Abstract

In order to deal with severe problems such as environmental pollution and climate change, the Chinese government has proposed the goal of carbon neutrality in 2030 and carbon peak in 2060. Strategic emerging industries have become key areas of high-quality growth of green economy. In order to solve the practical problems of insufficient funds and financing constraints, this paper empirically measures the financing efficiency of strategic emerging industries. Based on the Super Slack-Based Measure model, this paper selects the data analysis of listed companies in Beijing, Tianjin and Hebei from 2011 to 2020. At the same time, this paper systematically combs the index system that affects financing efficiency based on grounded theory. Based on the binary relation and structural level of adjacent matrix and reachable matrix, the explanatory analysis is carried out. On this basis, a systematic GMM model is established to explore the significance of different factors influencing financing efficiency. The research shows that the strategic emerging industry is still in the initial stage, the financing efficiency is not high and the financing output is insufficient. The factors affecting financing efficiency can be divided into 6 dimensions, 20 indicators in total and 5 multipole hierarchical levels. Credit financing, equity financing, financing constraints, technological innovation and government support are the important factors affecting financing efficiency.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Under the traditional economic model, the extensive growth mode of “high input, high energy consumption and high pollution” has induced adverse problems such as environmental pollution, resource waste and ecological imbalance. In September 2020, in order to deal with the increasingly serious problem of climate change, the Chinese government proposed the “dual carbon” goal of “carbon peak” by 2030 and “carbon neutral” by 2060. At the Climate Ambition Summit in December 2020, General Secretary Xi Jinping further stated that by 2030, China’s carbon dioxide emissions per unit of GDP will fall by over 65% from 2005 levels, and non-fossil energy will account for around 25% of primary energy consumption. Medium-term targets include increasing forest volume by 6 billion cubic meters from 2005 and installing renewable energy capacity. Under the goal of carbon neutrality, the development and expansion of strategic emerging industries, mainly high-tech and low-pollution industries, will help optimize the industrial and energy structure. Strategic emerging industries are characterized by innovation and green features, integrating new technologies such as big data, cloud computing, artificial intelligence, blockchain, Internet of Things and platform economy. At present, with the outbreak of COVID-19, volatile changes in the international political environment and increasing downward pressure on the economy, strategic emerging industries are confronted with practical difficulties such as increased operating costs and insufficient funds. Improving financing efficiency has become a key issue to be urgently solved for strategic emerging industries.

The study of industrial financing theory began in the 1950s, and a number of representative theoretical schools emerged, such as the early financing theory school (Durand and Finance 1952), modern financing theory school (Modigliani and Miller 1958) and the new Order theory school (Myers 1984). Due to the dominant position of traditional industries such as manufacturing industry, many scholars have analyzed the problems related to manufacturing finance by applying industrial financing theory. Manufacturing enterprises will play a mediating role in the division of global value chain through their overseas investment activities (Kojima 1978). Technology-intensive manufacturing enterprises can significantly improve their position in the global value chain through direct foreign investment (Nie and Li 2022). External financing has a significant impact on manufacturing industry to improve export (Ceptureanu et al.2014). In the case of capital constraint, whether the quantity of products produced by manufacturing enterprises is sufficient is related to carbon price and recovery rate, and the financing decision of enterprises depends on the rate of return of capital(Wang and Chen 2017). Factors such as finance, energy, human capital and technology have significant effects on the growth of manufacturing industry in the short and long run (Arjun et al.2020). Empirical data based on India from 2011 to 2017 show that companies in Indian states mainly adopt conservative financing and investment strategies, which have a positive effect on the return on assets, but a negative effect on the financial sustainability of the industry (Farhan et al.2021). In the binary closed-loop supply chain composed of risk-averse suppliers and risk-neutral oems, three financing modes, partial trade credit, full trade credit and pure bank credit, can be formed (Zhang and Chen 2020).

Since the Paris Agreement was put forward in 2015, 120 countries around the world have proposed carbon neutrality targets, and research on the green transformation of traditional manufacturing has become a hot issue. In order to achieve carbon neutrality, environmental regulation has become a common policy tool. In the traditional economic theory, some scholars believe that environmental regulation will increase the cost of enterprises and reduce the profit space (Whalley and Whitehead 1994). However, the Porter hypothesis suggests that this loss can be reversed through a compensation mechanism (Porter and Linde 1995). Later, some scholars put forward the concept of green governance, which is a collaborative governance system involving the government, enterprises, society and market. The concept of green governance requires the remodeling of the internal and external governance environment of traditional enterprises and the eventual realization of green transformation (Lin and Chen 2017). Environmental technology standards can effectively reduce pollution emission intensity and promote green transformation of manufacturing enterprises (Wan et al.2021). In addition, environmental tax can promote technological innovation and improve production efficiency (Franco and Marin 2017). The positive effect of environmental governance performance on economic growth can be verified by the empirical analysis of China’s emission right pilot project (Ren et al.2019).

With the promotion of the green transformation of traditional industries, strategic emerging industries have become an important direction of the transformation and upgrading of China’s industrial economic structure and derived a lot of valuable achievements. Developing strategic emerging industries is a rational choice for China to stand at the inflection point of economic transformation and explore the road to the rise of a great power (Hu and Zheng 2020). Financial support is a favorable guarantee for the cultivation and development of strategic emerging industries and is conducive to reducing external financing costs of enterprises (Zeng et al.2021). The government provides funds for the industry through financial subsidies and other means to alleviate the defects of the capital market(Barbosa and Silva 2018). In addition, empirical data show that financial support is conducive to the sustainable development of strategic emerging industries (Streimikiene 2016). However, because strategic emerging industries are characterized by high risk and high investment, government subsidies will affect the leverage ratio of enterprises in strategic emerging industries (Cai and Liu 2020). There are also studies that financial support is not conducive to the improvement of innovation efficiency of strategic emerging industries, but government subsidies help enterprises get more financial support (Yan et al.2020). It can be seen that financial support plays an important role in the growth of strategic emerging industries.

The above literature on financing theory, green transformation and financial support for strategic emerging industries has achieved abundant results. Scholars in developed countries have carried out theoretical research on financing earlier, forming systematic scientific theories, but these theories have limited application in the field of strategic emerging industries. Chinese scholars have produced many research results on financial support for strategic emerging industries. However, there are still some problems. For example, there are many studies on the measurement of financing efficiency, but there is insufficient research on the factors affecting financing efficiency. Therefore, it is necessary to deeply study the screening mechanism of factors affecting financing efficiency, and analyze the relationship between different factors. The main purpose of this paper is to try to solve these problems.

Theoretical assumptions

Referencing to existing relevant studies (Sohail et al. 2021a, b; Sohail et al.2020), in order to study the possible factors affecting financing efficiency, this paper firstly carries out theoretical analysis from financing supply, financing allocation, financing performance, social environment, financial environment and policy environment, and puts forward corresponding hypotheses.

-

(1)

Financing supply factors and financing efficiency

The paper mainly considers financing supply from the angle of capital channel, respectively from the angle of internal channel and external channel. According to MM’s sequential financing theory, due to the low cost, the industry prefers internal financing, mainly from investment income and shareholder investment. In the development of industry, internal and external capital is the main source of financing supply. Financing supply factors may include equity, debt and so on (Sun 2020). These factors have a direct impact on financing efficiency. Therefore, this paper proposes the first hypothesis of the study.

-

H1: Financing supply factors have a positive impact on financing efficiency

-

(2)

Financing allocation factors and financing efficiency

Financing allocation is the goal of maximizing capital investment returns by optimizing the portfolio of raised funds. Referring to the existing research basis, this paper considers capital structure, financing cost, capital utilization efficiency, corporate liquidity, capital allocation, financing constraints and other indicators as the main factors to measure financing allocation. Capital structure is the proportion of capital raised through different channels, which directly affects the cost and income of industrial financing (Cui et al.2014). Financing cost refers to the cost of obtaining capital input and the cost of interest and dividend after raising capital. Due to the difficulty in measuring costs such as equity financing, this paper mainly selects the ratio of cash to maturity as a proxy variable of financing cost (Chen 2013). Capital utilization efficiency is an important factor in financing allocation. Chen et al. (2015) proposed to take paid-in capital utilization rate as an evaluation index to measure the benefits generated by paid-in capital. In contrast, this paper selects the return on invested capital as a specific index, so as to reflect the quality of income generated by all capital investment. Corporate liquidity directly determines the stability and sustainability of an enterprise’s business. Cash flow is the basic representation of corporate liquidity, and sales cash ratio is selected as an evaluation indicator (Bi et al.2015). In addition, the proportion of net cash flow generated by investment activities is selected as the evaluation index of capital allocation. Financing constraints have a negative impact on the financing allocation of enterprises, and the commonly used evaluation parameters are mainly through the construction of comprehensive evaluation indexes including financing scale, cash flow, etc. In this paper, a common KZ index is established to measure it (Yu et al.2018).

Based on the above analysis, the second hypothesis is proposed:

-

H2: Financing allocation factors have a positive impact on financing efficiency

-

(3)

Financing performance factors and financing efficiency

The financing performance of strategic emerging industries mainly affects the financing output level of financing efficiency. In order to reflect the role of financing in driving industrial growth, operating ability, growth ability and technological innovation can be considered as evaluation indexes of financing performance. Operating capacity can represent profitability and solvency, measured by the main business growth rate. Growth capacity mainly reflects the sustainable ability of enterprise development caused by financing performance and is represented by the growth rate of total assets. Technological innovation is an important feature of strategic emerging industries, and industrial financing is bound to play an important role in technological innovation. Therefore, the ratio of intangible assets is selected as an evaluation index of technological innovation (Du and Cao 2017). Based on the above analysis, the third hypothesis of this paper can be put forward:

-

H3: Financing performance factors have a positive impact on financing efficiency

-

(4)

Social environmental factors and financing efficiency

Social environment has a far-reaching effect on industrial financing activities. Changes in the external environment sometimes lead to drastic fluctuations in industrial financing and development activities, such as the “financial crisis”, “COVID-19” and other social environments, which bring profound changes in the pattern of industrial development (Tian 2019). Therefore, from the characteristics of the industry, business environment, macroeconomic risk, social development level and other factors are considered as indicators of social environmental factors. The business environment will have a significant impact on the contract choice between financing subjects (Yang et al.2020). Therefore, this paper chooses the actual amount of foreign investment utilized in the region as the measurement standard of business environment. Macroeconomic risks have a greater impact on financing efficiency, and the consumer price index (CPI) should be considered as a specific indicator. The smaller the CPI is, the lower the economic risk is. Conversely, the higher the CPI is, the higher the risk is. Therefore, based on the above analysis, the following hypotheses are proposed:

-

H4: Social environmental factors have a significant impact on financing efficiency

-

(5)

Financial environment factors and financing efficiency

Due to the significant difference in financial level in different regions, such special background should be taken into account for factors influencing financing efficiency (Ma and Wang 2017). For regions with high financial market maturity, strategic emerging industries can achieve their financing goals more easily, with lower financing channels and transaction costs. However, in the region with low financial maturity, there is a greater probability of transaction information asymmetry between the financial sector and industrial financing, and the resistance of financing constraints is more obvious. Therefore, the index selection of financial environment factors in this paper considers two aspects: financial environment and financial innovation. Among them, the financial environment is measured by social financing scale and borrowing rate of financial institutions from the perspective of financing demand and supply and demand of financing market. Financial innovation is evaluated according to the level of financial development, and the regional capital formation rate can be used as a proxy variable. According to the analysis, the fifth hypothesis is obtained as follows:

-

H5: Financial environment factors have a positive impact on financing efficiency

-

(6)

Policy environmental factors and financing efficiency

Policy support is a key factor in the cultivation and growth of emerging industries (Lu et al.2018). Therefore, in order to measure the impact of the policy environment, government subsidies are considered as an indicator in line with mainstream practice. On the one hand, government subsidies can directly provide needed funds for the industry; on the other hand, they also have the signal transmission property of market financing, which helps attract diversified capital to flow to emerging fields (Yan et al.2020). This paper selects the logarithm of government subsidies as a specific index of policy environment. Based on the above research, the following hypotheses can be obtained:

-

H6: Government environmental factors have a positive impact on financing efficiency

The possible marginal contribution of this paper is as follows: First, it expands the selection method of factors affecting financing efficiency of strategic emerging industries. Previous studies mainly focused on qualitative analysis, which was fragmented and biased. This paper takes multi-level coding and saturation test as the basis of systematic classification to build an index system of factors affecting financing efficiency. Secondly, the binary relation and structural level interpretation analysis of the influencing factors are made by adjacency matrix and reachable matrix. Thirdly, the system GMM model is established to explore the significance of different elements. The feasible methods for selecting, classifying and evaluating financing efficiency factors are expanded and enriched from theoretical and practical dimensions.

Materials and methods

Measurement method of financing efficiency of strategic emerging industries

In order to overcome the shortcomings of the classical DEA model, Tone K (2001) proposed an improved SBM model (Slack-Based Measure, namely the farthest distance function to the frontier), which mainly considered the Slack variable into the calculation of efficiency value. According to the analysis of Tone et al. the solution form of SBM model can be obtained.

If there are K decision unit, the input and output vectors are respectively expressed as X, Y. So, define the production set as follows:

where, if the input–output quantity \(DMU\left({x}_{1},{y}_{1}\right)\) of a specific decision-making unit has the following relationship:

In the above formula, if \({s}^{-}\ge 0\), it means that the input of DMU is redundant; if \({s}^{+}\ge 0\), it means that the output of DMU is insufficient, that is, the efficiency is slack. Therefore, the linear expression of the SBM model can be transformed as follows:

In the above model, θ can be used as the target value of efficiency, m respectively represents the output category and n input category of efficiency. \({s}_{i}^{+}\) and \({s}_{i}^{-}\) are members of \({s}^{+}\) and \({s}^{-}\). α represents the column vectors.

According to the above SBM model, the allowable efficiency value can be extended to be greater than 1. After deformation and transformation, super SBM model based on variable scale is obtained, and the specific expression is as follows:

In the above model, n samples were selected as decision units, and \(\mathrm{X}={x}_{ij}\) and \(\mathrm{Y}={y}_{ij}\) were defined as input and output vectors respectively. ρ represents the efficiency value of decision-making unit, m and k represent the categories of input–output indicators and λ represents column vectors. Meanwhile, \({x}_{i0}\left(i=1\cdots m\right)\) and \({y}_{r0}\left(r=1\cdots k\right)\) represent the elements of X and Y respectively. \({S}_{i}^{-}\) and \({S}_{r}^{+}\) represent the relaxation variables.

Methods of screening the influencing factors of financing efficiency of strategic emerging industries

The above DEA model method using super SBM is a non-parametric estimation technique, which only considers the results of input and output and does not consider the intermediate process. Therefore, specific factors affecting financing efficiency cannot be accurately evaluated. Therefore, it is necessary to further study the specific indicators affecting financing efficiency. In order to systematically and comprehensively grasp the influencing factors of financing efficiency, grounded theory can be introduced for screening.

Grounded theory was first proposed by Glaser and Strauss (Glaser and Strauss 1967). Different from the traditional research paradigm, grounded theory is a bottom-up theoretical model. In the process of research, relevant hypotheses are not put forward first, but theories are summarized and analyzed according to empirical data. The core of this approach is to sublimate new concepts and ideas from past facts (Chen 1999). The main method of rooting theory is to collect relevant data of existing studies and carry out systematic analysis according to data coding. Figure 1 is the main process of grounded theory method, including research design, literature collection, open coding, spindle coding, selective coding. Then, the conclusion is drawn according to the saturation degree of the theory (Pandit 1996; Xu and Xiaoyu 2014; Zhang and Chen 2020).

Considering the lack of special research on the factors influencing the financing efficiency of strategic emerging industries in China, this issue is still in the exploratory stage and belongs to the frontier research field. Therefore, the driving factors of financing efficiency can be screened based on grounded theory.

This paper will use the method of literature research, starting from the existing academic papers, through a large number of literature summary, extracting the main aspects of the influencing factors. At the same time, considering that strategic emerging industries are mainly proposed by the Chinese government, there are few foreign studies; therefore, bibliometrics is used to obtain data. CNKI, Wanfang, Baidu Wenku, Chaoxing are commonly used literature platforms. From the integrity and authority of literature, this paper chooses CNKI as the main source of literature.

On CNKI, 195 literatures can be obtained by selecting “strategic emerging industries”, “financing efficiency” and “influencing factors” as the subject retrieval, and 45 literatures can be obtained by searching similar “financial support efficiency” and “influencing factors”. A total of 240 articles were obtained.

Relationship method of influencing factors of financing efficiency based on explanatory structure model

In order to explore the relationship between different factors influencing financing efficiency of strategic emerging industries, it is necessary to introduce explanatory structure model to comprehensively analyze. Interpertatice Structural Model (ISM Model) was first proposed by American scholar Warfidld (Warfield 2007). This model can efficiently deal with the complex relationships in the system and clarify the logicality between different ideas and concepts. ISM model is helpful to analyze the internal correlation among various factors of financing efficiency (Wang et al.2018).

Using ISM model to analyze the relationship between system elements has become an important method in the academic world and has been widely applied, such as safety factors (Li and Jiang 2019), ecological institutional environment (Lou and Mu 2021), public opinion risk control (Cao and Hou 2021), fire risk assessment (Sun et al.2020), urban business environment analysis (Chen et al.2021) and other fields.

The main modeling steps of ISM model are as follows:

-

Step1: adjacency matrix is formed by analyzing the internal correlation of different elements.

The adjacency matrix describes the direct or indirect relationship between different factors.

Suppose there are n factors affecting financing efficiency, which are \(\left({T}_{1},{T}_{2},{T}_{3}\cdots {T}_{n}\right)\) respectively. Therefore, the square matrix \(n\times n\) of F is used to represent the binary relationship of influencing factors. That is, F is the adjacency matrix, and each element in F is represented by \({b}_{ij}\); then, the following equation can be obtained:

If there is a direct relationship between elements \({T}_{i}\) and \({T}_{j}\), then \({b}_{ij}\) is 1; otherwise, \({b}_{ij}\) is 0, which can be expressed by the formula as follows:

-

Step2: Establish the reachable matrix.

The main calculation method of reachable matrix is to multiply the adjacent matrix F by the identity matrix I, and then deduce the final matrix according to the rules of Boolean algebra. For example, if some element \({T}_{i}\) in a matrix system can be changed to \({T}_{j}\) by a degree of identity matrix, and \({T}_{j}\) can go one more time to \({T}_{q}\). Therefore, we can assume that \({T}_{q}\) can be obtained from \({T}_{i}\) by 2 unit changes (Pan and Hu 2020).

In the operation, the Boolean algebra formula is as follows:

By adding two matrices, i.e. by calculating a certain power term until:\(\left(F+I\right)\)

Then, the matrix D can be regarded as the reachable matrix of factors affecting financing efficiency.

-

Step3: present the hierarchical relationship between all factors in the form of ladder structure logic diagram, and explain the correlation of different elements.

From the reachable matrix D, it can be concluded that the element \({T}_{i}\) can reach the set \(Z\left({T}_{i}\right)\),

. \(Z\left({T}_{i}\right)\) represents the set of 1 elements in row i of matrix D.

. \(Z\left({T}_{i}\right)\) represents the set of 1 elements in row i of matrix D.

Further, the intersection of \(Z\left({T}_{i}\right)\) and \(X\left({T}_{i}\right)\) can be used to obtain the level \({A}_{\mathrm{i}}\) of the system, then:

\({A}_{1}\) represents the highest level of all factors influencing financing efficiency. Elements in \({A}_{1}\) cannot reach other elements, but all other elements can reach elements in \({A}_{1}\). If \({A}_{1}\) is determined, the elements of rows and columns corresponding to \({A}_{1}\) in the reachable matrix D can be removed, and then the second layer \({A}_{2}\) can be obtained by adopting \({A}_{1}\) similar path. Finally, in the same way, the other levels of \({A}_{3},{A}_{4}\cdots\) are advanced layer by layer until the lowest level of \({A}_{0}\) is determined.

Empirical test method of financing efficiency influencing factors based on dynamic panel regression model

There are many factors that affect the financing efficiency of strategic emerging industries. Although the grounded theory is used to collect a full range of variables as comprehensively as possible, the problem of missing variables is inevitable due to the deficiency of cognition and observation ability. The traditional least square method and other models assume that the covariance of the dependent variable and the error term is equal to 0. However, in the actual estimation, due to endogenous reasons, the results are biased. It is necessary to select a suitable model to empirically test the factors influencing the financing efficiency of strategic emerging industries.

In 1991, Arellano et al. proposed the GMM estimation model, which mainly aimed to overcome the bias and endogeneity problems existing in the model estimation, mainly through the first-order difference equation (Arellano and Bond 1991). Subsequently, Blun and Bond (2007) proposed the system GMM estimation model, which can solve the problem of weak instrumental variables existing in the first-order GMM estimation model. Therefore, on the basis of reference to relevant practices at home and abroad, this paper uses systematic GMM model to estimate the empirical analysis of the financing efficiency of strategic emerging industries and its influencing factors. The system GMM model changes the difference lag term into instrumental variable to improve the explanatory power of the results (Zhang and Sun 2012). The setting and results of the model will be determined according to the results of factors influencing the financing efficiency of strategic emerging industries.

Research results

Measurement results of financing efficiency of strategic emerging industries

In this paper, the input–output index of financing efficiency of strategic emerging industries is mainly based on scientific, rational and data availability principles. For reference, Zeng et al. (2021) studied the data of strategic emerging industries in Beijing-Tianjin-Hebei region from listed companies in the Stock Exchange and Shenzhen Stock Exchange from 2011 to 2020. Due to the length and focus of the study, the specific process is not described here. This paper mainly analyzes the measurement results of financing efficiency.

Through empirical modeling, the distribution of financing efficiency of 9 sub-industries of strategic emerging industries in Beijing-Tianjin-Hebei region can be obtained, as shown in Fig. 2. From the perspective of Beijing, the highest average financing efficiency of related service industry is 0.85. From 2011 to 2020, the average financing efficiency between 2012 and 2020 is greater than 1.0. This may be related to the expansion of market demand. In the context of policy stimulus and market environment changes, the output demand of relevant service industry expands and increases. In particular, in 2020, due to the outbreak of COVID-19, the demand of the biomedical industry keeps growing, and a large amount of capital from the capital market pours into the biological industry, which significantly increases the efficiency of industrial financing.

Tianjin's overall industrial financing efficiency is higher than that of Beijing, with an average value of 0.993. The values of related service industry, digital creativity and new energy vehicle industry are all greater than 1.0, indicating effective efficiency. This shows that Tianjin attaches great importance to the development of these three industries and has issued special policy documents for scientific and technological support during the 13th Five-Year Plan period. Next-generation information technology and high-end equipment manufacturing ranked the bottom two, but the lowest score was 0.807, higher than 0.8. The value of energy conservation and environmental protection industry is 0.993, close to 1.0. In order to control smog, sandstorms and other adverse environment, energy conservation and environmental protection industry has a special market demand in Tianjin, and the industrial development is sought after by investment.

The digital creativity, new material and new energy industries in Hebei province performed well, with efficiency values of 1.25, 1.152 and 1.071, respectively, greater than 1.0. The efficiency value of new energy vehicle industry is the lowest, only 0.653. The new energy vehicle industry in Hebei province is mainly represented by Great Wall Motor and has a low industrial density. Industrial financing is mainly research and development; output is insufficient. The efficiency value of related services is 0.988, close to 1.0. The fixed input of related service industry is small, and the elasticity of industrial financing is large. The value of biological industry and high-end equipment manufacturing was 0.827 and 0.825, respectively, which were at the middle level. On the whole, the average efficiency of industrial financing in Hebei province is 0.916, higher than that in Beijing. The main reason is that there are no obvious advantageous industries in Hebei Province. The industrial pattern mainly serves Beijing and Tianjin, but there is no large-scale industrial cluster.

Results of influential factors of financing efficiency of strategic emerging industries based on grounded theory

Figure 2 shows the measurement results of financing efficiency of strategic emerging industries. In order to further get the factors affecting efficiency, it will conduct in-depth research based on grounded theory.

Coding of influencing factors of financing efficiency

According to the operation mode of grounded theory, open coding mainly encodes, marks and logs the data related to the acquired topic. In this link, the factors that may affect financing efficiency are mainly coded, and the openness of data identification is realized through native coding as far as possible. Choose Nvivo 8.0 software as the tool.

There are many literatures studying the influence of financing efficiency factors. In the analysis of 68 selected literatures, it is inevitable that some literatures adopt duplicate or similar variables. Therefore, the specific research is carried out according to the following screening principles: on the one hand, sufficient factors affecting financing efficiency should be retained as far as possible, but only variables with significant effects should be retained; on the other hand, professional words or concept expressions of the original text should be used to make a thorough summary.

Finally, 102 theme-related codes were obtained after analysis. See Table 1 for relevant codes:

In terms of the analysis of theme-related factors, many indicators are cross-sectional and repetitive due to the differences in concept definition and research perspectives among scholars. For example, some enterprises’ financing ability is expressed by total assets, while others are measured by total assets. The expressions are inconsistent, but the connotation is the same. Therefore, it is necessary to combine some similar indicators and correct some inconsistent concepts. Based on the connotation and characteristics of financing efficiency of strategic emerging industries, and the interpretation and meaning of different indicators, this paper formed six spindle codes on the basis of multiple comparisons and comprehensive evaluation.

Index system of influencing factors of financing efficiency

Based on the above section, the scope of factors affecting the financing efficiency of strategic emerging industries has been preliminarily determined based on grounded theory. However, most of the evaluation indicators may have some defects; considering the scientific nature, availability and possible multicollinearity of the indicators, it is necessary to screen the indicators.

Principal component analysis can be used to reduce the dimension of the original evaluation index. On the one hand, it can reflect the main factors affecting the financing efficiency, and on the other hand, it can ensure the independence of the index. In addition, combined with the rationality of indicators and the availability of data, the index system is finally obtained as shown in Table 2, including a total of 20 indicators from 6 dimensions:

Finally, the index system of factors affecting financing efficiency is shown in Table 2:

Relationship results of influencing factors of financing efficiency based on explanatory structure model

Considering the complex factors influencing the financing efficiency of strategic emerging industries and the numerous logical levels, in order to describe the internal mechanism of different influencing factors, the ISM model is selected to solve this kind of system problems. The specific results are as follows:

Analysis of binary relations and establishment of adjacency matrix

-

(1)

Analysis of binary relations of elements

There may be many relationships among the factors affecting the financing efficiency of strategic emerging industries. According to the common practice of existing research, this paper adopts Delphi method, literature method, interview method and questionnaire survey method to preliminarily determine. Then, the internal relationship of different elements is determined by repeated statistics. Figure 3 shows how the different elements relate to each other.

-

(2)

Establishment of adjacency matrix

Adjacency matrix based on the relationship between different factors of financing efficiency. Indicators of 6 dimensions that affect financing efficiency include 20 factors, mainly including: Capital channels, internal financing, capital structure, financing cost, capital utilization efficiency, corporate liquidity, capital allocation, financing constraints, operating capacity, growth capacity, technological innovation, macroeconomic conditions, macroeconomic risks, social environment, financial environment, financial innovation, government support, etc. The adjacency matrix between different factors is shown in Table 3:

Reachable matrix calculation and element hierarchy division

-

(1)

Establish the reachable matrix

Adjacency matrix is used to reveal the direct relationship between the influencing factors of financing efficiency, but this model is difficult to reflect the indirect relationship. Reachable matrices can overcome this determination.

By using the above methods, the accessibility matrix of different factors of the efficiency of obtaining financing is calculated by SPSS software.

Table 4 represents the addition of adjacency and identity matrices. Table 5 is the reachable matrix of influencing factors of financing efficiency obtained after transformation.

In the reachable matrix, different relations between elements can be represented by the number “0” or “1”, where “1” represents a certain feasible path from element A to element B, while “0” indicates that there is no such relationship between the two.

-

(2)

Hierarchical division of elements

With the help of SPSS19.0 software and the accessibility matrix, the reachable set, advance set and intersection of factors affecting financing efficiency of strategic emerging industries can be obtained. The specific results are shown in Table 6:

Test model results of influencing factors of financing efficiency of strategic emerging industries

-

(1)

Results of model construction

According to the above analysis, the factors influencing the financing efficiency of strategic emerging industries include financing supply factor, financing allocation factor, financing performance factor, social environment factor, financial environment factor, policy environment factor and other internal and external factors. In order to further test the influence and role of different factors on financing efficiency, this paper intends to empiricalize the panel data of strategic emerging industries in Beijing-Tianjin-Hebei region. According to relevant practices (Han and Hu 2016; Duan and Chen 2020),considering that the financing efficiency of the previous period may have an impact on the financing efficiency of the next period. And in order to reduce the estimation error caused by omitted variables, the lagging term of \({eff}_{it}\) is introduced and the dynamic panel regression model is set as follows:

In the above equation, reference to existing studies, the financing efficiency measured by Super SBM model was selected as the explained variable. \({eff}_{it}\) and \({eff}_{it-i}\) represent financing efficiency and lagging term respectively. Considering the scientific nature, authority, availability and integrity of the data, explanatory variables are selected as follows: \(Nci\) represents the total amount of non-current liabilities as a proxy variable of debt financing; \(Stb\) Is short-term borrowing, as a proxy variable of credit financing; \(Tote\) Represents the total share capital, indicating the scale of equity financing; \(Unpro\) Represents undistributed profit and represents the scale of internal financing; \(Fat\) Represents the ratio of fixed assets, indicating the capital structure; \(Ocdd\) Represents the ratio of cash to maturity debt as a proxy variable of financing cost; \(Roc\) Represents the rate of return on invested capital, and represents the efficiency of capital utilization; \(Cats\) Represents sales cash ratio, representing corporate liquidity; Ncfn Represents the proportion of net cash flow in financing, indicating the allocation of funds; Dbt Represents the financing constraint index, choosing the KZ exponent; Tgrt Represents the growth rate of total assets, indicating the growth power of industrial financing; Opgrt Represents the growth rate of main business, indicating the operating power of industrial financing; Inta Represents the ratio of intangible assets, indicating the technical innovation of financing; Fcu On behalf of the actual use of foreign capital, indicating the strength of foreign investment; Cpi Is the consumer price index, indicating the level of macroeconomic risk; Sii Represents the social livelihood index, indicating the level of social development; Ssf Represents the scale of social financing and indicates the demand of financial market; Yeb Represents the balance of deposits at the end of the year, representing the level of financial development; Rcfr Represents the regional capital formation rate, indicating the degree of financial marketization; Govs Represents the number of government subsidies, indicating the degree of government support to the industry.

-

(2)

Data sources and statistical results

The value of financing efficiency of strategic emerging industries selected in this part is mainly measured by five-stage DEA model. The financing input, financing allocation and financing performance related indicators of influencing factors of financing efficiency are all from RESSET Financial database, mainly extracted from the annual report data of listed companies. Meanwhile, due to the lag of statistical yearbook, the time period is from 2011 to 2018. The social and environmental factors of financing are from China Statistical Yearbook (2012–2019), Beijing Statistical Yearbook (2012–2019), Tianjin Statistical Yearbook (2012–2019) and Hebei Statistical Yearbook (2012–2019). The financial factors are from China Economic Network, and the government subsidies are from WIND Finance. Due to unknown reasons, some variables have incomplete data. According to common practice, linear interpolation method, multiple filling method and other methods are used to complete, and some samples with serious missing are deleted. After data screening and cleaning, descriptive statistics of relevant variables are obtained as shown in Table 7.

Research and discussion

Discussion on different results of financing efficiency of strategic emerging industries

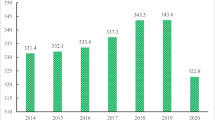

According to the calculation in Fig. 2, relevant results of financing efficiency of strategic emerging industries in Beijing-Tianjin-Hebei region can be obtained by using super SBM. It is necessary to discuss the efficiency differences between different regions of Beijing, Tianjin and Hebei. According to the calculation results, the financing efficiency results of Beijing, Tianjin and Hebei region during 2011–2020 are obtained and compared among different regions, as shown in Fig. 4 (Due to space, results from Tianjin and Hebei are not shown in this paper).

From the comparison of the results, the mean overall efficiency of Beijing, Tianjin and Hebei is shown in Fig. 4, and the specific values are 0.993, 0.916 and 0.759, \(\mathrm{Tianjin}>\mathrm{Hebei}>\mathrm{Beijing}\). This is related to the industrial development stage of the three places. Beijing has a large number of enterprises, large scale, many leading enterprises, higher industrial maturity, large R&D investment, high cost and low financing efficiency in the short term. Tianjin benefits from regional advantages and industrial base, and industrial input is accelerating the output with high efficiency. The number of industries in Hebei province is relatively small, the industrial density is low and the strategic emerging industries are still in the initial stage, attracting a lot of capital attention, but the financing output is still insufficient. This fully shows that the financing efficiency of Beijing, Tianjin and Hebei region has significant heterogeneity.

Discussion on the main category relationship of influencing factors of financing efficiency of strategic emerging industries

According to the grounded theory, the coding situation of different influencing factors of financing efficiency can be obtained based on open coding. It is also necessary to discuss the relationship between different influencing factor categories, which can be effectively discussed by selective coding. Selective coding outlines the connections between core categories and other categories. The purpose of selective coding is to clarify the relationship between existing categories and codes. According to the core category of this paper, the following relationship structure is established, as shown in Table 8:

Then, theoretical saturation test mainly evaluates whether the existing category is comprehensive and whether other categories can be derived. Assuming that new categories can be generated, it is necessary to re-mine or add other data. Similarly, if no new categories can be generated, then the theory reaches saturation and passes the test.

According to the saturation test of the factors influencing the financing efficiency of strategic emerging industries in this paper, it is found that no new categories and relationships are generated after the work of the above three links. Therefore, it can be considered that the research in this paper has reached theoretical saturation.

Hierarchical discussion on influencing factors of financing efficiency based on explanatory structure model

As shown in Table 9, the accessibility matrix D of financing efficiency influencing factors can be used to obtain \(Z\left({T}_{j}\right)\) and \(Z\left({T}_{j}\right)\) respectively, and then the relevant influencing factors of the first level can be obtained by using \(Z\left({T}_{j}\right)\) and\(Z\left({T}_{j}\right)\). According to the results, the factors in the first layer mainly include four factors:\({T}_{5},{T}_{10},{T}_{11},{T}_{13}\). After deleting the rows and columns corresponding to the elements of the first layer in the reachable matrix D, the elements of the second layer can be obtained by using \(Z\left({T}_{j}\right)\bigcap X\left({T}_{j}\right)\) in the new matrix, mainly including\({T}_{1},{T}_{2},{T}_{3},{T}_{4},{T}_{6},{T}_{7},{T}_{12}\). Similar methods can be used to further subdivide the 20 influencing factors of financing efficiency into 5 levels. Table 8 is a summary of results of different levels. It can be seen that the set of level \({A}_{1}\) is \(\left\{{T}_{5},{T}_{10},{T}_{11},{T}_{13}\right\}\). The set of \({A}_{2}\) levels is; \(\left\{{T}_{1},{T}_{2},{T}_{3},{T}_{4},{T}_{6},{T}_{7},{T}_{12}\right\}\). The set of \({A}_{3}\) levels is\(\left\{{T}_{8},{T}_{15},{T}_{19}\right\}\). The set of \({A}_{4}\) levels is\(\left\{{T}_{9},{T}_{20}\right\}\). The set of \({A}_{5}\) levels is\(\left\{{T}_{14},{T}_{16,},{T}_{17},{T}_{18}\right\}\).

According to Table 8 of the previous section, factors affecting financing efficiency can be divided into five levels.

According to the intensity of the relationship, factors can be divided into three types: the most directly related layer: \({A}_{1}\) layer, which has the most significant effect on financing efficiency; layer of indirect influencing factors: \({A}_{2}\sim {A}_{4}\) layer, these factors have an effect step by step; bottom layer: \({A}_{5}\) layer, mainly environmental factors, which have a deep effect on industrial financing efficiency. As shown in Fig. 5, specific analysis is as follows:

Discussion on the empirical results of influencing factors of financing efficiency based on systematic GMM model

According to the above analysis, the factors influencing the financing efficiency of strategic emerging industries include financing supply factor, financing allocation factor, financing performance factor, social environment factor, financial environment factor, policy environment factor and other internal and external factors. In order to further test the influence and effect of different factors on financing efficiency, this paper intends to conduct empirical analysis through systematic GMM model.

The specific empirical results of relevant data obtained from statistical yearbooks and annual reports of listed companies are shown in Table 10. Through data analysis and comparison in Beijing, Tianjin and Hebei, it can be found that:

First, the efficiency of industrial financing in Beijing is significantly affected by Stb, Roc, Cats, Dbt, Fcu, Sii, Yeb, Rcfr, Govs and other factors, passing the 1% test. Among them, credit financing, capital utilization efficiency and corporate liquidity all have a positive impact on financing efficiency. According to the above analysis, the strategic emerging industries in Beijing are more mature than those in other regions, and a number of high-tech enterprises have been cultivated. The industrial life cycle in Beijing has evolved from the primary stage to the mature stage. Beijing's industrial financing mode has gradually shifted to rely on credit financing and other models. The main reason is that through asset accumulation and credit improvement, more financial support can be obtained. The main reason is that through the accumulation of assets, credit can get more financial support. The higher the capital utilization rate is, the higher the financing efficiency is. A considerable proportion of strategic emerging industry enterprises in Beijing can obtain stable cash flow through the transformation of scientific and technological achievements and improve the capital flow rate of enterprises. Sii, Yeb, Rcfr and Govs have significant effects on financing efficiency. Beijing gathers a large number of top technical innovation high-level talents and a large number of headquarters of financial institutions, forming a benign industrial financing environment. The government’s financing support will raise the financing efficiency of the industry.

Second, the effect of Tianjin and Beijing are basically the same. For example, the influence of Nci, Stb, Tote, Roc, Dbt and other factors passed the significance test of 1%. In addition to financing supply, allocation and performance factors, the impact of financing constraints on the financing of Tianjin’s strategic emerging industries cannot be ignored. From the index coefficient, it is significantly negative. Meanwhile, Yeb, Rcfr, Govs and other environmental factors were also significant. This suggests that economic level, financial markets and government support are important financing factors. Tianjin is at a medium level of development in the Beijing-Tianjin-Hebei region, taking on the task of relieving Beijing of non-capital functions, and playing an important role in accepting industrial transfer from Beijing. At the same time, as a municipality directly under the central government and one of the northern economic centers, Tianjin’s industrial development environment is conducive to promoting the growth of strategic emerging industries and the implementation of financing activities.

Third, the influencing factors of financing efficiency in Hebei have commonness and heterogeneity with those in Beijing and Tianjin. On the one hand, Nci, Stb, Tote and other financing supply factors have a significant impact on financing efficiency, and the coefficient of equity financing factors is 0.224, indicating that equity financing and internal investment are important financing methods, which are in line with low-density and small-scale industries in Hebei. Through the science and technology innovation board, small and medium-sized board and other equity markets can raise funds. On the other hand, Ocdd, Cats, Ncfn, Tgrt and other financing allocation and financing performance factors do not play a significant role. This shows that on the whole, industrial financing in Hebei province has not entered the stage of large-scale financing results. Return on capital, sales cash ratio and growth rate of total assets have no significant effect.

Therefore, through the results of the above empirical analysis, it can be found that the influencing factors screened by grounded theory have a significant impact on the financing efficiency of strategic emerging industries, which verifies the scientific nature of this study.

Research conclusions

This paper first empirically measures the financing efficiency of strategic emerging industries based on the non-parametric DEA model of super SBM. In order to explore the specific factors affecting financing efficiency, the existing high-quality literature classification of financing efficiency index is scanned by the rooted theory panorama, and the main influencing factors of financing efficiency are identified through open, spindle coding and other links. Considering the complex relationship among factors affecting financing efficiency and the numerous logical levels, an explanatory structure model is constructed. In this paper, the Delphi method is adopted to construct a binary directed graph. The elements are divided into different levels by adjacency matrix and reachable matrix, and the structure of the elements at different levels is systematically analyzed. In addition, panel data of The Beijing-Tianjin-Hebei region are selected to establish empirical studies on the samples of different regions and industries using the systematic GMM model, and the significance of the impact of different factors on financing efficiency is comparatively analyzed. The main conclusions include:

First, the empirical measurement of financing efficiency of strategic emerging industries in Beijing, Tianjin and Hebei shows that the strategic emerging industries in Beijing, Tianjin and Hebei are still in the initial stage, attracting a lot of capital attention, but the financing output is still insufficient. There is significant heterogeneity in Beijing, Tianjin and Hebei, and the financing efficiency within the nine major industries is also obvious.

Secondly, the factors affecting the financing efficiency of strategic emerging industries in Beijing-Tianjin-Hebei region can be divided into six dimensions and a total of 20 indicators through the open and spindle coding links of grounded theory.

Thirdly, in order to systematically analyze the correlation between different influencing factors, the interpretation structure model is introduced to clarify the logic and hierarchy of different factors. Based on the binary relations of different elements, adjacency matrix and reachability matrix were established respectively to form a multi-level hierarchical interpretation structure model, and all factors were divided into five levels.

Finally, the system GMM model is established to empirically analyze the influencing factors of financing efficiency. Through empirical analysis results, it can be found that financing supply factors, financing allocation factors, financing performance factors, social environment factors, financial environment factors and policy environment factors will affect financing efficiency. Sii, Yeb, Rcfr and Govs have significant effects on the financing efficiency in Beijing, and the influencing factors of industry in Beijing, Tianjin and Hebei are heterogeneous. Credit financing, equity financing, financing constraints, technological innovation and government support are the important factors affecting the nine industries.

This paper innovatively expands the classification and testing methods of factors affecting financing efficiency of strategic emerging industries, and verifies the hypotheses through empirical testing. It is innovative in theory and practice.

The above research conclusions of this paper will help the government and enterprises to formulate appropriate policies to promote the growth of strategic emerging industries, reduce environmental pollution, improve the ecological environment and achieve the goal of “double carbon”.

Data availability

Not applicable.

References

Arellano M, Bond S (1991) Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. Rev Econ Stud 1991:58

Arjun K, Sankaran A, Kumar S, Das M (2020) An endogenous growth approach on the role of energy, human capital, finance and technology in explaining manufacturing value-added: a multi-country analysis. Heliyon 2020:e04308

Barbosa N, Silva F (2018) Public financial support and firm-specific characteristics: evidence from Portugal. Eur Plan Stud 2018:670–686

Bi XF, Zhang JM, Li HY (2015) Industrial policy, managers’ overconfidence and firm liquidity risk. Account Res 2015(03):57–63

Blun DL, Bond S (2007) GMM estimation with persistent panel data: an application to production functions. Economet Rev 2007:321–340

Cai M, Liu S (2020) The influence of government subsidies on the leverage ratio of strategic emerging industries. Contemp Econ Res 2020:90–100

Cao HJ, Hou T (2021) Research on the structural relationship of risk influencing factors of government public opinion based on ISM. Hubei Soc Sci 2021(5):43–51

Ceptureanu EG, Ceptureanu S, Herteliu C (2014) Evidence regarding external financing in manufacturing MSEs using partial least squares regression. Ann Oper Res 2014:1189–1202

Chen Q, Ding Y, Dun S (2021) Study on influencing factors of urban business environment based on interpretive structure Model. Econ Restructuring 2021:193–200

Chen W (2013) Analysis on the influence of financing mode on financing efficiency of small and medium-sized enterprises. China Securities and Futures 2013(3):123–123

Chen XM (1999) The ideas and methods of grounded theory. Educ Res Exp 1999:58–63

Chen Z, Wang SB (2015) Research on the impact of regional finance on Smes in China—based on the spatial perspective of capital utilization efficiency. Econ Problems 2015(3):120–124

Cui J, Hu HQ, Zhang DH (2014) Research on financing efficiency of non-listed smes: evidence from manufacturing non-listed smes. Soft science 2014(12):84–88

Du CZ, Cao YQ (2017) Financial capital and the development of emerging industries. Nankai Journal (Philosophy and Social Sciences Edition) 2017(1):123–137

Duan WJ, Chen WH (2020) International comparison of monetization rates—systematic GMM estimation based on dynamic panel data. Macroeconomic Research 2020:62–69

Durand D, Finance C (1952) Costs of debt and equity funds for business: Trends and problems of measurement. Conference on research in business finance. National Bureau of Economic Research, Inc 1952:215–262

Farhan N, Almaqtari FA, Al-Matari EM et al (2021) Working capital management policies in Indian listed firms: a state-wise analysis. Sustainability 2021:13

Franco C, Marin G (2017) The effect of within-sector, upstream and downstream environmental taxes on innovation and productivity. Environ Resour Econ 2017:261–291

Glaser BG, Strauss AL (1967) The discovery of grounded theory: strategies for qualitative research. Aldine, Chicago, p 1967

Han G, Hu W (2016) Macroeconomic uncertainty, entrepreneur confidence and fixed asset investment: a systematic GMM approach based on China’s provincial dynamic panel data. Sci Finance Econ 2016:79–89

Hu HF, Zheng FF (2020) Review of ten years’ research on strategic emerging industries based on knowledge graph. Research Manag 2020:240–256

Kojima K (1978) Direct foreign investment: a Japanese model of multinational business operations. Praeger Publishers, New York

Li HS, Jiang Qi (2019) Research on the influencing factors of construction workers’ unsafe behavior based on DeMatel-ISM. J Eng Manag 2019:143–147

Lin YH, Chen, YS (2017) Determinants of green competitive advantage: the roles of green knowledge sharing, green dynamic capabilities, and green service innovation. Quality & Quantity: Int J Methodol 2017:1663–1685

Lou C, Mu Q (2021) Research on the influencing factors of information ecological system environment based on interpretive structure Model. Inf Sci 2021(6):19–26

Lu X, He XH, Dai X, Xin T (2018) Ding YP (2018) Financial development, government subsidies and R&D investment: empirical evidence from listed companies in strategic emerging industries. J Capital Univ Econ Bus 1:49–58

Ma H, Wang YY (2017) Financial environment, integration of industry and finance and the growth of Chinese enterprises. Finance Econ 1:59–71

Modigliani F, Miller MH (1958) The cost of capital corporation finance and the theory of investment. American Economic Review 1958:443–453

Myers SC (1984) The capital structure puzzle. J Finance 39(3):575–592

Nie F, Li L (2022) Foreign direct investment, deindustrialization and its impact on global value chain division of manufacturing enterprises. Int Trade Issues 2022:160–174

Pan Y, Hu Z (2020) Agricultural supply chain financial risk generation factors: based on explanatory structure model. Rural Econ 2020(7):103–110

Pandit NR (1996) The creation of theory: a recent application of the grounded theory method. Qualitative Report 1996(2):1–15

Porter ME, Linde C (1995) Towards a new conception of the environment-competitiveness relationship. J Econ Perspect 1995:97–118

Ren SG, Zheng J, Liu DH et al (2019) Whether the emission trading system improves the total factor productivity of enterprises—evidence from Chinese listed companies. China Ind Econ 2019:5–23

Sohail AJ, Rashid L, Lin L (2020) An analysis of relationship between environmental regulations and firm performance with moderating effects of product market competition: empirical evidence from Pakistan. J Clean Prod 2020(254):120197

Sohail AJ, Rashid L, Tao J et al (2021) How environmental regulations and corporate social responsibility affect the firm innovation with the moderating role of chief executive officer (CEO) power and ownership concentration? J Clean Prod 2021(308):127212

Sohail AJ, Tze SO, Rashid L et al (2021) Conceptualizing the moderating role of CEO power and ownership concentration in the relationship between audit committee and firm performance: empirical evidence from Pakistan. Sustainability 2021(11):6329

Streimikiene D (2016) Review of financial support from EU structural funds to sustainable energy in Baltic states. Renew Sustain Energy Rev 2016:1027–1038

Sun W (2020) An empirical study on the financing factors of emerging technology industrialization based on DEMATEL method. Sci Technol Prog Countermeasures 2020(21):70–77

Sun W, Wei S, Tian X, Xu S, Shi M (2020) Comprehensive assessment of fire risk in Guizhou Minority villages. China Saf Sci J 2020(30):130–137

Tian CY (2019) Macroeconomic environment, cost of capital and firm financing constraints. Journal of Yantai University (Philosophy and Social Sciences) 32(2):101–112

Tone K (2001) A slacks-based measure of efficiency in data envelopment analysis. Eur J Oper Res 130(3):498–509

Wan PB, Yang M, Chen L (2021) How environmental technology standards affect the green transformation of China’s manufacturing industry—based on the perspective of technological transformation. China Ind Econ 2021:118–136

Wang L, Li H, Tian HW (2018) An empirical study on the constraints of third party evaluation of public security policy effect based on interpretive structural equation model. Manage Rev 2018:266–274

Wang Y, Chen W (2017) Effects of emissions constraint on manufacturing/remanufacturing decisions considering capital constraint. J Atmos Pollut Res 2017:455–464

Warfield JN (2007) Binary matrices in system modeling. IEEE Trans Syst Man Cybern 2007:441–449

Whalley N, Whitehead B (1994) It’s not easy being green. Harv Bus Rev 1994:46–52

Xu J, Xiaoyu QU (2014) Qualitative research on driving factors of environmental technology innovation behavior in equipment manufacturing enterprises based on grounded theory. Manag Rev 90–101

Yan JZ, Qi N, Tong C (2020) How do government subsidies and financial support affect innovation efficiency? Empirical evidence from listed companies in China’s strategic emerging industries. Soft Science 2020:41–46

Yang C, Bai XJ, Zhao Y (2020) Business environment, debt sources and financing discrimination: an empirical study from the perspective of contract heterogeneity. Contemp Finance Econ 2020(6):13

Yu WCYH, Liang PH (2018) Tax collection, fiscal pressure and corporate financing constraints. China Ind Econ 2018(1):100–118

Zeng G, Guo HX, Geng CX (2021) A five-stage DEA model for technological innovation efficiency of China’s strategic emerging industries, considering environmental factors and statistical errors. Pol J Environ Stud 2021:927–941

Zhang JQ, Sun Y (2012) Dynamic characteristics of endogenous and absorptive capacity of foreign technology spillovers: an empirical study based on systematic GMM estimation. Econ Rev 2012:74–83

Zhang YM, Chen WD (2020) Optimal production and financing portfolio strategies for a capital-constrained closed-loop supply chain with OEM remanufacturing. J Clean Prod 2020:123467

Funding

This research was funded by Tianjin philosophy and social science planning project (No. TJGLQN19XSX-006), by the Fundamental Research Funds for the Central Universities supported by Civil Aviation University of China (No. 3122019012).

Author information

Authors and Affiliations

Contributions

GZ and CG conceived the experiments. GZ and HG performed the experiments, analyzed the data and proofread the paper. All authors wrote the paper.

Corresponding author

Ethics declarations

Ethics approval and consent to participate

Not applicable.

Consent for publication

Not applicable.

Competing interests

The authors declare no competing interests.

Additional information

Responsible Editor: Roula Inglesi-Lotz

Publisher's note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Highlights

• Grounded theory is helpful to expand the selection method of factors influencing financing efficiency of strategic emerging industries.

• The hierarchical structure of influencing factors of financing efficiency can be effectively explained by adjacency matrix and reachable matrix.

• Systematic GMM model effectively verifies the significant impact of multiple factors on financing efficiency.

Rights and permissions

Springer Nature or its licensor holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Zeng, G., Guo, H. & Geng, C. Mechanism analysis of influencing factors on financing efficiency of strategic emerging industries under the “dual carbon” background: evidence from China. Environ Sci Pollut Res 30, 10079–10098 (2023). https://doi.org/10.1007/s11356-022-22820-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-022-22820-4