Abstract

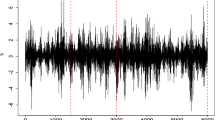

In this paper we present a stochastic volatility (SV) model assuming that the return shock has a skew-Student-t distribution. This allows a parsimonious, flexible treatment of skewness and heavy tails in the conditional distribution of returns. An efficient Markov chain Monte Carlo (MCMC) algorithm is developed and used for parameter estimation and forecasting. The MCMC method exploits a skew-normal mixture representation of the error distribution with a gamma distribution as the mixing distribution. The developed methodology is applied to the NASDAQ daily index returns. Bayesian model selection criteria as well as out-of-sample forecasting in a value-at-risk (VaR) study reveal that the SV model based on skew-Student-t distribution provides significant improvement in model fit as well as prediction to the NASDAQ index data over the usual normal model.

Similar content being viewed by others

References

Abanto-Valle CA, Bandyopadhyay D, Lachos VH, Enriquez I (2010) Robust Bayesian analysis of heavy-tailed stochastic volatility models using scale mixtures of normal distributions. Comput Stat Data Anal 54:2883–2898

Abanto-Valle CA, Migon HS, Lachos VH (2011) Stochastic volatility in mean models with scale mixtures of normal distributions and correlated errors: a bayesian approach. J Stat Plan Infer 141:1875–1887

Abanto-Valle CA, Migon HS, Lachos VH (2012) Stochastic volatility in mean models with heavy-tailed distributions. Braz J Probab Stat 26:402–422

Ando T (2006) Bayesian inference for nonlinear and non-gaussian stochastic volatility model wit leverge effect. J Jpn Stat Soc 36:173–197

Ando T (2007) Bayesian predictive information criterion for the evaluation of hierarchical Bayesian and empirical Bayes models. Biometrika 94:443–458

Azzalini A (1986) Further results on a class of distributions which include the normal ones. Statistica 46:199–208

Azzalini A (2005) The skew-normal distribution and related multivariate families. Scand J Stat 32:159–188

Azzalini A, Capitanio A (2003) Distributions generated by perturbation of symmetry with emphasis on a multivariate skew-t distribution. J R Stat Soc: Ser B 65:367–389

Bayes CL, Branco MD (2007) Bayesian inference for the skewness parameter of the scalar skew-normal distribution. Braz J Probab Stat 21:141–163

Branco MD, Dey DK (2001) A general class of multivariate skew-elliptical distributions. J Multivar Anal 79:99–113

Cappuccio N, Lubian D, Raggi D (2004) Mcmc bayesian estimation of a skew-GED stochastic volatility model. Stud Nonlinear Dyn Econ 8:article 6

Cappuccio N, Lubian D, Raggi D (2006) Investigating asymmetry in U.S. stock market indexes: evidence from a stochastic volatility model. Appl Financ Econ 16:479–490

Carter CK, Kohn R (1994) On Gibbs sampling for state space models. Biometrika 81:541–553

Chen Q, Gerlach R, Lub Z (2012) Bayesian value-at-risk and expected shortfall forecasting via the asymmetric laplace distribution. Comput Stat Data Anal 56:3498–3516

Chib S, Greenberg E (1995) Understanding the Metropolis-Hastings algorithm. Am Stat 49:327–335

Chib S, Nardari F, Shepard N (2002) Markov Chain Monte Carlo methods for stochastic volatility models. J Econ 108:281–316

Christoffersen P (1998) Evaluating interval forecasts. Int Econ Rev 39:841–862

Christoffersen P, Pelletier D (2004) Backtesting value-at-risk: a duration-based approach. J Financ Econ 2:84–108

de Jong P, Shephard N (1995) The simulation smoother for time series models. Biometrika 82:339–350

Delatola EI, Griffin JE (2011) Bayesian nonparametric modelling of the return distribution with stochastic volatility. Bayesian Anal 6:901–926

Fonseca TCO, Ferreira MAR, Migon HS (2008) Objective Bayesian analysis for the student-t regression model. Biometrika 95:325–333

Frühwirth-Schnater S (1994) Data augmentation and dynamic linear models. J Time Ser Anal 15:183–202

Geweke J (1992) Evaluating the accuracy of sampling-based approaches to the calculation of posterior moments. In: Bernardo JM, Berger JO, Dawid AP, Smith AFM (eds) Bayesian statistics, vol 4. Oxford University Press, Oxford, pp 169–193

Gneiting T, Raftery AE (2007) Strictly proper scoring rules, prediction and estimation. J Am Stat Assoc 6:901–926

Good IJ (1952) Rational decisions. J R Stat Soc, Ser B 14:107–114

Hansen BE (1994) Autoregressive conditional density estimation. J Financ 35:705–730

Harvey C, Sidique A (1999) Autoregressive conditional skewness. J Financ Quant Anal 34:465–487

Harvey C, Sidique A (2000) Conditional skewness in asset pricing tests. J Financ 55:1263–1296

Henze N (1986) A probabilistic representation of the skew-normal distribution. Scand J Stat 13:271–275

Jacquier E, Polson N, Rossi P (2004) Bayesian analysis of stochastic volatility models with fat-tails and correlated errors. J Econ 122:185–212

Jondeau E, Rockinger M (2003) Conditional volatility, skewness and kurtosis: existence, persistence and co-movements. J Econ Dyn Control 27:1699–1737

Kim S, Shepard N, Chib S (1998) Stochastic volatility: likelihood inference and comparison with ARCH models. Rev Econ Stud 65:361–393

Koopman S (1993) Disturbance smoothers for State Space models. Biometrika 80:117–126

Kupiec PH (1995) Techniques for verifying the accuracy of risk measurement models. J Deriv 3:73–84

Liesenfeld R, Jung RC (2000) Stochastic volatility models: conditional normality versus heavy-tailed distrutions. J Appl Econ 15:137–160

McAleer M, da Veiga B (2008) Single-index and portfolio models for forecasting value-at-risk thresholds. J Forecast 27:217–235

Melino A, Turnbull SM (1990) Pricing foreign options with stochastic volatility. J Econ 45:239–265

Mittnik S, Paolella MS (2000) Conditional density and value-at-risk prediction of asian currency exchange rates. J Forecast 19:313–333

Nakajima J, Omori Y (2012) Stochastic volatility model with leverage and asymmetrically heavy-tailed error using gh skew student’s t-distribution. Comput Stat Data Anal 56:3690–3704

Pemstein D, Quinn KV, Martin AD (2007) The Scythe statistical library: an open source C++ library for statistical computation. J Stat Softw VV(II):1–29

Pitt M, Shephard N (1999) Filtering via simulation: auxiliary particle filter. J Am Stat Assoc 94:590–599

Rosa GJM, Padovani CR, Gianola D (2003) Robust linear mixed models with Normal/Independent distributions and bayesian MCMC implementation. Biom J 45:573–590

Shephard N, Pitt M (1997) Likelihood analysis of non-Gaussian measurements time series. Biometrika 84:653–667

Taylor S (1982) Financial returns modelled by the product of two stochastic processes-a study of the daily sugar prices 1961–75. In: Anderson O (ed) Time series analysis: theory and practice, vol 1. North-Holland, Amsterdam, pp 203–226

Taylor S (1986) Modeling financial time series. Wiley, Chichester

Tierney L (1994) Markov chains for exploring posterior distributions (with discussion). Ann Stat 21:1701–1762

Tsiotas G (2012) On generalised asymmetric stochastic volatility models. Comput Stat Data Anal 56:151–172

Watanabe T, Omori Y (2004) A multi-move sampler for estimate non-Gaussian time series model: comments on Shepard and Pitt (1997). Biometrika 91:246–248

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Abanto-Valle, C.A., Lachos, V.H. & Dey, D.K. Bayesian Estimation of a Skew-Student-t Stochastic Volatility Model. Methodol Comput Appl Probab 17, 721–738 (2015). https://doi.org/10.1007/s11009-013-9389-9

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11009-013-9389-9

Keywords

- Markov chain Monte Carlo

- Non-Gaussian and nonlinear state space models

- Skew-Student-t

- Stochastic volatility

- Value-at-risk