Abstract

These pre-registered studies shed light on the cues that individuals use to identify rich people. In two studies (N = 598), we first developed a factor-analytical model that describes the content and the mental structure of 24 wealth cues. A third within-subject study (N = 89) then assessed the perception of rich subgroups based on this model of wealth cues. Participants evaluated the extent to which the wealth cues applied to two distinct subgroups of rich people. The results show: German and US-American participants think that one can identify rich people based on the same set of cues which can be grouped along the following dimensions: luxury consumption, expensive hobbies, spontaneous spending, greedy behavior, charismatic behavior, self-presentation, and specific possessions. However, Germans and US-Americans relied on these cues to different degrees to diagnose wealth in others. Moreover, we found evidence for subgroup-specific wealth cue profiles insofar as target individuals who acquired their wealth via internal (e.g., hard work) compared to external means (e.g., lottery winners) were evaluated differently on these wealth cues, presumably because of their perceived differences in valence and competence. Together, this research provides new insights in the cognitive representation of the latent construct of wealth. Practical implications for research on the perception of affluence, and implications for political decision makers, are discussed in the last section.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

‘In our western society, a person is rich if he or she buys unnecessarily many new items, is reluctant to go through the hassle of having things repaired, and can afford any luxury, like buying a new car every few years.‘ This response came from one of our participants after being asked how rich people can be identified. Indeed, this statement is in line with studies that examined how rich people are perceived by others. It has been shown that rich people are rated to possess many assets such as cars, houses, or jewelry (e.g., Bertram-Hümmer et al., 2015; Maaravi & Hameiri, 2019; Ragusa, 2015). Furthermore, the rich are seen as cold but competent (Wu et al., 2018) and they are believed to have a different physical appearance than less affluent people (Bjornsdottir & Rule, 2017, 2020). Thus, it seems that individuals believe that the rich are in many ways different from the general population.

Notably, research examining stereotypes about ‘the rich’ (Christopher & Schlenker, 2000; Ragusa, 2015; Wu et al., 2018) suggests that besides few negative stereotypes (e.g., Sarkar et al., 2020), rich people have a generally positive, competent and enviable image (e.g., Cheng & Tracy, 2013). Furthermore, earlier research also investigated how cues of wealth (like cars, houses, etc.), affect the perception and ratings of wealth cues and the rich in general (e.g., Maaravi & Hameiri, 2019; Bertram-Hümmer & Baliki, 2015). It was, for example, shown that individuals can correctly identify the rich based on certain shoes or behaviors (Gillath et al., 2012; Kraus & Keltner, 2009) and that individuals rate certain other possessions as indicative for wealth (e.g., Maaravi & Hameiri, 2019).

What is still missing are studies that deal with wealth cues more broadly, as previous studies have often used only selected wealth cues. This is important since visible cues of wealth represent a starting point for several social-cognitive processes such as stereotype activation and application to form judgments of others. Specifically, social cognition research showed that visible social cues are used by individuals to categorize others into distinct groups (Macrae & Bodenhausen, 2000). Furthermore, it is assumed that such a categorization process leads to an automatic stereotype activation (Roth et al., 2018), which in turn is often followed by explicit evaluations that drive social behaviors (Macrae & Bodenhausen, 2000). For example, visible cues of wealth make individuals categorize others as rich (Christopher & Schlenker, 2000). This categorization into the group of the rich indeed leads individuals to form different impressions of these persons on a variety of social judgment dimensions more or less closely tied to affluence. Accordingly, Christopher and Schlenker (2000) observed that individuals indicated that the rich have different abilities and personality traits than the less wealthy. Among other things, such evaluations of the rich have been shown to be responsible for discrimative behaviors against the rich (e.g., Gino & Pierce, 2010).

The present studies therefore examine the content and the mental structure of cues that individuals utilize to categorize someone as being rich (i.e., wealth cues). Furthermore, it investigates differences between German and US-American participants by exploring whether some cues are more important for German or American participants than other cues in the identification of rich people. Lastly, we investigate whether (competence/valence) stereotypes of two subgroups of rich people (i.e., rich individuals who worked versus did not work for their money, Sarkar et al., 2020) would lead individuals to say that certain wealth cues are more specific for some rich subgroups than for others.

Background

It seems that a collective understanding of the concept ‘wealth’ is still missing as researchers as well as lay people do not fully agree on how wealth should be defined. Yet it can be differentiated from related constructs such as socioeconomic status (i.e., education, income, etc.), sociometric status (e.g., power, prestige, etc.), social class or dominance (Anderson et al., 2015; Kraus et al., 2012). One problem of attempts to uniformly define wealth is that they are commonly based on either objective or subjective indicators of wealth (e.g., Götte, 2015). Objective indicators refer to thresholds of objectively measurable goods such as income or assets, whereas subjective definitions take the subjective perception of individuals into account (e.g., stereotypes and feelings) (Gasiorowska, 2014).

The present study builds on the subjective definitions and asks individuals what cues they think are indicative for richness and Brunswik’s lens model (Asendorpf, 2018; Brunswik, 1956) is used here as a theoretical basis to describe how individuals derive and use cues to categorize individuals. This model assumes that many traits (such as extraversion or wealth) are not directly perceptible but represent latent constructs that must be inferred from visible cues. Furthermore, the lens model distinguishes between ecologically valid cues and subjectively utilized cues. Ecological validity of a cue is indicated by the factual covariation of a cue (e.g., money) and the criterion (e.g., wealth). Cue utilization, however, is indicated by the covariation of a cue (e.g., an expensive jacket) and subjective estimates of the criterion (e.g., subjective judgments of wealth). Thus, the present research is focused on better understanding the set of subjectively valid cues (i.e., those that people use to infer wealth) instead of ecologically valid cues.

From the perspective of the lens model, utilized cues might actually be ecologically invalid and the usage of ecologically invalid cues might furthermore be explained by a social learning process and the observation that individuals are prone to mis-interpret some social signals (Asendorpf, 2018). An empirical example for dissociations between ecological validity and cue utilization in the realm of wealth is reported by Bjornsdottir and Rule (2017). The authors observed that individuals correctly inferred objective wealth from faces of people with neutral expressions. The ecologically valid cues in this case are subtle expressions of positive affect, which apparently are more prevalent in the faces of rich people. Participants who were asked to evaluate wealth from faces with explicitly happy expressions (a cue that is different from subtle expressions of positive affect), however, failed to identify the ecologically valid cue. Instead, the authors observed that happy faces were rated rich because individuals’ mis-interpreted the happy expressions as an indicator of wealth, independently of their actual social class. Thus, we conclude that individuals’ self-reported wealth cues will for the most part be ecologically valid, however, some cues will lack ecological validity but may be used (and reported) nevertheless.

Wealth cues: the underlying structure

The subjective knowledge and underlying cue utilization can be interpreted as being a part of stereotypes about the rich. Social stereotypes contain knowledge about (subjectively) typical features of social groups. Subjective wealth cues exactly fit that description: They represent knowledge about perceivable features of the group of the rich and earlier research suggests that such stereotypes are mentally organized along stereotype dimensions (e.g., Kornadt & Rothermund, 2011; Fiske et al., 2002; Ragusa, 2015). Relevant for the present research, Ragusa (2015) concluded that stereotypes about the rich can be clustered into six categories. He used an exploratory cluster analysis method and found evidence for the following clusters: greedy, materialistic, celebrious, personal traits, commerce, and free enterprise (Ragusa, 2015). Another study systematically examined one specific wealth cue dimension, namely a dimension labeled ‘spending implies wealth’ (Kappes et al., 2021). It indicates that individuals’ belief that rich people are identifiable on basis of their spending behavior. On this basis, we assume that different wealth cues can be mapped to several latent wealth cue dimensions and that these dimensions reflect an overall imagination of how rich people look like.

Previous research on wealth cues

Previous research used wealth cues either as dependent variables (e.g., Garcia et al., 2019; Robeyns et al., 2021) or as independent variables to examine several outcomes that can be assumed to be related to perceptions of wealth but are not these perceptions themselves. Examples are situational temptations, behaviors related to wealth or the evaluation of others. One study for example, showed that the presence of money triggers amoral behavior (Gino & Pierce, 2009). Another study found that individuals are less likely to honk when expensive (compared to non-expensive) cars drive below speed limit in front of them (Doob & Gross, 1968). Yet other studies showed that rich individuals are rated to have more favorable personality traits than individuals who do not display wealth cues (Christopher & Schlenker, 2000; Skafte, 1989; Sussman et al., 2014). Thus, wealth cues trigger a variety of behaviors and evaluation processes and the question arises why some cues are perceived as more or less indicative for wealth.

One answer to this question could be that wealth cues are learned by observing the social environment. Indeed, there is evidence that individuals judge wealth on basis of their direct social environment (Galesic et al., 2018), and that individuals would say that different wealth cues are indicative to judge a person as rich, depending on which culture individuals come from. In the western world, for example, one frequently finds that individuals relate wealth to certain lifestyles, clothes, or housing types (e.g., Maaravi & Hameiri, 2019; Jahng, 2019), whereas individuals from Africa indicate that skin color and amount of cattle are cues of wealth (e.g., Bonn et al., 1999). Thus, we argue that it is unrealistic to describe a model of wealth cues that holds true for the entire world population. However, the present research aims at developing a model of wealth cues that might be used in the western world where individuals share similar standards of living.

Advantages of a newly developed wealth cue model

The rationale for developing an empirically validated model that describes the underlying structure of wealth cues, was as follows: First, such a model can make future research on the perception of wealth more comparable. For example, some research on wealth cues relied on cars as indicators of affluence (e.g., Maaravi & Hameiri, 2019), while other research (Skafte, 1989) provided participants with information about target persons’ solvency. Although the researchers’ intention behind these distinct operationalizations is to experimentally vary or measure the same latent construct (wealth), it is likely that different aspects of wealth become salient based on these different procedures. In the car example, individuals are likely to think about lifestyle aspects of a rich target, while in the latter example, individuals would more likely think about investment, shopping habits, or other financial aspects of wealth. It follows that only very narrow and specific aspects of wealth were assessed in these individual studies when only some wealth cues were taken into account. A systematic examination of a comprehensive set of wealth cues and their relation to each other hence seems preferable to economically map the broad range of wealth cues that individuals encounter in their daily lives and actually utilitze to infer affluence in others. This is especially important when researchers or practitioners want to utilize wealth cues to appropriately represent rich individuals without directly disclosing the bank account of individuals.

Second the use of a uniform wealth cue model might help to categorize earlier research on wealth. For example, it was found that rich (compared to non-rich) people received higher first offers in business negotiations (Maaravi & Hameiri, 2019) when they displayed wealth through their cars. However, one might question if this pattern would hold true if other wealth cues were used. A model that captures the full complexity of wealth cues for the rich could help to check if some wealth cues trigger different psychological processes than others, to systematize the results, and to generate theories about the perception of the rich.

Third, we assume that such a model can reveal specific wealth cue profiles when it is used to examine different subgroups of rich people. That is, using a comprehensive wealth cue model to examine subgroups of rich people could reveal systematic differences between subgroups in terms of the specific sets of cues that are seen as characteristic for indicating wealth of these groups. For example, individuals might think that some wealth cues (e.g., charismatic appearance) are more indicative for some rich subgroups (e.g., entrepreneurs) than for others (e.g., lottery winners). This proposition will be tested in Study 3.

Study overview

The present research aims at identifying subjective wealth cues and describing the structure (the interrelations) of wealth cues (Pilot Study and Studies 1–2). Furthermore, in Study 2, we aimed to replicate the structure of the wealth cue model for participants from Germany and the USA. Lastly, Study 3 tests the practical usefulness of the developed model by testing whether individuals ascribe different wealth cues to two different subgroups of the rich. We hypothesize that individuals have different stereotypes about competence and valence of these rich subgroups which leads to different evaluations. Based on this assumption, we predict different wealth cue profiles of these rich subgroups.

The structure of the studies is as follows: In a Pilot Study, we identify wealth cues by asking participants qualitatively via an open answer format for their opinion, what cues they use to identify rich people. Importantly, wealth cues were not predefined by us, but participants were asked to generate subjectively valid cues through free association (i.e., qualitatively). Building on these wealth cues, Study 1 then examines the underlying structure of latent factors behind these wealth cues via an exploratory factor analysis (EFA). In Study 2, we validate the factor structure identified in Study 1 by means of a confirmatory factor analysis (CFA). In this study, we also validate the model for participants from Germany and the USA. Importantly, in these studies, we do not specify any group of rich people in particular but ask for the group of the rich more generally to develop a model that can be applied more broadly. The rationale is that we assume that the content and the structure of such a model is applicable for many rich subgroups although the agreement to certain wealth cues might be higher for some rich subgroups than for others (see Study 3). All analyses were conducted with SPSS 25 and SPSS AMOS 25. Studies 1–3 were pre-registeredFootnote 1.

Pilot study

To generate wealth cues, N = 86 psychology students of a German university (Mage = 20.73, SD = 2.31; n = 69 female) were asked to write two sentences in response to each of the following questions: ‘How would you know someone is rich?’, ‘What does a person need to have in order to be recognized as rich?’ and ‘What kind of lifestyle do you need to be recognizable as rich?’ (See Appendix A in the supplements).

We obtained 516 wealth cue replies using this method. One answer was for example: ‘You can tell when someone is not paying attention to his or her budget when he or she goes shopping’. Next, we summarized similar responses into distinct categories and re-formulated the resulting sentences into a standardized format so that the sentences can be clearly understood and in a manner that it is possible for people to directly recognize the cues. Summarizing was done by grouping conceptually similar items according to the abstract category they had in common. For example, cues referring to brand-name shoes or brand-name jackets were grouped into one category labelled ‘expensive clothing’. Most of the resulting wealth cues read as follows: ‘If a person shows/is/has/likes… it is a sign s/he is rich’ or ‘A rich person is…’. One example wealth cue after editing is: ‘If a person goes shopping for fun several times a month (e.g., for clothes, jewelry), it is a sign that s/he is rich’. In a last step, two experts discussed each item for its applicability for the next study. In sum, a list of 67 unique wealth cues emerged.

Study 1

The Pilot Study qualitatively identified wealth cues. Study 1 uses an EFA approach to examine the underlying factor structure of these wealth cues. We refer to the emerging factors as wealth cue dimensions. We first aim to develop an exploratory model that describes the content and the structure of the single cues for the group of the rich which shall be confirmatorily replicated in Study 2. The EFA was chosen to derive a broad but parsimonious model (in terms of number of items) to describe cues that are subjectively related to rich people.

Method

Participants

Two hundred German Amazon mTurkers took part in this online study (n = 40 female). The sample size corresponds approximately to a one-item-three-participants’ ratio. Around 59% of the participants were between 18 and 29 years old and 28% were between 30 and 39 years old. The remaining sample was younger than 20 years old (7%) or older than 40 years (15%).

Procedure

To assess whether individuals would indicate that rich individuals are identifiable based on the 67 wealth cues, we employed the following instruction: ‘Below you are presented with sentences that contain statements about how you can tell or recognize that a person is rich. Please rate to what extent you agree with the following statements using the scale from 1 = ‘do not agree at all’; 7 = ‘strongly agree’. Lastly, participants provided demographic information (sex, age, and household net income).

Results

The procedure that we used for the EFA approach was similar to Rinn et al. (2019). Three items did not meet the criteria of normal distribution (item identifier: AF34, AF38, AF39). These items had skewness and/or kurtosis outside the acceptable range of ± 2 and were removed from further analyses. The remaining 64 items were internally consistent (Cronbach’s α = 0.95) and omitting individual items would not have improved internal consistency. Thus, we kept all items for the further analyses. Next, the Kaiser-Meyer-Olkin test and the Bartlett test of sphericity showed that the data were suitable for an EFA (KMO = 0.87; Bartlett: χ2 [2016] = 7412.22, p < .001). Visual inspection of the scree-plot suggested that approximately four factors were meaningful to interpret and Velicer’s MAP test indicated that four to seven factors were meaningful to interpret. Thus, to avoid using the Kaiser criterion, as suggested by Howard (2016) and to derive as many factors as possible, we moved on by forcing SPSS to derive a seven-factor solution at the beginning.

EFA results and a preliminary CFA

We used a maximum likelihood method with a promax rotation, beginning with a seven-factor solution. We then removed six items due to small communalities (< 0.30), however left two items due to theoretical reasons (these items were reported elsewhere), so we decided to keep them for the next rotation. The next rotation yielded several items that had double loadings, that is items that load on a different factor with a factor loading of > = 0.30. We removed 11 items with double loadings. Due to theoretical reasons, we did not remove two items with double loadings (i.e., we assumed that they might be able to load on emerging factors in the next analysis). We proceeded with the next rotation and again removed eight items due to double loadings. We then reduced the number of factors to first 6 and, after an unsatisfactory final solution, to 5 in order to get a neat factor solution. In the next analysis we again removed five items due to double loadings. We did not remove one item because we again assumed that it might be able to load on emerging factors in the next analysis. After the next analysis, we removed 3 items with double loadings and kept one item because we assumed that they might be able to load on emerging factors in the next analysis. After the next rotation, we found a clear five factor structure. Howard (2016) recommended to rotate the last solution again which however, again yielded double loadings. We removed these items and reduced the factors to four. This solution yielded the final factor solution that was rotated again (see Appendix B in the supplements).

Because first, Factors 1 and 2 had more than twice as many items than Factors 3 and 4, and second, because from a theoretical point of view they seemed to be splitable, we ran separate EFAs for each of these factors to derive sub-factors with fewer items. Appendix C (in the supplements) shows the solution of the EFA procedures. As can be seen there, Factor 1 was split into three and Factor 2 was split into two sub-factors. We labelled Factor 1 ‘high spending willingness’. This factor comprised the sub-dimensions: ‘luxury consumption’ (Factor 1a); ‘expensive hobbies’ (Factor 1b); ‘spontaneous spending’ (Factor 1c). Factor 2, ‘character’ comprised the wealth dimension ‘greedy behavior’ (Factor 2a), which contains visible cues such miserliness or that someone does not like to pay for meals for others. Furthermore, the ‘charismatic behavior’ dimension (Factor 2b) comprises visible cues such as charismatic or extraverted behaviors. Lastly, we labelled Factor 3 ‘self-presentation’ because within factor rich people are described as presenting themselves with status symbols, and we labelled Factor 4 ‘possessions’ because this factor describes that rich people are believed to possess certain material objects.

We decided to apply a CFA to the same dataset as the one we used to build our model for two reasons. Following van Prooijen and van der Kloot (2001), follow-up CFA’s are recommended as a first assessment of whether a model built based on an EFA approach is worth to be validated with a new sample. The aspired generalizability might be compromised (a) because the decision criteria used to extract factors might have been too liberal; (b) because we constructed a higher order structure of the data that cannot be tested via conventional EFA approaches. We used a ML higher order CFA approach. This three-layered structure (see Fig. 1) was supposed to represent the common latent construct of the above-described factors, the Factors 1–4 identified in the EFA, and (3) the sub-factors identified for Factors 1 and 2. These factors (Factor 1; 1a, 1b, 1c; Factor 2: 2a, 2b; Factor 3 and Factor 4) were modelled as latent variables because we assumed underlying (latent) constructs described by the indicators (i.e., our wealth cue items). In this model, the error terms of AF41 and AF13, AF21 and AF50; AF28 and AF53, AF28 and AF01 and AF14 and AF12 were correlated because of similar wording and a somehow overlapping content. Also note that one item (AF24) was removed from the model due to poor factor loading.

In sum, the model fit (χ2[238] = 378.66; p < .001; SRMR = 0.06; CFI = 0.92; RMSEA = 0.05) meets the threshold for acceptable fit that was also used in previous research (e.g., Lai & Green, 2016). Particularly notable is the fact that the three-layered model had a better model fit than a two-layered model (χ2[243] = 471.38; p < .001; SRMR = 0.07; CFI = 0.87; RMSEA = 0.07) that was suggested by the results of the EFA without splitting. This supports the appropriateness of splitting Factor 1 and Factor 2 in the way we have described above. Table 1 shows the descriptives and Table 2 shows the intercorrelations of the final factors. Descriptively, the factors with the highest means are the factors ‘expensive hobbies’ (M = 5.13, SD = 1.23) and ‘possessions’ (M = 4.49, SD = 1.10) while the agreement with the character dimensions ‘greedy behavior’ (M = 3.19, SD = 1.11) and ‘charismatic behavior’ (M = 2.33, SD = 1.21) is less strong.

Discussion

Study 1 provides novel insights regarding the content and the structure of wealth cues. It is noteworthy that some of our wealth cue dimensions share some characteristics with stereotypes of rich people. For example, Ragusa (2015) asked participants to provide stereotypes about rich people and found evidence for a stereotype content similar to our character dimension (greedy behavior; Factor 2a) and possession (Factor 4) dimension. However, in contrast to Ragusa (2015), we asked participants which characteristics they thought would be required to recognize someone as being rich, by which we forced participants to produce cues that are visible from outside. Thus, the character dimension that we described above was not only a non-visible feeling or stereotype of rich people but was summarized from explicitly named cues that are used to recognize rich people.

Notably, the greedy behavior dimension shares similarities with the theoretical conceptualization of greed described by Lambie and Haugen (2019). The authors describe greed as a desire for money, insatiability to gain more, a retention motive, and an excessive desire for more possessions. These characteristics are all present within the greedy behavior dimension that we found, which shows that the greedy behavior dimension as described in our wealth dimension has a good construct validity.

Importantly, the content and structure of our wealth cue dimensions included some aspects that were not identified in previous research, for example the ‘character’ wealth cue dimension ‘charismatic behavior’ (Factor 2a), which shows that rich people are believed to be able to attract others. Another wealth dimension, self-presentation (Factor 3), reflects the notion that people showing off their possessions or costly free-time activities in social media are likely to be perceived as rich. A further wealth dimension is the ‘high willingness to spend’ (Factor 1), with three sub dimensions wealth that also reflect how a rich person is believed to be recognized by the population. That is, it seems that individuals believe that people who have a high willingness to spend money (Factor 1) or to spontaneously spend money (Factor 1c) for hobbies (Factor 1b) and for luxuries (Factor 1a) are rich. Most interestingly, the wealth dimension ‘possessions’ has the highest agreement that the containing wealth cues signal wealth. Even though these wealth cue dimensions are intuitively not surprising, they are only rarely examined in previous research (e.g., Kappes et al., 2021) and our model offers a first insight about the mental organization of wealth cues.

Although we acknowledge that there is a debate about the validity and usability of various fit indices, (i.e., which one is to report and how various fit indices play together, what happens when two indices disagree, e.g., Lai & Green, 2016), we conclude that the model we reported showed an acceptable fit. Regarding the wealth cue agreement, we interpret the results as follows: In the Pilot Study, all single cues were semantically produced such that they can be used to recognize rich people, which justifies that the wealth cues can be referred to as subjectively valid wealth cues. However, when individuals are asked to rate how accurate they are, it seems that some perform better than others. Most participants agree that expensive hobbies are a valid cue to recognize affluence, whereas the charismatic behavior and greed behavior cues are less valid, yet not unusable, indicators of wealth. That is, the descriptives (maxima and standard deviations) indicate that there are some individuals who agree that people who display these cues can be described wealthy. Thus, we assume that our model is suitable to map which cues people perceive as subjectively valid. The following study aimed to validate the structure of the model developed in Study 1.

Study 2

Study 1 provided first evidence for a latent wealth cue construct. However, Study 1 was an exploratory approach that we used to build a theoretical model and we used the same data set to carry out EFAs and a CFA. In the present study we address these concerns and aim to validate the factorial structure that we found in Study 1 by replicating the model. Furthermore, as argued before, it is likely that the validity of wealth cues differs across cultures (e.g., Bonn et al., 1999; Wu et al., 2018), but since individuals form their impression of wealth on the basis of other people around them (Galesic et al., 2018), we assume that the model that we presented in Study 1 would appropriately explain the content and the structure of wealth cues in the western world. If this assumption holds true, we should find an acceptable model fit for individuals from two western cultures that share a similar standard of living such as Germany and the USA. The two countries are described as being individualistic, similarly masculine, and similar in the power distance domain (Hofstede et al., 2010). However, it may well be that individuals from two culturally similar countries have a different wealth concept in mind, which we are also going to test in this study.

Method

Participants

In sum, N = 398 (n = 195 American, n = 203 German) participants took part in an online study via www.prolific.co. The sample size corresponds to a sixteen participants-per-item ratio overall. In this study, n = 172 participants were female (n = 220 male) Footnote 2 and 46% of the participants were between 20 and 29, 25% were between 30 and 39 and 12% were between 40 and 50 years old.

Material and Procedure

The procedure was the same as in Study 1. This time, we collected data about the 24 items that remained after the EFA in Study 1. Furthermore, to use the items in the USA, a native speaker translated the items to English, and we translated them back to German. We then checked if the wording and the meaning of these back-translated items matched the original and corrected the English versions accordingly if they did not. Additionally, to check if the mean scores of each dimension matched the subjective importance of each dimension to recognize rich people, we asked participants to rank the dimensions using a flashcard method. That is, we provided participants with seven virtual flashcards with the names of each dimension as a heading and the descriptions below. The ranking order placed the most important element atop, that is, the first rank was given to the most important dimension to recognize someone as rich, seventh rank was assigned to the least important dimension.

Results

In line with the pre-registration, we examined whether the model developed in Study 1 could be replicated for German and US-American participants. Results indicated first an acceptable model fit overall participants (χ2[238] = 737.29, p < .001, SRMR = 0.07; CFI = 0.91; RMSEA = 0.07). Splitting the samples by country (see Fig. 2) showed that both models had an acceptable fit. The model fit for the German sample was χ2(216) = 445.79, p < .001, SRMR = 0.08; CFI > 0.90; RMSEA = 0.07, and for the American sample was χ2(216) = 589.72, p < .001, SRMR = 0.07; CFI > 0.90; RMSEA = 0.09. This validates our assumption that the content and the structure of the models is similar for two western countries.

To test whether individuals from both countries have a similar wealth cue concept in mind (i.e., whether the model is measurement invariant), we conducted a factorial invariance analysis and tested for metric invariance (Crowson, 2020). Results indicated that the χ2 difference between the more and the less restrictive models was significant χ2(23) = 69.8, p < .001. This indicates that the measurements are not measurement invariant.

The by-country descriptive statistics for the aggregated dimensions are displayed in Table 3, and the intercorrelations averaged over all participants are displayed in Table 4. The descriptives for the single items in Studies 1 and 2 can be found in Appendix E (in the supplements). Furthermore, exploratory analyses examining whether individuals from the two countries differ in their agreement that the wealth cues can be used to identify rich people can be found in Appendix F in the supplements.

Briefly, on average, the agreement to the factors ‘expensive hobbies’ and ‘possessions’ was descriptively higher than for the character sub-factors ‘greedy behavior’ and ‘charismatic behavior’. The intercorrelations show that all dimensions and sub-dimensions were significantly related to each other with at least a medium effect size (see Table 4). Notably, the rank order of the average dimension scores matched the flashcard ranking (see Table 3). That is, participants ranked ‘expensive hobbies’ first, and this dimension also had the highest average score. The dimension ‘charismatic behavior’ was ranked last, and the average agreement score was lowest.

Discussion

These results replicated the wealth cue model and indicate the existence of a latent wealth construct that might represent an overall image of how rich people look like – not only for the German but also for the American sample. We thus found evidence for the assumption that two countries that are similar on many cultural dimensions (Hofstede et al., 2010) share a similar mental structure of wealth cues. Notably however, although the structure of wealth cues was similar for participants from both countries, results from a factorial invariance analysis suggested that individuals from both countries differ regarding the underlying wealth cue concept. This suggests that there is a certain degree of context dependency in the perception of richness on the basis of wealth cues that is influenced by culture.

The finding that the flashcard ranking matched the scores of the Likert-scale ratings has two important implications for the present research: First, it showed that the wealth cues can be ranked in their subjective agreement with different measurement methods. This speaks for a high reliability of the wealth cue dimensions. Second, it showed that although we collected data on a crowdsourcing platform, the data quality was good. Participants conscientiously dealt with the questionnaire and took it seriously.

Study 3

In the previous studies, we found evidence for wealth cue dimensions that describe how individuals identify rich people. The following study aims to demonstrate the usefulness of the newly developed model by examining the extent to which different rich subgroups are perceived differently. In particular, we want to find out whether the model, which aims to capture the wealth cues of rich individuals as a whole, would potentially be able to capture rich subgroups as well. We argue that this is important because earlier research showed that the rich are not a homogenous group, but they are rather a diverse group with several subgroups. For example, there are different subgroups of rich people that differ in how they acquired their wealth.

Evidence suggests that individuals evaluate the rich differently depending on whether they acquired their wealth through their own efforts (internal means) or by chance or luck (external means) (Kirby, 1999; Sussman et al., 2014; Wu et al., 2018; Zitelmann, 2020). Rich people who acquired their wealth via internal means (e.g., entrepreneurs or CEOs) are rated to have more positive personality traits than individuals who acquired their wealth through external means (e.g., lottery winners or heirs; Sussman et al., 2014; Wu et al., 2018). Furthermore, rich people who acquired their wealth via internal means are seen as being more competent (Wu et al., 2018) and are evaluated more positively (Kirby, 1999; Zitelmann, 2020) than people who acquired their wealth via external means. The latter are typically seen as being lavish and lazy (Kaplan, 1987).

This line of research suggests that there are at least two (non-orthogonal) stereotype dimensions (competence and valence) that capture the essence of why rich subgroups are perceived differently. In Study 3, we hypothesized that these competence/valence stereotypes would make different wealth cue dimensions salientFootnote 3. Specifically, we hypothesized that different subgroups of the rich are characterized by different wealth cue dimensions. If there are indeed systematic differences in what wealth cues individuals attribute to rich individuals of different subgroups of the rich, then it should be possible to identify subgroup-specific wealth cue profiles.

To examine this, we assumed the following: By forming an impression about others, people tend to categorize individuals as being a member of a specific social group and check if these individuals have certain characteristics that are typical of the group (e.g., Macrae & Bodenhausen, 2000). For subgroups of rich people, it was found that people who got rich via internal means were perceived more positively, more likeable (Kirby, 1999; Sussman et al., 2014) and more competent (Sussman et al., 2014; Wu et al., 2018) than individuals who acquired their wealth via external means. Thus, these characteristics go along with individuals who earned their money through their own work. Accordingly, it can be assumed that participants rate wealth cues that reflect competence as being predictive of somebody’s membership in the rich subgroup of persons who acquired their wealth via external (compared to internal) means. Analogously, wealth cues that signal negative (compared to positive) valence should be more predictive of someone belonging to the group of persons who acquired their wealth externally (compared to internally).

We expected that the seven wealth cue dimensions from Study 2 are differentially important for recognizing ‘internally’ versus ‘externally’ rich. The first dimension is ‘high spending willingness’ and can be further split up into the three wealth cues ‘luxury consumption’, ‘expensive hobbies’, and ‘spontaneous spending’. Thus, it seems that individuals attribute wasteful spending to the overall group of rich people. Compared to this, individuals with internal wealth sources are seen as competent because they worked hard for their status and wealth (Sussman et al., 2014; Wu et al., 2018). Additionally, being frugal might be seen as a skill that is helpful in accumulating wealth. So, persons who acquired their wealth by internal means should be rated as being more competent in dealing with money than people with external wealth sources. Hence, people with internal wealth sources should be assigned greater thrift, and consequently rated lower than people with external wealth sources on the dimension ‘high spending willingness’ (H1). This is analogously true for the three wealth cue dimensions (Hypothesis 1a [H1a]: luxury consumption; H1b: expensive hobbies; H1c: spontaneous spending).

The second dimension is ‘character’ and involves the two wealth cue dimensions ‘greedy behavior’ (negative valence) and ‘charismatic behavior’ (positive valence). According to the valence levels, we expected people with internal wealth sources to be rated lower concerning ‘greedy behavior’ compared to people with external wealth sources (H2a) and higher concerning ‘charismatic behavior’ (H2b).

Another wealth cue dimension is ‘self-presentation’. Since self-presentation has positive (e.g., brave) as well as negative (showing off) aspects, we did not assign it clear positive or negative valence (the items appeared neutral in valence). Hence, we had no hypothesis about the agreement with the wealth cues summarized in this dimension. The items of the self-presentation dimension are also formulated rather neutrally regarding the competence dimension. Therefore, we refrained from positing a specific hypothesis on how internal vs. external means of wealth acquisition would affect self-presentation ratings. The corresponding analysis should be treated as exploratory.

For the last wealth cue dimension, ‘possessions’, there was also no clear valence, nor did it clearly indicate competence or the opposite thereof. As both individuals with internal wealth sources and those with external wealth sources would typically fulfill the requirement of having the kind of money to attain possessions, we expected comparable ratings for both groups on this dimension (H3). Thus, the confidence interval of the mean comparison for ‘possessions’ should include 0 and the associated p-value of the t-test should exceed p = .100.

Method

Participants

We collected data from a convenience sample (N = 100 Germans, n = 11 had to be excluded due to pre-registered criteria) online (n = 63 female). Participants were on average M = 29.52 years old (SD = 12.44). Many participants were students (n = 63).

Material and Procedure

In this within-subjects experimental design, participants were shown four vignettes. Two of them described people who acquired their wealth via internal means (i.e., a CEO and an entrepreneur) and two of them described people who acquired their wealth via external means (i.e., an heir and a lottery winner). Source of wealth (internal vs. external means) is the independent variable. The vignettes were shown in a randomized order and were inspired by a previous study (Sussman et al., 2014) but they have been translated into German and adapted for improved comprehensibility. The vignettes were pre-tested to show that people who acquired their wealth internally (compared to externally) were perceived as being more competent (N = 124; F[1,123] = 1122.76, p < .001, ηpart2 = 0.90)Footnote 4.

The dependent variables were the scale values on the dimensions that we reformulated to test our hypotheses (see above). We instructed participants to indicate whether they would agree that the person in each vignette displays the characteristics described in the wealth cues, on a scale from 1 (do not agree at all) to 7 (fully agree). One example from the luxury consumption wealth cue is ‘this person always wears the latest fashion’Footnote 5.

Since we assumed that people who acquired their wealth via internal would be rated as more positive than those rich by external means, we asked participants to evaluate the likeability of the four rich persons using the following question: ‘You have now ‘met’ four different people. If you had to spend an evening with one of the four people described, which one would you choose?’. We further collected demographic variables and for exploratory purposes a German version of a just world belief scale (not reported here).

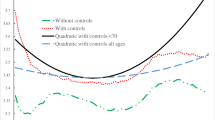

Results

We first calculated mean scores for each wealth dimension. We then averaged mean scores for each dimension across the two vignettes that described individuals with internal versus external wealth sources. To test our hypotheses H1-H3, we conducted a 7 (wealth dimension) X 2 (source of wealth) repeated measurement ANOVA. Results (see Fig. 3) showed significant main effects of both wealth cues (F[6,528] = 41.76, p < .001, ηpart2 = 0.32) and source of wealth (F[1,528] = 43.07, p < .001, ηpart2 = 0.33). Most importantly, however, the interaction between the wealth cues and wealth source was significant (F[6,528] = 48.36, p < .001, ηpart2 = 0.35). Simple slope analyses via paired-sample t-tests showed that, as predicted, individuals who acquired their wealth via internal means, compared to those with external means, were rated as engaging in less luxury consumption (H1a, t[88] = -6.06, p < .001, d = -0.64) and as having fewer expensive hobbies (H1b, t[88] = -5.99, p < .001, d = -0.63). Furthermore, they were seen as less likely to spontaneously spend money (H1c, t[88] = -9.86, p < .001, d = -1.05), less greedy behavior (H2a, t[88] = -4.45, p < .001, d = -0.47), and more charismatic behavior (H2b, t[88] = 5.46, p < .001, d = 0.58). The exploration showed that people who acquired their wealth via internal (vs. external) means were perceived as engaging in less self-presentation (t[88] = -6.74, p < .001, d = -0.72). Furthermore, we unexpectedly found that they were perceived as having more possessions than people who acquired their wealth via external means (H3, t[88] = 4.54, p < .001, d = 0.48).

Validating previous findings (Kirby, 1999), a chi-square test shows, as predicted, that participants would rather spend time with people who acquired their wealth via internal than via external means, χ2(1) = 38.44, p < .001. Results showed that n = 81 participants would rather spend time with the CEO (n = 26), or the entrepreneur (n = 55) compared to n = 19 who would spend time with the lottery winner (n = 12) or the heir (n = 7), which speaks for the assumption that the former were perceived as being more positive in valence than the latter.

Lastly, we test intra-class correlations among the vignettes by testing whether participants rated the wealth cues similarly depending on the source of wealth that was described in the vignettes. The intra-class correlations can be rated as average with ICC = 0.502 in the condition where the target person earned their wealth by hard work and ICC = 0.521 in the condition where the target person earned their wealth by external means. Thus, the vignettes were somewhat similar but also produced inter-individual variance.

Discussion

Study 3 tested whether wealth cues related to competence and valence of rich subgroups are distinctly predictive for individuals who acquired their wealth via internal means (e.g., a CEO) compared to external means (i.e., a lottery winner) which leads to specific wealth cue profiles. As predicted, wealth cue dimensions associated with lower competence (like a high generalized willingness to spend) were perceived as more descriptive of people who acquired their wealth via external means. We assume that a common belief is that it is unlikely that individuals can get rich via internal means only when they display a certain degree of competence or in simpler terms: incompetent people cannot get rich by their own effort. This complements Horwitz and Dovidio (2015) who stated that an important aspect of the perception of the rich is the legitimacy of their wealth.

On the other hand, people who acquired their wealth via internal means were perceived more positively, that is, they were more likeable and had higher ratings in charismatic behavior, than target persons who acquired their wealth through external means. This fits the assumption of Langer (1975) who noted that individual’s belief that ‘good things happen to people who do good things, and bad things happen to people who do bad things’ (Langer, 1975, p. 312). This reasoning and our empirical findings align with prior research on stereotypes about different subgroups of the social category of the rich that show that individuals who earned their wealth via internal (compared to external) mean are evaluated more positively (Sussman et al., 2014; Wu et al., 2018).

Regarding our exploratory finding, we found that participants evaluated the target persons who acquired their wealth via external (compared to internal) means to have a higher engagement in self-presenting behavior. Since people who acquired their wealth via external means are perceived more negatively than the other group, it might be that despite the neutral wording of the items, this dimension is perceived negatively as bragging behavior. This would explain why the more positively rated people with internal wealth sources were rated lower on this dimension compared to those with external wealth sources.

An explanation for the unexpected result concerning the ‘possessions’ dimension (H4), it could be that although the items included in this dimension were neutrally formulated (in terms of valence), the items wereperceived to contain a positive connotation as they depict desirable objects. Accordingly, the rich prototype with internal wealth sources was rated more positively and higher on the ‘possessions’ items than the person with external wealth sources. Furthermore, the single wealth cues could be taken to indicate competence to some extent (e.g., caring about a healthy lifestyle and taking care of finances). This could be associated more strongly with the internal wealth source prototype, which was generally perceived as more competent. Taken together, this study confirmed that the evaluation of the relative importance of different wealth cue dimensions for recognizing somebody as rich was at least partly based on stereotypes about distinct subgroups of rich people (Wu et al., 2018).

General discussion

We examined the content and the structure of wealth cues, which are a part of the rich stereotype. So far, research has either asked participants to reproduce stereotypes about the rich without focusing on visible cues (e.g., Ragusa, 2015) or made a pre-selection of wealth cues (e.g., Bertram-Hümmer et al., 2015). But it remained unclear if these approaches appropriately reflect the full range of wealth cues and how these cues can be structured to aptly describe the mental representation of the latent wealth construct. Our work addressed this gap in the literature. We systematically studied wealth cues generated by participants through free association, rather than predefined attributes that qualify a person as rich. Our studies thereby added important novel insights to our understanding of the range of attributes taken to indicate wealth, and how these wealth cues are organized to form one complex cognitive representation of the social category of the rich.

First, regarding the content, the present research revealed subjective wealth cues that were rarely studied so far. To our knowledge, there are no studies that examined the role of charismatic behavior and only few that examined greedy behavior in the subjective perception of wealth in other people. One reason might be that traits in general are hard to observe and to operationalize. Greedy behavior might be overlooked, possibly because stereotypes about the rich are mainly positive (Christopher & Schlenker, 2000; Ragusa, 2015). Furthermore, we are also not aware of any study that examined the role of wasteful behavior in rich people, as indicated by the spontaneous spending dimension. Although there is one recent study that developed a ‘spending implies wealth belief scale’ (Kappes et al., 2021), our spontaneous spending dimension is more differentiated as it contains three sub-dimensions that are more specific about what individuals shall spend their money on to be identifiable as rich. Thus, contrary to earlier studies (e.g., Bertram-Hümmer & Baliki, 2015; Kappes et al., 2021; Ragusa, 2015), our research provides a validated model of various wealth cues.

Our wealth cue model also shows some parallels with earlier research regarding the content. We confirmed the prior findings that rich people are recognized by specific possessions (e.g., Bertram Hümmer et al., 2015; Ragusa, 2015). Moreover, we observed that individuals ascribed a high spending willingness (luxury consumption, expensive hobbies) to the rich, which is somewhat in line with what Maaravi and Hameiri (2019) have found in their examination of the influence of wealth cues (e.g., cars) on first offers in business negotiations. Based on their findings that wealth cues go along with high first offers, it may be concluded that individuals believe that rich people are more willing to spend than people who do not show such cues. In addition, our results further showed that rich people are also thought to have different looks because they present themselves with different symbols compared to people who are not rich (Gillath et al., 2012). And although some wealth cue dimensions do not appear to be new, or intuitively surprising, the present results allow a broader understanding of their meaning (i.e., their content) and yield possible operationalizations of the wealth cue dimensions.

Regarding the structure, our wealth cue model indicates that wealth cues cluster around latent dimensions just like stereotypes of the rich and other subgroups of the society do (Kornadt & Rothermund, 2011; Ragusa, 2015). Furthermore, the results indicate an overall latent factor that may reflect how individuals imagine how a rich person looks like. This is in line with the assumption that several directly observable cues combined serve as a lens through which it is possible to infer an underlying latent construct of wealth (Asendorpf, 2018; Brunswik, 1956). Notably however, results from a factorial invariance analysis show that although the structure of wealth cues is similar for participants in Germany and the USA, it seems that the abstract concept of what is typical for a rich person differs in both countries. We speculate that the different wealth concepts stem from different observations of conspicuous consumption behavior of rich people in Germany and the USA.

Regarding the wealth cue profiles, we found that some wealth cues are more indicative for people who acquired their wealth via internal compared to external means than other wealth cues. So far, studies that examined these subgroups of the rich (e.g., Sussman et al., 2014; Wu et al., 2018) have only investigated the likeability of those rich groups (Sussman et al., 2014), for example with the use of stereotypes from the stereotype content model (Sarkar et al., 2020; Wu et al., 2018). In contrast to this, Study 3 revealed that people relate specific behaviors and use different wealth cues to identify these rich subgroups, because the subgroups are seen as differently competent and likeable. The results revealed that wealth cues can be distinguished in their perceived valence and competence which shows that the developed wealth cues have a good predictive validity.

Limitations

The wealth cues that were generated in the Pilot Study stem from students and two experts in this research area. It is thereby possible that there could be further relevant wealth cues that were not covered through our sample and could in the future be included by asking participants from other classes of society. Moreover, our research is likely to be subject to cultural dependency (Bonn et al., 1999) because wealth cues might differ across cultures (especially within the ‘possessions’ domain), meaning that depending on the cultural background, different cues are believed to indicate that a person is rich. Furthermore, this study relied on semantic descriptions of participants and what cues they use to identify rich people. Research has shown that individuals, however, can identify affluence based on non-verbal cues that did not show up in the verbal descriptions of the participants (such as positive affect, Bjornsdottir & Rule, 2017). Thus, it seems that there are cues that are hard to verbalize but that still are used to identify the rich.

Directions for future research

Our studies provide a broader understanding of the content and the structure of wealth cues. Future research might examine whether the wealth cues that we identified here are ecologically valid cues of rich people. Brunswik’s (1956) lens model might be a framework for such research. Furthermore, we found that although the wealth cue structure was similar among two countries that share a similar living standard, there were systematic differences regarding the relative importance of individual cues. This prompts further cross-cultural research regarding the perception of wealthy people.

Furthermore, Maaravi and Hameiri (2019) showed that individuals received higher first offers in business negotiations when they were perceived being rich. Given the insights from our studies, there is now a set of cues that are related to rich people that goes beyond money and single indicators of wealth (or status), such as cars or leather-bound books. It may be an interesting avenue for future research to experimentally manipulate these wealth cues to check which of them are most important for certain behaviors related to wealthy people.

Implications

The findings of our studies are relevant for theories on the perception of wealth since they suggest that wealth cues are not ‘absolute’. That is, people differ to some extent regarding what wealth cues they deem to be indicative of richness (see e.g., the results of the pilot study), the country of origin seems to make a difference in what kind of wealth cue concept people have in mind, and wealth cues differ depending on what subgroups of rich people individuals think of. Thus, the stereotype activation and the subsequent judgement of others is not only subject to visible cues but also the context in which these cues are presented (Macrae & Bodenhausen, 2000).

The findings of our studies are also of practical relevance. One major implication for individuals working as legal decision makers (e.g., political decision makers or judges) is the following: Earlier research has shown that wealth triggers social expectations (e.g., Götte, 2015). Since wealth cues might be used to categorize someone being rich, individuals who display such cues are admired by others as they are also perceived as competent (Wu et al., 2018) and assumed to have desirable personality traits (Christopher & Schlenker, 2000; Leckelt et al., 2019) that lead to great social advantages. A recent paper for example, reports on a court case in the USA which involved two comparable crimes (two juveniles who drove drunk and killed pedestrians) (Weiner & Laurent, 2021). One of the two cases was committed by a poor person and the other was committed by a rich person. In both cases, the attorneys used the same defense strategy. Notably, however, the rich defendant was sentenced to only 10 years’ probation whereas the poor defendant was sentenced to 20 years’ imprisonment. It seems as if the presence (or absence) of wealth cues leads to certain decisions that are at risk to turn out to be unfair probably because judges ascribe more positive personality traits to rich individuals than to poorer ones. We therefore recommend that individuals who work in legal decision-making contexts should be aware of the existence of such social class stereotypes and try to counteract against them to not be at risk to make unfair decisions.

For researchers who aim to examine the perception of wealthy people, the model that we developed indicates what cues individuals use to identify rich people. Thus, there is now a set of replicated wealth cues that might help to categorize earlier research. Furthermore, these wealth cues might serve as dependent variables in future studies like we used them in our Study 3, or to measure perceived wealth without directly asking individuals how much money this person earns or how rich they are.

There are also implications for the legislative branch. As outlined above, there is no uniform definition of wealth and research demonstrates that individuals form their impression of wealth and probably wealth cues based on other people around them (Galesic et al., 2018). Thus, debates (e.g., about whom to tax) are prone to be influenced by individuals with whom a person interacts on a regular basis and not by uniform definitions. When addressing, for instance, tax or social security reform, legislators should clearly define who the rich are before they start to talk about them. Otherwise, it is likely that they disadvantage certain social classes because they base their reasoning on their own experiences or on wealth cues that might be perceived differently depending on one’s own social standing.

Summary and conclusion

Although wealth is an important topic that even the ancient philosophers already dealt with, it is relatively understudied in psychology. Understanding the perception of wealth, however, is important since our (political) attitudes and behaviors are heavily influenced by perceptual and social cognition processes. The present research provides a new model of wealth cues that are subjectively related to the rich in two western societies. Between these culturally similar countries, wealth cues may differ in their subjective validity to indicate affluence but not in terms of their underlying structure and relation to the latent construct of wealth. In addition, the findings showed that subgroups of rich people are characterized by different wealth cue profiles, presumably because individuals have different stereotypes about these groups.

CFA model from Study 1. Note. All paths were significant at the p < .001 level. The error terms were not significantly correlated (all ps > 0.07). Factor explanation: F1: ‘high spending willingness’. F1a: ‘luxury consumption’; F1b: ‘expensive hobbies’; F1c: ‘spontaneous spending’; F2: ‘character’; F2a: greedy behavior’; F2b: ‘charismatic behavior’; F3: ‘self-presentation’; F4: ‘possessions’

Results of the CFA in Study 2. Note. Figure 2A shows the model for the German sample. In the German sample, the following error terms were significantly correlated: AF41 and AF13 (B = 0.213, SE = 0.103, p = .038), and AF28 and AF01 (N = − .278, SE = 0.183, p < .001). No other error terms were significantly correlated in the German sample (all ps > 0.128). Figure 2B shows the model for the American sample. The following error terms were significantly correlated in the American sample: AF28 and AF53 (B = − 0.632, SE = 0.206, p = .002), AF14 and AF12 (B = 0.511, SE = 0.13, p < .001), and AF28 and AF01 (B = − 0.436, SE = 0.201, p = .030). In the American sample, no other error terms were significantly correlated (all ps > 0.445)

Data Availability

The pre-registrations can be found here:

Study 1: https://doi.org/10.17605/OSF.IO/GP9FA

Study 2: https://doi.org/10.17605/OSF.IO/BCZ6V

Study 3: https://aspredicted.org/um2rb.pdf

Data, material, and supplements can be found here: https://doi.org/10.17605/OSF.IO/A7HC9

Notes

Pre-registrations: Study 1: Study1_PreRegistration, Study 2: Study2_PreRegistration, Study 3: Study3_PreRegistration.

Because there was considerable variability in the studies regarding the sex ratio, we report separate analyses that take sex differences into account in Appendix D in the supplements. Results from a MANOVA show that there were no sex differences in the subjective importance of the wealth cues in Study 1. However, in Study 2, there were sex differences regarding the character dimension: Greedy behavior and charismatic behavior were more important for males than females to identify a rich person.

Note that for the present research we assumed that valence is a different attribute than the warmth construct that was described in the Stereotype Content Model (Fiske et al., 2002). Although warmth and (positive) valence might be partly overlapping, in this research valence refers to behaviors that can be viewed as positive or negative. For example, a person can build a company on their own, which is considered as positive and competent, but not warm. Hence, valence and competence can be related to each other and therefore represent non-orthogonal constructs.

For more information about the data of the pre-study as well as the vignettes themselves, please contact the corresponding author.

Due to technical difficulties, we only collected two of three items of the wealth cue ‘possessions’. AF65 was not collected.

References

Anderson, C., Hildreth, J. A. D., & Howland, L. (2015). Is the desire for status a fundamental human motive? A review of the empirical literature. Psychological Bulletin, 141, 574–601. https://doi.org/10.1037/a0038781

Asendorpf, J. B. (2018). Persönlichkeit: Was uns ausmacht und warum. [Personality: What makes us special and why]. Springer. https://doi.org/10.1007/978-3-662-56106-5

Bertram-Hümmer, V., & Baliki, G. (2015). The role of visible wealth for deprivation. Social Indicators Research, 124, 765–783. https://doi.org/10.1007/s11205-014-0824-2

Bjornsdottir, R. T., & Rule, N. O. (2017). The visibility of social class from facial cues. Journal of Personality and Social Psychology, 113, 530–546. https://doi.org/10.1037/pspa0000091

Bjornsdottir, R. T., & Rule, N. O. (2020). Negative emotion and perceived social class. Emotion, 20, 1031–1041. https://doi.org/10.1037/emo0000613

Bonn, M., Earle, D., Lea, S., & Webley, P. (1999). South African children’s views of wealth, poverty, inequality and unemployment. Journal of Economic Psychology, 593–612.

Brunswik, E. (1956). Perception and the representative design of psychological experiments. Berkeley: University of California Press.

Cheng, J. T., & Tracy, J. L. (2013). The impact of wealth on prestige and dominance rank relationships. Psychological Inquiry, 24, 102–108. https://doi.org/10.1080/1047840X.2013.792576

Christopher, A. N., & Schlenker, B. R. (2000). The impact of perceived material wealth and perceiver personality on first impressions. Journal of Economic Psychology, 21, 1–19. https://doi.org/10.1016/S0167-4870(99)00033-1

Crowson, H. M. (2020). Testing for measurement invariance using AMOS. Downloaded from https://drive.google.com/file/d/1GVi5dqRiScVdxJdJ27LGpP_x_Aixm2o0/

Doob, N., & Gross, C. (1968). Status of frustrator as an inhibitor of horn-honking responses. The Jorunal of Social Psychology, 76, 213–218. https://doi.org/10.1080/00224545.1968.9933615

Fiske, S. T., Cuddy, A. J. C., Glick, P., & Xu, J. (2002). A model of (often mixed) stereotype content: Competence and warmth respectively follow from perceived status and competition. Journal of Personality and Social Psychology, 82, 878–902. https://doi.org/10.1037/0022-3514.82.6.878

Galesic, M., Olsson, H., & Rieskamp, J. (2018). A sampling model of social judgment. Psychological Review, 125, 363–390. https://doi.org/10.1037/rev0000096

Garcia, S. M., Weaver, K., & Chen, P. (2019). The status signals paradox. Social Psychological and Personality Science, 10, 690–696. https://doi.org/10.1177/1948550618783712

Gasiorowska, A. (2014). The relationship between objective and subjective wealth is moderated by financial control and mediated by money anxiety. Journal of Economic Psychology, 43, 64–74. https://doi.org/10.1016/j.joep.2014.04.007

Gillath, O., Bahns, A. J., Ge, F., & Crandall, C. S. (2012). Shoes as a source of first impressions. Journal of Research in Personality, 46, 423–430. https://doi.org/10.1016/j.jrp.2012.04.003

Gino, F., & Pierce, L. (2009). The abundance effect: Unethical behavior in the presence of wealth. Organizational Behavior and Human Decision Processes, 109, 142–155. https://doi.org/10.1016/j.obhdp.2009.03.003

Gino, F., & Pierce, L. (2010). Robin Hood under the hood: Wealth-based discrimination in illicit customer help. Organization Science, 21, 1176–1194. https://doi.org/rsc10900498

Götte, S. (2015). Wahrnehmung von Armut und Reichtum in Deutschland [Perception of poverty and wealth in Germany]. Weimar. aproxima Gesellschaft für Markt- und Sozialforschung.

Hofstede, G., Hofstede, G. J., & Minkov, M. (2010). Cultures and organizations: Software of the mind: Intercultural cooperation and its importance for survival. McGraw-Hill.

Horwitz, S. R., & Dovidio, J. F. (2015). The rich—love them or hate them? Divergent implicit and explicit attitudes toward the wealthy. Group Processes & Intergroup Relations, 20, 1–29. https://doi.org/10.1177/1368430215596075

Howard, M. C. (2016). A review of exploratory factor analysis decisions and overview of current practices: What we are doing and how can we improve? International Journal of Human-Computer Interaction, 32, 51–62. https://doi.org/10.1080/10447318.2015.1087664

Jahng, M. R. (2019). Watching the rich and famous: The cultivation effect of reality television shows and the mediating role of parasocial experiences. Media Practice and Education, 20, 319–333. https://doi.org/10.1080/25741136.2018.1556544

Kaplan, H. R. (1987). Lottery winners: The myth and reality. Journal of Gambling Behavior, 3, 168–178. https://doi.org/10.1007/BF01367438

Kappes, H. B., Gladstone, J. J., & Hershfield, H. E. (2021). Beliefs about whether spending implies wealth. Journal of Consumer Research, 48, 1–21. https://doi.org/10.1093/jcr/ucaa060

Kirby, B. J. (1999). Income source and race effects on new-neighbor evaluations. Journal of Applied Social Psychology, 29, 1497–1511. https://doi.org/10.1111/j.1559-1816.1999.tb00149.x

Kornadt, A. E., & Rothermund, K. (2011). Contexts of aging: Assessing evaluative age stereotypes in different life domains. The Journals of Gerontology: Series B, 66B, 547–556. https://doi.org/10.1093/geronb/gbr036

Kraus, M. W., & Keltner, D. (2009). Signs of socioeconomic status: A thin-slicing approach. Psychological Science, 20, 99–106. https://doi.org/10.1111/j.1467-9280.2008.02251.x

Kraus, M. W., Piff, P. K., Denton, M., Rheinschmidt, R., M. L., & Keltner, D. (2012). Social class, solipsism, and contextualism: How the rich are different from the poor. Psychological Review, 119, 546–572. https://doi.org/10.1037/a0028756

Lai, K., & Green, S. B. (2016). The problem with having two watches: Assessment of fit when RMSEA and CFI disagree. Multivariate Behavioral Research, 51, 220–239. https://doi.org/10.1080/00273171.2015.1134306

Lambie, G. W., & Haugen, J. S. (2019). Understanding greed as a unified construct. Personality and Individual Differences, 141, 31–39. https://doi.org/10.1016/j.paid.2018.12.011

Langer, E. J. (1975). The illusion of control. Journal of Personality and Social Psychology, 32, 311–328. https://doi.org/10.1037/0022-3514.32.2.311

Leckelt, M., Richter, D., Schröder, C., Küfner, A. C. P., Grabka, M. M., & Back, M. D. (2019). The rich are different: Unravelling the perceived and self-reported personality profiles of high-net-worth individuals. British Journal of Psychology, 110, 769–789. https://doi.org/10.1111/bjop.12360

Maaravi, Y., & Hameiri, B. (2019). Deep pockets and poor results: The effect of wealth cues on first offers in negotiation. Group Decision and Negotiation, 28, 43–62. https://doi.org/10.1007/s10726-018-9599-1

Macrae, C. N., & Bodenhausen, G. V. (2000). Social cognition: Thinking categorically about others. Annual Review of Psychology, 51, 93–120. https://doi.org/10.1146/annurev.psych.51.1.93

Ragusa, J. M. (2015). Socioeconomics: Explaining variation in preferences for taxing the rich. American Politics Research, 43, 327–359. https://doi.org/10.1177/1532673X14539547

Rinn, R., Stamov Rossnagel, C., & Lal, T. N. (2019). Development and validation of the counterscript driver questionnaire (CSD-14). Current Psychology. https://doi.org/10.1007/s12144-019-00470-z

Roth, J., Deutsch, R., & Sherman, J. W. (2018). Automatic antecedents of discrimination. European Psychologisthttps://doi.org/10.1027/1016-9040/a000321

Robeyns, I., Buskens, V., van de Rijt, A., Vergeldt, N., & van der Lippe, T. (2021). How rich is too rich? Measuring the riches line. Social Indicators Research, 154, 115–143. https://doi.org/10.1007/s11205-020-02552-z

Sarkar, A., Nithyanand, D., Sella, F., Sarkar, R., Mäkelä, I., Kadosh, C., Elliot, R., A. J., & Thompson, J. M. (2020). Knowledge of wealth shapes social impressions. Journal of Experimental Psychology: Applied. https://doi.org/10.1037/xap0000304

Skafte, D. (1989). The effect of perceived wealth and poverty on adolescents’ character judgments. The Journal of Social Psychology, 129, 93–99. https://doi.org/10.1080/00224545.1989.9711703

Sussman, L., Dubofsky, D. A., Levitan, A. S., & Swidan, H. M. (2014). Good rich, bad rich: Perceptions about the extremely wealthy and their sources of wealth. International Journal of Business and Social Science, 44–58.

Van Prooijen, J. W., & van der Kloot, W. A. (2001). Confirmatory analysis of exploratively obtained factor structures. Educational and Psychological Measurement, 61, 777–792. https://doi.org/10.1177/00131640121971518

Wu, S. J., Bai, X., & Fiske, S. T. (2018). Admired rich or resented rich? How two cultures vary in envy. Journal of Cross-Cultural Psychology, 49, 1114–1143. https://doi.org/10.1177/0022022118774943

Zitelmann, R. (2020). Upward classism: Prejudice and stereotyping against the wealthy. Economic Affairs, 40, 162–179. https://doi.org/10.1111/ecaf.12407

Acknowledgements

We thank our student assistants Kathrin Zimmermann and Laura Pfannstiel for their support in the preparation of the data collection. We thank Dr. Anand Krishna and Patricia Zwikel for their language editing support. The results of the Studies 1–2 were presented in the Social Psychology colloquium at the Wuppertal University in December 2020 and the German SoDoc Workshop 2020.

Funding

The present research did not receive any external funding.

Open Access funding enabled and organized by Projekt DEAL.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Competing Interests

The authors state that they do not have any competing interests and that they did not receive any external funding.

Conflict of interest disclosure

The manuscript is original, not previously published, and not submitted under concurrent consideration elsewhere. No author has a potential conflict of interest. We did not receive specific funding for this work.

Consent to participate

Informed consent was obtained from all individual participants included in the study.

Conflict of interest disclosure

The manuscript is original, not previously published, and not submitted under concurrent consideration elsewhere. No author has a potential conflict of interest. We did not receive specific funding for this work.

Compliance with ethical standards and informed consent

All procedures followed were in accordance with the ethical standards of the responsible committee on human experimentation (institutional and national) and with the Helsinki Declaration of 1975, as revised in 2000. Informed consent was obtained from all participants. Study 2 and 3 were ethically approved by the IRB of the Julius-Maximilians-Universität Würzburg (GZEK 2020-26).

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Rinn, R., Ludwig, J., Fassler, P. et al. Cues of wealth and the subjective perception of rich people. Curr Psychol 42, 27442–27457 (2023). https://doi.org/10.1007/s12144-022-03763-y

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12144-022-03763-y