Abstract

An important strand of research on corporate bankruptcies via Chapter 11 in the United States has appropriately focused on the firm characteristics associated with emergence as viable business entities. This necessarily involves considering factors (such as management changes) that arise during the restructuring process. We consider a narrower question - which ex-ante factors are important in influencing the bankruptcy court’s decision in a Chapter 11 application: approval of the reorganization plan or dismissal culminating in the firm’s liquidation. We use a competing risks model and find that while financial attributes such as firm size matter, the formation of a creditors committee, debt prepackaging prior to filing, and judicial experience significantly impact the outcome as well as the duration of the legal process. The latter is important because it clearly influences the direct costs of bankruptcy and has also been used in the literature as a useful proxy for harder to measure indirect costs. We believe our approach which explicitly captures the time dimension provides a useful input to the cost-benefit considerations associated with a Chapter 11 filing.

Similar content being viewed by others

Notes

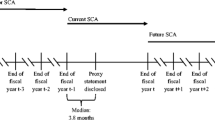

Prepackaging refers to cases where the debtor drafts a plan, submits it to a vote of the impaired classes, and purports to have the necessary acceptances before filing the case.

Economic applications include modeling of competing risks associated with unemployment (Katz and Meyer 1990), welfare spells (Blank 1989), mortgage terminations (Deng et al. 2000; Ciochetti et al. 2002), strategic acquisitions (Dickerson et al. 2003), corporate survival (He et al. 2010), and rent to own contracts (Anderson and Jaggia 2012).

Given independence between risks, these models are easily estimated as single-risk hazard models by treating completed transactions from other exits as censored at the point of completion (see Narendranathan and Stewart 1991).

See the website: http://lopucki.law.ucla.edu/ for details.

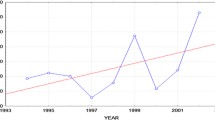

Total assets are measured in real terms (2014 dollars).

See Thomas (1996) for a detailed discussion.

This is unsurprising since we know from Table 1 that 605 out 657 (92.1%) were reorganized.

We should mention that the simulation results need to be interpreted with caution. We report and discuss the estimates in Tables 3 and 4, cognizant of the fact that these are based on the particulars of the simulation program. We therefore request the reader to treat our discussion in the context of broad economic magnitudes and directional findings while recognizing that the same data might yield slightly different estimates depending on the simulation protocol.

The bankruptcy cost literature is quite divided on the magnitudes involved (see Bris et al. 2006) but there appears to be a consensus that costs in dollar terms are positively correlated with firm size.

It is possible that in some jurisdictions, cases are not assigned randomly and that some discretion is exercised taking judicial experience into account. However, in our sample that does not appear to be the case. The correlation coefficient between firm size (as measured by the book value of total assets) and the judicial experience variable is statistically indistinguishable from zero.

Standard hazard models are inappropriate because they assume that the event of interest (reorganization) will eventually occur.

References

Anderson MH, Jaggia S (2012) Return, purchase, or skip? Outcome, duration, and consumer behavior in the rent-to-own market. Empir Econ 43(1):313–334

Asquith P, Gertner R, Scharfstein D (1994) Anatomy of financial distress: an examination of junk-bond issuers. Q J Econ 109(3):625–658

Bandopadhyaya A (1994) An estimate of the hazard rate of firms under chapter 11 protection. Rev Econ Stat 76(2):346–350

Blank R (1989) Analyzing the length of welfare spells. J Public Econ 39:245–273

Bogan VL, Sandler CM (2012) Are firms on the right page with chapter 11? An analysis of firm choices that contribute to post-bankruptcy survival. Appl Econ Lett 19(7):609–613

Bris A, Welch I, Zhu N (2006) The costs of bankruptcy: chapter 7 liquidation versus chapter 11 reorganization. J Financ 61(3):1253–1303

Chatterjee S, Dhillon US, Ramirez GG (1996) Resolution of financial distress: debt restructurings via chapter 11, prepackaged bankruptcies, and workouts. Financ Manag 25(1):5–18

Ciochetti BA, Deng Y, Gao B, Yao R (2002) The termination of commercial mortgage contracts through prepayment and default: a proportional hazard approach with competing risks. Real Estate Econ 30(4):595–633

Deng Y, Quigley JM, Order RV (2000) Mortgage terminations, heterogeneity and the exercise of mortgage options. Econometrica 68(2):273–307

Denis DK, Rodgers KJ (2007) Chapter11: duration, outcome, and post-reorganization performance. J Financ Quant Anal 42(1):101–118

Dickerson AP, Gibson HD, Tsakalotos E (2003) Is attack the best form of defence? A competing risks analysis of acquisition activity in the UK. Camb J Econ 27(3):337–357

Franks JR, Torous WN (1989) An empirical investigation of U.S. firms in reorganization. J Financ 44:747–769

He Q, Chong TT, Li L, Zhang J (2010) A competing risks analysis of corporate survival. Financ Manag 39(4):1697–1718

Jaggia S, Thosar S (1995) Contested tender offers: an estimate of the hazard function. J Bus Econ Stat 13(1):113–119

Katz L, Meyer B (1990) Unemployment duration, recall expectations, and unemployment outcomes. Q J Econ 105:973–1002

Lancaster, T. 1990. The econometric analysis of transition data. Cambridge University Press

Li K (1999) Bayesian analysis of duration models: an application to chapter 11 bankruptcy. Econ Lett 63(3):305–312

LoPucki LM, Doherty JW (2015) Bankruptcy survival. UCLA Law Rev 62(4):970–1015

Narendranathan W, Stewart M (1991) Simple methods for testing for the proportionality of cause-specific hazards in competing risks models. Oxf Bull Econ Stat 53:1–28

Partington G, Russel P, Stevenson M, Torbey V (2001) Predicting return outcomes to shareholders from companies entering chapter 11 bankruptcy. Manag Financ 27(4):78–96

Tashjian E, Lease RC, McConnell JJ (1996) An empirical analysis of prepackaged bankruptcies. J Financ Econ 40:135–162

Thomas J (1996) On the interpretation of the covariate estimates in the independent competing-risks models. Bull Econ Res 48:27–39

Thorburn KS (2000) Bankruptcy auctions: costs, debt recovery, and firm survival. J Financ Econ 58:337–368

van den Berg, G. 2001. Duration models: specification, identification, and multiple durations. In Handb Econ, Heckman J. J., and E. Leamer (eds), Volume 5, 3381–3460, North-Holland

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Jaggia, S., Thosar, S. An evaluation of chapter 11 bankruptcy filings in a competing risks framework. J Econ Finan 43, 569–581 (2019). https://doi.org/10.1007/s12197-018-9458-6

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12197-018-9458-6