Abstract

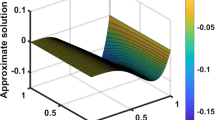

Exotic option contracts typically specify a contingency upon an underlying asset price monitored at a discrete set of times. Yet, techniques used to price such options routinely assume continuous monitoring leading to often substantial price discrepancies. A brief review of relevant option-pricing methods is presented. The pricing problem is transformed into one of Wiener–Hopf type using a z-transform in time and a Fourier transform in the logarithm of asset prices. The Wiener–Hopf technique is used to obtain probabilistic identities for the related random walks killed by an absorbing boundary. An accurate and efficient approximation is obtained using Padé approximants and an approximate inverse z-transform based on the trapezoidal rule. For simplicity, European barrier options in a Gaussian Black–Scholes framework are used to exemplify the technique (for which exact analytic expressions are obtained). Extensions to different option contracts and options driven by other Lévy processes are discussed.

Similar content being viewed by others

References

Black F and Scholes M (1973). The pricing of options and corporate liabilities. J Polit Economy 81: 637–654

Harrison JM and Kreps DM (1979). Martingales and arbitrage in multiperiod securities markets. J Econ Theory 20: 381–408

Harrison JM and Pliska SR (1981). Martingales and stochastic integrals in the theory of continuous trading. Stochastic Process Appl 11: 215–260

Delbaen F and Schachermayer W (1994). A general version of the fundamental theorem of asset pricing. Math Ann 300: 463–520

Airoldi M (2005). A moment expansion approach to option pricing. Quant Finance 5(1): 89–104

Borovkov K and Novikov A (2002). On a new approach to calculating expectations for option pricing. J Appl Probab 39(4): 889–895

Broadie M, Glasserman P and Kou S (1997). A continuity correction for discrete barrier options. Math Finance 7: 325–349

Broadie M, Glasserman P and Kou S (1999). Connecting discrete and continuous path-dependent options. Finance Stoch 3: 55–82

Broadie M and Yamamoto Y (2005). A double-exponential fast Gauss transform algorithm for pricing discrete path-dependent options. Oper Res 53(5): 764–779

Fusai G and Recchioni MC (2007). Analysis of quadrature methods for pricing discrete barrier options. J Econom Dynam Control 31: 826–860

Hörfelt P (2003). Extension of the corrected barrier approximation by Broadie, Glasserman and Kou. Finance Stoch 7: 231–243

Howison S and Steinberg M (2007). A matched asymptotic expansion approach to continuity corrections for discretely sampled options. Part 1: barrier options–Appl Math Finance 14(1):63–89

Kou SG (2003). On pricing of discrete barrier options. Statist Sinica 13: 955–964

Petrella G and Kou S (2004). Numerical pricing of discrete barrier and lookback options via Laplace transforms. J Comp Finance 8(1): 1–38

Tse WM, Li LK and Ng KW (2001). Pricing discrete barrier and hindsight options with the tridiagonal probability algorithm. Manage Sci 47(3): 383–393

Fusai G, Abrahams ID and Sgarra C (2006). An exact analytical solution for discrete barrier options. Finance Stoch 10(1): 1–26

Abate J and Whitt W (1992). Numerical inversion of probability generating functions. Oper Res Lett 12: 245–251

Abrahams ID (2000). The application of Padé approximants to Wiener–Hopf factorization. IMA J Appl Math 65: 257–281

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Green, R., Abrahams, I.D. & Fusai, G. Pricing financial claims contingent upon an underlying asset monitored at discrete times. J Eng Math 59, 373–384 (2007). https://doi.org/10.1007/s10665-007-9176-0

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10665-007-9176-0