Abstract

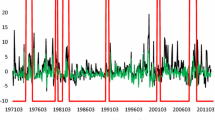

This paper provides additional empirical evidence of the relationship between the volatility of returns and trading activity in foreign exchange markets. Five-minute yen/dollar returns exhibit significant skewness, kurtosis, negative first-order autocorrelation and heteroskedasticity. Market activity (as measured by the intensity of quote arrivals) has a positive and statistically significant effect on conditional returns volatility. Such evidence is consistent with predictions of mixture of distrubutions models.

Similar content being viewed by others

References

Baillie, Richard T., andTim Bollerslev. “Intra-Day and Inter-Market Volatility in Foreign Exchange Rates”.Review of Economic Studies 58, no. 3 (May 1991): 565–585.

Bollerslev, Tim, andIan Domowitz. “Trading Patterns and Prices in the Interbank Foreign Exchange Market”.Journal of Finance 48, no. 4 (September 1993): 1421–1443.

Engle, Robert F., Takatoshi Ito, andWen-Ling Lin. “Meteor Showers or Heat Waves? Heteroskedastic Intra-Daily Volatility in the Foreign Exchange Market.”Econometrica 58, no. 3 (May 1990): 525–542.

Goodhart, Charles A.E., andL. Figliouli. “Every Minute Counts in Financial Markets”.Journal of International Money and Finance 10, no. 1 (March 1991): 23–52.

Glynn, Lenny. “The Forex Game”.Institutional Investor 22, no. 6 (June 1988): 88–97.

Harris, Lawrence. “Transaction Data Tests of the Mixture of Distributions Hypothesis.”Journal of Financial and Quantitative Analysis 22, no. 2 (June 1987): 127–141.

Ito, Takatoshi, andV. Vance Roley. “News From the U.S. and Japan: Which Moves the Yen/Dollar Exchange Rate?”.Journal of Monetary Economics 19, no. 2 (March 1987): 255–277.

JP Morgan.World Holiday and Time Guide 1993. 75th ed. J.P. Morgan and Co. Incorporated, 1993.

Lo, Andrew W., andA. Craig MacKinlay. “An Econometric Analysis of Nonsynchronous Trading”.Journal of Econometrics 45, no. 1–2 (July–August 1990): 181–211.

Müller, Ulrich A., Michel M. Dacorogna, Richard B. Olsen, Olivier V. Pictet, Matthias Schwarz, andClaude Morgenegg. “Statistical Study of Foreign Exchange Rates, Empirical Evidence of a Price Change Scaling Law, and Intraday Analysis.”Journal of Banking and Finance 14, no. 6 (December 1990): 1189–1208.

Tygier, Claude.Basic Handbook of Foreign Exchange: A Guide to Foreign Exchange Dealing. 2d ed. London: Euromoney Publications, 1988.

Wasserfallen, Walter. “Flexible Exchange Rates: A Closer Look”.Journal of Monetary Economics 23, no. 3 (May 1989): 511–521.

Wasserfallen, Walter, andHeinz Zimmerman. “The Behavior of Intra-Daily Exchange Rates”.Journal of Banking and Finance 9, no. 1 (March 1985): 55–72.

Wood, Robert A., Thomas H. McInish, andJ. Keith Ord. “An Investigation Of Transactions Data For NYSE Stocks”.Journal of Finance 40, no. 3 (July 1985): 723–739.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Smaby, T.R. An examination of the intraday behavior of the yen/dollar exchange rate: The relationship between trading activity and returns volatility. J Econ Finan 19, 39–50 (1995). https://doi.org/10.1007/BF02920213

Issue Date:

DOI: https://doi.org/10.1007/BF02920213