Abstract

The present paper considers the exploitation of a common-property, nonrenewable resource, by individuals concerned with their social status. Assuming that the social status is reflected by the individuals’ relative consumptions, we formalize this motivation by means of a utility function, depending on the individual’s actual consumption and on the consumption level he aspires, the latter being related to the consumptions in his reference group. We compare the benchmark cooperative solution with a noncooperative Markov-perfect Nash equilibrium. We confirm, under more general conditions than in the existing literature, that the individuals’ concern for social status exacerbates the tragedy of the commons. We finally discuss the policy implications and provide a taxation scheme capable of implementing the cooperative solution as a noncooperative Markov-perfect Nash equilibrium.

Similar content being viewed by others

Notes

The agents can only choose strategies that allow the other players’ plans to be satisfied, given the exhaustion constraint.

The agents are allowed to choose strategies that may frustrate the other players’ plans, due to the exhaustion constraint.

Importantly, remark that this literature relies on simple specifications, using isoelactic utility functions.

This last result holds only if extraction is costly. With costless extraction, no impact on the resource exploitation is found.

We do not consider open-loop Nash equilibria. The advantage of Markov-perfect Nash equilibria is that they satisfy the condition of subgame perfectness [10].

An anonymous referee remarks that the results presented here can be related with Rincon-Zapatero et al. [34] and Rincon-Zapatero [33], dealing with the characterization of Nash equilibria in differential games by means of a system of partial differential equations. Indeed, they illustrate their results with an application to nonrenewable resources games. Although some similarities exist, Rincon-Zapatero et al. [34] and Rincon-Zapatero [33] did not obtain the characterization proposed here, due to their focus on finite-horizon problems.

Here, we use the notation: c −i (t)=(c 1(t),…,c i−1(t),c i+1(t),…,c n (t)).

Here and below, v 1(c i ,y i ) and v 2(c i ,y i ) denote the first and second derivatives of v(c i ,y i ), respectively.

Remark that if v 2(c i ,y i )=0, for all c i and y i , we obtain the standard common-pool model of exploitation of an exhaustible resource, as a special case of our model.

Note that α=0 in the special case where v 2(c i ,y i )=0, for all c i and y i .

In a competitive economy, Arrow and Dasgupta [3] prove that this condition implies that the socially optimal and market equilibrium paths coincide.

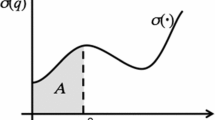

Here, in saying that c is decreasing in σ(⋅), we mean that when comparing two problems only differing with respect to their elasticity of marginal utility, σ 1(⋅) and σ 2(⋅) (say), the optimal consumption c will be smaller in the second problem when σ 1(c)<σ 2(c) for all c.

As α<1, we have (n−1+α)/n<1. Thus, examples of standard utility functions satisfying this condition are u(c)=ln(c) and (c 1−μ−1)/(1−μ) with μ>1.

Here, in saying that c ∗ is decreasing in σ(⋅), we mean that if two problems only differ with respect to their elasticity of marginal utility, σ 1(⋅) and σ 2(⋅) (say), the noncooperative consumption will be smaller in the second problem when σ 1(c)<σ 2(c) for all c.

Of course, the assumption that φ i (⋅)=ϕ i (⋅) seems natural. However, by definition, it means that the social planner has perfect information on the individuals’ reference groups and on the way they determine their aspiration levels. This seems a very demanding assumption. It is thus worth noticing that this assumption is not necessary to obtain our implementation result.

References

Alpizar F, Carlsson F, Johansson-Stenman O (2005) How much do we care about absolute versus relative income and consumption? J Econ Behav Organ 56:405–421

Alvarez-Cuadrado F, Long NV (2008) Relative consumption and resource extraction. Working Paper 2008s-27, Cirano

Arrow KJ, Dasgupta PS (2009) Conspicuous consumption, inconspicuous leisure. Econ J 119(541):497–516

Becker GS (1974) A theory of social interactions. J Polit Econ 82(6):1063–1093

Bolle F (1986) On the oligopolistic extraction of non-renewable common-pool resources. Economica 53(212):519–527

Brekke KA, Howarth RB (2002) Status, growth and the environment. Edward Elgard, Cheltenham

Carroll C et al. (1997) Comparison utility in a growth model. J Econ Growth 2:339–367

Clark AE, Oswald AJ (1996) Satisfaction and comparison income. J Public Econ 61:359–381

Clark AE, Frijters P, Shields MA (2008) Relative income, happiness, and utility: an explanation for the Easterlin paradox and other puzzles. J Econ Lit 46(1):95–144

Dockner E et al. (2000) Differential games in economics and management science. Cambridge University Press, New York

Duesenberry JS (1949) Income, saving, and the theory of consumer behavior. Cambridge, MA

Dupor B, Liu W-F (2003) Jealousy and equilibrium overconsumption. Am Econ Rev 93(1):423–428

Easterlin R (1974) Does economic growth improve the human lot? Some empirical evidence. In: David PA, Reder M (eds) Nations and households in economic growth: essays in honor of Moses Abramowitz. Academic Press, New York, pp 89–125

Easterlin R (1995) Will raising the incomes of all increase the happiness of all? J Econ Behav Organ 47:35–47

Easterlin R (2001) Income and happiness: toward a unified theory. Econ J 111:465–484

Frank RH (1985) The demand for unobservable and other nonpositional goods. Am Econ Rev 75(1):101–116

Galí J (1994) Keeping up with the Joneses: consumption externalities, portfolio choice, and asset prices. J Money Credit Bank 26(1):1–8

Hollander H (2001) On the validity of utility statements: standard theory versus Duesenberry’s. J Econ Behav Organ 45:227–249

Howarth RB (1996) Status effects and environmental externalities. Ecol Econ 16:25–34

Katayama S, Long NV (2010) A dynamic game of status-seeking with public capital and an exhaustible resource. Optim Control Appl Methods 31:43–53

Liebenstein H (1950) Bandwagon, snob, and veblen effects in the theory of consumers’ demand. Q J Econ 64(2):183–207

Ljungqvist L, Uhlig H (2000) Tax policy and aggregate demand management under catching up with the Joneses. Am Econ Rev 90(3):356–366

Long NV (2011) Dynamic games in the economics of natural resources: a survey. Dyn Games Appl 1:115–148

Long NV (2010) Dynamic games in economics: a survey. World Scientific, Singapore

Long NV, McWhinnie S (2012) The tragedy of the commons in a fishery when relative performance matters. Ecol Econ 81:140–154

Long NV, Shimomura K (1998) Some results on the Markov equilibria of a class of homogeneous differential games. J Econ Behav Organ 33:557–566

Long NV, Shimomura K, Takahashi H (1999) Comparing open loop and Markov-perfect equilibria in a class of differential games. Jpn Econ Rev 50(4):457–469

Luttmer RFP (2005) Neighbors as negatives: relative earnings and well-being. Q J Econ 120(3):963–1002

McAdams RH (1992) Relative preferences. Yale Law J 102(1):1–104

McMillan J, Sinn HW (1984) Oligopolistic extraction of a common property resource: dynamic equilibria. In: Kemp MC, Long NV (eds) Essays in the economics of exhaustible resources. North-Holland, Amsterdam, pp 89–125

Ng YK, Wang J (1993) Relative income, aspiration, environmental quality, individual and political myopia: why may the rat race for material growth be welfare reducing? Math Soc Sci 26:3–23

Pollak RA (1976) Interdependent preferences. Am Econ Rev 66(3):309–320

Rincon-Zapatero JP (2004) Characterization of Markovian equilibria in a class of differential games. J Econ Dyn Control 28:1243–1266

Rincon-Zapatero JP, Martinez J, Martin-Herran G (1998) New method to characterize subgame perfect Nash equilibria in differential games. J Optim Theory Appl 96(2):377–395

Sinn HW (1984) Common property resources, storage facilities and ownership structures: a Cournot model of the oil market. Economica 51(203):235–252

Smith A (1759) The theory of moral sentiments

Veblen T (1899) The theory of the leisure class: an economic study of institutions

Weiss Y, Fershtman C (1998) Social status and economic performance: a survey. Eur Econ Rev 42:801–820

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

1.1 A.1 Proof of Lemma 1

Consider any vector of individual consumptions \(C ( t ) = ( c_{i} ( t ) ) _{i=1}^{n}\). Recall that \(V ( C ( t ) ) =\sum_{i=1}^{n}v ( c_{i} ( t ) ,\phi _{i} ( c_{-i} ( t ) ) ) \). Let \(\overline {C} ( t ) = ( \overline{c}_{i} ( t ) ) _{i=1}^{n}= ( \sum_{i=1}^{n}c_{i} ( t ) /n ) _{i=1}^{n}\) represent the equal redistribution of \(C ( t ) = ( c_{i} ( t ) ) _{i=1}^{n}\). We need to show that if \(C ( t ) \neq \overline{C} ( t ) \), then \(V ( \overline{C} ( t ) ) >V ( C ( t ) ) \).

By definition,

Since the consumption vector \(\overline{C} ( t ) = ( \sum_{i=1}^{n}c_{i} ( t ) /n ) _{i=1}^{n}\) is symmetric, we have (by Assumption 1(b))

Substituting into (8), we get

Now, remark that

After substitution, this yields

Clearly, if \(C ( t ) \neq\overline{C} ( t ) \), by concavity of v,

and

Now, recall that, for all i, v is decreasing in y i , and ϕ i (c −i (t))≥∑ j≠i c j (t)/(n−1) (by Assumption 1(a)). It follows that

for all i and, summing over i, that

Finally, this allows us to show that

which shows Lemma 1.

1.2 A.2 Proof of Proposition 1

The social problem is to choose c(⋅) to maximize

Define the current-value Hamiltonian

where λ is a costate multiplier associated with the state x.

A feasible control path c(⋅) with the corresponding state trajectory x(⋅) is optimal if there exists λ(⋅) such that

Now, f(x) being such that

let c(t), x(t), and λ(t) for all t satisfy

We show below that the proposed control path c(⋅) is feasible and satisfies conditions (9), (10), and (11). Proposition 1 follows.

(1) Feasibility. We first show, in Lemmas 1 and 2, that the proposed control path c(⋅) is feasible.

Lemma 1

For all x>0, f(x)>0, and f(0)=0.

Proof

If x=0, f(0)=0 follows from Θ(0)=0. Likewise, lim x→∞ f(x)=∞ follows from lim c→∞ Θ(c)=∞. If 0<x<∞, as Θ(0)=0<δx/n<∞=lim c→∞ Θ(c) and Θ(c) is continuous, there exists 0<f(x)<∞ such that Θ(f(x))=δx/n (by the intermediate value theorem). As Θ(c) is increasing (since Θ′(c)=σ(c)>0 for all c), this solution is unique. □

Lemma 2

The individual consumption path c(⋅) generates a trajectory of the resource stock x(⋅) such that x(t)≥0 for all t and lim t→∞ x(t)=0.

Proof

By definition, the individual consumption path c(⋅) generates a trajectory x(⋅) such that \(\dot{x} ( t ) =-nf ( x ( t ) ) \) for all t, with initial condition x(0)=x 0. Lemma 2 follows directly from the properties of f(⋅), which imply that \(\dot{x}( t ) =-nf ( x ( t ) ) <0\) when x(t)>0 and \(\dot{x} ( t ) =0\) when x(t)=0. □

(2) Necessary conditions. We now check that the necessary conditions (9), (10), and (11) are satisfied.

Let T represent the time of depletion of the resource stock (including the possibility that T=∞).

Lemma 3

Along the path x(⋅) induced by f(⋅), the marginal utility u′(f(x(t))) grows at the rate δ for all t<T and is equal to u′(0) for all t≥T.

Proof

First, remark that Θ(f(x))=δx/n for all x implies that σ(f(x))f′(x)=δ/n for all x (by differentiation).

Define p(t)=u′(f(x(t))) for all t.

For all t<T, differentiation yields

Substituting \(\dot{x} ( t ) =-nf ( x ( t ) ) \) and dividing by p(t)=u′(f(x(t))), we get

For all t≥T, x(t)=0 (by definition) and f(0)=0 imply that p(t)=u′(0). □

The maximum condition (9) follows directly from Lemma 3.

The adjoint equation (10) is satisfied by construction of λ(t).

The transversality condition (11) is satisfied since e −δt λ(t)=u′(f(x 0)) by construction and lim t→∞ x(t)=0 by Lemma 2.

1.3 A.3 Proof of Property 1

For all n, let c ∘ satisfy Θ(c ∘)=δx 0/n, and let C ∘=nc ∘. By differentiation we obtain

By the mean value theorem, given that Θ(0)=0, there exists c, with 0<c<c ∘, such that

Hence, we have

By substitution it follows that

which proves the property.

1.4 A.4 Proof of Proposition 2

Consider any player i. Assume that all individuals j≠i play the Markovian strategy \(s_{j}^{\ast}=g ( x ) \), where g(x) satisfies

Then, noting that y i (t)=ϕ i (g(x(t)),…,g(x(t)))=g(x(t)) for all t by Assumption 1(b), the problem of the remaining player i is to find a consumption path, c i (⋅), maximizing

Define the current-value Hamiltonian

where λ i is a costate multiplier associated with the state x.

A feasible control path c i (⋅) with the corresponding state trajectory x(⋅) is optimal if there exists λ i (⋅) such that

Let c i (t) and x(t) for all t satisfy

We show below that the proposed consumption path c i (⋅)=g(x(⋅)) is feasible, and we find λ i (⋅) to satisfy conditions (12), (13), and (14). Proposition 2 follows.

(1) Feasibility. It is immediate to adapt Lemmas 1 and 2 to show that the proposed control path c i (⋅) is feasible.

(2) Necessary conditions. Let T represent the time of depletion of the resource stock (including the possibility that T=∞). We first construct λ i (⋅) to simultaneously satisfy the maximum condition (12) and the adjoint condition (13). We then prove that the transversality condition (14) holds.

For all t<T, as x(t)>0, c i (t)=g(x(t))>0. Thus, the maximum condition (12) requires that

To show that the adjoint condition (13) holds, differentiate this expression to get

Substitute \(\dot{x} ( t ) =-ng ( x ( t ) ) \) and use λ i (t)=u′(g(x(t)))/(1−α) to obtain

Now, by differentiation, Ψ(g(x))=δx/n for all x implies that

Thus, after substitution, we can write

Finally, using λ i (t)=v 1(c i (t),g(x(t))) and v 2(c i (t),g(x(t)))=−αv 1(c i (t),g(x(t))) (as c i (t)=g(x(t))), we derive

which is the adjoint equation (13).

For t≥T, as x(t)=0, c i (t)=g(0)=0. Thus, the maximum condition (12) requires that

Assume that λ i (t) satisfies the adjoint equation (13) with λ i (T)=v 1(0,0). Then, we can show that

Substituting v 2(0,0)=−αv 1(0,0)=−αλ i (T) and rearranging, we can write

As e (δ+(n−1)g′(0))(t−T)≥1, this implies that λ i (t)≥λ i (T)=v 1(0,0), which proves that the maximum condition (12) is true.

To verify the transversality condition (14), we need to separate the cases where T is finite or infinite. If T is finite, the condition is trivially verified since x(t)=0 for all t≥T. If T is infinite, define A(t)=e −δt λ i (t)x(t). By differentiation we obtain

Using

we get

Now, by definition, for all x, g(x) satisfies Ψ(g(x))=δx/n, which is equivalent to

A first implication is that (by differentiation with respect to x)

A second implication is that there exists c, with 0<c<g(x), such that (by the mean value theorem)

This piece of information implies that, for all t, there exists c, with 0<c<g(x(t)), such that

Now, as t tends to infinity, the resource stock x(t) converges to 0, implying that both g(x(t)) and c (as 0<c<g(x(t))) converge to 0. From this we can write

which implies that the transversality condition (14) holds.

1.5 A.5 Proof of Property 2

For all n, let c ∗ satisfy Θ(c ∗)−(n−1+α)c ∗/n=δx 0/n, and let C ∗=nc ∗. By differentiation we show

Let us show the first assertion. By the mean value theorem, given that Θ(0)=0, there exists c, with 0<c<c ∗, such that

Assume that σ(c)>1 for all c. Then, Θ(c ∗)>c ∗, implying that dc ∗/dn<0. Likewise, one can prove that dc ∗/dn=0 if σ(c)=1 for all c and dc ∗/dn>0 if σ(c)<1 for all c.

As dC ∗/dn=c ∗+dc ∗/dn, the second assertion directly follows from the first one.

Let us now prove the third assertion. Since

we can write, after substitution,

Using anew Θ(c ∗)=σ(c)c ∗, we can show that

and, after substitution,

It follows that dC ∗/dn>0 whenever σ(c ∗)≥σ(c), which proves the property.

1.6 A.6 Proof of Proposition 3

Consider any player i. Assume that all individuals j≠i play the Markovian strategy \(s_{j}^{\ast}=f ( x ) \), where f(x) satisfies Θ(f(x))=δx/n. Then, noting that y i (t)=ϕ i (f(x(t)),…,f(x(t)))=f(x(t)), z i (t)=φ i (f(x(t)),…,f(x(t)))=f(x(t)) and τ(z i (t))≡(n−1+α)u′(f(x(t)))/((1−α)n) for all t, the problem of the remaining player i is to find a consumption path, c i (⋅), maximizing

Define the current-value Hamiltonian

where λ i is a costate multiplier associated with the state x.

A feasible control path c i (⋅), with corresponding state trajectory x(⋅), is optimal if there exists λ i (⋅) such that

Now, f(x) being such that Θ(f(x))=δx/n for all x, let c i (t) and x(t) for all t satisfy

We show below that the proposed consumption path c i (⋅)=f(x(⋅)) is feasible, and we find λ i (⋅) to satisfy conditions (15), (16), and (17). Proposition 3 follows.

(1) Feasibility The proposed path, being identical to the socially optimal consumption path, is clearly feasible (see Lemmas 1 and 2).

(2) Necessary conditions Let T represent the time of depletion of the resource stock (including the possibility that T=∞). We first construct λ i (⋅) to simultaneously satisfy the maximum condition (15) and the adjoint condition (16). We then prove that the transversality condition (17) holds.

For all t<T, as x(t)>0 (by definition), c i (t)=f(x(t))>0. Thus, the maximum condition (12) requires that (using v 1(c i (t),f(x(t)))=u′(f(x(t)))/(1−α) and τ(f(x(t)))=(n−1+α)u′(f(x(t)))/((1−α)n))

To show that the adjoint condition (16) holds, differentiate this expression to get

Substitute \(\dot{x} ( t ) =-nf ( x ( t ) ) \) and use λ i (t)=u′(f(x(t)))/n to obtain

Now, by differentiation, Θ(f(x))=δx/n for all x implies that

Thus, after substitution, we can write

Finally, we can verify that this precisely coincides with the adjoint equation (16). Indeed, using c i (t)=f(x(t)), v 1(c i (t),f(x(t)))=u′(f(x(t)))/(1−α), v 2(c i (t),f(x(t)))=−αu′(f(x(t)))/(1−α), and λ i (t)=u′(f(x(t)))/n, we can show that

For t≥T, as x(t)=0, c i (t)=f(0)=0. Thus, the maximum condition (15) requires that

Assume that λ i (t) satisfies the adjoint equation (16) with λ i (T)=v 1(0,0)−τ(0). Then, we can show that

Substituting v 2(0,0)+τ(0)=(n−1)λ i (T) and rearranging, we can write

As e (δ+(n−1)f′(0))(t−T)≥1, this implies that λ i (t)≥λ i (T)=v 1(0,0)−τ(0), which proves that the maximum condition (15) is true.

The transversality condition (17) is immediate since if T is finite, x(t)=0 for all t≥T, and if T is infinite, then \(e^{-\delta t}\lambda_{i} ( t ) =\frac{1}{n}u^{\prime } ( f ( x_{0} ) ) \) for all t, and lim t→∞ x(t)=0.

Rights and permissions

About this article

Cite this article

Rouillon, S. Do Social Status Seeking Behaviors Worsen the Tragedy of the Commons?. Dyn Games Appl 4, 73–94 (2014). https://doi.org/10.1007/s13235-013-0087-6

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13235-013-0087-6