Abstract

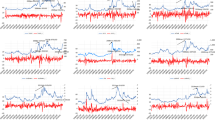

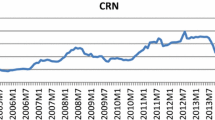

Crop prices in the United States (USA), and especially corn prices, have been displaying important changes in the last 10 years, after the ethanol mandate in 2005. Motivated by these significant price changes, there has been a growing interest in the study of price transmission from oil prices to agricultural commodity prices. In this contribution, we concentrate on the relationship between the price of oil and the prices of three agricultural commodities that are used for biofuels production: corn, soybeans, and sugar. In doing so, we apply linear Granger causality tests, the nonlinear causality test of Diks and Panchenko (J Econ Dyn Control 30:1647–1669, 2006), and the Brooks and Hinich (J Empir Financ 6:385–404) cross-bicorrelation test to daily data over the period from 1990 to 2016.

Coherent with the previous studies, we find weak linear Granger causality, but strong bidirectional nonlinear causality, especially for the period from 2006 to 2016. Using the Brooks and Hinich test, we also identify the number of epochs (nonoverlapped windows) where there is nonlinear dependence between each pair of series. We find that most cross-bicorrelation windows coincide from 2006 to 2016, indicating that the nonlinear dynamics between the series studied have changed in recent years in the aftermath of the ethanol mandate. Our results provide hints in order to improve our understanding of the effects of the implemented policies in the energy sector on agricultural commodities.

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Similar content being viewed by others

References

Baek, E., & Brock, W. (1992). A general test for nonlinear Granger causality: Bivariate model. Iowa State University and University of Wisconsin at Madison, Working Paper.

Balcombe, K., & Rapsomanikis, G. (2008). Bayesian estimation and selection of nonlinear vector error correction models: The case of the sugar-ethanol-oil nexus in Brazil. American Journal of Agricultural Economics, 90, 658–668.

Beckmann, J., & Czudaj, R. (2014). Volatility transmission in agricultural futures markets. Economic Modelling, 36, 541–546.

Bekiros, S. D., & Diks, C. G. H. (2008). The relationship between crude oil spot and futures prices: Cointegration, linear and nonlinear causality. Energy Economics, 30, 2673–2685.

Brock, W. A., Scheinkman, J. A., Dechert, W. D., & LeBaron, B. (1996). A test for independence based on the correlation dimension. Econometric Reviews, 15, 197–235.

Brooks, C., & Hinich, M. J. (1999). Cross-correlations and cross-bicorrelations in Sterling exchange rates. Journal of Empirical Finance, 6, 385–404.

Carter, C., Rausser, G., & Smith, A. (2012). The effect of the US ethanol mandate on corn prices. Unpublished manuscript. http://www.ourenergypolicy.org/wp-content/uploads/2013/07/The-Effect-oftheUS-Ethanol-Mandate-on-Corn-Prices-.pdf

Chavas, J.-P., & Holt, M. T. (1990). Acreage decisions under risk: The case of corn and soybeans. American Journal of Agricultural Economics,72, 529–538.

Cho, G., Sheldon, I. M., & McCorriston, S. (2002). Exchange rate uncertainty and agricultural trade. American Journal of Agricultural Economics, 84, 931–942.

Cont, R. (2001). Empirical properties of asset returns: Stylized facts and statistical issues. Quantitative Finance, 1, 223–236.

De Gorter, H., Drabik, D., & Just, D. R. (2015). The economics of biofuel policies: Impacts on price volatility in grain and oilseed markets. New York: Springer.

De Gorter, H., & Just, D. R. (2010). The social costs and benefit of biofuels: The intersection of environmental, energy and agricultural policy. Applied Economic Perspectives and Policy, 32, 4–32.

Deaton, A., & Laroque, G. (1992). On the behaviour of commodity prices. Review of Economic Studies, 59, 1–23.

Deaton, A., & Laroque. G. (1995). Estimating a nonlinear rational expectations commodity price model with unobservable state variables. Journal of Applied Econometrics, 10, S9–S40.

Dickey, D. A., & Fuller, W. A. (1981). Likelihood ratio statistics for autoregressive time series with a unit root. Econometrica, 49, 1057–1072.

Diks, C., & Panchenko, V. (2006). A new statistic and practical guidelines for nonparametric Granger causality testing. Journal of Economic Dynamics and Control, 30, 1647–1669.

Dillon, B. M., & Barrett, C. B. (2015). Global oil prices and local food prices: Evidence from east Africa. American Journal of Agricultural Economics, 98, 154–171.

Du, X., & McPhail, L. L. (2012). Inside the black box: The price linkage and transmission between energy and agricultural markets. The Energy Journal, 33, 171–194.

Ford, C., & Senauer, B. (2007). How biofuels could starve the poor. Foreign Affairs, 86, 41–53.

Granger, C. (1969). Investigating causal relations by econometric models and cross spectral methods. Econometrica, 37, 424–438.

Granger, C. (2014). Forecasting in business and economics. London: Academic Press.

Hiemstra, C., & Jones, J. D. (1994). Testing for linear and nonlinear Granger causality in the stock price-volume relation. Journal of Finance, 49, 1639–1664.

Hinich, M. J. (1996). Testing for dependence in the input to a linear time series model. Journal of Nonparametric Statistics, 6, 205–221

Im, K. S., Lee, J., & Tieslau, M. A. (2014). More powerful unit root tests with non-normal errors. In Festschrift honor Peter Schmidt (pp. 315–342). New York: Springer.

Jarque, C., & Bera, A. (1987). A test for normality of observations and regression residuals. International Statistical Review, 55, 163–172.

Jawadi, F., & Prat, G. (2012). Arbitrage costs and nonlinear adjustment in the G7 stock markets. Applied Economics, 44, 1561–1582.

Mackey, M. C. (1989). Commodity price fluctuations: Price dependent delays and nonlinearities as explanatory factors. Journal of Economic Theory, 48, 497–509.

Mensi, W., Hammoudeh, S., Nguyen, D. K., & Yoon, S.-M. (2014). Dynamic spillovers among major energy and cereal commodity prices. Energy Economics, 43, 225–243.

Nazlioglu, S. (2011). World oil and agricultural commodity prices: Evidence from nonlinear causality. Energy Policy, 39, 2935–2943.

Nazlioglu, S., Erdem, C., & Soytas, U. (2013). Volatility spillover between oil and agricultural commodity markets. Energy Economics, 36, 658–665.

Nazlioglu, S., & Soytas, U. (2011). World oil prices and agricultural commodity prices: Evidence from an emerging market. Energy Economics, 33, 488–496.

Patterson, D. M., & Ashley, R. A. (2000). A nonlinear time series workshop: A toolkit for detecting and identifying nonlinear serial dependence, vol. 2. New York: Springer.

Prat, G., & Uctum, R. (2011). Modelling oil price expectations: Evidence from survey data. The Quarterly Review of Economics and Finance, 51, 236–247.

Romero-Meza, R., Coronado, S., & Serletis, A. (2014). Oil and the economy: A cross bicorrelation perspective. Journal of Economic Asymmetries, 11, 91–95.

Serletis, A., & Istiak, K. (2018). Broker-dealer leverage and the stock market. Open Economies Review, 29(2), 215–222.

Serletis, A., Malliaris, A. G., Hinich, M. J., & Gogas, P. (2012). Episodic nonlinearity in leading global currencies. Open Economies Review, 23, 337–357.

Serra, T., Zilberman, D., & Gil, J. (2011a). Price volatility in ethanol markets. European Review of Agricultural Economics, 38, 259–280.

Serra, T., Zilberman, D., Gil, J. M., & Goodwin, B. K. (2011b). Nonlinearities in the U.S. corn-ethanol-oil price system. Agricultural Economics, 38, 259–280.

U.S. Energy Information Administration. (2013). Accessed Dec 10, 2016 from http://www.eia.gov/todayinenergy/detail.php?id=11511

Verteramo, L. J., & Tomek, W. G. (2016). Anticipatory signals of structural changes in U.S. corn demand. In Proceedings of the NCCC-134 Conference on Applied Commodity Price Analysis, Forecasting, and Market Risk Management, St. Louis, MO.

Working, H. (1949). The theory of price of storage. American Economic Review, 39, 1254–1262.

Zhang, Z., Lohr, L., Escalante, C., & Wetzstein, M. (2009). Ethanol, corn, and soybean price relations in a volatile vehicle-fuels market. Energies, 2, 320–339.

Zhang, Z., Lohr, L., Escalante, C., & Wetzstein, M. (2010). Food versus fuel: What do prices tell us? Energy Policy, 38, 445–451.

Zivot, E., & Wang, J. (2006). Modeling financial time series with S-PLUS. New York: Springer.

Acknowledgements

Rafael Romero-Meza and Semei Coronado are grateful for the support of FONDECYT (Project 1111034) and Universidad de Guadalajara for funding this research.

Author information

Authors and Affiliations

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2018 Springer Nature Switzerland AG

About this chapter

Cite this chapter

Coronado, S., Rojas, O., Romero-Meza, R., Serletis, A., Chiu, L.V. (2018). Crude Oil and Biofuel Agricultural Commodity Prices. In: Jawadi, F. (eds) Uncertainty, Expectations and Asset Price Dynamics. Dynamic Modeling and Econometrics in Economics and Finance, vol 24. Springer, Cham. https://doi.org/10.1007/978-3-319-98714-9_5

Download citation

DOI: https://doi.org/10.1007/978-3-319-98714-9_5

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-98713-2

Online ISBN: 978-3-319-98714-9

eBook Packages: Economics and FinanceEconomics and Finance (R0)