Abstract

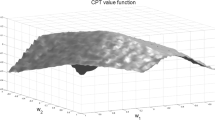

We derive the optimal portfolio choice for an investor who behaves according to Cumulative Prospect Theory (CPT). The study is done in a one-period economy with one risk-free asset and one risky asset, and the reference point corresponds to the terminal wealth arising when the entire initial wealth is invested into the risk-free asset. When it exists, the optimal holding is a function of a generalized Omega measure of the distribution of the excess return on the risky asset over the risk-free rate. It conceptually resembles Merton’s optimal holding for a CRRA expected-utility maximizer. We derive some properties of the optimal holding and illustrate our results using a simple example where the excess return has a skew-normal distribution. In particular, we show how a CPT investor is highly sensitive to the skewness of the excess return on the risky asset. In the model we adopt, with a piecewise-power value function with different shape parameters, loss aversion might be violated for reasons that are now well-understood in the literature. Nevertheless, we argue that this violation is acceptable.

Similar content being viewed by others

References

Abdellaoui M., Bleichrodt H., Paraschiv C.: Loss aversion under prospect theory: a parameter-free measurement. Manag. Sci. 53(10), 1659–1674 (2007)

Allais M.: Le Comportement de l’Homme Rationnel Devant le Risque: Critique des Axiomes et Postulats de l’école Américaine. Econometrica 21(4), 503–546 (1953)

Barberis N., Huang M.: Stocks as lotteries: the implications of probability weighting for security prices. Am. Econ. Rev. 98(5), 2066–2100 (2008)

Baucells M., Heukamp F.: Stochastic dominance and Cumulative Prospect Theory. Manag. Sci. 52(9), 1409–1423 (2006)

Benartzi S., Thaler R.: Myopic loss aversion and the equity premium puzzle. Q. J. Econ. 110(1), 73–92 (1995)

Berkelaar A., Kouwenberg R., Post T.: Optimal portfolio choice under loss aversion. Rev. Econ. Stat. 86(4), 973–987 (2004)

Bernardo A., Ledoit O.: Gain, loss and asset pricing. J. Polit. Econ. 108(1), 144–172 (2000)

Camerer C., Loewenstein G., Rabin M.: Advances in behavioral economics. Princeton University Press, Princeton (2004)

Cascon, A., Keating, C., Shadwick, W.: The Omega Function. The Finance Development Centre. Working Paper (2003)

Davies G.B., Satchell S.E.: The behavioural components of risk aversion. J. Math. Psychol. 51(1), 1–13 (2007)

De Giorgi E., Hens T.: Making prospect theory fit for finance. Financ Mark Portf Manag 20(3), 339–360 (2006)

De Giorgi, E., Hens, T., Levy, H.: Existence of CAPM Equilibria with Prospect Theory Preferences. NCCR-FINRISK Working Paper, no. 85. Available at SSRN: http://ssrn.com/abstract=420184 (2004)

De Giorgi, E., Hens, T., Mayer, J.: A Behavioral Foundation of Reward-Risk Portfolio Selection and the Asset allocation Puzzle. EFA 2006 Zurich Meetings Paper. Available at SSRN: http://ssrn.com/abstract=899273 (2006)

De Giorgi, E., Hens, T., Rieger, M.: Financial Market Equilibria with Cumulative Prospect Theory. Swiss Finance Institute Research Paper, no. 07-21. Available at SSRN: http://ssrn.com/abstract=985539 (2008)

Denneberg D.: Non-Additive Measure and Integral. Kluwer, Dordrecht (1994)

Edwards W.: Subjective probabilities inferred from decisions. Psychol. Rev. 69(2), 109–135 (1962)

Eeckhoudt L., Gollier C., Schlesinger H.: Economic and Financial Decisions Under Risk. Princeton University Press, Princeton (2005)

Ellsberg D.: Risk, ambiguity and the savage axioms. Q. J. Econ. 75(4), 643–669 (1961)

Fellner W.: Distortion of subjective probabilities as a reaction to uncertainty. Q. J. Econ. 75(4), 670–689 (1961)

Fishburn P.: Nonlinear Preference and Utility Theory. The Johns Hopkins University Press, Baltimore (1988)

Genton M.: Skew-Elliptical Distributions and Their Applications: A Journey Beyond Normality. Chapman and Hall/CRC, Boca Raton (2004)

Gollier C.: Optimum insurance of approximate losses. J. Risk Insur. 63(3), 369–380 (1996)

Gollier C.: The Economics of Risk and Time. The MIT Press, Cambridge (2001)

Gomes F.: Portfolio choice and trading volume with loss-averse investors. J. Bus. 78(2), 675–706 (2005)

Handa J.: Risk, probabilities and a new theory of cardinal utility. J. Polit. Econ. 85(1), 97–122 (1977)

Jarrow R., Zhao F.: Downside loss aversion and portfolio management. Manag. Sci. 52(4), 558–566 (2006)

Jin H., Zhou X.Y.: Behavioral portfolio selection in continous time. Math. Finance 18(3), 385–426 (2008)

Kahneman D., Tversky A.: Prospect theory: an analysis of decision under risk. Econometrica 47(2), 263–291 (1979)

Keating C., Shadwick W.: A universal performance measure. J. Perform. Meas. 6(3), 59–84 (2002)

Köbberling V., Wakker P.: An index of loss aversion. J. Econ. Theory 122(1), 119–131 (2005)

Merton R.: Lifetime portfolio selection under uncertainty: the continuous-time case. Rev. Econ. Stat. 51(3), 247–257 (1969)

Neilson W.S.: Comparative risk sensitivity with reference-dependent preferences. J. Risk Uncertain. 24(2), 131–142 (2002)

Quiggin J.: A theory of anticipated utility. J. Econ. Behav. 3(4), 323–343 (1982)

Schmeidler D.: Integral representation without additivity. Proc. Am. Math. Soc. 97(2), 255–261 (1986)

Schmeidler D.: Subjective probability and expected utility without additivity. Econometrica 57(3), 571–587 (1989)

Schmidt U., Zank H.: What is loss aversion?. J. Risk Uncertain. 30(2), 157–167 (2005)

Schmidt U., Zank H.: Linear Cumulative Prospect Theory with applications to portfolio selection and insurance demand. Decis. Econ. Finance 30, 1–18 (2007)

Starmer C.: Developments in non-expected utility theory: the hunt for a descriptive theory of choice under risk. J. Econ. Lit. 38(2), 332–382 (2000)

Tversky A., Kahneman D.: Advances in prospect theory: cumulative representation of uncertainty. J. Risk Uncertain. 5(4), 297–323 (1992)

Wakker P.: Separating marginal utility and probabilistic risk aversion. Theory Decis. 36(1), 1–44 (1994)

Wakker P., Tversky A.: An axiomatization of cumulative prospect theory. J. Risk Uncertain. 7(7), 147–176 (1993)

Wang S., Young V.: Ordering risks: expected utility theory versus Yaari’s dual theory of risk. Insur. Math. Econ. 22, 145–161 (1998)

Yaari M.: The dual theory of choice under risk. Econometrica 55(1), 95–115 (1987)

Zank, H.: On probabilities and loss aversion. Theory Decis. (2009). doi:10.1007/s11238-008-9117-z

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Bernard, C., Ghossoub, M. Static portfolio choice under Cumulative Prospect Theory. Math Finan Econ 2, 277–306 (2010). https://doi.org/10.1007/s11579-009-0021-2

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11579-009-0021-2