Abstract

Pig sector in China is faced with high risks, such as price fluctuation and food safety, and environmental regulation uncertainty. The recent African swine fever has caused public panic and drop down of pork consumption in a short term. The “wu-shui-gong-zhi” policy is a newly recognized environmental policy risk, and its key content is to shut down directly the pig farms close to water resources. Lots of small- and medium-sized farms have been affected, especially in coastal provinces. Supply chain integration received wide attention in supply chain management. Literature has shown that a well-coordinated food supply chain will bring positive outcomes for chain stakeholders. However, the relationship between food supply chain integration and resilience is not empirically captured. This research aims to explore the relationship between supply chain integration and supply chain resilience, and the mechanism of how supply chain integration works on supply chain resilience. To achieve the research purpose, an in-depth ethnographical case study is performed. Four cases in China’s pig sector were selected, with different types of supply chain integration between cooperative and companies. They differ in supply chain resilience levels. We found that supply chain integration has a positive effect on supply chain resilience through agility and robustness. Supply chain agility also has positive relationship with supply chain robustness. It implies that supply chain stakeholders should efficiently exchange information, enhance circulation rate, and jointly make plans to be more resilient to risks. The government needs to make policies to encourage and facilitate supply chain integration among supply chain members to enhance supply chain resilience.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Pig sector in China is faced with high risks, including the long-lasting ones, such as price fluctuation and food safety, and a new risk, which is the environmental regulation uncertainty (Ji et al. 2018). The risks have left a negative impact on the livestock economy. The recent African swine fever has caused public panic and drop down of pork consumption in a short term. Scholars found that price fluctuations show a periodic trend, which means that price fluctuations come into force every 35 to 45 months in the pig industry (Mao and Zeng 2008). The “wu-shui-gong-zhi” policy is a newly recognized environmental policy risk, and its key content is to shut down directly the pig farms close to water resources. Lots of small- and medium-sized farms have been affected, especially in coastal provinces (China environmental protection news 2015).

Supply chain integration received wide attention in supply chain management. Literature has shown that a well-coordinated food supply chain will bring positive outcomes for chain stakeholders, such as sustainable economic performance (Ali et al. 2017), social performance (Dries et al. 2009), and environmental performance (Miranda-Ackerman et al. 2017), as well as stronger market power (Poray et al. 2003), competitiveness (Brinkmann et al. 2011), and more innovation (Petersen et al. 2005). However, the relationship between food supply chain coordination and resilience is not empirically captured. In order to reduce uncertainties, new institutional arrangements start to emerge and develop in the pig sector in China, such as innovative forms of integration between farmers’ cooperatives and firms (Bijman and Hu 2011).

The research aims to use four case studies to explore the relationship between supply chain integration and supply chain resilience, and the mechanism of how supply chain integration works on supply chain resilience. The study has several contributions theoretically and in practice. First, it provides new empirical evidence to resource-based view (RBV) (Helfat and Winter 2011; Dentoni et al. 2016). It also theoretically extended RBV by identifying the positive relationship between supply chain agility and supply chain robustness, which are two types of capabilities; Second, it brings implications to supply chain members and policymakers, pointing out the importance to encourage supply chain integration and remove the barriers to build up supply chain integration.

Literature review

Agri-food supply chain integration

Supply chain integration has been defined “as the degree to which a manufacturer strategically collaborates with its supply chain partners and collaboratively manages intra- and inter- organization process. The goal is to achieve effective and efficient flows of products and services. Information, money and decisions, to provide maximum value to the customer at low cost and high speed” (Flynn et al. 2010). Integration is considered as the degree of supply chain optimization (Romano 2003), while coordination is a pattern of decision-making and communication (Malone 1987) among supply chain actors. Coordination and integration are highly intertwined (Wever et al. 2009). Integration in supply chains can be reached by different combinations of integration and coordination mechanisms. The collaborative supply chain relationships in the food sector normally include market relations, short-term contracts, long-term contracts, joint ventures, strategic alliances, and vertical integration (Van der Vorst 2000).

Fearne (1998) identified the driving forces of supply chain integration, which include changing consumer demand, food safety scandals, and supply chain risks. Anastasiadis and Poole (2015) noted that barriers of SC coordination include incomplete information sharing, coordination difficulties due to the number of linking entities, lack of trust among stakeholders, malfunctions originating from diverse strategic planning practices, different entrepreneurial mentalities, and failure to understand opportunities in agri-food sectors. Studies focused on the role of ASC collaboration in value creation, offering solutions to improve value added methods, and reduce cost and waste along the chain. The means that improve the economic performance of ASCs which were necessary to include were the improvement of information sharing (Kaipia et al. 2013; Martens and Dooley 2010) and adoption of efficient consumer response (ECR) (Martens and Dooley 2010; Fearne and Hughes 1999). A factor that hindered value creation throughout the chain was outdated information on market demand (Wagner and Young 2009).

Regarding the supply chain integration in the agri-food chain in China, it is found that the integrated relationship in Chinese agri-food supply chain is more innovative and comprehensive than the commonly recognized ones in existing literature. Some representative ones include “company + cooperative + farmers” (Huang et al. 2002), “cooperatives + farmers + companies” model (Kong and Shi 2009), “supermarket + production base,” and “supermarket + cooperatives” (Pu et al. 2012). Scholars found that the supply chain coordination has positive contributions to farmers’ access to the market. It reduces intermediate links and increases farmers’ income (Hu 2005; Wang and Han 2002).

Supply chain agility and robustness

There are other two concepts which are embedded deeply in the supply chain resilience area, which are supply chain agility and supply chain robustness. As literature indicates, they might have close relationship with supply chain resilience. Supply chain agility refers to “the ability of the supply chain to respond quickly to change (Charles et al. 2010)”. Christopher and Peck (2004) first proposed two core components of supply chain agility, which are visibility and velocity. Visibility refers to the transparency level of information exchange among supply chain stakeholders. If the information transaction among chain members is highly transparent, then the supply chain is highly visible. Velocity refers to the speed that products or services circulate along the supply chain, and the supply chain velocity is high if the circulation rate is fast. Supply chain visibility and velocity together determine the agility of the supply chain, and it is found that an agile supply chain is more likely to respond and adapt to the external changes, which leads to supply chain resilience. Current studies on the relationship between supply chain agility and resilience are very limited, but existing ones proposed a possible positive relationship (Scholten et al. 2014; Azadeh et al. 2014).

Supply chain robustness refers to the ability of the supply chain to maintain its function despite internal or external disruptions (Brandon-Jones et al. 2014). Robustness emphasizes the supply chain’s ability to withstand risk (Wieland and Wallenburg 2012; Wallace and Choi 2011). Durach et al. (2015) pointed out two main dimensions to measure the robustness of the supply chain based on the review of the robustness of the supply chain, which are resistance and the avoidance. Resistance refers to the ability of the supply chain to withstand disturbances, while avoidance refers to the ability of the supply chain to avoid vulnerabilities. Therefore, the supply chain with strong robustness is as follows: first, proactively identifies and avoids risks; second, the supply chain is always equipped with multiple emergency plans, and uses appropriate solutions when encountered with risks. Though limited, existing research tried to explain the positive relationship between supply chain robustness and resilience. When the supply chain has a good ability to avoid and withstand the risk, it is easier for the supply chain to prepare for and recover from the risks; thus, the supply chain has a higher resilience (Ponnambalam et al. 2014; Wieland and Wallenburg 2013). However, empirical research remains very few.

Therefore, supply chain agility reflects the information exchange and circulation efficiency of the chain, and robustness reflects the extent to which supply chain members work together to avoid and resist risks. They might have positive relationships with resilience, but there is a research gap regarding empirical evidence.

Supply chain resilience and agri-food supply chain resilience

The increasingly vulnerable external environment in supply chain and the serious economic consequences of supply chain risks have made the supply chain resilience a hot research topic in the supply chain management field in recent years (Robeiro and Barbosa-Povoa 2018). Resilience is discussed more at organizational level in current management studies (Annarelli and Nonino 2016), while resilience at supply chain level is comparatively limited. Scholars started to approach this concept by performing literature reviews (Mandal 2014; Godivan et al. 2017). In these review articles, scholars on one hand explored how to define supply chain resilience and its influencing factors and, on the other hand, tried to propose a series of practices that could improve supply chain resilience (Jüttner and Maklan 2011).

Though there is no universal definition of supply chain resilience in the academic world, the definition provided by Ponomarov and Holcomb (2009) seemed to gain much acceptance. They defined supply chain resilience based on a combination of different disciplines as follows:

“The adaptive capability of the supply chain to prepare for unexpected events, respond to disruptions, and recover from them by maintaining continuity of operations at the desired level of connectedness and control over structure and function.”

The definition highlighted three key elements of resilience, which are “preparedness,” “response and adaptation,” and “recovery.” From the perspective of “preparedness,” when the supply chain stakeholders are able to clearly understand the risk profiles, accurately predict the probability and consequences of risks, and actively make preparations, the supply chain resilience is high (Kamalahmadi and Parast 2016; Brusset and Teller 2017). From the perspective of “response and adaptation,” when the supply chain stakeholders can respond quickly to the risks and smoothly adapt to the changes, the supply chain has a high resilience (Tukamuhabwa et al. 2017; Mandal 2012). From the perspective of “recovery,” the supply chain has a high level of resilience when the supply chain system can quickly recover from the original state, or achieves a better situation. (Godivan et al. 2017). We use Fig. 1 to show the three dimensions of the definition of supply chain resilience, which at the same time provides the main sources of measurement to resilience.

Agri-food supply chain resilience is still a new topic and related research just started. Literature focused on risk profile and resilience concept discussion (Zhao et al. 2017), impact of agri-food chain resilience on supply chain performance (Nyamah et al. 2017), and supply chain modeling (Behzadi et al. 2018). Regarding studies under Chinese context, there are a very few researches that clearly discussed the concept “resilience” in agri-food supply chain except one, which explored agricultural cooperative sustainability from the perspective of organizational resilience (Ji et al. 2018). Although studies did not mention the exact resilience concept, related topics are discussed. Scholars also reviewed the risk profiles in agri-food chains in China (Ye and Meng 2007) and proposed that the improvement of the risk management ability among agri-food chain stakeholders can improve the supply chain operation (Liu and Li 2011). Generally speaking, research on supply chain resilience is still in lack, and empirical studies in agri-food supply chain resilience in China context remain very few (Luo et al. 2018).

Relationships among supply chain integration, supply chain agility and robustness, and supply chain resilience in agriculture sector

Literature studying the relationships between supply chain integration, supply chain agility and robustness, and supply chain resilience remains limited, but current research provided some clues to study the relationships among the four constructs.

Tukamuhabwa et al. (2015) summarized that the two theories mainly applied in supply chain resilience are resource-based view (RBV) and dynamic capabilities, and these two theories are closely related. According to RBV logic, resources may need to be combined and utilized together in order to create capabilities (Grant 1991). Previous studies have indicated that integration can be treated as a resource that helps firms adapt to environmental changes and rapidly respond to disruptions (Hohenstein et al. 2015; Ponomarov and Holcomb 2009), and integration provides the capability to reduce the costs and risks of coordination and of transactions by providing managers an opportunity to understand focal areas that need attention (Brusset and Teller 2017). These indicated the positive relationship between integration and resilience.

According to the RBV, strategic resources and/or capabilities may lead to competitive advantage (Barney 1991), and the bundling of resources may lead to capability development (Grant 1991). Brandon-Jones et al. (2014) considered that both supply chain connectivity and information sharing can be positioned as resource, and these resources may lead to the improvement of supply chain visibility, which is considered as a capability. System-wide visibility allows organizations to identify a broad range of bottlenecks and other potential risks and therefore take mitigating action before a disruption occurs. Therefore, supply chain visibility may lead to an enhancement of supply chain resilience (Brandon-Jones et al. 2014).

The literature review in the “Supply chain agility and robustness” section shows that supply chain visibility is an important perspective of supply chain agility. Thus, supply chain agility, as a supply chain capability, may contribute to supply chain resilience. Pettit et al. (2010) stated that agility enables a clear view of the whole chain, which may help in detecting signals of impending disruptions. Supply chain robustness is defined as the ability of the supply chain to maintain its function despite internal or external disruptions (Kitano 2004). Definitions of robustness focus on the ability to continue with operations (Stonebraker et al. 2009) while resisting the impact of supply chain disruptions. Robust supply chain is always equipped with multiple emergency plans, and uses appropriate solutions when encountered with risks. When the supply chain has a good ability to avoid and withstand the risk, it is easier for the supply chain to prepare for and recover from the risks; thus, the supply chain has a higher resilience (Ponnambalam et al. 2014; Wieland and Wallenburg 2013). A supply chain visibility capability also promotes robustness. System-wide visibility allows organizations to identify a broad range of bottlenecks and other potential risks and therefore take mitigating action before a disruption occurs.

Based on the literature review, we found that supply chain resilience might be influenced by supply chain agility and robustness, and they are also the mechanism of how supply chain coordination influences supply chain resilience. Existing literature also indicated the possible positive relationship between supply chain agility and supply chain robustness. Literature on food supply chain resilience is scant; studies on the relationship between supply chain integration and resilience revealed some preliminary findings, but it is under-explored; and empirical evidence is in urgent need. Studies have investigated the relationships between supply chain integration and food safety, and supply chain integration and firm performance, while resilience as a possible outcome of supply chain coordination has not received full attention (JOM editorial 2009).

Data and methodology

Case study method

Four different supply chain integration modes are selected to study and their supply chain resilience. They are (1) federal cooperative mode (Jin’xin cooperative), (2) “cooperative + farmers + company” mode (Long’zhu cooperative and its Chun’ran Agro-Food Tech Co. Ltd.), (3) “company + cooperative + farmers” mode (Jin’zhong Food Co. Ltd. and its Jin’li cooperative), and (4) “vertical integration” mode (Mu’yuan Food Co. Ltd.). Table 1 provides the basic information of the four cases. The four cases differ in their level of supply chain integration and resilience. The most two innovative supply chain integration modes are Jin’zhong and Long’zhu cases, while Jin’xin and Mu’yuan adopted comparatively mature supply chain integration modes. However, we did not choose to use only Jin’zhong and Long’zhu because Jin’xin and Mu’yuan provide very good examples to be compared with, and to draw conclusions. To do this research, we not only used data from field studies but also used second-hand data from official web pages of the companies.

Data collection

In total, we carried out interviews with 14 interviewees (four interviewees for “Jin’xin”; four interviewees for “Chun’ran”; three interviewees for “Jin’zhong”; and three interviewees for “Mu’yuan”) from May 2016 to March 2018. The interviewees include all the presidents of the four companies/cooperatives, and some core members of the cooperative to ensure that a comprehensive view is captured. All the presidents and some key core members were interviewed twice or more.

Research instruments included face-to-face semi-structured interviews lasting 60–120 min per interview and archival data from the website of the companies, or from direct observation. Our interview protocol addresses the following key issues: (1) four companies/cooperative’s profile; (2) their supply chain integration; (3) their supply chain resilience.

We carried out at least two rounds of data collection/field visits for each case company (Table 1). Generally, in the first round of data collection, we tried to understand the business models of the case companies/cooperatives. In the second round of field visits, we collected data with regard to the supply chain resilience and integration. The field researchers (co-authors) visited each of the four companies. For each visit, the field researchers made field notes with 10–20 pages in length based on direct observations of the case companies/cooperatives’ operation.

Data analysis

Following the procedure delineated by Miles and Huberman (1994), we carried out within-case analysis first for each of the four companies/cooperatives respectively. We interactively conducted the coding. First, each field researcher individually coded the data and then, we compared the individually coded data between the co-authors to ensure consistency and inter-coder reliability. Disagreements are resolved along the way. This process led to clarification and, on occasion, redefinition of the constructs and discussion of the evidence. We reached consensus on all constructs before calling the process complete.

The within-case analysis is to, on one hand, gain a broad understanding of the business models of each case company and, on the other hand, supply chain integration and resilience of the cases. The cross-case analysis was performed and findings tabulated, to formulate the conceptual mechanism of how supply chain integration influences supply chain resilience. We employed “clustering” for data analysis (grouping and then conceptualizing objects) at a case level.

Case description

The study adopted four case companies/cooperatives in China’s pig sector. The profiles of the four case cooperatives are detailed in Table 1. Here, we summarize some key information of the four case companies/cooperatives.

Jin’xin federal cooperative

Jin’xin federal cooperative is united by three cooperatives, which are Jin’xin pig production cooperative, Bai’ou’sen pig production cooperative, and Hong’bai’ta pig production cooperative. The main purpose why Mr. Deng Yongwen (hereafter Deng) established the federal cooperative is to unite farmers to purchase feed together and to reduce production cost, thinking that most of the member farmers are small-scaled ones with 30–50 head of pigs produced annually in the backyard. Totally, there are around 150 member farmers in the federal cooperative while Deng is a comparatively larger producer. Member farmers did not know anything before joining the cooperative, but now they rely on Mr. Deng for all the pig production processes, from feed purchasing to vaccination use etc. To some extent, the federal cooperative contributed to improve the safe production of farmers, and reduce the food safety risk. Deng helped farmers to contact brokers to come to purchase pigs. However, Deng did not make further integration with downstream stakeholders, so member farmers still suffer from market risk.

Long’zhu cooperative and its Chun’ran Agro-Tech Co. Ltd.

Long’zhu cooperative (hereafter Long’zhu) was founded in 2010 with a group of 36 farmer members in the Quzhou area, Zhejiang province. The initial purpose of establishing the cooperative is to purchase feed together (from Kesheng, a local feed company). With the development of Long’zhu, Zhao found that market price fluctuation made the profits of farmers under uncertainties, so he decided to make a downstream integration to generate a profit premium for farmer members. Zhao started the Chun’ran Agro-Tech Co. Ltd. (hereafter Chun’ran) and registered a pork brand “Jiu’hao’mu’chang” to sell premium-quality pork to the marketFootnote 1. During 2012–2015, “Jiu’hao’mu’chang” did not sell well in the market due to an inappropriate pricing strategy (only 10% higher than conventional products) and an improper distribution strategy (distributed through the wet/informal market instead of the formal high-end market). But after 2015, Zhao figured out a new strategy to make the pork successful in the market, thus his pig production could shield from market risks. Zhao also innovatively started a pig production waste company (called Kai’qi Energy Co. Ltd.) to help member farmers to avoid the risks from the changing environmental policy of the government.

Jin’zhong Food Co. Ltd. and its Jin’li cooperative

Jin’zhong Food Co. Ltd. (hereafter abbreviated as Jin’zhong) is located in Qionglai, a prefecture belonging to Chengdu, the capital of Sichuan Province in China. Jin’zhong is a leading pork production/processing company in south west China. The pigs slaughtered by Jin’zhong reached two million heads annually. In August 2005, Mr. Liu Xiang (hereafter Liu), president of Jin’zhong, decided to set up a cooperative called “Jin’li” in order to overcome the problems that Jin’zhong faces in pig sourcing price vulnerability and risks in food safety. The establishment of Jin’li cooperative was supported by Qionglai local government and it was the very first cooperative in the pig industry in China. Between 2005 and 2015, Jin’li cooperative brought benefits for both Jin’zhong and local pig farmers. Jin’zhong has a more stable source of high-quality pigs though coordinating with local farmers. Small pig producers are able to improve their pig production process, thanks to the guidance and training offered by Jin’li cooperative.

Mu’yuan Food Co. Ltd.

Mu’yuan Co. Ltd. (hereafter Mu’yuan) was founded in 1992. Now it is a top-listed agricultural company in China. Its business includes feed production, pig production, and pig slaughtering. The feed production volume of Mu’yuan reached five million tons annually, pig production reached ten million heads annually, and pigs slaughtered reached one million heads. The supply chain of Mu’yuan is integrated, managing the feed production, pig production, and slaughtering itself. Now there are branches of Mu’yuan across nine provinces across the country. Thus, Mu’yuan handles well pig production safety. Mu’yuan puts emphasis on the recycling economy; it developed a way to use production wastes into fertilizers for planting, driving the surrounding farmers to develop ecological agriculture vigorously.

Cross-case analysis

Supply chain integration

As mentioned in the literature review, supply chain integration is not such a new concept in supply chain management, and it refers to a collection of formal or informal institutional relationships among supply chain members (Nyaga et al. 2010). The level of supply chain integration could be measured by two dimensions, which are stability (stable and long-term cooperation) and intensity (high frequency of transaction) (Ji et al. 2012).

For Jin’xin federal cooperative, we rate the stability and intensity of supply chain integration both as low. Though Jin’xin consists of three cooperatives, they do not have real long-term relationships except purchasing feed products together from time to time. Deng indicated that there are some conflicts between Jin’xin and Ou’bai’sen, so Ou’bai’sen does not always purchase feed together with him. Jin’xin federal does not have a close relationship with the downstream stakeholder; they have not attempted to build up any connections with pig sellers, but are using spot market relationships instead.

Regarding the supply chain integration between Long’zhu and Chun’ran, the level of stability is moderate. On one hand, there are three farms of Long’zhu that provide pigs for Chun’ran in the long term, while most of the farms do not have a long-term relationship with Long’zhu. Long’zhu cooperative members are either constant. Some members joined and some members left because the cooperative law allows members to join and exit from the cooperative according to members’ willingness. So, the number of Long’zhu members changed overtime, and just some of them have stable relationships with Chun’ran. Regarding the intensity of supply chain integration, we rate the level as low, because there is no high transaction between Long’zhu and Chun’ran, and the sourcing of pigs of Chun’ran from Long’zhu accounts for only 5% of Long’zhu’s production. Zhao indicated that, as Chun’ran has not fully made the market accept his premium pork, he does not need to source a great number of pigs from Long’zhu.

In terms of the supply chain integration between Jin’zhong and its Jin’li cooperative, we rate the stability as moderate to high. Generally, farmers of Jin’li have stable relationships with Jin’zhong, relying on Jin’zhong to source feed and sell pigs. However, Jin’zhong has problems regarding transactions with small farmers of Jin’li; the small farmers do not always sell pigs to Jin’zhong and behave opportunistically. In terms of level of intensity integration, we rate it as high, as Jin’li farmers transact frequently with Jin’zhong, they closely exchange information on quality and price, and Jin’li farmers are connected with Jin’zhong in many aspects. From 2005 to 2015, the percentage of Jin’zhong’s pig supply through Jin’li increased from 10 to 40%.

For Mu’yuan, the stability and intensity of supply chain intensity are high. Mu’yuan is a traditional pig production company, but it integrates both upstream and downstream. It has a high stable relationship with producers because farmers produce pigs as it is required by Mu’yuan; they abide by all safety standards given by Mu’yuan. Mu’yuan has a stable relationship with downstream because it accounts for 40% share of a slaughtering company. Mu’yuan has a very good relationship with pork retailers; it sells pigs to nine provinces in China. As food safety and quality of Mu’yuan is high, it seldom faces problems of selling pigs with low price. It has long-term contracts with downstream stakeholders.

Based on the analysis above, we conclude the stability and intensity of supply chain intensity of the four cases as follows, which is shown in Table 2.

Supply chain agility

Based on the literature review, agility of the supply chain is defined as “the ability of the supply chain to respond quickly to change,” and it could have a positive influence on supply chain coordination. The two dimensions of supply chain agility are visibility and velocity (Christopher and Peck 2004), so we will analyze the agility of the supply chain based on these two dimensions. Visibility of the supply chain refers to transparency of information exchange between supply chain stakeholders, while velocity of the supply chain refers to the circulation rate along the supply chain.

For Jin’xin, the visibility between it and its downstream stakeholder is low. As it sells the pigs to county yard brokers, the brokers do not have complete information how the pigs were produced, whether or not the pigs have ever suffered epidemic diseases, and how the pigs were treated and cured. So quality information is at a low transparency level; thus, the visibility is low. The velocity is also low, because Jin’xin depends a lot on pig brokers to sell pigs; whole pig brokers do not source pigs from Jin’xin especially when pigs are overproduced in some certain years. On the other hand, pig brokers sometimes do not pay for the pigs immediately after the sales, but delay the payment for some time.

For Long’zhu and Chun’ran, we rate their visibility as moderate to low. Chun’ran releases information only to certain farms which provide pigs to it, while other farms do not have sufficient market information. Similarly, the velocity between Chun’ran and Long’zhu is volatile, considering that premium pork sold by Chun’ran is not stable. The market performance of “Jiu’hao’mu’chang” was not satisfactory when it was established, but it became better since Zhao changed the strategy. Zhao indicated that he has not fully figured out the way to expand the sales, and he is still making attempts.

In terms of the agility between Jin’zhong and Jin’li, the visibility is moderate to high. Jin’zhong provides feed products and veteran services to Jin’li cooperative members, so the production information could be transferred in a comparatively higher way. However, we do not rate it as high because farmers produce pigs independently, so Jin’xin does not have full information on how pigs were produced by individual pig farmers. Regarding the velocity, we also rate it as moderate to high. On one hand, Jin’zhong sources pigs quickly from Jin’li pig farmers when needed. Jin’li farmers usually would like to sell pigs to Jin’zhong because Jin’zhong does not charge them for feed cost, but reduce part of the profits as feed cost when farmers sell pigs to them. On the other hand, Jin’zhong suffered from opportunistic behaviors of small farmers, refusing to sell pigs to them when market price increases. And on these occasions, Jin’zhong has to purchase more from pig production companies.

Regarding the supply chain agility for Mu’yuan, it has a high level of visibility and velocity with its chain partners. For example, the exchange of quality and price information between it and its retailers are very transparent; they adopted RFID technology to trace the information of pig production process. The circulation rate of the supply chain between Mu’yuan and its retailers is also high; Mu’yuan can always provide pigs with required quality and quantity to its buyers.

Based on the analysis above, the supply chain agility of the four cases is described in Table 3.

Supply chain robustness

Supply chain robustness is defined as the ability of the supply chain to maintain its function despite internal or external disruptions. There are two dimensions of supply chain robustness, which are resistance and avoidance. Therefore, we adopted these two dimensions as measurements to rate supply chain robustness of the four cases, which is shown in Table 4.

Regarding the robustness of the Jin’xin, it has low level of resistance and low level of avoidance. Jin’xin’s ability in resisting to and avoiding risks is low. Farmer members suffered loss from not knowing the market well. Though it existed as a federal cooperative, the cooperative cannot protect farmers from suffering from epidemic disease and changing environmental policies. Small farmers dominate the production of the cooperative, and they are very vulnerable to disease risk and policy risk. The regulation on controlling pig production wastes is extending to the whole country, and the local government is considering to shut down some of the pig producers whose farms are close to water source.

In terms of the supply chain robustness of Long’zhu and Chun’ran, they formed moderate to low robustness. Long’zhu avoids being affected by the regulation risk through operating a pig production waste recycling company. The company is also resistant to this risk. However, Chun’ran could not fully avoid market risk because Zhao could not help all member farmers to sell premium pork products through Chun’ran. Only a small portion of farmers avoid being affected by price vulnerability because premium pork price is usually fixed.

In terms of the supply chain robustness of Jin’zhong and Jin’li, they formed moderate to high resistance and avoidance to risks. Jin’zhong helped Jin’li farmers to sell pigs; thus, farmers are more resistant to market price risks. Jin’zhong also helped farmers to improve production safety, so farmers are less vulnerable to epidemic diseases. However, Jin’zhong has not taken measures to help farmers be more resistant and avoid the regulation risk, which means that there will be farmers affected by the stricter regulation.

Regarding the resistance and avoidance of Mu’yuan, it has comparatively high resistance to market price change, epidemic disease, and environmental regulation. Mu’yuan pays great attention in safe production of pigs, and it has its own professional veteran team to help avoid being affected by prevailing diseases. In addition, Mu’yuan innovated its own way to recycle the production wastes, so the production process meets the requirements of the national regulation. Therefore, Mu’yuan has a high level of supply chain robustness.

Supply chain resilience

As stated in the literature review, supply chain resilience could be measured through preparedness for risks and its speed of response to and recover from risks (Ponomarov and Holcomb 2009). That is, the more the supply chain prepared for upcoming risks, the more quickly it adapts to and recovers from undergoing risks, and the higher resilience it has. In our study, we used the following three dimensions to measure the resilience of the four cases: preparedness to potential risks and speed of response to and recovery from risks. These three dimensions were operationalized by combining risk sources: environmental policy uncertainty, epidemic disease risk, and price fluctuation.

For Jin’xin federal cooperative, we rate the preparedness to potential risks and speed of adaptation to and recover from all the risks as low. Jin’xin consists of three cooperatives in name, but loose relationship among them in reality. Before the risks came, Jin’xin did not take any measures in advance for environmental policy itself, even not to say the cooperation with Ou’bai’sen and Hong’bai’ta cooperative. When risks came, Jin’xin suffered and did not respond to the risks actively, and we could see that Jin’xin is not recovering from the risks, but being affected for a long time. We can say that Jin’xin has low levels of supply chain resilience, and it is very vulnerable to risks.

We rate a moderate level of the supply chain resilience between Long’zhu and its Chun’ran. Before the risks came, Long’zhu had made some effort to prepare. For the environmental policy risk, Long’zhu was fully prepared, while for market risk, it was not very well prepared. So its preparedness is moderate. Long’zhu tried to respond to the market vulnerability by starting Chun’ran Co. Ltd., and the response was quick but not very effective. So the adaptation of Long’zhu is moderate to high. Regarding the recovery from risks, it has been a long time (since 2012) for Long’zhu struggling to manage the market, so the recovery rate of Long’zhu is moderate to low. Therefore, combining the rate of Long’zhu in preparedness, adaptation, and recovery, its resilience is moderate.

For Jin’zhong and Jin’li resilience, we rate the preparedness of Jin’zhong as moderate. Jin’zhong knew well the epidemic disease risk and market price uncertainty, while it did not anticipate the environmental policy change. It has prepared for the two risks it foresaw, but it did not prepare well for the environmental policy change. We rate the adaptation of Jin’zhong as moderate, Jin’zhong adapted to the market price change and potential disease risk by coordination with farmers using Jin’li cooperative, so the adaptation rate is fast, while it could not completely control the risks. We rate the recovery of Jin’zhong and Jin’li as moderate to high. Jin’zhong quickly and well handled the market price after the establishment of Jin’li, making the sourcing price stabilized; it also made the pig supply meet higher safety standards. But the adaptation to environmental policy uncertainty is not high. Regarding the recovery, we rate Jin’zhong as moderate to high, because Jin’zhong quickly recovered from the risks except environmental policy uncertainty.

When we compare the supply chain resilience between Long’zhu (and its Chun’ran) and Jin’zhong and its Jin’li, we find that their difference in supply chain resilience mainly lies on their capability in dealing with market price risk. As a leading meat processing company in Sichuan province, Jin’zhong has been very preventive and adaptive to the market price fluctuation through maintaining various sourcing channels (Ji et al. 2017). Jin’zhong also faces directly to end consumers in the supply chain, which features that it knows well the consumer demand and it produces meat products adjusting to the market need. Long’zhu cooperative and its Chun’ran Co. Ltd. were initiated by a farmers’ cooperative, and the pig farmers are more specialized in pig production instead of knowing well the market. Though Mr. Zhao was a government officer, he does not have much experience in the market. Long’zhu and Chun’ran found it hard to manage the changing market vulnerability, and its capability in managing market risk is not as good as that of Jin’zhong and its Jin’li. Therefore, we rate the supply chain resilience of Jin’zhong and its Jin’li higher than that of Long’zhu and Chun’ran.

For Mu’yuan, we rate the preparedness, adoption, and recovery as high in three dimensions. The evidence are that Mu’yuan foresaw all three types of risks and made full preparations. It adapted to the changes quickly and effectively by vertically integrating the supply chain. It also recovered quickly. Therefore, the resilience of Mu’yuan is high.

Based on the analysis, we can summarize the supply chain resilience of the four cases as shown in Table 5.

Conclusions and implications

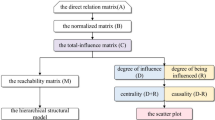

The conclusions of the article could be illustrated through the following propositions. We adopt Table 6 to illustrate the supply chain integration, agility, robustness, and resilience together in one table. And we can thus propose their relationships as follows.

Proposition 1

Supply chain integration has a positive relationship with supply chain agility. In our case study, Jin’xin has the lowest level of supply chain integration among the four cases; its visibility and velocity are also at the lowest level. Information sharing and transactions between Jin’xin and farmers are not smooth. From Long’zhu and its Chun’ran to Jin’zhong and its Jin’li, and to Mu’yuan, the level of supply chain integration increases. The supply chain agility also increases from moderate-low to moderate-high to high. Therefore, the positive relationship between supply chain integration and supply chain agility is proposed. A stable and intense supply chain integration relationship brings an efficient information sharing, knowledge exchange, and production transaction between suppliers and buyers, which means that there is a high level of supply chain agility between the supplier and the buyer.

Proposition 2

Supply chain integration is positively related with supply chain robustness. In our case study, Mu’yuan has the highest level of supply chain integration; the intense and stable relationship it has with its supply chain partners makes it become more resistant to risks and makes it easier to avoid the effects of risks through information sharing, as well as through tentative collaboration. It thus brings the highest level of supply chain robustness. We can see that, from Jin’xin to Long’zhu and its Chun’ran and to Jin’zhong and its Jin’li, with the level of supply chain integration increases, the level of supply chain robustness also increases. A more stable and intense supply chain relationship contributes to supply chain partner’s capability to identify risks and collaborative activities to avoid risks, which forms higher level supply chain robustness.

Proposition 3

Supply chain agility and supply chain robustness are positively related. Interestingly, we find that supply chain agility contributes positively to supply chain robustness. With higher supply chain agility, the supply chain partners have higher level of transacting information in a more transparent way, which increases the possibility of identifying supply chain risks and the possibility to collaborate to avoid risks. From the cases in our study, it is found that, when supplier and buyer establish a quick and reliable circulation relationship, which means that the velocity of the supply chain is high, the supply chain partners become more resistant to risks because they prepare solutions in their daily transactions. For example, when price risk comes, Mu’yuan suffers less than the other three case companies because it could source from its long-term partners with stable price.

Proposition 4

Supply chain agility positively contributes to supply chain resilience. From the cases in our research, we can conclude that higher level of supply chain agility will bring higher level of supply chain resilience. From Jin’xin to Mu’yuan, their supply chain agility level is from low to high, and their supply chain resilience also rate from low to high. It is found that, compared with companies with lower level of supply chain agility (i.e., Jin’xin, Long’zhu, and Chun’ran), companies with higher level of supply chain agility (i.e., Jin’zhong and its Jin’li, and Mu’yuan) have higher possibility to predict the risks more accurately through more transparent information exchange, and it is easier for them to jointly adapt to and recover from risks through better collaboration. In other words, with more transparent information exchange and better joint collaboration, supply chain members are able to prepare for, adapt to, and recover from the risks better, which means that supply chain agility positively contributes to supply chain resilience.

Proposition 5

Supply chain robustness has a positive influence on supply chain resilience. From the case study in our research, we can conclude that the higher level of supply chain robustness will bring higher level of supply chain resilience. Among the four cases, Mu’yuan has been taking measures to prevent itself from the risks, as well as to avoid the effects from environmental risk, market price risk, and epidemic risk. Compared with the other three case companies, Mu’yuan is also more resistant to the risks that exist for long time in the pig industry (i.e., market price fluctuation and epidemic disease); thus, Mu’yuan shows a high level of supply chain robustness. The robust supply chain system makes Mu’yuan recover from risks faster than the rest of the three case companies, which means that it has the highest level of supply chain resilience. Therefore, supply chain robustness is positively related with the supply chain resilience.

The propositions are further presented in Fig. 2.

From the case study, we also achieve some theoretical and practical implications as follows.

Theoretically, we find that the way how supply chain integration influences supply chain resilience through supply chain agility and supply chain robustness is well embedded in the resource-based view (RBV) theory. Supply chain integration provides resources to supply chain partners. The resources, such as information exchange, knowledge sharing, and mutual learning of technology, contribute positively to form the capabilities of supply chain partners, which are supply chain agility and supply chain robustness. The ability of supply chain agility and supply chain robustness thus brings the supply chain performance, which is supply chain resilience. RBV provides a good theoretical base for our study to build up a theoretical framework as shown in Fig. 2. From the case study, we also extended something new to RBV. Through the elaboration of our case study, it is found that between the capabilities, supply chain agility positively related with supply chain robustness, which means that one type of capability could influence another type of capability, and they jointly influence supply chain resilience. In traditional RBV theories, research usually focus on how resources could be utilized to build up capabilities, while the influence between capabilities is not largely mentioned. From our case study, it is found that there are relationships between capabilities.

We also propose practical implications from this case study.

First, focal companies of the supply chain should address the important role that supply chain integration plays in enhancing supply chain resilience. Through building up a stable and intense integration, the supply chain partners could make the resources such as information and technology into mutual capabilities, so that the supply chain partners respond to each other faster and more efficiently. Meanwhile, the supply chain partners become more resistant to risks, which will in turn enhance supply chain resilience.

Second, policymakers should encourage the supply chain partners to build up integration relationship and provide support to remove the barriers to build up integrations in agri-food supply chains. Agricultural sector naturally faces great vulnerabilities; if policymakers provide support, such as favorable policies, or capital and technology, it will be easier for focal companies to exchange information and technology and build up supply chain agility and supply chain robustness. Policymakers could also help to enhance the supply chain agility and supply chain robustness by providing other types of services for the focal companies to establish integrations.

In our case study, the results show that vertically integrated mode presents the highest level resilience, following the “company+ cooperative + farmers” mode, and then “cooperative + farmers + company” mode, and lowest resilience from federal cooperative mode. It means that currently vertically integrated supply chain relationship is most efficient for agri-food supply chain members to sustain risks. However, the essence to become resilient in supply chain is not necessarily to adopt the vertically integrated mode; but, the essence is to explore rich resources through integration and facilitate the resources to become two important supply chain capabilities, which are supply chain agility and supply chain robustness.

Data availability

All data generated and analyzed during this study are included in this published article.

Notes

Long’zhu collaborated with Animal Science School of Zhejiang University to create a type of feed with added tea leaves, which made the tastes of pork better. Zhao made the pork a premium one in the market.

References

Ali MH, Zhan Y, Alam SS, Tse YK, Tan KH (2017) Food supply chain integrity: the need to go beyond certification. Ind Manag Data Syst 117(8):1589–1611

Anastasiadis F, Poole N (2015) Emergent supply chains in the agrifood sector: insights from a whole chain approach. Supply Chain Manag 20:353–368

Annarelli A, Nonino F (2016) Strategic and operational management of organizational resilience: current state of research and future directions. Omega-Int J Manag Sci 62:1–18

Azadeh A, Atrchin A, Salehi V, Shojaei H (2014) Modelling and improvement of supply chain with imprecise transportation delays and resilience factors. Int J Log Res Appl 17(4):269–282

Barney J (1991) Firm resources and sustained competitive advantage. J Manag 17(1):99–120

Behzadi G, O’Sullivan MJ, Olsen TL, Zhang A (2018) Agribusiness supply chain risk management: a review of quantitative decision models. Omega 79:21–42

Bijman J, Hu D (2011) The rise of new farmer cooperatives in China -- evidence from Hubei Province. J Rural Cooperation 39(2):99–113

Brandon-Jones E, Squire B, Autry CW, Petersen KJ (2014) A contingent resource-based perspective of supply chain resilience and robustness. J Supply Chain Manag 50(3):55–73

Brinkmann D, Lang J, Petersen B, Wognum N, Trienekens J (2011) Towards a chain coordination model for quality management strategies to strengthen the competitiveness of European pork producers. J Chain Netw Sci 11(2):137–153

Brusset X, Teller C (2017) Supply chain capabilities, risks, and resilience. Int J Prod Econ 184:59–68

Charles A, Lauras M, Wassenhove LV (2010) A model to define and assess the agility of supply chains: building on humanitarian experience. Int J Phys Distrib Logist Manag 40(8/9):722–741

China environmental protection news (2015) Provinces in China are speeding up the implementation of “wu-shui-gong-zhi” policy. Available at: http://www.hbzhan.com/news/detail/102728.html (accessed Mar, 2018)

Christopher M, Peck H (2004) Building the resilient supply chain. Int J Logist Manag 15(2):1–14

Dentoni D, Bitzer V, Pascucci S (2016) Cross-sector partnerships and the co-creation of dynamic capabilities for stakeholder orientation. J Bus Ethics 135(1):35–53

Dries L, Germenji E, Noev N, Swinnen JFM (2009) Farmers, vertical coordination, and the restructuring of dairy supply chains in central and eastern Europe. World Dev 37(11):1742–1758

Durach CF, Maria JS, Xenophon K, Machuca JAD (2015) Antecedents and dimensions of supply chain robustness: a systematic literature review. Int J Phys Distrib Logist Manag 45(1/2):118–137

Fearne A (1998) The evolution of partnerships in the meat supply chain: insights from the British beef industry. Supply Chain Manag 3:214–231

Fearne A, Hughes D (1999) Success factors in the fresh produce supply chain: Insights from the UK. Supply Chain Manag 4:120–131

Flynn BB, Huo B, Zhao X (2010) The impact of supply chain integration on performance: a contingency and configuration approach. J Oper Manag 28:58–71

Godivan K, Fattahi M, Keyvanshokooh E (2017) Supply chain network design under uncertainty: a comprehensive review and future research directions. Eur J Oper Res 263:108–141

Grant RM (1991) The resource-based theory of competitive advantage: implications for strategy formulation. Calif Manag Rev 33(3):114–135

Helfat CE, Winter SG (2011) Untangling dynamic and operational capabilities: strategy for the (n)ever-changing world. Strateg Manag J 32(3):1243–1250

Hohenstein NO, Feisel E, Hartmann E, Giunipero L (2015) Research on the phenomenon of supply chain resilience: a systematic review and paths for further investigation. Int J Phys Distrib Logist Manag 45(1):90–117

Hu DH (2005) “Dual structure” of agricultural products -- on the influence of supermarket development on agriculture and food safety, China Rural Economy, Vol.2, pp.12-18. (Published in Chinese)

Huang ZH, Xu XC and Feng GS (2002) Analysis of influencing factors for the development of farmer professional cooperative organizations -- discussion on the development status of farmer professional cooperative organizations in Zhejiang province, China Rural Economy, Vol.3, pp.13-21. (Published in Chinese)

Ji C, de Felipe I, Briz J, Trinekens J (2012) An empirical study on governance structure choices in China’s pork supply chains – from transaction cost economics and transaction value analysis perspectives. Int Food Agribusiness Manag Rev (IFMAR) 15(2):121–157

Ji C, Jia F, Trienekens J (2017) Managing the Pork Supply Chain through a Cooperative - the case of Jinzhong Co. Ltd. Int Food Agribus Manag Rev 20(3):415–426

Ji C, Jia F, Xu XC (2018) Agricultural co-operative sustainability: evidence from four Chinese pig production co-operatives. J Clean Prod 197:1095–1107

JOM editorial (2009) Perspectives on risk management in supply chains. J Oper Manag 27:114–118

Jüttner U, Maklan S (2011) Supply chain resilience in the global financial crisis: an empirical study. Supply Chain Manag 16(4):246–259

Kaipia R, Dukovska-Popovska I, Loikkanen L (2013) Creating sustainable fresh food supply chains through waste reduction. Int J Phys Distrib Logist Manag 43:262–276

Kamalahmadi M, Parast MM (2016) A review of the literature on the principles of enterprise and supply chain resilience: major findings and directions for future research. Int J Prod Econ 171:116–133

Kitano H (2004) Biological robustness. Nat Rev Genet 5(11):826–837

Kong XZ and Shi BQ (2009) Operational mechanism, basic functions and influencing factors of current farmer professional cooperative organizations, Rural Economy, Vol.1, pp. 3-9. (Published in Chinese)

Liu XM, Li ZN (2011) Research on supply chain risk of agricultural products. Agric Econ 1:47–48 (Published in Chinese)

Luo JL, Ji C, Qiu CX, Jia F (2018) Agri-food supply chain management: bibliometric and content analyses. Sustainability 10(5):1573–1595

Malone TW, Yates J, Benjamin R (1987) Electronic markets and electronic hierarchies: effects of information technology on market structure and corporate strategies. Commun ACM 30(6):484–497

Mandal S (2012) An empirical investigation into supply chain resilience. J Supply Chain Manag 9(4):46–61

Mandal S (2014) Supply chain resilience: a state-of-the-art review and research directions. Int J Disaster Resilience Built Environ 5(4):427–453

Mao XF, Zeng YC (2008) Identifying pig period of pig price based on time series, China Rural Economy, Vol.12, pp. 4-13. (Published in Chinese)

Martens BJ, Dooley FJ (2010) Food and grocery supply chains: A reappraisal of ECR performance. Int J Phys Distrib Logist Manag 40:534–549

Miles MB and Huberman AM (1994) Qualitative data analysis: an expanded sourcebook. Thousand Oaks, London

Miranda-Ackerman MA, Azzaro-Pantel C, Aguilar-Lasserre AA (2017) A green supply chain network design framework for the processed food industry: application to the orange juice agrofood cluster. Comput Ind Eng 109:369–389

Nyaga GN, Whipple JM, Lynch DF (2010) Examining supply chain relationships: do buyer and supplier perspectives on collaborative relationships differ. J Oper Manag 28(2):101–114

Nyamah EY, Jiang YS, Feng Y, Enchill E (2017) Agri-food supply chain performance: an empirical impact of risk. Manag Decis 55(5):872–891

Petersen KJ, Handfield RB, Ragatz GL (2005) Supplier integration into new product development: coordination produce, process. J Oper Manag 23(3/4):371–388

Pettit TJ, Fiksel J, Croxton KL (2010) Ensuring supply chain resilience: development of a conceptual framework. J Bus Logist 31(1):1–21

Ponnambalam L, Wenbin L, Fu X, Yin XF, Wang Z and Goh SM (2014) Decision trees to model the impact of disruption and recovery in supply chain networks, IEEE International Conference on Industrial Engineering & Engineering Management, pp.948-952

Ponomarov SV, Holcomb MC (2009) Understanding the concept of supply chain resilience. Int J Logist Manag 20(1):124–143

Poray M, Gray A, Boehlje M, Preckel PV (2003) Evaluation of alternative coordination systems between producers and packers in the pork value chain. Int Food Agribusiness Manag Rev 6(2):65–78

Pu XJ, Zhu XY, Jiang L (2012) Vertical cooperation research on “agricultural-supermarket docking” supply chain -- channel fee, income sharing and Pareto improvement. J Northwest Agric For Univ (social science edition) 6:50–54

Robeiro JR, Barbosa-Povoa A (2018) Supply chain resilience: definitions and quantitative modelling approaches–a literature review. Comput Ind Eng 115:109–122

Romano P (2003) Coordination and integration mechanisms to manage logistic processes across supply networks. J Purch Supply Manag 9:119–134

Scholten K, Scott PS, Fynes B (2014) Mitigation processes – antecedents for building supply chain resilience. Supply Chain Manag 19(2):211–228

Stonebraker PW, Goldhar J, Nassos G (2009) Weak links in the supply chain: measuring fragility and sustainability. J Manuf Technol Manag 20:161–177

Tukamuhabwa B, Stevenson M, Busby J (2015) Supply chain resilience: definition, review and theoretical foundations for further study. Int J Prod Res 53(18):5592–5623

Tukamuhabwa B, Stevenson M, Busby J (2017) Supply chain resilience in a developing country context: a case study on the interconnectedness of threats, strategies and outcomes. Supply Chain Manag 2(6):486–505

Van der Vorst JGAG (2000) Effective food supply chains, generating, modelling and evaluating supply chain scenarios, Wageningen University, the Netherlands

Wallace SW, Choi TM (2011) Flexibility, information structure, options, and market power in robust supply chains. Int J Prod Econ 134(2):284–288

Wagner BA, Young JA (2009) Seabass and seabream farmed in the Mediterranean: swimming against the tide of market orientation. Supply Chain Manag 14(6):435–446

Wang K and Han JQ (2002) Management of agricultural industrial chain, China Rural Economy, Vol.5, pp.9-12. (Published in Chinese)

Wever M, Wognum N and Trienekens J (2009) Supply chain integration and coordination in the agri-food sector. IEEE International Technology Management Conference (ICE). https://doi.org/10.1109/ITMC.2009.7461420

Wieland A, Wallenburg CM (2012) Dealing with supply chain risks: linking risk management practices and strategies to performance. Int J Phys Distrib Logist Manag 42(10):887–905

Wieland A, Wallenburg CM (2013) The influence of relational competencies on supply chain resilience: a relational view. Int J Phys Distrib Logist Manag 43(4):300–320

Ye CL, Meng SD (2007) Literature review on risk management of agricultural products (food) supply chain, Supplement to agricultural economics, pp.200-205. (Published in Chinese)

Zhao G, Liu S, Lopez C (2017) A literature review on risk sources and resilience factors in agri-food supply chains, Collaboration in a Data-Rich World, pp.739-752

Funding

This study was funded by the National Natural Science Foundation of China (Nos. 71403243 and 71333011) and the Think Tank project of the Social Science Foundation of Zhejiang Province, titled “Research on resilience of agri-food supply chain under the COVID-19 pandemic shock (20ZK12YB).”

Author information

Authors and Affiliations

Contributions

NZ conducted the field survey and analyzed the case data. CJ conducted the filed survey and interpreted the case data. NY participated in the filed survey. All authors read and approved the final manuscript.

Corresponding author

Ethics declarations

Competing interests

The authors declare that they have no competing interests.

Ethics approval and consent to participate

Not applicable.

Consent for publication

Individuals involved in our data consent to have their data published in a journal article.

Additional information

Responsible editor: Philippe Garrigues

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Zhuo, N., Ji, C. & Yin, N. Supply chain integration and resilience in China’s pig sector: case study evidences from emerging institutional arrangements. Environ Sci Pollut Res 28, 8310–8322 (2021). https://doi.org/10.1007/s11356-020-11130-2

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-020-11130-2