Abstract

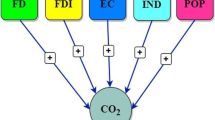

Sub-Saharan Africa (SSA) is considered the most vulnerable to challenges emanating from climate changes. A number of factors notably accelerated changes in growth influence SSA environment. Linking financial sector within growth and environmental outcomes has been the focus of policy makers and researchers. This study investigated the dynamic relationships between credit supply, economic growth, and the environment from the perspectives of the four sub-regional economies (Central, East, Southern, and West African regions) in SSA over the period 1990–2018. In addition, the study tested Environmental Kuznets Curve hypothesis across sub-regions. We employed panel vector autoregressive (panel VAR) model in a generalized method of moment framework to investigate the topic. The panel VAR results revealed that (i) economic growth negatively influence on carbon emissions of Central African countries but not in the East, Southern and West African sub-regions, (ii) credit supply had significantly positive influence on carbon emissions and economic growth of Central and East African sub-regions but negative influence on carbon emissions and economic growth West African sub-regions in SSA, and (iii) carbon emissions had significantly negatively influence on credit supply of East and West African sub-regions. The granger causality results revealed bidirectional causal links between credit supply and carbon emissions, economic growth, and credit supply in the Central and East African sub-regions, while most of the relationships were unidirectional. The impulse response function revealed that the impact of one variable on another vary throughout the periods and across sub-regions. Similarly, the elasticity of the variables to each other varies across sub-regions over the period studied. EKC hypothesis was validated in East African sub-region but was rejected in Central (u-shape relationship), Southern, and West African sub-regional economies indicating variations in growth and environmental outcomes among the sub-regional economies. Specific sub-regional policy recommendations are discussed.

Similar content being viewed by others

Data availability

The datasets generated and/or analyzed during the current study are available in the World Development Indicators repository, https://data.worldbank.org/

References

Abid M (2016) Impact of economic, financial, and institutional factors on CO2 emissions: evidence from sub-Saharan Africa economies. Util Policy 41:85–94

Abrigo MRM, Love I (2016) Estimation of panel vector autoregression in Stata: a package of programs (working papers 201602). Department of Economics, University of Hawaii at Manoa, Hawaii

Acheampong AO (2019) Modelling for insight: does financial development improve environmental quality? Energy Econ 83:156–179

Adzawla W, Sawaneh M, Yusuf AM (2019) Greenhouse gasses emission and economic growth nexus of sub-Saharan Africa. Sci Afr 3:e00065

Ahmad M, Zhao Z, Irfan M, Mukeshimana MC (2019) Empirics on influencing mechanisms among energy, finance, trade, environment, and economic growth: a heterogeneous dynamic panel data analysis of China. Environ Sci Pollut Res 26:14148–14170

Al-mulali U, Binti Che Sab CN (2012) The impact of energy consumption and CO2 emission on the economic growth and financial development in the Sub Saharan African countries. Energy 39(1):180–186

Andrews DWK, Lu B (2001) Consistent model and moment selection procedures for GMM estimation with application to dynamic panel data models. J Econom 101(1):123–164

Antonakakis N, Cunado J, Filis G, De Gracia FP (2017) Oil dependence, quality of political institutions and economic growth: a panel VAR approach. Resour Policy 53:147–163

Azam M, Khan AQ, Abdullah HB, Qureshi ME (2016) The impact of CO 2 emissions on economic growth: evidence from selected higher CO 2 emissions economies. Environ Sci Pollut Res 23(7):6376–6389

Bandura WN, Dzingirai C (2019) Financial development and economic growth in Sub-Saharan Africa: the role of institutions. PSL Q Rev 72(291):315–334

Bekhet HA, Matar A, Yasmin T (2017) CO2 emissions, energy consumption, economic growth, and financial development in GCC countries: dynamic simultaneous equation models. Renew Sust Energ Rev 70:117–132

Berger G, Flynn A, Hines F, Johns R (2001) Ecological modernisation as a basis for environmental policy: current environmental discourse and policy and the implications on environmental supply chain management. Innovation 14(1):55–72

Boyd JH, Smith BD (1992) Intermediation and the equilibrium allocation of investment capital: implications for economic development. J Monet Econ 30(3):409–432

Caldecott B, McDaniels J (2014) Financial dynamics of the environment: risks, impacts, and barriers to resilience, Smith School of Enterprise and the environment, University of Oxford

Caldecott B, Howarth N, McSharry P (2013) Stranded assets in agriculture: protecting value from environment-related risks. Stranded Asset Programme, Smith School of Enterprise and the environment, Oxford University

Canova F, Ciccarelli M (2013) Panel vector autoregressive models: a survey☆ The views expressed in this article are those of the authors and do not necessarily reflect those of the ECB or the Eurosystem. In VAR models in macroeconomics—new developments and applications: essays in honor of Christopher A. Sims. Emerald Group Publishing Limited, pp 205-246

Charfeddine L, Khediri K (2016) Financial development and environmental quality in UAE: Cointegration with structural breaks. Renew Sust Energ Rev 55:1322–1335

Charfeddine L, Khediri K (2019) Impact of renewable energy consumption and financial development on CO2 emissions and economic growth in the MENA region: a panel vector autoregressive (PVAR) analysis. Renew Energy 139:198–213. https://doi.org/10.1016/j.renene.2019.01.010

Choi E, Heshmati A, Cho Y (2010) An empirical study of the relationships between CO2 emissions, economic growth and openness (IZA Discussion Paper No. 5304). The Institute for the Study of Labor, Bonn

Destek MA, Sinha A (2020) Renewable, non-renewable energy consumption, economic growth, trade openness and ecological footprint: evidence from organisation for economic co-operation and development countries. J Clean Prod 242:118537

Dryzek JS (2013) The politics of the earth: environmental discourses. Oxford university press

Dufrenot G, Mignon V, Tsangarides C (2009) The trade-growth nexus in the developing countries: a quantile regression approach. CEPII, WP No 2009–04

Eberhardt M, Teal F (2011) Econometrics for grumblers: a new look at the literatureon cross-country growth empirics. J Econ Surv 25(1):109–155

Ejuvbekpokpo SA (2014) Impact of carbon emissions on economic growth in Nigeria. Asian J Basic Appl Sci 1(1):15–25

Ganda F (2019) The environmental impacts of financial development in OECD countries: a panel GMM approach. Environ Sci Pollut Res 26(7):6758–6772

Gao J, Zhang L (2014) Electricity consumption–economic growth–CO2 emissions Nexus in sub-Saharan Africa: evidence from panel Cointegration. Afr Dev Rev 26(2):359–371

Gergel SE, Bennett EM, Greenfield BK, King S, Overdevest CA, Stumborg B (2004) A test of the environmental Kuznets curve using long-term watershed inputs. Ecol Appl 14(2):555–570

Hanif I (2018) Impact of economic growth, nonrenewable and renewable energy consumption, and urbanization on carbon emissions in Sub-Saharan Africa. Environ Sci Pollut Res 25(15):15057–15067

Howes M (2005) Politics and the environment: risk and the role of government and industry. Allen & Unwin, Sydney

Ibrahim M, Alagidede P (2018) Nonlinearities in financial development–economic growth nexus: evidence from sub-Saharan Africa. Res Int Bus Financ 46(C):95–104

Kireyev AP (2000) Comparative macroeconomic dynamics in the Arab world; a panel var approach, IMF working papers 00/54, International Monetary Fund

Kuznets S (1955) Economic growth and income inequality. Am Econ Rev 45(1):1–28

Love I, Zicchino L (2006) Financial development and dynamic investment behavior: evidence from panel VAR. Q Rev Econ Financ 46(2):190–210

Majeed MT, Mazhar M (2019) Financial development and ecological footprint: a global panel data analysis. Pak J Commer Soc Sci 13(2):487–514

Manu EK, Xuezhou W, Paintsil IO, Gyedu S, Ntarmah AH (2020) Financial development and economic growth nexus in Africa. Bus Strateg Dev. https://doi.org/10.1002/bsd2.113

Mehdi BJ, Slim BY, Ozturk I (2014) The Role of Renewable Energy Consumption and Trade: Environmental Kuznets Curve Analysis for Sub-Saharan Africa Countries, MPRA Paper 54300. University Library of Munich, Germany

Menegaki AN (2019) The ARDL method in the energy-growth Nexus field; best implementation strategies. Economies 7(105):1–16

Mensah IA, Sun M, Gao C, Omari-Sasu AY, Zhu D, Ampimah BC, Quarcoo A (2019) Analysis on the nexus of economic growth, fossil fuel energy consumption, CO2 emissions and oil price in Africa based on a PMG panel ARDL approach. J Clean Prod 228:161–174

Mol AP (2000) The environmental movement in an era of ecological modernisation. Geoforum 31:45–56

Mol AP, Sonnenfeld DA (eds) (2000) Ecological modernisation around the world: persectives and critical debates. Psychology Press

Musah M, Kong Y, Mensah IA, Antwi SK, Donkor M (2020) The link between carbon emissions, renewable energy consumption, and economic growth: a heterogeneous panel evidence from West Africa. Environ Sci Pollut Res 27:28867–28889. https://doi.org/10.1007/s11356-020-08488-8

Nakhooda S (2011) Asia, the multilateral development banks and energy governance. Glob Policy 2:120–132

Ngongang E (2015) Financial development and economic growth in sub-Saharan Africa: a dynamic panel data analysis. Eur J Sustain Dev 4(2):369

Nieto M (2017) Banks and environmental sustainability: some reflections from the perspective of financial stability. CEPS

Ntarmah AH, Kong Y, Gyan MK (2019) Banking system stability and economic sustainability: a panel data analysis of the effect of banking system stability on sustainability of some selected developing countries. Quant Financ Econ 3(4):709–738

Odhiambo NM (2017) CO2 emissions and economic growth in sub-Saharan African countries: a panel data analysis. Int Area Stud Rev 20(3):264–272

Omri A, Daly S, Rault C, Chaibi A (2015) Financial development, environmental quality, trade and economic growth: what causes what in MENA countries. Energy Econ 48:242–252

Pesaran MH (2003) A simple panel unit root test in the presence of cross section dependence, Cambridge Working Papers in Economics 0346, Faculty of Economics (DAE), University of Cambridge

Pesaran MH (2004) General diagnostic tests for cross section dependence in panels. CESifo Working Papers No.1233, 255–60

Pesaran MH (2007) A simple panel unit root test in the presence of cross-section dependence. J Appl Econ 22: 265–312

Saat SA, Ali N (2014) Analysing the sustainability of solid waste policy in Malaysia using the ecological modernization theory. Geografia 10(6)

Salahuddin M, Gow J, Ozturk I (2015) Is the long-run relationship between economic growth, electricity consumption, carbon dioxide emissions and financial development in Gulf Cooperation Council Countries robust? Renew Sust Energ Rev 51:317–326

Salim RA, Rafiq S (2012) Why do some emerging economies proactively accelerate the adoption of renewable energy? Energy Econ 34:1051–1057

Schmidt-Traub G, Shah A (2015) Investment needs to achieve the sustainable development goals. Sustainable Development Solutions Network, Paris and New York

Shoaib HM, Rafique MZ, Nadeem AM, Huang S (2020) Impact of financial development on CO2 emissions: a comparative analysis of developing countries (D8) and developed countries (G8). Environ Sci Pollut Res 27:12461–12475

Sims CA (1980) Macroeconomics and reality. Econometrica 48:1–48

Ssali MW, Du J, Mensah IA, Hongo DO (2019) Investigating the nexus among environmental pollution, economic growth, energy use, and foreign direct investment in 6 selected sub-Saharan African countries. Environ Sci Pollut Res 26(11):11245–11260

Tiwari AK (2011) Energy consumption, CO2 emissions and economic growth: evidence from India. J Int Bus Econ 12(1):85–122

Vander Stichele M (2015) How financialization influences the dynamics of the food supply chain. Can Food Stud 2(2):258–266

Vo XV, Zaman K (2020) Relationship between energy demand, financial development, and carbon emissions in a panel of 101 countries: “go the extra mile” for sustainable development. Environ Sci Pollut Res 27:23356–23363

Westerlund J (2007) Testing for panel cointegration with multiple structural breaks. Oxf Bull Econ Stat 68(1):101–132

World Bank Group (2020) World development indicators 2020. World Bank, Washington DC [Dataset]

World Energy Council (2017) Regional perspective for sub-Saharan Africa: preparing for ‘the grand transition’. World Energy Council

Yusuf AM, Abubakar AB, Mamman SO (2020) Relationship between greenhouse gas emission, energy consumption, and economic growth: evidence from some selected oil-producing African countries. Environ Sci Pollut Res 27:15815–15823. https://doi.org/10.1007/s11356-020-08065-z

Zaidi SA, Song JY, Lee JH, Kim SM, Kim Y (2019) Experimental investigation on micro-fabrication of wearable dry-patching flexible substrate using transparent superhydrophobic polyimide. Mater Res Express 6(8):086434

Zakaria M, Bibi S (2019) Financial development and environment in South Asia: the role of institutional quality. Environ Sci Pollut Res 26(8):7926–7937

Funding

This work was supported by the National Natural Science Foundation [grant number 71371087].

Author information

Authors and Affiliations

Contributions

AHN contributed in all areas of the work including conceptualization, methodology, formal analysis, and writing. YK contributed in key parts of the work including conceptualization, leadership, and writing. AFO contributed in writing the original draft of the work while SG contributed in writing, reviewing and editing.

Corresponding author

Ethics declarations

Competing interests

The authors declare that they have no competing interests.

Ethical approval

Not applicable.

Consent to participate

Not applicable.

Consent to publish

Not applicable.

Additional information

Responsible editor: Nicholas Apergis

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Ntarmah, A.H., Kong, Y. & Manu, E.K. Investigating the dynamic relationships between credit supply, economic growth, and the environment: empirical evidence of sub-regional economies in Sub-Saharan Africa. Environ Sci Pollut Res 28, 5786–5808 (2021). https://doi.org/10.1007/s11356-020-10875-0

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-020-10875-0