and the institutional context drive economic growth. Strategic Entrepreneurship Journal, 7(1), 50–69.

Bjørnskov, C., & Foss, N. J. (2016). Institutions, entrepreneurship, and economic growth: What do we know and what do we still need to know? Academy of Management Perspectives, 30(3), 292–315.

Blanchflower, D. G., & Oswald, A. J. (1998). What makes an entrepreneur? Journal of Labor Economics, 16(1), 26–60. https://doi.org/10.1086/209881.

Boudreaux, C. J., Nikolaev, B. N., & Klein, P. (2019). Socio-cognitive traits and entrepreneurship: The moderating role of economic institutions. Journal of Business Venturing, 34(1), 178–196.

Brockhaus, R. H. (1982). The psychology of the entrepreneur. In C. A. Kent, D. L. Sexton, & K. H. Vesper (Eds.), Encyclopedia of Entrepreneurship (pp. 39–56). Englewood Cliffs, NJ: Prentice Hall.

Caliendo, M., Fossen, F. M., & A.S. Kritikos. (2009). Risk attitudes of nascent entrepreneurs–new evidence from an experimentally validated survey. Small Business Economics, 32(2), 153–167.

Caliendo, M., Fossen, F. M., & Kritikos, A. S. (2014). Personality characteristics and the decisions to becomeand stay self-employed. Small Business Economics, 42(4), 787–814.

Chandler, A. (1977). The visible hand: The Managerial Revolution in American Business. Cambridge: Belknap Press.

Chandler, A. (1990). Scale and scope: The Dynamics of industrial capitalism. Cambridge: Harvard University Press.

De Soto, H. (2000). The mystery of capital: Why capitalism Triumphs in the West and fails everywhere else. Basic Books.

Frese, M. (2009). Towards a psychology of entrepreneurship: An action theory perspective. Foundations and Trends in Entrepreneurship, 5, 437–496.

Hofstede, G. (1981)., Culture’s Consequences: International differences in work-related values. New York: Sage.

Knight, F. (1921). Risk, uncertainty, and profit. Boston, MA: Houghton Mifflin Co.

Lerner, J. (2009). Boulevard of broken dreams. Why public efforts to Boost Entrepreneurship and Venture Capital have failed–and what to do about it. Princeton: Princeton University Press.).

Li, Y., Kenney, M., Patton, D., et al. (2022). Entrepreneurial ecosystems and industry knowledge: Does the winning region take all? Small Business Economics. https://doi.org/10.1007/s11187-022-00681-y.

Lundvall, B. (1992). National Systems of Innovation: An Analytical Framework. London: Pinter.

McClelland, D. C. (1961). The Achieving Society. New York: Free Press.

Müller, G. F., & Gappisch, C. (2005). Personality types of entrepreneurs. Psychological Reports, 96(3), 737–746.

Niklas, E. and Magnus Henrekson (2017). “Entrepreneurship and Institutions: A Bidirectional Relationship,”Foundations and Trends in Entrepreneurship,191–263.

Obschonka, M., Stuetzer, M., Gosling, S. D., Rentfrow, P. J., Lamb, M. E., Potter, J. J, et al. (2015). Entrepreneurial regions: Do macro-psychological cultural characteristics of regions help solve the “knowledge paradox” of economics? Plos One, 10(6), e0129332.

Olson, M. (1965). The logic of collective action. Cambridge: Harvard University Press.

Olson, M. (1982). The rise and decline of nations: Economic growth, stagnation and social rigidities. New Haven: Yale University Press.

Oxenfeldt, A. R. (1943). New Firms and Free Enterprise: Pre-war and post-war aspects. Washington DC: American Council on Public Affairs.

Pekkala, S., Kerr Tina, K. W. R., & Xu (2018). Personality traits of entrepreneurs: A review of recent literature (foundations and Trends(r) in entrepreneurship. Foundations and Trends in Entrepreneurship, 65, 1–94.

Shapero, A. (1975). “The Displaced, Uncomfortable Entrepreneur’. Psychology Today(8),83–88.

Solow, R. (1956). A contribution to the theory of Economic Growth. Quarterly Journal of Economics, 39, 312–320.

Stuetzer, M., Obschonka, M., Audretsch, D. B., Wyrwich, M., Rentfrow, P. J., Coombes, M., Shaw-Taylor, L., & Satchell, M. (2015). Industry structure, entrepreneurship, and culture: An empirical analysis using historical coalfields. European Economic Review. https://doi.org/10.1016/j.euroecorev.2015.08.012.

Welter, F. (2011). Contextualizing entrepreneurship -- conceptual Challenges and Ways Forward. Entrepreneurship Theory and Practice, 35(1), 165–184.

Welter, F., Baker, T., & Wirsching, K. (2019). „Three waves and counting: The rising tide of contextualization in Entrepreneurship Research. “Small Business Economics, 52, 319–330.

Whyte, W. H. (1956). The Organization Man. New York: Simon and Schuster.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Compliance with ethical standards

No funding was received to assist with the preparation of this manuscript. The authors have no competing interests to declare that are relevant to the content of this article. All authors consent to the publication of materials and their information included in the manuscript.

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Audretsch, D.B. Institutions and entrepreneurship. Eurasian Bus Rev 13, 495–505 (2023). https://doi.org/10.1007/s40821-023-00244-5

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40821-023-00244-5