Abstract

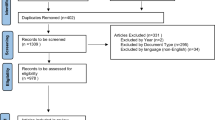

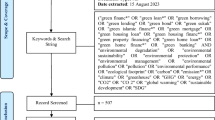

The revolutionary and transformative potential of FinTech has led to the Green Digital Finance Alliance, noting the dawn of a new era of FinTech—“the green FinTech”, yet, surprisingly, the scholarly exploration surrounding climate finance in general and green FinTech and climate FinTech remains restrained. In our attempt to decode the intricate interlinkage between green finance and FinTech, the study wrestles with the theoretical complexity of the “green FinTech” concept through a systematic review of relevant studies and conceptual mapping. We develop a comprehensive grasp of the concept, how to leverage it to combat the pressing climate crisis, and its implications for the FinTech segment—the first of its kind in the scanty green FinTech literature. Based on the PRISMA analysis, we find that green FinTech promotes a green economy through its manifold impact on all aspects of the finance sphere, thereby channelling climate finance and promoting sustainability. It has the power to heighten inclusivity, disclosure, trust, and democratisation, thus reducing information asymmetry and greenwashing. Hence, FinTech integration can be game-changing in eliminating the hurdles before conventional green finance. However, the literature remains fragmented, along with a young, growing green FinTech market. Therefore, this study proposes a framework for future researchers by providing a holistic research agenda to fully integrate “green FinTech” into practical real-world applications.

Similar content being viewed by others

Notes

GDFA is a not-for-profit foundation launched by the United Nations Environment Program (UNEP) and Ant Group at the World Economic Forum that works towards attaining sustainable transition. The GDFA’s green FinTech taxonomy can be accessed at https://www.greendigitalfinancealliance.org/initiatives/green-fintech-classification.

The ESGFINTECH100 list by FinTech Global is an annual list of the top 100 FinTech companies operating in the domain of ESG, available at https://fintech.global/esgfintech100/.

CommerzVentures is a venture capital firm concentrating on Climate FinTech investments, and they have backed climate FinTech like Doconomy and Climate X. Their 2023 Climate FinTech report is accessible at https://commerzventures.com/climatefintech.

Royal Park Partners provides advisory services for FinTechs and releases thematic reports and other insights on FinTech segments, accessible at https://www.royalparkpartners.com/esgfintech.

The KPMG report entitled “How can ESG fintech help financial institutions and their clients drive a net-zero future?” is available at https://singaporefintech.org/publications/. This is a post-event report, which discussed “Decarbonising the Financial Markets with ESG Fintechs”.

How can ESG fintech help financial institutions and their clients drive a net-zero future? https://singaporefintech.org/publications/

References

Abad-Segura E, González-Zamar MD, López-Meneses E, Vázquez-Cano E (2020) Financial technology: review of trends, approaches and management. Mathematics 8(6):951. https://doi.org/10.3390/math8060951

Abhilash Shenoy SS, & Shetty DK (2022) A state-of-the-art overview of green bond markets: evidence from technology empowered systematic literature review. Cogent Econ Financ, 10(1). https://doi.org/10.1080/23322039.2022.2135834

Ali O, Ally M, Dwivedi Y (2020) The state of play of blockchain technology in the financial services sector: a systematic literature review. Int J Inform Manag 54:102199. https://doi.org/10.1016/j.ijinfomgt.2020.102199

Allan BB, Meckling JO (2021) Creative learning and policy ideas: the global rise of green growth. Perspect Polit 21(2):443–461. https://doi.org/10.1017/s1537592721000037

Alt R, Beck R, Smits MT (2018) FinTech and the transformation of the financial industry. Electron Mark 28(3):235–243. https://doi.org/10.1007/s12525-018-0310-9

Anshari M, Almunawar MN, Masri M, Hamdan M (2019) Digital marketplace and FinTech to support agriculture sustainability. Energy Procedia 156:234–238. https://doi.org/10.1016/j.egypro.2018.11.134

Awais M, Afzal A, Firdousi S, Hasnaoui A (2023) Is FinTech the new path to sustainable resource utilisation and economic development? Resour Policy 81:103309. https://doi.org/10.1016/j.resourpol.2023.103309

Bachelet MJ, Becchetti L, Manfredonia S (2019) The green bonds premium puzzle: the role of issuer characteristics and third-party verification. Sustainability 11(4):1098. https://doi.org/10.3390/su11041098

Bajunaied K, Hussin N, Kamarudin S (2023) Behavioral intention to adopt FinTech services: an extension of unified theory of acceptance and use of technology. J Open Innov: Technol, Market, Complexity 9(1):100010. https://doi.org/10.1016/j.joitmc.2023.100010

Barroso M, Laborda J (2022) Digital transformation and the emergence of the Fintech sector: systematic literature review. Digit Bus 2(2):100028. https://doi.org/10.1016/j.digbus.2022.100028

Bayram O, Talay I, Feridun M (2022) Can Fintech promote sustainable finance? Policy lessons from the case of Turkey. Sustainability 14(19):12414. https://doi.org/10.3390/su141912414

Bhandary RR, Gallagher KS, Zhang F (2021) Climate finance policy in practice: a review of the evidence. Clim Policy 21(4):529–545. https://doi.org/10.1080/14693062.2020.1871313

Bhutta US, Tariq A, Farrukh M, Raza A, Iqbal MK (2022) Green bonds for sustainable development: review of literature on development and impact of green bonds. Technol Forecast Soc Chang 175:121378. https://doi.org/10.1016/j.techfore.2021.121378

Biju AKVN, Thomas AS, Thasneem J (2023) Examining the research taxonomy of artificial intelligence, deep learning & machine learning in the financial sphere—a bibliometric analysis. Qual Quant. https://doi.org/10.1007/s11135-023-01673-0

Biju AVN, Kodiyatt SJ, Krishna PPN, Sreelekshmi G (2023) ESG sentiments and divergent ESG scores: suggesting a framework for ESG rating. SN Bus Econ 3(12):209. https://doi.org/10.1007/s43546-023-00592-4

Blakstad S, & Allen R (2018) Green Fintech. FinTech Revolution, 183–199. https://doi.org/10.1007/978-3-319-76014-8_11

Butu HM, Nsafon BEK, Park SW, Huh JS (2021) Leveraging community based organizations and FinTech to improve small-scale renewable energy financing in sub-Saharan Africa. Energy Res Soc Sci 73:101949. https://doi.org/10.1016/j.erss.2021.101949

Cen T, & He R (2018) FinTech, green finance and sustainable development. Proceedings of the 2018 International Conference on Management, Economics, Education, Arts and Humanities (MEEAH 2018). https://doi.org/10.2991/meeah-18.2018.40

Chaklader B, Gupta BB, Panigrahi PK (2023) Analyzing the progress of FINTECH-companies and their integration with new technologies for innovation and entrepreneurship. J Bus Res 161:113847. https://doi.org/10.1016/j.jbusres.2023.113847

Chen Y, & Volz U (2022) Scaling up sustainable investment through blockchain‐based project bonds. Development Policy Review, 40(3). https://doi.org/10.1111/dpr.12582

Cheng X, Yao D, Qian Y, Wang B, Zhang D (2023) How does FinTech influence carbon emissions: evidence from China’s prefecture-level cities. Int Rev Financ Anal 87:102655. https://doi.org/10.1016/j.irfa.2023.102655

Collins C, Dennehy D, Conboy K, Mikalef P (2021) Artificial intelligence in information systems research: a systematic literature review and research agenda. Int J Inf Manage 60:102383. https://doi.org/10.1016/j.ijinfomgt.2021.102383

Cortellini G, Panetta IC (2021) Green bond: a systematic literature review for future research agendas. J Risk Financ Manag 14(12):589. https://doi.org/10.3390/jrfm14120589

Das SR (2019) The future of fintech. Financ Manage 48(4):981–1007. https://doi.org/10.1111/fima.12297

Delina LL (2023) Fintech RE in a global finance centre: expert perceptions of the benefits of and challenges to digital financing of distributed and decentralised renewables in Hong Kong. Energy Res Soc Sci 97:102997. https://doi.org/10.1016/j.erss.2023.102997

Dorfleitner G, & Braun D (2019) Fintech, digitalization and blockchain: possible applications for green finance. Palgrave Studies in Impact Finance, 207–237. https://doi.org/10.1007/978-3-030-22510-0_9

Dwivedi YK, Rana NP, Jeyaraj A, Clement M, Williams MD (2017) Re-examining the Unified Theory of Acceptance and Use of Technology (UTAUT): towards a revised theoretical model. Inf Syst Front 21(3):719–734. https://doi.org/10.1007/s10796-017-9774-y

Dwivedi YK, Hughes L, Kar AK, Baabdullah AM, Grover P, Abbas R, Andreini D, Abumoghli I, Barlette Y, Bunker D, Chandra Kruse L, Constantiou I, Davison R M, De’ R, Dubey R, Fenby-Taylor H, Gupta B, He W, Kodama M,...Wade M (2022) Climate change and COP26: are digital technologies and information management part of the problem or the solution? An editorial reflection and call to action. Int J Inform Manag, 63, 102456 https://doi.org/10.1016/j.ijinfomgt.2021.102456

Fankhauser S, Sahni A, Savvas A, Ward J (2015) Where are the gaps in climate finance? Climate Dev 8(3):203–206. https://doi.org/10.1080/17565529.2015.1064811

Fernandes CI, Veiga PM, Ferreira JJ, Hughes M (2021) Green growth versus economic growth: do sustainable technology transfer and innovations lead to an imperfect choice? Bus Strateg Environ 30(4):2021–2037. https://doi.org/10.1002/bse.2730

Firmansyah EA, Masri M, Anshari M, Besar MHA (2022) Factors affecting Fintech adoption: a systematic literature review. FinTech 2(1):21–33. https://doi.org/10.3390/fintech2010002

Frizzo-Barker J, Chow-White PA, Adams PR, Mentanko J, Ha D, Green S (2020) Blockchain as a disruptive technology for business: a systematic review. Int J Inf Manage 51:102029. https://doi.org/10.1016/j.ijinfomgt.2019.10.014

Green Digital Finance Alliance and Swiss Green Fintech Network (2022) Green Fintech Classification. https://www.greendigitalfinancealliance.org/initiatives/green-fintech-classification. Accessed 20/03/2023

Goldstein I, Jiang W, Karolyi GA (2019) To FinTech and beyond. Rev Financ Stud 32(5):1647–1661. https://doi.org/10.1093/rfs/hhz025

Hickel J, Kallis G (2019) Is green growth possible? New Polit Econ 25(4):469–486. https://doi.org/10.1080/13563467.2019.1598964

Hou H, Wang Y, Zhang M (2023) Impact of environmental information disclosure on green finance development: empirical evidence from China. Environ Dev Sustain. https://doi.org/10.1007/s10668-023-03472-x

Hughes A, Urban MA, Wójcik D (2021) Alternative ESG ratings: how technological innovation is reshaping sustainable investment. Sustainability 13(6):3551. https://doi.org/10.3390/su13063551

Imerman MB, Fabozzi FJ (2020) Cashing in on innovation: a taxonomy of FinTech. J Asset Manag 21(3):167–177. https://doi.org/10.1057/s41260-020-00163-4

Kabaklarlı E (2022) Green FinTech: sustainability of Bitcoin. Digital Finance 4(4):265–273. https://doi.org/10.1007/s42521-022-00053-x

Kollenda P (2022) Financial returns or social impact? What motivates impact investors’ lending to firms in low-income countries. J Bank Finance 136:106224. https://doi.org/10.1016/j.jbankfin.2021.106224

Kong T, Sun R, Sun G, Song Y (2022) Effects of digital finance on green innovation considering information asymmetry: an empirical study based on Chinese listed firms. Emerg Mark Financ Trade 58(15):4399–4411. https://doi.org/10.1080/1540496x.2022.2083953

Kossyva D, Theriou G, Aggelidis V, Sarigiannidis L (2023) Outcomes of engagement: a systematic literature review and future research directions. Heliyon 9(6):e17565. https://doi.org/10.1016/j.heliyon.2023.e17565

Kraus S, Breier M, Dasí-Rodríguez S (2020) The art of crafting a systematic literature review in entrepreneurship research. Int Entrep Manag J 16(3):1023–1042. https://doi.org/10.1007/s11365-020-00635-4

Lai TL, Liao SW, Wong SPS, Xu H (2020) Statistical models and stochastic optimization in financial technology and investment science. Annal Math Sci Appl 5(2):317–345. https://doi.org/10.4310/amsa.2020.v5.n2.a5

Lazaro L, Grangeia C, Santos L, Giatti L (2023) What is green finance, after all? – exploring definitions and their implications under the Brazilian biofuel policy (RenovaBio). J Clim Financ 2:100009. https://doi.org/10.1016/j.jclimf.2023.100009

Lee J, Khan VM (2022) Blockchain and energy commodity markets: legal issues and impact on sustainability. J World Energy Law Bus 15(6):462–484. https://doi.org/10.1093/jwelb/jwac030

Lee CC, Wang F, Lou R, Wang K (2023) How does green finance drive the decarbonization of the economy? Empirical evidence from China. Renew Energy 204:671–684. https://doi.org/10.1016/j.renene.2023.01.058

Lee KJ, & Jeong H (2022) A framework for digitizing green bond issuance to reduce information asymmetry. Econ, Law, Inst Asia Pac, 309–327. https://doi.org/10.1007/978-981-19-2662-4_15

Li Q, Sharif A, Razzaq A, Yu Y (2022) Do climate technology, financialization, and sustainable finance impede environmental challenges? Evidence from G10 economies. Technol Forecast Soc Chang 185:122095. https://doi.org/10.1016/j.techfore.2022.122095

Li B, & Xu Z (2021) Insights into financial technology (FinTech): a bibliometric and visual study. Financial Innovation, 7(1). https://doi.org/10.1186/s40854-021-00285-7

Liberati A, Altman DG, Tetzlaff J, Mulrow C, Gøtzsche PC, Ioannidis JPA, Clarke M, Devereaux PJ, Kleijnen J, Moher D (2009) The PRISMA statement for reporting systematic reviews and meta-analyses of studies that evaluate health care interventions: explanation and elaboration. PLoS Med 6(7):e1000100. https://doi.org/10.1371/journal.pmed.1000100

Liu Y, Chen L (2022) The impact of digital finance on green innovation: resource effect and information effect. Environ Sci Pollut Res 29(57):86771–86795. https://doi.org/10.1007/s11356-022-21802-w

Liu J, Li X, Wang S (2020) What have we learnt from 10 years of fintech research? a scientometric analysis. Technol Forecast Soc Chang 155:120022. https://doi.org/10.1016/j.techfore.2020.120022

Liu Y, Zhao C, Dong K, Wang K, Sun L (2023) How does green finance achieve urban carbon unlocking? Evid China Urban Clim 52:101742. https://doi.org/10.1016/j.uclim.2023.101742

Luo S, Sun Y, Yang F, Zhou G (2022) Does fintech innovation promote enterprise transformation? Evid China Technol Soc 68:101821. https://doi.org/10.1016/j.techsoc.2021.101821

MacAskill S, Roca E, Liu B, Stewart R, Sahin O (2021) Is there a green premium in the green bond market? Systematic literature review revealing premium determinants. J Clean Prod 280:124491. https://doi.org/10.1016/j.jclepro.2020.124491

Macchiavello E, Siri M (2020) Sustainable finance and fintech: can technology contribute to achieving environmental goals? A preliminary assessment of ‘green fintech’ and ‘sustainable digital finance.’ Eur Comp Financ Law Rev 19(1):128–174. https://doi.org/10.1515/ecfr-2022-0005

Mention AL (2019) The Future of Fintech. Res-Technol Manag 62(4):59–63. https://doi.org/10.1080/08956308.2019.1613123

Migliorelli M (2021) What do we mean by sustainable finance? Assessing existing frameworks and policy risks. Sustainability 13(2):975. https://doi.org/10.3390/su13020975

Mirza N, Umar M, Afzal A, Firdousi SF (2023) The role of fintech in promoting green finance, and profitability: evidence from the banking sector in the euro zone. Econ Anal Policy 78:33–40. https://doi.org/10.1016/j.eap.2023.02.001

Muchiri MK, Erdei-Gally S, Fekete-Farkas M, Lakner Z (2022) Bibliometric analysis of green finance and climate change in post-paris agreement era. J Risk Financ Manag 15(12):561. https://doi.org/10.3390/jrfm15120561

Muganyi T, Yan L, Sun HP (2021) Green finance, fintech and environmental protection: evidence from China. Environ Sci Ecotechnol 7:100107. https://doi.org/10.1016/j.ese.2021.100107

Muhammad S, Pan Y, Magazzino C, Luo Y, Waqas M (2022) The fourth industrial revolution and environmental efficiency: the role of fintech industry. J Clean Prod 381:135196. https://doi.org/10.1016/j.jclepro.2022.135196

Mukul E, Büyüközkan G (2023) Digital transformation in education: a systematic review of education 4.0. Technol Forecast Soc Chang 194:122664. https://doi.org/10.1016/j.techfore.2023.122664

Murinde V, Rizopoulos E, Zachariadis M (2022) The impact of the FinTech revolution on the future of banking: opportunities and risks. Int Rev Financ Anal 81:102103. https://doi.org/10.1016/j.irfa.2022.102103

Naz F, Karim S, Houcine A, Naeem MA (2022) Fintech growth during COVID-19 in MENA region: current challenges and future prospects. Electron Commer Res. https://doi.org/10.1007/s10660-022-09583-3

Nenavath S (2022) Impact of fintech and green finance on environmental quality protection in India: by applying the semi-parametric difference-in-differences (SDID). Renew Energy 193:913–919. https://doi.org/10.1016/j.renene.2022.05.020

Nordhaus WD (2011) The architecture of climate economics: designing a global agreement on global warming. Bullet Atom Sci 67(1):9–18. https://doi.org/10.1177/0096340210392964

Nordhaus W (2018) Projections and uncertainties about climate change in an era of minimal climate policies. Am Econ J Econ Pol 10(3):333–360. https://doi.org/10.1257/pol.20170046

Numan U, Ma B, Sadiq M, Bedru HD, Jiang C (2023) The role of green finance in mitigating environmental degradation: empirical evidence and policy implications from complex economies. J Clean Prod 400:136693. https://doi.org/10.1016/j.jclepro.2023.136693

Pang D, Li K, Wang G, Ajaz T (2022) The asymmetric effect of green investment, natural resources, and growth on financial inclusion in China. Resour Policy 78:102885. https://doi.org/10.1016/j.resourpol.2022.102885

Pee L, Pan SL (2022) Climate-intelligent cities and resilient urbanisation: challenges and opportunities for information research. Int J Inf Manage 63:102446. https://doi.org/10.1016/j.ijinfomgt.2021.102446

Popp D (2012). The Role of Technological Change in Green Growth. https://doi.org/10.3386/w18506

Puschmann T (2017) Fintech. Business & Information. Syst Eng 59(1):69–76. https://doi.org/10.1007/s12599-017-0464-6

Puschmann T, Hoffmann CH, Khmarskyi V (2020) How green FinTech can alleviate the impact of climate change—the case of Switzerland. Sustainability 12(24):10691. https://doi.org/10.3390/su122410691

Rejeb A, Suhaiza Z, Rejeb K, Seuring S, Treiblmaier H (2022) The Internet of Things and the circular economy: a systematic literature review and research agenda. J Clean Prod 350:131439. https://doi.org/10.1016/j.jclepro.2022.131439

Ren YS, Ma CQ, Chen XQ, Lei YT, Wang YR (2023) Sustainable finance and blockchain: a systematic review and research agenda. Res Int Bus Financ 64:101871. https://doi.org/10.1016/j.ribaf.2022.101871

Renduchintala T, Alfauri H, Yang Z, Pietro RD, Jain R (2022) A survey of blockchain applications in the FinTech sector. J Open Innov: Technol, Market, Complex 8(4):185. https://doi.org/10.3390/joitmc8040185

Reza-Gharehbagh R, Arisian S, Hafezalkotob A, Makui A (2022) Sustainable supply chain finance through digital platforms: a pathway to green entrepreneurship. Ann Oper Res. https://doi.org/10.1007/s10479-022-04623-5

Ringe WG (2021) Investor-led Sustainability in Corporate Governance. SSRN Electron J. https://doi.org/10.2139/ssrn.3958960

Sahabuddin M, Sakib MN, Rahman MM, Jibir A, Fahlevi M, Aljuaid M, Grabowska S (2023) The evolution of FinTech in scientific research: a bibliometric analysis. Sustainability 15(9):7176. https://doi.org/10.3390/su15097176

Saleem H, Khan MB, Mahdavian SM (2022) The role of green growth, green financing, and eco-friendly technology in achieving environmental quality: evidence from selected Asian economies. Environ Sci Pollut Res 29(38):57720–57739. https://doi.org/10.1007/s11356-022-19799-3

Sandberg M, Klockars K, Wilén K (2019) Green growth or degrowth? Assessing the normative justifications for environmental sustainability and economic growth through critical social theory. J Clean Prod 206:133–141. https://doi.org/10.1016/j.jclepro.2018.09.175

Schalatek L (2012) Democratizing climate finance governance and the public funding of climate action. Democratization 19(5):951–973. https://doi.org/10.1080/13510347.2012.709690

Schmidt L, Apergi M, Eicke L, & Weko S (2023) Who believes in green growth? Strategic framing and technology leadership in the UNFCCC negotiations. Climate Policy, 1–16. https://doi.org/10.1080/14693062.2023.2248061

Schulz K, Feist M (2021) Leveraging blockchain technology for innovative climate finance under the Green Climate Fund. Earth Syst Governance 7:100084. https://doi.org/10.1016/j.esg.2020.100084

Sreelekshmi G, Biju AV (2023a) Exploring the interconnection of FinTech and climate sustainability: scoping through a qualitative methodology. In The sustainable Fintech revolution: building a greener future for finance pp 292–311. IGI Global. https://doi.org/10.4018/979-8-3693-0008-4.ch015

Sreelekshmi G, Biju AV (2023b) Green bonds for mobilising environmental finance: a conceptual framework for a greener economy. In Handbook of research on sustainable consumption and production for greener economies pp 160–177. IGI Global. https://doi.org/10.4018/978-1-6684-8969-7.ch010

Stolbov M, Shchepeleva M (2023) Does one size fit all? Comparing the determinants of the FinTech market segments expansion. J Financ Data Sci 9:100095. https://doi.org/10.1016/j.jfds.2023.01.002

Stroebel J, Wurgler J (2021) What do you think about climate finance? J Financ Econ 142(2):487–498. https://doi.org/10.1016/j.jfineco.2021.08.004

Sun Y, Li S, Wang R (2022) Fintech: from budding to explosion - an overview of the current state of research. RMS 17(3):715–755. https://doi.org/10.1007/s11846-021-00513-5

Taghizadeh-Hesary F, Yoshino N (2019) The way to induce private participation in green finance and investment. Financ Res Lett 31:98–103. https://doi.org/10.1016/j.frl.2019.04.016

Tamasiga P, Onyeaka H, Ouassou EH (2022) Unlocking the green economy in African countries: an integrated framework of FinTech as an enabler of the transition to sustainability. Energies 15(22):8658. https://doi.org/10.3390/en15228658

Tao R, Su CW, Naqvi B, Rizvi SKA (2022) Can Fintech development pave the way for a transition towards low-carbon economy: a global perspective. Technol Forecast Soc Chang 174:121278. https://doi.org/10.1016/j.techfore.2021.121278

Taskin D, Dogan E, Madaleno M (2022) Analyzing the relationship between energy efficiency and environmental and financial variables: a way towards sustainable development. Energy 252:124045. https://doi.org/10.1016/j.energy.2022.124045

Wan S, Lee YH, Sarma VJ (2023) Is Fintech good for green finance? Empirical evidence from listed banks in China. Econ Anal Policy 80:1273–1291. https://doi.org/10.1016/j.eap.2023.10.019

Wang M, Li X, Wang S (2021) Discovering research trends and opportunities of green finance and energy policy: a data-driven scientometric analysis. Energy Policy 154:112295. https://doi.org/10.1016/j.enpol.2021.112295

Wüstenhagen R, Menichetti E (2012) Strategic choices for renewable energy investment: conceptual framework and opportunities for further research. Energy Policy 40:1–10. https://doi.org/10.1016/j.enpol.2011.06.050

Xiao Y, Watson M (2019) Guidance on conducting a systematic literature review. J Plan Educ Res 39(1):93–112. https://doi.org/10.1177/0739456X17723971

Xie J, Chen L, Liu Y, Wang S (2023) Does fintech inhibit corporate greenwashing behavior?-evidence from China. Financ Res Lett 55:104002. https://doi.org/10.1016/j.frl.2023.104002

Yang Y, Su X, Yao S (2021) Nexus between green finance, fintech, and high-quality economic development: empirical evidence from China. Resour Policy 74:102445. https://doi.org/10.1016/j.resourpol.2021.102445

Zarrouk H, El Ghak T, Bakhouche A (2021) Exploring economic and technological determinants of FinTech startups’ success and growth in the United Arab Emirates. J Open Innov: Technol, Market, Complex 7(1):50. https://doi.org/10.3390/joitmc7010050

Zhang Y (2023) Impact of green finance and environmental protection on green economic recovery in South Asian economies: mediating role of FinTech. Econ Chang Restruct. https://doi.org/10.1007/s10644-023-09500-0

Zhang D, Zhang Z, Managi S (2019) A bibliometric analysis on green finance: current status, development, and future directions. Financ Res Lett 29:425–430. https://doi.org/10.1016/j.frl.2019.02.003

Zhang D, Mohsin M, Taghizadeh-Hesary F (2022) Does green finance counteract the climate change mitigation: asymmetric effect of renewable energy investment and R&D. Energy Econ 113:106183. https://doi.org/10.1016/j.eneco.2022.106183

Zhou G, Zhu J, Luo S (2022) The impact of fintech innovation on green growth in China: mediating effect of green finance. Ecol Econ 193:107308. https://doi.org/10.1016/j.ecolecon.2021.107308

Zou Z, Liu X, Wang M, Yang X (2023) Insight into digital finance and fintech: a bibliometric and content analysis. Technol Soc 73:102221. https://doi.org/10.1016/j.techsoc.2023.102221

Acknowledgements

Both authors thank the University of Kerala for the facility of online databases like Web of Science and Scopus. The first author acknowledges the UGC for the Junior Research Fellowship award, and the second author acknowledges the ICSSR for funding the major research project, and the major research project serves as instrumental to this paper.

Funding

The first author is receiving grants from the University Grants Commission( UGC) Junior Research Fellowship( JRF) scheme. The second author receives funding from ICSSR (Indian Council of Social Science Research) for the project titled “The Effect of Investors” Sentiments on Sustainability and ESG Ratings on the Performance of Indian Companies (file No F.No.02/6/2022–23/ICSSR/RP/MJ/GEN).

Author information

Authors and Affiliations

Contributions

SG—conceptualization, data curation, formal analysis, investigation, methodology, validation, visualization, writing, editing, revisions.

AVNB—idea, conceptualization, supervision, funding, investigation, methodology, project administration, validation, visualization, editing, revisions.

Corresponding author

Ethics declarations

Ethical approval

Not applicable. This article does not contain any studies with human participants or animals by any of the authors.

Consent to participate

We, both authors, are informed and voluntarily agree for this submission.

Consent for publication

We, both authors, declare our permission to publish the manuscript titled “Is green FinTech reshaping the finance sphere? Unravelling through a systematic literature review” in the journal Environmental Science and Pollution Research.

Competing interests

The authors declare no competing interests.

Additional information

Responsible Editor: Nicholas Apergis

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Geetha, S., Biju, A.V.N. Is green FinTech reshaping the finance sphere? Unravelling through a systematic literature review. Environ Sci Pollut Res 31, 1790–1810 (2024). https://doi.org/10.1007/s11356-023-31382-y

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-023-31382-y