Abstract

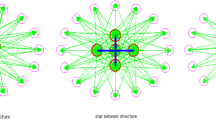

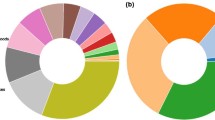

In a transaction between two firms, the buyer is expected to pay the seller with cash; however, due to the buyer’s lack of liquidity, an account receivable might be provided instead. Accounts Receivable Financing (ARF) is a type of trade credit that facilitates Korean interfirm transactions. Under ARF, the obligation to reimburse the bank is imputed to the seller if the buyer does not repay the loan to the bank. When the buyer confronts a liquidity shortage and fails to repay the trade credits, unfortunately, the shock is not limited to damage to only the seller because it propagates throughout the interfirm network. The shock is easily propagated because it is highly likely that the seller would also be unable to repay obligations to its own sellers. Since annual interfirm networks follow a scale-free network model, a single liquidity shock triggers a systemic risk. The insolvency of topologically more central buyer firms is shown to pose a higher potential risk to the financial market. In contrast, the firm size is not significantly related to potential risk. Therefore, firms with high centrality should be closely monitored to prevent insolvency crisis and propagation of the liquidity shock in the interfirm network.

Similar content being viewed by others

References

Albert, R., Jeong, H., & Barabási, A.-L. (2000). Error and attack tolerance of complex networks. Nature, 406, 378–382.

Allen, F., & Gale, D. (2000). Financial contagion. Journal of Political Economy, 108(1), 1–33.

Barabási, A.-L., & Albert, R. (1999). Emergence of scaling in random networks. Science, 286, 509–512.

Battiston, S., Gatti, D. D., Gallegati, M., Greenwald, B., & Stiglitz, J. E. (2012a). Liaisons dangereuses: Increasing connectivity, risk sharing, and systemic risk. Journal of Economic Dynamics and Control, 36(8), 1121–1141.

Battiston, S., Gatti, D. D., Gallegati, M., Greenwald, B., & Stiglitz, J. E. (2012b). Default cascades: When does risk diversification increase stability? Journal of Financial Stability, 8(3), 138–149.

Battiston, S., Puliga, M., Kaushik, R., Tasca, P., & Caldarelli, G. (2012c). DebtRank: Too central to fail? Financial networks, the FED and systemic risk. Scientific Reports, 2, 541.

Boissay, F., & Gropp, R. (2013). Payment defaults and interfirm liquidity provision. Review of Finance, 17(6), 1853–1894.

Bongini, P., Nieri, L., & Pelagatti, M. (2015). The importance of being systemically important financial institutions. Journal of Banking and Finance, 50, 562–574.

Boss, M., Elsinger, H., Summer, M., & Thurner, S. (2004a). Network topology of the interbank market. Quantitative Finance, 4(6), 677–684.

Boss, M., Summer, M., & Thurner, S. (2004b). Contagion flow through banking networks. In Lecture notes in computer science (Vol. 3038, pp. 1070–1077).

Cheng, I. H., Hong, H., & Scheinkman, J. A. (2015). Yesterday’s heroes: Compensation and risk at financial firms. Journal of Finance, 70(2), 839–879.

Clauset, A., Shalizi, C. R., & Newman, M. E. J. (2009). Power-law distributions in empirical data. SIAM Review, 51(4), 661–703.

Coad, A., Segarra, A., & Teruel, M. (2016). Innovation and firm growth: Does firm age play a role? Research Policy, 45(2), 387–400.

Cohen, R., Erez, K., ben-Avraham, D., & Havlin, S. (2001). Breakdown of the internet under intentional attack. Physical Review Letters, 86(16), 3682–3685.

De Nicolo, G., & Kwast, M. L. (2002). Systemic risk and financial consolidation: Are they related? Journal of Banking & Finance, 26(5), 861–880.

Georg, C.-P. (2013). The effect of the interbank network structure on contagion and common shocks. Journal of Banking & Finance, 37(7), 2216–2228.

Godlewski, C. J., Sanditov, B., & Burger-Helmchen, T. (2012). Bank lending networks, experience, reputation, and borrowing costs: Empirical evidence from the french syndicated lending market. Journal of Business Finance & Accounting, 39(1–2), 113–140.

Graham, J. R., Harvey, C. R., & Puri, M. (2013). Managerial attitudes and corporate actions. Journal of Financial Economics, 109(1), 103–121.

Hill, M. D., Kelly, G. W., & Lockhart, G. B. (2012). Shareholder returns from supplying trade credit. Financial Management, 41(1), 255–280.

Huang, X., Zhou, H., & Zhu, H. B. (2012). Assessing the systemic risk of a heterogeneous portfolio of banks during the recent financial crisis. Journal of Financial Stability, 8(3), 193–205.

Karimi, F., & Raddant, M. (2016). Cascades in real interbank markets. Computational Economics, 47(1), 49–66.

Kini, O., & Williams, R. (2012). Tournament incentives, firm risk, and corporate policies. Journal of Financial Economics, 103(2), 350–376.

Kosmidou, K. V., Kousenidis, D. V., & Negakis, C. I. (2015). The impact of the EU/ECB/IMF bailout programs on the financial and real sectors of the ase during the Greek sovereign crisis. Journal of Banking & Finance, 50, 440–454.

Lenzu, S., & Tedeschi, G. (2012). Systemic risk on different interbank network topologies. Physica A: Statistical Mechanics and its Applications, 391(18), 4331–4341.

Liu, J.-G., Wang, Z.-T., & Dang, Y.-Z. (2005). Optimization of robustness of scale-free network to random and targeted attacks. Modern Physics Letters B, 19(16), 785–792.

Markose, S., Giansante, S., & Shaghaghi, A. R. (2012). ’Too interconnected to fail’ financial network of US CDS market: Topological fragility and systemic risk. Journal of Economic Behavior & Organization, 83(3), 627–646.

Martinez-Sola, C., Garcia-Teruel, P. J., & Martinez-Solano, P. (2014). Trade credit and SME profitability. Small Business Economics, 42(3), 561–577.

Mishkin, F. S. (2006). How big a problem is too big to fail? A review of Gary Stern and Ron Feldman’s “too big to fail: The hazards of bank bailouts”. Journal of Economic Literature, 44(4), 988–1004.

Newman, M. E. J. (2003). The structure and function of complex networks. SIAM Review, 45(2), 167–256.

Newman, M. E. J. (2005). A measure of betweenness centrality based on random walks. Social Networks, 27(1), 39–54.

O’Hara, M., & Shaw, W. (1990). Deposit insurance and wealth effects: The value of being ’too big to fail’. Journal of Finance, 45(5), 1587–1600.

Ono, A., & Uesugi, I. (2009). Role of collateral and personal guarantees in relationship lending: Evidence from Japan’s SME loan market. Journal of Money, Credit and Banking, 41(5), 935–960.

Pagano, M. S., & Sedunov, J. (2016). A comprehensive approach to measuring the relation between systemic risk exposure and sovereign debt. Journal of Financial Stability, 23, 62–78.

Poledna, S., & Thurner, S. (2014). Elimination of systemic risk in financial networks by means of a systemic risk transaction tax. arXiv:1401.8026.

Stern, G. H., & Feldman, R. J. (2004). Too big to fail: The hazards of bank bailouts. Washington, D.C.: Brookings Institution Press.

Stiglitz, J. E. (2010). Risk and global economic architecture: Why full financial integration may be undesirable. American Economic Review, 100(2), 388–392.

Tanizawa, T., Paul, G., Cohen, R., Havlin, S., & Stanley, H. E. (2005). Optimization of network robustness to waves of targeted and random attacks. Physical Review E, 71(4), 047101.

Wagner, W. (2010). Diversification at financial institutions and systemic crises. Journal of Financial Intermediation, 19(3), 373–386.

White, H. (1980). A heteroskedasticity-consistent covariance matrix estimator and a direct test for heteroskedasticity. Econometrica, 48(4), 817–838.

Zhou, C. (2010). Are banks too big to fail? Measuring systemic importance of financial institutions. International Journal of Central Banking, 6(4), 205–250.

Author information

Authors and Affiliations

Corresponding author

Additional information

This work was supported by the National Research Foundation of Korea Grant funded by the Korean Government (2014S1A3A2044459).

Rights and permissions

About this article

Cite this article

Kwon, O., Yun, Sg., Han, S.H. et al. Network Topology and Systemically Important Firms in the Interfirm Credit Network. Comput Econ 51, 847–864 (2018). https://doi.org/10.1007/s10614-017-9648-x

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10614-017-9648-x