Abstract

We develop an international capital asset pricing model in the presence of shadow costs of incomplete information and short sales. Our model shows the direct effect of exchange rate risk, information costs and short sales costs on asset prices. At equilibrium, this model gives an explicit expression of two systematic risk premium. The first one is linked to the exchange rate. The second one is related to international market risk. Our model explains in part the well-known home bias equity by market segmentation. This model, which is proposed for the first time in the literature, can be seen as an international version of Wu et al. (Rev Quant Finance Account 7:119–136, 1996) and Merton (J Finance 42:483–511, 1987) models of capital market equilibrium in international markets. Our analysis shows that the dispersion in beliefs increases the market inefficiency, and that short sale constraints can reduce the cost of ignorance and the magnitude of the home bias equity. Our model provides an operational approach in asset pricing to take account of previous important costs.

Similar content being viewed by others

1 Introduction

The gains from international diversification have been emphasized by several authors including Solnik (1974) and De Santise and Bruno (1997) and more recently by Nguyen et al. (2017). International asset management shows that international diversification benefits more than portfolio diversification in the national setting. Despite the gains from international diversification, most investors hold nearly all of their wealth in domestic assets. In international finance, this refers to what is called the “home bias equity”. Many authors tend to explain this bias by market frictions such as transaction costs, taxes, restrictions on foreign ownership, asymmetric information, short sale and exchange risk, etc.…Black (1974), Stulz (1981) and Cooper and Kaplanis (2000) and more recently Arouri et al. (2012) present a model of International Asset Pricing in the case of market segmentation.

Deadweight costs and market restrictions on assets have an impact on portfolio choice and market segmentation. Cooper and Kaplanis (1994) extend the model developed by Adler and Dumas (1983) to account for deadweight costs. The empirical test provided by Cooper and Kaplanis (1994) shows that the effect of inflation rate risk and the differences between the consumption baskets do not explain the “home bias equity” in international finance. Lewis (1999), Aboura and Bellalah (2006) use a similar tax model as Black (1974) in order to explain the home bias equity. The authors show that the two market imperfections in the asset pricing have the same rule and they are very important in theoretical and practical activity on the market. Errunza and Losq (1985) present a two-country-model to characterize the mild segmentation. The foreign investors, called unrestricted, can trade on assets that are both ‘eligible’ (or restricted) and ‘ineligible’ (or unrestricted). Domestic investors trade only on the ‘eligible’ or unrestricted assets. The model presented by Arouri et al. (2012) can be seen as an extended version of Errunza and Losq (1985, 1989). If some investors do not hold all international assets because of direct and/or indirect barriers, the world market portfolio would not be efficient and the traditional international CAPM must be extended by the addition of a new factor. The later would capture the local risk “undiversifiable” in international setting.

The introduction of information uncertainty and its effects on the pricing of assets explain the international diversification bias. The perfect market model can provide a good description of the financial system in the long-run, but it fails to account for several anomalies due to omitted factors such as information costs and short sales constraints. The analysis in Merton (1987) shows that a reconciling of finance theory with empirical violations of the complete-information (perfect market model) implies a departure from the standard paradigm. However, as it appears in Merton (1987), “It does, however suggest that researchers be cognizant of the insensitivity of this model to institutional complexities and…. I believe that even a modest recognition of institutional structures and information costs can go a long way toward explaining financial behavior that is otherwise seen anomalous to the standard friction-less-market model”.

Wu et al. (1996) extend Merton (1987) model. They propose an incomplete information capital market equilibrium with heterogeneous expectations and short sale restrictions, namely the GCAPM model. This latter one shows that shadow costs of incomplete information and equilibrium security returns are positively related to the divergence of investor beliefs and negatively related to the firm’s investor base. Wu et al. (1996) find that short sale restrictions mitigate the inefficiency of the market portfolio due to divergent beliefs. This is because short sales can reduce the opportunity cost of ignorance. Systematic risk in the GCAPM is affected not only by the Beta, but also by the variance of residual return and the size of the company. The effect of short sales restrictions on equilibrium prices is more evident and pronounced for smaller and less known securities. The analysis increases the robustness of Merton’s asset pricing model.

Recently, Dumas et al. (2017) have developed an international financial market model in which domestic and foreign investors have different beliefs in the economic information signals. Their model explains the standard international pricing anomalies such as the equity home bias, the co-movement of returns and international capital flows.

Hirshleifer et al. (2016) present a model of asset pricing in the case of asymmetric information. They show that asset portfolios have three components: an informationally passive portfolio based upon equilibrium prices; an information-based portfolio based upon private information and equilibrium prices; and the risk-free asset. In the same way, Bellalah (2015) presents an analytic solution for derivatives in the presence of both shadow costs of incomplete information and short sales. The methodology implemented by the author incorporates shadow costs of incomplete information and short sales in the options and their underlying securities.

Given the above evidence on the role of market frictions and market imperfections in international finance, we develop an International Asset Pricing Model in the presence of the shadow costs of incomplete information and short sales restrictions. This model, which is derived for the first time in the literature, can be seen as an international version of the models of Merton (1987) and Wu et al. (1996). Our analysis introduces a systematic risk of international market and exchange rate risk. The paper is organized as follow. First, we present our model and we give explicit equations for asset pricing in international setting. Second section, we simulate our model and we outline the link between our theoretical results and the empirical evidence. Proofs are relegated to appendix.

2 International asset pricing within shadow costs of incomplete information and short sales

Following the analysis in Adler and Dumas (1983), we use the following assumptions:

A 1

There are K countries and currencies. All returns are stated in nominal terms of the Kth currency (\( k_{p } \)). There are K equity index assets and K − 1 risky currency assets.

The price of the ith asset has the following dynamics:

where \( Y_{i } \): is the market value of index asset i in terms of the reference currency of country K denoted by \( k_{p } \); \( \mu_{i} \), the expected rate of return of asset i, which can be denoted by E(Ri); \( \sigma_{i} \), the standard deviation of asset I; \( dz_{i} \), the increment to a standard Wiener process.

A 2

Following the notations in Merton (1987) and Wu et al. (1996), we assume that there are two “shadow costs” λ ki and \( \gamma_{i}^{k} \) associated separately with the information constraint and the short-selling constraint.

Based on this assumption, relation (1) can be written as:

Relation (2) is similar to Cooper and Kaplanis (1994), who extended the model of Adler and Dumas (1983) to account for deadweight costs as in Black (1974).

A 3

There are K investor types. The price index \( P^{k} \) of an investor of type k expressed in the reference currency follows the process:

where \( P^{k} \) the price index; \( \pi^{k} \), the expected value of the instantaneous rate of inflation; \( \sigma_{{P^{k} }} \), the standard deviation of the instantaneous rate of inflation; \( dz_{{P^{k} }} \), the increment to a standard Wiener process.

Using the same method as in Adler and Dumas (1983) and the Bellman principal, we obtainFootnote 1:

Proposition 1

(Risk premia at equilibrium with shadow costs)

where \( w_{j}^{k} \) the optimal holding allocated to asset i by investor k; \( \frac{1}{{a^{k} }} =\uptheta^{k} \), the investor’s risk aversion; \( \sigma_{ij} = cov\left( {R_{i} ,R_{j} } \right) \), the covariance of the nominal rate of return of asset i and j; \( \sigma_{{i\pi^{k} }} = cov\left( {R_{i} ,\pi^{k} } \right) \), the covariance of the rate or return of asset i and investor’s rate inflation.

Remark 1

(Relation (4) is different from Eq. (8) of Adler and Dumas (1983) in which appears the effect of the shadow costs of incomplete information and short sale).

Relation (4) can be written as follows:

Let us derive an explicit international version of asset pricing model in the presence of shadow costs of incomplete information and short sale. To achieve our goal, we multiply both sides of Eq. (5) by \( \frac{{W^{k} }}{{\uptheta^{k} }} \) to obtain:

where \( W^{k} \) denotes the wealth of investor k.

Relation (6) can be written as follows:

Let us denote by \( w_{i}^{m} \) the proportion of asset i in the international market portfolio as:

Aggregating expression (7) over all investors, we get the following resultFootnote 2:

Proposition 2

(The expected rate of return of security i, as a function of the shadow costs of incomplete information, the short sales)

where \( \uptheta\; = \;\frac{{\mathop \sum \nolimits_{k}^{K} W^{k} }}{{\mathop \sum \nolimits_{k}^{K} \frac{{W^{k} }}{{A^{k} }}}} \): the global harmonic mean degree of risk aversion, \( \sum\nolimits_{k}^{K} {W^{k} } \): the global wealth; \( R_{m} = \sum\nolimits_{i = 1} {w_{i}^{m} } R_{i} \): the rate of return of the global market portfolio; \( \sum\nolimits_{i = 1}^{2n - 1} {\lambda_{i}^{k} } = \lambda_{i} \): the global shadow cost of incomplete information, \( \sum\nolimits_{i = 1}^{2n - 1} {\gamma_{i}^{k} } = \gamma_{i} \): the global shadow cost linked to the short sale.

Remark 2

(If we consider that the purchasing power parity does not hold, in this case, our asset pricing model includes K + 1 risk premia) The first is linked to the global market portfolio, the second for the valuation currency’s own inflation and K − 1 additional risk that reflect the other country’s uncertain inflation.

The effect of foreign inflation rates denominated in the reference currency \( k_{p } \) has two components.

The first reflects the inflation in the foreign currency. The second shows the changes in the exchange rate between the foreign currency and the reference one \( k_{p } \).

We assume as in Solnik (1974) and Sercu (1980) that the inflation rate in each country’s is not random, when measured in its own currency. This special case allows us to derive a model that shows the effect of two systematic risk premiums, and the effect of information costs and short sales. In this situation, there is no inflation risk premium for the reference currency and the K − 1 risk premium are attributed to nominal foreign exchange risks which can be aggregated in a single currency index.

Based on this hypothesis, Relation (9) becomes:

where \( {\text{e}}^{k} \) refers to the percentage change of currency k relative to currency \( k_{p } \).

A careful examination of Relation (10) shows that the coefficients of the K covariance terms sum to one and that the choice of the reference currency is irrelevant. This result is consistent with Sercu (1980), and O’Brien and Dolde (2000) who shows that the common fund is independent of the choice of the measurement currency.

In order to derive our global currency index capital asset pricing model in the presence of the shadow costs of incomplete information and short sale constraint GCAPMI, we formulate the following assumptions:

A 4

We assume as in O’Brien and Dolde (2000) and Cooper and Kaplanis (1994) that the aggregate risk tolerances are equal across border, which means that \( \uptheta^{k} =\uptheta \). This assumption was used by French and Poterba (1991) in their empirical analysis of the home bias equity.

A 5

We consider that the K − 1 currency risk factors can be aggregated into a portfolio. The exact weights of this portfolio are unobservable as suggested by Adler and Dumas (1983) and O’Brien and Dolde (2000). This assumption is not critical for the practitioners, who are able to use a proxy currency index.

Based on these assumptions, Relation (10) implies the following property:

Remark 3

(Differences in information are important in financial and real markets)

where \( = \frac{{\mathop \sum \nolimits_{{k \ne k_{p} }} W^{k} e_{k} }}{W} \): the wealth-weighted index of the percent changes in all other currencies in terms of the reference currency \( k_{p } \).

Relation (11) shows that information costs are used in several contexts to explain some puzzling phenomena like the ‘home equity bias’, the ‘weekend effect’, “the smile effect”,Footnote 3 etc. Kadlec and Mc Connell (1994) document the effect on share value on the NYSE and report the results of a joint test of Merton’s (1987) investor recognition factor and Amihud and Mendelson’s (1989) liquidity factor as explanations of the listing effect. In addition to transaction costs, the Merton’s shadow cost λ can be seen as a proxy for changes in the bid-ask spread.

In addition, Van Nieuwerburgh and Veldkamp (2009) study information immobility and the home bias puzzle. They argue that home bias arises because domestic investors can predict domestic asset payoffs more accurately than foreigners can. The model presented by these authors investigate a common criticism of information-based models of the home bias: If domestic investors have less information about foreign stocks, why don’t they choose to acquire foreign information, reduce their uncertainty about foreign payoffs, and undo their portfolio bias?

A 6

To derive our global currency index asset pricing model with information costs and short sale, we apply Relation (11) to \( R_{m} \) (the international market portfolio) and to \( R_{e} \) that reflects the variation in X.

Based on (A6) and Relation (11), we get:

where the term \( \lambda_{m} \) corresponds to the information cost about the market (it can be interpreted as the weighted average of \( \lambda_{i} \)), and \( \gamma_{m} \) corresponds to the weighted average of \( \gamma_{i} \).

Applying Relation (11) to Re we get:

Relation (13) does not contain the shadow costs of incomplete information about the exchange rate and short sale. Indeed, we can extend our analysis by including these costs in our model. For simplicity, we focus our model on the effect of these costs on asset price, and not on exchange market. In our model, these costs are paid by the investor to be informed about the other country in order to trade in foreign markets and take a short or long position.

Solving Eqs. (12) and (13) simultaneously for \( \uptheta \) and \( \left( {1 -\uptheta} \right) \) and rearranging givesFootnote 4:

where

Proposition 3

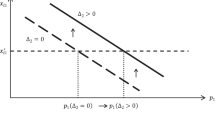

(The global currency index asset pricing model within information cost and constraint on short sale) The most important implication of our model is that the world market portfolio is not efficient and that a complete international diversification is not achievable due to the information costs and short sale.

The presence of these costs shows that international markets are partially segmented. Relation (14) can be seen as an international version of Merton (1987) model in the case of exchange rate risk and short sale. Our GCAPMI shows that short sale restrictions mitigate the inefficiency of the market portfolio due to divergent beliefs. This is because short sales can reduce the opportunity cost of ignorance. In addition, our model shows that systematic risk is affected not only by the beta but also by the variance of residual return and the size of the company.

3 Simulation results

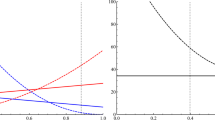

In the previous section we develop the international capital asset pricing model under information costs and short sale. This section provides some simulation results to show the effect of these market frictions on asset prices. In one hand, Fig. 1 shows that the expected rate of return is an increasing function of information cost. This cost tends to increase the value cost of capital. Our finding is consistent with Jiang (1993). This author shows that the existence of uninformed investors increases the risk premium. Jiang (1993) develops a dynamic asset-pricing model under asymmetric information. In his model investors have different information concerning the future growth rate of dividends. They rationally extract information from prices as well as dividends and maximize their expected utility. The model has a closed-form solution to the rational expectations. On the other hand, Fig. 2 shows that the short sale cost is a decreasing one on firm asset.

In Table 1 we have simulated the value of the expected rate of return for different levels of information and short sale costs. Our results show that this rate increases when the value of \( \lambda i \) increases, and decreases for a higher value of \( \gamma_{i} \).

At the empirical level we can argue that our model given by Relation (14) supports the evidence in Kang and Stulz (1997), and Dahlquist and Robertsson (2001) and more recently Nezafat et al. (2015) and Dumas et al. (2017) where the home bias equity is explained by asymmetric information and market restriction.

The empirical test provided by Kang and Stulz (1997) shows that the investor portfolio is biased against small firm and that the investors overinvesting in large firms in Japan due to the availability of information about these large firms. The authors find that holdings are relatively large in firms with large export sales. This evidence is consistent with the conjecture that foreigns investors invest in firms they are better informed about. From this fact, the authors suggest that the home bias is derived by informational asymmetries. Brennan and Cao (1997) develop a model of international equity portfolio investment flows based in informational endowments between foreign and domestic investors. In this model, they show that when domestics investors possess information advantage over foreign investors about their domestic market, investor tend to purchase foreign assets in periods when the return in foreign asset is high. Bryan and Alexander (2012), study the importance of information asymmetry in asset pricing by using three experiments. The authors find that prices and uninformed demand fall as asymmetry increases. The results confirm that information asymmetry is priced and imply that a primary channel that links asymmetry to prices is liquidity. This finding is consistent with our model that shows the effect of information costs on expected rate of return

4 Conclusion

This paper presents an International Capital Asset Pricing Model in the presence of exchange rate risk, shadow costs of incomplete information and short-sales constraints. The model introduces a first component λk which corresponds to a pure information cost due to imperfect knowledge and heterogeneous expectations. The second component \( \gamma_{k} \) represents the additional cost caused by the short-selling constraint. The shadow cost associated with the short-selling constraint should come into the picture even in the case of homogeneous beliefs due to the difference in investor’s information set. In the case of divergent beliefs, the shadow cost of short sales would not be the same for all investors. Our model, which appears for the first time in the literature, reveals the importance of market frictions and its effect on the gains from diversification. The model shows that asymmetric information and short sales constraints can explain the home bias equity observed in international and domestic markets. At equilibrium, our model exhibits two systematic risk premiums and shows how the costs affect the expected rate of return and asset prices. Short-sale restrictions increase the likelihood that an investor will not expend the resources to become informed about a security. This tends to lower the expected payoff from acquiring the information about a security. Testing this model remains a future challenge which depends on the availability of the data linked to the construction of proxy variable for the information cost. In addition, this model can be extended to the case of short sales constraints and information costs in exchange markets.

Change history

19 February 2019

A Correction to this paper has been published: https://doi.org/10.1007/s10479-019-03171-9

Notes

References

Aboura, S., & Bellalah, M. (2006). The effect of asymmetric information and transaction costs on asset pricing: Theory and test. International Journal of business, 2(11), 219–236.

Adler, M., & Dumas, B. (1983). International portfolio choice and corporation finance: A synthesis. Journal of Finance, 38(3), 925–984.

Amihud, Y., & Mendelson, H. (1989). The effects of beta, bid-ask spread, residual risk, and size on stock returns. The Journal of Finance, 44(2), 479–486.

Arouri, M., Nguyen, D. K., & Pukthuanthong, K. (2012). An international CAPM for partially integrated markets: Theory and empirical evidence. Journal of Banking & Finance, 36(9), 2473–2493.

Bellalah, M. (2000). A reexamination of corporate risks under shadow costs of incomplete information. International Journal of Finance and Economics, 6(1), 41–58.

Bellalah, M. (2001). Valuation of American CAC 40 index options and wildcard options. International Review of Economics and Finance, 10, 75–94.

Bellalah, M. (2015) On information costs, short sales and the pricing of extendible options, steps and Parisian options. Annals of Operations Research 1–27.

Bellalah, M., & Jacquillat, B. (1995). Option valuation with information costs: Theory and tests. The Financial Review, 30(3), 617–635.

Black, F. (1974). International capital market equilibrium with investment barriers. Journal of Financial Economics, 1, 337–352.

Brennan, M., & Cao, H. (1997). International portfolio investment flows. Journal of Finance, 52(5), 1851–1880.

Bryan, K, & Alexander, L. (2012) Testing asymmetric-information asset pricing models. The Review of Financial Studies, 25, 3.45.

Cooper, I., & Kaplanis, K. (1994). What explains the home bias equity in potfolio investment. The Review of Financial Studies, 7, 45–60.

Cooper, I., & Kaplanis, K. (2000). Partially segmented international capital markets and international capital budgeting. Journal of International Money and Finance, 19, 309–329.

Dahlquist, M., & Robertsson, G. (2001). Direct foreign ownership, institutional investors, and firm characteristics. Journal of Financial Economics, 59(3), 413–440.

De Santise, G., & Bruno, G. (1997). International asset pricing and portfolio diversification with time-varying risk. Journal of Finance, 52, 1881–1912.

Dumas, B., Lewis, K. K., & Osambelo, E. (2017). Differences of opinion and international equity markets. The Review of Financial Studies, 30(3), 750–800.

Errunza, V., & Losq, E. (1985). International asset pricing under mild segmentation: theory and test. Journal of Finance, 40, 105–124.

Errunza, V., & Losq, E. (1989). Capital flow controls, international asset pricing and investors’ welfare: A multi-country framwork. Journal of Finance, 44, 1025–1038.

French, K., & Poterba, J. (1991). Investor diversification and international equity markets. American Economic Review, 81, 222–226.

Hirshleifer, D., Chong, H., & Siew, T. (2016) Information asymmetry, market participation, and asset prices. March, 2016. Available at SSRN: http://people.stern.nyu.edu/jhasbrou/SternMicroMtg/SternMicroMtg2016/Papers/47.pdf.

Jiang, W. (1993). A model of intertemporal asset prices under asymmetric information. Review of Economic Studies, 60, 249–282.

Kadlec, G., & Mc Connell, J. (1994). The effect of market segmentation and liquidity on asset prices. Journal of Finance, 49, 611–636.

Kang, J., & Stulz, R. (1997). Why is there a home bias? An analysis of foreign portfolio equity in Japan. Journal of Financial Economics, 46, 4–28.

Lewis, K. (1999). Trying to explain home bias in equities and consumption. Journal of Economic Literature, 37, 571–608.

Merton, R. (1987). An equilibrium market model with incomplete information. Journal of Finance, 42(3), 483–511.

Nezafat, P., Schroder, Mark D., & Wang, Q (2015). Information acquisition and asset prices with short-sale constraints. Available at SSRN: http://ssrn.com/abstract=2257093 or http://dx.doi.org/10.2139/ssrn.2257093.

Nguyen, D., Al Janabi, M. A. M., Hernandez, J. A., & Berger, T. (2017). Multivariate dependence and portfolio optimization algorithms under illiquid market scenarios. European Journal of Operational Research, 259(3), 1121–1131.

O’Brien, J., & Dolde, W. (2000). A currency index global capital asset pricing model. European Financial Management, 6(1), 7–18.

Sercu, P. (1980). A generalisation of the international asset pricing model Revue de l’Association Française de. Finance, 1, 91–135.

Solnik, B. (1974). The international pricing of risk: An empirical investigation of the capital market structure. Journal of Finance, 29, 48–54.

Stulz, R. (1981). On the effect of international investment. Journal of Finance, 36, 923–934.

Van Nieuwerburgh, S., & Veldkamp, L. (2009). Information immobility and the home bias puzzle. Journal of Finance, 64(3), 1187–1215.

Wu, C., Li, Q., & Wei, K. J. (1996). Incomplete-information capital market equilibrium with heterogeneous expectations and short sale restrictions. Review of Quantitative Finance and Accounting, 7, 119–136.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

We are grateful to Yves Simon, Paris 2017 International Finance Conference, IFC and seminar participants at the University of Picardie Jules Verne.

Appendices

Appendix 1

To get Relation 4, we consider homothetic direct utility functionsFootnote 5:

where C is the nominal rate of consumption; P, the price level index, V(.) a function homogenous of degree zero in C and P.

Based on Relation (2) and (3) and calling \( \varpi = \left\{ {w_{i} } \right\} \), the vector components sum to one.

In this case the wealth dynamic is:

where \( W^{k} \), the nominal Wealth.

We denote \( J(C,P,t) \) the maximum value of relation (A1) subject to (A2). The bellman principal states that this function must be stationary or that the total expected rate on increase must be identically zero:

The homogeneity of degree zero of function \( V(C,P,s) \) implies that \( J(W,P,t) \) and \( C(W,P,t) \) which satisfy (A3) must be homogeneous of degree zero in W and P.

Using Euler’s theorem, we get:

Therefore, we have:

Substituting the above relations into (A3), we get:

The derivatives of (A4) with respect to C and \( w_{i} \) are set equal to zero, thus, we get:

And

Defining \( \alpha^{k} = \frac{{ - J_{W} }}{{J_{WW} }}W \) as the investor’s risk tolerance. We get rewrite (A6) in the form of required nominal yield on security i, which gives our relation (4).

Appendix 2

Aggregating Relation (7) over all investors, we get:

Rearranging (A1) and using the definition of \( x_{i}^{m} \) we obtain:

which yields relation (9).

Appendix 3

We have expressions (12) and (13):

Let us look to ratio \( \frac{(12)}{(13)} \):

From (A2) we obtain:

Rearranging expression (A3) gives:

From (A4) we have:

We can write (A6) as follows:

Substituting (A5) and (A7) in (11) we get:

Relation (A8) can be written as follows:

Relation (A9) can be written as follows:

This relation corresponds to Eq. (14).

Rights and permissions

OpenAccess This article is distributed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits unrestricted use, distribution, and reproduction in any medium, provided you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made.

About this article

Cite this article

Bellalah, M., Dammak, F.A. International capital asset pricing model: the case of asymmetric information and short-sale. Ann Oper Res 281, 161–173 (2019). https://doi.org/10.1007/s10479-019-03133-1

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-019-03133-1