Summary.

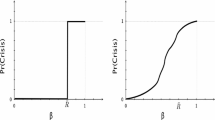

In a three-period finite exchange economy with incomplete financial markets and retrading, we study the effects of the degree of incompleteness and of changes in the financial structure on asset price volatility. In what are essentially no aggregate risk economies, asset price volatility is a sunspot-like phenomenon. If markets are completed by financial innovation, asset price volatility reduction is generic. With aggregate risk, changes in the financial structure affect asset price volatility through a pecuniary externality. Financial innovation which decreases equilibrium price volatility can be crafted under conditions of sufficient market incompleteness. Numerical examples illustrate the role of risk aversion for volatility changes and show that, with or without aggregate risk, reducing the degree of incompleteness per se is not necessarily associated with a volatility reduction.

Similar content being viewed by others

Author information

Authors and Affiliations

Corresponding author

Additional information

Received: 10 October 2003, Revised: 3 June 2004,

JEL Classification Numbers:

C60, D52, G10.

Correspondence to: Alessandro Citanna

This research project stems from and expands previous work circulated as “Financial innovation and price volatility”, GSIA Working Paper #1996-E30 and “Controlling price volatility through financial innovation”, Kellogg Working Paper #2002-1338. We thank Herakles Polemarchakis and Chris Telmer for their comments. We are grateful to an anonymous referee for careful reviews of earlier versions. The first author thanks also GSIA - Carnegie Mellon University for the kind hospitality during Fall 2002, when part of this project was completed.

Rights and permissions

About this article

Cite this article

Citanna, A., Schmedders, K. Excess price volatility and financial innovation. Economic Theory 26, 559–587 (2005). https://doi.org/10.1007/s00199-004-0532-2

Issue Date:

DOI: https://doi.org/10.1007/s00199-004-0532-2