Abstract

This paper shows the uneven role played in the inflation dynamics of African franc zone countries by their integration in a regional monetary union. We obtain three main results sharply contrasting the central- (CEMAC) and west-African (WAEMU) regions. First, differences in the structure of economies and national fiscal stances play a similar role in both unions and appear as potential sources of inflation differentials. Second, even though co-movements are the principal drivers of inflation dynamics in both subregions, global factors dominate regional ones in WAEMU while both play an equal role in CEMAC. Thirdly, spatial interactions are unimportant in CEMAC due to little intra-zone trade, but take an asymmetric form in WAEMU due to the large size of Ivory Coast and Senegal.

Similar content being viewed by others

Notes

The West African Economic and Monetary Union (WAEMU) and the Central African Member States (CEMAC) are part of the Franc zone, which is made up of geopolitical zones where currencies (FCFA) were pegged to the French Franc and are now linked to the euro by a fixed parity system guaranteed by the French Treasury. WAEMU is composed of eight countries (Benin, Burkina Faso, Ivory Coast, Guinea-Bissau, Mali, Niger, Senegal and Togo) and monetary policy is carried out at the regional level by the Central Bank of West African States (BCEAO). CEMAC is made up of six countries (Cameroon, Gabon, Central Africa, Congo, Equatorial Guinea and Chad) with a single Central Bank, the Bank of Central African State (BEAC).

We replicated our factor extraction on yearly data and obtained qualitatively similar results as those reported below.

Several authors (Dornbusch et al. 1990; Easterly and Schmidt 1993; Hamburger and Zwick 1981) stress that if a government finances budget deficits by selling government bonds to the public then budget deficits will not create any inflation as no new money is created in the process. However, if borrowing is made from banks then deposits will expand and cause inflation.

We exclude zone Franc member countries from the sample in order to avoid including purely regional factors among global factors. We assume that regional factors are unique to the union members.

We initially used the three approaches. The SW and FRLH approaches both select only four factors, while standard PCA keeps six factors. Moreover, the variance explained by FRHL is higher.

Such a situation is likely to persist in a much as franc-zone governments are engaged in ambitious investment programmes which will boost aggregate demand and inflation. In this context the productivity of public expenditure is key.

References

Alesina A, Barro RJ Tenreyro S (2002) Optimal currency areas. NBER Working Paper No. 9072, National Bureau of Economic Research

Altissimo F, Benigno P, Palenzuela DR (2005) Long-run determinants of inflation differentials in a monetary union. NBER Working Paper No.11473, National Bureau of Economic Research

Anselin L (1988a) Spatial econometrics, methods and models. Kluwer Academic Publishers, Dordrecht

Anselin L (1988b) Lagrange multiplier tests diagnostics for spatial dependence and spatial heterogeneity. Geogr Anal 20(1):1–17

Anselin L, Hudak S (1992) Spatial econometrics in practice: A review of software options. Reg Sci Urban Econ 22(3):509–536

Anselin L, LeGallo J, Jayet H (2008) Spatial panel econometrics. In: Matyas L, Sevestre P (eds) The econometrics of panel data, fundamentals and recent developments in theory and practice, 3rd edn. Kluwer, Dordrecht, p 901-969

Baltagi BH (2005) Econometric analysis of panel data, 3rd edn. Wiley, Chichester

Beck GW, Hubric K, Marcellino M (2006) Regional inflation dynamics within and across euro area countries and a comparison with the US. ECB Working Paper No. 681, European Central Bank

Beck GW, Hubric K, Marcellino M (2009) Regional inflation dynamics within and across euro area countries and a comparison with the United States. Econ Policy 24(57):141–184

Blommestein HJ (1983) Specification and estimation of spatial econometric models. Reg Sci Urban Econ 13(2):251–270

Bourmont M, (2012) La résolution d'un problème de multicolinearité au sein des études portant sur les déterminants d'une publication volontaire d'informations : Proposition d'un algorithme de décision simplifié basé sur les indicateurs de Belsley, Kuh et Welsch (1980). Comptabilités et innovation, Grenoble, France. pp.cd-rom, 2012

Boyle GE, McCarthy TG (1999) Simple measures of convergence in per capita GDP: A note on some further international evidence. Appl Econ Lett 6:343–347

Caceres C, Marcos PR, Darlena T (2011) Inflation dynamics in the CEMAC Region. IMF Working Paper No11/232, International Monetary Fund

Carrasco CA, Ferreiro J (2014) Latin American inflation differentials with USA inflation: Does inflation targeting make a difference? J Econ Policy Reform 17(1):13–32

Catão L , Terrones M (2003) Fiscal deficits and inflation, IMF Working Paper 03/65, International Monetary Fund

Cecchetti SG, Mark CN, Sonora RJ (2002) Price index convergence among United States cities. Int Econ Rev 43:1081–1099

Chimobi OP, Igwe OL (2010) Budget deficit, money supply and inflation in Nigeria. Eur J Econ Finance Adm Sci 19(3):52–60

Ciccarelli M, Mojon B (2010) Global inflation. Rev Econ Stat 92(3):524–535

Diagne A, Doucouré FB, (2001) Les canaux de transmission de la politique monétaire dans les pays de l'UEMOA, C.R.E.A Working paper No.01/10/EM

Diaw A, Sarr F (2011) Notes d’information sur l’inflation pour le compte de la BCEAO, BCEAO working paper NoDT/11/02, Banque Centrale des Etats de l’Afrique de l’Ouest

Diop PL, (2002) Convergence nominale et convergence réelle : Une application des concepts de sigma-convergence et de beta-convergence aux économies de la CEDEAO. BCEAO Working Paper No.531, Banque Centrale des Etats de l’Afrique de l’Ouest

Dornbusch R, Sturzenegger F, Wolf H, Fischer S, Barro RJ (1990) Extreme inflation: Dynamics and stabilization. Brook Pap Econ Act 2:1–84

Dua P, Gaur U (2010) Determination of inflation in an open economy Phillips curve framework: The case of developed and developing Asia Countries. Macroecon Finance Emerg Mark Econ 3:33–51

Easterly W, Schmidt HK (1993) Fiscal deficits and macroeconomic performance in developing countries. World Bank Res Obs 8(2):211–237

Ehrhart H, Mrabet H, Rocher E. (2012), Les sources de l’inflation dans les pays de la zone CFA. Colloque Banque de France, Juin

Elhorst JP (2003) Specification and estimation of spatial panel data models. Int Reg Sci Rev 26(3):244–268

Florax R, Folmer H (1992) Specification and estimation of spatial linear regression models. Reg Sci Urban Econ 22(3):405–432

Forni M, Reichlin L (2001) Federal policies and local economies: Europe and the US. Eur Econ Rev 45(1):109–134

Forni M, Hallin M, Lippi M, Reichlin L (2000) The generalized factor model: Identification and estimation. Rev Econ Stat 82(4):540–554

Forni M, Hallin M, Lippi M, Reichlin L (2004) The generalized factor model: Consistency and rate. J Econ 119(2):231–255

Forni M, Hallin M, Lippi M, Reichlin L (2005) The generalized dynamic factor model: One sided estimation and forecasting. J Am Stat Assoc 100(471):830–840

Forni M, Giannone D, Lippi M, Reichlin L (2007) Identifying shocks and propagation mechanisms in VAR and factor models. ECB Working paper No. 712, European Central Bank

Förster M, Tillmann P (2014) Reconsidering the international comovements of inflation. Open Econ Rev 25(5):841–863

Frankel JA, Rose AK (1998) The endogeneity of the optimum currency area criteria. Econ J 108(449):1009–1025

Hamburger MJ, Zwick B (1981) Deficits, money and inflation. J Monet Econ 7:141–150

Honohan P, Lane PR (2003) Divergent inflation rates in EMU. Econ Pol 18(37):357-394

Hotelling H (1933) Analysis of a complex of statistical variables into principal components. Journal of Educational Psychology 24(6):417-441

Ishaq T, Mohsin MH (2015) Deficits and inflation: Are monetary and financial institutions worthy to consider or not? Borsa Istanbul Review 15(3):180-191

Kinda T (2011) Modeling inflation in Chad. IMF Working Paper No.11/57, International Monetary Fund

Kumo WL (2011) Growth and macroeconomic convergence in Southern Africa. Working Paper No 130, African Development Bank Group

Kose A, Otrok C, Whiteman C (2008) Understanding the evolution of world business cycles. Int Econ Rev 75(1):110–130

Kose MA, Otrok C, Whiteman CH (2003) International business cycles: World, region, and country-specific factors. Am Ec Rev 93(4):1216–1239

Leeper EM (1991) Equilibria under ‘active’ and ‘passive’ monetary and fiscal policies. J Monet Econ 27(1):129–147

Levin A, Lin C-F, Chu C-SJ (2002) Unit root tests in panel data: Asymptotic and finite-sample properties. J Econ 108(1):1–24

Licheron J (2007) Explaining inflation differentials in the euro area: Evidence from a dynamic panel data model. Economie Internationale 4(112):73–97

Monacelli T, Sala L (2009) The international dimension of inflation: Evidence from disaggregated consumer price data. J Money Credit Bank 41(s1):101–120

Mumtaz H, Surico P (2012) Evolving international inflation dynamics: World and country-specific factors. J Eur Econ Assoc 10(4):716–734

Mumtaz H, Simonelli S, Surico P (2011) International comovements, business cycle and inflation: A historical perspective. Rev Econ Dyn 14(1):176–198

Muzafar HS, Kok CC, Baharom AH (2011) Budget deficits and inflation in thirteen Asian developing countries. Int J Bus Soc Sc 2(9):192-204

Nayef S, Al-Sabaey M (2012) Inflation sources across developed and developing countries: Panel approach. Int Bus Econ Res J 11(2):185–194

Neely CJ, Rapach DE (2011) International comovements in inflation rates and country characteristics. J Int Money Financ 30(7):1471–1490

Nguyen ADM, Dridi J, Unsal FD, Williams OH (2015) On the drivers of Inflation in Sub-Saharan Africa. IMF working paper No. 15/189, International Monetary Fund

Ogawa E, Kumamoto M (2008) Inflation differentials and the differences of monetary policy effects among euro area countries. TCER Working Paper Series N° 9, Tokyo Center for Economic Research

Onwioduokit EA (1999) Fiscal deficits and inflation dynamics in Nigeria: An empirical investigation of causal relationship. Cent Bank Niger Econ Financ Rev 37(2):1–16

Pearson K (1901) On lines and planes of closest fit to systems of points in space. Philos Mag 2:559–572

Rabanal P (2009) Inflation differentials between Spain and the EMU: A DSGE perspective. J Money Credit Bank 41(6):1141–1166

Ridhwan M (2016) Inflation differentials, determinants, and convergence: Evidence from Indonesia subnational data. The Journal of Developing Areas 50(5):257-277

Sargent T, Wallace N (1981) Some unpleasant monetarist arithmetic. Federal Reserve Bank of Minneapolis, Quarterly Review, 5(3):1-17

Stock JH, Watson MW (2002a) Forecasting using principal components from a large number of predictors. J Am Stat Assoc 97(460):1167–1179

Stock JH, Watson MW (2002b) Macroeconomic forecasting using diffusion indices. J Bus Econ Stat 20(2):147–162

Valdovinos CGF, Gerling K (2011) Inflation uncertainty and relative price variability in WAEMU Countries. IMF working paper 11/59, International monetary fund

Weber AA, Beck GW (2005) Inflation rate dispersion and convergence in monetary and economic unions:Lessons for the ECB. CFS Working Paper No. 2005/31

Webber DJ, White P (2009) An alternative test to check the validity of convergence results. App Ec Let 16:1825–1829

Woodford M (2001) Fiscal requirements for price stability. J Money Credit Bank 33(3):669–728

Wooldridge JM (2002) Econometric analysis of cross section and panel data. MIT Press, Cambridge

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix 1

Appendix 2 Main Determinants of Inflation Differentials

In order to identify some determinants of inflation differentials for each of the two subregions, we follow the same approach as Honohan and Lane (2003), thereafter HL, modelling inflation differentials as follows:

where π it , \( {\pi}_t^E \) are the annual national and regional inflation rates respectively; Z it , \( {Z}_t^E \) are national and regional (control) variables that exert a short-term influence on the inflation rate; FP it , \( {FP}_t^E \), are the national and regional Purchasing Power Parity (PPP) factors and \( {FP}_t^{\ast } \), \( {FP}_t^{E\ast } \), are the national and regional long-run equilibrium price levels. Assuming that the countries share a common long-run price level, the above equation can be simplified to:

Taking into account that each subregion is characterized by the free flows of goods, people and capital, we assume that the long run prices are the same across countries and focus on the reduced form of eq. 6 which can be written as follows:

where α t are time-dummies that capture common movements in inflation and explanatory variables.

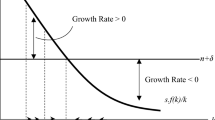

This means that the regressions are explaining inflation differentials in terms of idiosyncratic national changes in the determinants. Vector Z consists of several key variables, namely the unemployment rate (representing labor market institutions), economic sectors (production structure), the degree of openness (share of the average of exports and imports in output), exchange rate (external effect) and fiscal balance. Another prominent variable is the lagged Purchasing Power Parity factor (convergence conditioning variable). Theoretically, if there is convergence in inflation rates the estimated values of δ will be negative. This would imply that inflation of a region with an initially relatively high inflation rate would increase more slowly (or decrease faster) in the subsequent period than that of a region with an initially relatively low inflation rate.

Then this model’s specification can be written as:

The potentials determinants of inflation differentials are the unemployment rate (ump it ), Purchasing Power Parity (fp it ), the degree of openness (ouv it ), nominal exchange rate changes (Δtcen it ), the GDP share of the primary sector (agr it ), the GDP share of manufacturing (manu it ), the output gap (gap), total factor productivity growth (Δprod it ) and the fiscal balance (sb it ). Data are annual and cover the sample 1995–2015. Fiscal balances are extracted from zone franc reports. Purchasing Power Parity factors, the unemployment rate, imports and exports, output and the production structure come from the World Bank’s World Development Indicators (WDI) data base, while nominal effective exchange rates are obtained from the IMF (IFS) and total factor productivity from the The Conference Board Total Economy Database and the Federal Reserve Economic Data.

Appendix 3

Appendix 4

Appendix 5

Rights and permissions

About this article

Cite this article

Girardin, E., Sall, C.A.T. Inflation Dynamics of Franc-Zone Countries Determinants, Co-movements and Spatial Interactions. Open Econ Rev 29, 295–320 (2018). https://doi.org/10.1007/s11079-017-9456-x

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11079-017-9456-x