Abstract

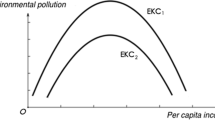

The surge in economic and human development has led to increasing concerns about environmental degradation, thus necessitating effective strategies to enhance sustainability and environmental quality. Therefore, this study empirically examines the impact of environmental fiscal policies, environmental technologies, and research and development (R&D) expenditures on achieving environmental sustainability in the G7 countries. Using advanced econometric techniques, including the Cross-Sectionally Augmented Autoregressive Distributed Lags (CS-ARDL) model and the Dynamic Common Correlated Effects (DCCE) approach, the study identifies both short-run and long-run correlations between the aforementioned variables and their impact on greenhouse gas (GHG) emissions. Our findings confirm the inverted U-shaped Kuznets Curve relationship and reinforce the previous literature on the complex dynamics between economic growth and GHG emissions specific to developed countries. The research also supports the effectiveness of well-designed environmental taxes in reducing environmental degradation and GHG emissions, consistent with and extending existing studies in this area. In addition, the study provides empirical evidence of the critical role of environmental technologies and targeted R&D expenditures in improving environmental quality. In terms of policy implications, our research underscores the urgency for policymakers in the G7 countries to fine-tune environmental taxation mechanisms and increase investment in sustainable technological solutions. Specific recommendations include the development of more efficient tax systems that adhere to the polluter-pays principle, as well as financial incentives such as tax credits and subsidies aimed at accelerating green technology adoption and innovation. In doing so, the study seeks to contribute to the broader discourse on environmental policy and sustainable development, providing valuable perspectives for both the academic community and policy actors.

Similar content being viewed by others

Data availability

The data used in this study is indicated in the text under the reference OECD (2023). Data availability is from OECD.Stat: Green Growth Indicators. Retrieved from https://stats.oecd.org/Index.aspx?DataSetCode=GREEN_GROWTH.

References

Abbas S, Gui P, Chen A, Ali N (2022) The effect of renewable energy development, market regulation, and environmental innovation on CO2 emissions in BRICS countries. Environ Sci Pollut Res 29(39):59483–59501

Ahmad M, Satrovic E (2023) How do transportation-based environmental taxation and globalization contribute to ecological sustainability? Ecol Inform 74:102009

Ahmed Z, Ahmad M, Murshed M, Ibrahim Shah M, Mahmood H, Abbas S (2022) How do green energy technology investments, technological innovation, and trade globalization enhance green energy supply and stimulate environmental sustainability in the G7 countries? Gondwana Res 112:105–115

Aladejare SA (2023) Does external debt promote human longevity in developing countries? Evidence from West African countries. Fudan J Humanit Soc Sci 16(2):213–237

Alola AA, Muoneke OB, Okere KI, Obekpa HO (2023) Analysing the co-benefit of environmental tax amidst clean energy development in Europe’s largest agrarian economies. J Environ Manag 326(Pt B):116748

Amin N, Shabbir MS, Song H, Farrukh MU, Iqbal S, Abbass K (2023) A step towards environmental mitigation: do green technological innovation and institutional quality make a difference? Technol Forecast Soc Chang 190:122413

Amri F, Bélaïd F, Roubaud D (2018) Does technological innovation improve environmental sustainability in developing countries? Some evidence from Tunisia. J Energy Dev 44(1/2):41–60

Amri F, Arouri M, Bélaïd F (2019) Economic growth and environmental degradation: the role of sectoral dynamics and social sustainability in MENA countries. J Energy Dev 45(1/2):159–174

Awaworyi Churchill S, Inekwe J, Smyth R, Zhang X (2019) R&D intensity and carbon emissions in the G7: 1870–2014. Energy Econ 80:30–37

Aydin M, Degirmenci T, Yavuz H (2023) The influence of multifactor productivity, research and development expenditure, renewable energy consumption on ecological footprint in G7 countries: testing the environmental Kuznets curve hypothesis. Environ Model Assess 28:693–708

Aziz N, Hossain B, Lamb L (2021) Does green policy pay dividends? Environ Econ Policy Stud 24(2):147–172

Belaïd F (2022) Implications of poorly designed climate policy on energy poverty: global reflections on the current surge in energy prices. Energy Res Soc Sci 92:102790

Belaïd F, Massié C (2023) The viability of energy efficiency in facilitating Saudi Arabia’s journey toward net-zero emissions. Energy Economics 124:106765

Belaïd F, Al-Sarihi A, Al-Mestneer R (2023) Balancing climate mitigation and energy security goals amid converging global energy crises: the role of green investments. Renew Energy 205:534–542

Ben Youssef A, Borderon-Carrez S, Dahmani M (2021) Territories’ adaptation to climate change and the effects of pandemics. In: Anand S, Kennet M (eds) Survival solutions for the economy, biodiversity, climate and health. The Green Economics Institute, UK

Böhringer C, Rivers N (2021) The energy efficiency rebound effect in general equilibrium. J Environ Econ Manag 109:102508

Bozatli O, Akca H (2023) The effects of environmental taxes, renewable energy consumption and environmental technology on the ecological footprint: Evidence from advanced panel data analysis. J Environ Manag 345:118857

Chen Y, Lee C-C (2020) Does technological innovation reduce CO2 emissions? Cross-country evidence. J Clean Prod 263:121550

Chen M, Jiandong W, Saleem H (2022) The role of environmental taxes and stringent environmental policies in attaining the environmental quality: evidence from OECD and non-OECD countries. Front Environ Sci 10:1976

Chudik A, Pesaran MH (2015) Common correlated effects estimation of heterogeneous dynamic panel data models with weakly exogenous regressors. J Econom 188(2):393–420

Chudik A, Mohaddes K, Pesaran MH, Raissi M (2016) Long-run effects in large heterogeneous panel data models with cross-sectionally correlated errors. Essays in honor of Aman Ullah, pp 85–135. https://doi.org/10.1108/s0731-905320160000036013

Chudik A, Mohaddes K, Pesaran MH, Raissi M (2017) Is there a debt-threshold effect on output growth? Rev Econ Stat 99(1):135–150

Costantini V, Crespi F, Marin G, Paglialunga E (2017) Eco-innovation, sustainable supply chains and environmental performance in European industries. J Clean Prod 155:141–154

Dahmani M, Mabrouki M, Youssef A (2021a) The ICT, financial development, energy consumption and economic growth nexus in MENA countries: panel CS-ARDL Evidence (No. 2021-46). Groupe de REcherche en Droit, Economie, Gestion (GREDEG CNRS), Université Côte d’Azur, France

Dahmani M, Mabrouki M, Ragni L (2021b) Decoupling analysis of greenhouse gas emissions from economic growth: a case study of Tunisia. Energies 14(22):7550

Dahmani M, Mabrouki M, Ben Youssef A (2023) The ICT, financial development, energy consumption and economic growth nexus in MENA countries: dynamic panel CS-ARDL evidence. Appl Econ 55(10):1114–1128

Dauda L, Long X, Mensah CN, Salman M, Boamah KB, Ampon-Wireko S, Kofi Dogbe CS (2021) Innovation, trade openness and CO2 emissions in selected countries in Africa. J Clean Prod 281:125143

Ditzen J (2021) Estimating long-run effects and the exponent of cross-sectional dependence: an update to xtdcce2. Stata J Promot Commun Stat Stata 21(3):687–707

Doğan B, Chu LK, Ghosh S, Truong HHD, Balsalobre-Lorente D (2022) How environmental taxes and carbon emissions are related in the G7 economies? Renew Energy 187:645–656

Dogan A, Pata UK (2022) The role of ICT, R&D spending and renewable energy consumption on environmental quality: testing the LCC hypothesis for G7 countries. J Clean Prod 380:135038

Du K, Li P, Yan Z (2019) Do green technology innovations contribute to carbon dioxide emission reduction? Empirical evidence from patent data. Technol Forecast Soc Change 146:297–303

Erdoğan S, Yıldırım S, Yıldırım DÇ, Gedikli A (2020) The effects of innovation on sectoral carbon emissions: evidence from G20 countries. J Environ Manag 267:110637

European Commission (2018) Horizon 2020—work programme 2018–2020. European Union

Federal Ministry for Economic Affairs and Energy (2022) Renewable energy. https://www.bmwi.de/Redaktion/EN/Dossier/renewable-energy.html. Retrieved 25 Feb 2023

Ghazouani A, Jebli MB, Shahzad U (2021) Impacts of environmental taxes and technologies on greenhouse gas emissions: contextual evidence from leading emitter European countries. Environ Sci Pollut Res 28(18):22758–22767

Godil DI, Yu Z, Sharif A, Usman R, Khan SAR (2021) Investigate the role of technology innovation and renewable energy in reducing transport sector CO2 emission in China: a path toward sustainable development. Sustain Dev 29(4):694–707

Government of Canada (2022) Innovation and clean growth research, development, and demonstration programs. https://natural-resources.canada.ca/science-and-data/funding-partnerships/funding-opportunities/funding-grants-incentives/innovation-and-clean-growth-research-development-and-demonstration-programs/innovation-and-clean-growth-research. Retrieved 25 Feb 2023

Grossman G, Krueger A (1991) Environmental impacts of a North American Free Trade Agreement. NBER working paper No. 3914. National Bureau of Economic Research, Cambridge, MA

Hailemariam A, Ivanovski K, Dzhumashev R (2022) Does R&D investment in renewable energy technologies reduce greenhouse gas emissions? Appl Energy 327:120056

Hájek M, Zimmermannová J, Helman K, Rozenský L (2019) Analysis of carbon tax efficiency in energy industries of selected EU countries. Energy Policy 134:110955

Hao L-N, Umar M, Khan Z, Ali W (2021) Green growth and low carbon emission in G7 countries: how critical the network of environmental taxes, renewable energy and human capital is? Sci Total Environ 752:141853

Hashmi R, Alam K (2019) Dynamic relationship among environmental regulation, innovation, CO2 emissions, population, and economic growth in OECD countries: a panel investigation. J Clean Prod 231:1100–1109

Hassan ST, Khan SU-D, Xia E, Fatima H (2020) Role of institutions in correcting environmental pollution: an empirical investigation. Sustain Cities Soc 53:101901

He P, Chen L, Zou X, Li S, Shen H, Jian J (2019) Energy taxes, carbon dioxide emissions, energy consumption and economic consequences: a comparative study of nordic and G7 countries. Sustainability 11(21):6100

Inglesi-Lotz R (2017) Social rate of return to R& D on various energy technologies: where should we invest more? A study of G7 countries. Energy Policy 101:521–525

Jahanger A, Hossain MR, Onwe JC, Ogwu SO, Awan A, Balsalobre-Lorente D (2023) Analyzing the N-shaped EKC among top nuclear energy generating nations: a novel dynamic common correlated effects approach. Gondwana Res 116:73–88

Jiang R, Liu B (2023) How to achieve carbon neutrality while maintaining economic vitality: an exploration from the perspective of technological innovation and trade openness. Sci Total Environ 868:161490

Kander A, Jiborn M, Moran DD, Wiedmann TO (2015) National greenhouse-gas accounting for effective climate policy on international trade. Nat Clim Change 5(5):431–435

Khan Z, Ali S, Umar M, Kirikkaleli D, Jiao Z (2020) Consumption-based carbon emissions and International trade in G7 countries: the role of environmental innovation and renewable energy. Sci Total Environ 730:138945

King M, Tarbush B, Teytelboym A (2019) Targeted carbon tax reforms. Eur Econ Rev 119:526–547

Kocak E, Alnour M (2022) Energy R&D expenditure, bioethanol consumption, and greenhouse gas emissions in the United States: non-linear analysis and political implications. J Clean Prod 374:133887

Kostakis I, Arauzo-Carod J-M (2023) The key roles of renewable energy and economic growth in disaggregated environmental degradation: evidence from highly developed, heterogeneous and cross-correlated countries. Renew Energy 206:1315–1325

Kuo Y, Maneengam A, Phan The C, Binh An N, Nassani AA, Haffar M, Qadus A (2022) Fresh evidence on environmental quality measures using natural resources, renewable energy, non-renewable energy and economic growth for 10 Asian nations from CS-ARDL technique. Fuel 320:123914

Li R, Jiang R (2020) Investigating effect of R&D investment on decoupling environmental pressure from economic growth in the global top six carbon dioxide emitters. Sci Total Environ 740:140053

Liu N, Yao X, Wan F, Han Y (2023) Are tax revenue recycling schemes based on industry-differentiated carbon tax conducive to realizing the “double dividend”? Energy Economics 124:106814

Meireles M, Robaina M, Magueta D (2021) The effectiveness of environmental taxes in reducing CO2 emissions in passenger vehicles: the case of Mediterranean countries. Int J Environ Res Public Health 18(10):5442

Ministry of Economy, Trade and Industry (2021) Long-term strategy under the Paris Agreement. Government of Japan. https://unfccc.int/sites/default/files/resource/Japan_LTS2021.pdf. Retrieved 25 Feb 2023

Mol APJ, Sonnenfeld DA (2000) Ecological modernization around the world: an introduction. Environ Polit 9(1):1–16

Mongo M, Belaïd F, Ramdani B (2021) The effects of environmental innovations on CO2 emissions: empirical evidence from Europe. Environ Sci Policy 118:1–9

Morley B (2012) Empirical evidence on the effectiveness of environmental taxes. Appl Econ Lett 19(18):1817–1820

Ni X, Wang Z, Akbar A, Ali S (2022) Natural resources volatility, renewable energy, R&D resources and environment: evidence from selected developed countries. Resour Policy 77:102655. https://doi.org/10.1016/j.resourpol.2022.102655

OECD (2020) Managing environmental and energy transitions for regions and cities. OECD Publishing, Paris. https://doi.org/10.1787/f0c6621f-en

OECD (2023) OECD.Stat: green growth indicators. Retrieved from https://stats.oecd.org/Index.aspx?DataSetCode=GREEN_GROWTH

Omri A, Kahouli B, Afi H, Kahia M (2022) Impact of environmental quality on health outcomes in Saudi Arabia: does research and development matter? J Knowl Econ 14:4119–4144

Özmen İ, Özcan G, Özcan CC, Bekun FV (2022) Does fiscal policy spur environmental issues? New evidence from selected developed countries. Int J Environ Sci Technol 19(11):10831–10844

Pearce DW (1991) The role of carbon taxes in adjusting to global warming. Econ J 101(407):938–948

Pesaran MH (2007) A simple panel unit root test in the presence of cross-section dependence. J Appl Econom 22(2):265–312

Pesaran MH (2015) Testing weak cross-sectional dependence in large panels. Econom Rev 34(6–10):1089–1117

Pesaran MH, Yamagata T (2008) Testing slope homogeneity in large panels. J Econom 142(1):50–93

Sadiq M, Chau KY, Ha NTT, Phan TTH, Ngo TQ, Huy PQ (2023) The impact of green finance, eco-innovation, renewable energy and carbon taxes on CO2 emissions in BRICS countries: evidence from CS ARDL estimation. Geosci Front. https://doi.org/10.1016/j.gsf.2023.101689

Safi A, Chen Y, Wahab S, Zheng L, Rjoub H (2021) Does environmental taxes achieve the carbon neutrality target of G7 economies? Evaluating the importance of environmental R&D. J Environ Manag 293:112908

Sarpong KA, Xu W, Gyamfi BA, Ofori EK (2023) Can environmental taxes and green-energy offer carbon-free E7 economies? An empirical analysis in the framework of COP-26. Environ Sci Pollut Res 30:51726–51739

Sencer Atasoy B (2017) Testing the environmental Kuznets curve hypothesis across the U.S.: evidence from panel mean group estimators. Renew Sustain Energy Rev 77:731–747

Serener B, Kirikkaleli D, Addai K (2022) Patents on environmental technologies, financial development, and environmental degradation in Sweden: evidence from novel Fourier-based approaches. Sustainability 15(1):302

Shahzadi I, Yaseen MR, Iqbal Khan MT, Amjad Makhdum MS, Ali Q (2022) The nexus between research and development, renewable energy and environmental quality: evidence from developed and developing countries. Renew Energy 190:1089–1099

Sharif A, Kartal MT, Bekun FV, Pata UK, Foon CL, Kılıç Depren S (2023) Role of green technology, environmental taxes, and green energy towards sustainable environment: insights from sovereign Nordic countries by CS-ARDL approach. Gondwana Res 117:194–206

Shayanmehr S, Radmehr R, Ali EB, Ofori EK, Adebayo TS, Gyamfi BA (2023) How do environmental tax and renewable energy contribute to ecological sustainability? New evidence from top renewable energy countries. Int J Sustain Dev World 30(6):650–670

Shobande OA, Ogbeifun L (2023) Pooling cross-sectional and time series data for estimating causality between technological innovation, affluence and carbon dynamics: a comparative evidence from developed and developing countries. Technol Forecast Soc Change 187:122192

Silajdzic S, Mehic E (2018) Do environmental taxes pay Off? The impact of energy and transport taxes on CO2 emissions in transition economies. South East Eur J Econ Bus 13(2):126–143

Swamy PAVB (1970) Efficient inference in a random coefficient regression model. Econometrica 38(2):311

Tao R, Umar M, Naseer A, Razi U (2021) The dynamic effect of eco-innovation and environmental taxes on carbon neutrality target in emerging seven (E7) economies. J Environ Manag 299:113525

Ullah S, Luo R, Adebayo TS, Kartal MT (2023) Dynamics between environmental taxes and ecological sustainability: evidence from top-seven green economies by novel quantile approaches. Sustain Dev 31(2):825–839

United States Department of Energy (2022) Fuel cells. https://www.energy.gov/eere/fuelcells/fuel-cells. Retrieved 25 Feb 2023

Wang F, Harindintwali JD, Yuan Z, Wang M, Wang F, Li S, Yin Z, Huang L, Fu Y, Li L, Chang SX, Zhang L, Rinklebe J, Yuan Z, Zhu Q, Xiang L, Tsang DCW, Xu L, Jiang X, Liu J, Wei N, Kästner M, Zou Y, Ok YS, Shen J, Peng D, Zhang W, Barceló D, Zhou Y, Bai Z, Li B, Zhang B, Wei K, Cao H, Tan Z, Zhao L, He X, Zheng J, Bolan N, Liu X, Huang C, Dietmann S, Luo M, Sun N, Gong J, Gong Y, Brahushi F, Zhang T, Xiao C, Li X, Chen W, Jiao N, Lehmann J, Zhu Y-G, Jin H, Schäffer A, Tiedje JM, Chen JM (2021) Technologies and perspectives for achieving carbon neutrality. The Innovation 2(4):100180

Wang Z, Sami F, Khan S, Alamri AM, Zaidan AM (2023) Green innovation and low carbon emission in OECD economies: sustainable energy technology role in carbon neutrality target. Sustain Energy Technol Assess 59:103401

Westerlund J (2007) Testing for error correction in panel data. Oxford Bull Econ Stat 69:709–748

Wolde-Rufael Y, Mulat-weldemeskel E (2023) Effectiveness of environmental taxes and environmental stringent policies on CO2 emissions: the European experience. Environ Dev Sustain 25(6):5211–5239

Yakita A, Zhang D (2022) Environmental awareness, environmental R&D spillovers, and privatization in a mixed duopoly. Environ Econ Policy Stud 24(3):447–458

Youssef AB, Dahmani M, Mabrouki M (2023) The impact of environmentally related taxes and productive capacities on climate change: insights from European economic area countries. Environ Sci Pollut Res 30(44):99900–99912

Zhang Z, Zheng Q (2023) Sustainable development via environmental taxes and efficiency in energy: evaluating trade adjusted carbon emissions. Sustain Dev 31(1):415–425

Zhao A, Wang J, Sun Z, Guan H (2022) Environmental taxes, technology innovation quality and firm performance in China—a test of effects based on the Porter hypothesis. Econ Anal Policy 74:309–325

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

About this article

Cite this article

Dahmani, M. Environmental quality and sustainability: exploring the role of environmental taxes, environment-related technologies, and R&D expenditure. Environ Econ Policy Stud 26, 449–477 (2024). https://doi.org/10.1007/s10018-023-00387-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10018-023-00387-9