Abstract

In this paper, we have considered a duopolistic model of environmental product differentiation with two types of consumers (green and brown) to analyze how environmental awareness affects the environment. “Green” consumers value the physical and environmental attributes of the good they purchase while “brown” consumers only value the physical attributes. We find that more environmental awareness may not be good news for the environment as the firm that produces the good without environmental attributes may increase its sales. The result depends on the degree of product differentiation and the cost to achieve it. Social welfare can also be inversely related to environmental awareness if the negative environmental effect dominates the positive market effect.

Similar content being viewed by others

References

Arora S., Gangopadhyay S. (1995). Towards a Theoretical Model of Voluntary Overcompliance. Journal of Economic Behavior and Organization 28:289–309

Cason T. N., Gangadharan L. (2002). Environmental Labeling and Incomplete Consumer Information in Laboratory Markets. Journal of Environmental Economics and Management 43:113–134

Darbi M. R., Karni E. (1973). Free Competition and the Optimal Amount of Fraud. Journal of Law and Economics 16:67–88

Environmental Protection Agency 742-R-98-009 (1998), Environmental Labeling Issues, Policies and Practices Worldwide

Gabszewicz J., Thisse J-F. (1979). Price Competition, Quality and Income Disparities. Journal of Economic Theory 20:340–359

Kirchhoff S. (2000). Green Business and Blue Angels. Environmental and Resource Economics 15:403–420

Mattoo A., Singh H. V. (1994). Eco-Labelling: Policy Considerations. Kyklos 47(1):53–65

Mussa M., Rosen S. (1978). Monopoly and Product Quality. Journal of Economic Theory 18:301–317

Moraga-Gonzalez J. L., Padrón-Fumero N. (2002). Environmental Policy in a Green Market. Environmental and Resource Economics 22:419–447

Shaked A., Sutton J. (1982). Relaxing Price Competition Through Product Differentiation. Review of Economic Studies 49:3–13

Teisl M. F., Roe B., Hicks R. L. (2002). Can Eco-Labels Tune a Market? Evidence from Dolphin-Safe Labeling. Journal of Environmental Economics and Management 43:339–359

Acknowledgements

The author would like to thank two anonymous referees and Sjak Smulders for their helpful comments and suggestions. The author also thanks conference participants at the EAERE 2003 (Bilbao) and the XIX Jornadas de Economía Industrial held in Castellón, Spain for helpful comments.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix 1

Proof of Proposition 1

First, we show that p *1 (α)b > p *2 (α)(b + 1). Let us suppose that the inequality does not hold. Then, from (1a) and (1b) it follows that

what it is a contradiction.

Next, we show that \(p_{1}^{\ast}(\alpha)= \hbox{arg\; max}\Pi _{1}(p_{1},p_{2}^{\ast }(\alpha), \alpha)\). A price p 1 such that, given p *2 (α), firm 2 sells only to brown consumers cannot maximize firm 1’s profits. The best price firm 1 can choose is \(\frac{p_{2}^{\ast}(\alpha)(b+1)}{b}\), but firm 1 can increase its profits by choosing a price such that firm 2 sells to both types of consumers. In that case, firm 1 solves

The interior solution to this problem is p *1 (α). Thus, given p *2 (α), p *1 (α) maximizes firm 1’s profits.

We show now that \(p_{2}^{\ast}(\alpha)=\hbox{arg max} \Pi_{2}(p_{1}^{\ast}(\alpha),p_{2},\alpha)\). Given p *1 (α), firm 2 can focus only on the brown consumers. The best price it can choose is \(\frac{p_{1}^{\ast}(\alpha)b}{(1+b)}\). However, if firm 2 sells also to green consumers, it solves

The interior solution to this problem is p *2 (α). Thus, given p *1 (α), p *2 (α) maximizes firm 2’s profits. Therefore, the prices (p *1 (α),p *2 (α)) constitute an equilibrium.

Let us assume that there also exists a pair of equilibrium prices \((\hat{p}_{1},\hat{p}_{2})\neq(p_{1}^{\ast}(\alpha),p_{2}^{\ast}(\alpha))\). By the definition of equilibrium, \(\hat{p}_{i}=\hbox{arg\; max} \Pi _{i}(p_{i},\hat{p}_{j},\alpha)\) \(\forall i=1,2, i\neq j\) and \(\hat{p}_{1}b > \hat{p}_{2}(1+b)\). By this implies that \((\hat{p}_{1},\hat{p}_{2})=(p_{1}^{\ast}(\alpha),p_{2}^{\ast}(\alpha))\). Thus, the equilibrium is unique.□

Appendix 2

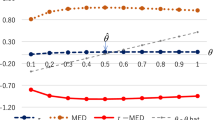

We first show that \(\frac{{\rm d}q_{2}^{\ast}(\alpha)}{{\rm d}\alpha}=\frac{2b-(1-c)\left[4(1+\alpha b)^{2}-\alpha^{2}b^{2}\right]}{(4+3\alpha b)^{2}}\). From (2a), (3a) and (3b), we have:

We now show that \(\frac{{\rm d}^{2}q_{2}^{\ast}(\alpha)}{{\rm d}\alpha^{2}}=-\frac{4b[3b+2(1-c)]}{[4+3\alpha b] ^{3}} < 0 \quad \forall \alpha \).

Appendix 3

When \(\alpha(\theta)=\bar{\alpha}+a(\theta -0.5)\), the relevant demand functions are given by:

and the equilibrium prices \((p_{1}^{\ast}(\bar{\alpha},a),p_{2}^{\ast}(\bar{\alpha},a))\) are characterized by the following first order conditions derived from the firms’ profits maximization problems:

where \(\hat{\theta}^{\ast}=p_{1}^{\ast}(\bar{\alpha},a)-p_{2}^{\ast}(\bar{\alpha},a)\) and \(\underline{\theta}^{\ast}=\frac{p_{2}^{\ast}(\bar{\alpha},a)}{b}\). The change in firm 2’s equilibrium output when a changes is given by:

A sufficient condition for pollution to increase (at least, for some range) with a is that the marginal change in firm 2’s equilibrium output evaluated at a = 0 must be positive. From (A.1) and (A.2), total differentiation evaluated at a = 0 yields:

From (A.4) and (A.5), we obtain:

From (A.3), we have:

When a = 0, the expressions for \(\hat{\theta}^{\ast}\), p *1 and p *2 are similar to those in (1a), (1b) and (2a). Note also that \(\hat{\theta}^{\ast} > 0.5\). When \(\bar{\alpha}\) goes to zero, we have:

where \(\hat{\theta}^{\ast}\) and \(\underline{\theta}^{\ast}\) are given by (2a) and (2b) evaluated at α = 0. After plugging them into the above expression, we have:

When \(\bar{\alpha}\) is quite small, the marginal change in firm 2’s output evaluated at a = 0 is positive if c and b are such that 12c 2 − 4c(2 − b) > 5b 2 + 4(1 − b). Therefore, it follows that pollution increases with a (at least, for some range).The qualitative results in Proposition 2 hold. Note that when a = 0, we are in the same scenario analysed in the main text, and therefore, the same results should hold.

Rights and permissions

About this article

Cite this article

Rodríguez-Ibeas, R. Environmental Product Differentiation and Environmental Awareness. Environ Resource Econ 36, 237–254 (2007). https://doi.org/10.1007/s10640-006-9026-y

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10640-006-9026-y