Abstract

This paper reports an experimental comparison of attitudes toward time and toward money in experience-based decisions. Preferences were elicited under rank-dependent utility for prospects with two or three consequences expressed either in time or in monetary units. Probabilities were unknown but learned through sampling. More specifically, time and money were compared under two conditions. In a first experiment, both consequences and probabilities of prospects were unknown and learned through sequential sampling. In a second experiment, the possible consequences were revealed after the sampling. A real incentive system was implemented for both time and money. The heterogeneity of preferences was assessed for time and for money through individual and mixed modeling estimations. We observe that the nature of consequences (time or money) modifies probability weighting in terms of elevation and sensitivity. Subjects exhibit more optimism and less sensitivity to probability changes when deciding about time than about money. Revealing the consequences impacts the shape of the utility function and leaves probability weighting unchanged. We also observe that the real incentives have no effect except for the reduction in decision errors. This effect is stronger for money than for time.

Similar content being viewed by others

Notes

We accounted for between-subject heteroscedasticity by allowing \(\sigma \) to vary across individuals. However errors are assumed to be homoscedastic across choices. If this assumption is violated, standard errors may be biased. For this reason, inference relies either on bootstrap or on a comparison of individual-level parameters.

Halton draws were generated by the halton function provided by the randomtoolbox package, in the R software (The R development core team 2005).

The range of possible time gains also varied from \(0\) to \(1\) hour as in the present study. Regarding money, the authors considered hypothetical payoffs over [\(0\) €, \(1200\) €]. In the present study, smaller monetary consequences were considered (up to \(150\) €). This allowed for the implementing of real incentives for money as well as for time.

A case of risk was considered under EBD by Barron and Ursino (2013). Subjects could sample without replacement, which allowed them to learn the objective probabilities.

References

Abdellaoui, M., Baillon, A., Placido, L., & Wakker, P. (2010). The rich domain of uncertainty: Source functions and their experimental implementation. American Economic Review, 101(2), 695–723.

Abdellaoui, M., Bleichrodt, H., & L’Haridon, O. (2008). A tractable method to measure utility and loss aversion under prospect theory. Journal of Risk and Uncertainty, 36(3), 245–266.

Abdellaoui, M., & Kemel, E. (2014). Eliciting prospect theory when consequences are measured in time units: Time is not money. Management Sciences, 60(7), 1844–1859.

Abdellaoui, M., L’Haridon, O., & Praschiv, C. (2011). Experience-based versus description-based decision making: Do we need two different prospect theory specification? Management Science, 57, 1879–1895.

Andersen, S., Harrison, G., Hole, A., Lau, M., & Rutstrm, E. (2012). Non-linear mixed logit. Theory and Decision, 73(1), 77–96.

Barron, G., & Ursino, G. (2013). Underweighting rare events in experience based decisions: Beyond sample error. Journal of Economic Psychology, 39, 278–286.

Bleichrodt, H., & Pinto, J. (2000). A parameter-free elicitation of the probability weighting function in medical decision analysis. Management Science, 46, 1485–1496.

Beauchamp, J., Benjamin, D., Chabris, C., & Laibson, D. (2012). How malleable are risk preferences and loss aversion, Harvard University mimeo.

Bruhin, A., Fehr-Duda, H., & Epper, T. (2010). Risk and rationality : Uncovering heterogeneity in probability distortion. Econometrica, 78(4), 1375–1412.

Camilleri, A., & Newell, B. (2011). When and why rare events are underweighted: A direct comparison of the sampling, partial feedback, full feedback and description choice paradigms. Psychonomic Bulletin and Review, 18, 377–384.

Camilleri, A., & Newell, B. (2009). The role of mental representations in experience-based choice. Judgment and Decision Making, 4, 518–529.

De Palma, A., Ben-Akiva, M., Brownstone, D., Holt, C., Magnac, T., McFadden, D., et al. (2008). Risk, uncertainty and discrete choice models. Marketing Letters, 19, 269–285.

Etchart-Vincent, N. (2004). Is probability weighting sensitive to the magnitude of consequences? An experimental investigation on losses. Journal of Risk and Uncertainty, 28(3), 217–235.

Fehr-Duda, H., Bruhin, A., & Epper, T. (2010). Rationality on the rise: Why relative risk aversion increases with stake size. Journal of Risk and Uncertainty, 40(2), 147–180.

Gigerenzer, G., & Hoffrage, U. (1995). How to improve Bayesian reasoning without instruction: Frequency formats. Psychological Review, 102(4), 684–704.

Goldstein, W.M., & Einhorn, H.J. (1987). Expression theory and the preference reversal phenomena. Psychological Review, 94(2), 236.

Gonzalez, R., & Wu, G. (1999). On the shape of the probability weighting function. Cognitive Psychology, 38, 29–166.

Hadar, L., & Fox, C. (2009). Information asymmetry in decision from description versus decision from experience. Judgment and Decision Making, 4(4), 317325.

Hau, R., Pleskac, T., Kiefer, J., & Hertwig, R. (2008). The description-experience gap in risky choice: The role of sample size and experienced probabilities. Journal of Behavioral Decision Making, 21, 493518.

Hertwig, R., Barron, G., Weber, E., & Erev, I. (2004). Decisions from experience and the weighting of rare events. Psychological Science, 15(8), 534–539.

Hertwig, R., Barron, G., Weber, E., & Erev, I. (2006). The role of information sampling in risky choice. In K. Fiedler & P. Juslin (Eds.), Information sampling and adaptive cognition (pp. 72–91). New York: Cambridge University Press.

Hey, J., & Orme, C. (1994). Investigating generalizations of expected utility theory using experimental data. Econometrica, 62(6), 1291–1326.

Kemel, E., & Paraschiv, C. (2013). Prospect theory for joint time and money consequences in risk and ambiguity. Transportation Research Part B, 56, 81–95.

Klibanoff, P., Marinacci, M., & Mukerji, S. (2005). A smooth model of decision making under ambiguity. Econometrica, 73(6), 1849–1892.

Knight, F. (1921). Risk, uncertainty and profit. New York: Augustus Kelley.

Krawczyk, M. (2015). Probability weighting in different domains: The role of stakes, fungibility, and affect, working paper 15/2015(132), University of Warsaw.

Li, Z., & Hensher, D. (2011). Prospect theoretic contributions in understanding traveller behaviour: A review and some comments. Transport Reviews, 31(1), 97–115.

Prelec, D. (1998). The probability weighting function. Econometrica, 66, 497–527.

R Development Core Team. (2005). R: A language and environment for statistical computing, Vienna: R Foundation for Statistical Computing. http://www.Rproject.org

Stott, H. (2006). Cumulative prospect theorys functional menagerie. Journal of Risk and Uncertainty, 32(2), 101–130.

Savage, L. (1954). The foundations of statistics. New York: Wiley. Dover edition, 1972.

Toubia, O., Johnson, E., Evgeniou, T., & Delqui, P. (2013). Dynamic experiments for estimating preferences: An adaptive method of eliciting time and risk parameters. Management Science, 59(3), 613–640.

Train, K. (2009). Discrete choice methods with simulation. New York: Cambridge University Press.

Ungemach, C., Chater, N., & Stewart, N. (2009). Are probabilities overweighted or underweighted when rare outcomes are experienced (rarely)? Psychological Science, 20, 473–479.

Wakker, P. (2010). Prospect theory: For risk and ambiguity. New York: Cambridge University Press.

Wilcox, N. (2008). Stochastic models for binary discrete choice under risk: A critical primer and econometric comparison. Research in Experimental Economics, 12, 197–292.

Acknowledgments

This project was part of a Ph.D dissertation, entitled “Attitudes towards Uncertainty with Monetary and Time Consequences: Experimental Investigations”. The Ph.D program was funded by MEDDE/DRI. The paper benefited from the valuable suggestions of the Ph.D committee. The authors thank Anisa Shyti and Corina Paraschiv for their reading and helpful remarks. They are also grateful to an anonymous reviewer and the associate editor for their constructive comments.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

1.1 Appendix 1: Modified bisection method

The bisection method was implemented as follows. For a given prospect \(\left( x,p_x, y, p_y, z\right) \), the [\(z,x\)] interval was bisected in order to locate its certainty equivalent \(c^{*}\). The procedure began with a certain offer \(c_1\) such as \(c_1= \mathrm{EV}\left( P\right) \pm 10\). If \(c_1\) was preferred, then the certainty equivalent \(c^{*}\) stood in the \([z, c_1]\) interval. In this case, a second certain offer \(c_2\) was proposed, where \(c_2\) was the midpoint of the \([z, c_1]\) interval. Otherwise, \(c^{*}\) was in the \([c_1, x]\), and \(c_2 =c_1+ 0.5\left( x-c_1\right) \) was proposed.

The procedure was iterated until the certainty equivalent was restrained to an interval \([c_\mathrm{inf}, c_\mathrm{sup}]\), with \(c_\mathrm{sup}-c_\mathrm{inf}< 5\) (for money, \(2\) for time). While the standard bisection method would stop here, the adapted method introduced two last choices that allowed us to confirm that the certainty equivalent \(c^{*}\) was in the interval. The two last choices involving \(c_\mathrm{sup}\) and \(c_\mathrm{inf}\) were repeated. In Table 7, we consider a decision maker who experienced the prospect \(\left( 60, 0.25; 30, 0.25, 0\right) \) and is indifferent between saving 28 min for sure and receiving this prospect.

1.2 Appendix 2: Mixed modeling

The likelihood of a series of choices observed by a subject \(i\) writes

Assuming that \(\genfrac(){0.0pt}0{\beta _\mathrm{m}}{\beta _t} \equiv N\left( \genfrac(){0.0pt}0{\overline{\beta _\mathrm{m}}}{\overline{\beta _t}} \begin{bmatrix} \theta _\mathrm{m},&\theta _{\mathrm{m},t}\\ \theta _{\mathrm{m},t}^t,&\theta _t \end{bmatrix} \right) \equiv N\left( \varTheta \right) \) this likelihood becomes:

.

The total likelihood writes

.

The integral of equation (4) does not have a closed form. Therefore, it has has to be simulated.

Considering R draws \(\beta _r\) such that \(\beta _r\sim N\left( \varTheta \right) \), the likelihood \(L_i\left( \varTheta \right) \) can be approximated by its simulated value

Then, the total likelihood can be estimated as

If the number of draws is large enough, the simulated likelihood \(L_{s}\left( \varTheta \right) \) converges to \(L\left( \varTheta \right) \) and the parameters \(\varTheta \) that maximize the \(L\left( \varTheta \right) \) can be obtained by maximizing \(L_{s}\left( \varTheta \right) \).

1.3 Appendix 3: Descriptive statistics on certainty equivalents

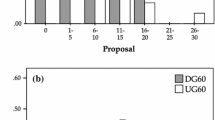

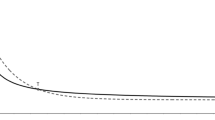

1.4 Appendix 4: Distributions of observed frequencies

See Fig. 7.

1.5 Appendix 5: Estimations based on observed frequencies

Rights and permissions

About this article

Cite this article

Kemel, E., Travers, M. Comparing attitudes toward time and toward money in experience-based decisions. Theory Decis 80, 71–100 (2016). https://doi.org/10.1007/s11238-015-9490-3

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11238-015-9490-3