Abstract

We analyze the impact of interchange fees on consumers’ and merchants’ incentives to adopt an innovative payment instrument, in a setting with adoption externalities between consumers and merchants. We show that consumer adoption decreases with the interchange fee for high degrees of externality, and varies non-monotonically with it for low degrees of externality. The profit-maximizing interchange fee coincides with the social optimum when externalities are strong, whereas it is too high when they are weak. We also compare the issuers’ incentives to innovate when they cooperate and when they make their innovation decisions independently.

Similar content being viewed by others

Notes

In the United States, in 2011, the Federal Reserve Board, mandated by the Dodd-Frank Wall Street Reform and the Consumer Protection Act, set a price cap for debit card interchange fees.

In a document that is posted on its website, MasterCard contends that “because interchange balances the benefits and costs of electronic payment systems, it encourages the participants in the system to innovate and invest in the future”. In a press release (IP/13/730 from the 24/07/2013), the European Commission claims that the limitation of interchange fees which has been proposed in July 2013 in Europe will also encourage innovation.

A report published by the Bank for International Settlements states: “So far, there is little to be found in the theoretical and empirical literature that sheds light on the relationship between interchange fees and innovation. The scarcity of the literature dealing with the impact of interchange fees on innovation suggests that further research is needed” (CPSS Report, 2012).

For detailed examples of innovations in various countries, see the CPSS Report, 2012.

The assumption that the acquirers are distinct from the issuers is consistent with the literature and market observations (see, e.g., Wright 2012). If the issuers and the acquirers are identical, the interchange fee becomes neutral in our model.

The adoption fee can be either positive or negative.

The fact that banks tend to charge low or zero transaction fees for debit cards is acknowledged among others by Guibourg and Segendorf (2007) for Sweden and Bolt et al. (2010) for the Netherlands. Other models that assume fixed consumer fees (in a three-party network) include Bolt and Chakravorti (2008) and Chakravorti and Roson (2004).

In the absence of hinterlands, issuers’ equilibrium profits would not depend on the interchange fee, and therefore the interchange fee would not affect the incentives to invest in quality.

Since we assumed that the acquirers are perfectly competitive, the payment association can be seen as a joint-venture governed by the two issuers.

Studying the possibility of negative interchange fees increases the complexity of the model without adding much to our findings. This assumption is compatible with real-worl markets. In most payment systems, interchange fees flow from the acquiring side to the issuing side, one notable exception being the EFTPOS debit card system in Australia. In addition, most ATM networks involve fees that flow from issuers to the owners of the ATMs.

We assume that it is never in the consumer’s interest to buy the EPI from both issuers.

In principle, we should write here the expected number of merchants. However, consistent with the two-sided market literature (e.g., Caillaud and Jullien 2003), we assume that consumers have rational responsive expectations, which means that consumers form their expectations after firms have chosen their qualities and prices. To simplify the presentation, we will refer to only the actual number of merchants and consumers.

In our setting, it suffices to assume that the degree of S2B externality \( \alpha _{B}\) increases with the per-transaction quality of service.

The detailed analysis is available upon request from the authors.

The adoption cost includes, for example, the cost of the new equipment, the cost of training staff for the new payment methods, etc. Fixed costs might differ because merchants have different skills in using payment systems or different opportunity costs in using an electronic payment instrument instead of cash.

The merchants’ transactional benefit of using the electronic payment instrument is defined relative to their benefit of using the legacy payment instrument (e.g., cash), which is normalized to zero. In our setting, there is no merchant internalization of the consumer benefit of using the electronic payment instrument (see Wright 2012).

More precisely, Assumption 2 (i) implies that \(t>2\beta \alpha _{B}b_{S}\), such that some merchants—but not all—adopt the EPI. If the transportation cost is very low, consumer demand is so high that all merchants adopt the innovation.

Note that it must be that \(\pi \left( m\right) >0\), otherwise no merchant adopts the EPI.

The second-order conditions always hold. See “Appendix 2.1” for details.

See “Appendix 2.2”.

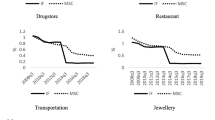

For expositional reasons, Fig. 1 is constructed with a mass 1/2 of consumers on the Hotelling line.

Carbo-Valverde et al. (2016) find that a 10% reduction in the rate of decline per quarter in the average interchange fee resulted in an increase in merchant acceptance per quarter of up to 1.4%. A 10% increase in the rate of merchant adoption resulted in a 0.36% increase in the adoption rate of debit cards by consumers.

In the Proposition, we assume that the joint profits \(\Pi _{1}+\Pi _{2}\) are concave. Due to their algebraic complexity, we cannot prove it analytically. However, the various numerical simulations that we ran suggest that this is the case. For example, it is true for our two numerical examples in Fig. 1.

That is, \(\beta =0.5\), \(b_{S}=0.5\), \(k_{I}=0\), \(\theta _{1}=\theta _{2}=0.5\) , \(t=3\) and \(v_{B}=4\). As for Fig. 1, we assume that there is a mass 1/2 of consumers on the Hotelling line.

This is referred to as R&D cartelization in the R&D cooperation literature (see Kamien et al. 1992). As in the baseline model, we assume that the payment technologies that are developed by the issuers are compatible on the merchants’ side.

As \((\theta ^{NC})^{*}\) and \((\theta ^{C})^{*}\) have highly complex algebric expressions, we omit them here. In both cases, the conditions for a local maximum hold if \(\rho \) is sufficiently high, and we assume that this is the case. See “Appendix 4.1” for details.

The detailed analysis is provided in a supplementary note that is available upon request from the authors.

We can prove this result analytically only for small and high values of the interchange fees. For intermediate values, numerical simulations suggest that \((\theta ^{NC})^{*}>(\theta ^{C})^{*}\) still holds.

We ran our simulations for the parameter values of Fig. 1.

References

Baxter, W. (1983). Bank interchange of transactional paper: Legal and economic perspectives. Journal of Law & Economics, 26, 541–588.

Bedre-Defolie, O., & Calvano, E. (2013). Pricing payment cards. American Economic Journal: Microeconomics, 5, 206–31.

Belleflamme, P., & Peitz, M. (2010). Platform competition and seller investment incentives. European Economic Review, 54, 1059–1076.

Bolt, W., & Chakravorti, S. (2008). Economics of payment cards: A status report. Electronic Banking, Law & Commerce Report, 13(10), 1–16.

Bolt, W., Jonkjer, N., & Van Renselaar, C. (2010). Incentives at the counter: An empirical analysis of surcharging card payments and payment behaviour in the Netherlands. Journal of Banking & Finance, 34, 1738–1744.

Bourreau, M., & Verdier, M. (2014). Cooperative and noncooperative R&D in two-sided markets. Review of Network Economics, 13(2), 175–190.

Caillaud, B., & Jullien, B. (2003). Chicken & egg: Competition among intermediation service providers. RAND Journal of Economics, 34, 309–328.

Carbo-Valverde, S., Chakravorti, S. & Fernandez, F.R. (2016). Regulating two-sided markets: An empirical investigation. Review of Economics and Statistics 98, (Forthcoming).

Chakravorti, S. & Roson, R. (2004). Platform Competition in Two- Sided Markets: The Case of Payment Networks. Federal Reserve Bank of Chicago Emerging Payments Occasional Paper Series, 2004–2009.

Chakravorti, S. (2010). Externalities in payment card networks: Theory and evidence. Review of Network Economics 9, Article 3.

Committee on Payment and Settlement Systems (2012). Innovation in retail payments. Report of the Working Group on Innovations in Retail Payments, May 2012, Bank for International Settlements.

Gans, J. S., & King, S. P. (2003). The neutrality of interchange fees in payment systems. Topics in Economic Analysis & Policy, 3, 1–16.

Guibourg, G., & Segendorf, B. (2007). A note on the price—and cost structure of retail payment services in the Swedish banking sector 2002. Journal of Banking and Finance, 31, 2817–2827.

Humphrey, D., Kim, M., & Vale, B. (2001). Realizing the gains from electronic payments. Journal of Money, Credit & Banking, 33, 216–234.

Kamien, M. I., Muller, E., & Zang, I. (1992). Research joint ventures and R&D cartels. American Economic Review, 82, 1293–306.

Kiser, E. (2002). Predicting household switching behavior and switching costs at depository institutions. Review of Industrial Organization, 20, 349–365.

Kim, M., Kliger, D., & Vale, B. (2003). Estimating switching costs and oligopolistic behavior. Journal of Financial Intermediation, 12, 25–56.

Lin, M., Shaojin, L., & Whinston, A. (2011). Innovation and price-competition in a two-sided market. Journal of Management Information Systems, 28, 171–202.

McAndrews, J. & Wang, Z. (2012). The Economics of two-sided payment card markets: Pricing, adoption and usage. Working Paper 12-06, Federal Reserve Bank of Richmond.

(2012). Reserve Bank of Australia (2012). Strategic review of innovation in the payments system. Sydney: Reserve Bank of Australia.

Rochet, J.-C., & Tirole, J. (2002). Cooperation among competitors: The economics of payment card associations. RAND Journal of Economics, 33, 549–570.

Rochet, J.-C., & Tirole, J. (2003). Platform competition in two-sided markets. Journal of the European Economic Association, 1, 990–1029.

Shy, O. (2002). A quick-and-easy method for estimating switching costs. International Journal of Industrial Organization, 20, 71–87.

Shy, O., & Wang, Z. (2011). Why do payment card networks charge proportional fees? American Economic Review, 101, 1575–90.

Verdier, M. (2010). Interchange fees and incentives to invest in quality of a payment card system. International Journal of Industrial Organization, 28, 539–554.

Verdier, M. (2011). Interchange fees in payment card systems: A survey of the literature. Journal of Economic Surveys, 25, 273–297.

Wang, Z. (2010). Market Structure and payment card pricing: What drives the interchange? International Journal of Industrial Organization, 28, 86–98.

Wright, J. (2003). Optimal payment card systems. European Economic Review, 47, 587–612.

Wright, J. (2004). Determinants of optimal interchange fees in payment systems. Journal of Industrial Economics, 52, 1–26.

Wright, J. (2012). Why payment card fees are biased against retailers. RAND Journal of Economics, 43, 761–780.

Acknowledgements

We thank the Editor, Lawrence White, and two anonymous referees for their valuable comments. We also thank Yossi Spiegel and Raphaël Levy for useful remarks, as well as seminar participants at Mines ParisTech and University of Paris-Dauphine, and participants at the Paris ICT Conference (2011), the Conference on the Economics of Payments (Bank of Canada, 2012), the EARIE Conference (Rome, 2012), and the ECB/Banca d’Italia Workshop on Interchange Fees (Rome, 2014).

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix

1.1 Appendix 1: Stage 3 (Adoption of the Payment Instrument)

1.1.1 Appendix 1.1: Proof of Lemma 1

We have \(\partial \widetilde{n}_{S}/\partial p_{i}=-\left( \beta /t\right) \mu (m)\pi \left( m\right) <0\), as \(\pi \left( m\right) >0\) and \(\mu (m)>0\) . Similarly, we have \(\partial \widetilde{n}_{S}\)\(/\partial m<0\). We also find that \(\partial \widetilde{n}_{S}/\partial \theta _{i}=-\partial \widetilde{n}_{S}/\partial p_{i}>0\). \(\square \)

1.1.2 Appendix 1.2: Proof of Lemma 2

From (2), we have \(\partial \widetilde{D} _{B}/\partial p_{i}=-(\beta /t)\mu (m)<0\). We also have \(\partial \widetilde{ D}_{B}/\partial m=(2\alpha _{B}\beta /t)\partial \widetilde{n}_{S}/\partial m<0\), as \(\partial \widetilde{n}_{S}\)\(/\partial m<0\). Finally, we find that \(\partial \widetilde{D}_{B}/\partial \theta _{i}=(\beta /t)\mu (m)>0\). \(\square \)

1.1.3 Appendix 1.3: Proof of Lemma 3

From (6), we have

since \(\partial \widetilde{n}_{S}/\partial p_{i}<0\). Furthermore, we have \( \partial \widetilde{D}_{B}^{i}/\partial \theta _{i}=-\partial \widetilde{D} _{B}^{i}/\partial p_{i}>0\). For \(j\ne i\), we have

Since \(t-2\beta \left( 1+\beta \right) (b_{S}-m)\alpha _{B}\ge t-2\beta \left( 1+\beta \right) b_{S}\alpha _{B}\), and since from Assumption 2 (iii), \( t-2\beta \left( 1+\beta \right) b_{S}\alpha _{B}>0\), we have \(t-2\beta \left( 1+\beta \right) (b_{S}-m)\alpha _{B}>0\). Since \(\mu (m)>0\), we can conclude that \(\partial \widetilde{D}_{B}^{i}/\partial p_{j}>0\). Finally, we have \(\partial \widetilde{D}_{B}^{i}/\partial \theta _{j}=-\partial \widetilde{D}_{B}^{i}/\partial p_{j}<0\). \(\square \)

1.2 Appendix 2: Stage 2 (Prices)

1.2.1 Appendix 2.1: Second-Order Condition

The second-order condition holds if and only if

This inequality always holds as \(\partial \widetilde{D}_{B}^{i}/\partial p_{i}\le 0\) (Lemma 3) and because we have necessarily \(1+a\partial \widetilde{n}_{S}/\partial p_{i}\ge 0\) from Assumption 2 (ii). Indeed, if \(t>2\beta b_{S}(b_{S}+\alpha _{B})\), for all \(m\le b_{S}\) and \(a\le b_{S}\), we have \(t>\beta b_{S}(a+2\alpha _{B})\), which implies that \(1+a\partial \widetilde{n} _{S}/\partial p_{i}\ge 0\). \(\square \)

1.2.2 Appendix 2.2: Prices are Strategic Complements

Let \(p_{i}^{BR}\) denote the best-response of issuer i. From the implicit function theorem, since \(\partial ^{2}\Pi _{i}/\partial p_{i}^{2}<0\), \( \partial p_{i}^{BR}/\partial p_{j}\) has the sign of \(\partial ^{2}\Pi _{i}/\partial p_{i}\partial p_{j}\). From the FOC (7), we have

From Lemma 1, we have \(\partial \widetilde{n} _{S}/\partial p_{j}=\partial \widetilde{n}_{S}/\partial p_{i}\le 0\). From Lemma 3, we have \(\partial \widetilde{D}_{B}^{i}/\partial p_{i}<0\) and \(\partial \widetilde{D} _{B}^{i}/\partial p_{j}>0\). Finally, from the FOC, we have necessarily \( (1+a\partial \widetilde{n}_{S}/\partial p_{i})\ge 0\). Hence, \(\partial ^{2}\Pi _{i}/\partial p_{i}\partial p_{j}>0\), which proves that prices are strategic complements. \(\square \)

1.3 Appendix 3: Stage 1 (Interchange Fee)

1.3.1 Appendix 3.1: Proof of Proposition 1

First, we compute the derivative of the issuer’s price in the symmetric equilibrium at \(a=0\). We have

where \(E\left( t\right) =\left( 2\alpha _{B}\beta \left( 1+\beta \right) +b_{S}\left( 2\beta +1\right) (3\beta +1)\right) t^{2}-2\alpha _{B}\beta \left( 1+\beta \right) (5b_{S}\beta +2\alpha _{B}\beta +2b_{S})b_{S}t+4b_{S}^{3}\alpha _{B}^{2}\beta ^{2}\left( 1+\beta \right) ^{2} \). Therefore, \(\left. \partial p^{*}/\partial a\right| _{a=0}<0\) if and only if \(E\left( t\right) >0\). As the coefficient of the \(t^{2}\) factor in E is positive, this second-order polynomial is U-shaped, and it has two positive roots. The highest root is

Since \(\sqrt{b_{S}^{2}\alpha _{B}^{2}\beta ^{4}\left( 1+\beta \right) ^{2}\left( b_{S}^{2}+12\alpha _{B}b_{S}+4\alpha _{B}^{2}\right) }\le \sqrt{ b_{S}^{2}\alpha _{B}^{2}\beta ^{4}\left( 1+\beta \right) ^{2}\left( 9b_{S}^{2}+12\alpha _{B}b_{S}+4\alpha _{B}^{2}\right) }\) and \(\sqrt{ b_{S}^{2}\alpha _{B}^{2}\beta ^{4}\left( 1+\beta \right) ^{2}\left( 9b_{S}^{2}+12\alpha _{B}b_{S}+4\alpha _{B}^{2}\right) }=b_{S}\alpha _{B}\beta ^{2}\left( 1+\beta \right) \left( 3b_{S}+2\alpha _{B}\right) \), we have

We find that \(\overline{t}^{+}<4\alpha _{B}\beta b_{S}\), and therefore under Assumption 2 (i), we always have \(t^{+}<\overline{t}^{+}<t\). This implies that under Assumption 2 (i), we have \(E(t)>0\). Since \(v_{B}>k_{I}\) from Assumption 1, it follows that \(\left. \partial p^{*}/\partial a\right| _{a=0}<0\).

Second, since \(v_{B}>k_{I}\) from Assumption 1,

if and only if \(b_{S}\left( 2\beta +1\right) (3\beta +1)>2\alpha _{B}\beta \left( 1+\beta \right) \). \(\square \)

1.3.2 Appendix 3.2: Proof of Proposition 2

For all parameter values, since \(v_{B}>k_{I}\) from Assumption 1, consumer adoption decreases with a at \(a=b_{S}\), as

We now compute \(dD_{B}^{*}/da\) at \(a=0\) for low and high values of \( \alpha _{B}\). First, we have

and hence, \(D_{B}^{*}\) is increasing with a at \(a=0\) for low values of \(\alpha _{B}\). Second, we compute \(dD_{B}^{*}/da\) at \(a=0\) at the maximum value of \(\alpha _{B}\) that is given by Assumption 2 (i). We have

Since \(v_{B}>k_{I}\) from Assumption 1, this expression has the sign of \( 4(b_{S})^{2}\beta \left( 3\beta +1\right) (5\beta +1)-t(17\beta ^{2}+6\beta +1)\), which is positive for high values of \(b_{S}\), and negative otherwise. To sum up, if \(\alpha _{B}\) is high and \(b_{S}\) is low, \(D_{B}^{*}\) is decreasing both at \(a=0\) and at \(a=b_{S}\). Otherwise, \(D_{B}^{*}\) is increasing at \(a=0\) and decreasing at \(a=b_{S}\). \(\square \)

1.3.3 Appendix 3.3: Proof of Proposition 3

We have

and hence, \(dn_{S}^{*}/da\) has the sign of \(-G\). We find that \( G=(t+(2\left( v_{B}-k_{I}\right) +\theta _{1}+\theta _{2})\beta )G_{1}\), and therefore, since \(v_{B}>k_{I}\) from Assumption 1, G has the sign of \(G_{1}\) . \(G_{1}\) is a polynomial of degree 2 of \(\alpha _{B}\) and it has an inverted bell curve, as the coefficient in \((\alpha _{B})^{2}\) is positive if \(a<b_{S}\), since

and \(t(3\beta +1)>2\left( b_{S}-a\right) ^{2}\beta \left( \beta +1\right) \) from Assumption 2 (ii). We compute the discriminant of \(G_{1}\) and show that it is strictly negative if t is sufficiently high, which proves that \( dn_{S}^{*}/da>0\). The discriminant of \(G_{1}\) is equal to \(\Delta _{G_{1}}=-16\left( b_{S}-a\right) ^{2}t^{2}\beta ^{4}\left( \beta +1\right) \times g\), and hence, it has the opposite sign to that of g. We have \( g=2\left( 4\beta +1\right) t^{2}-2\left( b_{S}-a\right) (2b_{S}\beta \left( 3\beta +1\right) -a\left( 2\beta +1\right) \left( 5\beta +1\right) )t-\left( b_{S}-a\right) ^{2}\beta \left( \beta +1\right) (4a(2\beta +1)(b_{S}-a)+b_{S}^{2}\beta )\). Note that \(\left. g\right| _{t=0}<0\). However, the first two terms of g can rearranged so that

where \(g_{0}\) contains terms that are independent of t. Since the first term in the equation above is increasing in t, then g is positive for sufficiently high values of t. We can derive a sufficient condition for \( g\ge 0\), using the fact that \(\left( b_{S}-a\right) (2b_{S}\beta (3\beta +1)-a(2\beta +1)(5\beta +1))\le 2b_{S}^{2}\beta \left( 3\beta +1\right) \), and that \(-g_{0}\le b_{S}^{2}\beta \left( \beta +1\right) \left[ \beta b_{S}^{2}+4b_{S}^{2}\left( 2\beta +1\right) \right] =b_{S}^{4}\beta \left( \beta +1\right) \left( 9\beta +4\right) \). For \(g\ge 0\) to hold, it is then sufficient that

A simpler sufficient condition can be obtained by using the fact that \( t>2\beta b_{S}^{2}\) from Assumption 2 (ii), and replacing for \(t=2\beta b_{S}^{2}\) in the term into brackets in the above expression. Rearranging the expression, we obtain

If this (sufficient) condition holds, then \(dn_{S}^{*}/da<0\) for all a . \(\square \)

1.3.4 Appendix 3.4: Proof of Proposition 4

First, we show that when \(\alpha _{B}=0\), the derivative of the joint profits in the symmetric equilibrium is strictly positive at \(a=0\). We have

Therefore, for low values of the degree of S2B externality (around 0), the profit-maximizing interchange fee is strictly positive. Second, we show that when \(\alpha _{B}\) is high, the derivative of the joint profits in the symmetric equilibrium is strictly negative at \(a=0\). From Assumption 2, \( \overline{\alpha }_{B}=t/(4\beta b_{S})\) is a maximum for \(\alpha _{B}\). We have

which has the sign of \(\beta b_{S}^{2}\left( 3\beta +1\right) \left( 13\beta +3\right) -t\left( 10\beta ^{2}+5\beta +1\right) \). This expression decreases with t, and we find that it is negative for \(t=4\beta b_{S}^{2}\) . Therefore, the derivative of \(\Pi _{1}+\Pi _{2}\) is strictly negative at \( a=0\), and assuming that joint profits are concave, it implies that \(a^{\pi }=0\).

1.3.5 Appendix 3.5: Proof of Corollary 1

(i) When \(\alpha _{B}=0\), we find that \(a^{S}=0\), \(a^{\pi }=a^{B}=b_{S}/2\) and that \(a^{V}\in \left[ 0,b_{S}/2\right) \). Therefore, \(a^{S}\le a^{V}<a^{B}=a^{\pi }\). We begin by showing that \(a^{S}=0\). We have

As the denominator is positive and \(v_{B}>k_{I}\) under Assumption 1, \( dn_{S}^{*}/da<0\) iff \(\left( 4\beta +1\right) t-2\left( b_{S}-a\right) ^{2}\beta \left( 3\beta +1\right) >0\), which is always true under Assumption 2 (ii). Therefore, \(dn_{S}^{*}/da<0\) for all \(a\ge 0\), which implies that \(a^{S}=0\). Second, we prove that \(a^{B}=b_{S}/2\). We have

As the numerator is independent of a, the maximum of \(D_{B}^{*}\) in a is given by the minimum of the denominator, at \(a^{B}=b_{S}/2\). Third, we show that \(a^{\pi }=b_{S}/2\). We find that

From Assumption 2 (ii), we have \(\left( 8\beta +3\right) t-2a\left( b_{S}-a\right) \beta \left( 3\beta +1\right) >0\), and the denominator is positive. Therefore, \(d\Pi /da=0\) iff \(a=b_{S}/2\). Since \(\left. d^{2}\Pi /da^{2}\right| _{a=b_{S}/2}<0\), we have \(a^{\pi }=b_{S}/2\). Finally, since \(a^{B}=b_{S}/2\) and \(a^{S}=0\), then \(a^{V}\in [0,b_{S}/2]\). Besides,

Therefore, \(a^{V}\in [0,b_{S}/2)\).

(ii) Under Assumption 3, and from Propositions 2 and 3, consumer and merchant adoption decrease with the interchange fee if \(\alpha _{B}\) is high and \(b_{S}\) is low. In this case, consumer and merchant adoption are maximized when the interchange fee is set to zero. As from Proposition 4, we have \(a^{\pi }=0\), consumer and merchant adoption is maximized at the profit-maximizing interchange fee.

1.3.6 Appendix 3.6: Proof of Proposition 5

The merchants’ surplus is

Define \(u^{*}=v_{B}+\theta +\alpha _{B}n_{S}^{*}-p^{*}\). In the symmetric equilibrium, consumer surplus is

Finally, define total user surplus as \(TUS=MS+CS\). Under the assumption that TUS is concave in a, if \(\left. dTUS/da\right| _{a=a^{\pi }}\le 0\) and \(a^{\pi }>0\), we have \(a^{\pi }\ge a^{W}\).

(i) If \(\alpha _{B}=0\), we have

where

Since \(t(4\beta +1)+2a(a-b_{S})\beta (3\beta +1)\) is minimal for \(a=b_{S}/2\) and positive for \(a=b_{S}/2\) (as by Assumption \(t\ge 4\beta b_{S}^{2}\)), \( \left. dTUS/da\right| _{\alpha _{B}=0}\) has the sign of \(-y(a)\). Since y is increasing in a, y is minimal for \(a=0\). We have \(y(0)=\beta b_{S}(t-b_{S}^{2}(6\beta +2))\). There are two cases. If \(t\ge b_{S}^{2}(6\beta +2)\), we have \(y(a)\ge 0\) for all \(a\in \left[ 0,b_{S} \right] \). Therefore, we have \(\left. dTUS/da\right| _{\alpha _{B}=0}\ge 0\) for all \(a\in \left[ 0,b_{S}\right] \), which implies that \( a^{W}\le a^{\pi }\). If \(t\in \left[ 4\beta b_{S}^{2},b_{S}^{2}(6\beta +2) \right] ,\)we denote by

the level of interchange fee such that \(y(\widetilde{a})=0\). We have \( y(a)\le 0\) for \(a\in \left[ 0,\widetilde{a}\right] \) and \(y(a)\ge 0\) for \( a\in \left[ \widetilde{a},b_{S}\right] \). Therefore, we have \(\left. dTUS/da\right| _{\alpha _{B}=0}\ge 0\) for \(a\in \left[ 0,\widetilde{a} \right] \) and \(\left. dTUS/da\right| _{\alpha _{B}=0}\le 0\) for \(a\in \left[ \widetilde{a},b_{S}\right] \). Therefore, if \(a^{\pi }\le \widetilde{ a}\), we have \(\left. dTUS/da\right| _{(\alpha _{B}=0,a=a^{\pi })}\ge 0\) . Provided that TUS is concave in a, this implies that \(a^{\pi }\le a^{W}\). If \(a^{\pi }\ge \widetilde{a}\), we have \(a^{\pi }\ge a^{W}\).

(ii) From Assumption 2, \(\overline{\alpha }_{B}=t/(4\beta b_{S})\) is a maximum for \(\alpha _{B}\). In this case, we have \(a^{\pi }=0\). We have

where \(h(t)=-t^{2}(17\beta ^{2}+6\beta +1)-16b_{S}^{2}\beta ^{3}t+8b_{S}^{4}\beta ^{2}(3\beta +1)(5\beta +1)\). We have \(h(4b_{S}\beta )\le 0\). Since h is decreasing with t, this implies that \(h(t)\le 0\) for all \(t\ge 4b_{S}\beta \). Therefore, we have

Provided that TUS is decreasing with a, we can conclude that \(a^{\pi }=a^{W}\) if the degree of S2B externality is high. It is not possible to prove analytically that TUS decreases with a. However, we ran simulations and checked that this was true for large sets of parameter values. We also checked that TUS is decreasing for all \(\beta \), and that it is still decreasing if we increase \(\alpha _{B}\) or \(b_{S}\).

Appendix 4: Quality Investments

1.1 Appendix 4.1: Second-Order Conditions

No-cooperation We have \(d^{2}\Pi _{i}/d\theta _{i}^{2}=d^{2}\widetilde{\Pi }_{i}/d\theta _{i}^{2}-\rho \). Since \(d^{2}\widetilde{\Pi }_{i}/d\theta _{i}^{2}\) is independent of \(\theta _{i}\), the second-order condition is satisfied if \( \rho \) is high enough.

No-cooperation We have \(d^{2}(\Pi _{1}+\Pi _{2})/d\theta _{i}^{2}=d^{2}(\widetilde{\Pi } _{1}+\widetilde{\Pi }_{2})/d\theta _{i}^{2}-\rho \). Since \(d^{2}(\widetilde{ \Pi }_{1}+\widetilde{\Pi }_{2})/d\theta _{i}^{2}\) is independent of \(\theta _{i}\), \(d^{2}(\Pi _{1}+\Pi _{2})/d\theta _{i}^{2}<0\) if \(\rho \) is high enough. Furthermore, the determinant of the Hessian matrix is positive if

The denominator is positive. The numerator is also positive as \(\left( 2\beta +1\right) t-2\beta (\beta +1)\alpha _{B}(b_{S}-a)>0\) from Assumption A2 (i), and \(t-\left( b_{S}-a\right) \left( a+2\alpha _{B}\right) \beta >0\) from Assumption A2 (ii). Therefore, the SOC holds.

1.2 Appendix 4.2: Proof of Proposition 6

No-cooperation We begin by proving that equilibrium quality investments are decreasing with the interchange fee at \(a=b_{S}\). We have

As the denominator is strictly positive from the SOC at \(a=b_{S}\), \(\left. d(\theta ^{NC})^{*}/da\right| _{a=b_{S}}\) has the sign of \( N_{1}=-\rho \beta \left( 4\beta +1\right) [t+2\beta (v_{B}-k_{I})]N_{1}^{\prime }\), where \(N_{1}^{\prime }\) is a sum of positive terms. Hence, from Assumption 1, \(\left. d(\theta ^{NC})^{*}/da\right| _{a=b_{S}}<0\).

Now, we study the variations of quality investments with respect to the interchange fee at \(a=0\). We have \(\left. d(\theta ^{NC})^{*}/da\right| _{a=0}=N_{2}/D_{2}\). Since \(D_{2}\) is a square, it is strictly positive, and therefore, \(\left. d(\theta ^{NC})^{*}/da\right| _{a=0}\) has the same sign as \(N_{2}\). When \(\alpha _{B}=0\), we have

At the other extreme, when \(\alpha _{B}\rightarrow \infty \), \(N_{2}\) goes to \(-\infty \), as \(t-2\beta (v_{B}-k_{I})>0\).

Cooperation We begin by proving that equilibrium quality investments are decreasing with the interchange fee at \(a=b_{S}\). We have

As the denominator is strictly positive, \(\left. d(\theta ^{C})^{*}/da\right| _{a=b_{S}}\) has the sign of \(N_{3}=-2\rho \beta ^{2}\left( 4\beta +1\right) [t+2\beta (v_{B}-k_{I})]N_{3}^{\prime }\), where \( N_{3}^{\prime }\) is a sum of positive terms. Therefore, from Assumption 1, \( \left. d(\theta ^{C})^{*}/da\right| _{a=b_{S}}<0\).

Now, we study the variations of the equilibrium quality investment with respect to the interchange fee at \(a=0\). We have \(\left. d(\theta ^{C})^{*}/da\right| _{a=0}=N_{4}/D_{4}\). Since \(D_{4}\) is a square, it is strictly positive, and hence, \(\left. d(\theta ^{C})^{*}/da\right| _{a=0}\) has the same sign as \(N_{4}\). When \(\alpha _{B}=0\), we have

whereas when \(\alpha _{B}\rightarrow \infty \), \(N_{4}\) goes to \(-\infty \), as \(t-2\beta (v_{B}-k_{I})>0\).

1.3 Appendix 4.3: Proof of Proposition 7

Let \(\epsilon \left( a\right) \equiv (\theta ^{NC})^{*}-(\theta ^{C})^{*}\). We start by showing that \(\epsilon \left( b_{S}\right) >0\). We have

In the no-cooperation scenario, if \(a=b_{S}\), the SOC holds iff \(kt(4\beta +1)^{2}(4\beta +3)^{2}>(2\beta +1)\left( 8\beta ^{2}+8\beta +1\right) ^{2}\). We find that if this is true, the denominator of \(\epsilon \left( b_{S}\right) \) is strictly positive, hence \(\epsilon \left( b_{S}\right) >0\).

Now, we prove that \(\epsilon \left( 0\right) \ge 0\) if \(\alpha _{B}\) is small or if it is high. First, we find that \(\left. \epsilon \left( 0\right) \right| _{\alpha _{B}=0}=\epsilon \left( b_{S}\right) >0\). Second, from Assumption 2, \(\alpha _{B}\) is bounded from above by \(\overline{\alpha } _{B}=\min \left\{ t/(4\beta b_{S}),t/(2\beta (1+\beta )b_{S})\right\} \). Note that \(\overline{\alpha }_{B}=t/(4\beta b_{S})\) if \(\beta <1\), and \( \overline{\alpha }_{B}=t/(2\beta (1+\beta )b_{S}\) otherwise. To begin with, assume that \(\beta <1\). We have

The SOC in the no-cooperation scenario at \(a=0\) and \(\alpha _{B}=t/(4\beta b_{S})\) holds iff \(kt(7\beta +1)^{2}(5\beta +3)^{2}>(3\beta +1)\left( 17\beta ^{2}+14\beta +1\right) ^{2}\). If this is true, then the denominator of \(\left. \epsilon \left( 0\right) \right| _{\alpha _{B}=\overline{ \alpha }_{B}}\) is strictly positive, hence \(\left. \epsilon \left( 0\right) \right| _{\alpha _{B}=\overline{\alpha }_{B}}>0\). Finally, we find that when \(\beta >1\), \(\left. \epsilon \left( 0\right) \right| _{\alpha _{B}= \overline{\alpha }_{B}}=0\). Therefore, \(\left. \epsilon \left( 0\right) \right| _{\alpha _{B}=\overline{\alpha }_{B}}\ge 0\) for all \(\beta \).

Rights and permissions

About this article

Cite this article

Bourreau, M., Verdier, M. Interchange Fees and Innovation in Payment Systems. Rev Ind Organ 54, 129–158 (2019). https://doi.org/10.1007/s11151-018-9648-6

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11151-018-9648-6