Abstract

We present a dynamic model that shows how different types of land tenancy contracts and their time-related characteristics influence farmers’ decisions to invest in soil improvement and productive inputs. Using recent household and plot-level data from the Brong-Ahafo Region in Ghana, we analyze the impact of land tenancy arrangements, contract duration, as well as the number of times the contract has been renewed in the past on the intensity of investment in soil conservation measures such as ditches and farmyard manure and productive inputs like chemical fertilizer. The empirical findings generally confirm the predictions of the theoretical model and reveal that the intensity of investments on different plots cultivated by a given farmer varies significantly with the type of tenancy arrangement on the plot as well as the time-related characteristics of the contract.

Similar content being viewed by others

Explore related subjects

Discover the latest articles and news from researchers in related subjects, suggested using machine learning.Notes

We use the terms soil quality and soil fertility synonymously.

To focus the analysis on the time related characteristics of the tenancy arrangements, we do not consider production risks, or risks associated with the evolution of the soil quality. However, as rightly indicated by an anonymous reviewer, the consideration of risk could alter the production and investment behavior of the tenants. As indicated by Stiglitz (1974) and Dubois (2008), sharecropping allows sharing these risks between the landlord and tenant. In the case where farmers are risk averse, sharecropping provides incentives for intensive production, whereas fixed-rent contracts tend to encourage reduced production intensity. Hence, we expect that the consideration of risks would result in a narrowing of the differences in the production and investment behavior found in the theoretical analysis.

Apart from anthropogenic activities, the evolution of the soil depends on the climate, topography, organisms, parent material (C-Horizon) and aging (time). To model the influence of non-anthropogenic factors for soil formation, landscape evolution models postulate that soil formation initially increases with time but declines exponentially with soil thickness. In other words, soil formation for older soils which have not been rejuvenated by volcanic eruptions or alluvial processes is hardly taking place. This is often the case for African soils. Moreover, even soil formation processes for younger soils are very slow (0.5–1.5 cm per 1,000 years), so that the time horizon is clearly far beyond the planning horizon of the farmer. For these two reasons, Eq. (1) considers only anthropogenic factors in the form of agricultural activities.

Depending on the nature of the soil conserving investment, the share \(\phi \) may vary. The costs of long lasting and high investments are more likely to be covered entirely by landlords, while less expensive and short lasting investments may be shared between farmers and landlords.

For the output and the investment costs, we only consider share contracts with a linear rule. It is, however, significant to note that the optimal contract may be non-linear. Given that our analysis does not focus on the design of the optimal sharing contracts, and linear sharing rules for the output and investment costs are the norm in the Brong-Ahafo region, we base our analysis on this rule.

It is significant to note that if the optimal soil fertility increases over time, the downward sloping curves rotate counter clockwise, resulting in lower optimal levels of mineral fertilizer for all three tenancy arrangements (not shown in Fig. 2).

These include variables such the attitude towards risk, the discount rate, farming knowledge and access to credit.

It is important to note that besides raising the cost of self-cultivation, greater distance between landowner and plot may also increase the cost of monitoring the plot, if leased out, resulting in potentially biased estimates (Jacoby and Mansuri 2008). However, sharecroppers, who are likely to be monitored, are normally not supervised in the study area. Hence, this problem does not arise in our estimation strategy.

The \(\chi ^2\) statistics for the validity tests of the overidentifying restrictions presented in Table 2 fail to reject the exclusion restriction that the instruments affect investment only via land tenure arrangements.

In accordance with most of the literature we use the term tenure security to refer to the insecurity of the claim of the realized investment at the end of the contract.

As noted by Besley (1995), they could also be representing village-level variation in tenancy arrangements.

We refrain from computing marginal effects from the estimated coefficients. As pointed out by Deininger and Ali (2008), marginal effects of coefficients based on Tobit estimates depend heavily on the distributional assumptions.

References

Aghion P, Bolton P (1987) Contract as a barrier to entry. Am Econ Rev 77(3):388–401

Aghion P, Dewatripont M, Rey P (1994) Renegotiation design with unverifiable information. Econometrica 62(2):257–282

Akhter A, Abdulai A, Goetz R (2012) Impacts of tenancy arrangements on investment and efficiency: evidence from Pakistan. Agr Econ 43(1):85–97

Bandiera O (2007) Contract duration and investment incentives: evidence from land tenancy agreements. J Eur Econ Assoc 5(5):953–986

Bandiera O, Rasul I (2006) Social networks and technology adoption in Northern Mozambique. Econ J 116:869–902

Besley T (1995) Property rights and investment incentives, theory and evidence from Ghana. J Polit Econ 103:903–937

Blundell RW, Smith R (1989) Estimation in a class of simultaneous equation limited dependent variable models. Rev Econ Stud 56:37–57

Brickley JA, Misra S, Horn RV (2006) Contract duration: evidence from franchising. J Law Econ 49(1):173–196

Cantor R (1988) Work effort and contract length. Economica 55(219):343–353

Deininger K, Ali A (2008) Do overlapping land rights reduce agricultural investment? Evidence from Uganda. Am J Agr Econ 90:869–882

Dubois P (2002) Moral hazard, land fertility and sharecropping in a rural area of the Philippines. J Dev Econ 68:35–64

Dubois P (2008) Sharecropping. In: Durlauf S, Blume L (eds) The new Palgrave dictionary of economics, 2nd edn. Palgrave Macmillan. doi:10.1057/9780230226203.1519

Guriev S, Kvasov D (2005) Contracting on time. Am Econ Rev 95(5):1369–1385

Hart O (1995) Firm, contracts, and financial structure. Oxford University Press, Oxford

Holden S, Deininger K, Ghebru H (2009) Impacts of low-cost land certification on investment and productivity. Am J Agr Econ 91:359–373

Jacoby H, Mansuri G (2008) Land tenancy and non-contractible investment in rural Pakistan. Rev Econ Stud 75:763–788

Jacoby H, Li G, Scott R (2002) Hazards of expropriation. Am Econ Rev 92(5):1420–1447

Joskow PL (1987) Contract duration and relationship-specific investments: empirical evidence from coal markets. Am Econ Rev 77(1):168–185

Lee L (1992) Amemiya’s generalized least squares and tests of over identification in simultaneous equation models with qualitative or limited dependent variables. Econ Rev 11(3):319–328

Lichtenberg E (2007) Tenants, landlords, and soil conservation. Am J Agr Econ 89:298–307

Rey P, Iossa E (2012) Building reputation for contract renewal: implications for performance dynamic and contract duration. Institut d’Économie Industrielle Toulouse (IDEI), Working Papers 757

Stiglitz J (1974) Incentives and risk sharing in sharecropping. Rev Econ Stud 41:219–255

Wooldridge J (2002) Econometric analysis of cross section and panel data. The MIT Press, Boston

Yoder J, Hossain I, Epplin F, Doye D (2008) Contract duration and the division of labor in agricultural land leases. J Econ Behav Organ 65:714–733

Acknowledgments

The authors would like to thank the journal editor and two anonymous reviewers for very useful comments and suggestions on an earlier version of the paper. Part of Abdulai’s research was supported by the German Research Foundation. Part of Goetz’s research was supported by the Spanish Ministry of Economics and Competitiveness grant, Econ2010-17020, with partial funding from the program FEDER of the European Union and by the Government of Catalonia grants XREPP and 2009 SGR189.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix 1

The shadow value of the soil quality at time \(t\) is given by

For \(\lambda ^C\) note that \(t=(i-1)k+s\). An increase in soil quality at time \(t\) benefits the fixed-rent farmer’s or sharecropper’s farm profits at the most for \(k\)-years, whereas the owner-cultivator takes advantage of the same increase until \(T\). This can be seen in Eq. (14) from the upper limit of the integrals which do not form part of an exponent. Hence, one can conclude that the shadow price of the fixed-rent tenant or sharecropper, \(\lambda ^C\), is less than the shadow price of the owner cultivator, \(\lambda ^O\) for any identical soil quality \(S\). Yet, this result cannot be extended over the entire trajectories of \(\lambda ^C\) because the trajectories of the soil qualities will only coincide by chance. If the upper limits of the integral (\(ik=T\)) were identical one might expect that \(\lambda ^O(t)\) is lower than\(\lambda ^C(t)\). However, since \(\lambda ^O(t)\) and \(\lambda ^C(t)\) are determined by the stream of the discounted farm profits with respect to a marginal improvement of soil quality from time \(t\) until the end of the planning horizon, their values depend crucially on the length of the planning horizon. Since\(\lambda ^O(t)\) takes into account the next \(T-t\) years and \(\lambda ^C((i-1)k+s)\) considers only the next \(k-s\) years, it is expected that the longer time horizon of the owner-cultivator guarantees that \(\lambda ^C\), is lower than the shadow price of the owner, \(\lambda ^O\) for any soil quality \(S\) and any remaining planning horizon.

Appendix 2

Due to the concavity of the production function the term \(Y_S\) will decrease with an increase in soil fertility and increase with a decrease in soil fertility. For fixed-rent tenant and sharecroppers we obtain that

Following the same steps we also obtain that \({d\lambda ^O}/dS<0\).

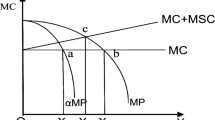

Appendix 3

In the opposite case erosion processes are dominant and cannot be compensated by the application of manure, \((\alpha _M -\alpha _Y Y_M )<0\). In this case, as shown in Fig. 4 and summarized in Observation 2 it is efficient for owners to apply less manure than fixed-rent tenants, i.e., \(\tilde{M}^O<M^T\). Depending on the severity of the erosion processes, owners may even apply less manure than sharecroppers, i.e., \(\tilde{\tilde{M}}^O< \quad M^S\). Owners choose \(\tilde{\tilde{M}}^O\), if the marginal value of the decrease in soil fertility, \(\left| {\lambda ^O(\alpha _M -\alpha _y Y_M )} \right| \) is greater than the value of the marginal product that corresponds to the sharcropper, \(\gamma pY_M \). However, owners apply more manure than sharecroppers if \(\left| {\lambda ^O(\alpha _M -\alpha _y Y_M )} \right| <\gamma pY_M \).

Appendix 4

To examine how the optimal investment behavior evolves over time we choose for the sake of concreteness a specific point in time, let say \(k/2\), i.e., we analyze the optimal investment behavior of the different farmers for the cases where \(S(\left. t \right| _{t>k/2} )>S_0 \), and \(S(\left. t \right| _{t>k/2} )<S_0\). If \(S(\left. t \right| _{t>k/2} )>S_0 \), it is optimal for farmers to build up soil fertility over time, while it would be optimal for them to reduce soil fertility, if \(S(\left. t \right| _{t>k/2} )<S_0 \). We consider the case where owner-cultivators build up soil fertility (\(S(\left. t \right| _{t>k/2} )>S_0 )\), while tenants do the opposite. In this situation, the curves \(pY_M \) and \((1-\gamma )pY_M \) rotate clockwise as shown by the discontinuous line for the case of \((1-\gamma )pY_M\) in Fig. 1. Similarly, the curve \(pY_M +\lambda ^O(\alpha _M -\alpha _Y Y_M )\) rotates counter clockwise. Figure 1 shows a decline in the optimal level of manure for owner-cultivators (\(\tilde{M}^O)\), and an increase in the optimal level for sharecroppers over time (\(\tilde{M}^S)\). The optimal behavior of fixed-rent tenants is similar to that of sharecroppers, but is not shown in Fig. 1 in the interest of brevity. The opposite results are obtained, if owner-cultivators reduce soil fertility (\(S(\left. t \right| _{t>k/2} )<S_0 )\), and tenants build up soil capital (\(S(\left. t \right| _{t>k/2} )>S_0 )\). Likewise, if we consider the case where \(F,M\) and \(S\) are complements, i.e., \(Y_{FS} ,Y_{MS} >0\), the curves would rotate clockwise, resulting in opposite results.

Appendix 5

See Table 4.

Rights and permissions

About this article

Cite this article

Abdulai, A., Goetz, R. Time-Related Characteristics of Tenancy Contracts and Investment in Soil Conservation Practices. Environ Resource Econ 59, 87–109 (2014). https://doi.org/10.1007/s10640-013-9719-y

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10640-013-9719-y