Abstract

We develop a model of labor productivity as a combination of capital-labour ratio, vintage of capital stock, regional externalities, and total factor productivity (TFP). The skewness of TFP distribution is related to different growth theories. While negative skewness is consistent with the neo-Schumpeterian idea of catching up with leaders, zero skewness supports the neoclassical view that deviations from the frontier reflect only idiosyncratic productivity shocks. We argue that positive skewness is consistent with an economy where exogenous technology is combined with non-transferable knowledge accumulated in specific sectors and regions. This argument provides the framework for an empirical model based on stochastic frontier analysis. The model is used to analyse regional and sectoral inequalities in Denmark.

Similar content being viewed by others

Notes

This section, and corresponding interpretation of our empirical results, owes much to the comments of an anonymous referee, encouraging us to discuss our work in the context of the international technology transfer literature.

It is reasonable to think that positive skewness should be expected in sectors where innovation and creative destruction are more intense. Conversely, in mature sectors where a technological frontier is relatively well defined and the efficient use of public good technology is the main driver of competition, positive skewness will tend to decrease or even become negative.

If differences in evolution of labour skills were a key element of regional differentiation, the inclusion of a corresponding variable would be necessary. Given the social homogeneity of Denmark (see, for example, Castro 1994), this is not necessary.

This is similar to what is known in the literature as the time invariant efficiency model, except that in our case invariance is across regions rather than time.

See Kumbhakar and Lovell (2000) for further references and detailed discussion of inference in stochastic frontier production and cost functions.

In addition to sector-time effects on the conditional mean, we can also include additional fixed effects in the production function. The resulting model is (weakly) identified by functional form, but does not offer additional insights into the study of growth and inequality.

We used weighted averages using share in total sectoral production as weights; see also Pesaran (2006). Results with equally weighted averages are very similar.

Bornholm, Hovedstad or Greater Copenhagen metropolitan area, Vestsjælland (West Zealand), Storstrøm, Fyn (Funen), Søndre Jylland (Southern Jutland), Ribe, Vejle, Århus, Ringkøbing, Viborg and Nord Jylland (Northern Jutland). It may be noted that the above regional division of Denmark changed recently. This does not affect our empirical study, since the used data ends in 1994.

Food, textiles, wood and furniture, paper and publishing, chemicals, glass and ceramics, metals and engineering, other manufacturing and public sector. The initial data set included 21 sectors, 12 of each are not used in this study. Agriculture was dropped because of substantial overlap with the oil and gas industries, the transport and communications sector was dropped because it was difficult to allocate the productive resources (labour and capital) to specific regions, while construction, electricity, gas and water were dropped because good investment data (required for computation of capital stock) were not available for all the regions, and finally, private services were dropped because investment data were not available at regional level.

An alternative measure of embodiment is based on variation in the composition of capital stock by type (Caselli and Wilson 2004). We explore the second option, by examining share of capital stock in buildings, plant/machinery and vehicles, and find only limited regional variation. Following Caselli and Wilson (2004), it may thus be argued that such low variation is a result of homogeneity across Danish regions in human capital and other productive factors; this is consistent with empirical evidence reported in Castro (1994).

The medcouple, a recently proposed robust estimator of skewness (Brys et al. 2004), based on all values of the residual including the extreme values was also positive.

Shares in total sectoral production are used as weights. Equally weighted averages give very similar results.

We also estimated a simpler model where the conditional mean of the productivity enhancing disembodied technology varied only over the sectors but not over time. The results did not change significantly.

The common correlated effects methodology (Pesaran 2006), on which these estimates are based, relate to a standard fixed effects model. Our model here is different, and the nature of asymptotics is different too. Therefore, estimates of Model (d) have to be treated with some caution. We use these results solely for robustness checks.

These figures must be treated with caution because of potential omitted variable bias. However, the effect of omitted variables here is reduced because we are not inferring on the coefficient estimates as such, but only on the overall contributions of the variables to the total variance.

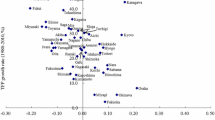

As discussed above, regional externalities reflect local capacity to develop or absorb disembodied technology. It is important to stress that our analysis is limited to manufacturing and public services. Therefore, the leading position of Copenhagen which is mainly based on financial and other private services is not as evident as expected.

An alternative methodology would be estimating the conditional mean model, described by (2) and (5), and using the estimated coefficients on the sector-time dummies. However, this approach imposes stronger assumptions which do not appear to be consistent with the data.

The regions, however, show different absorptive capacities reflected in specific fixed effects.

Under this method, transport investment incurred in a year depreciates to zero in 6 years’ time, for example.

Previous 28 years for buildings, 9 years for machinery and 5 years for transport.

References

Abramovitz M (1986) Catching up, forging ahead, and falling behind. J Econ Hist 46:385–406

Aghion P, Howitt P (1992) A model of growth through creative destruction. Econometrica 60:323–351

Aghion P, Howitt P (2006) Appropriate growth policy: a unifying framework. The 2005 Joseph Schumpeter Lecture. J Eur Econ Assoc 4:269–314

Aigner DJ, Lovell CAK, Schmidt P (1977) Formulation and estimation of stochastic frontier of production function models. J Econometrics 6:21–37

Barro RJ, Sala-i-Martin X (1995) Economic growth. McGraw-Hill, New York

Battesse GE, Coelli TJ (1988) Prediction of firm-level technical efficiencies with a generalized frontier production function and panel data. J Econometrics 38:387–399

Battesse GE, Coelli TJ (1992) Frontier production functions, technical efficiency, and panel data with application to paddy farmers in India. J Prod Anal 3:153–169

Braczyk HJ, Cooke P, Heidenreich M (1998) Regional innovation systems. UCL Press, London

Brys G, Hubert M, Struyf A (2004) A robust measure of skewness. J Comput Graph Stat 13:996–1017

Carree MA (2002) Technological inefficiency and the skewness of the error component in stochastic frontier analysis. Econ Lett 77:101–107

Caselli F, Wilson DJ (2004) Importing technology. J Monetary Econ 51:1–32

Castro EA (1994) Regional development asymmetries and innovative capacity: a model based on embodiment of technical progress. University of Aveiro. Unpublished PhD Thesis

Coe D, Helpman E (1995) International R&D spillovers. Eur Econ Rev 39:859–887

Coelli T, Perelman S, Romano E (1999) Accounting for environmental influences in stochastic frontier models: with application to international airlines. J Prod Anal 11:251–273

D’Agostino RB, Balanger A, D’Agostino RB Jr (1990) A suggestion for using powerful and informative tests of normality. Am Stat 44:316–321

DeLong JB, Summers LH (1991) Equipment investment and economic growth. Q J Econ 106:445–502

Dosi G (1997) Opportunities, incentives and the collective patterns of technological change. Econ J 107:1530–1547

Dosi G, Freeman C, Nelson RR, Silverberg G, Soete L (eds) (1988) Technical change and economic theory. Pinter Publishers, London

Edquist C, Lundvall B-Å (1993) Comparing the Danish and Swedish systems of innovation. In: Nelson RR (ed) National innovation systems. A comparative analysis. Oxford University Press, Oxford, pp 265–295

Essletzbichler J, Winther L (1999) Regional technological change and path-dependency in the Danish food processing industry. Geogr Ann 81A:179–196

Fagerberg J (1988) Why growth rates differ. In: Dosi G, Freeman C, Nelson RR, Silverberg G, Soete L (eds) Technical change and economic theory. Pinter Publishers, London, pp 432–457

Färe R, Grosskopf S, Norris M, Zhang Z (1994) Productivity growth, technical progress and efficiency change in industrialized countries. Am Econ Rev 84:66–83

Fritsch M, Stephan A (2004) The distribution and heterogeneity of technical efficiency within industries—an empirical assessment. Discussion Paper 453, DIW Berlin

Funke M, Niebuhr A (2005) Regional geographic research and development spillovers and economic growth: evidence from West Germany. Reg Stud 39:143–153

Furobotn EG, Richter R (eds) (1992) The new institutional economics: a collection of articles from the journal of institutional economics. Texas A&M University Press, College Station

Green A, Mayes D (1991) Technical inefficiency in manufacturing industries. Econ J 101:523–538

Greenwood J, Hercowitz Z, Krusell P (1997) Long-run implications of investment-specific technological change. Am Econ Rev 87:342–362

Grossman GM, Helpman E (1991) Innovation and growth in the global economy. MIT Press, Cambridge

Hansen F, Jensen-Butler C (1996) Economic crisis and the regional and local economic effects of the welfare state: the case of Denmark. Reg Stud 30:167–187

Hultberg PT, Nadiri MI, Sickles RC (2004) Cross-country catch-up in the manufacturing sector: impacts of heterogeneity on convergence and technology adoption. Empirical Econ 29:753–768

Jensen-Butler C (1992) Rural industrialization in Denmark and the role of public policy. Urban Stud 29:881–904

Jensen-Butler C, Madsen B (2005) Decomposition analysis: an extended theoretical foundation and its application to the study of regional income growth in Denmark. Environ Planning A 37:2189–2208

Keller W (2004) International technology diffusion. J Econ Lit 42:752–782

Klump R, Preissler H (2000) CES production functions and economic growth. Scand J Econ 102:41–56

Kneller R, Stevens PA (2006) Frontier technology and absorptive capacity: evidence from OECD manufacturing industries. Oxf Bull Econ Stat 68:1–21

Krüger JJ (2006) Using the manufacturing productivity distribution to evaluate growth theories. Struct Change Econ Dyn 17:248–258

Kumar S, Russell R (2002) Technological change, technological catch-up, and capital deepening: relative contributions to growth and convergence. Am Econ Rev 92:527–548

Kumbhakar SC, Ghosh S, McGuckin JT (1991) A generalized production frontier approach for estimating determinants of inefficiency in US dairy farms. J Bus Econ Stat 9:279–286

Kumbhakar SC, Lovell CAK (2000) Stochastic frontier analysis. Cambridge University Press, Cambridge

Lucas RE Jr (1988) On the mechanics of economic development. J Monetary Econ 22:3–42

Lucas RE Jr (2000) Some macroeconomics for the twenty-first century. J Econ Perspect 14:159–178

Lundvall B-Å (ed) (1992) National systems of innovation. Francis Pinter, London

Mankiw NG (1995) The growth of nations. Brookings Pap Econ Act 1:275–326

Manski CF (1993) Identification of endogenous social effects: the reflection problem. Rev Econ Stud 60:531–542

Meeusen W, Van den Broeck J (1977) Efficiency estimation from Cobb-Douglas production functions with composed error. Int Econ Rev 18:435–444

Nelson RR (1980) Production sets, technological knowledge, and R&D: fragile and overworked constructs for analysis of productivity growth? Am Econ Rev 70:62–67

Nelson RR, Winter SG (1982) An evolutionary theory of economic change. Harvard University Press, Cambridge

Nelson RR, Winter SG (2002) Evolutionary theorising in economics. J Econ Perspect 16:23–46

Pesaran MH (2006) Estimation and inference in large heterogenous panels with multifactor error structure. Econometrica 74:967–1012

Prescott EC (1998) Needed: a theory of total factor productivity. Lawrence R. Klein Lecture 1997. Int Econ Rev 39:525–551

Romer PM (1986) Increasing returns and long-run growth. J Polit Econ 94:1002–1037

Romer PM (1990) Endogenous technological change. J Polit Econ 98:S71–S102

Schmidt P, Lovell CAK (1979) Estimating technical and allocative inefficiency relative to stochastic production and cost frontiers. J Econometrics 9:343–366

Simar L, Wilson PW (2005) Estimation and inference in cross-sectional, stochastic frontier models. Technical Report 0541, Institut de Statistique, Université Catholique de Louvain

Solow RM (1956) A contribution to the theory of economic growth. Q J Econ 70:65–94

Solow RM (1957) Technical change and aggregate production function. Rev Econ Stat 39:312–320

Solow RM (1960) Investment and technical progress. In: Arrow KJ, Karlin S, Suppes P (eds) Mathematical methods in the social sciences. Proceedings of the first Stanford symposium 1959. Stanford University Press, Stanford, pp 89–104

Swan TW (1956) Economic growth and capital accumulation. Econ Rec 32:334–361

Temple J (1999) The new growth evidence. J Econ Lit 37:112–156

Temple J (2003) The long-run implications of growth theories. J Econ Surv 17:497–510

Tsionas EG (2006) Inference in dynamic stochastic frontier models. J Appl Econ 21:669–676

Williamson OE (1996) The mechanisms of governance. Oxford University Press, Oxford

Acknowledgement

The authors gratefully acknowledge Jose Manuel Martins for his valuable assistance and discussions, and Charles Nolan and a referee for useful comments and suggestions. The usual disclaimer applies.

Author information

Authors and Affiliations

Corresponding author

Additional information

The paper is dedicated to the fond and loving memory of Chris Jensen-Butler, who died while we were working on the paper.

Appendices

Appendix 1: measurement of capital stock and vintage

As discussed in the text, a major challenge was in using annual data on investment in buildings, machines and transport at the region and sector level to estimate capital stock and the age of capital. Essentially, our data construction strategy was to obtain annual capital stock estimates by aggregating depreciated values of lagged investment for several preceding years. The depreciation rates used varied by the type of investment as well as with the lag. Vintage of capital for each year at the region × sector level was similarly estimated as a weighted average of the age of capital, taking the depreciated value of capital stock as the respective weight for each vintage.

Crucially, the estimation of both capital stock and age of capital relied on obtaining appropriate depreciation rates for different types of capital. For this purpose, we used two alternative methods.

Method 1

In this rather simplistic formulation, we considered fixed depreciation rates of 1/30, 1/10 and 1/6 of initial book value per year for buildings, machines and transport respectively. These fixed depreciation rates approximately matched average annual depreciation rates for aggregate capital stock in Denmark over the period of analysis.

Following this depreciation scheme, we computed total value of capital stock for each sector, region and year (1979–1993). Thus, capital stock, by type of capital, in the year t for region r and sector i was estimated as:

where K (tr) rit , K (ma) rit and K (ba) rit denote capital stock in transport, machinery and buildings respectively and similarly I (tr) rit , I (ma) rit and I (ba) rit denote investment by type of capital goods.

We used a similar procedure to estimate the average age of capital. For this purpose, a weighted average was used, where the age of investment in each year was simply weighted by its depreciated value in the current year. For example, average age of transport capital in the year t for region r and sector i was estimated as:

where a (tr) rit is the average age of transport capital (in years). It is assumed that investments during a given year have an average age of 6 months when the accounting year closes. The average age of capital for the other types of capital were computed similarly.

Method 2

The above method is simplistic and may not be satisfactory, in that it assumes a fixed rate of depreciation of capital irrespective of the vintage. It also assumes that capital depreciates at a constant rate rather than a compounded depreciation rule.Footnote 19

As an alternative, we collected data (from Danmarks Statistik) on total depreciation and stock of capital at replacement cost, by sector and year for the entire period under study. Using these data, we estimated a nonlinear regression model regressing log of aggregate depreciation on lagged log-investments for several previous years.Footnote 20

The estimated compounded depreciation rates were the following:

Buildings: 0.018 (past 1–12 years), 0.040 (13–20 years) and 0.084 (21–28 years).

Machinery: 0.000 (past 1–3 years), 0.079 (4–6 years) and 0.372 (7–9 years).

Transport: 0.078 (past 1–3 years) and 0.360 (4–5 years).

For each capital type, we assumed zero depreciation for the current year.

There were several nice features of these estimation results. First, the R 2 is 0.988, which is very good given that we have 144 observations and only eight estimated depreciation parameters. The residuals showed some evidence of heteroscedasticity, but autocorrelation was not significant. Second, for each type of capital, the residual undepreciated capital is relatively low. After 28 years, 29% of initial investment in buildings remain; 19% of machinery remain after 9 years; and 22% of transport investment remain undepreciated after 5 years. Third, the a priori expected relationship of increasing depreciation rates with vintage of capital is maintained in the estimates.

Assuringly, the empirical results obtained by adopting the two alternative depreciation rules to compute capital stock and age of capital are very similar. Hence, in the interests of clarity in exposition, we report empirical results only using Method 2. Results using Method 1 are available with the authors.

Appendix 2: additional results and robustness

See Table 3

Rights and permissions

About this article

Cite this article

Bhattacharjee, A., de Castro, E. & Jensen-Butler, C. Regional variation in productivity: a study of the Danish economy. J Prod Anal 31, 195–212 (2009). https://doi.org/10.1007/s11123-008-0128-0

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11123-008-0128-0

Keywords

- Regional growth models

- Total factor productivity

- Stochastic frontier analysis

- Skewness

- Technological trajectories