Abstract

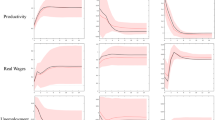

This article investigates the dynamics of aggregate wages and prices in the United States (US) and the Euro Area (EA) with a special focus on persistence of real wages, wage and price inflation. The analysis is conducted within a structural vector error-correction model, where the structural shocks are identified using the long-run properties of the theoretical model, as well as the cointegrating properties of the estimated system. Overall, in the long run, wage and price inflation emerge as more persistent in the EA than in the US in the face of import price, unemployment, or permanent technology shocks. This finding is robust to the changes in the sample period and in the models’ specifications entertained in the article.

Similar content being viewed by others

References

Abbritti M, Weber S (2008) Labor market rigidities and the business cycle: Price vs. quantity restricting institutions. IHEID Working Papers 01-2008, Economics Section, The Graduate Institute of International Studies

Altissimo F, Ehrmann M, Smets F (2006) Inflation persistence and price-setting behaviour in the Euro Area: a summary of the IPN evidence. Occasional Papers 46, European Central Bank

Balmaseda M, Dolado JJ, Lopez-Salido JD (2000) The dynamic effects of shocks to labour markets: evidence from OECD countries. Oxford Econ Pap 52(1): 3–23

Bårdsen G, Fisher PG (1999) Economic theory and econometric dynamics in modelling wages and prices in the United Kingdom. Empir Econ 24(3): 483–507

Bårdsen G, Nymoen R (2009) U.S. natural rate dynamics reconsidered. In: Castle J, Shephard N (eds) The methodology and practise of econometrics. A Festschrift in honour of David F. Hendry. Oxford University Press, Oxford

Bårdsen G, Eitrheim Ø, Jansen ES, Nymoen R (2005) The econometrics of macroeconomic modelling. Oxford University Press, Oxford

Bårdsen G, Hurn S, McHugh Z (2007) Modelling wages and prices in Australia. Econ Rec 83(261): 143–158

Bentolila S, Dolado JJ, Jimeno JF (2008) Does immigration affect the Phillips curve? Some evidence for Spain. Eur Econ Rev 52(8): 1398–1423

Bils M, Klenow PJ (2004) Some evidence on the importance of sticky prices. J Political Econ 112(5): 947–985

Blanchard O, Galí J (2007) Real wage rigidities and the new Keynesian model. J Money Credit Bank 39(s1): 35–65

Blanchard O, Katz LF (1999) Wage dynamics: reconciling theory and evidence. Am Econ Rev 89(2): 69–74

Blinder AS, Cannetti ERD, Lebow DE, Rudd JB (1998) Asking about prices: a new approach to understanding price stickiness. Russel Sage Foundation, New York

Brüggemann R (2006) Sources of German unemployment: a structural vector error correction analysis. Empir Econ 31(2): 409–431

Canova F, Gambetti L, Pappa E (2007) The structural dynamics of output growth and inflation: some international evidence. Econ J 117(519): C167–C191

Carstensen K, Hansen G (2000) Cointegration and common trends on the West German labour market. Empir Econ 25(3): 475–493

Cheung YW, Lai KS (1993) Finite-sample sizes of Johansen’s likelihood ratio tests for cointegration. Oxford Bull Econ Stat 55(3):313–328

Christiano LJ, Eichenbaum M, Evans CL (2005) Nominal rigidities and the dynamic effects of a shock to monetary policy. J Political Econ 113(1): 1–45

Crowder WJ, Hoffman DL, Rasche RH (1999) Identification, long-run relations, and fundamental innovations in a simple cointegrated system. Rev Econ Stat 81(1): 109–121

Dhyne E, Alvarez LJ, Bihan HL, Veronese G, Dias D, Hoffmann J, Jonker N, Lunnemann P, Rumler F, Vilmunen J (2006) Price changes in the Euro Area and the United States: some facts from individual consumer price data. J Econ Perspect 20(2): 171–192

Dias DA, Marques CR (2010) Using mean reversion as a measure of persistence. Econ Model 27(1): 262–273

Druant M, Fabiani S, Kezdi G, Lamo A, Martins F, Sabbatini R (2009) How are firms’ wages and prices linked: survey evidence in Europe. Working Paper Series 1084, European Central Bank

EC (2007) Employment in Europe. European Commission

Erceg CJ, Henderson DW, Levin AT (2000) Optimal monetary policy with staggered wage and price contracts. Journal of Monetary Economics 46(2): 281–313

Fabiani S, Druant M, Hernando I, Kwapil C, Landau B, Loupias C, Martins F, Mathä T, Sabbatini R, Stahl H, Stokman A (2006) What firms’ surveys tell us about price-setting behavior in the Euro Area. Int J Central Bank 2(3):3–47

Fagan G, Henry J, Mestre R (2001) An area-wide model (AWM) for the Euro Area. Working Paper Series 42, European Central Bank

Feldstein M (2008) Did wages reflect growth in productivity?. J Policy Model 30(4): 591–594

Forslund A, Gottfries N, Westermark A (2008) Prices, productivity and wage bargaining in open economies. Scand J Econ 110(1): 169–195

Gadzinski G, Orlandi F (2004) Inflation persistence in the European Union, the Euro Area and the United States. Working Paper Series 414, European Central Bank

Galí J (1999) Technology, employment, and the business cycle: do technology shocks explain aggregate fluctuations?. Am Econ Rev 89(1): 249–271

Giannone D, Lenza M, Reichlin L (2008) Explaining the great moderation: it is not the shocks. J Eur Econ Assoc 6(2–3): 621–633

Gonzalo J, Ng S (2001) A systematic framework for analyzing the dynamic effects of permanent and transitory shocks. J Econ Dyn Control 25(10): 1527–1546

Greenslade JV, Hall SG, Henry SGB (2002) On the identification of cointegrated systems in small samples: a modelling strategy with an application to UK wages and prices. J Econ Dyn Control 26(9–10): 1517–1537

Hansen H, Warne A (2001) The cause of Danish unemployment: demand or supply shocks?. Empir Econ 26(3): 461–486

Jacobson T, Vredin A, Warne A (1997) Common trends and hysteresis in Scandinavian unemployment. Eur Econ Rev 41(9): 1781–1816

Johansen S (1995) Identifying restrictions of linear equations with applications to simultaneous equations and cointegration. J Econom 69(1): 111–132

Johansen S (2002) A small sample correction for the test of cointegrating rank in the vector autoregressive model. Econometrica 70(5): 1929–1961

Juselius K (2006) The Cointegrated VAR model. Oxford University Press, Oxford

King RG, Plosser CI, Stock JH, Watson MW (1991) Stochastic trends and economic fluctuations. Am Econ Rev 81(4): 819–840

Klenow PJ, Kryvtsov O (2008) State-dependent or time-dependent pricing: does it matter for recent U.S. inflation?. Q J Econ 123(3): 863–904

Layard R, Nickell S, Jackman R (1991) Unemployment: macroeconomic performance and the labour market. Oxford University Press, Oxford

Levin AT, Piger JM (2004) Is inflation persistence intrinsic in industrial economies? Working Paper Series 334, European Central Bank

Levin AT, Onatski A, Williams JC, Williams N (2005) Monetary policy under uncertainty in micro-founded macroeconometric models. NBER Working Papers 11523, National Bureau of Economic Research, Inc

Lindbeck A (1993) Unemployment and macroeconomics. The MIT Press, Cambridge

Lütkepohl H (2006) Structural vector autoregressive analysis for cointegrated variables. AStA Adv Stat Anal 90(1): 75–88

Marcellino M, Mizon GE (2000) Modelling shifts in the wage-price and unemployment-inflation relationships in Italy, Poland and the UK. Econ Model 17(3): 387–413

Marcellino M, Mizon GE (2001) Small-system modelling of real wages, inflation, unemployment and output per capita in Italy 1970–1994. J Appl Econom 16(3): 359–370

Nakamura E, Steinsson J (2008) Five facts about prices: a reevaluation of menu cost models. Q J Econ 123(4): 1415–1464

Nickell SJ, Andrews M (1983) Unions, real wages and employment in Britain 1951–1979. Oxford Econ Pap 35(0): 183–206

Pagan A, Pesaran MH (2008) Econometric analysis of structural systems with permanent and transitory shocks. J Econ Dyn Control 32(10): 3376–3395

Peersman G (2005) What caused the early millennium slowdown? Evidence based on vector autoregressions. J Appl Econom 20(2): 185–207

Peersman G, Robays IV (2009) Oil and the Euro Area economy. Econ Policy 24: 603–651

Pétursson TG (2002) Wage and price formation in a small open conomy: Evidence from Iceland. Working Paper 16, Central Bank of Iceland

Pétursson TG, Sløk T (2001) Wage formation and employment in a cointegrated VAR model. Econom J 4(2): 2

Staiger D, Stock JH, Watson MW (2002) Prices, wages and the U.S. NAIRU in the 1990s. In: Kruger A, Solow R (eds) The roaring nineties. Russel Sage Foundation, New York

Vermeulen P, Dias D, Dossche M, Gautier E, Hernando I, Sabbatini R, Stahl H (2007) Price setting in the Euro Area: Some stylised facts from individual producer price data. Working Paper 727, European Central Bank

Warne A (1993) A common trends model: Identification, estimation and inference. Papers 555, Stockholm—International Economic Studies

Author information

Authors and Affiliations

Corresponding author

Additional information

The views expressed in this paper are those of the authors and do not necessarily reflect those of the Banco de Portugal or the Eurosystem.

Rights and permissions

About this article

Cite this article

Duarte, R., Marques, C.R. The dynamic effects of shocks to wages and prices in the United States and the Euro Area. Empir Econ 44, 613–638 (2013). https://doi.org/10.1007/s00181-012-0561-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-012-0561-9