Abstract

We propose a new approach for identifying and measuring the degree of financial constraint faced by firms and use it to investigate the effect of financial constraints on firm survival and development. Using panel data on French manufacturing firms over the 1996–2004 period, we find that (1) financial constraints significantly increase the probability of exiting the market, (2) access to external financial resources has a positive effect on the growth of firms in terms of sales, capital stock and employment, (3) financial constraints are positively related with productivity growth in the short-run. We interpret this last result as the sign that constrained firms need to cut costs in order to generate the resources they cannot raise on financial markets.

Similar content being viewed by others

Notes

The variables are (1) cash flow to fixed assets, (2) market to book ratio, (3) debt to total assets, (4) dividends to fixed assets, and (5) cash to fixed assets.

The variables included in the model are (1) the ratio of long-term to total debt, (2) a dividend dummy, (3) sales growth (both for the individual firm and the sector), (4) (the log of) total assets, (5) the number of analysts following the firm, (6) the ratio of liquid to total assets, (7) the industry debt to assets ratio.

There are (1) the current ratio, (2) the debt ratio, (3) the fixed charge coverage, (4) the net income margin, (5) sale growth, and (6) slack over total assets. See Cleary (1999) for a definition of the variables.

This is very much similar to what a probit or a logit estimation would do. In fact, multiple discriminant analysis is nothing more than an ancestor of these methodologies, which, because of current computer power, are probably preferable as more robust.

An obvious requirement of this methodology is working with quoted firms. One could then derive a score for non quoted firms as well, but it is not clear how well the index would behave.

This is the maximum amount of resources that a firm can devote to self-financing, and corresponds to the French capacité d’autofinancement.

To account for the presence of outliers we trim the top and bottom 0.5% observations for each variable.

We have tried other ways to combine the information, with identical results. Additional details are available upon request.

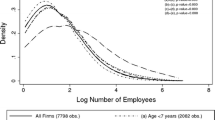

The survey (Enquête Annuelle d’Entreprises) is conducted by the French Ministry of Industry. The surveyed unit is the legal (not the productive) unit, which means that we are dealing with firm-level data. To investigate the role of financial constraints on growth and survival, firm, rather than plant level data, seem appropriate.

Chirinko and Schaller (1995) note that focusing on manufacturing only—as it is often done in the literature—may exaggerate the role played by financial constraints because of the specialized nature of the assets involved in those firms.

See Bellone et al. (2008) for more details on the method and a full description of the variables.

See Chapters 17 and 18 of Cameron and Trivedi (2005) for a discussion on the appropriate choice of distribution for the parameter of unobserved heterogeneity.

References

Aghion P, Angeletos GM, Banerjee A, Manova K (2005) Volatility and growth: credit constraints and productivity-enhancing investment. Working paper 11349, National Bureau of Economic Research

Aghion P, Askenazy P, Berman N, Cette G, Eymard L (2007a) Credit constraints and the cyclicality of R&D investment: evidence from France. Working paper 2007-4, Weatherhead Center for International Affairs

Aghion P, Fally T, Scarpetta S (2007b) Credit constraints as a barrier to the entry and post-entry growth of firms. Econ Policy 22(52):731–79

Altman E (1968) Financial ratios, discriminant analysis and the prediction of corporate bankruptcy. J Finance 23(4):589–609

Becchetti L, Trovato G (2002) The determinants of growth of small and medium sized firms. The role of the availability of external finance. Small Bus Econ 19(4):291–306

Beck T, Demirguc-Kunt A, Laeven L, Levine R (2005a) Finance, firm size, and growth. Policy research working paper series 3485, The World Bank

Beck T, Demirguc-Kunt A, Maksimovic V (2005b) Financial and legal constraints to firm growth: does firm size matter? J Finance LX(1):137–77

Bellone F, Musso P, Nesta L, Quéré M (2008) Market selection along the firm life cycle. Ind Corp Change Forthcoming

Binks M, Ennew C (1996) Growing firms and the credit constraint. Small Bus Econ 8(1):17–25

Bond S, Meghir C (1994) Dynamic investment models and the firm’s financial policy. Rev Econ Stud 61(2):197–222

Cameron A, Trivedi P (2005) Microeconometrics: methods and applications. Cambridge University Press

Campa JM, Shaver JM (2002) Exporting and capital investment: on the strategic behavior of exporters. IESE research papers 469, IESE Business School

Carpenter R, Petersen B (2002) Is the growth of small firms constrained by internal finance? Rev Econ Stat 84(2):298–309

Caves DW, Christensen LR, Diewert WE (1982) Multilateral comparisons of output, input, and productivity using superlative index numbers. Econ J 92(365):73–86

Chirinko R, Schaller H (1995) Why does liquidity matter in investment equations? J Money, Credit Bank 27(2):527–48

Cleary S (1999) The relationship between firm investment and financial status. J Finance 54(2):673–92

Cleary S (2006) International corporate investment and the relationships between financial constraint measures. J Bank Financ 30(5):1559–80

Demirguc-Kunt A, Maksimovic V (1998) Law, finance, and firm growth. J Finance LIII(6):2107–137

Devereux M, Schiantarelli F (1990) Investment, financial factors and cash flow: evidence from U.K. panel data. In: Hubbard G (ed) Information, capital markets and investment. University of Chicago Press, pp 279–306

Fazzari S, Hubbard G, Petersen B (1988) Financing constraints and corporate investment. Brookings Pap Econ Act 1:141–95

Gilchrist S, Himmelberg C (1995) Evidence on the role of cash flow for investment. J Monet Econ 36(3):541–572

Good DH, Nadiri MI, Sickles R (1997) Index number and factor demand approaches to the estimation of productivity. In: Pesaran H, Schmidt P (eds) Handbook of applied econometrics: microeconometrics. Blackwell, Oxford, pp 14–80

Greenaway D, Guariglia A, Kneller R (2005) Do financial factors affect exporting decisions? GEP research paper 05/28, Leverhulme Center

Holtz-Eakin D, Joulfaian D, Rosen H (1994) Sticking it out: entrepreneurial survival and liquidity constraints. J Polit Econ 102:53–75

Hoshi T, Kashyap A, Scharfstein D (1991) Corporate structure, liquidity, and investment: evidence from Japanese industrial groups. Q J Econ 106(1):33–60

Hubbard G (1998) Capital-market imperfections and investment. J Econ Lit 36(1):193–225

Jenkins S (1995) Easy ways to estimate discrete time duration models. Oxf Bull Econ Stat 57:129–138

Jeong H, Townsend R (2005) Discovering the sources of TFP growth: occupational choice and financial deepening. Working paper 05.19, IEPR

Kadapakkam PR, Kumar P, Riddick L (1998) The impact of cash flows and firm size on investment: the international evidence. J Bank Financ 22(3):293–320

Kaplan S, Zingales L (1997) Do investment-cash flow sensitivities provide useful measures of financing constraints?. Q J Econ 112(1):169–215

Lamont O, Polk C, Saa-Requejo J (2001) Financial constraints and stock returns. Rev Financ Stud 14(2):529–54

Levine R (2005) Finance and growth: theory and evidence. In: Aghion P, Durlauf S (eds) Handbook of economic growth, vol 1. Elsevier, chap 12, pp 865–934

Modigliani F, Miller M (1958) The cost of capital, corporation finance and the theory of investment. Am Econ Rev 48(3):261–97

Nickell S, Nicolitsas D (1999) How does financial pressure affect firms? Eur Econ Rev 43(8):1435–1456

Nickell S, Nicolitsas D, Dryden N (1997) What makes firms perform well? Eur Econ Rev 41(3-5):783–796

Prentice R, Gloeckler L (1978) Regression analysis of grouped survival data with application to breast cancer data. Biometrics 34:57–67

Savignac F (2006) The impact of financial constraints on innovation: evidence from French manufacturing firms. Cahiers de la Maison des Sciences Economiques v06042, Université Panthéon-Sorbonne (Paris 1)

Whited T (2006) External finance constraints and the intertemporal pattern of intermittent investment. J Financ Econ 81(3):467–502

Whited T, Wu G (2006) Financial constraints risk. Rev Financ Stud 19(2):531–59

Winker P (1999) Causes and effects of financing constraints at the firm level. Small Bus Econ 12(2):169–81

Acknowledgements

The authors blame each other for any remaining mistakes. They nevertheless agree on the need to thank Sylvain Barde, Flora Bellone, Jean-Luc Gaffard, Sarah Guillo, Evens Salies, and above all Lionel Nesta for useful comments and discussions.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Musso, P., Schiavo, S. The impact of financial constraints on firm survival and growth. J Evol Econ 18, 135–149 (2008). https://doi.org/10.1007/s00191-007-0087-z

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00191-007-0087-z