Abstract

This study explores the interdependence among a sanitary crisis, environmental degradation, oil prices, and economic activity in the USA based on weekly data over the period from January 03, 2020, to October 02, 2020, through VECM and Granger causality methods. The study period is characterized by lockdowns and mobility restrictions due to COVID-19 pandemic that may affect the economic and energy sector in the USA. Thus, a meticulous analysis of the impact of a sanitary crisis on economic and energy sectors seems to be crucial. Findings are very interesting and confirm the existence of a significant impact of a COVID-19 pandemic on WTI oil price. More importantly, bidirectional causal relations between the three couples: COVID-19 infections–carbon emission, COVID-19 infections–economic growth, and COVID-19 infections–oil price are also discovered. Taken together, our empirical findings are effective for the relevant authorities and policymakers in the USA to develop an appropriate financial and fiscal policy such as reducing interest rates, subsidizing, promoting sustainable industrialization, and carbon taxation to boost investment and to recover the economic growth without harming the environment and complicating the sanitary situation.

Similar content being viewed by others

1 Introduction

Actually, our world is undergoing one of the most severe global health emergencies due to COVID-19 disease. This global pandemic has uprooted our ways of life, and it can be considered as the biggest worldwide crisis in generations. Indeed, the growing corona virus pandemic has a tremendous impact on health systems, economies, and societies all over the world.

During this serious global crisis, the USA is no exception by registering a large human toll reaching 19,210,166 total infection cases and 338,263 total deaths until December 2020, a number that greatly exceeds the American lives that were lost in the Vietnam War.

Moreover, the outbreak of the coronavirus (COVID-19) pandemic has upended the US economies. Indeed, gross domestic product (GDP) fell at a 32.9% annualized rate; the most important US economic slowdown since records began back in 1947. More explicitly, according to Triggs and Kharas (2020), this unprecedented economic crisis is caused by a package of a demand shock, a supply shock, and a financial shock together.

Besides, due to lockdowns, travel restrictions, and economic turbulence, the energy sector is also severely affected by this alarming crisis. More obviously, referring to Global Energy Review 2020, countries in partial lockdown are experiencing an average of 18% decline in energy demand against an average of 25% recession for countries adopting a full lockdown.

Our analysis is motivated by various factors including the importance of the energy sector especially crude oil commodity that is considered as a cornerstone of countries economies notably during troubled periods and crisis. The extreme volatility of oil prices during the last year brings challenges to governments—particularly oil-producing countries and CO2 emission defiance which is a key factor for sustainable development. This study is also motivated by the integration of some other independent variables such as COVID-19 infection numbers. All those factors highlight the importance of having a meticulous analysis of the influence of a sanitary crisis on oil prices and environmental quality.

Since energy is essential for driving economic growth, the scope of our paper is, thus, to carry out a first but focused analysis on the connection between the energy sector, environmental degradation, and the sanitary crisis. Otherwise, the main objective of this research is to show a deeper study of the interactions between CO2 emission, oil price, GDP, and COVID-19 infections number in the USA both in the short- and long-term horizon.

Hence, this work revolves around the following key questions:

-

How did the pandemic affect the energy sector in the USA?

-

What was the impact of the sanitary crisis on crude oil price?

-

How did the pandemic impact CO2 emission in the USA?

Indeed, if the linkage between economic growth, oil price, and environmental degradation has been sufficiently discussed in the existing literature (Holtz-Eakin & Selden, 1995; Dinda, 2004, 2005; Aslanidis & Iranzo, 2009; AKbostanci et al., 2009; Shahbaz & Sinha, 2019; Adjei Mensah et al., 2019;…), a prior research has been neglected to investigate the impact of a sanitary crisis on this relationship.

By filling in this gap, the focus of this paper is to contribute further to the existing literature by examining the different interactions among CO2, GDP, and oil prices in the presence of a sanitary crisis. To the best of our knowledge, this is one of the first studies investigating the connection between sanitary crises, environmental degradation, and the crude oil market in the USA. To do this, we perform an unrestricted VAR analysis based on a recent and extended-time period covering several scenes of major economic collapses such as the COVID-19 sanitary crisis. Thereby, this research tries to identify specific policies and mechanisms that can help to boost the USA economy, while taking into account environmental conservation in the presence of COVID-19 pandemic.

The rest of the paper is organized as follows:

-

Section 2 reviews the existing literature.

-

Section 3 presents the methodological framework and a detailed description of the data.

-

Section 4 analyzes the empirical results.

-

Section 5 concludes the paper with policy implications.

2 Literature review

The existing literature has sufficiently documented the interdependence between CO2 emission growth and several other determining factors such as GDP growth, trade, transportation, energy consumption, oil price, urbanization. It is noteworthy that economic growth (GDP growth) has been considered as the main determinant of the evolution of pollution. Indeed, the linkage between CO2 emission and GDP growth has been intensively debated in Literature (AKbostanci et al., 2009; Aslanidis & Iranzo, 2009; Dinda, 2004, 2005; Holtz-Eakin & Selden, 1995; Lim et al., 2014; Shahbaz & Sinha, 2019).

Other studies prove that not only GDP can be considered as a key factor, but they also show that energy consumption plays a paramount role in explaining the growth of CO2 emission (Apergis & Payne, 2009; Acravci and Ozturk, 2010; Bartleet & Gounder, 2010).

To investigate the causal relationships between economic growth, carbon emission, petroleum products, natural gas consumption, and total fossil fuels, Lotfalipour et al., (2010) applied the Toda-Yamamoto method for Iran during the period 1967–2007. They proved the existence of a unidirectional Granger causality running from petroleum products, natural gas consumption, and GDP to carbon emission. Similarly, Chandran and Tang (2013) tackled the linkage between CO2 emission, economic growth, and coal consumption for both China and India spanning the period 1965–2009. Empirical results showed a significant unidirectional causality relation running from the economic growth to the Chinese’s CO2 emission. Moreover, a significant causal relationship between CO2 emission and coal consumption as well as between economic growth and coal consumption has been determined. The results also showed the existence of a bidirectional causality relationship between economic growth and CO2 emission and a unidirectional causality running from economic growth to coal consumption in India.

Based on an error correction model and co-integration analysis, Lim et al. (2014) studied the short- and long-run causality among three vectors: CO2 emission, economic growth, and oil consumption in the Philippines over the period 1965–2012. Three major findings are concluded from this study: the existence of a bidirectional causality relation between oil consumption and economic growth and among oil consumption and CO2 emission, the existence of unidirectional causality running from CO2 emission to economic growth.

Recently, using panel data, Al-mulali and Che Sab (2018) investigated the nexus between CO2 emission, GDP growth, and total coal consumption in 10 countries (India, China, Germany, Russia, USA, South Africa, Australia, South Korea, Poland, and Japan) spanning the period 1992–2009. The authors reported that CO2 emission and total coal consumption presented a long-run relationship with GDP growth.

The Bootstrap ARDL model has been applied to examine the relationship between CO2 emission, coal consumption, and economic growth for both China and India from 1969 to 2015 in the paper of Lin et al. (2018). The main finding showed the absence of a long-run relationship among those three vectors for both countries.

In a similar vein, Dong et al. (2018) employed a panel unit root, co-integration estimation and causality tests to discuss the nexus of CO2 emission, gas consumption, and GDP for a set of 14 Asia Pacific countries over the period 1970–2016.

Apart from energy consumption and economic growth, a diverse set of explanatory variables has been used to explain CO2 emission such as energy price. Indeed, many authors started from the common idea supporting that fluctuation in energy prices affects directly energy consumption and production to investigate the correlation between energy price and CO2 emission.

Bloch et al. (2012) explored the relationship between CO2 emission, coal price, coal consumption, and income in China over the period 1965–2008. The authors proved that the estimated variables are co-integrated.

For their part, Adjei Mensah et al. (2019) studied the causal link amid carbon emission, oil price, economic growth, and fossil fuel energy applying the PMG panel ARDL approach over the period 1990–2015 for a set of 22 African countries. Empirical results confirmed the existence of a unilateral causality link flow from oil prices toward economic growth, energy consumption, and carbon emission across all country groups in both long and short terms.

Starting from the expectation of a negative impact of oil price on carbon emission, MALIK et al. (2020) investigated the symmetric and asymmetric relation of FDI, oil price, and per capita income on CO2 emission in Pakistan over the period 1971–2014 using ARDL and nonlinear ARDL methodologies. Authors showed that oil price has a positive impact on CO2 emission in the short run and a negative effect in the long run.

Although quite a several empirical research has dealt with the interdependence between carbon emission, economic growth, and energy price, a relatively little attention has been paid to the linkage amongst the aforementioned variables in the presence of a sanitary crisis.

Amongst the rare papers, Albulescu (2020) studied the linkage between oil price, COVID-19 infection cases, VIX, and EPU applying the ARDL method on daily data covering the period starting from January 21, 2020, to March 09, 2020. Empirical results showed that, in the long run, the COVID-19 infections have a marginally negative impact on crude oil prices.

In the same line, Mzoughi et al., (2020) studied the nexus between CO2 emission, VIX index, oil prices, and COVID-19 infections over the period January 22, 2020, March 30, 2020, applying unrestricted VAR. The authors proved that COVID-19 infections negatively affected crude oil prices.

Other studies investigated the impact of the COVID-19 pandemic on the oil price fluctuations (Atri et al., 2021; Adedeji et al., 2021; Le et al., 2021, Alqahtani et al., 2021; Bourghelle et al., 2021; Azomahou et al., 2021), while other recent researches focused on the relationship between COVID-19 and environmental degradation (Syed and Ullah 2021; Wu et al., 2021). Despite the interesting idea, the literature is less conclusive and unambiguous on the impact of a sanitary crisis on, simultaneously, economic growth, environmental degradation, and oil price.

In this pursuit, we fill in this gap in the existing literature and we contribute by exploring the impact of COVID-19 disease on the trio oil prices, CO2 emission, and economic growth in the USA based on a weekly data starting from January 03, 2020, to October 02, 2020.

3 Data and model specification

This section is reserved to describe the data as well as the empirical method implemented in this study.

3.1 Description of data

The main goal of our research was to investigate the impact of the current COVID-19 pandemic and the economic growth on both oil price and CO2 emission from oil consumption in the United Nations. To achieve our purpose, we used a weekly frequency dataset for the four vectors mentioned above covering the period from January 03, 2020, to October 02, 2020.

The observations regarding COVID-19 infected cases were collected from the daily reports produced by the World Health Organization. The WTI oil price data were obtained from the U.S. Energy Information Administration. Moreover, CO2 emission was calculated based on the weekly consumption of crude oil in the USA obtained from the U.S. Energy Information Administration. Then, using the “temporal disaggregation (Chow & Lin, 1973)” method, we estimated the weekly gross domestic product (constant 2012 US $) based on the monthly series extracted from the Macroeconomic Advisers website.

The investigated period covers a considerable episode of the major sanitary turbulence in the world at the beginning of 2020.

Our investigation starts with a graphic analysis of all our variables. As illustrated in Fig. 1 above, the evolution of the carbon emission, WTI oil price, and gross domestic product (constant 2012 US $) records a sharp decline during the 2020 sanitary crisis. Obviously, with the appearance of COVID-19 pandemic in the USA, the CO2 emission from crude oil consumption registered an unprecedented decrease starting from March 2020 to Jun 2020, a slight increase and a short phase of stabilization, thereafter, during the beginning of the third quarter of the year 2020 followed by a second recession at the end of August 2020 and a second stabilization from September 2020. This evidence may be explained by the fact that the US Government ordered lockdowns and mobility restrictions from March 2020 that affect directly the use of means of transport and, thus, the oil consumption. On the other side, following the corona virus shock, gross domestic product shows a marked decrease since March 2020 and, thereafter, an improvement from the middle of April 2020 to stabilize with a level lower than that recorded before the pandemic.

Furthermore, like the gross domestic product and CO2 emission, the WTI crude oil price reveals a hard decline from January 2020 to record its lowest level in the middle of April 2020 and, subsequently, begins to improve and to stabilize since the middle of June 2020 at a level weaker than that reached before the COVID-19 disease.

3.2 Econometric methodology

Applying convenient methodology for the time series data is the most important part of the time series analysis since wrong modeling or using wrong method leads to biased and unreliable estimates. The first step to conduct a time series analysis is to examine the stationarity of the variables under consideration. In fact, the method selection of time series analysis is strictly related to the unit root test results. More explicitly, methods commonly applied to investigate the stationary time series cannot be used to inspect integrated series. If unit root test results reveal that all variables of interest are stationary, then the methodology becomes simple and, in such a case, ordinary least square (OLS) or vector autoregressive (VAR) models can be used to evaluate the relationship between the given variables and can provide reliable estimates. If all the variables of interest are integrated of order 1, OLS and VAR models can lead to biased estimates and in this case vector error correction model (VECM) seems to be the most appropriate to analyze the relationship. Similarly, an autoregressive distributed lag (ARDL) model is used for time series with mixed order of integration and can provide unbiased estimates.

After verifying all the models and intending to examine the impact of a sanitary crisis and economic growth on crude oil evolution, on the first hand, and CO2 emission, on the other hand, our study adopts the VECM analysis. The VECM model is one of the most used models in the toolkit of applied macroeconomists. Indeed, due to its easiness and flexibility, VECM models are commonly used for forecasting and analyzing the dynamic behavior of financial and economic time series and, subsequently, conducting certain types of policy recommendations.

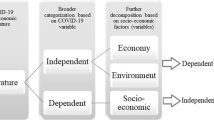

More explicitly, this methodology can be schematized as follows (Fig. 2):

3.3 Model specification

To examine the effect of a sanitary crisis on WTI oil price and CO2 emission, two models were employed in this study. In the first model, WTI oil price is used as a dependent variable while in the second model the CO2 emission represents the endogenous variable. Equations (1) and (2) represent the functional specifications for both models adopted in this study. All variables are specified in natural logarithms, and the functional form of the model is expressed as follows:

where \({\alpha }_{0}\) denotes the intercept, loilprice represents the WTI oil price, LGDP is the gross domestic product, linfections represents the number of COVID-19 infections cases, lCO2 is the carbon emission from oil consumption, and \({\varepsilon }_{t}\) is the stochastic disturbance term.

If the literature proved the existence of a negative impact of the COVID-19 pandemic on the oil price (Albulescu, 2020; Mzoughi et al., 2020), no work, to our knowledge, has analyzed the impact of this crisis on the CO2 emission, hence the interest of our study.

4 Estimation results and discussions

To check the integration order of the variables, we conducted three-unit root tests. A first impression of the non-stationarity of all our variables can be deducted from the visual plot of the variables depicted in Fig. 1. To confirm or disconfirm this suspicion, we employed ADF, PP, and KPSS tests. The unit root tests shown in Table 1 yield interesting results. All the variables under consideration in this analysis are non-stationary at levels but become stationary in the first difference. Thereby, we conclude that all the time series are integrated into order 1 \((I(1))\) at a 1% level of significance. Hence, we can proceed with the co-integration test.

Given that all our time series are integrated into order 1, then it is rightful to inspect the presence of a co-integration relation performing the Johansen method. However, before proceeding with Johansen co-integration test, it is essential to investigate the lag length. This step is crucial since the results can become biased if we choose an inappropriate lag. Based on LR (likelihood ratio test), HQ (Hannan–Quinn information criterion), and AIC (Akaike information criterion), the appropriate lag length is two. After being certain of the appropriate lag length, the Johansen co-integration test can be conducted. Both the results of trace statistics and maximum eigenvalue tests unanimously point to the same issue that there is a co-integration relationship, at the 5% level of significance (Table 2). More clearly, trace statistics show the existence of four co-integration relations while maximum eigenvalue test confirms the existence of only one relation. Obviously, we retain only one co-integration relation.

We can therefore conclude that there is a sort of co-movement amongst the analyzed variables in the long-run. This allows us to quantify the long–run coefficient amongst the variables applying the VECM model as tools to examine the magnitude of the co-integration relation. Thus, the next step would be the estimation of Eqs. (1) and (2) aforementioned.

Table 3 reports the results of the error correction model. This approach is powerful since it is used to moderate adjustments leading to a long-run equilibrium situation. The first main result attracts our attention. Indeed, for both models, the speed of adjustment is negative and significant, as expected, implying that a phenomenon of return to equilibrium exists. More explicitly, for the first equation, the speed of adjustment is equal to -0.237510 implying that WTI oil price can adjust toward its long-term level with about 2.37% of the adjustment taking place within the first week. For the second model, the correction term is lesser signaling that the adjustment is slower. We note that the speed of adjustment is significant at 10% statistical level and negative signifying that for CO2 emission about 1.22% of the disequilibrium is corrected within one week.

As shown in Table 3, WTI oil price is positively influenced by its delayed values of one period and negatively influenced by its delayed values of two periods. More clearly, a 1% upturns in the oil price having one and two lag lengths lead, respectively, to an increase in the actual price by 1.33% and a decrease by 1.26%. Moreover, the results reveal a positive and statistically significant relationship with oil price stemming from an increase in gross domestic product. Meaning that a GDP (delayed with one and two periods) increase in the USA directly stimulates WTI oil price. In addition, the environmental degradation seems to have a positive and significant impact on WTI oil price. Indeed, stimulation in CO2 emission results in an increase in WTI oil price. This result can be explained by the fact that with the increase of CO2 emission, policy makers can intervene by the increase of oil prices in order to reduce the consumption of this product and consequently the emission of carbon dioxide. More importantly, with a 95% confidence interval, a negative and significant link is detected between WTI oil price and COVID-19 number of infections. This result confirms those found by Mzoughi et al. (2020) and Albulescu (2020). More explicitly, following a 1% increase in the number of infected cases having two lag length, the WTI oil price dropped by, respectively, 0.016374%. Despite its weakness, this result is expected. Indeed, following the COVID-19 pandemic, the USA has adopted a lockdown strategy and mobility restrictions like many other countries in the world which leads to a deep economic stagnation, a fall in world demand for crude oil and, consequently, a meltdown in crude oil prices. Wald test results, as shown in Table 4, strengthen the findings of VECM estimation. Obviously, according to the Wald test, the previous variations in oil price, as well as COVID-19 infections, environmental degradation and economic growth indexes are significant when the dependent variable is WTI oil price confirming, thus, the existence of a short-term causality relationship among those variables.

To conclude with this model, the value of R-square and F-statistic indicates the goodness of fit, which validate the adequacy of the model for policy direction and guidance. Moreover, as presented in Table 5, there is no serial correlation or heteroscedasticity in the fitted model according, respectively, to LM and Breusch–Pagan–Godfrey tests. Furthermore, in order to ensure the robustness of our findings, we investigated the dynamic stability of our model using the cumulative sum of recursive residuals (CUSUM). CUSUM test is primordial in order to examine the stability of short and long-run parameters. The plot depicted in Fig. 1 reports the results of this test, and it shows that the overall model is stable within the 95% threshold limit.

Outcomes of the second model are broadly not expected. The estimation results show that the lagged CO2 emission is statistically significant. However, the estimated coefficients of COVID-19 infections, economic growth, and WTI oil price are statistically insignificant. Going into greater detail, all things being equal, a 1% increase in CO2 emission having two, lag length decreases its actual level by 0.46%. A plausible explanation is that the closer the shock is in the time, the more it attracts the attention of the community to solve it.

Furthermore, our findings are not in concordance with the result found by Mzoughi et al. (2020) suggesting that the COVID-19 infection cases have a negative and statistically significant impact on carbon emission, which confirm that COVID-19 new infections slow down the rate of CO2 emission.

Sinking deeper into our analysis, the Wald test shows that WTI oil prices, GDP, and CO2 emission are globally significant. More clearly, even if the coefficient of GDP is not significant based on the VECM approach, economic growth is globally significant when the dependent variable is carbon emission. This issue is in concordance with the literature results (Al-mulali & Che Sab, 2018; Chandran & Tang, 2013; Lotfalipour et al., 2010) which prove the existence of a relationship between economic development and environmental degradation.

To check the stability of this model, we conduct diverse robustness testing such as LM test, Breusch–Pagan–Godfrey heteroscedasticity test, the cumulative sum of recursive residuals. Overall, based on R-squared and F-statistic this model is acceptable and estimated results are trusted and can be considered for policy direction. Moreover, it is established that there is neither serial correlation nor heteroscedasticity in the model as presented in Table 5. Furthermore, the plot of CUSUM is within the boundaries which confirms that the overall model is stable.

The next step was to apply the Granger causality approach to identify and to analyze the structures of the causal relationships among variables. Such knowledge is crucial to crafting appropriate policies. Table 6 shows the results outlining the causality between variables under consideration. Results reveal a unidirectional causality stemming from economic growth (GDP) to environmental degradation (CO2 emission). This finding is similar and corroborates the outcomes of Lindmark (2002), Ang (2007), Managi and Jena (2008), Ahmed and Long (2012), Kanijilal and Ghosh (2013), Shahbaz et al. (2014), Lacheheb et al. (2015), Sulaiman and Abdul-Rahim (2018). Moreover, similar to the finding of Adjei Mensah et al. (2019), a unidirectional causality is observed running from oil price to carbon emission. However, bidirectional causality exists between oil prices and economic growth. Otherwise, the feedback hypothesis was affirmed amongst these two variables. A chock in oil price will disturb the economic progress and any perturbation in the economic growth will affect the WTI oil price. Interestingly, our finding suggests the existence of bidirectional interconnection among COVID-19 infections and economic growth. Meaning that any variation in the number of infections disturbs the growth of economic events, and any slowdown in GDP will affect the number of infections. Notably, this finding is very innovative and interesting and it can be explained by the fact that following the increase in COVID-19 infection cases, the USA government adopts the lockdown strategy which leads to a shutdown of many production activities and investments and, consequently, affects the US economic growth. Also, an economic revival can be explained by relaxation of mobility restrictions and lockdown and a gradual return to social and economic life which leads to the re-assembly and re-spread of the virus. Besides, another bidirectional relationship between COVID-19 infections and environmental degradation is detected. This result can be explained in two ways. On the one hand, a chock in the number of COVID-19 infections pushes the government to reduce movements (which lead to the reduction of the use of means of transport) and decline economic activities which affects, subsequently, the emission of CO2. On the other hand, since corona virus is a respiratory disease and is spread through the air, may be, it is sensitive to air pollution and the level of CO2 in the atmosphere. Moreover, since the main sources of CO2 are means of transport and factories, lockdown and economic activities declining can disturb CO2 emission and, consequently, COVID-19 infection cases. These two last bidirectional linkages may explain the fact that the most industrialized countries such as the USA are upstream of the most affected countries by this virus. Finally, Granger causality indicates a bidirectional relationship between COVID-19 infections and oil price. Two plausible reasons can be advanced to explain this understandable finding. First, any perturbation in infection cases can affect economic activities, the demand for crude oil and, subsequently, oil prices. More explicitly, the response of the government following a chock in infection cases is lockdown and reduction of economic activities which increased uncertainty and declining investor’s confidence and investments projects relating to energy especially crude oil, leading therefore to oil prices disturbance. Second, any disturbance in WTI oil prices is a result of a change in lockdown strategy and economic activities level affecting, consequently, infection cases (Figs. 3 and 4).

5 Conclusion and policy implications

Using weekly time-series data from January 03, 2020, to October 02, 2020, the present research aims to highlight the influence of COVID-19 infections on environmental degradation and WTI oil price in the USA within the VECM approach. Moreover, this study looked at the causal link amid COVID-19 infection, CO2 emission, economic growth, and oil price. Granger causality method is employed to inspect the interaction among the variables under consideration in this work.

Despite that, the link between oil price, CO2 emission, and economic growth is well documented in the literature; rare are the researches that examine this interaction in presence of a sanitary crisis. Importantly, considering the shortcomings in previous studies, our paper contributes to the existing literature and seeks to fill this gap by adding the COVID-19 infection variables in our model.

Broadly, several findings in our paper merit highlighting. Indeed, the estimation results suggest that there is a co-integration relation among economic growth, environmental degradation, oil price, and sanitary crisis. More importantly, VECM output proves that the COVID-19 pandemic plays a paramount role in determining the level of oil price in the short-term. Moreover, in the same line with previous studies, VECM outcomes show that economic development affects the level of CO2 emission in the USA.

Lastly, the Granger causality method confirms two unidirectional causalities stemming from economic growth (GDP) and oil price to CO2 emission. These empirics endorse the findings of Lacheheb et al. (2015), Sulaiman Abdul-Rahim (2018), Adjei Mensah et al., (2019) and implying that policies relating to increasing economic growth through investments in the energy sector or increasing oil prices should be taken into consideration as they could improve the USA GDP without affecting the level of CO2 emission.

Moreover, a bidirectional causal link is evidenced amid oil price and economic growth. This outcome implies that special attention should be given to implanting a price policy since any fluctuations experienced in oil prices can affect the amount of the USA economic activity.

Furthermore, a bidirectional connectedness noticed under the Granger causality test is flanked by three couples: COVID-19 infection–the USA economic growth, sanitary crisis–oil price, and COVID-19 infection–carbon dioxide emission. This finding is very important, and it shows the accuracy and gravity of the situation in the USA. Indeed, not only this unprecedented sanitary crisis may affect the economic growth, oil price, and carbon dioxide emission in the USA, but also any capricious and ill-considered fluctuations in these three vectors may contribute to complicating the sanitary situation.

Notably, the results are very innovative and encouraging from a policy point of view. Indeed, in the light of these findings, several implications in economic and environmental terms for the USA must be highlighted. First, since the Corona virus pandemic is one of the most serious economic and energy shocks in modern history, a coordinated multi-country policy is needed to face this sanitary crisis. Moreover, the USA government and policymakers must work on two axes: urgent policy to mitigate the crisis at the current stage and more effective strategies to handle the post-COVID-19 period. No doubt, in the short-run, fiscal relief and loan facilitation to affected factories with mandatory accompanying by state-appointed economic and financial experts can be quite effective to save these companies from bankruptcy and to guarantee the rights of financial institutions. This solution must be accompanied by an arsenal of other policies and strategies to speed up the economy and to protect the environment in the post-crisis period. Financial and fiscal reforms such as reductions in interest rates, subsidization, promotion of sustainable industrialization may help the USA government to boost investors. Moreover, to protect the environment, the USA government needs to make strong policies to enforce carbon taxation, encourage the people-public–private partnerships in pursuit of promoting environmental awareness, and encourage the green-based economy.

References

Acravci, I., & Ozturk, I. (2010). On the relationship between energy consumption, CO2 emissions and economic growth in Europe. Energy, 35, 5412–5420.

Adedeji, A.N., Ahmed F.F., & Adam, S.U. (2021). Examining the dynamic effect of COVID-19 pandemic on dwindling oil prices using structural vector autoregressive model. Energy, 230

Adjei Mensah I., Sun M., Gao C., Omari-Sasu A., Zhu D., Ampimah B., & Quarcoo A. (2019). Analysis on the nexus of economic growth, fossil fuel energy consumption, CO2 emissions and oil price in Africa based on a PMG panel ARDL approach. Journal of Cleaner Production 228, 161e174

Ahmed, K., & Long, W. (2012). Environmental Kuznets curve and Pakistan: An empirical analysis. Procedia Economics and Finance, 1, 4–13.

Akbostanci, E., Türüt-Asik, S., & Tunç, G. I. (2009). The relationsship between income and environment in Turkey: Is there an environmental kuznets curve ? Energy Policy, 37, 861–867.

Albulescu, C. (2020). Coronavirus and oil price crash. HAL Id: hal-02507184 https://hal.archives-ouvertes.fr/hal-02507184v2.

Al-Mulali, U., & Che Sab, C. N. B. (2018). The impact of coal consumption and CO2 emission on economic growth. Energy Sources, Part b: Economics, Planning, and Policy, 13(4), 218–223. https://doi.org/10.1080/15567249.2012.661027

Alqahtani, A., Selmi, R., & Hongbing, O. (2021). The financial impacts of jump processes in the crude oil price: Evidence from G20 countries in the pre- and post-COVID-19. Resources Policy, 72

Ang, J. (2007). CO2 emissions, energy consumption and output in France. Energy Policy, 35, 4772–4778.

Apergis, N., & Payne, J. E. (2009). Energy consumption and economic growth in Central America : Evidence from a panel cointegration and error correction model. Energy Economics., 31, 211–216.

Aslanidis, N., & Iranzo, S. (2009). Environment and development: Is there a Kuznets curve for CO2 emissions? Applied Economics, 41, 803–810.

Atri, H., Kouki, S., & Gallali, M.I. (2021). The impact of COVID-19 news, panic and media coverage on the oil and gold prices: An ARDL approach. Resources Policy, 72

Azomahou, T.T., Ndung’u, N., & Ouédraogo, M. (2021). Coping with a dual shock: The economic effects of COVID-19 and oil price crises on African economies. Resources Policy, 72.

Bartleet, M., & Gounder, R. (2010). Energy consumption and economic growth in New Zealand: Results of trivariate and multivariate models. Energy Policy, 38, 3508–3517.

Bloch, H., Rafiq, S., & Salim, R. (2012). Coal consumption, CO2 emission and economic growth in China: Empirical evidence and policy responses. Energy Economics, 34(2), 518–528. https://doi.org/10.1016/j.eneco.2011.07.014

Bourghelle, D., Jawadi, F., & Rozin, P. (2021). Oil price volatility in the context of Covid-19. International Economics, 167, 39–49.

Chandran, V. G. R., & Tang, C. F. (2013). The dynamic links between CO2 emissions, economic growth and coal consumption in China and India. Applied Energy, 104, 310–318.

Chow, G., & Lin, A.. (1973). Best linear unbiased interpolation, distribution, and extrapolation of time series by related series. The Review of Economics and Statistics, 53.

Dickey, D.A., & Fuller, W.A. (1979). Distribution of the estimators for autoregressive time series with a unit root. Journal of the American Statistical Association, 366a (74).

Dinda, S. (2004). Environmental Kuznets curve hypothesis: A survey. Ecological Economics, 49(4), 431–455.

Dinda, S. (2005). A theoretical basis for the environmental Kuznets curve. Ecological Economics, 53(3), 403–413.

Dong, K., Sun, R., Li, H., & Liao, H. (2018). Does natural gas consumption mitigate CO2 emissions: Testing the environmental Kuznets curve hypothesis for 14 Asia-Pacific countries. Renewable and Sustainable Energy Reviews, 94, 419–429. https://doi.org/10.1016/j.rser.2018.06.026

Holtz-Eakin, D., & Selden, T. M. (1995). Stoking the fires? CO2 emissions and economic growth. Journal of Public Economics, 57(1), 85–101.

Kanijilal, K., & Ghosh, S. (2013). Environmental Kuznet’s curve for India: Evidence from tests for cointegration with unknown structural braks. Energy Policy, 56, 509–515.

Kwiatkowski,D., Phillips, P., Schmidt, P., & Shin,Y. (1992). Testing the null hypothesis of stationarity against the alternative of a unit root: How sure are we that economic time series have a unit root? Journal of Econometrics, 1–3(54), 159–178

Lacheheb, M., Rahim, A., & Sirag, A. (2015). Economic growth and carbon dioxide emissions: Investigating the environmental Kuznets curve hypothesis in Algeria. Ecological Economics Policy, 5, 1125–1132.

Le, T.H., Le, A.T., & Le, H.C. (2021). The historic oil price fluctuation during the Covid-19 pandemic: What are the causes? Research in International Business and Finance, 58

Lim, K.-M., Lim, S.-Y., & Yoo, S.-H. (2014). Oil consumption, CO2 emission, and economic growth: Evidence from the Philippines. Sustain, 6(2), 967–979. https://doi.org/10.3390/su6020967

Lin, F.-L., Inglesi-Lotz, R., & Chang, T. (2018). Revisit coal consumption, CO2 emissions and economic growth nexus in China and India using a newly developed bootstrap ARDL bound test. Energy Exploration & Exploitation, 36(3), 450–463. https://doi.org/10.1177/0144598717741031

Lindmark, M. (2002). An EKC-pattern in historical perspective: Carbon dioxide emissions, technology, fuel prices and growth in Sweden 1870–1997. Ecological Economics, 42, 333–347.

Lotfalipour, M. R., Falahi, M. A., & Ashena, M. (2010). Economic growth, CO2 emissions, and fossil fuels consumption in Iran. Energy, 35(12), 5115–5120. https://doi.org/10.1016/j.energy.2010.08.004

Malik M.Y., Latif K., Khan Z., Daud Butt H., Hussain M., & Nadeem M.A. (2020). Symmetric and asymmetric impact of oil price, FDI and economic growth on carbon emission in Pakistan: Evidence from ARDL and non-linear ARDL approach. Science of the Total Environment, 726, 138421

Managi, S., & Jena, P. (2008). Environmental productivity and Kuznets curve in India. Ecological Economics, 65, 432–440.

Mzoughi H., Urom C., Salah Uddin G., & Guesmi K. (2020). The effects of COVID-19 pandemic on oil prices, CO2 emissions and the stock market: Evidence from a VAR model. Electronic copy available at: https://ssrn.com/abstract=3587906

Phillips, P. C., & Perron, P. (1988). Testing for a unit root in time series regression. Biometrika, 2(75), 335–346.

Shahbaz, M., & Sinha, A. (2019). Environmental Kuznets curve for CO2 emissions: A literature survey. Journal of Economic Studies, 46(1), 106–168.

Shahbaz, M., Sbia, R., Hamdi, H., & Ozturk, I. (2014). Economic growth, electricity consumption, urbanization and environmental degradation relationship in United Arab Emirates. Ecological Indicators, 45, 622–631.

Sulaiman, C., & Abdul-Rahim, A. (2018). Population growth and CO2 emission in Nigeria: A recursive ARDL approach. SAGE Open, 8, 1–14.

Syed, F., & Ullah, A. (2021). Estimation of economic benefits associated with the reduction in the CO2 emission due to COVID-19. Environmental Challenges, 3.

Triggs A., & Kharas H. (2020). The triple economic shock of COVID-19 and priorities for an emergency G-20 leaders meeting. Brookings Institution.

Wu, S., Zhou, W., Xiong, X., Burr, G.S., Cheng, P., Wang, P., Niu, Z., Hou, Y. (2021). The impact of COVID-19 lockdown on atmospheric CO2 in Xi’an, China. Environmental Research, 197.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Gam, I. Does a sanitary crisis drive oil prices and carbon emissions in the USA? Evidence from VECM modeling. Environ Dev Sustain 24, 10616–10632 (2022). https://doi.org/10.1007/s10668-021-01875-2

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10668-021-01875-2