Abstract

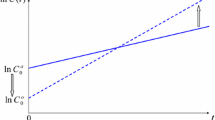

A simple open-economy AK model with collateral constraints accounts for growth breaks and growth-reversal episodes, during which countries face abrupt changes in their growth rate that may lead to either growth miracles or growth disasters. Absent commitment to investment by the borrowing country, imperfect contract enforcement leads to an informational lag such that the debt contracted upon today depends upon the past stock of capital. The no-commitment delay originates a history effect by which the richer a country has been in the past, the more it can borrow today. For (arbitrarily) small delays, the history effect offsets the growth benefits from international borrowing and dampens growth, and it leads to both leapfrogging in long-run levels and growth breaks. When large enough, the history effect originates growth reversals and we connect the latter to leapfrogging. Finally, we argue that the model accords with the reported evidence on changes in the growth rate at break dates. We also provide examples showing that leapfrogging and growth reversals may coexist, so that currently poor but fast-growing countries experiencing sharp growth reversals may end up, in the long-run, significantly richer than currently rich but declining countries.

Similar content being viewed by others

References

Aghion P., Bacchetta P., Banerjee A. (2004) Financial development and the instability of open economies. Journal of Monetary Economics 51: 1077–1106

Askenazy P., Le Van C. (1999) A model of optimal growth strategy. Journal of Economic Theory 85: 24–51

Bellman R., Cooke K. (1963) Differential-difference equations. Academic Press, New-York

Boucekkine R., Licandro O., Puch L., de Rio F. (2005) Vintage capital and the dynamics of the AK model. Journal of Economic Theory 120: 39–72

Boucekkine, R., Fabbri, G., & Pintus, P. (2011). Leapfrogging, growth reversals and welfare. Discussion Paper GREQAM 2011-13.

Cohen D., Sachs J. (1986) Growth and external debt under risk of debt repudiation. European Economic Review 30: 526–560

Cuberes D., Jerzmanowski M. (2009) Democracy, diversification and growth reversals. Economic Journal 119: 1270–1302

Devereux M., Yetman J. (2010) Leverage constraints and the international transmission of shocks. Journal of Money Credit and Banking 42: 71–105

Djankov S., Hart O., McLiesh C., Shleifer A. (2008) Debt enforcement around the world. Journal of Political Economy 116: 1105–1149

Freedman H. I., Kuang Y. (1991) Stability switches in linear scalar neutral delay equations. Funkcialaj Ekvacioj 34: 187–209

Hausmann R., Pritchett L., Rodrik D. (2005) Growth accelerations. Journal of Economic Growth 10: 303–329

Jones B., Olken B. (2008) The anatomy of start-stop growth. Review of Economics and Statistics 90: 582–587

Kordonis I.-G. E., Niyianni N. T., Philos C. G. (1998) On the behavior of the solutions of scalar first order linear autonomous neutral delay differential equations. Archiv der Mathematik 71: 454–464

McDermott, J. (2010).Negative growth: Misgovernance in an open economy. Mimeo University of South Carolina.

Mendoza E. (2010) Sudden stops, financial crises and leverage. American Economic Review, 100(5): 1941–1966

Paasche B. (2001) Credit constraints and international financial crises. Journal of Monetary Economics 48: 623–650

Shampine L. F. (2009) Dissipative approximations to neutral DDEs. Applied Mathematics and Computation 203: 641–648

Stokey, N. (2010). Catching up and falling behind. Mimeo University of Chicago.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Boucekkine, R., Pintus, P.A. History’s a curse: leapfrogging, growth breaks and growth reversals under international borrowing without commitment. J Econ Growth 17, 27–47 (2012). https://doi.org/10.1007/s10887-011-9070-5

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10887-011-9070-5