Abstract

Using data from the 2018 National Financial Capability Study (NFCS), this study examined the relationships between poor financial behaviors, receiving government assistance, and financial satisfaction while accounting for adverse financial experiences. The logistic regression results showed that both poor financial behaviors and adverse financial experiences increased the likelihood of receiving government assistance. The OLS results indicated that receiving government assistance significantly increased levels of financial satisfaction, whereas poor financial behaviors significantly decreased levels of financial satisfaction. While the magnitude of these associations for both receiving government assistance and poor financial behaviors was small, adverse financial experiences had a stronger influence on the levels of financial satisfaction. When we combined poor financial behaviors and receiving government assistance into a categorical variable, we gained additional insights into the connections between these constructs that warrants further research.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Government assistance was created with the goal of supporting those in financial need until they are able to maintain basic financial necessities. Through these government programs, many Americans have the opportunity to get back on their feet after unexpected hardships. Despite the importance of government assistance in aiding many individuals and families through various financial hardships, receiving government assistance has also been shown to create some difficulties for individuals’ financial behaviors (Brüggen et al., 2017; Pirog et al., 2017). However, few studies have examined associations between financial behaviors and receiving government assistance, and how these two constructs together are associated with financial satisfaction.

There are over 70 different government assistance programs that provide money, food, housing, education, or other services for low-income households in the U.S. (Law, 2020). These government assistance programs are funded through a combination of local, state, and federal government spending. Among these programs, Medicaid and the Supplemental Nutrition Assistance Program (SNAP) are two of the largest sources of government assistance (Hastings & Shapiro, 2018). Most government assistance eligibility is based on a government means-test, which determines where the household income lies relative to the federal poverty level based on household size. This guideline is often somewhere below 150% of the current poverty level depending on the program (Assistant Secretary for Planning and Evaluation, 2020; Center for Medicare & Medicaid Services, 2022). These requirements may be adjusted based on whether the applicant has children, is pregnant, or has a disability. Some individuals may be completely ineligible depending on the program, such as college students or undocumented immigrants (Center on Budget and Policy Priorities, 2022).

According to data collected in 2012 by the U.S. Census Bureau, 21.3% of all people in the U.S participated in some form of government assistance program (U.S. Census Bureau, 2015). In 2019, 72.5 million Americans received Medicaid and 38 million individuals were enrolled in SNAP (Center for Medicare & Medicaid Services, 2022; Nchako & Cai, 2020). Those enrolled in SNAP are typically at or below 130% of the federal poverty level and 86% of SNAP benefits go to households with a child, elderly person, or person with disabilities (Hartline-Grafton, n.d.). The majority of families on government assistance participated in more than one means-test program. Of families receiving government assistance, about 25% of families were Black and almost 30% were of Hispanic origin (U.S. Bureau of Labor Statistics, 2018).

In previous studies, three significant drivers of increased enrollment in government assistance have been identified. Economic downturns, natural disasters, and the recent opioid epidemic have all pushed more families to seek Medicaid and other government assistance (Counsel of Economic Advices, 1997; Gruber & Sommers, 2020). Government assistance functions on a fairly short-term basis, with most programs limiting participation to five years (60 months) or less (Butler, 2013). While program eligibility periods vary, no program is meant to be a constant sustaining resource (Rowe & Giannarelli, 2006). Government programs have standards in place to prevent long-term use of government assistance such as limiting the benefits of SNAP to three months within three years for certain demographic groups (Irving, 2015; U.S. Census Bureau, 2015).

2 Current Study

In this study, we seek to better understand the connections between financial behaviors, receiving government assistance, and financial satisfaction, while accounting for financial experiences during a standard economic period for the U.S. (i.e., not during a recession or pandemic). Specifically, using data from 21,314 individuals from the 2018 National Financial Capability Study (NFCS), this study aims to address two primary research questions. First, we examine the associations between poor financial behaviors and receiving government assistance, when accounting for adverse financial experiences (RQ1). Second, we investigate how receiving government assistance, poor financial behaviors, and adverse financial experiences influence financial satisfaction (RQ2).

A unique contribution of this study includes creating a categorical variable that combined whether participants received government assistance and whether they engaged in poor financial behaviors. Through creating this categorical variable, we were able to obtain additional insights into the two research questions in this study. The findings of this study provide information that financial practitioners and educators can use to help their clients improve their financial satisfaction. Further, the findings can provide insights for policy makers regarding the extent to which government assistance is related to financial behaviors and financial satisfaction.

3 Related Literature

3.1 Government Assistance and Financial Outcomes

It is evident that being on government assistance can help low-income families reduce unpaid medical bills, improve credit scores, increase available credit, and decrease excessive credit spending (Brevoort et al., 2017; Miller et al., 2018). Both Brevoort et al., (2017) and Miller et al., (2018) found that Medicaid improved financial well-being by reducing medical bills. Beyond Medicaid, government assistance can help reduce the negative impacts of unexpected events in one’s financial life (e.g., income drop, loss of job, sickness of family members, etc.). However, receiving government assistance can also cause misinterpretations and frustration when individuals attempt to manage their finances (Marlowe et al., 1996). For example, while government assistance can help with groceries or utility bills, it does not provide financial resources beyond necessities. With limited control over their financial situation, individuals may become discouraged and lack the motivation to properly manage their finances (Brüggen et al., 2017).

Many government assistance programs also have income and asset thresholds. Because of these restrictions, families and individuals cannot save money or increase assets without the risk of losing government benefits, and positive financial behaviors such as saving are negatively impacted (O’Brien, 2008; Pirog et al., 2017). Those receiving government assistance may lack access to proper financial education and management skills needed to improve financial satisfaction. Previous studies have shown that not being able to achieve one’s own financial expectations decreased one’s financial satisfaction (Brüggen et al., 2017; Burcher et al., 2018).

3.2 Financial Behaviors, Financial Experiences, and Financial Satisfaction

The link between financial behaviors and financial satisfaction is an important topic of study in the personal finance field. Financial satisfaction (also referred to as financial well-being or financial health) can be defined as satisfaction with one’s current financial status and level of debt or as having financial security and financial freedom of choice (Aboagye & Jung, 2018; Brüggen et al., 2017; Garcia-Mata & Zeron-Felix, 2022; Greenberg & Hershfield, 2019; Joo & Grable, 2004). Considering the financial diversity of individuals in terms of income, assets, debt management, financial security, and more, financial satisfaction is based on one’s perception of their financial situation (Greenberg & Hershfield, 2019). Financial satisfaction is often achieved through healthy financial behaviors. Healthy financial behaviors include having an emergency fund, having a retirement fund, monitoring one’s credit, and debt management. On the other hand, unhealthy financial behaviors, such as spending more than one earns, overdrawn bank accounts, maintaining a credit card balance, or making late payments, have been shown to decrease individuals’ financial well-being and satisfaction (Xiao et al., 2014).

Financial knowledge has been closely linked to financial behavior in previous research (Coskuner, 2016; Perry & Morris, 2005; Robb & Woodyard, 2011; Xiao et al., 2014). Specifically, previous studies have found strong associations between financial knowledge and both short- and long-term financial behaviors (Delgadillo & Lee, 2021; Henager & Cude, 2016). Previous research has also distinguished the impact of subjective financial knowledge and objective financial knowledge on financial behaviors. Subjective financial knowledge is commonly defined as confidence (Atlas et al., 2019). Objective financial knowledge is defined as the combination of financial competence, mathematical ability, and understanding of financial matters (Lind et al., 2020). Both subjective and objective financial knowledge can play an important role in financial behaviors and are both strong predictors of financial well-being and satisfaction (Lind et al., 2020).

Previous studies have explored the relationship between financial behaviors, financial satisfaction, and other moderating factors. Financial education, taught at home or in a formal classroom, personal expectations of finances, and standard of living play key roles in individuals’ financial behaviors and overall financial well-being (Brüggen et al., 2017; Burcher et al., 2018). Factors such as overspending and having student loans or mortgage debt have been found to decrease financial satisfaction (Aboagye & Jung, 2018).

Another factor that can influence financial satisfaction is adverse financial experiences. An adverse financial experience is an event or situation that one does not currently have control over, such as a loss in income, inability to pay bills, or having too much debt (O’Neill et al., 2006; Stumm et al., 2013). Unlike financial behaviors, the individual has no power to stop the situation, but rather they must try to adjust financially during or after the adverse experience. Previous studies have found that unexpected financial experiences had a large impact on financial satisfaction during and after the 2007–2009 recession (Hunter & Heath, 2017; Kim et al., 2017; Shin & Kim, 2018). Von Stumm et al. (2013) found that individuals’ financial behaviors were associated with adverse financial experiences, while Bisgaier and Rhodes (2011) connected adverse financial experiences to individuals’ financial satisfaction. Based on these previous studies, financial behaviors and financial experiences should be investigated together in trying to understand individuals’ financial satisfaction.

3.3 Conceptual Framework and Hypotheses

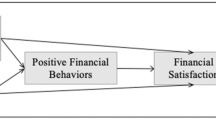

Netemeyer et al. (2018) examined what factors influence financial well-being and satisfaction. They found that expected future financial security (e.g., positive financial behaviors) and stress from current money management (e.g., late payments, lack of self-control, etc.) were significant factors in predicting financial well-being. Specifically, expected future financial security had a positive impact on financial well-being, whereas current money management stress had a negative influence on financial well-being. Consistent with Netemeyer et al.’s (2018) conceptual framework, in the current study, we examined poor financial behaviors which could be an indicator of stress from current money management and a factor working against future financial security. We also argue that adverse financial experiences are important factors that increase stress from current money management and work against future financial security. As individuals want to reduce stress from current money management, and as government assistance can be helpful in reducing such stress, we propose Hypothesis 1 (H1) that poor financial behaviors will increase the likelihood of receiving government assistance, when controlling for adverse financial experiences.

When looking at the role of receiving government assistance through this conceptual lens, there could be multiple interpretations. Perhaps the most straight forward interpretation is that those who are receiving government assistance may experience lower levels of stress from current money management which would lead to higher financial satisfaction. Garcia-Mata & Zeron-Felix (2022) explained that one component of financial satisfaction includes fulfilling one’s needs and wants; government assistance programs may help fulfill this requirement. Specifically, government assistance programs can improve one’s current financial state and lead to higher levels of financial satisfaction as they can help reduce various financial burdens or stress such as unpaid medical bills, excessive credit spending, and can lead individuals to a better financial life (Brevoort et al., 2017; Miller et al., 2018). Thus, we propose Hypothesis 2a (H2a), that those who receive government assistance will be more likely to have higher financial satisfaction than those who do not receive government assistance, when controlling for poor financial behaviors and adverse financial experiences.

On the other hand, when applying Netemeyer et al.’s (2018) conceptual framework, it could also be proposed that receiving government assistance might lead to lower levels of financial satisfaction because individuals receiving government assistance could have little expectation of future financial security and they could be experiencing money management stress. Especially, as discussed previously, government assistance programs are temporary solutions that often limit saving and asset holdings which can impact long-term financial planning of participants (O’Brien, 2008; Pirog et al., 2017).

Given the potential influence of government assistance to both enhance and reduce financial satisfaction levels, depending on other factors, we aimed to investigate the associations of financial behaviors, receiving government assistance, and financial satisfaction in two different ways. Garcia-Mata & Zeron-Felix (2022) determined that while a main driver of financial satisfaction is to fulfill one’s needs and wants, some individuals may participate in irrational financial behaviors that also influence their financial satisfaction levels. Thus, we further investigated these associations by creating a categorical variable that combined poor financial behaviors and receiving government assistance to create four distinct groups. Using this categorical variable, we propose Hypothesis 2b (H2b) that there will be significant differences between these groups; however, given that contradictory conclusions could be drawn from this theory, we refrained from hypothesizing which groups will report higher financial satisfaction in comparison to other groups.

4 Methods

4.1 Data

This study employed data from the 2018 National Financial Capability Study (NFCS), collected by the Financial Industry Regulatory Authority (FINRA) Investor Education Foundation. NFCS data were collected through online surveys to over 25,000 American adults in 2009, 2012, 2015, and 2018 (FINRA, 2022). A total of 27,091 individuals were recruited for the survey. In the multivariate analyses, the sample was weighted using data from the American Community Survey to be representative of the national population in terms of age, gender, race/ethnicity, education, and Census division. The largest component of the NFCS, the State-by-State Survey, was conducted across a large, diverse sample in order to provide comprehensive data on the financial capability of the U.S. population (FINRA, 2020).

4.2 Sample

In this study, if respondents reported either “prefer not to say” or “don’t know” on key variables (i.e., government assistance, financial behaviors, financial experiences, and financial satisfaction), they were excluded from the study sample. Retired individuals and those who were younger than 18 at the time of the survey were also excluded from the sample. Following this procedure, the final sample included 21,314 individuals. Approximately 18% of the study sample indicated that they were receiving government assistance at the time of the survey. The mean age of participants was 49 years, and there were slightly more female than male respondents in the study sample. Overall, a higher proportion of the sample were White, married, homeowners, had some college education, worked in the labor force, and reported an annual household income between $25,000-$49,999.

4.3 Variable Measures

In this study, our primary variables of interest were poor financial behaviors, receiving government assistance, and financial satisfaction. To test H1 and H2a, the likelihood of receiving government assistance (GA) and the level of financial satisfaction (FS) were included as dependent variables in our empirical analyses. For the GA variable, we used a question in the 2018 NFCS survey where the respondents were asked “Do you receive either Medicaid benefits or food stamps/SNAP (D40)?” In the multivariate analyses, the responses to this question were coded as 1 if they received any government assistance and as 0 if they did not. For the FS variable, we used the following question asking about satisfaction with one’s current personal financial state: “Overall, thinking of your assets, debts, and savings, how satisfied are you with your current personal financial condition (J1)?” The response to this question ranged from 1 (very dissatisfied) to 10 (very satisfied).

For the poor financial behaviors, an index variable was created by using five items: (1) Having more than 9 credit cards (1 = if yes, 0 = if otherwise); (2) Spending more than they earn (1 = if yes, 0 = if otherwise); (3) Not having an emergency fund (1 = if yes, 0 = if otherwise); (4) Not having any IRAs or 401k accounts (1 = if yes, 0 = if otherwise); and (5) Using any of the Alternative Financial Services (e.g., auto title loan, payday loan, advance on tax refund, use of a pawn shop, and use of rent-to-own store) in the past 5 years (1 = if yes, 0 = if otherwise). To create a continuous index variable for poor financial behaviors, we summed “1” (as indicator of such poor financial behaviors) for all five items.

Adverse financial experiences variable was included as an important explanatory variable in both the GA and FS models. Specifically, an index variable was created for the adverse financial experiences by using five questions in the survey: (1) Experiencing unexpected large income drop in the past 12 months (1 = if yes, 0 = if otherwise); (2) Having difficulty in paying all bills in a typical month (1 = if responses are 1–2; 0 if otherwise; 3) Having too much debt right now (1 = if responses are 5–7, 0 if otherwise); 4) Having unpaid medical debt (1 = if yes, 0 if otherwise); and 5) Having been contacted by a debt collection agency in the past 12 months (1 = if yes, 0 if otherwise). We summed the five items to create a continuous index variable to measure adverse financial experiences.

Given the connections between financial knowledge and financial satisfaction (Lind et al., 2020), we included two types of financial knowledge in our empirical analyses: (1) subjective financial knowledge and (2) objective financial knowledge. Subjective knowledge was measured through a question that asked, “How would you assess your overall financial knowledge” (1 = very low, to 7 = very high). This question can reflect individuals’ confidence in personal finance. On the other hand, the objective financial knowledge represents individuals’ financial knowledge score that was created by summing six financial literacy questions (i.e., numeracy, inflation, bonds, mortgage, investment, and compound interest questions). Both of these financial knowledge variables were included as continuous variables in our empirical analyses.

As control variables, socio-economic measures were included in both Logistic and OLS regression models. Age, age squared, and number of children were included as continuous variables, whereas gender, marital status, race/ethnicity, education, employment status, homeownership status, and household income were included as dummy categorical variables. The measurements of these categorical variables were as follows, with the reference group shown in parentheses: gender [females, (males)], marital status [never-married singles, divorced/widowed singles, (married)], race/ethnicity [Black, Hispanic, Asian/other, (White)], education [less than high school/high school graduate, some college, college graduates, (post-college)], employment status [working, (non-working)], and household income [(less than $25,000), $25,000-$49,999, $50,000-$74,999, $75,000-$99,999, more than $100,000].

To test H2b, we combined two variables - poor financial behaviors (PFB) and government assistance (GA), resulting in four groups: 1) NoPFB*GA (those who do not report poor financial behaviors and receive government assistance; 2) NoPFB*NoGA (those who do not report poor financial behaviors and do not receive government assistance); 3) PFB*GA (those who report poor financial behaviors and receive government assistance); and 4) PFB*NoGA (those who report poor financial behaviors, but do not receive government assistance; and 3and;). We used the PFB*NoGA group as a reference group to measure the connections between financial behaviors, receiving government assistance, and financial satisfaction.

4.4 Statistical Analyses

First, means, medians, and percentages of the variables included in the multivariate analyses were calculated (Table 1). Second, to examine whether poor financial behaviors increased the likelihood of receiving government assistance, we conducted a logistic regression analysis (Table 2). Lastly, to examine the role of government assistance in financial satisfaction as well as the influence of poor financial behaviors and adverse financial experiences on financial satisfaction, Ordinary Least Square (OLS) regression analyses were conducted (Table 3). In particular, two OLS regression analyses for financial satisfaction were performed: FS Model 1 assessed the effect of receiving government assistance and engaging in poor financial behaviors on financial satisfaction, while FS Model 2 examined the difference in the levels of financial satisfaction through the four groups that were created by combining poor financial behaviors and receiving government assistance. Significance was assessed at the 95% confidence interval.

All analyses were completed in SAS 9.4 (SAS Institute, 2013). We tested for multicollinearity using the variance inflation factor (VIF); no multicollinearity issues were detected. We used the weight variable (wgt_n2) from the 2018 NFCS data in the regression analyses to make the results more representative of the current population in the U.S.

5 Results

5.1 Descriptive Results

Table 1 provides descriptive information related to the study’s key constructs, including receiving government assistance, poor financial behaviors, our combination of receiving government assistance and financial behaviors, adverse financial experiences, and financial satisfaction. Additionally, Table 1 provides socio-demographic characteristics of the study sample. The percentage of those receiving government assistance was 18.3%. The mean level of poor financial behaviors (range 0–5) was 1.9, meaning that on average, participants engaged in about two of five possible poor financial behaviors. The mean value for adverse financial experiences (range 0–5) was 1.6, meaning that on average, participants faced between one to two adverse financial experiences. The level of financial satisfaction was 5.8 (range 1–10), suggesting that the sample as a whole was only moderately satisfied with their current financial state.

Table 1 also shows the distribution of the four groups based on combinations of receiving government assistance and engaging in poor financial behaviors. Specifically, those who reported poor financial behaviors and received government assistance comprised 8.5% of the sample, while those who did not report poor financial behaviors but received government assistance comprised 9.8% of the sample. These two groups show that among individuals who receive government assistance, there is little difference in the percentage of those that engage or do not engage in poor financial behaviors. Those who reported poor financial behaviors but do not receive government assistance comprised 17.8% of the sample. The majority of the sample was comprised of those who did not report poor financial behaviors and did not receive government assistance (63.8%).

The mean level of subjective financial knowledge (5.2; range 1–7) was higher than the mean level of objective financial knowledge (4.4; range 1–7). As for the sociodemographic characteristics of the study, age ranged from 18 years to 97 years with a mean of 49 years. Approximately 35% of the sample had financially-dependent children. Regarding race/ethnicity, the majority of the sample was White (76.4%), followed by Black individuals (8.8%), Hispanic individuals (7.8%) and Asian/Other individuals (7.0%). In this study, 62.1% of the sample did not have a college degree. Regarding marital status, only 55.3% of the sample was married. Despite having removed individuals who had retired, 57.3% of the sample reported that they were currently employed (in the labor force full-time, part-time, or self-employed). The majority of the sample were homeowners (65.3%) and reported an annual household income between $25,000-$49,999 (24.8%).

6 Logit Results: Determinants of Receiving Government Assistance

In this study, we hypothesized that poor financial behaviors would increase the likelihood of receiving government assistance (H1). Table 2 shows that all else being equal, poor financial behaviors were small but statistically significant. Specifically, the odds ratio showed that those who reported poor financial behaviors were 5% more likely to receive government assistance. However, those who reported experiencing adverse financial hardships were 55% more likely to receive government assistance.

Other predictors that increased the likelihood of receiving government assistance are also presented in Table 2. We saw that income levels drove the largest changes in likelihood of receiving government assistance. Specifically, when compared to those who made less than $25,000, other income groups were between 68 and 87% less likely to receive government assistance. Employment status was also an important predictor, suggesting that being currently employed decreased the likelihood of receiving government assistance by 54%. Interestingly, while subjective financial knowledge increased the likelihood of receiving government assistance (15% increase), objective financial knowledge scores decreased the likelihood (17% decrease). We saw some of the largest increases in the likelihood of receiving government assistance among those who were not married (53–72% increase), among Black individuals (48% increase compared to White individuals), and those who had dependent children (40%). We saw significant decreases among Hispanic and Asian/Other individuals (17% and 22%, respectively when compared to White individuals). When compared to those with a post-college degree, groups without a college degree were between 21 and 26% more likely to receive government assistance.

7 OLS Results: Determinants of Financial Satisfaction

We ran two OLS regression models to better understand the effects of receiving government assistance and poor financial behaviors on financial satisfaction. Specifically, in FS Model 1, we included receiving government assistance as a dichotomous variable and poor financial behaviors as a continuous variable. In FS Model 2, we combined these two variables (receiving government assistance and poor financial behaviors) to create four distinct groups based. The OLS results are presented in Table 3. In both models, we found a similar pattern of significant predictors across all variables with the exception of the number of children (which was no longer significant in this second model). Both FS models 1 and 2 had similar indices of fit (F = 742.12, p < .001, R2 = 0.44; F = 696.77, p < .001, R2 = 0.44).

7.1 Hypothesis 2a

We hypothesized that those who receive government assistance are more likely to have higher financial satisfaction than those who do not receive government assistance (H2a). Table 3 shows that all else being equal, receiving government assistance was positively associated with financial satisfaction, supporting Hypothesis 2a. We also saw that engaging in poor financial behaviors and adverse financial experiences were negatively associated with levels of financial satisfaction. In looking at the standardized beta values (b), receiving government assistance had a small impact (b = 0.075), engaging in poor financial behaviors had a small, though slightly larger impact (b = − 0.116) on financial satisfaction, while adverse financial experiences had the largest effect (b = − 0.327) on financial satisfaction among these key variables.

Other significant predictors are also presented in Table 3. While the effect of subjective financial knowledge was positive, the effect of objective financial knowledge was negative. These results suggest that while confidence in financial knowledge is important in increasing financial satisfaction, objective financial knowledge may contribute to a more realistic assessment of one’s financial situation. However, in looking at the standardized beta coefficients for these two variables, we highlight that subjective financial knowledge (b = 0.301) was much larger than objective financial knowledge (b = − 0.083).

Regarding socio-demographic characteristics, most variables were statistically significant, including age, gender, children, marital status, race/ethnicity, homeownership, and household income. Identifying as female, having more dependent children, being unmarried, were all negatively associated with financial satisfaction. Black individuals reported higher financial satisfaction than their White counterparts, while Asian/Other individuals reported lower financial satisfaction than White individuals. However, there was no significant difference between Hispanic and White individuals in their financial satisfaction. According to housing tenure, homeowners reported higher financial satisfaction than renters. Looking at income, all four income groups reported significantly higher financial satisfaction than those whose annual income was less than $25,000. Interestingly, there was no significant difference in financial satisfaction between those who were currently employed and those who were not currently working.

7.2 Hypothesis 2b

In this study, we aimed to understand whether there were differences between groups based on a combination of engaging in poor financial behaviors and receiving government assistance. FS Model 2 in Table 3 shows that the coefficient associated with NoPFB*GA was statistically significant and positive, suggesting that those who were not engaged in poor financial behaviors but received government assistance had significantly higher financial satisfaction than the reference group, PFB*NoGA (those with poor financial behaviors and no government assistance). Table 3 also shows that the other two coefficients associated with the combination of poor financial behaviors and government assistance were statistically significant and positive. The findings suggest that both groups, NoPFB*NoGA (those with no poor financial behaviors and no government assistance) and PFB*GA (those with poor financial behaviors and receiving government assistance), had significantly higher financial satisfaction than PFB*NoGA (those with poor financial behaviors and no government assistance).

8 Discussion

Using nationally representative data, we explored connections between receiving government assistance, engaging in poor financial behaviors, and financial satisfaction, while accounting for adverse financial experiences. In particular, we hypothesized that those who reported poor financial behaviors would be more likely to receive government assistance (H1). Our results supported this hypothesis as well as Netemeyer’s (2018) framework of financial well-being. However, despite the significance of the association, the magnitude was small and the OLS results suggested that adverse financial experiences were a better predictor of receiving government assistance than poor financial behaviors. This finding is in line with the goal of government assistance which is to provide temporary relief during difficult times (Butler, 2013).

Interestingly, we found that while high subjective financial knowledge increased the likelihood of receiving government assistance, high levels of objective financial knowledge decreased the likelihood. This means that while individuals’ self-rating of perceived financial knowledge led to an increased likelihood of receiving government assistance, individuals’ actual financial knowledge (e.g., understanding numeracy, inflation, bonds, mortgages, investments, and compound interest in loans) reduced the likelihood of receiving government assistance. Previous research has found that high financial knowledge often leads people to make better financial decisions (Garcia-Mata & Zeron-Felix, 2022). However, approximately 11% of Americans are overconfident in their financial knowledge and capabilities (Porto & Xiao, 2016). This overconfidence in financial knowledge likely contributes to our finding that higher subjective knowledge increased the likelihood of receiving government assistance. Together, these findings support the need for financial education programs to reach those who might perceive their financial knowledge as sufficient, but who are lacking in actual financial knowledge.

Previous studies have been inconsistent in determining whether government assistance can increase financial satisfaction and well-being (Brevoort et al., 2017; Brüggen et al., 2017; Marlowe et al., 1996; Miller et al., 2018). Given these inconsistencies, we aimed to investigate the associations of poor financial behaviors, receiving government assistance, and financial satisfaction in two different ways. These analyses highlighted some unexpected findings. While the OLS regression model that treated receiving government assistance and poor financial behaviors as two distinct variables (FS Model 1) provided the anticipated results, the OLS regression model that combined these variables into a categorical variable (FS Model 2) suggested that there may be additional nuances in the association between these constructs that warrants further research. Specifically, FS Model 2 implied that even if individuals engaged in poor financial behaviors, if they also received government assistance, they reported higher financial satisfaction than their counterparts. Additionally, individuals who did not engage in poor financial behaviors, regardless of whether they received government assistance, reported significantly higher levels of financial satisfaction than our comparison group (i.e., those who engaged in poor financial behaviors and did not receive government assistance).

These results highlight that both reducing poor financial behaviors and receiving government assistance, particularly following an adverse financial experience, can play an important role in enhancing individuals’ financial satisfaction. In other words, it can be said that while government assistance can increase financial satisfaction, its influence on an individual’s financial satisfaction may be dependent on whether they practice poor or healthy financial behaviors. Studies have shown that stress from money management and financial satisfaction are closely related, with greater stress reducing one’s financial and even personal well-being (Bisgaier & Rhodes, 2011; Garcia-Mata & Zeron-Felix, 2022; Greenberg & Hershfield, 2019). Thus, our findings suggest that receiving government assistance can lead to an improved sense of financial satisfaction which could help alleviate stress and act as an emotional safety net for low-income families. This is contrary to previous findings which found that individuals receiving government assistance recognized that they were not in an ideal financial situation, and thus suggested that receiving the government assistance decreased their financial satisfaction (Marlowe et al., 1996).

Finally, we note that following the onset of the COVID-19 pandemic, financial distress and hardship increased the financial stress but decreased the financial satisfaction of many families and individuals in the U.S. (Kelley et al., 2022). Although we focus on data collected before the onset of COVID-19, a better understanding of the connections between financial behaviors, adverse financial experiences, receiving government assistance, and financial satisfaction may still have important implications for mitigating the ongoing negative effects of the COVID-19 pandemic on the financial satisfaction of Americans. Specifically, the economic ramifications of the pandemic led to record high inflation rates of 9.1% in June 2022 (Trading Economics, 2022) which may necessitate the need for both government assistance and improved financial behaviors for some individuals.

8.1 Implications

In recent years, researchers have worked to define, study, and understand financial satisfaction, and the various factors related to it. The findings of this study provide insight into both the theoretical and practical implications of poor financial behaviors and receiving government assistance on financial satisfaction. Netemeyer et al. (2018) discussed the role that expected future financial security and stress from current money management play in one’s financial satisfaction. Similarly, Garcia-Mata & Zeron-Felix (2022) proposed that financial satisfaction is related to the fulfillment of one’s needs and wants as well as their financial decisions. The current study found that poor financial behaviors could decrease one’s financial satisfaction while receiving government assistance. This assistance in turn satisfies one’s financial needs and reduces money stress, which could increase financial satisfaction. Confirming the theoretical foundations of these relationships can provide greater support in the study of financial satisfaction as well as indicate a logical need for financial education and government assistance programs. However, while we acknowledge the utility of Netemeyer’s (2018) and Garcia-Mata and Zeron-Felix’s (2022) work in conceptualizing this study, we also highlight the need for theories focused specifically on understanding the role of government assistance in individuals’ finances. Such theories would be instrumental in guiding both research and policy in this area.

In terms of practical applications, the findings of this study can help financial practitioners and educators involved in government assistance programs or those working with people in low-income communities. In particular, financial educators can help families and individuals to acknowledge their financial behaviors, adverse financial experiences, and how these experiences may influence their financial satisfaction. These professionals can support individuals and families on government assistance in recognizing financial behaviors and situations that contribute to their need for government assistance and what steps they could take towards being financially independent.

Based on the findings of this study, government assistance can be important for individuals’ financial satisfaction. The findings of this study also indicate that poor financial behaviors decreased individuals’ financial satisfaction. Thus, financial practitioners can assist those with poor financial behaviors to find the motivation behind their financial behaviors, and help them create a plan to change. As these professionals help their clients better understand “poor” or “healthy” financial behaviors and their financial outcomes, individuals can make more informed financial decisions.

The findings of this study also provide insights for government officials, policy makers, and social workers in that receiving government assistance is positively associated with financial satisfaction. Government assistance was created to provide temporary help to individuals in need (Law, 2020). However, when individuals were not engaging in poor financial behaviors, regardless of government assistance, financial satisfaction increased. Policy makers should apply this information by instituting more financial education and counseling courses for those receiving government assistance. The findings of this study highlight that poor financial behaviors play an important role in receiving government assistance and decreasing financial satisfaction. Government programs can work to ensure that individuals and families who are receiving government assistance also obtain important objective financial knowledge such as understanding numeracy and calculating interest rates, and financial management skills/strategies such as budgeting and the ability to set up an emergency fund (Fu, 2020). This financial education can improve individuals’ financial behaviors to prepare for long-term financial satisfaction that extends beyond government assistance.

8.2 Limitations and Future Study

There are some limitations in this study. First, the question we used for the government assistance variable only asked about whether the respondent received Medicaid or SNAP benefits. There are many different types of government assistance programs that individuals and families can participate in. Future research should investigate the impacts of a larger variety of government assistance programs on financial satisfaction. Additionally, the indicators of poor financial behaviors and adverse financial experiences variables were limited and did not include all types of poor financial behaviors or adverse financial experiences. Thus, investigating additional measures related to financial behaviors and financial experiences could provide more insight for practitioners and researchers.

Further, the cross-sectional nature of this study is an important limitation. Longitudinal research is needed to understand the long-term effects of receiving government assistance on financial satisfaction. In addition, this study only investigated financial satisfaction. The impact of poor financial behaviors and receiving government assistance should also be investigated in conjunction with objective measures of financial well-being in future research. We also note that our study focused only on individuals residing in the U.S.; however, there are significant differences in financial well-being and satisfaction based on geographical and cultural context (Fu, 2020). Thus, we recommend that these constructs are investigated among populations outside of the U.S. Finally, combining receiving government assistance and poor financial behaviors into a categorical variable provided interesting insights. Therefore, we encourage future research to continue to thoughtfully combine other variables in ways that can deepen our understanding of the connections between related constructs.

9 Conclusion

Government assistance has provided many Americans with the opportunity to get back on their feet after having an unexpected hardship, such as a loss in income or a medical emergency. This study examined the connections between poor financial behaviors, receiving government assistance, and financial satisfaction while accounting for adverse financial experiences. While we identified a small association between poor financial behaviors and receiving government assistance, we found that experiencing adverse financial events was a much stronger predictor of receiving government assistance. Although previous research has found mixed results for whether receiving government assistance ultimately improves or decreases financial satisfaction, we found a positive association between receiving government assistance and financial satisfaction, while both poor financial behaviors and adverse financial experiences decreased financial satisfaction.

While the data utilized for the current study was collected before COVID-19, the results are applicable in light of the pandemic. Specifically, COVID-19 has had salient effects on many individuals’ and families’ financial satisfaction, and government assistance has been crucial in helping many of them through these challenges. Given the increases in government assistance programs, it is important that future research explores these associations during and following the COVID-19 pandemic.

We conclude that financial satisfaction can be impacted by an individual’s financial behaviors, adverse financial experiences, and receiving government assistance. Short-term financial management skills and long-term financial behaviors are a crucial part of building financial capability for most Americans. By determining how receiving government assistance is associated with both financial behaviors and financial satisfaction, we hope that financial educators and professionals can continue to aid those in difficult financial situations.

References

Aboagye, J., & Jung, J. Y. (2018). Debt holding, financial behavior, and financial satisfaction. Journal of Financial Counseling and Planning, 29(2), 208–217. https://doi.org/10.1891/1052-3073.29.2.208.

Assistant Secretary for Planning and Evaluation (2020). U.S. federal poverty guidelines used to determine financial eligibility for certain federal programs. https://aspe.hhs.gov/poverty-guidelines

Atlas, S. A., Lu, J., Micu, P. D., & Porto, N. (2019). Financial knowledge, confidence, credit use, and financial satisfaction. Journal of Financial Counseling and Planning, 30(2), 175–190.

Bisgaier, J., & Rhodes, K. V. (2011). Cumulative adverse financial circumstances: Associations with patient health status and behaviors. Health & Social Work, 36(2), 129–137.

Brevoort, K., Grodzicki, D., & Hackmann, M. (2017). Medicaid and financial health. National Bureau of Economic Research.http://www.nber.org/papers/w24002

Brüggen, E., Hogreve, J., Holmlund, M., Kabadayi, S., & Löfgrene, M. (2017). Financial well-being: a conceptualization and research agenda. Journal of Business Research, 79, 228–237. https://doi.org/10.1016/j.jbusres.2017.03.013.

Burcher, S., Serido, J., Danes, S., Rudi, J., & Shim, S. (2018). Using the expectancy-value theory to understand emerging adult’s financial behavior and financial well-being. Society for the Study of Emerging Adulthood, 9(1), 1–10. https://doi.org/10.1177/2167696818815387.

Butler, S. (2013). Older women doing home care: Exploitation or ideal job? Journal of Gerontological Social Work, 56(4), 299–317.

Center for Medicare & Medicaid Services (2022). Medicaid eligibility. https://www.medicaid.gov/medicaid/eligibility/index.html

Center on Budget and Policy Priorities (2022, June 9). Policy basics: The Supplemental Nutrition Assistance Program (SNAP). https://www.cbpp.org/research/food-assistance/policy-basics-the-supplemental-nutrition-assistance-program-snap

Center on Budget and Policy Priorities (2019, November 7). Chart book: SNAP helps struggling families put food on the table. https://www.cbpp.org/research/food-assistance/chart-book-snap-helps-struggling-families-put-food-on-the-table

Coskuner, S. (2016). Understanding factors affecting financial satisfaction: the influence of financial behavior, financial knowledge, and demographics. Imperial Journal of Interdisciplinary Research, 2(5), 377–385.

Delgadillo, L. M., & Lee, Y. G. (2021).Association between financial education affective and cognitive financial knowledge, and financial behavior. Family and Consumer Sciences Research Journal, 50(1), 59–75.

FINRA (2020). National Financial Capability Study: Data and Downloads FINRA Investor Education Foundation. https://www.usfinancialcapability.org/downloads.php

Fu, J. (2020). Ability or opportunity to act: what shapes financial well-being? World Development, 128, 104843.

Garcia-Mata, O., & Zeron-Felix, M. (2022). A review of the theoretical foundations of financial well–being. International Review of Economics, 69,145–176. https://doi.org/10.1007/s12232-022-00389-1

Greenberg, A. E., & Hershfield, H. E. (2019). Financial decision making. Consumer Psychology Review, 2(1), 17–29.

Gruber, J., & Sommers, B. (2020). Paying for Medicaid – state budgets and the case for expansion in the time of Coronavirus. The New England Journal of Medicine, 382(24), 2279–2282.

Hartline-Grafton, H. (n.d.) (Ed.). New USDA report provides picture of who participates in SNAP. Food Research & Action Center. https://frac.org/blog/new-usda-report-provides-picture-of-who-participates-in-snap

Hastings, J., & Shapiro, J. (2018). How are SNAP benefits spent? Evidence from a retail panel. American Economic Review, 108(12), 3493–3540. https://doi.org/10.1257/aer.20170866.

Henager, R., & Cude, B. J. (2016). Financial literacy and long-and short-term financial behavior in different age groups. Journal of Financial Counseling and Planning, 27(1), 3–19.

Hunter, J., & Heath, C. (2017). The relationship between credit card use behavior and household well-being during the great recession: implications for the ethics of credit use. Journal of Financial Counseling and Planning, 28(2), 213–224. https://doi.org/10.1891/1052-3073.28.2.213.

Irving, S. (2015, May 28). How long do people receive assistance? United States Census Bureau. https://www.census.gov/newsroom/blogs/random-samplings/2015/05/how-long-do-people-receive-assistance.html

Joo, S., & Grable, J. E. (2004). An exploratory framework of the determinants of financial satisfaction. Journal of Family and Economic Issues, 25, 25–50.

Kelley, H. H., Lee, Y., LeBaron-Black, A., Dollahite, D. C., James, S., Marks, L. D., & Hall, T. (2022). Change in financial stress and relational wellbeing during COVID-19: Exacerbating and alleviating influences. Journal of Family and Economic, 1–19.

Kim, K. T., Wilmarth, M., & Henager, R. (2017). Poverty levels and debt indicators among low-income households before and after the great recession. Journal of Financial Counseling and Panning, 28(2), 196–212. https://doi.org/10.1891/1052-3073.28.2.196.

Law, L. (2020, January 3). Important welfare statistics for 2020. Lexington Law. https://www.lexingtonlaw.com/blog/finance/welfare-statistics.html

Lind, T., Ahmed, A., Skagerlund, K., Strömbäck, C., Västfjäll, D., & Tinghög, G. (2020). Competence, confidence, and gender: the role of objective and subjective financial knowledge in household finance. Journal of Family and Economic Issues, 41(4), 626–638.

Marlowe, J., Godwin, D., & Maddux, E. (1996). Barriers to effective financial management among welfare recipients. Advancing the Consumer Interest, 8(2), 9–13.

Miller, S., Hu, L., Kaestner, R., Mazumder, B., & Wong, A. (2018). The ACA Medicaid expansion in Michigan and financial health. National Bureau of Economic Researchhttp://www.nber.org/papers/w25053

Nchako, C., & Cai, L. (2020, March 16). A closer look at who benefits from SNAP: State-by-state fact sheets. Center on Budget and Policy Priorities. https://www.cbpp.org/research/food-assistance/a-closer-look-at-who-benefits-from-snap-state-by-state-fact-sheets#Utah

Netemeyer, R. G., Warmath, D., Fernandes, D., & Lynch, J. G. Jr. (2018). How am I doing? Perceived financial well-being, its potential antecedents, and its relation to overall well-being. Journal of Consumer Research, 45(1), 68–89.

O’Brien, R. (2008). Ineligible to save? Asset limits and the saving behavior of welfare recipients. Journal of Community Practice, 16(2), 183–199.

O’Neill, B., Prawitz, A., Sorhaindo, B., Kim, J., & Garman, E. (2006). Changes in health, negative financial events, and financial distress/financial well-being for debt management program clients. Journal of Financial Counseling and Planning, 17(2), 46–63.

Perry, V. G., & Morris, M. D. (2005). Who is in control? The role of self-perception, knowledge, and income in explaining consumer financial behavior. Journal of Consumer Affairs, 39(2), 299–313.

Pirog, M., Gerrish, E., & Bullinger, L. (2017). TANF and SNAP asset limits and the financial behavior of low-income householdshttps://www.pewtrusts.org/~/media/Assets/2017/09/%20TANF_and_SNAP_Asset_Limits_and_the_Financial_Behavior_of_Low_Income_Households.pdf

Porto, N., & Xiao, J. J. (2016). Financial literacy overconfidence and financial advice seeking. Journal of Financial Service Professionals, 70(4), 78-88.

Robb, C., & Woodyard, A. (2011). Financial knowledge and best practice behavior. Journal of Financial Counseling and Planning, 22(1), 60–70.

Rowe, G., & Giannarelli, L. (2006). Getting on, staying on, and getting off welfare: the complexity of state-by-state policy choices. The Urban Institute, A(70), 1–8.

SAS Institute. (2013). SAS 9.4. SAS Institute Inc.

Shin, S. H., & Kim, K. T. (2018). Perceived income changes, savings, motives, and household savings. Journal of Financial Counseling and Planning, 29(2), 396–409. https://doi.org/10.1891/1052-3073.29.2.396.

Stumm, S., O’Creevy, M., & Furham, A. (2013). Financial capability, money attitudes, and socioeconomic status: risks for experiencing adverse financial events. Personality and Individual Differences, 54(3), 344–349. https://doi.org/10.1016/j.paid.2012.09.019.

Trading Economics (2022). United States inflation rate. Trading Economics. https://tradingeconomics.com/united-states/inflation-cpi

Census Bureau, U. S. (2015, May 28). 21.3% of U.S. population participates in government assistance programs each month. https://www.census.gov/newsroom/archives/2015-pr/cb15-97.html

U.S. Bureau of Labor and Statistics (2018, January). Program participation and spending patterns of families receiving government means-tested assistance. https://www.bls.gov/opub/mlr/2018/article/program-participation-and-spending-patterns-of-families-receiving-means-tested-assistance.htm

Xiao, J. J., Chen, C., & Chen, F. (2014). Consumer financial capability and financial satisfaction. Social Indicators Research, 118(1), 415–432. https://doi-org/10.1007/s11205-013-0414-8

Funding

No funding was received by the authors for this study.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of Interest

The authors declare no conflicts of interests.

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Lee, Y.G., Hales, E. & Kelley, H.H. Financial Behaviors, Government Assistance, and Financial Satisfaction. Soc Indic Res 166, 85–103 (2023). https://doi.org/10.1007/s11205-022-03051-z

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11205-022-03051-z