Abstract

Despite the upgrading of the attention and investment of new energy in Chinese public, its market efficiency and associations with other assets are relatively rarely explored. This paper, firstly, explores the multifractal feature and market efficiency of Chinese new energy market (NEI) by the multifractal detrended fluctuation analysis. Secondly, the multifractal cross-correlation analysis is performed to discuss the multifractality of cross-correlations between NEI and crude oil, external new energy indices (Global (SPGCE), United States (ECO) and Europe (ERIX)) and safe-haven asset (GOLD) respectively. The results show that Chinese new energy market has obvious multifractality with low market efficiency, which is mainly sourced from long-range correlation. It has the strongest linkages with external new energy markets and most insignificant association with gold. The heterogeneous sources contribute to their multifractal cross-correlations. It provides useful enlightenment for decision-makers to implement energy policy and reform, and for investors to make investment decisions.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

China’s demand for energy is huge and will continue to grow for some time to come. However, traditional energy is non-renewable and harmful to the environment. As an alternative for traditional energy, new energyFootnote 1 has risen to an important field related to national security. At the end of 2020, a total of 44 countries in the world have officially announced their carbon neutrality targets. President Xi Jinping clearly stated that China will peak carbon emissions by 2030 and strive to achieve carbon neutrality by 2060 at the 75th United Nations General Assembly. The financial market has set off a “new energy fever” again and again. In academia, new energy has also received a lot of attention, such that it is worthwhile to study the efficiency, statistical characteristics and risk features of the new energy market.

Many scholars have carried out researches around new energy and studied the correlations between new energy and other assets. What has received the most attention is the relevance of new energy and crude oil. However, the conclusions of literatures are not completely consistent. Most scholars consider that new energy and crude oil fluctuate in the same direction (Managi & Okimoto, 2013), and some believe that the relationship between the two is rather time-varying than invariable (Reboredo et al., 2017). But recent years, the opinion that crude oil had little effect on the new energy company share price has also emerged (Sun et al., 2019). In addition, the associations between new energy and technology stocks have also been concerned about (Kassouri et al., 2021). There are also some literatures exploring the linkages between new energy and other assets, including carbon market, gold, thermal coal and green bonds, etc. (Dutta et al., 2018; Elie et al., 2019; Gu et al., 2020; Hammoudeh et al., 2020). It is noted that most of the existing literatures focus on the S&P Global Clean Energy Index (SPGCE), Wilder Hill Clean Energy Index (ECO) and European Renewable Energy Index (ERIX), but few works study Chinese new energy market. For example, based on Chinese market, Wen et al. (2014) explored the dynamic linkage of new energy index and the price of fossil fuel companies. Zhang and Du (2017) took the high-technology companies into account and concluded that the associations between new energy company stock prices and high-tech stock prices is bigger than that of fossil fuel stocks. Discussion on the linkages of Chinese new energy market to other assets is very limited, especially the associations with crude oil price, gold price and external new energy markets have not been studied yet.

In the academic field, the financial market is always regarded as a complex system (Niu & Wang, 2014). More and more scholars discovered the limitations of the Efficient Market Hypothesis and utilized nonlinear methods to study financial markets (Abbaszadeh et al., 2020; Amman & Kendrick, 1995; Fisher & Hughes Hallett, 1992; Kendrick et al., 2014; Ola et al., 2014; Rounaghi & Zadeh, 2016). As a representative nonlinear approach, multifractal methods have been widely applied. Among them, multifractal detrended fluctuation analysis (MF-DFA) (Kantelhardt et al., 2002) is the most prevalent, which has been extensively used to analyze the market patterns and efficiencies of stock, fund, foreign exchange, cryptocurrencies, futures and commodities markets (Yan et al., 2021; Kristjanpoller et al., 2020; Zou & Zhang, 2020; etc.). Particularly, Shahzad et al. (2020) utilized MF-DFA to explore the features of ERIX, ECO and SPGCE. They concluded that the multifractal properties of ERIX and ECO are only sourced from the fat-tail distribution, while not only long-range correlation but fat-tail distribution contributed to the multifractal features of SPGCE. Developed from MF-DFA, multifractal detrended cross-correlation analysis (MF-DCCA) (Zhou, 2008) has become well-known for exploring cross-correlation and multifractality between variables. For instance, Wang et al. (2021) investigated the association between new energy sector and Shanghai Composite Index using MFCCA. They found that the persistence of cross-correlation of SSEC/new energy is weaker than SSEC/finance, but stronger than the SSEC/consumption and SSEC/medicine. Though they showed the multifractality of cross-correlation, they didn't explore the source further. Besides, the market efficiency and its source of China's new energy has not been studied using multifractal method, let alone its cross-correlation with other more assets from different markets.

Therefore, there are two main purposes to write this article: firstly, to explore the shape of Chinese new energy market and analyze its market efficiency by MF-DFA; secondly to analyze the linkages between the China’s new energy index and three sorts of assets, namely crude oil (domestic Daqing crude oil and international WTI crude oil), external new energy indices (SPGCE, ECO, ERIX) and safe-haven asset (GOLD) respectively. To have an in-depth exploration, we further dissect the sources of multifractality. Briefly speaking, it is found that there exists multifractal feature in Chinese new energy market, and its efficiency is low. The long-range correlation is the most important factor for the multifractality, which is different from that of SPGCE, ECO and ERIX (Shahzad et al., 2020). Then, the heterogeneous strengths and sources of the cross-correlation between Chinese new energy market and other six assets are discovered by cross-correlation analysis and MF-DCCA. As far as we know, this paper is the first comprehensive discussion on the multifractal property and efficiency of Chinese new energy market and its association with other assets, both in terms of methodology and data coverage.

The results will, on one hand, help Chinese government recognize the characteristics of the clean energy market. The government can fully understand the linkages between new energy and traditional energy, so as to formulate relevant policies combing the current situation of the country, and provide the basis for the smooth realization of the energy revolution. On the other hand, investors can understand the efficiency of the new energy market and clarify the extent to which the price of the new energy index reflects market information. At the same time, the study of cross-correlation relationship provides investors with risk aversion information of new energy index, and helps investors to better carry out the portfolio and risk management. Besides, the study of this work can also have some enlightenment for the new energy firms.

The remaining work is arranged like this: Sect. 2 summarizes the relevant literature. Section 3 briefly introduces the method. Section 4 shows the data. In Sect. 5, the empirical findings and related discussions are given. Section 6 concludes.

2 Literature Review

This part reviews and summarizes the existing literature from two perspectives. The first is about the relationships between new energy and other assets, and the second is on the multifractality studies in the financial field.

2.1 Relationships Between New Energy and Other Assets

The researches on the relationships between new energy and other assets are summarized in three categories, namely traditional energy, technology stocks and other variables. As for the associations between new energy and traditional ones, crude oil occupies the vast majority, and the conclusions in the literature are not always consistent. Some scholars consider that they have a positive correlation. For instance, Managi and Okimoto (2013) applied Markov-switching VAR approach and found that after 2007, oil prices and clean energy prices were positively related. Based on the perspective of volatility, Dutta (2017) found that the influence of oil volatility shock on clean energy was positive, indicating that the higher the oil volatility, the greater the volatility of clean energy. But some scholars have proposed that the impact is not as high as expected. For example, Reboredo (2015) found that 30% of both the upside and downside risks of renewable energy companies could be attributed to oil price dynamics. Sun et al. (2019) drew the conclusion that the price of fossil energy (oil, coal and natural gas) had little impact on the stock price fluctuations of new energy companies. Besides, some works showed that the correlation is time-varying (Dawar et al., 2021; Reboredo et al., 2017). Moreover, several studies are performed about the correlation between new energy and other energy sources except crude oil. For instance, Gu et al. (2020) showed that there is a substitution effect between clean energy and thermal coal.

Many literatures have focused on the linkages between new energy and technology corporations. Henriques and Sadorsky (2008) and Kumar et al. (2012) proposed earlier that clean energy is developed and rationally used based on specific technologies, so the prices would be positively correlated to the technology ones. Afterwards, many academics have extended the view from different perspectives. For example, Bondia et al. (2016) confirmed the one-way short-term causality from prices of technology share to clean energy stock. Niu (2021) used the time-dependent intrinsic correlation method to analyze the correlation and concluded that renewable energy and technology companies had positive relationship. Further, the relationship was strongest in the long-term, and then short-term, medium-term followed. However, Kassouri et al. (2021) found that during 2004–2017, investors’ expectations for clean energy returns were unaffected by technology stocks on any time scales.

In addition, relationships between new energy and other assets have been investigated. For instance, from the perspective of behavioral finance, it was demonstrated that the Twitter sentiment had no significant impact on new energy stock returns (Reboredo & Ugolini, 2018). The correlation between new energy and carbon dioxide emissions had obvious regional differences (Dutta et al., 2018). Besides, in the case of clean energy index volatility, especially for SPGCE, holding gold can achieve the goal of safety (Elie et al., 2019). The causality between new energy and green bonds was time-varying, and came to be obvious until 2019 (Hammoudeh et al., 2020). Yahya et al. (2020) found that new energy and non-ferrous metal had a stronger dependence during turbulent times, but weaker during economic prosperity. The financial pressure showed a negative impact on new energy stocks in European bull market as well as the bull and bear markets in the United States (He et al., 2021).

It is noted that global, U.S. and European new energy markets are the most discussed renewable energy markets and there is still much room for exploration on Chinese new energy market. For the literatures on Chinese new energy market, as we know, there is no discussion of the impact of domestic crude oil and gold prices on it. In addition, the relationship between China's new energy and ECO, ERIX and SPGCE is also worth studying.

2.2 Multifractality Study in the Financial Field

Fractal theory was first proposed by Mandelbrot (1963). After that, Peters (1991) creatively combined chaos and fractal theory and applied them to the study of financial markets. The fractal market hypothesis (FMH) does not ignore the anomalies in the financial market, reduces many assumptions in the efficient market hypothesis (EMH), and uses a nonlinear paradigm to reflect the operating conditions of the real financial market (Moradi et al., 2019). Fractal theory has experienced the evolution from single-fractal to multifractal. The single-fractal describes the time series fluctuations from a macro level, while the multifractal method explores the local partial fractal structure of the sequence in more details. Since the proposal of multifractality, scholars have proposed a variety of methods, such as MF-DFA, MF-DCCA, MF-X-DMA (Jiang & Zhou, 2011), MF-ADCCA (Cao et al., 2014), MF-CCA (Oswiecimka et al., 2014) etc., to expand their understanding of the financial market or issues from a new perspective. MF-DFA has been applied to investigate the market patterns and efficiency of stock markets (Wang et al., 2009), gold market (Mali & Mukhopadhyay, 2014), foreign exchange markets (Norouzzadeh & Rahmani, 2006), cryptocurrencies (Al-Yahyaee et al., 2020; Mnif et al., 2020), and futures markets (Wang et al., 2019). It has also been utilized to test the impact of important events, such as COVID-19, on the markets (Aslam et al., 2020; Mensi et al., 2021a, b). Though some nonlinear models, like stochastic unit root process, component and fractionally integrated GARCH-RV models, etc., can also test the market efficiency, they are limited to illustrate the efficiency from the same type of local fluctuations. (Wang et al., 2009). Compared to the wavelet transform modulus maxima (WTMM), an improved multifractal formalism, MF-DFA is simpler to determine the multifractal scaling performance of the data series. Further, the MF-DFA might have slight advantages especially in the case of short series and negative \(q\) values (Kantelhardt et al., 2002). In addition, many works exploited the MF-DCCA approach to study the relationships among financial assets in the light of the fractal market hypothesis (Wang et al., 2020; Yao et al., 2020, etc.). As the financial market is becoming more and more complete, the multifractal characteristics and associations of a variety of assets have been studied. More details can refer to Li et al. (2020), and we will not list them here.

To mention, the multifractal features and sources of SPGCE, ECO and ERIX have been considered (Shahzad et al., 2020). However, as far as we know, there is no literature to discuss Chinese new energy market from a multifractal perspective, and its market pattern and efficiency have not been discussed yet. Hence, it is greatly valuable to have a comprehensive investigation of the multifractal feature and efficiency of Chinese new energy market, as well as the cross-correlations between NEI and different assets (like crude oil, other new energy markets and safe-haven asset), which is also the main target in this paper.

3 Methodology

3.1 MF-DFA

The detrended fluctuation analysis (DFA), proposed by Peng et al. (1994), originally is devoted to exploring the fractal structure of DNA molecular chains. Thereafter, Kantelhardt et al. (2002) proposed multifractal DFA (MF-DFA), a more practical model, to explore the multifractality in nonstationary time series, which is implemented through the following steps:

-

(1)

Suppose a time series \(\left\{{X}_{t},t=\mathrm{1,2},3\dots N\right\}\) with length N. Calculate the profile as

$$ Y_{i} = \mathop \sum \limits_{t = 1}^{i} \left[ {X_{t} - \overline{X}} \right] $$(1)where

$$ \overline{X} = \frac{1}{N}\mathop \sum \limits_{k = 1}^{N} X_{t} $$(2) -

(2)

Partition the profile \(\left\{ {Y_{i} } \right\}_{i = 1, \ldots ,N}\) into \(N_{s} \equiv {\text{int}}\left( \frac{N}{s} \right)\) non-overlapping segments with equal length s. Since the length N is always not divisible by s, a little portion in the tail of the series may remain. To take the whole profile into account, we repeat the same segmentation process starting from the other end. Hence, \({2N}_{s}\) segments are gotten in total.

-

(3)

Determine the local trend for every segment through the least-square fitting. And for \(v=1,...,{N}_{s}\), calculate the variance

$$ F_{v}^{2} \left( s \right) = \frac{1}{s}\mathop \sum \limits_{i = 1}^{s} \left\{ {Y\left[ {\left( {v - 1} \right)s + i} \right] - y_{v} \left( i \right)} \right\}^{2} $$(3)while for \(v = N_{s} + 1,...,2N_{s}\)

$$ F_{v}^{2} \left( s \right) = \frac{1}{s}\mathop \sum \limits_{i = 1}^{s} \left\{ {Y\left[ {N - \left( {v - 1} \right)s + i} \right] - y_{v} \left( i \right)} \right\}^{2} $$(4)where \({y}_{v}(i)\) is the local trend of segment v obtained by second order polynomial.

-

(4)

Take the mean value of all the segments to have the \(q\) th order fluctuation function,

$$ F_{q} \left( s \right) = \left\{ {\frac{1}{{2N_{s} }}\mathop \sum \limits_{v = 1}^{{2N_{s} }} \left[ {F_{v}^{2} \left( s \right)} \right]^{q/2} } \right\}^{1/q} $$(5)$$ F_{0} \left( s \right) = {\text{exp}}\left\{ {\frac{1}{{4N_{s} }}\mathop \sum \limits_{v = 1}^{{2N_{s} }} lnF_{v}^{2} \left( s \right)} \right\} $$(6)where the order q goes to any real value.

-

(5)

Make analysis of log–log plots \(F_{q} \left( s \right)\) versus s for every q value to measure the scaling behavior of the fluctuation functions. \(F_{q} \left( s \right)\) raises for large values as a power-law of s in the case that the data \(X_{t}\) has a long-range power-law correlation, that is to say

$$ F_{q} \left( s \right)\sim s^{h\left( q \right)} $$(7)Generally speaking, the exponent \(h\left( q \right)\) may count on q. If \(h\left( q \right)\) is constant for all q, the data series is mono-fractal. Otherwise, the series is multifractal. Note that when \(q = 2\), this approach simplifies to the initial DFA technique (Kantelhardt et al., 2002). At this moment, \(h\left( 2 \right) > 0.5\) denotes the persistence of the types of fluctuations. Otherwise, \(h\left( 2 \right) < 0.5\) suggests the anti-persitent of this kind of fluctuations. When \(h\left( 2 \right) = 0.5\), the types of fluctuations reveal random walk behavior.

-

(6)

The multifractal scaling exponent \(\tau \left( q \right)\) is related to \(h\left( q \right)\) through

$$ \tau \left( q \right) = qh\left( q \right) - D_{f} $$(8)where \(D_{f}\) is the measurement of geometric objects’ fractal dimension, and we set it as \({D}_{f}=1\) in this case. Thus, \(\tau (q)\) displays the scale-dependency of both smaller fluctuations for negative q values and larger fluctuations for positive q values. The τ(q) exponent of multifractal series increases nonlinearly with q. Then calculate the multifractal spectrum \(f(\alpha )\) by the Legendre transform of \(\tau (q)\):

$$ \alpha = \frac{d\tau \left( q \right)}{{dq}} = h\left( q \right) + qh^{\prime}\left( q \right) $$(9)$$ f\left( \alpha \right) = \alpha q - \tau \left( q \right) = q\left[ {\alpha - h\left( q \right)} \right] + 1 $$(10)

where \(f(\alpha )\) is the measurement of the time series’ dimension. \(f(\alpha )\) is a delta function and for the mono-fractal time series, there is only one value of \(\alpha \); otherwise, there is a distribution of \(\alpha \) values. \(\Delta h\) and \(\Delta \alpha\), calculated as \(\left\{\mathrm{max}({h}_{q})-\mathrm{min}({h}_{q})\right\}\) and \(\left\{\mathrm{max}(\alpha )-\mathrm{min}(\alpha )\right\}\) respectively, can be considered as two measurements of the multifractal degree (Mnif et al., 2020).

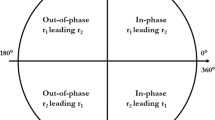

3.2 MF-DCCA

To quantify cross-correlation between non-stationary time series, an extended model of DFA, detrended cross-correlation analysis (DCCA) was put forward by Podobnik and Stanley (2008). Combining the thinking of MF-DFA and DCCA methodology, Zhou (2008) put forward multifractal detrended cross-correlation analysis (MF-DCCA) to reveal the multifractal properties of two non-stationary time series. In this paper, we utilize MF-DCCA to investigate the linkages between Chinese new energy markets and other six markets. This method can be demonstrated briefly as follows:

-

(1)

Suppose two data series \(\left\{ {x_{t} } \right\}\) and \(\left\{ {y_{t} } \right\}\) with N elements. The profiles of two time series can be calculated as, for \(i = 1, \ldots ,N\)

$$ X\left( i \right) = \mathop \sum \limits_{t = 1}^{N} \left( {x_{t} - \overline{x}} \right) $$(11)$$ Y\left( i \right) = \mathop \sum \limits_{t = 1}^{N} \left( {y_{t} - \overline{y}} \right) $$(12)where \(\overline{x }\) and \(\overline{y }\) respectively denote the means over the two whole time series respectively.

-

(2)

Make division of the two profiles \({\left\{{X}_{i}\right\}}_{i=1,\dots ,N}\) and \({\left\{{Y}_{i}\right\}}_{i=1,\dots ,N}\) into \({N}_{s}\equiv \) non-overlapping subseries of equal length s. Like the MF-DFA method, to fully investigate the information contained in the whole time series, we finally obtain \({2N}_{s}\) non-overlapping segments.

-

(3)

Determine the detrended covariance for each segment \(v\) of the profile. For \(v=1,...,{N}_{s}\),

$$ F_{v}^{2} \left( s \right) = \frac{1}{s}\mathop \sum \limits_{i = 1}^{s} \left| {\left[ {X\left( {v - 1} \right)s + i} \right] - x_{v} \left( i \right)} \right| \times \left| {\left[ {Y\left( {v - 1} \right)s + i} \right] - y_{v} \left( i \right)} \right| $$(13)and for \(v = N_{s} + 1,...,2N_{s}\),

$$ F_{v}^{2} \left( s \right) = \frac{1}{s}\mathop \sum \limits_{i = 1}^{s} \left| {X\left[ {N - \left( {v - 1} \right)s + i} \right] - x_{v} \left( i \right)} \right| \times \left| {Y\left[ {N - \left( {v - 1} \right)s + i} \right] - y_{v} \left( i \right)} \right| $$(14)where the \(x_{v} \left( i \right)\) and \(y_{v} \left( i \right)\) are fitted by second order polynomial respectively.

-

(4)

Average the local fluctuation function for all the subseries:

$$ F_{xy} \left( {q,s} \right) = \left\{ {\frac{1}{{2N_{s} }}\mathop \sum \limits_{v = 1}^{{2N_{s} }} \left[ {F_{v}^{2} \left( s \right)} \right]^{q/2} } \right\}^{1/q} $$(15)$$ F_{xy} \left( {0,s} \right) = {\text{exp}}\left\{ {\frac{1}{{4N_{s} }}\mathop \sum \limits_{v = 1}^{{2N_{s} }} lnF_{v}^{2} \left( s \right)} \right\} $$(16) -

(5)

Calculate the slope of the log–log plot of \(F_{q} \left( s \right)\) versus \(s\). This directly determines the scaling exponent \(h_{xy} \left( q \right)\), which reflects the power-law relationship between two related time series as

$$ F_{xy} \left( {q,s} \right)\sim s^{{h_{xy} \left( q \right)}} $$(17)

Especially, if \(\left\{{x}_{t}\right\}\) and \(\left\{{y}_{t}\right\}\) are two identical sequences, MF-DCCA amounts to MF-DFA. And when q = 2, it turns out to become DCCA.

According to Zou and Zhang (2020), the Renyi exponent \({\tau }_{xy}(q)=q{h}_{xy}(q)-1\) can be used to reveal the multifractal properties. If \({\tau }_{xy}(q)\) is nonlinearly varying with q, the cross-correlation of x(t) and y(t) is considered to be multifractal; otherwise, it is mono-fractal. After Legendre transform, the singularity strength \({\alpha }_{xy}(q)\) and the singularity spectrum \({f}_{xy}(\alpha )\) are calculated to describe the cross-correlation,

Similarly, the width of the spectrum \(\Delta \alpha_{xy}\), equivalent to \(\left\{ {{\text{max}}\left( {\alpha_{xy} } \right) - {\text{min}}\left( {\alpha_{xy} } \right)} \right\}\), as well as \(\Delta h_{xy} = \left\{ {{\text{max}}\left( {h_{xy} } \right) - {\text{min}}\left( {h_{xy} } \right)} \right\}\) describes the strength of multifractal cross-correlation.

3.3 The generation of transformed series

It is noted that long memory, fat-tail distribution and extreme events may contribute to the fractal characteristic (He & Wang, 2017). To test the source of multifractality, we transform the original return series into the shuffled, staggered and EVremoved series, to eliminate the three sources respectively through shuffling processing, phase random processing and extreme values removing processing in the following way (Wang et al., 2019; Mali & Mukhopadhyay, 2014; He & Wang, 2017):

Firstly, the shuffled series is to eliminate long memory effect, which is determined by shuffling and reordering the original sequence:

-

(1)

Randomly select a pair of random natural numbers \((p,q)\), where \(p<N\),\(q<N\);

-

(2)

Exchange the data at position \(p\) and position \(q\) in the original series;

-

(3)

Repeat the first two steps \(20*N\) times to ensure that the order of the original sequence is sufficiently disrupted.

Secondly, the influence of fat-tail distribution is removed by staggered series through the phase random processing to weaken the non-Gaussianness and generate sequence with normal distribution:

-

(1)

Discrete Fourier transform of the original sequence;

-

(2)

Rotate the sequence obtained in the first step by a random phase angle;

-

(3)

Perform an inverse Fourier transform on the sequence.

Lastly, given that violent fluctuations have an impact on the series’ property, EVremoved series occurs:

-

(1)

Make location and sort the original sequence from small to large, and remove the data points at the front end \(T/2\) and the last end \(T/2\), where T is the total amount of extreme data removed, and define \(T=5\%*N\);

-

(2)

Randomly select data from the remaining \(N-T\) data to replace the T vacancy. At this time the length of the series is restored to N again;

-

(3)

Rearrange the obtained N data to make them the same position as the data in the original series.

4 Data

4.1 Index Selection

In this paper, the CSI CN Mainland New Energy Index (000,941.CSI), short for CN New Energy (NEI), released by China Securities Index Co., Ltd is selected to analyze the multifractal characteristics and market efficiency of Chinese new energy market. This indicator selects 50 samples from the securities of listed companies involved in new energy production, new energy storage, new energy vehicles and other businesses in the Shanghai and Shenzhen stock markets, which are relatively larger in size and more profitable in the new energy sector. It can accurately and comprehensively report the overall performance of Chinese new energy market.

Besides, this work will explore the cross-correlation relationship between Chinese new energy market and its domestic traditional crude oil market, safe-haven asset, international crude oil and international renewable energy markets. There are two types of Daqing crude oil and Shengli crude oil in China and the Daqing crude oil price (DAQ) is selected to represent China’s crude oil market. Daqing Oilfield is the largest oil production base in China, therefore, Daqing crude oil spot is the main trading object and it determines the price mechanism of China's crude oil market (Lin et al., 2020). Shanghai Gold Exchange gold spot price (GOLD) is selected as the indictor of gold market in China (Pho et al., 2021). WTI crude oil, S&P Global Clean Energy Index (SPGCE), Wilder Hill Clean Energy Index (ECO) and European Renewable Energy Index (ERIX) are selected as indicators respectively on behalf of the international crude oil, global clean energy, U.S. clean energy and European clean energy markets. As is known, WTI crude oil expresses the market supply and demand conditions of the largest oil trading in the world, and is the benchmark price in the international energy market. SPGCE is a diverse portfolio involving in clean energy business, which provides liquid and tradable exposure to 30 companies worldwide. These companies are closely related to clean energy equipment, technology companies and clean energy production. ECO is comprised of clean and renewable energy companies in the United States, such as biofuels, hydrogen, solar energy, etc. (Dutta, 2017; Yahya et al., 2020). ERIX represents the share price of European companies related with new energy businesses like water, marine, solar, biofuels, wind and geothermal (Shahzad et al., 2020).

All the datasets from October 28, 2009 to March 31, 2021 are selected, the beginning of which is determined by NEI’s officially release date. Each sample covers 2619 daily data points (the data of the mismatched trading days are removed). Three indicators for Chinese market (NEI, DAQ and GOLD) and SPGCE are obtained from Wind database. ECO is collected from Yahoo Finance, while ERIX from Bloomberg and WTI from U.S. Energy Information Administration.

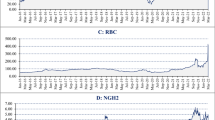

4.2 Descriptive statistics

Figure 1 shows the price fluctuations of China’s new energy index and other six assets. Since its releasing, NEI has experienced two periods of relatively obvious rise. The first period is experienced of intense volatility under the influence of China's bull stock market and the Paris Agreement adopted at the 2015 Paris Climate Conference. The second segment is influenced by China's 14th 5-Year Plan after 2020, which emphasizes the importance of green growth and clearly proposes to accelerate the development of new energy industry. The DAQ and WTI prices moved roughly in line and they both decreased sharply under the influence of COVID-19 in 2020. The trends of SPGCE, ECO and ERIX indexes were not exactly the same in the first 3 years, but they become basically similar after 2012. NEI have also showed the same tendency with them since 2020. When crude oil fell sharply due to COVID-19, the price of gold rose, and even achieved the highest price during the sample period, reflecting that gold had a hedging effect on crude oil (Mensi et al., 2021a, b).

For the purpose of eliminating the influence of absolute price fluctuations, the logarithmic return of the index is adopted, calculated as \({r}_{t}=\mathrm{ln}\left({P}_{t}\right)-\mathrm{ln}({P}_{t-1})\), where \({P}_{t}\) represents the price of the index at time t. Table 1 lists the descriptive statistics of the logarithmic returns for the seven analyzed variables. The NEI is in line with the GOLD’s average return, but the standard deviation of the former is about twice that of the latter, showing a higher volatility. Compared with crude oil of both DAQ and WTI, NEI has smaller fluctuations. Among four new energy indicators, except SPGCE, the average returns of the other three are all positive, indicating that the new energy market of China, America and Europe has a good development during the observation period, which is higher than the global level. ECO has the largest standard deviation, followed by NEI and ERIX, while SPGCE is the most stable with the smallest standard deviation. The skewness of each variable is significantly non-zero, and each kurtosis is greater than 3, showing an obvious “sharp peak and fat-tail” feature. In addition, through J-B statistics, it is further proved that their returns do not obey the standard normal distribution, which rejects Efficient Market Hypothesis.

5 Results and Discussions

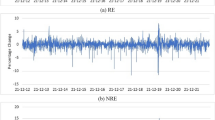

5.1 Multifractal Analysis of NEI Returns

5.1.1 Multifractal Property by MF-DFA

For the sake of studying the multifractal property of Chinese new energy market, we exploit MF-DFA technic to NEI return series. The range of time scale is set as \(20<s<N/10\), where N is the length of the data. Figure 2a shows the log–log plot of the fluctuation functions \({F}_{q}(s)\) versus time scale \(s\), with the value of q from − 10 to 10. Whatever value q takes, almost every line fitting the fluctuation functions curve well, illustrating that there is a power law relationship between \({F}_{q}(s)\) and \(s\). The generalized Hurst exponent of NEI returns in Fig. 2b shows an obvious smoothly-decreasing tendency (not a constant) with the value of q, indicating significant multifractal property. For q = 2, the classical Hurst exponent is 0.5338, suggesting a relatively positive persistent fluctuations, which also means a slightly strong positive long-range correlation. In other words, the NEI’s return can be positively influenced by the former returns. When the returns increased (decreased) in the past, the returns will very likely increase (decrease) afterwards. For q > 4, \(h(q)\) falls below 0.5, indicating anti-persistent fluctuations. It can be concluded that the return sequence exists persistent properties for smaller-scale fluctuations, while displays anti-persistent features for larger-scale fluctuations. NEI’s multifractal feature can be further indicated through the multifractal scaling exponent \(\tau (q)\) in Fig. 2c, where \(\tau (q)\) is increasing nonlinearly with q. Observing the concavity and convexity of the \(\tau (q)\) curve, it can be roughly concluded that the NEI sequence has a relatively strong multifractal property. Figure 2d exhibits the multifractal spectrum \(f(\alpha )\). The spectrum displays a single peak function not a point, also declaring that NEI series has no mono-fractality, but a multifractal feature.

Furthermore, \(\Delta h\) and \(\Delta \alpha\), are calculated for the efficiency intensity of Chinese new energy market quantitatively. The greater \(\Delta h\) and \(\Delta \alpha\) means the higher degree of multifractality and the lower market efficiency. The \(\Delta h\) and \(\Delta \alpha\) of NEI are 0.4471 and 0.6014 respectively, which are far from 0, showing that the Chinese new energy market has obvious multifractal characteristics, and the market efficiency is low.

5.1.2 Source of Multifractal Characteristics

It is generally believed that long memory, fat-tail distribution and extreme values are three main reasons for multifractalities (He & Wang, 2017). To explore the multifractal source of NEI, the return series is transformed to series that eliminates the above three sources by shuffling processing (Wang et al., 2019), phase random processing (Mali & Mukhopadhyay, 2014) and extreme values removing processing (He & Wang, 2017) respectively. The transformed series are named as shuffled, staggered and EVremoved series. If any of them has a significantly lower multifractal degree, indicating that this source is the main source of multifractality of NEI returns.

As shown in Fig. 3a, the generalized Hurst exponents of shuffled, staggered and EVremoved series are all related to q, showing that they hold multifractal properties. But the structural characteristics are different. Apparently, the changes of \(h(q)\) for the shuffled series become gentler. The \(\Delta h\) in Table 2, which is the degree of multifractality, displays that \(\Delta h_{Shuffled} < \Delta h_{Staggered} < \Delta h_{EVremoved} < \Delta h_{Original}\). The result indicates that three main factors all contribute to the multifractality of the NEI return series, while long memory has the greatest impact with \(\Delta h\) reducing from 0.4471 to 0.1411. Besides, to mention, the classic Hurst exponents of three deformed sequences are smaller than the original series. Especially, the \(h(2)\) of EVremoved series is 0.4620, showing anti-persistent fluctuations. It can be interpreted that the following value will be inversely influenced by the present value. While for staggered series, \(h(2)\) is very close to 0.5, indicating the sequence is random walk and the present returns will not have an impact of the future returns.

The multifractal spectrum in Fig. 3b shows and confirms the similar results. In comparison, its shuffled series has the smaller width of the multifractal spectrum than that of any other test series, showing that the multifractal degree of reordering series is the lowest. Compared with the original sequence, the multifractal degree of staggered series and EVremoved series is also lowered, but the degree of reduction is comparatively slight. In other words, the long-term memory contributes most to the multifractal characteristics of the NEI return series. In addition, it is observed that the \(\Delta \alpha\) of EVremoved series is the second smallest, indicating that the local fluctuations in NEI return series become more even after removing the extreme values, followed by staggered series.

5.2 Multifractal Cross-Correlations Between NEI and Other Assets

5.2.1 Cross-Correlation Analysis

Firstly, we exploit the cross-correlation statistic \({Q}_{cc}(m)\) (Podobnik et al., 2009) to qualitatively test whether there is cross-correlation between the NEI returns and other assets, that is, Daqing crude oil (DAQ), China’s gold (GOLD), WTI crude oil and three new energy indexes (SPGCE, ECO and ERIX). For two time series, \(\left\{{x}_{t},\mathrm{t}=\mathrm{1,2},...N\right\}\) and \(\left\{{y}_{t},\mathrm{t}=\mathrm{1,2},...N\right\}\), the \({Q}_{cc}(m)\) statistic is defined by the following formula:

where \({c}_{i}\) is the coefficient of cross correlation. \({Q}_{cc}(m)\) statistic roughly obeys the Chi-square distribution with m degrees of freedom\(\chi^{2} {\text{m}}\). \({Q}_{cc}(m)\) exceeds \(\chi^{2} {\text{m}}\) at the 5% significance level represents the null hypothesis that the inexistent cross-correlation between the two sequences is rejected with 95% confidence. Under this circumstance, \(\left\{{x}_{t}\right\}\) and \(\left\{{y}_{t}\right\}\) is considered to be cross-correlated, and vice versa.

Figure 4 calculates the cross-correlation statistics \({Q}_{cc}(m)\) of six pairs of variables, in which the degree of freedom is \(m\in \left[\mathrm{0,600}\right]\). It can be found that the \({Q}_{cc}(m)\) of NEI-SPGCE, NEI-ECO and NEI-ERIX are always greater than the critical value, indicating that Chinese new energy market has significant cross-correlation with the global, U.S. and European new energy markets. The cross-correlation statistics of NEI-GOLD fluctuate around the critical value, showing that their cross-correlation is insignificant. It implies that gold can play a role in diversifying risks in the investment portfolio of new energy industry. In addition, it is noted that when the degree of freedom is less than 390, the cross-correlation statistics of NEI-DAQ is higher than the critical value, demonstrating a significant cross-correlation, while there is no cross-correlation between NEI and DAQ when the freedom degree higher than 390. For NEI-WTI, in the case of \(m\in (\mathrm{0,160})\bigcup (\mathrm{300,600})\), there is no cross-correlation and for \(m\in (\mathrm{160,300})\), the cross-correlation relationship significantly exists. Besides, the cross correlation of NEI-DAQ has a larger range of significance than NEI-WTI. In other words, as a representative of the internal crude oil market, Daqing crude oil has a stronger association with NEI than the external market of WTI.

Secondly, the DCCA coefficient (Zebende, 2011) is utilized to quantify the cross-correlation. It is decribed as a fraction, whose numerator is the fluctuation function of detrended covariance \({F}_{DCCA}^{2}\) (q = 2 in MF-DCCA) and the denominator is the product of two detrended variance \({F}_{DFA}^{2}\).

The value range of \({\rho }_{DCCA}\) is \(\left[-1,1\right]\). There exists anti cross-correlation when \(-1<{\rho }_{DCCA}<0\). And for \(0<{\rho }_{DCCA}<1\), there is cross-correlation. For particular, when \({\rho }_{DCCA}=-1\), that represents two series are anti cross-correlated perfectly; \({\rho }_{DCCA}=0\) reveals there exists no cross-correlation; and \({\rho }_{DCCA}=1\) represents perfect cross-correlation.

Figure 5 depicts the DCCA coefficients for the six pairs of assets under different window size \(s\). All the coefficients are above zero, showing positive cross-correlations (except one point for NEI-WTI). Then, China’s new energy index holds an obviously stronger association with other new energy indices, among which NEI-SPGCE has the strongest performance, closely followed by NEI-ECO. European new energy has the weakest linkage with NEI. Besides, it is seen that at large scale s, their correlations are strengthened. Daqing crude oil is more related with NEI than WTI. The DCCA coefficient of NEI-GOLD is the smallest on the whole, demonstrating a weak correlation.

5.2.2 MF-DCCA Analysis

In this subsection, we furthermore explore the multifractal property of the cross-correlations between NEI and other six assets by MF-DCCA. Figure 6 obtains the log–log graphs of fluctuation function \({F}_{xy}(q,s)\) versus time scale s, which apparently shows that each pair of assets has power-law relationships. Figure 7a–c depict the generalized Hurst exponent \({h}_{xy}(q)\), multifractal scaling exponent \({\tau }_{xy}(q)\) and multifractal spectrum \({f}_{xy}(\alpha )\) respectively. Obviously, for each return pair, \({h}_{xy}(q)\) and \({\tau }_{xy}(q)\) is nonlinearly changing with the change of q, which suggests the multifractal characteristics of every cross-correlation. The difference between the \({h}_{xy}(q)\) and \({\tau }_{xy}(q)\) curves is that the former is quite different for each pair correlation, while the \({\tau }_{xy}(q)\) of six pairs of correlations are basically the same. For instance, when \(q\hspace{0.17em}\)< – 3, the NEI-DAQ and NEI-WTI, as well as NEI-SPGCE and NEI-ERIX almost have the equal values. It is difficult to compare the strength difference of multifractal features by simply observing each line’s convexity.

But the strength of multifractality is noticed to be very different. Table 3 exhibits the degree of multifractality \(\Delta h_{xy}\) and the width of multifractal spectrum \(\Delta \alpha_{xy}\). It is observable that the multifractality of NEI-ERIX is the most obvious in the new energy category. NEI-SPGCE has a weaker multifractal property. The multifractality of the cross-correlation of NEI-ECO is the least obvious with \(\Delta h_{xy}\). only 0.0396. The \(\Delta \alpha_{xy}\) of NEI-ECO is 0.0743, which is close to 0, again indicating that the cross-correlation hardly processes multifractal feature. The \(\Delta h_{xy}\) of NEI-WTI and NEI-ERIX are almost the same, while \(\Delta \alpha_{xy}\) of NEI-WTI is a bit bigger (\(\Delta \alpha_{xy}\)= 0.4516), verifying the most significant multifractal property. In regard to the cross correlation between China’s new energy market and crude oil markets, there is a stronger multifractality of international market than domestic one, for the \(\Delta \alpha_{xy}\) of NEI-WTI (0.4516) is higher than NEI-DAQ (0.3104). In terms of the two pairs of domestic assets, NEI-GOLD has a relatively weaker multifractal feature than NEI-DAQ.

5.2.3 Sources of Multifractal Cross-Correlation Characteristics

Similar to investigating the source of NEI multifractal features, we obtain shuffled series, staggered series and EVremoved series of NEI, DAQ, GOLD, WTI, SPGCE, ECO, ERIX respectively and perform MF-DCCA on each pair of NEI and other assets. Table 4 illustrates a comparison of strength of multifractality for the original return pairs and deformed sequences. As for NEI-DAQ, \( \Delta h_{xy}\) and \(\Delta \alpha_{xy}\) of the EVremoved series are both significantly decreased in comparison with that of the original return pair, where \(\Delta h_{xy}\) changes from 0.1813 to 0.0462 and \(\Delta \alpha_{xy}\) from 0.3104 to 0.1168. It indicates that extreme value is the primary source of NEI-DAQ multifractal property. Extreme value is secondary source of multifractal NEI-WTI, and the distribution of fat-tail is the principal source for NEI-WTI’s multifractal property. In terms of NEI-GOLD, the \(\Delta h_{xy}\) and \(\Delta \alpha_{xy}\) of EVremoved series has a maximum change, implying the extreme value is the biggest contribution to the multifractal characteristic of their cross-correlation. With regard to NEI-SPGCE and NEI-ERIX, the shuffled series process the lowest multifractality, implying that the long-term memory contributes most to the multifractal relevance of them. The staggered series of NEI-ECO exhibits a relatively much lower degree of multifractality, declaring that fat-tailed distribution contributes more to the multifractal cross-correlation relationship of NEI and ECO.

6 Conclusions

With the increase of public awareness of environmental protection and sustainable development, new energy is becoming more and more popular. This paper focuses on the efficiency of China’s new energy market (NEI) and cross-correlation with other assets. The MF-DFA is first exploited to verify the multifractal characteristics of Chinese new energy market. The results suggest that it is indeed multifractal, implying that it is not efficient enough. Further, we explore the source of its multifractality and conclude that long-range correlation contributes most. Then, the association and multifractality between Chinese new energy market and six assets are explored by cross-correlation analysis and MF-DCCA, including domestic crude oil, domestic gold, international crude oil, global new energy market (SPGCE), U.S. new energy market (ECO), and European new energy market (ERIX). The heterogeneous strength of the cross-correlations is revealed. In terms of associations with other new energy markets, NEI displays the strongest association with SPGCE, followed by ECO, and the European market shows the weakest association. Further, the long memory leads to the multifractalities of NEI-SPGCE and NEI-ERIX, while what contributes more to the multifractality of NEI-ECO is fat-tail distribution. With regard to the crude oil, internal market has a greater linkage with NEI than external market. Extreme values mainly lead to the multifractal NEI-DAQ, and fat-tail distribution is the major source for NEI-WTI. Besides, extreme values also lead to the multifractality of NEI-GOLD, and that may also make some contributions to the insignificant influence of the gold market on the new energy market.

The findings of this paper will have certain reference significance for the Chinese government, new energy companies and investors. Firstly, the authorities can have a comprehensive understanding of the associations between new energy market and other markets so as to make policies that are more suitable for the current situation in China. For example, Chinese new energy market has strong linkages with the international new energy markets, so the government should pay full attention to relevant policies formulated by foreign governments. Besides, China's new energy market is proved to be more significantly affected by domestic oil prices than international ones. Therefore, when formulating policies related to energy reform, the government should not only focus on the factors that affect international crude oil, but also pay special attention to changes in domestic oil prices to avoid shocks in the new energy business. Secondly, based on the research conclusions of other studies and this work, the new energy estate is affected by many factors to varying degrees. However, it all boils down to the degree of development of the new energy industry itself. Thus, for companies, they need to increase R&D investment or publicity, gradually reduce the cost of new energy production and increase the public's awareness of employing new energy, and finally realize the dominance of the new energy share in the energy field. Thirdly, investors can find out the pattern of new energy market in China and make the correct investment decisions. The low-efficiency market gives investors chance to gain excess income. In turn, the herding effect of investors creates a higher autocorrelation, which is exact the source of the multifractality of Chinese new energy market. Thus, considering the connection between new energy markets, investors should notice the price trends of the foreign new energy markets to avoid linkage risks. Lastly, investing in gold and new energy markets at the same time is regarded as a wise decision, because a certain degree of risk diversification can be achieved. It is worth mentioning that we have discovered the multifractality of Chinese new energy market, indicating that it is not suitable to study the characteristics of China's new energy market under the framework of the Efficient Markets Hypothesis.

In the future, our work can be extended in the following directions. Firstly, the correlation relationship does not mean the causality. Therefore, the causality between China’s new energy stock market with other new energy indices and traditional fossil is worth exploring. Besides, based on a microscopic perspective, the relationship between the stock price of individual firms in the new energy field can also be considered to analyze. For investors, constructing energy-themed portfolios from individual stocks may be more useful and easier to implement than indices.

Notes

The concept of new energy used in this article is consistent with the clean energy, renewable energy, and alternative energy used in other literatures.

References

Abbaszadeh, M. R., Nooghabi, M. J., & Rounaghi, M. M. (2020). Using Lyapunov’s method for analysing of chaotic behaviour on financial time series data: A case study on Tehran stock exchange. National Accounting Review, 2(3), 297–308.

Al-Yahyaee, K. H., Mensi, W., Ko, H., Yoon, S., & Kang, S. H. (2020). Why cryptocurrency markets are inefficient: The impact of liquidity and volatility. North American Journal of Economics and Finance, 52, 101168.

Amman, H. M., & Kendrick, D. A. (1995). Nonconvexities in stochastic control models. International Economic Review, 36(2), 455–475.

Aslam, F., Aziz, S., Nguyen, D. K., Mughal, K. S., & Khan, M. (2020). On the efficiency of foreign exchange markets in times of the COVID-19 pandemic. Technological Forecasting and Social Change, 161, 120261.

Bondia, R., Ghosh, S., & Kanjilal, K. (2016). International crude oil prices and the stock prices of clean energy and technology companies: Evidence from non-linear cointegration tests with unknown structural breaks. Energy, 101, 558–565.

Cao, G., Cao, J., Xu, L., & He, L. (2014). Detrended cross-correlation analysis approach for assessing asymmetric multifractal detrended cross-correlations and their application to the Chinese financial market. Physica A: Statistical Mechanics and Its Applications, 393, 460–469.

Dawar, I., Dutta, A., Bouri, E., & Saeed, T. (2021). Crude oil prices and clean energy stock indices: Lagged and asymmetric effects with quantile regression. Renewable Energy, 163, 288–299.

Dutta, A. (2017). Oil price uncertainty and clean energy stock returns: New evidence from crude oil volatility index. Journal of Cleaner Production, 164, 1157–1166.

Dutta, A., Bouri, E., & Noor, M. H. (2018). Return and volatility linkages between CO2 emission and clean energy stock prices. Energy, 164, 803–810.

Elie, B., Naji, J., Dutta, A., & Uddin, G. S. (2019). Gold and crude oil as safe-haven assets for clean energy stock indices: Blended copulas approach. Energy, 178, 544–553.

Fisher, P. G., & Hughes Hallett, A. J. (1992). Nonstationary model solution techniques and the USA algorithm: Some practical experience. Journal of Economic Dynamics and Control, 16, 109–116.

Gu, F., Wang, J. Q., Guo, J. F., & Fan, Y. (2020). How the supply and demand of steam coal affect the investment in clean energy industry? Evidence from China. Resources Policy, 69, 101788.

Hammoudeh, S., Ajmi, A. N., & Mokni, K. (2020). Relationship between green bonds and financial and environmental variables: A novel time-varying causality. Energy Economics, 92, 104941.

He, S. S., & Wang, Y. D. (2017). Revisiting the multifractality in stock returns and its modeling implications. Physica A: Statistical Mechanics and Its Applications, 467, 11–20.

He, X. J., Mishra, S., Aman, A., Shahbaz, M., Razzaq, A., & Sharif, A. (2021). The linkage between clean energy stocks and the fluctuations in oil price and financial stress in the US and Europe? Evidence from QARDL approach. Resources Policy, 72, 102021.

Henriques, I., & Sadorsky, P. (2008). Oil prices and the stock prices of alternative energy companies. Energy Economics, 30(3), 998–1010.

Jiang, Z. Q., & Zhou, W. X. (2011). Multifractal detrending moving-average cross-correlation analysis. Physical Review E, 84(1 Pt 2), 16106.

Kantelhardt, J. W., Zschiegner, S. A., Koscielny-Bunde, E., Havlin, S., Bunde, A., & Stanley, H. E. (2002). Multifractal detrended fluctuation analysis of nonstationary time series. Physica A: Statistical Mechanics and Its Applications, 316(1), 87–114.

Kassouri, Y., Kacou, K. Y. T., & Alola, A. A. (2021). Are oil-clean energy and high technology stock prices in the same straits? Bubbles Speculation and Time-Varying Perspectives. Energy, 232, 121021.

Kendrick, D. A., Amman, H. M., & Tucci, M. P. (2014). Learning about learning in dynamic economic models. Handbook of Computational Economics, 3, 1–35.

Kristjanpoller, W., Bouri, E., & Takaishi, T. (2020). Cryptocurrencies and equity funds: Evidence from an asymmetric multifractal analysis. Physica A: Statistical Mechanics and Its Applications, 545, 123711.

Kumar, S., Managi, S., & Matsuda, A. (2012). Stock prices of clean energy firms, oil and carbon markets: A vector autoregressive analysis. Energy Economics, 34(1), 215–226.

Li, S., Lu, X., & Liu, X. (2020). Dynamic relationship between Chinese RMB exchange rate index and market anxiety: A new perspective based on MF-DCCA. Physica A: Statistical Mechanics and Its Applications, 541, 123405.

Lin, Y., Xiao, Y., & Li, F. (2020). Forecasting crude oil price volatility via a HM-EGARCH model. Energy Economics, 87, 104693.

Mali, P., & Mukhopadhyay, A. (2014). Multifractal characterization of gold market: A multifractal detrended fluctuation analysis. Physica A: Statistical Mechanics and Its Applications, 413, 361–372.

Managi, S., & Okimoto, T. (2013). Does the price of oil interact with clean energy prices in the stock market? Japan and the World Economy, 27, 1–9.

Mandelbrot, B. (1963). The variation of certain speculative prices. The Journal of Business, 36(4), 394–419.

Mensi, W., Al Rababa’A, A. R., Vo, X. V., & Kang, S. H. (2021). Asymmetric spillover and network connectedness between crude oil, gold, and Chinese sector stock markets. Energy Economics, 98, 105262.

Mensi, W., Vo, X. V., & Kang, S. H. (2021). Upside-downside multifractality and efficiency of green bonds: the roles of global factors and COVID-19. Finance Research Letters, 43, 101995.

Mnif, E., Jarboui, A., & Mouakhar, K. (2020). How the cryptocurrency market has performed during COVID 19? A multifractal analysis. Finance Research Letters, 36, 101647.

Moradi, M., Nooghabi, M. J., & Rounaghi, M. M. (2019). Investigation of fractal market hypothesis and forecasting time series stock returns for Tehran stock exchange and London stock exchange. International Journal of Finance & Economics, 26(1), 662–378.

Niu, H. L. (2021). Correlations between crude oil and stocks prices of renewable energy and technology companies: A multiscale time-dependent analysis. Energy, 221, 119800.

Niu, H. L., & Wang, J. (2014). Phase and multifractality analyses of random price time series by finite-range interacting biased voter system. Computational Statistics, 29(5), 1045–1063.

Norouzzadeh, P., & Rahmani, B. (2006). A multifractal detrended fluctuation description of Iranian rial–US dollar exchange rate. Physica A: Statistical Mechanics and Its Applications, 367, 328–336.

Ola, M. R., Nooghabi, M. J., & Rounaghi, M. M. (2014). Chaos process testing (using local polynomial approximation model) in predicting stock returns in Tehran stock exchange. Asian Journal of Research in Banking and Finance, 4(11), 100–109.

Oswiecimka, P., Drozdz, S., Forczek, M., Jadach, S., & Kwapien, J. (2014). Detrended cross-correlation analysis consistently extended to multifractality. Physical Review E, 89(2), 23305.

Peng, C. K., Buldyrev, S. V., Havlin, S., Simons, M., Stanley, H. E., & Goldberger, A. L. (1994). Mosaic organization of DNA nucleotides. Physical Review E, 49(2), 1685–1689.

Peters, E. E. (1991). Chaos and order in the capital markets. European Company Law, 1, 1231.

Pho, K. H., Ly, S., Lu, R., Hoang, T. H. V., & Wong, W. (2021). Is Bitcoin a better portfolio diversifier than gold? A copula and sectoral analysis for China. International Review of Financial Analysis, 74, 101674.

Podobnik, B., Grosse, I., Horvatić, D., Ilic, S., Ivanov, P. C., & Stanley, H. E. (2009). Quantifying cross-correlations using local and global detrending approaches. The European Physical Journal B, 71(2), 243–250.

Podobnik, B., & Stanley, H. E. (2008). Detrended cross-correlation analysis: A new method for analyzing two nonstationary time series. Physical Review Letters, 100(8), 84102.

Reboredo, J. C. (2015). Is there dependence and systemic risk between oil and renewable energy stock prices? Energy Economics, 48, 32–45.

Reboredo, J. C., Rivera-Castro, M. A., & Ugolini, A. (2017). Wavelet-based test of co-movement and causality between oil and renewable energy stock prices. Energy Economics, 61, 241–252.

Reboredo, J. C., & Ugolini, A. (2018). The impact of twitter sentiment on renewable energy stocks. Energy Economics, 76, 153–169.

Rounaghi, M. M., & Zadeh, F. N. (2016). Investigation of market efficiency and Financial Stability between S&P 500 and London Stock Exchange: Monthly and yearly forecasting of time series stock returns using ARMA model. Physica A: Statistical Mechanics and Its Applications, 456, 10–21.

Shahzad, S. J. H., Bouri, E., Kayani, G. M., Nasir, R. M., & Kristoufek, L. (2020). Are clean energy stocks efficient? Asymmetric multifractal scaling behaviour. Physica A, 550, 124519.

Sun, C. W., Ding, D., Fang, X. M., Zhang, H. M., & Li, J. L. (2019). How do fossil energy prices affect the stock prices of new energy companies? Evidence from Divisia energy price index in China’s market. Energy, 169, 637–645.

Wang, F., Ye, X., & Wu, C. X. (2019). Multifractal characteristics analysis of crude oil futures prices fluctuation in China. Physica A: Statistical Mechanics and Its Applications, 533, 122021.

Wang, J., Shao, W., & Kim, J. (2020). Analysis of the impact of COVID-19 on the correlations between crude oil and agricultural futures. Chaos, Solitons & Fractals, 136, 109896.

Wang, J., Shao, W., Ma, C. M., Chen, W. B., & Kim, J. (2021). Co-movements between shanghai composite index and some fund sectors in China. Physica A: Statistical Mechanics and Its Applications, 573, 125981.

Wang, Y. D., Liu, L., & Gu, R. B. (2009). Analysis of efficiency for Shenzhen stock market based on multifractal detrended fluctuation analysis. International Review of Financial Analysis, 18(5), 271–276.

Wen, X. Q., Guo, Y. F., Wei, Y., & Huang, D. S. (2014). How do the stock prices of new energy and fossil fuel companies correlate? Evidence from China. Energy Economics, 41, 63–75.

Yahya, M., Ghosh, S., Kanjilal, K., Dutta, A., & Uddin, G. S. (2020). Evaluation of cross-quantile dependence and causality between non-ferrous metals and clean energy indexes. Energy, 202, 117777.

Yan, R., Yue, D., Wu, X., & Gao, W. (2021). Multiscale multifractal detrended fluctuation analysis and trend identification of liquidity in the China’s stock markets. Computational Economics. https://doi.org/10.1007/s10614-021-10215-5

Yao, C. Z., Liu, C., & Ju, W. J. (2020). Multifractal analysis of the WTI crude oil market, US stock market and EPU. Physica A: Statistical Mechanics and Its Applications, 550, 124096.

Zebende, G. F. (2011). DCCA cross-correlation coefficient: Quantifying level of cross-correlation. Physica A: Statistical Mechanics and Its Applications, 390(4), 614–618.

Zhang, G. F., & Du, Z. P. (2017). Co-movements among the stock prices of new energy, high-technology and fossil fuel companies in China. Energy, 135, 249–256.

Zhou, W. X. (2008). Multifractal detrended cross-correlation analysis for two nonstationary signals. Physical Review E, 77, 66211.

Zou, S., & Zhang, T. (2020). Multifractal detrended cross-correlation analysis of the relation between price and volume in European carbon futures markets. Physica A: Statistical Mechanics and Its Applications, 537, 122310.

Funding

The work was partially supported by the Fundamental Research Funds for the Central Universities (No. FRF-BR-20-04B).

Author information

Authors and Affiliations

Contributions

ZF: Investigation, Data curation, Writing-original draft. HN: Conceptualization, Supervision, Methodology, Writing-review &editing, Project administration. WW: Conceptualization, Supervision.

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no known competing financial interest or personal relationships that could have appeared to influence the work reported in this paper.

Ethical approval

The authors declare that they strictly follow the “Ethical Responsibilities of Authors” required by the journal.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Fu, Z., Niu, H. & Wang, W. Market Efficiency and Cross-Correlations of Chinese New Energy Market with Other Assets: Evidence from Multifractality Analysis. Comput Econ 62, 1287–1311 (2023). https://doi.org/10.1007/s10614-022-10301-2

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10614-022-10301-2