Abstract

We study the effects of pension reform on hours worked by three active generations, education of the young, the retirement decision of older workers, and aggregate growth in a four-period OLG model. The model explains important facts well for many OECD countries. Our simulation results prefer an intelligent pay-as-you-go system above a fully funded private system. Positive effects on employment and growth are the strongest when the pay-as-you-go system includes a tight link between individual labor income and the pension, and when it attaches a high weight to labor income earned as an older worker to compute the pension assessment base.

Similar content being viewed by others

Notes

The former may be particularly valuable from the perspective of relaxation and time to spend on personal activities of short duration. The latter may be valuable to enjoy activities which take more time and ask for longer-term commitment (e.g. long journeys, non-market activity as a volunteer).

The main results in this paper are not in any way influenced by the magnitude of π, Ω or ρ.

Our approach to model early retirement benefits as a function of a worker’s last labor income, similar to standard non-employment benefits, reflects regulation and/or common practice in many countries. In some countries (e.g. Belgium, the Netherlands) workers can enter the early retirement regime only from employment, with their benefits being linked to the last wage. In other countries (e.g. Denmark) there is only access from unemployment, with the early retirement benefit being linked to the unemployment benefit (Salomäki 2003). As to common practice, Duval (2003) confirms that in many countries, unemployment-related or disability benefits can be used de facto to bridge the time between the effective retirement age and old-age pension eligibility. Again there is a link between benefits and former wages.

We explain economy-wide wage growth in Section 3.3. Individuals take it as exogenous.

Domestic output and net factor income from abroad at the LHS of Eq. 24 constitute national income. Since in our model there are no unilateral transfers between a country and the rest of the world, we have that CA t = NX t + r t F t , with NX t representing net exports of goods and services. It is then easy to see that Eq. 24 can also be written in a maybe more common way as Y t = C t + I t + G ct + G yt + NX t .

And with the values of two parameters in the human capital production function (v, κ) that we discuss below (see also footnote 9).

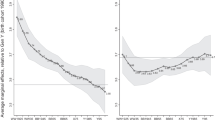

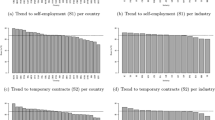

From our model’s predictions and the true data for 13 countries we computed for each variable (n 1, n 2, n 3, e, R, growth) the root mean squared error normalized to the mean. We minimized the average normalized RMSE over all six variables. More precisely, we adopted the following iterative procedure. We chose values for v and κ and then calibrated the efficiency parameter ϕ and the scale parameter σ. The values for v and κ had no influence on the calibration results for γ j and ρ. Given the obtained values for ϕ and σ, we computed the average normalized RMSE over all six variables. We then checked whether changes in v and κ, and a recalibration of σ and ϕ, could further reduce this statistic. We did this until no further reduction was possible.

This is the case in Austria, Belgium, France, Germany, Finland, and the UK. Workers cannot be structurally non-employed and still receive unemployment benefits in the Netherlands, Italy, Denmark, Norway and the US (OECD, 2004).

Note that we calculate government consumption as total government consumption in % of GDP, diminished with the fraction of public education outlays going to wages and working-expenses. The latter are included in productive expenditures.

In most countries, mandatory programs are public. For Denmark, the Netherlands and Sweden the data also include benefits from mandatory private systems. These benefits are earnings-related. Voluntary, occupational pensions are not included in our data.

For the sake of completeness, it should be mentioned that our proxy for b 4b also includes targeted and minimum pensions if they are relevant for a worker with mean income. Basic pensions pay the same amount to every retiree. Targeted plans pay a higher benefit to poorer pensioners and reduced benefits to better-off ones. Minimum pensions are similar to targeted plans. Their main aim is to prevent pensions from falling below a certain level (OECD 2005, p. 22–23). Our main motivation to merge these three categories in our proxy for b 4b is that they are not (or even inversely) linked to earnings.

In Austria, Norway and France earnings-related pensions are not calculated from average lifetime income but from average income during the final working years or a number of years with the highest earnings. Ideally, one would impose different weights p 1, p 2 and p 3. However, the pension replacement rate reported by the OECD would then no longer be reliable since it is based on the assumption of equal weights.

We also assume TFP to be the same in all countries. Note, however, that this assumption is not crucial. The utility function being separable and logarithmic in consumption, and goods production being Cobb–Douglas, the level of TFP does not matter for employment or growth rates. Also, differences across countries in TFP have no effect on cross-country performance differences in our model, at least if these TPF differences are constant.

A major element behind the deviation for this country seems to be underestimation of the fallback income position for structurally non-employed young workers. OECD data show very low replacement rates in Italy. However, as shown by Reyneri (1994), the gap between Italy and other European countries is much smaller than it seems. Reyneri (1994) points to the importance of family support as an alternative to unemployment benefits. Fernández Cordón (2001) shows that in Italy young people live much longer with their parents than in other countries. In 1995 for example about 56% of people aged 25–29 were still living with their parents in Italy. In about all other countries this fraction was below 23%. Of all non-working males aged 25–29 in Italy more than 80% were living with their parents. In France or Germany the corresponding numbers were close to 40%.

Effects are even (about 50%) smaller if labor taxes are adjusted to maintain a constant debt to GDP ratio.

More precisely, to keep the debt to GDP ratio constant, the government can raise lump sum transfers by 1.20% of output.

In particular, the gradual decline in b 4a and b 4b is announced at time t = 1 and implemented as follows. Pensions benefits are not reduced for retirees at the moment of policy implementation (t = 1), since retirees are not able to react to a pension reduction. In t = 2 and t = 3 the replacement rates are respectively reduced to 2/3 and 1/3 of their initial rates. From t = 4 onwards, b 4a and b 4b are zero. At each moment, overall labor tax rates are reduced to ex ante compensate for the decline in pension expenditures.

The announcement of the transition to a fully-funded system, and the perspective of a gradual fall in labor taxes during periods 2, 3 and 4, as described in footnote 19, makes individuals work less when young (and work more in later periods—at lower tax rates). Young individuals therefore study more, which is good for the evolution of human capital, and output. As we report in Table 5, however, this positive education effect is not permanent (on the contrary).

References

Altig DA, Auerbach AJ, Kotlikoff LJ, Smetters KA, Walliser J (2001) Simulating fundamental tax reform in the United States. Am Econ Rev 91(3):574–595

Arcalean C, Schiopu I (2010) Public versus private investment and growth in a hierarchical education system. J Econ Dyn Control 34(4):604–622

Auerbach AJ, Kotlikoff LJ (1987) Dynamic fiscal policy. Cambridge University Press, Cambridge

Auerbach AJ, Kotlikoff LJ, Hagemann RP, Nicoletti G (1989) The economic dynamics of an ageing population: the case of four OECD countries. OECD Economic Studies 12:97–130

Azariadis C, Drazen A (1990) Threshold externalities in economic development. Q J Econ 105(2):501–526

Barr N (2006) Pensions: overview of the issue. Oxf Rev Econ Policy 22(1):1–14

Barro RJ (1990) Government spending in a simple model of endogenous growth. J Polit Econ 98(5):S103–126

Benhabib J, Farmer REA (1994) Indeterminacy and increasing returns. J Econ Theory 63(1):19–41

Börsch-Supan AH, Ludwig A (2010) Old Europe ages: reforms and reform backlashes. NBER working paper #15744

Börsch-Supan AH, Ludwig A, Winter J (2006) Ageing, pension reform and capital flows: a multi-country simulation model. Economica 73(292):625–658

Boucekkine R (1995) An alternative methodology for solving non-linear forward-looking models. J Econ Dyn Control 19(4):711–734

Bouzahzah M, de la Croix D, Docquier F (2002) Policy reforms and growth in computational OLG economies. J Econ Dyn Control 26(12):2093–2113

Brandt N, Burniaux J-M, Duval R (2005) Assessing the OECD jobs strategy: past developments and reforms. OECD Economics department working papers, no 429 (annexes)

Buiter WH, Kletzer KM (1993) Permanent international productivity growth differentials in an integrated global economy. Scand J Econ 95(4):467–493

Cigno A (2010) How to avoid a pension crisis: a question of intelligent system design. CESifo Econ Stud 56(1):21–37

Cremer H, Lozachmeur J-M, Pestieau P (2008) Social security and retirement decision: a positive and normative approach. J Econ Surv 22(2):213–233

de la Croix D, Pierrard O, Sneessens HR (2010) Aging and pensions in general equilibrium: labor market imperfections matter. IZA discussion papers #5276

Devereux MP, Griffith R, Klemm A (2002) Corporate income tax reforms and international tax competition. Econ Policy 17(35):449–495

Dhont T, Heylen F (2008) Why do Europeans work (much) less? It is taxes and government expenditures. Econ Inq 46(2):197–207

Dhont T, Heylen F (2009) Employment and growth in Europe and the US: the role of fiscal policy composition. Oxford Econ Pap 61(3):538–565

Diamond PA (1965) National debt in a neoclassical growth model. Am Econ Rev 55(5):1126–1150

Docquier F, Michel P (1999) Education subsidies, social security and growth: the implications of a demographic shock. Scand J Econ 101(3):425–440

Docquier F, Paddison O (2003) Social security benefit rules, growth and inequality. J Macroecon 25(1):47–71

Duval R (2003) The retirement effects of old-age pension and early retirement schemes in OECD Countries. OECD economics department working papers, no 370

Feldstein MS (1974) Social security, induced retirement, and aggregate capital accumulation. J Polit Econ 82(5):905–926

Feldstein MS (2005) Rethinking social insurance. Am Econ Rev 95(1):1–24

Fenge R, Pestieau P (2005) Social security and early retirement. MIT Press, Cambridge

Fernández Cordón JA (2001) Youth as a transition to full autonomy. Fam Obs 3:4–11

Fisher WH, Keuschnigg C (2010) Pension reform and labor market incentives. J Popul Econ 23(2):769–803

Fougère M, Harvey S, Mercenier J, Mérette M (2009) Population ageing, time allocation and human capital: a general equilibrium analysis for Canada. Econ Model 26(1):30–39

Glomm G, Ravikumar B (1992) Public vs. private investment in human capital: endogenous growth and income inequality. J Polit Econ 100(4):818–834

Gruber J, Wise DA (2002) Social security programs and retirement around the world: microestimation. NBER working paper #9407

Hachon C (2010) Do Beveridgian pension systems increase growth. J Popul Econ 23(2):825–831

Hanushek EA, Woessmann L (2009) Do better schools lead to more growth? Cognitive skills, economic outcomes, and causation. NBER working paper #14633

Heijdra BJ, Romp WE (2009) Retirement, pensions and ageing. J Public Econ 93(3–4):586–604

Heylen F, Van de Kerckhove R (2010) Fiscal policy, employment by age, and growth in OECD economies. Paper presented at the 25th annual congress of the European Economic Association, Glasgow, August 2010 (www.sherppa.be)

Hu SC (1979) Social security, the supply of labor and capital accumulation. Am Econ Rev 69(3):274–283

Jaag C, Keuschnigg C, Keuschnigg M (2010) Pension reform, retirement, and life-cycle unemployment. Int Tax Public Finan 17(5):556–585

Juillard M (1996) Dynare: a program for the resolution and simulation of dynamic models with forward variables through the use of a relaxation algorithm. CEPREMAP working paper, no 9602

Kaganovich M, Meier V (2008) Social security systems, human capital, and growth in a small open economy. CESifo working paper, no 2488

Kaganovich M, Zilcha I (1999) Education, social security and growth. J Public Econ 71(2):289–309

Kemnitz A, Wigger BU (2000) Growth and social security: the role of human capital. Eur J Polit Econ 16(4):673–683

King RG, Rebelo S (1990) Public policy and economic growth: developing neoclassical implications. J Polit Econ 98(5):S126–150

Le Garrec G (2012) Social security, income inequality and growth. Journal of Pension Economics and Finance 11(1):53–70

Lindbeck A, Persson M (2003) The gains from pension reform. J Econ Lit 41(1):74–112

Ludwig A, Schelkle T, Vogel E (2012) Demographic change, human capital and welfare. Rev Econ Dyn 15(1):94–107

Lucas RE (1988) On the mechanics of economic development. J Monet Econ 22(1):3–42

Nickell S, Nunziata L, Ochel W (2005) Unemployment in the OECD since the 1960s. What do we know? Econ J 115(500):1–27

OECD (2004) Benefits and Wages, country specific files, www.oecd.org/els/social/workincentives

OECD (2005) Pensions at a glance: public policies across OECD countries. OECD, Paris

Ohanian LE, Raffo A, Rogerson R (2008) Long-term changes in labor supply and taxes: evidence from OECD countries, 1956–2004. J Monet Econ 55(8):1353–1362

Reyneri E (1994) Italy: a long wait in the shelter of the family and of safeguards from the state. In: Benoit-Guilbot O, Gaillie D (eds) Long-term unemployment. Pinter, London, pp 97–110

Rogerson R (2007) Taxation and market work: is Scandinavia an outlier? Econ Theor 32(1):59–85

Rogerson R, Wallenius J (2009) Micro and macro elasticities in a life cycle model with taxes. J Econ Theory 144(6):2277–2292

Salomäki A (2003) Remain in or withdraw from the labour market? A comparative study on incentives. European economy economic papers, no 193

Samuelson PA (1958) An exact consumption-loan model of interest, with or without the social contrivance of money. J Polit Econ 66(6):467–482

Sheshinski E (1978) A model of social security and retirement decisions. J Public Econ 10(3):337–360

Sommacal A (2006) Pension systems and intragenerational redistribution when labor supply is endogenous. Oxf Econ Pap 58(3):379–406

Stokey NL, Rebelo S (1995) Growth effects of flat-rate taxes. J Polit Econ 103(3):519–550

Turnovsky SJ (2000) Fiscal policy, elastic labor supply, and endogenous growth. J Monet Econ 45(1):185–210

Whiteford PB, Whitehouse E (2006) Pension challenges and pension reforms in OECD countries. Oxf Rev Econ Policy 22(1):78–94

Whitehouse E, D’Addio A, Chomik R, Reilly A (2009) Two decades of pension reform: what has been achieved and what remains to be done. Geneva Pap Risk Ins: Issues Practice 34(4):515–535

Woessmann L (2003) Schooling resources, educational institutions and student performance: the international evidence. Oxf Bull Econ Stat 65(2):117–170

Zhang J (1995) Social security and endogenous growth. J Public Econ 58(2):185–213

Zhang J, Zhang J (2003) Long-run effects of unfunded social security with earnings-dependent benefits. J Econ Dyn Control 28(3):617–641

Acknowledgements

We would like to thank David de la Croix, Fabian Kindermann, Pierre Pestieau, Dirk Van de gaer, Kelly Sorgeloos, Geert Vancronenburg, Jan Bonenkamp, and two anonymous referees for their constructive comments on earlier versions of this paper. We have also benefited from comments received at the 2011 OLG Days (Vielsalm, May 2011), the 10th Journées Louis-André Gérard-Varet—Conference in Public Economics (Marseille, June 2011), the 2011 Annual Meeting of the Society for Economic Dynamics (Ghent, July 2011), the 2011 Annual Congress of the International Institute of Public Finance (Ann Arbor, MI, USA) and seminars in Brussels and Louvain. We acknowledge support from the Flemish government (Steunpunt Fiscaliteit en Begroting—Vlaanderen) and the Belgian Program on Interuniversity Poles of Attraction, initiated by the Belgian State, Federal Office for scientific, technical and cultural affairs, contract UAP No. P 6/07. Tim Buyse acknowledges financial support from the Research Foundation—Flanders (FWO). Any remaining errors are ours.

Author information

Authors and Affiliations

Corresponding author

Additional information

Responsible editor: Alessandro Cigno

Electronic supplementary material

Below is the link to the electronic supplementary material.

Rights and permissions

About this article

Cite this article

Buyse, T., Heylen, F. & Van de Kerckhove, R. Pension reform, employment by age, and long-run growth. J Popul Econ 26, 769–809 (2013). https://doi.org/10.1007/s00148-012-0416-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00148-012-0416-x