Abstract

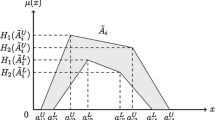

Selecting the right projects is the primary objective of project-oriented organizations. The main concern of this research is to propose a new optimizing model for project evaluation and project portfolio selection under interval-valued fuzzy (IVF) environment. Projects involvement in uncertainties and complexities is notable, and managers have to make decisions under uncertain environments. In order to assist top managers in project selection under these circumstances, investment capitals and net cash flows of the projects in this paper are presented as IVF numbers instead of crisp or classical fuzzy numbers. Using IVF sets enables the proposed model to consider uncertainty more practically which is achieved through addressing vagueness and lack of information intuitively. A new compound index that simultaneously takes risk and return into account is also presented. This approach illustrates both risk level and return level of project and then calculates the risk of unit return of project. Risk is measured by lower semi-variance of projects’ returns which is a direct, clear and widely accepted downside risk measure. The presented model is first proposed for project evaluation and comparison; then, it is extended for project portfolio selection problem. Finally, the proposed optimization model is exemplified by evaluating the candidate projects and selecting a portfolio of project in real case study of a holding company in developing countries. Moreover, a numerical example is presented to illustrate the capability of model in large-size problems.

Similar content being viewed by others

References

Medaglia A.L., Graves S.B., Ringuest J.L.: A multiobjective evolutionary approach for linearly constrained project selection under uncertainty. Eur. J. Oper. Res. 179(3), 869–894 (2007)

Mavrotas G., Diakoulaki D., Kourentzis A.: Selection among ranked projects under segmentation, policy and logical constraints. Eur. J. Oper. Res. 187(1), 177–192 (2008)

Iamratanakul, S.; Patanakul, P.; Milosevic, D.: Project portfolio selection: from past to present. In: Proceedings of the 2008 IEEE ICMIT, pp. 287–292 (2008)

Bard J.F., Balachandra R., Kaufmann P.E.: An interactive approach to R&D project selection and termination. IEEE Trans. Eng. Manag. 35(3), 139–146 (1988)

Wang J., Xu Y., Li Z.: Research on project selection system of pre-evaluation of engineering design project bidding. Int. J. Project Manag. 27(6), 584–599 (2009)

Martino J.P.: Research and development project selection. Wiley, New York (1995)

Ebrahimnejad S., Hosseinpour M.H., Nasrabadi A.M.: A fuzzy bi-objective mathematical model for optimum portfolio selection by considering inflation rate effects. Int. J. Adv. Manuf. Technol. 69(1-4), 595–616 (2013)

Chiu C.Y., Park C.S.: Capital budgeting decisions with fuzzy projects. Eng. Econ. 43(2), 125–150 (1998)

Chiadamrong N.: An integrated fuzzy multi-criteria decision making method for manufacturing strategies selection. Comput. Ind. Eng. 37(1), 433–436 (1999)

Kuchta D.: Fuzzy capital budgeting. Fuzzy Sets Syst. 111(3), 367–385 (2000)

Lin C., Hsieh P.J.: A fuzzy decision support system for strategic portfolio management. Decis. Support Syst. 38(3), 383–398 (2004)

Enea M., Piazza T.: Project selection by constrained fuzzy AHP. Fuzzy Optim. Decis. Mak. 3(1), 39–62 (2004)

Huang X.: Credibility-based chance-constrained integer programming models for capital budgeting with fuzzy parameters. Inf. Sci. 176(18), 2698–2712 (2006)

Wei C.C., Liang G.S., Wang M.J.J.: A comprehensive supply chain management project selection framework under fuzzy environment. Int. J. Proj. Manag. 25(6), 627–636 (2007)

Rebiasz B.: Fuzziness and randomness in investment project risk appraisal. Comput. Oper. Res. 34(1), 199–210 (2007)

Wang J., Hwang W.L.: A fuzzy set approach for R&D portfolio selection using a real options valuation model. Omega 35(3), 247–257 (2007)

Carlsson C., Fullér R., Heikkilä M., Majlender P.: A fuzzy approach to R&D project portfolio selection. Int. J. Approx. Reason. 44(2), 93–105 (2007)

Huang X.: Mean-semivariance models for fuzzy portfolio selection. J. Comput. Appl. Math. 217(1), 1–8 (2008)

Chen C.T., Cheng H.L.: A comprehensive model for selecting information system project under fuzzy environment. Int. J. Proj. Manag. 27(4), 389–399 (2009)

Liao S.H., Ho S.H.: Investment project valuation based on a fuzzy binomial approach. Inf. Sci. 180(11), 2124–2133 (2010)

Zhang W.G., Mei Q., Lu Q., Xiao W.L.: Evaluating methods of investment project and optimizing models of portfolio selection in fuzzy uncertainty. Comput. Ind. Eng. 61(3), 721–728 (2011)

Perez, F.; Gomez, T.: Multiobjective project portfolio selection with fuzzy constraints. Ann. Oper. Res. (2014). doi:10.1007/s10479-014-1556-z

Carlsson, C.; Fuller, R.; Mezeiz, J.: Project selection with interval-valued fuzzy numbers. In: 2011 IEEE 12th International Symposium on Computational Intelligence and Informatics (CINTI) (2011)

Grattan-Guinness I.: Fuzzy Membership Mapped onto Intervals and Many-Valued Quantities. Math. Logic Q. 22(1), 149–160 (1976)

Cornelis C., Deschrijver G., Kerre E.E.: Advances and challenges in interval-valued fuzzy logic. Fuzzy Sets Syst. 157(5), 622–627 (2006)

Yao J.S., Lin F.T.: Constructing a fuzzy flow-shop sequencing model based on statistical data. Int. J. Approx. Reason. 29(3), 215–234 (2002)

Hong D.H., Lee S.: Some algebraic properties and a distance measure for interval-valued fuzzy numbers. Inf. Sci. 148(1), 1–10 (2002)

Carlsson C., Fullér R.: On possibilistic mean value and variance of fuzzy numbers. Fuzzy Sets Syst. 122(2), 315–326 (2001)

Floricel S., Miller R.: Strategizing for anticipated risks and turbulence in large-scale engineering projects. Int. J. Proj. Manag. 19(8), 445–455 (2001)

Chapman C.B., Ward S.C., Klein J.H.: An optimized multiple test framework for project selection in the public sector, with a nuclear waste disposal case-based example. Int. J. Proj. Manag. 24(5), 373–384 (2006)

Ghorbal-Blal I.: The role of middle management in the execution of expansion strategies: The case of developers’ selection of hotel projects. Int. J. Hosp. Manag. 30(2), 272–282 (2011)

Miller K.D., Reuer J.J.: Measuring organizational downside risk. Strat. Manag. J. 17(9), 671–691 (1996)

Belaid F.: Decision-making process for project portfolio management. Int. J. Serv. Oper. Inf. 6(1-2), 160–181 (2011)

Markowitz H.M.: Portfolio selection: efficient diversification of investments (Vol. 16). Yale University Press, London (1968)

Hassanzadeh F., Collan M., Modarres M.: A practical approach to R&D portfolio selection using the fuzzy pay-off method. IEEE Trans. Fuzzy Syst. 20(4), 615–622 (2012)

Gupta P., Inuiguchi M., Mehlawat M.K., Mittal G.: Multiobjective credibilistic portfolio selection model with fuzzy chance-constraints. Inf. Sci. 229, 1–17 (2013)

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Mohagheghi, V., Mousavi, S.M. & Vahdani, B. A New Optimization Model for Project Portfolio Selection Under Interval-Valued Fuzzy Environment. Arab J Sci Eng 40, 3351–3361 (2015). https://doi.org/10.1007/s13369-015-1779-6

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13369-015-1779-6