Abstract

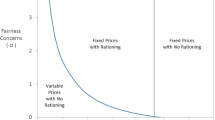

Second-best Pareto optimal pricing by a regulated firm subject to demand and capacity shocks is examined. Nonlinear price schedules for the firm's customers are obtained that are contingent on capacity realizations. The second-best Pareto optimal mechanism also is implemented by an allocation mechanism based on the consumer's choice of a minimum demand or firm power level. The optimal mechanism is implemented as well by a general form of priority pricing.

Similar content being viewed by others

References

Boiteux, M. 1971. “On the Management of Public Monopolies subject to Budget Constraints.” Journal of Economic Theory 3: 219–240.

Chao, H.P., and R. Wilson. 1987. “Priority Service: Pricing, Investment and Market Organization.” American Economic Review 77: 899–916.

Guesnerie, R., and J.J. Laffont. 1984. “A Complete Solution to a Class of Principal-Agent Problems with an Application to the Control of a Self-Managed Firm.” Journal of Public Economics 25: 329–369.

Doane, M.J., and D.F. Spulber. 1990. “Design and Implementation of Electricity Curtailment Programs.” Northwestern University, Kellogg G.S.M. Working Paper No. 90-30.

Harris, M., and A. Raviv. 1981. “A Theory of Monopoly Pricing Schemes with Demand Uncertainty.” American Economic Review 71: 347–365.

Marchand, M.G. 1974. “Pricing Power Supplied on an Interruptible Basis.” European Economic Review 5: 263–274.

Maskin, E., and J. Riley. 1984. “Monopoly with Incomplete Information.” Rand Journal of Economics 15: 171–196.

Mussa, M., and S. Rosen. 1978. “Monopoly and Product Quality.” Journal of Economic Theory 18: 310–317.

Panzar, J.C., and D.S. Sibley. 1978. “Public Utility Pricing Under Risk: The Case of Self-Rationing.” American Economic Review 68: 888–895.

Ramsey, F.P. 1927. “A Contribution to the Theory of Taxation.” Economic Journal 37: 47–61.

Spence, A.M. 1977. “Nonlinear Prices and Welfare.” Journal of Public Economics 8: 1–18.

Spulber, D.F. 1990. “Capacity-Contingent Nonlinear Pricing by Regulated Firms.” Northwestern University, Kellogg G.S.M. Working Paper No. 90-23.

Spulber, D.F. 1992. “Optimal Nonlinear Pricing and Contingent Contracts.” International Economic Review, 33 (forthcoming).

Viswanathan, N., and E.T.S. Tse. 1989. “Monopolistic Provision of Congested Service with Incentive-Based Allocation of Priorities.” International Economic Review 30: 153–174.

Wilson, R. 1989a. “Efficient and Competitive Rationing.” Econometrica 57: 1–40.

Wilson, R. 1989b. “Ramsey Pricing of Priority Service.” Journal of Regulatory Economics 1: 189–202.

Woo, C.K. 1990. “Efficient Electricity Pricing with Self-Rationing.” Journal of Regulatory Economics 2: 69–81.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Spulber, D.F. Capacity-contingent nonlinear pricing by regulated firms. J Regul Econ 4, 299–319 (1992). https://doi.org/10.1007/BF00134924

Issue Date:

DOI: https://doi.org/10.1007/BF00134924