Abstract

South Asia is primarily affected by environmental degradation. As a result, it is worthwhile to explore the impact of international capital flows on the ecological sustainability of the South Asian region. There are many studies in the literature on the CO2-remittances nexus, CO2-FDI nexus, and CO2-economic growth; however, no study has yet taken remittances and FDI into account in the symmetric and asymmetric model for the South Asian region. To address the research gap, this study investigates the effect of international capital flows, fossil fuel energy consumption, and economic growth on South Asian carbon emissions. This study examines the effect of fossil fuel energy consumption, remittances, foreign direct investment, and economic growth on the environmental sustainability of the South Asian region from 1975 to 2020. Autoregressive distributive lag (ARDL) and non-linear ARDL (NARDL) models are used to estimate the symmetrical and asymmetrical relationships among the variables. The findings of the ARDL models reveal that fossil fuel energy consumption and economic growth increase while remittances and FDI decrease carbon dioxide (CO2) in the long run. According to the NARDL empirical findings, positive remittances and negative FDI shock reduce CO2. Besides, the positive and negative fossil fuel energy consumption shock increases CO2. Moreover, the positive (negative) economic growth shock increases (decreases) CO2. The cumulative dynamic multipliers revealed the adjustment pattern to new long-run equilibria. The study recommends that policymakers regard remittances and FDI as policy instruments, particularly when developing long-term strategies and policies connected to environmental quality.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Environmental sustainability is a global concern, and the use of fossil fuels has adverse effects on the environment (Khan et al. 2021, 2022f; Weili et al. 2022). Fossil fuel energy consumption (FFEC) is primarily a non-renewable energy source. These fuels are the world’s principal energy source and were produced over millions of years from organic material. Despite a pervasive scientific consensus that present levels of fossil-fuel usage intimidate the environment with disastrous levels of global warming, the utilization of fossil fuels has continued and expanded (Painter 2019; Yousuf et al. 2022). The flue gases generated as a result of combustion are a significant source of excess carbon emissions, leading to rising carbon levels in the atmosphere (Marland et al. 1985). The COVID-19 recovery could be a tipping point for governments looking to reduce environmental degradation. The key findings of the Production Gap Report to stay on a 1.5 °C trajectory between 2020 and 2030 include reducing fossil fuel production by an annual 6% globally. Instead, countries are planning and predicting a 2% yearly growth, which would increase treble production by 2030 while staying under the 1.5 °C limit. As seen globally that the lockdown measures for the COVID-19 outbreak have resulted in short-term reductions in coal and gas production (Zhongming and Wei 2020).

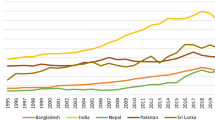

Specifically in South Asia, environmental pollution has become a major concern. South Asia, with 1.86 billion people, had around a quarter (24%) of the world’s population. The annual population growth of the region is 1.15% in 2020. From a global perspective, South Asia is a critical economic zone. The region has grown at an annual rate of 5.6% from 2000 to 2020. The yearly economic growth remained higher than 7% in different years over the last two decades; 2003–2007, 2010, and 2015–2016, while declined to a minimum of − 5.7% in 2020 due to COVID-19 (WDI 2022). Environmental degradation is indeed a problem among regional countries. With expected industrial activity and population increases, each South Asian country’s contribution to regional air pollution has grown over time (Adebanjo and Shakiru 2022; Hasnat et al. 2018). In India and Pakistan, environmental degradation is significantly caused by thermal power plants and traffic congestion. In Bangladesh, vehicular emissions and brick kilns are the biggest polluters. In Bhutan, the most significant source of air pollution is forest fires. In Nepal, the air quality is worsening due to harmful pollutants present in high concentrations. According to the Statistical review of World Energy 2021, coal is the dominant fuel in the region. Many factors, including urbanization, industrialization, and fossil fuels dependency, are responsible for increasing carbon emissions in the atmosphere (Khwaja et al. 2012).

Many studies examined the link between energy consumption, carbon emissions, and other explanatory variables for different regions (Ahmad et al. 2021; Balsalobre-Lorente et al. 2022; Khan et al. 2020d; Rahman et al. 2019; Yang et al. 2020). However, the link between international financial flows and environmental degradation had not been examined in the South Asian region. Many workers migrate yearly from South Asian countries, making remittances (REM) an essential funding source for economic development. Remittances are funds sent home by citizens living in another country that account for a significant amount of the country’s output. Individual household incomes are considerably supplemented while local economies rely on remitted money. In 2018, the low- and middle-income countries received more than three quarters (US$ 529 billion) of global remittances (US$ 689 billion). Remittances to Tajikistan, Kyrgyz Republic, Nepal, Tonga, and Moldova were more than a quarter of the country’s aggregate output (Ratha et al. 2016). Remittances are an important source of income and a financial lifeline for many developing economies that affect their socioeconomic and demographic characteristics, i.e., the balance of payment, exchange rate, poverty, inequality, production, and consumption. They are affected by the home and host countries’ economic conditions (Khan et al. 2022e; Umair & Waheed 2017). The influx of remittances is doubled that of FDI. In 2020, South Asian remittances were US$ 147 billion, while the region’s FDI was US$ 69 billion (WDI 2022). The increase in remittances increases consumption and production, affecting environmental sustainability (Ahmad et al. 2022).

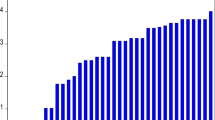

FDI is also essential for the growth of emerging economies. It is a corporation’s investment in projects by controlling equity ownership of 10% or more other than the country of origin (Jamil et al. 2022; Khan et al. 2020c, 2022d; Lane & Milesi-Ferretti 2003). Trade liberalization and financial development attract FDI inflows in contributing to economic growth (Jamil 2022; Khan et al. 2020b, 2022a). FDI increases employment opportunities, boosts entrepreneurship and competitiveness, and intensifies productivity, technology, and innovation (Sabir et al. 2020). The increase in these financial flows affects environmental degradation (Khan et al. 2020d, 2022c; Rahman et al. 2019; Yang et al. 2020). South Asian remittances remained at an annual average of 3.7% and 4.2% of the aggregate output during 2001–2010 and 2011–2020, respectively, while FDI remained at a yearly average of 1.6% during 2001–2020. Remittances are increasing and have sustained a minimum value of 3% annually since 2001. With the global economic expansion, FDI peaked at 3.3% in 2008. The FFEC increased from an annual average of 36.8% of the total in 1975–1980 to 70.3% in 2011–2020. The increase in international capital flows and fossil fuel consumption supported the real per capita income increase from an annual average of 413.7 US$ during 1975–1980 to 1575.9 US$ during 2011–2020. The real per capita income peaked in 2020 (1743 US$). The solid fuel consumption emissions increased from an annual average of 199.2 megatons during 1975–1980 to 1432.4 megatons during 2011–2020.

Most of the developing and emerging economies are facing difficulties related to environmental degradation because foreign finance is used to import fossil fuels to expand their economies causing environmental degradation. To lessen environmental deterioration, renewable energy must be used; yet, developing nations might not yet be at the point where they can obtain renewable energy. To safeguard environmental quality, it is crucial for developing nations to adopt policies that encourage the use of renewable energy instead of nonrenewable sources (Khan et al. 2021). South Asia is primarily affected by environmental degradation. As a result, it is worthwhile to investigate the impact of international capital flows on the ecological sustainability of the South Asian region. There are many studies in the literature on the CO2-remittances nexus, CO2-FDI nexus, CO2-economic growth, and others, but no study has yet taken remittances and FDI into account in the symmetric and asymmetric model for the South Asian region. This study aims to fill in the gaps in the literature by addressing different research questions. The four hypotheses in this context include (i) remittances significantly contribute to the environmental sustainability of South Asia (ii) FDI significantly improves the environmental quality of South Asia (iii) FFEC significantly contributes to South Asia’s environmental degradation, and (iv) The region’s economic growth is interrelated to environmental degradation. The findings reveal that the explanatory variables have a short- and long-run effect on South Asian carbon emissions. The ARDL model is better for a small data sample, non-stationary, and mixed-order integrated time series (Ndem et al. 2022). ARDL results show that an increase in REM and FDI decreases CO2 while increasing FFEC and GDP increases CO2. NARDL results for non-linear cointegration show that increasing the positive part of REM diminishes CO2. The rise in the positive and negative parts of FDI decreases CO2. The increase in the positive and negative parts of FFEC significantly adds to CO2. Finally, a rise in the positive part of GDP significantly increases CO2, while an increase in the negative part reduces CO2.

The remainder of the study is structured as follows: The “Literature review” section critically evaluates the theoretical and empirical literature review. Materials and methods are discussed in the “Materials and methods” section followed by empirical findings in the “Results and discussions” section. Finally, the conclusions are drawn in the “Conclusion and policy implications” section.

Literature review

Remittances and environmental sustainability

Remittances are significantly associated with environmental sustainability. Remittance growth has substantial socioeconomic and demographic effects on countries and regions. It supports an increased standard of living and improved financial systems (Meyer and Shera 2017). Therefore, remittances have a positive economic effect that contributes to human welfare. Furthermore, remittances are critical to support the balance of payment in low-income countries, generate employment opportunities, and expand global integration. Concurrently, increased production and consumption due to remittances increase carbon emissions (Rehman et al. 2019; Xu et al. 2021). Remittances contribute to the country’s economic development and industrialization via financial system improvement that has the potential to increase carbon emissions (Mohsin et al. 2022; Wang et al. 2021). In contrast, the increased remittances are liable to reduce carbon emissions via investment in education and affordability of eco-friendly resources at micro- and macro-levels (Zafar et al. 2022). Remittances are among the key factors in financial development since they boost the resources available for credit (Farhani and Ozturk 2015; Li and Tse 2015).

Besides, Neog and Yadava (2020) examined an asymmetric relationship between CO2 emissions and remittances in India for the years 1980 to 2014. The study used time series data to develop a nonlinear ARDL model based on the theoretical links. The findings of the NARDL bound test imply the variables’ long-run cointegration. The results demonstrate that, in contrast to a negative shock, a positive shock in remittances increases CO2 emissions. Moreover, Brown et al. (2020) considered a modified version of the EKC, to find the relationship between CO2 emissions and remittances. The study employed ARDL bounds testing methods to Jamaican data (1976–2014) to clarify the causal connection between these factors. The findings show only statistically significant evidence of an asymmetric response of CO2 to changes in remittances in the short-run, but there is a long-run cointegrating link between remittances and CO2 on a per capita basis. The study suggested for creating initiatives that encourage investors and consumers to use remittances to make eco-friendly purchases.

FDI and environmental sustainability

Besides remittances, FDI is also linked to environmental sustainability. FDI increases capital inflows, supports the BOP constraints, promotes export, increases employment opportunities, increases competition among developing countries, and advances technology. However, marginal social costs remain higher if all marginal damages in the form of environmental degradation are added due to this FDI-led production- and consumption-polluting activities (Mohsin et al. 2022). FDI boosts domestic production. The investment rate also rises with access to new financial and technological resources. However, FDI, financial development, and energy consumption are interrelated to affect economic growth (Xu et al. 2018; Ziaei 2015). Earlier studies on FDI have mainly concentrated on production-based pollution, neglecting to consider consumption-based pollution (Liddle 2018). Trade is substantial for consumption-based emissions. However, they are not effective for territory-based emissions. Imports raise consumption-based emissions, while exports reduce them. The importance of fossil fuels in terms of energy is substantially more significant when it comes to emissions based on territory. A few studies showed that trade and globalization stimulate territory-based CO2 emissions (Abbasi et al. 2022a; Hasanov et al. 2018). Therefore, the consumption-related carbon emissions and FDI could be positively linked, confirming the pollutant haven hypothesis predicated on the assumption that FDI inflows negatively impact receiving economies (Gyamfi 2021).

For the top five developing-nation emitters of GHG from fuel combustion between 1982 and 2016, Sarkodie and Strezov (2019) determined the impact of FDI, economic growth, and energy consumption on GHG emissions. The research demonstrated the validity of the pollution haven hypothesis and discovered a significant positive relationship between energy usage and GHG emissions. The SDGs will be accomplished by developing nations with FDI that includes the transfer of clean technologies and improvements in labor and environmental management standards. Besides, Jain (2017) examined the connections between environmental degradation, economic development, energy use, and FDI in six sub-Saharan African countries between 1980 and 2014. The results showed unidirectional causality running CO2 to FDI in the long-run. CO2 levels rose by 49% for every 1% increase in energy consumption. The study recommended using eco-technology to protect lives and preserve a green environment. In a panel of BRI nations from 1995 to 2016, Khan et al. (2020a) examined the effects of FDI and renewable energy on CO2 emissions by employing GMM and FMOLS. The BRI panel’s pollution haven hypothesis is refuted by empirical findings that renewable energy is effective in reducing CO2 emissions and the negative sign of FDI with CO2 emissions.

Fossil fuels consumption and environmental sustainability

For millennia, fossil fuel consumption is resulting in excessive pollution, traffic congestion, and increase environmental stress (Miller 2013). All countries and regions promote the need for a paradigm shift away from fossil fuels and toward renewable energy sources (Abbasi et al. 2022b; Asongu et al. 2020; Martins et al. 2019; Midilli & Dincer 2008). Earlier studies have determined the link between the use of fossil fuels and carbon emissions. Therefore, the adoption of more robust energy conservation programs is essential to reduce emissions and pollution (Al-Mulali and Sab 2012a, b; Alam et al. 2016; Apergis and Ozturk 2015; Behera and Dash 2017; Diao et al. 2009; Fodha and Zaghdoud 2010; Tao et al. 2008). In addition, fossil fuel resource extraction, delivery, and use are vulnerable to climate change, especially when combined with other global-scale changes. For example, changes in ambient temperature can have a direct impact on fossil energy demand. Since the year 2000, fossil fuel emissions have risen dramatically, partially due to the failure of most Kyoto Protocol signatories to reduce CO2 emissions and partly due to China (the world’s leading emitter) and India’s exceptionally rapid industrial expansion (Levin 2013).

Moreover, Koengkan (2018) examined how the use of renewable energy affected CO2 emissions in five MERCOSUR countries. The short- and long-run results of the ARDL model showed that economic expansion and fossil fuel consumption raised CO2 emissions, whereas renewable energy use decreased them. Hanif (2017) examined how the use of fossil fuels, the use of electricity, and urbanization affected the environmental degradation that occurred in a panel of 20 developing Latin American and Caribbean economies by employing the system GMM from 1990 to 2015. The findings show that urbanization and fossil fuels both considerably contribute to environmental degradation. The results have also supported the EKC hypothesis. Lau et al. (2014) investigated the EKC for Malaysia between 1970 and 2008 on CO2 emissions, economic growth, FDI, and trade openness. The study, which considered FDI and trade, came to the inverted-U-shaped conclusion that there is an inverted U-shaped relationship between economic growth and CO2 emissions in both the short and long run for Malaysia.

Hanif et al. (2019) studied the long- and short-run effects of economic expansion, FDI, and the use of fossil fuels on CO2 emissions in fifteen developing Asian countries. The ARDL model was used to analyze panel data for the years 1990 to 2013 in the empirical evidence. The findings demonstrated that efforts to promote economic growth contribute to the production of CO2 emissions and that the use of fossil fuels worsens the environment by increasing CO2 emissions. The results also provided proof that EKC exists in the panel. Finally, the research implied that limiting the use of fossil fuels and encouraging an environmentally sustainable economic growth approach will be beneficial for the overall wellbeing of the countries.

Economic growth and environmental sustainability

The issue of how to protect the environment has been a fundamental aspect for academia and policymakers for a couple of decades. There is a contentious discussion over the term “green growth” (Ekins 2002). A substantial amount of literature has previously determined the relationship between economic expansion and carbon emissions (Al-Mulali and Sab 2012a, b; Alam et al. 2016; Apergis and Ozturk 2015; Dashper 2020; Diao et al. 2009; Fodha and Zaghdoud 2010; Hanif 2018; Kirikkaleli 2020; Nasreen et al. 2017; Tao et al. 2008; Wang et al. 2016). Long-term policies should promote the use of renewable energy sources in different sectors. By employing FMOLS and the Granger causality test between 1973 and 2018, Salazar-Núñez et al. (2022) investigated the connections between energy consumption, economic growth, and CO2 emissions in Mexico. Economic growth had the largest impact on CO2 emissions, which gives empirical support for an EKC for Mexico. Renewable and nonrenewable energy and economic expansion contribute significantly to environmental degradation. The causality results also endorsed the relationship among the variables.

In a panel of 22 of the top remittance-receiving countries, Zafar et al. (2022) investigated the link between remittances, export diversification, education, and CO2 emissions while adjusting for renewable energy and economic growth. The study used a variety of econometric techniques to show that export diversification, remittances, and renewable energy all contribute to slowing down environmental deterioration. In contrast, environmental deterioration is increased by economic expansion. Shan et al. (2021) gave detailed accounts of CO2 emissions for 294 Chinese cities. According to the findings, just 11% of cities showed high decoupling between 2005 and 2015, while 66% of cities showed weak decoupling and 23% showed no decoupling at all. The study also found that the improvement in production and carbon efficiency, which leads to a decrease in emission intensity, is the most significant socioeconomic element in explaining the economic-emission decoupling in cities. CO2 emissions and emissions-GDP decoupling in Chinese cities may have implications for other emerging nations when designing low-carbon growth strategies.

A critical analysis of the literature shows that several studies researched the relationship between international capital flows, energy use, CO2 emissions, and other explanatory variables. For example, Deng et al. (2022), Rani et al. (2022), and Yang et al. (2020) studied the influence of remittances, energy use, and other macroeconomics variables on CO2 for a panel of countries while Ahmad et al. (2022) and Neog and Yadava (2020) conducted the same for a single country’s time series analysis. Rahman et al. (2019) and Zhang et al. (2022) examined the effect of FDI along with remittances, energy consumption, and other macroeconomics variables on environmental degradation for a panel of countries, while Jafri et al. (2022). Therefore, it is concluded that the past literature review mostly used ARDL and NARDL for a single country analysis.

In contrast, other studies used NARDL-PMG, FMOLS, DOLS, and GMM for panel estimation. The earlier studies mostly remain limited to a country or two except Rani et al. (2022) which linked remittances, economic growth, and fossil fuel only for SAARC countries. None of the earlier studies have examined the symmetric and asymmetric impact of remittances along with FDI, FFEC, and per capita income (GDP) on environmental sustainability for the South Asian region. Along with remittances, South Asian countries experienced a fundamental shift in the 1990s that has been even more pronounced in subsequent years in the FDI environment (Sahoo 2006). South Asia is one of the world’s most populous regions. The population distribution of South Asia is rapidly transforming the way. A massive population implies that energy is used extensively for economic growth, resulting in increased CO2 emissions. As a result, the current study employs remittance and FDI as a tool for economic growth and reveals their involvement in boosting CO2 emissions for the region (Rahman et al. 2019). India and Pakistan are among the top remittance-receiving countries while India is among the top CO2 emitter economies, FDI destination, and energy consumers among these economies (WDI 2022). However, the empirical findings are still insufficient for advising effective policy to increase energy efficiency and environmental quality because of differences in periods, variables evaluated, countries or regions selection, and models used, particularly in the South Asian region. A summary of the literature is provided in Table 1.

Materials and methods

Data source

The study examined the link between fuel energy consumption and international capital flows with carbon emissions in South Asia from 1975 to 2020. The natural logarithm of the variables is used to analyze the proportional link between the variables. The summary of the dataset is shown in Table 2. The World Development Indicator, WDI (2022), collects data for all the variables in question.

Model

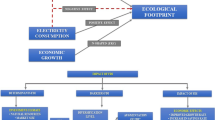

The changes in REM, FDI, FFEC, and GDP are among the most critical factors in CO2 emission. The functional form and model are constructed as follows:

where \({\mathrm{\alpha }}_{0}\) is the intercept, \({\mathrm{\alpha }}_{1}\) to \({\mathrm{\alpha }}_{4}\) are the slopes, and εt is the error term. For time series analysis, there are irregular ups and downs in the movement of variables over time, and the relationship between variables could be interrelated directly. There are random walks and drifts in the time trend of related variables. Graphical representations of related variables would also be analyzed to test trends and drift in variables. The initial stages will determine descriptive statistics and correlation between associated variables. The time series should be separated from random effects and required to be stationary. With a null hypothesis of unit root, ADF (Dickey and Fuller 1979), and PP (Phillips and Perron 1988) testsare used for the order of integration. Stationarity test by unit root testing is required for meaningful estimation and interpretation of the relationship for policy implication. ADF unit root test is used to find the maximum number of integrations. Besides, the PP test is robust against heteroscedasticity, allows for weaker assumptions on the distribution of errors, and controls for higher-order serial correlation (Khanal et al. 2022). The ADF test is more appropriate for finite data, while the PP test provided a non-parametric correction to t test statistics employed by Mohsin et al. (2022). As a result, the study used both the ADF and PP tests to check stationarity. The least-squares method for the individual intercept is used in the ADF and PP tests in Eqs. (3) and (4) as.

where \(\Delta\) is the first difference operator, \({\alpha }_{0}\) is the intercept, \(p\) is the lag order of the autoregressive process, and \({\varepsilon }_{t}\) is the error term.

Long-run relationships between series are relatively more important for policymakers than short run as these variables are used to change the policies with caution. Moreover, outcomes of changes in one variable significantly cause a short- or long-run difference in related variables as all macroeconomic variables, to some extent, are interrelated with each other. There are several econometric approaches with their applications to obtain long-run relations. Engle and Granger (1987) was widely used for the long-run relationship among variables in the past. This study used the ARDL technique by Pesaran et al. (2001) to analyze the long-run relationship between the variables. ARDL is preferred over others as the order of integration is not a significant subject matter, while old techniques required testing of the order of integration in the initial steps. Another significance of the model is that it can be used effectively for relatively small samples, for instance, whether the variables may have different lags. The ARDL model representation is devised in Eq. (5) as:

The study used Pesaran et al. (2001) technique to formulate long-run functional relationships between related variables. F test is employed in this methodology with a joint significance test. The cointegration is assessed based on the bounds F test. F test would be indecisive in the range of upper and lower bound limits. Equation (6) represents the error correction term (ECT) as:

ECT shows the speed of adjustment (λ) to the steady-state. A simple and linear model has two limitations: it cannot be used to test for asymmetric uncertainty effects, and the data may include other nonlinearities. NARDL is the extension of simple ARDL. Shin et al. (2014) developed the NARDL for short- and long-run nonlinearities generated through positive and negative partial sum decompositions of the explanatory variables. As a result, using more robust statistical methodologies, this study attempts to fill a gap in the existing literature. Compared to ARDL, the NARDL approach has different advantages. The NARDL approach distinguished between short- and long-run asymmetries, testing dependent variable responses to positive and negative changes in each explanatory factor, and is adaptive to cointegration dynamics between variables (Ahmad et al. 2022). None of the earlier studies have yet examined asymmetries to decompose the shocks of explanatory variables into partial positive and negative sums for the South Asian region. The policymakers are concerned more about asymmetries that typical symmetrical approaches do not capture. The explanatory variables are divided into positive and negative changes by a partial sum approach:

Substituting Eqs. (7)–(14), the modified model in Eq. (15) will be as follows:

Results and discussions

The mean value of the logarithmic variables, CO2, REM, FDI, FFEC, and GDP, are 13.14, 0.86, − 1.21, 3.99, and 6.54, respectively (Table 3). All variables have a positive mean value except the FDI. The higher standard deviation implies that the FDI is widely distributed among the member countries. The min–max values for FDI also indicate the same. The data is nearly symmetrical for CO2 and GDP. REM has the highest (leptokurtic) while GDP and CO2 have the lowest (platykurtic) kurtosis values among the variables. Following the descriptive statistics, a correlation matrix indicates the degree of relationship between the variables. There is a strong positive correlation among the variables.

Table 4 shows the results of the ADF and PP unit root tests. The study used the maximum available lag length with automatic selection criteria (using EViews 10). Some variables are stationary at the level, but all are stationary at the first difference. Only REM is stationary at the level and the first difference, with both trend and trend and intercept in ADF and PP. The variables in this study have a mixed nature of stationarity properties, stationary at both the level, and the first difference.

The short-run and long-run ARDL and NARDL estimates are reported in Table 5. The study used the maximum available lag length with automatic selection criteria (dependent variable maximum lags = 2 and regressors maximum lags = 2). According to ARDL’s empirical findings, the short-run analysis shows that there is a positive effect of REM and FFEC on CO2; that is, a 1% rise in REM and FFEC contributes to CO2 by 0.08% and 1.81% at the 1% significance level, respectively. Furthermore, the result indicates that FDI is negatively related to CO2 in the short run; a 1% rise in FDI contributes by 0.03% to CO2. The long-run association of the ARDL model shows that FFEC and GDP are positive while REM and FDI are negatively related to CO2 significantly. According to the findings, a 1% increase in FFEC and GDP contributes 0.98% and 1.40% to CO2, respectively. On the other hand, the long-run analysis shows that a 1% increase in REM and FDI decreases CO2 by − 0.18% and − 0.04%, respectively. The findings imply that South Asia's international capital flows are reducing CO2 while energy consumption and economic growth adversely affect the environment. NARDL estimates are also summarized in Table 5. The short-run analysis shows that REM + and FFEC + positively impact CO2. The results reveal that a 1% increase in the REM + and FFEC + increases CO2 by 0.10% and 1.28%. A 1% rise in GDP- increases CO2 by 6.52%, while a 1% increase in the FDI- causes a decrease in CO2 by 0.02%. The long-run analysis shows that REM + is significant and negatively related to CO2, while the negative part is negative but insignificant. A 1% rise in REM + decreases CO2 by 0.31%. A 1% increment in FDI + insignificantly decreases CO2 by 0.06%, while a 1% gain in FDI- significantly decreases CO2 by 0.11%. A 1% increase in FFEC + and FFEC- significantly increases CO2 by 1.08% and 106.44%, respectively. Finally, a 1% rise in GDP + significantly increases CO2 by 1.84%, while a 1% increase in GDP- significantly increases CO2 by 22.18%. The results are consistent with Rani et al. (2022), Zafar et al. (2022), Wang et al. (2021), Yang et al. (2020), and Rahman et al. (2019).

The bound test of ARDL and the NARDL confirms the long-run relationship among the variables. ECT has a negative and statistically significant value for the ARDL (− 0.61) and the NARDL (− 0.47), ensuring the pace with which the system adjusts to the long-run equilibrium path. The ECT results are consistent with many studies that have also estimated a relatively high speed of adjustment to equilibrium such as Khalid et al. (2021) estimated a value of − 0.51 for Bangladesh, − 0.57 for India, − 0.96 for Nepal, − 0.69 for Pakistan, − 0.94 for Sri Lanka, − Ali et al. (2019) estimated − 0.76 for Pakistan, − Shahbaz et al. (2015) estimated more than − 0.7 for many African countries, Waqih et al. (2019) estimated − 0.52 for SAARC region, Attiaoui et al. (2017) estimated − 0.44 for African countries, and Jafri et al. (2022) estimated − 0.64 (ARDL), and − 0.74 (NARDL) for China.

The study uses multiple statistical tests on the dataset to confirm the validity of the findings, including the tests for serial correlation, heteroskedasticity, and normality. All diagnostic test statistics show no evidence of model misspecification.

Figure 1 shows the results of the CUSUM and CUSUMSQ for ARDL (Fig. 1a and b) and NARDL (Fig. 1c and d) models to look at the parameter constancy, as suggested by Brown et al. (1975) and Pesaran and Pesaran (1999). The findings indicate that the statistics graph for CUSUM and CUSUMSQ stays within the critical range at the 5% threshold, indicating that the coefficients of the energy equation are stable (Fig. 1a and d) otherwise crossing the range at the 5% threshold (Fig. 1b and c). The study employed the recursive coefficients test for stability assessment (Rahman and Alam 2022; Taghvaee et al. 2022). All the plotted figures have expressed the better stability of this model (Fig. 1e and f).

The dynamic multiplier graphs are drawn in Fig. 2. The cumulative dynamic multipliers revealed the adjustment pattern to new long-run equilibria. For example, the adjustment to positive and negative shocks at a specific prediction horizon is represented by the positive (continuous black) and negative (dashed black) curves. The broken red asymmetry plot shows the difference in the responses of multipliers with 95% confidence intervals. The plots further reveal that negative shocks in decomposed variables (excluding FFEC) affect the long run more than positive shocks. In contrast, positive shocks in FFEC affect the long run more than negative shocks.

Conclusion and policy implications

There are many studies in the literature on the CO2-remittances nexus, CO2-FDI nexus, CO2-economic growth, and others, but no study has yet taken remittances and FDI into account in the model for the South Asian region. This research examines if international capital flows, fossil fuel energy consumption, and economic growth have symmetric and asymmetric impacts on South Asian carbon emissions. The study employed a time series data set from 1975 to 2020 for the South Asian region ignored by the existing literature. The main contribution is that it uses a new asymmetric ARDL technique to examine whether international capital flows have positive or negative shocks. The study used ADF and PP for the unit root test. The ARDL and NARDL results confirm a linear and non-linear connection between the CO2, REM, FDI, FFEC, and GDP in the short and long run. According to the empirical evidence, the positive effect of FFEC outweighs the negative impact of FFEC, while the opposite is true for the other variables.

Carbon emissions have been a major cause of extreme environmental pollution, with negative repercussions for human life regardless of whether a country’s economy is developed or underdeveloped. Therefore, cutting such emissions in developing nations is critical to maintaining economic growth. South Asia mainly relies on fossil fuels to meet its energy needs, whose imports are primarily financed by international capital flows. Despite increased energy output, the demand is much more than the supply. As a result, countries rely on fossil fuel imports to meet their energy needs. Initiatives to enhance energy security include diversifying the energy mix, raising the proportion of renewable energy sources, fostering regional cooperation to maximize the hydropower potential of the region, and putting energy-saving measures in place to minimize transmission and distribution losses.

The region’s large economies contributing more to environmental degradation should serve as a platform for national and regional bodies to collaborate on similar concerns about transboundary pollution (Han and BiBi 2022; Khan et al. 2022b). It is essential that all sectors, especially the industrial sector of South Asian countries, should be sensitized to ensure that emission levels comply with worldwide health and environmental standards. These regulations should be enforced with legal consequences to ensure and limit the type and amount of environmental degradation. The International Energy Agency (IEA) emphasizes a historic surge in renewable and energy investment to avoid severe climate change impacts. The clean energy investment must have tripled to four trillion dollars to achieve net zero emissions by 2050. This will create millions of new employment opportunities and boost global economic development. Financially constrained countries can efficiently use remittances and FDI for these investments. However, sustainable energy investments frequently face an uphill battle due to controlled prices or taxes that favor fossil fuels in almost all South Asian countries (IEA 2021). In addition, the region needs to improve its green infrastructure through international capital flows. The present levels of fossil fuel energy use are ineffective for environmental protection. To achieve long-term environmental and economic goals, governments must adopt transformation initiatives toward green energy and less polluting economic growth sectors. This study is limited to the South Asian region. However, this can be expanded to other regions for a comparative study, particularly by using more recent data and other sources of foreign financial flows such as foreign aid and others.

Data availability

These data were obtained from the World Development Indicators, DataBank organized by the World Bank.

References

Abbasi KR, Hussain K, Haddad AM, Salman A, Ozturk I (2022a) The role of financial development and technological innovation towards sustainable development in Pakistan: fresh insights from consumption and territory-based emissions. Technol Forecast Soc Chang 176:121444. https://doi.org/10.1016/j.techfore.2021.121444

Abbasi KR, Shahbaz M, Zhang J, Irfan M, Alvarado R (2022b) Analyze the environmental sustainability factors of China: the role of fossil fuel energy and renewable energy. Renew Energy 187:390–402. https://doi.org/10.1016/j.renene.2022.01.066

Adebanjo SA, Shakiru TH (2022) Dynamic relationship between air pollution and economic growth in Jordan: an empirical analysis. J Environ Sci Econ 1:30–43. https://doi.org/10.56556/jescae.v1i2.17

Ahmad M, Ul Haq Z, Khan Z, Khattak SI, Ur Rahman Z, Khan S (2019) Does the inflow of remittances cause environmental degradation? Empirical evidence from China. Econ Res-Ekonomska Istraživanja 32:2099–2121

Ahmad M, Khan Z, Rahman ZU, Khattak SI, Khan ZU (2021) Can innovation shocks determine CO2 emissions (CO2e) in the OECD economies? A new perspective. Econ Innov New Technol 30:89–109. https://doi.org/10.1080/10438599.2019.1684643

Ahmad W, Ozturk I, Majeed MT (2022) How do remittances affect environmental sustainability in Pakistan? Evid NARDL Approach Energy 243:122726. https://doi.org/10.1016/j.energy.2021.122726

Al-Mulali U, Sab CNBC (2012a) The impact of energy consumption and CO2 emission on the economic growth and financial development in the Sub Saharan African countries. Energy 39:180–186. https://doi.org/10.1016/j.energy.2012.01.032

Al-Mulali U, Sab CNBC (2012b) The impact of energy consumption and CO2 emission on the economic and financial development in 19 selected countries. Renew Sustain Energy Rev 16:4365–4369. https://doi.org/10.1016/j.rser.2012.05.017

Alam MM, Murad MW, Noman AHM, Ozturk I (2016) Relationships among carbon emissions, economic growth, energy consumption and population growth: testing environmental Kuznets curve hypothesis for Brazil, China, India and Indonesia. Ecol Ind 70:466–479. https://doi.org/10.1016/j.ecolind.2016.06.043

Ali R, Bakhsh K, Yasin MA (2019) Impact of urbanization on CO2 emissions in emerging economy: evidence from Pakistan. Sustain Cities Soc 48:101553. https://doi.org/10.1016/j.scs.2019.101553

Apergis N, Ozturk I (2015) Testing environmental Kuznets curve hypothesis in Asian countries. Ecol Indic 52:16–22. https://doi.org/10.1016/j.ecolind.2014.11.026

Asongu SA, Agboola MO, Alola AA, Bekun FV (2020) The criticality of growth, urbanization, electricity and fossil fuel consumption to environment sustainability in Africa. Sci Total Environ 712:136376. https://doi.org/10.1016/j.scitotenv.2019.136376

Attiaoui I, Toumi H, Ammouri B, Gargouri I (2017) Causality links among renewable energy consumption, CO2 emissions, and economic growth in Africa: evidence from a panel ARDL-PMG approach. Environ Sci Pollut Res 24:13036–13048. https://doi.org/10.1007/s11356-017-8850-7

Balsalobre-Lorente D, Ibáñez-Luzón L, Usman M, Shahbaz M (2022) The environmental Kuznets curve, based on the economic complexity, and the pollution haven hypothesis in PIIGS countries. Renew Energy 185:1441–1455. https://doi.org/10.1016/j.renene.2021.10.059

Behera SR, Dash DP (2017) The effect of urbanization, energy consumption, and foreign direct investment on the carbon dioxide emission in the SSEA (South and Southeast Asian) region. Renew Sustain Energy Rev 70:96–106. https://doi.org/10.1016/j.rser.2016.11.201

Brown L, McFarlane A, Campbell K, Das A (2020) Remittances and CO2 emissions in Jamaica: an asymmetric modified environmental Kuznets curve. J Econ Asymmetries 22:e00166. https://doi.org/10.1016/j.jeca.2020.e00166

Brown RL, Durbin J, Evans JM (1975) Techniques for testing the constancy of regression relationships over time. J R Stat Soc Ser B Methodol 37:149–163. https://doi.org/10.1111/j.2517-6161.1975.tb01532.x

Dashper K (2020) Mentoring for gender equality: supporting female leaders in the hospitality industry. Int J Hosp Manag 88:102397. https://doi.org/10.1016/j.ijhm.2019.102397

Deng Z, Liu J, Sohail S (2022) Green economy design in BRICS: dynamic relationship between financial inflow, renewable energy consumption, and environmental quality. Environ Sci Pollut Res 29:22505–22514. https://doi.org/10.1007/s11356-021-17376-8

Diao XD, Zeng SX, Tam CM, Tam VW (2009) EKC analysis for studying economic growth and environmental quality: a case study in China. J Clean Prod 17:541–548. https://doi.org/10.1016/j.jclepro.2008.09.007

Dickey DA, Fuller WA (1979) Distribution of the estimators for autoregressive time series with a unit root. J Am Stat Assoc 74:427–431. https://doi.org/10.1080/01621459.1979.10482531

Ekins P (2002) Economic growth and environmental sustainability: the prospects for green growth. Routledge, London. https://doi.org/10.4324/9780203011751

Engle RF, Granger CW (1987) Co-integration and error correction: representation, estimation, and testing. Econometrica: Journal of the Econometric Society 251–276. https://doi.org/10.2307/1913236

Farhani S, Ozturk I (2015) Causal relationship between CO2 emissions, real GDP, energy consumption, financial development, trade openness, and urbanization in Tunisia. Environ Sci Pollut Res 22:15663–15676. https://doi.org/10.1007/s11356-015-4767-1

Fodha M, Zaghdoud O (2010) Economic growth and pollutant emissions in Tunisia: an empirical analysis of the environmental Kuznets curve. Energy Policy 38:1150–1156. https://doi.org/10.1016/j.enpol.2009.11.002

Gyamfi BA (2021) Consumption-based carbon emission and foreign direct investment in oil-producing Sub-Sahara African countries: the role of natural resources and urbanization. Environ Sci Pollut Res 1-13. https://doi.org/10.1007/s11356-021-16509-3

Han L, BiBi R (2022) The role of technological innovations and renewable energy consumption in reducing environmental degradation: evidence from the belt and road initiative countries. Environ SciPollut Res 1-15. https://doi.org/10.1007/s11356-022-21006-2

Hanif I (2017) Economics-energy-environment nexus in Latin America and the Caribbean. Energy 141:170–178. https://doi.org/10.1016/j.energy.2017.09.054

Hanif I (2018) Impact of fossil fuels energy consumption, energy policies, and urban sprawl on carbon emissions in East Asia and the Pacific: A panel investigation. Energ Strat Rev 21:16–24. https://doi.org/10.1016/j.esr.2018.04.006

Hanif I, Raza SMF, Gago-de-Santos P, Abbas Q (2019) Fossil fuels, foreign direct investment, and economic growth have triggered CO2 emissions in emerging Asian economies: some empirical evidence. Energy 171:493–501. https://doi.org/10.1016/j.energy.2019.01.011

Hasanov FJ, Liddle B, Mikayilov JI (2018) The impact of international trade on CO2 emissions in oil exporting countries: territory vs consumption emissions accounting. Energy Econ 74:343–350. https://doi.org/10.1016/j.eneco.2018.06.004

Hasnat GT, Kabir MA, Hossain MAJHoemm (2018) Major environmental issues and problems of South Asia, particularly Bangladesh. In: Hussain C (ed) Handbook of Environmental Materials Management. Springer, Cham. https://doi.org/10.1007/978-3-319-58538-3_7-1

IEA (2021) Net zero by 2050, IEA, Paris. https://www.iea.org/reports/net-zero-by-2050. Accessed 2 Jul 2022

Islam M (2022) Do personal remittances cause environmental pollution? Evidence from the top eight remittance-receiving countries. Environ Sci Pollut Res 29:35768–35779. https://doi.org/10.1007/s11356-021-18175-x

Itoo HH, Ali N (2022) Analyzing the causal nexus between CO2 emissions and its determinants in India: evidences from ARDL and EKC approach. Manag Environ Qual. https://doi.org/10.1108/MEQ-01-2022-0014

Jafri MAH, Abbas S, Abbas SMY, Ullah S (2022) Caring for the environment: measuring the dynamic impact of remittances and FDI on CO2 emissions in China. Environ Sci Pollut Res 29:9164–9172. https://doi.org/10.1007/s11356-021-16180-8

Jain H (2017) Trade liberalization process and India’s growth experiences, trade liberalisation, economic growth and environmental externalities. Palgrave Macmillan, Singapore. https://doi.org/10.1007/978-981-10-2887-8_4

Jamil MN (2022) Critical analysis of energy consumption and its impact on countries economic growth: an empirical analysis base on countries income level. J Environ Sci Econ 1:1–14. https://doi.org/10.56556/jescae.v1i2.11

Jamil MN, Rasheed A, Mukhtar Z (2022) Corporate social responsibility impacts sustainable organizational growth (firm performance): an empirical analysis of Pakistan stock exchange-listed firms. J Environ Sci Econ 1:25–29. https://doi.org/10.56556/jescae.v1i2.16

Khalid K, Usman M, Mehdi MA (2021) The determinants of environmental quality in the SAARC region: a spatial heterogeneous panel data approach. Environ Sci Pollut Res 28:6422–6436. https://doi.org/10.1007/s11356-020-10896-9

Khan A, Hussain J, Bano S, Chenggang Y (2020a) The repercussions of foreign direct investment, renewable energy and health expenditure on environmental decay? An econometric analysis of B&RI countries. J Environ Planning Manage 63:1965–1986. https://doi.org/10.1080/09640568.2019.1692796

Khan H, Khan I, Binh TT (2020b) The heterogeneity of renewable energy consumption, carbon emission and financial development in the globe: a panel quantile regression approach. Energy Rep 6:859–867. https://doi.org/10.1016/j.egyr.2020.04.002

Khan H, Khan I, Kim Oanh LT, Lin Z (2020c) The dynamic interrelationship of environmental factors and foreign direct investment: dynamic panel data analysis and new evidence from the globe. Math ProblEng 2020c. https://doi.org/10.1155/2020/2812489

Khan H, Weili L, Khan I (2022a) Institutional quality, financial development and the influence of environmental factors on carbon emissions: evidence from a global perspective. Environ Sci Pollut Res 29:13356–13368. https://doi.org/10.1007/s11356-021-16626-z

Khan H, Weili L, Khan I (2022b) The role of financial development and institutional quality in environmental sustainability: panel data evidence from the BRI countries. Environ SciPollut Res 1-12. https://doi.org/10.1007/s11356-022-21697-7

Khan H, Weili L, Khan I (2022c) Examining the effect of information and communication technology, innovations, and renewable energy consumption on CO2 emission: evidence from BRICS countries. Environ SciPollut Res 1-17. https://doi.org/10.1007/s11356-022-19283-y

Khan H, Weili L, Khan I (2022d) The role of institutional quality in FDI inflows and carbon emission reduction: evidence from the global developing and belt road initiative countries. Environ Sci Pollut Res 29:30594–30621. https://doi.org/10.1007/s11356-021-17958-6

Khan H, Weili L, Khan I, Han L (2022e) The effect of income inequality and energy consumption on environmental degradation: the role of institutions and financial development in 180 countries of the world. Environ Sci Pollut Res 29:20632–20649. https://doi.org/10.1007/s11356-021-17278-9

Khan I, Han L, Khan H, Kim Oanh LT (2021) Analyzing renewable and nonrenewable energy sources for environmental quality: dynamic investigation in developing countries. Mathe Probl Eng 2021. https://doi.org/10.1155/2021/3399049

Khan I, Han L, Khan H (2022f) Renewable energy consumption and local environmental effects for economic growth and carbon emission: evidence from global income countries. Environ Sci Pollut Res 29:13071–13088. https://doi.org/10.1007/s11356-021-16651-y

Khan ZU, Ahmad M, Khan A (2020d) On the remittances-environment led hypothesis: empirical evidence from BRICS economies. Environ Sci Pollut Res 27:16460–16471. https://doi.org/10.1007/s11356-020-07999-8

Khanal A, Rahman MM, Khanam R, Velayutham EJESR (2022) Does tourism contribute towards zero-carbon in Australia? Evid ARDL Modell Approach 43:100907. https://doi.org/10.1016/j.esr.2022.100907

Khwaja MA, Umer F, Shaheen N, Sherazi A, Shaheen FH (2012) Air pollution reduction and control in South Asia, Working Paper Series 121, Sustainable Development Policy Institute (SDPI) Islamabad. https://sdpi.org/sdpiweb/publications/files/Air%20Pollution%20Reduction%20and%20Control%20in%20South%20Asia%20(W-121).pdf. Accessed 10 Jun 2022

Kirikkaleli D (2020) New insights into an old issue: exploring the nexus between economic growth and CO2 emissions in China. Environ Sci Pollut Res 27:40777–40786. https://doi.org/10.1007/s11356-020-10090-x

Koengkan M (2018) The decline of environmental degradation by renewable energy consumption in the MERCOSUR countries: an approach with ARDL modeling. Environ Syst Decis 38:415–425. https://doi.org/10.1007/s10669-018-9671-z

Lane PR, Milesi-Ferretti GM (2003) International financial integration. IMF Staff Pap 50:82–113. https://doi.org/10.2307/4149916

Lau L-S, Choong C-K, Eng Y-K (2014) Investigation of the environmental Kuznets curve for carbon emissions in Malaysia: do foreign direct investment and trade matter? Energy Policy 68:490–497. https://doi.org/10.1016/j.enpol.2014.01.002

Levin SA (2013) Encyclopedia of biodiversity academic press, Amsterdam

Li WC, Tse H (2015) Health risk and significance of mercury in the environment. Environ Sci Pollut Res 22:192–201. https://doi.org/10.1007/s11356-014-3544-x

Liddle B (2018) Consumption-based accounting and the trade-carbon emissions nexus. Energy Econ 69:71–78. https://doi.org/10.1016/j.eneco.2017.11.004

Mahalik MK, Villanthenkodath MA, Mallick H, Gupta M (2021) Assessing the effectiveness of total foreign aid and foreign energy aid inflows on environmental quality in India. Energy Policy 149:112015. https://doi.org/10.1016/j.enpol.2020.112015

Marland G, Rotty R, Treat N (1985) CO2 from fossil fuel burning: global distribution of emissions. Tellus B 37:243–258. https://doi.org/10.1111/j.1600-0889.1985.tb00073.x

Martins F, Felgueiras C, Smitkova M, Caetano N (2019) Analysis of fossil fuel energy consumption and environmental impacts in European countries. Energies 12:964. https://doi.org/10.3390/en12060964

Meyer D, Shera A (2017) The impact of remittances on economic growth: an econometric model. Economia 18:147–155. https://doi.org/10.1016/j.econ.2016.06.001

Midilli A, Dincer I (2008) Hydrogen as a renewable and sustainable solution in reducing global fossil fuel consumption. Int J Hydrogen Energy 33:4209–4222. https://doi.org/10.1016/j.ijhydene.2008.05.024

Miller C (2013) Energy resources and policy: vulnerability of energy resources and resource availability–fossil fuels (oil, coal, natural gas, oil shale). Climate Vulnerability.https://doi.org/10.1016/B978-0-12-384703-4.00304-X

Mohsin M, Naseem S, Sarfraz M, Azam T (2022) Assessing the effects of fuel energy consumption, foreign direct investment and GDP on CO2 emission: new data science evidence from Europe & Central Asia. Fuel 314:123098. https://doi.org/10.1016/j.fuel.2021.123098

Nasreen S, Anwar S, Ozturk I (2017) Financial stability, energy consumption and environmental quality: evidence from South Asian economies. Renew Sustain Energy Rev 67:1105–1122. https://doi.org/10.1016/j.rser.2016.09.021

Ndem BE, James HT, Agala FB (2022) Autoregressive distributed lag approach (ARDL) to corruption and economic growth nexus in Nigeria. J Environ Sci Econ 1:8–14. https://doi.org/10.56556/jescae.v1i3.181

Neog Y, Yadava AK (2020) Nexus among CO2 emissions, remittances, and financial development: a NARDL approach for India. Environ Sci Pollut Res 27:44470–44481. https://doi.org/10.1007/s11356-020-10198-0

Painter DS (2019) Burning up: a global history of fossil fuel consumption. MIT Press One Rogers Street, Cambridge, MA 02142–1209, USA journals-info …

Pesaran B, Pesaran H (1999) Microfit 4.1 interactive econometric analysis. Oxford University Press, Oxford

Pesaran MH, Shin Y, Smith RJ (2001) Bounds testing approaches to the analysis of level relationships. J Appl Econ 16:289–326. https://doi.org/10.1002/jae.616

Phillips PC, Perron P (1988) Testing for a unit root in time series regression. Biometrika 75:335–346. https://doi.org/10.1093/biomet/75.2.335

Rahman MM, Alam K (2022) Impact of industrialization and non-renewable energy on environmental pollution in Australia: do renewable energy and financial development play a mitigating role? Renew Energy. https://doi.org/10.1016/j.renene.2022.06.012

Rahman Zu, Cai H, Ahmad M (2019) A new look at the remittances-FDI-energy-environment nexus in the case of selected Asian nations. Singap Econ Rev 1-19. https://doi.org/10.1142/S0217590819500176

Rani T, Wang F, Rauf F, Ali H (2022) Linking personal remittance and fossil fuels energy consumption to environmental degradation: evidence from all SAARC countries. Environ Dev Sustain 1-22. https://doi.org/10.1007/s10668-022-02407-2

Ratha D, Eigen-Zucchi C, Plaza S (2016) Migration and remittances factbook 2016, 3rd edtion. Washington, DC: World Bank. https://openknowledge.worldbank.org/bitstream/handle/10986/23743/9781464803192.pdf. Accessed 6 Mar 2022

Rehman A, Rauf A, Ahmad M, Chandio AA, Deyuan Z (2019) The effect of carbon dioxide emission and the consumption of electrical energy, fossil fuel energy, and renewable energy, on economic performance: evidence from Pakistan. Environ Sci Pollut Res 26:21760–21773. https://doi.org/10.1007/s11356-019-05550-y

Sabir S, Qayyum U, Majeed T (2020) FDI and environmental degradation: the role of political institutions in South Asian countries. Environ Sci Pollut Res 27:32544–32553. https://doi.org/10.1007/s11356-020-09464-y

Sahoo P (2006) Foreign direct investment in South Asia: Policy, trends, impact and determinants. Asian Development Bank. http://hdl.handle.net/11540/3644. Accessed 6 Mar 2022

Salazar-Núñez HF, Venegas-Martínez F, Lozano-Díez JA (2022) Assessing the interdependence among renewable and non-renewable energies, economic growth, and CO2 emissions in Mexico. Environ Dev Sustain 24:12850–12866. https://doi.org/10.1007/s10668-021-01968-y

Sarkodie SA, Strezov V (2019) Effect of foreign direct investments, economic development and energy consumption on greenhouse gas emissions in developing countries. Sci Total Environ 646:862–871. https://doi.org/10.1016/j.scitotenv.2018.07.365

Shahbaz M, Solarin SA, Sbia R, Bibi S (2015) Does energy intensity contribute to CO2 emissions? A trivariate analysis in selected African countries. Ecol Ind 50:215–224. https://doi.org/10.1016/j.ecolind.2014.11.007

Shan Y, Fang S, Cai B, Zhou Y, Li D, Feng K, Hubacek K (2021) Chinese cities exhibit varying degrees of decoupling of economic growth and CO2 emissions between 2005 and 2015. One Earth 4:124–134. https://doi.org/10.1016/j.oneear.2020.12.004

Sharma K, Bhattarai B, Ahmed S (2019) Aid, growth, remittances and carbon emissions in Nepal. Energy J 40. https://doi.org/10.5547/01956574.40.1.ksha

Shin Y, Yu B, Greenwood-Nimmo M (2014) Modelling asymmetric cointegration and dynamic multipliers in a nonlinear ARDL framework. In: Sickles R, Horrace W (eds) Festschrift in Honor of Peter Schmidt. Springer, New York, NY. https://doi.org/10.1007/978-1-4899-8008-3_9

Taghvaee VM, Arani AA, Soretz S, Agheli L (2022) Diesel demand elasticities and sustainable development pillars of economy, environment and social (health): comparing two strategies of subsidy removal and energy efficiency. Environ Dev Sustain 1-31. https://doi.org/10.1007/s10668-021-02092-7

Tao S, Zheng T, Lianjun T (2008) An empirical test of the environmental Kuznets curve in China: a panel cointegration approach. China Econ Rev 19:381–392. https://doi.org/10.1016/j.chieco.2007.10.001

Umair M, Waheed A (2017) What drives remittances from Saudi Arabia to Pakistan? Home versus host country’s economic conditions. Int Migr 55:141–153. https://doi.org/10.1111/imig.12344

Wang S, Li Q, Fang C, Zhou C (2016) The relationship between economic growth, energy consumption, and CO2 emissions: empirical evidence from China. Sci Total Environ 542:360–371. https://doi.org/10.1016/j.scitotenv.2015.10.027

Wang Z, Zaman S, Rasool SF (2021) Impact of remittances on carbon emission: fresh evidence from a panel of five remittance-receiving countries. Environ Sci Pollut Res 28:52418–52430. https://doi.org/10.1007/s11356-021-14412-5

Waqih MAU, Bhutto NA, Ghumro NH, Kumar S, Salam MA (2019) Rising environmental degradation and impact of foreign direct investment: an empirical evidence from SAARC region. J Environ Manage 243:472–480. https://doi.org/10.1016/j.jenvman.2019.05.001

WDI (2022) DataBank, World Development Indicators, The World Bank. https://databank.worldbank.org/source/world-development-indicators. Accessed 1 Jan 2022

Weili L, Khan H, Han L (2022) The impact of information and communication technology, financial development, and energy consumption on carbon dioxide emission: evidence from the Belt and Road countries. Environ Sci Pollut Res 29:27703–27718. https://doi.org/10.1007/s11356-021-18448-5

Xu X, Abbas HSM, Sun C, Gillani S, Ullah A, Raza MAA (2021) Impact of globalization and governance determinants on economic growth: an empirical analysis of Asian economies. Growth Chang 52:1137–1154. https://doi.org/10.1111/grow.12475

Xu Z, Baloch MA, Meng F, Zhang J, Mahmood Z (2018) Nexus between financial development and CO2 emissions in Saudi Arabia: analyzing the role of globalization. Environ Sci Pollut Res 25:28378–28390. https://doi.org/10.1007/s11356-018-2876-3

Yang B, Jahanger A, Khan MA (2020) Does the inflow of remittances and energy consumption increase CO2 emissions in the era of globalization? A global perspective. Air Qual Atmos Health 13:1313–1328. https://doi.org/10.1007/s11869-020-00885-9

Yousuf MU, Abbasi MA, Kashif M, Umair M (2022) Energy, exergy, economic, environmental, energoeconomic, exergoeconomic, and enviroeconomic (7E) analyses of wind farms: a case study of Pakistan. Environ Sci Pollut Res 1-24. https://doi.org/10.1007/s11356-022-20576-5

Zafar MW, Saleem MM, Destek MA, Caglar AE (2022) The dynamic linkage between remittances, export diversification, education, renewable energy consumption, economic growth, and CO2 emissions in top remittance-receiving countries. Sustain Dev 30:165–175. https://doi.org/10.1002/sd.2236

Zhang L, Yang B, Jahanger A (2022) The role of remittance inflow and renewable and non-renewable energy consumption in the environment: accounting ecological footprint indicator for top remittance-receiving countries. Environ Sci Pollut Res 29:15915–15930. https://doi.org/10.1007/s11356-021-16545-z

Zhongming Z, Wei L (2020) World’s governments must wind down fossil fuel production by 6% per year to limit catastrophic warming. Global S&T Development Trend Analysis Platform of Resources and Environment. http://119.78.100.173/C666/handle/2XK7JSWQ/306243. Accessed 8 Mar 2022

Ziaei SM (2015) Effects of financial development indicators on energy consumption and CO2 emission of European, East Asian and Oceania countries. Renew Sustain Energy Rev 42:752–759. https://doi.org/10.1016/j.rser.2014.10.085

Acknowledgements

Authors would like to thank the World Bank for publicizing the raw data and reports.

Author information

Authors and Affiliations

Contributions

M. Umair: conceptualization, data curation, formal analysis, investigation, software, writing, and reviewing. M.U.Yousuf: conceptualization, data curation, formal analysis, investigation, validation, writing, and reviewing.

Corresponding author

Ethics declarations

Ethical approval

Not applicable.

Consent to participate

Not applicable.

Consent for publication

Not applicable.

Competing interests

The authors declare no competing interests.

Additional information

Responsible Editor: Roula Inglesi-Lotz

Publisher's note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Umair, M., Yousuf, M.U. Evaluating the symmetric and asymmetric effects of fossil fuel energy consumption and international capital flows on environmental sustainability: a case of South Asia. Environ Sci Pollut Res 30, 33992–34008 (2023). https://doi.org/10.1007/s11356-022-24607-z

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-022-24607-z