Abstract

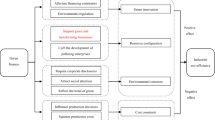

Based on the system theory and Pareto efficiency theory, this paper, based on the data of listed companies in China’s A-share manufacturing industry in 2011–2022, explores the impact of market-driven green finance and government-guided green finance on the carbon emission intensity of manufacturing enterprises, and analyzes the intermediary role of debt financing cost. A negative “U” relationship exists in market-driven green finance/government-guided green finance and the carbon emission intensity of manufacturing enterprises. Further research shows that under the higher debt financing cost, market-driven green finance played a weaker carbon reduction effect. The heterogeneity analysis found that market-driven green finance can have a significant non-linear impact of “promoting growth first and weakening later” on the carbon emissions of energy-saving and environmental protection enterprises, large enterprises, and enterprises with high human capital levels. Government-guided green finance has a significant non-linear impact on non-energy-saving and environmental protection enterprises and small enterprises. This paper provides the theoretical basis and practical inspiration for the government to formulate relevant low-carbon development policies and promote the innovation of green financial tools in the financial market.

Similar content being viewed by others

Data availability

Only publicly available datasets were used for the analysis.

References

Adikari AP, Liu HY, Dissanayake DMSLB, Ranagalage M (2023) Human capital and carbon emissions: the way forward reducing environmental degradation. Sustainability 15(4):2926

Al Mamun M, Boubaker S, Nguyen DK (2022) Green finance and decarbonization: evidence from around the world. Finance research letters 102807.

Bakry W, Mallik G, Nghiem XH, Sinha A, Vo XV (2023) Is green finance really?green??Examining the long-run relationship between green finance, renewable energy and environmental performance in developing countries. Renewable Energy 208:341–355

Benlemlih M, Jaballah J, Kermiche L (2023) Does financing strategy accelerate corporate energy transition?Evidence from green bonds. Bus Strateg Environ 32(1):878–889

Cao J, Law SH, Samad ARBA, Mohamad WNBW, Wang J, Yang X (2022) Effect of financial development and technological innovation on green growth—analysis based on spatial Durbin model. J Clean Prod 365:132865

Chen X, Chen ZG (2021) Can green finance development reduce carbon emissions? Empirical Evidence from 30 Chinese Provinces. Sustainability 13(21):12137

Dai YH, Zhao YH, Lei YW (2023) Do green finance policies increase corporate debt financing costs? Secur Mark Her 4:33–43

Fan HC, Peng YC, Wang HH, Xu ZW (2021) Green through finance? J Dev Econ 152:102683

Fang L, Tang HY (2022) The effect of carbon emissions trading on corporate carbon emission reduction——analysis of quasi-natural experimental methods based on data from Chinese listed companies. J Shaanxi Norm Univ(Philosophy and Social Sciences Edition) 51(05):14–29

Guo JJ, Fang Y (2022) Green credit, financing structure and corporate environmental investment. J World Econ 45(08):57–80

Guo W, Yang B, Ji J, Liu XR (2023) Green finance development drives renewable energy development: mechanism analysis and empirical research. Renew Energy 215:118982

He Y, Liu RZ (2023) The impact of the level of green finance development on corporate debt financing capacity. Finance Res Lett 52:103552

Hu J, Huang N, Shen HT (2020) Can market-incentive environmental regulation promote corporate innovation? A natural experiment based on China’s carbon emissions trading mechanism. J Financ Res 01:171–189

Huang DY, Liu CY, Yan ZH, Kou AJ (2023) Payments for Watershed Services and corporate green innovation. Int Rev Econ Financ 87:541–556

Huang HP, Yi MT (2023) Impacts and mechanisms of heterogeneous environmental regulations on carbon emissions: an empirical research based on DID method. Environ Impact Assess Rev 99:107039. https://doi.org/10.1016/j.eiar.2023.107039

Ji L, Jia P, Yan JS (2021) Green credit, environmental protection investment and debt financing for heavily polluting enterprises. Plos one 16(12):e0261311. https://doi.org/10.1371/journal.pone.0261311

Kathuria V (2006) Controlling water pollution in developing and transition countries-lessons from three successful cases. J Environ Manage 78(4):405–426

Lee CC, Lee CC (2022) How does green finance affect green total factor productivity? Evid China Energy Econ 107:105863

Li TR, Lin H (2023) Regional green finance, spatial spillover and high-quality economic development. Inq Into Econ Issues 04:157–174 (in Chinese)

Li SR, Shao QL (2022) Greening the finance for climate mitigation: an ARDL-ECM approach. Renew Energy 199:1469–1481

Li JC, Wang WW (2022) Who drives corporate risk-taking under environmental regulations: ‘transformation dynamic’ or ‘survival pressure’? China Popul Resour Environ 32(8):40–49

Li WA, Cui GY, Zheng MN (2021) Does green credit policy affect corporate debt financing?Evidence from China. Environ Sci Pollut Res 29(4):5162–5171

Li WQ, Fan JJ, Zhao JW (2022a) Has green finance facilitated China’s low-carbon economic transition? Environ Sci Pollut Res 29(38):57502–57515

Li BH, Huo YD, Yin S (2022b) Sustainable financing efficiency and environmental value in China’s energy conservation and environmental protection industry under the double carbon target. Sustainability 14(15):9604

Li YX, Yu CH, Shi JY, Liu YY (2023) How does green bond issuance affect total factor productivity? Evidence from Chinese listed enterprises. Energy Econ 123:106755. https://doi.org/10.1016/j.eneco.2023.106755

Liang JH, Song XW (2022) Can green finance improve carbon emission efficiency? Evidence from China. Front Environ Sci 10:955403. https://doi.org/10.3389/fenvs.2022.955403

Lin BQ, Tan RP (2019) Economic agglomeration and green economy efficiency in China. Econ Res J 54(02):119–132

Lin MA, Zeng HR, Zeng X, Mohsin M, Raza SM (2023) Assessing green financing with emission reduction and green economic recovery in emerging economics. Environ Sci Pollut Res 30(14):39803–39814

Liu FHM, Lai KPY (2021) Ecologies of green finance: green sukuk and development of green Islamic finance in Malaysia. Environ Plann A-Econ Space 53(8):1896–1914

Liu YW, Yang C, Zhou SC, Zhang YB (2022) Research on the impact of green credit policy on environmental information disclosure. Stat Res 39(11):73–87

Lu J (2021) Can the green merger and acquisition strategy improve the environmental protection investment of listed company? Environ Impact Assess Rev 86:106470

Lyu YW, Bai YY, Zhang JN (2023) Green finance policy and enterprise green development: evidence from China. Corp Soc Responsib Environ Manag 1–19. https://doi.org/10.1002/csr.2577

Qian XS, Tang YL, Fang S (2019) Does reform of the security interests system reduce the cost of corporate debt? Evidence from a natural experiment in China. J Financ Res 07:115–134

Qiao P, Yao X (2020) Will third-party treatment effectively solve issues related to industrial pollution in China? Sustainability 12(18):7685

Ran Q, Yang X, Yan H, Xu Y, Cao J (2023) Natural resource consumption and industrial green transformation: does the digital economy matter? Resour Policy 81:103396

Rasoulinezhad E, Taghizadeh-Hesary F (2022) Role of green finance in improving energy efficiency and renewable energy development. Energy Efficiency 15:14. https://doi.org/10.1007/s12053-022-10021-4

Shi JY, Yu CH, Li YX, Wang TH (2022) Does green financial policy affect debt-financing cost of heavy-polluting enterprises? An empirical evidence based on Chinese pilot zones for green finance reform and innovations. Technological Forecasting & Social Change 179:121678. https://doi.org/10.1016/j.techfore.2022.121678

Song DY, Zhu WB, Wang BB (2021) Micro-empirical evidence based on China’s carbon trading companies: carbon emissions trading, quota allocation methods and corporate green innovation. China Popul Resour Environ 31(1):37–47

Tina Dacin M, Goodstein J, Richard Scott W (2002) Institutional theory and institutional change: introduction to the special research forum. Acad Manag J 45(1):43

Wang YG, Li X (2023) The impact of government R&D subsidies on the green innovation performance of firms. China Ind Econ 02:131–149

Wang XH, Liu JH, Zhao YX (2021a) Effectiveness measurement of green finance reform and innovation pilot zone. Quant Tech Econ 38(10):107–127

Wang XY, Zhao HK, Bi KX (2021b) The measurement of green finance index and the development forecast of green finance in China. Environ Ecol Stat 28(2):263–285

Wang T, Liu XX, Wang H (2022) Green bonds, financing constraints, and green innovation. J Clean Prod 381:135134

Wang J, Wang J, Wang YW (2022b) How does digital finance affect the carbon intensity of the manufacturing industry? China Popul Resour Environ 32(7):1–11

Wang JQ, Tian JX, Kang YX, Guo K (2023) Can green finance development abate carbon emissions: evidence from China. Int Rev Econ Financ 88:73–91

Wei LL, Yang Y (2023) Financial resource misallocation and carbon emission——based on the perspective of green credit. J Northwest Norm Univ 60(03):126–133

Wei Q, Pan Y, Li LJ (2021) A comparative study of corporate emission reduction and social welfare under carbon quota and carbon subsidy policies. South China Finance 02:25–37

Wu CM, Hu JL (2019) Can CSR reduce stock price crash risk? Evidence from China’s energy industry. Energy Policy 128:505–518

Wu AB, Gong XY, Chen CL, Huang H (2023) Risk-taking effects of shadow banking by non-financial firms: Internal mechanisms and empirical evidence. China Ind Econ 04:174–192

Xiao J, Shen LY, Du XY (2023) Exploring the effect of human capital on carbon emissions: evidences from 125 countries. Environ Sci Pollut Res 30(36):85429–85445

Yan C, Bin X, Yuqi H (2023) Do smart services promote sustainable green transformation? Evidence from Chinese listed manufacturing enterprises. Plos one 18(4):e0284452. https://doi.org/10.1371/journal.pone.0284452

Yang X, Wang W, Wu H, Wang J, Ran Q, Ren S (2022a) The impact of the new energy demonstration city policy on the green total factor productivity of resource-based cities: empirical evidence from a quasi-natural experiment in China. J Environ Plann Manage 66(2):293–326

Yang X, Su X, Ran Q, Ren S, Chen B, Wang W, Wang J (2022) Assessing the impact of energy internet and energy misallocation on carbon emissions: new insights from China. Environ Sci Pollut Res 29(16):23436–23460

Yang X, Wang W, Su X, Ren S, Ran Q, Wang J, Cao J (2023a) Analysis of the influence of land finance on haze pollution: an empirical study based on 269 prefecture-level cities in China. Growth Chang 54(1):101–134

Yang QQ, Cui WA, Wang XF (2023b) Integrated development of green finance and green accounting in policy banks. Environ Sci Pollut Res 30(27):70742–70759. https://doi.org/10.1007/s11356-023-27380-9

Yang X, Wang J, Cao J, Ren S, Ran Q, Wu H (2021) The spatial spillover effect of urban sprawl and fiscal decentralization on air pollution: evidence from 269 cities in China. Empir Econ 63:847–875. https://doi.org/10.1007/s00181-021-02151-y

Yu F, Wang XJ, Ma GX, Wang ZQ (2017) Analysis of changes of production and emission of three wastes pollutants and evaluation of environment cost of rare earth refining in Baotou from 2000 to 2013. J Chin Soc Rare Earths 35(4):537–545

Yu YG, Yan YN, Shen PY, Li YT, Ni TH (2022) Green financing efficiency and influencing factors of Chinese listed construction companies against the background of carbon neutralization: a study based on three-stage DEA and system GMM. Axioms 11(9):467

Yu CH, Wu XQ, Zhang DY, Chen S, Zhao JS (2021) Demand for green finance: resolving financing constraints on green innovation in China. Energy Policy 153:112255. https://doi.org/10.1016/j.enpol.2021.112255

Zhang R, Guo XX (2022) Carbon emission trading system and corporate green governance. J Manag Sci 35(06):22–39

Zhang CY, Lin J (2022) An empirical study of environmental regulation on carbon emission efficiency in China. Energy Sci Eng 10(12):4756–4767

Zhang Y, Xing C, Wang Y (2020) Does green innovation mitigate financing constraints? Evidence from China’s private enterprises. J Clean Prod 264:121698

Zhang LY, Huang FM, Lu L, Ni XW, Iqbal S (2021a) Energy financing for energy retrofit in COVID-19: recommendations for green bond financing. Environ Sci Pollut Res 29(16):23105–23116

Zhang SL, Wu ZH, Wang Y, Hao Y (2021) Fostering green development with green finance: an empirical study on the environmental effect of green credit policy in China. J Environ Manag 296:113159

Zhang W, Zhu ZR, Liu XM, Cheng J (2022) Can green finance improve carbon emission efficiency? Environ Sci Pollut Res 29(45):68976–68989

Zhang K, Xiong ZY, Huang XJ (2023) Green bonds, carbon emission reduction effect and high-quality economic development. J Financ Econ 49(06):64–78

Zhao LP, Rao X, Lin QW (2023) Study of the impact of digitization on the carbon emission intensity of agricultural production in China. Sci Total Environ 903:166544

Zhao J, Taghizadeh-Hesary F, Dong KY, Dong XC (2022) How green growth affects carbon emissions in China: the role of green finance. Economic Research-Ekonomska Istraživanja 36:(1)2090–2111. https://doi.org/10.1080/1331677X.2022.2095522

Zheng JL, Jiang YH, Cui YD, Shen Y (2023) Green bond issuance and corporate ESG performance: steps toward green and low-carbon development. Res Int Bus financ 66:102007

Zhou ZF, Dong ZQ, Zeng HX, Xiao YX (2019) Differences of corporate carbon efficiency and its influencing factors: evidence from companies listed S&P500. Manage Rev 31(03):27–38

Acknowledgements

The authors thank the reviewers and editors for their constructive comments. Hope Miss.Zhang can enjoy her studying journey and find the meaning of life.

Funding

This study received financial support from the National Social Science Foundation of China (No. 21XRK007) and the Graduate Research and Innovation Project of Xinjiang Autonomous Regions (XJ2023G009).

Author information

Authors and Affiliations

Contributions

Jiaoning Zhang is the corresponding author. Jiaoning Zhang: visualization, formal analysis, writing—original draft. Xiaoyu Ma: conceptualization, supervision, funding acquisition. Jiamin Liu: review and editing. Sisi Zhang: methodology and data resources. All authors read and approved the final manuscript.

Corresponding author

Ethics declarations

Ethics approval

Not applicable.

Consent to participate

Not applicable.

Consent for publication

Not applicable.

Competing interests

The authors declare no competing interests.

Additional information

Responsible Editor: Nicholas Apergis

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Zhang, J., Ma, X., Liu, J. et al. All roads lead to Rome? The impact of heterogeneous green finance on carbon reduction of Chinese manufacturing enterprises. Environ Sci Pollut Res 30, 116147–116161 (2023). https://doi.org/10.1007/s11356-023-30524-6

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-023-30524-6