Abstract

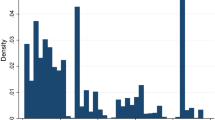

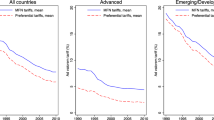

Combining for the first time a new dataset of non-tariff measures (NTMs) in 65 countries with the CEPII’s unit values database, we estimate average ad-valorem equivalents (AVEs) for sanitary and phytosanitary, technical-barriers-to trade and other measures by section of the Harmonized System of product classification. While most existing AVEs are obtained from indirect quantity-based estimation, ours are obtained from direct price-gap estimation. They lie in a single-digit range, i.e. substantially lower than previous estimates based on older data. Our results may reflect the progressive phasing out of command-and-control instruments such as quantitative restrictions in many countries; they also suggest that sanitary and technical regulations have not substituted for them as trade-restrictive interventions. Most interestingly, we show that deep-integration clauses in regional trade agreements, in particular the mutual recognition of conformity-assessment procedures, substantially reduce the price-raising effect of NTMs, possibly reflecting lower compliance costs.

Similar content being viewed by others

Notes

These compliance costs can be substantial. Without the recognition of conformity assessment, exporters are sometimes required to have their products tested by accredited laboratories separately for each destination country. In developing countries, these laboratories are typically owned and operated by private companies in quasi-monopoly situations with very stiff fees. For instance, rice exporters in Myanmar incur testing fees between $500 and $1000 per sample at private laboratories in the region. As samples have to be tested for every two 20’ containers, testing costs can reach up to 9 % of the FOB price. By comparison, the government export tax is slightly over 2 %.

There is thus a logical inconsistency in the MAST classification’s treatment of domestic subsidies and regulations, since subsidies to domestic producers are included on account of their potential effect on competition with imported products, whereas cost-raising domestic regulations are not, even though they may also distort competition, this time by penalizing domestic producers.

NTMs could conceptually affect products based on their production processes—say, restrictions on imported products based on differences in labor regulations between the importing and exporting country—but they would then be in violation of (inter alia) GATT Article III (national treatment).

We assume that NTMs are imposed on all origins (including the destination country itself), while other trade costs are bilateral.

For an alternative approach with incomplete pass-through, see e.g. Berman et al. (2012).

In an alternative specification, we followed Kee et al. (2009) and interacted NTM dummies with country covariates in order to generate predicted effects conditional on destination characteristics. Mapping back those characteristics into « real » importing countries makes it possible to retrieve predicted effects corresponding to the particulars of each importing country.

References

Anderson, J., & Neary, P. (1994). Measuring the restrictiveness of trade policy. World Bank Economic Review, 8, 151–169.

Anderson, J., & Van Wincoop, E. (2004). Trade costs. Journal of Economic Literature, 42, 691–751.

Andriamananjara, S., Dean, J., Feinberg, R., Ferrantino, M., Ludema, R., & Tsigas, M. (2004). The effects of non-tariff measures on prices, trade, and welfare: CGE implementation of policy-based price comparisons (USITC Working Paper 2004-04-A). Washington, DC: United States International Trade Commission.

Baldwin, R. (1989). Measuring nontariff trade policies (NBER Working Paper 2978). Cambridge, MA: National Bureau of Economic Research.

Beghin, J., Disdier A. C., & Marette, S. (2015). Trade restrictiveness indices in presence of externalities: An application to non-tariff measures. Canadian Journal of Economics, 48(4), 65–78.

Beghin, J., Disdier, A. C., Marette, S., & van Tongeren, F. (2012). Measuring costs and benefits of non-tariff measures in agri-food trade. World Trade Review, 11, 356–375.

Berman, N., Martin, P., & Mayer, T. (2012). How do different firms react to exchange-rate changes? Quarterly Journal of Economics, 127, 437–492.

Berthou, A., & Emlinger, C. (2011). The trade unit value database. International Economics, 128, 97–117.

Bourgeois, J., Dawar, K., & Evenett, S. (2007). A comparative analysis of selected provisions in free trade agreements. Brussels: Study Commissioned by DG Trade.

Cadot, O., & Gourdon, J. (2014). Assessing the price-raising effect of non-tariff measures in Africa. Journal of African Economies, 23(4), 425–463.

Carrère, C., & de Melo, J. (2011). Non-tariff measures: What do we know, what should be done? Journal of Economic Integration, 26, 169–196.

Chen, M. X., & Mattoo, A. (2008). Regionalism in standards: Good or bad for trade? Canadian Journal of Economics, 41(3), 838–863.

Czubala, W., Shepherd, B., & Wilson, J. (2009). Help or hindrance? The impact of harmonized standards on African exports. Journal of African Economies, 18(5), 711–744.

Deardorff, A., & Stern, R. (1997). Measurement of non-tariff barriers (Economics Department Working Paper 179). OECD.

Disdier, A. C., Fontagné, L., & Cadot, O. (2015). North–South standards harmonization and international trade: With Anne-Célia Disdier and Lionel Fontagné. World Bank Economic Review, 29, 327–352.

Djankov, S., Freund, C., & Pham, C. S. (2010). Trading on time. The Review of Economics and Statistics, 92(1), 166–173.

Feenstra, R. C. (1984). Voluntary export restraints in US autos, 1980–81: Quality, employment, and welfare effects. In R. E. Baldwin & A. O. Krueger (Eds.), The structure and evolution of recent US trade policy. Chicago: University of Chicago Press.

Ferrantino, M. (2006). Quantifying the trade and economic effects of non-tariff measures (OECD Trade Policy Working Paper 28).

Fontagné, L., Orefice, G., Piermartini, R., & Rocha, N. (2015). Product standards and margins of trade: Firm-level evidence. Journal of International Economics, 97(1), 29–44.

Gourdon, J. (2014). CEPII NTM-MAP: A tool for assessing the economic impact of non-tariff measures (Working Papers 2014-24). CEPII research center.

Henry de Frahan, B., & Vancauteren, M. (2006). Harmonisation of food regulations and trade in the single market: Evidence from disaggregated data. European Review of Agricultural Economics, 33(3), 337–360.

Hoekman, B., & Nicita, A. (2011). Trade policy, trade costs and developing country trade. World Development, 39(12), 2069–2079.

Kee, H. L., Nicita, A., & Olarreaga, M. (2009). Estimating trade restrictiveness indices. Economic Journal, 119, 172–199.

Leamer, E. (1990). The structure and effects of tariffs and nontariff barriers in 1983. In R. W. Jones & A. O. Krueger (Eds.), The political economy of international trade. Cambridge, MA: Basil Blackwell Inc.

Lejárraga, I., & Shepherd, B. (2013). Quantitative evidence on transparency in regional trade agreements (OECD Trade Policy Papers 153). Paris: OECD Publishing.

Maertens, M., & Swinnen, J. (2009). Trade, standards, and poverty: Evidence from Senegal. World Development, 37(1), 161–178.

Maskus, K., Otsuki, T., & Wilson, J. S. (2005). The costs of compliance with product standards for firms in developing countries: An econometric study (Working paper No. 3590). Washington, DC: World Bank.

Maur, J. C., & Shepherd, B. (2011). Product standards. In J.-P. Chauffour & J.-C. Maur (Eds.), Preferential trade agreement policies for development: A handbook. Washington, DC: World Bank.

Melitz, M. (2003). The impact of trade on intra-industry reallocations and aggregate industry productivity. Econometrica, 71, 1695–1725.

Moenius, J. (2004). Information versus product adaptation: The role of standards in trade (International Business and Markets Research Center Working Paper). Northwestern University.

Obsfeld, M., & Rogoff, K. (2000). The six major puzzles in macroeconomics: Is there a common cause? NBER macroeconomics annual. Cambridge, MA: MIT press.

Otsuki, T., Wilson, J. S., & Sewadeh, M. (2001). Saving two in a billion: Quantifying the trade effect of European food safety standards on African exports. Food Policy, 26(5), 495–514.

Piermartini, R., & Budetta, M. (2009). A mapping of regional rules on technical barriers to trade. In A. Estevadeordal, K. Suominen, & R. The (Eds.), Regional rules in the global trading system. Cambridge: Cambridge University Press.

Trefler, D. (1995). The case of the missing trade and other mysteries. American Economic Review, 85, 1029–1046.

Wilson, S., & Abiola, V. O. (2003). Standards and global trade: A voice for Africa. Washington, DC: World Bank.

Acknowledgments

We are grateful to Lionel Fontagné, Sébastien Jean, Frank Van Tongeren, Michael Ferrantino, Anne-Célia Disdier, Gianluca Orefice and to other participants at CEPII Conference “Non-tariff measures: Economic Analysis and Policy Appraisal” in Paris and at the “Issues on quantification of Non-tariff measures” session of the GTAP conference in Shanghai for useful comments and suggestions. Support from France’s Agence Nationale de la Recherche under grants ANR-10-LABX-14-01 and ANR-12-JSH1-0002-0 and from Switzerland’s NCCR WP6 “Impact assessment” is gratefully acknowledged.

Author information

Authors and Affiliations

Corresponding author

Additional information

The views expressed here are those of the authors and do not necessarily reflect those of the institutions to which they are affiliated.

Appendix

About this article

Cite this article

Cadot, O., Gourdon, J. Non-tariff measures, preferential trade agreements, and prices: new evidence. Rev World Econ 152, 227–249 (2016). https://doi.org/10.1007/s10290-015-0242-9

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10290-015-0242-9