Abstract

This chapter offers a comprehensive review and explanation of crowdfunding in China. It first extensively describes the status of crowdfunding in China by presenting the market facts, insights, and current regulations of the four main crowdfunding models (reward-based, equity-based, loan-based, and donation-based) respectively. Next, through a detailed up-to-date literature review of the key literature of Chinese crowdfunding, three main research streams are summarized and discussed covering success drivers, comparative studies of Chinese versus other contexts of crowdfunding practice, and applications of crowdfunding for creative and sustainability projects. Finally, both practical and research implications are presented together with the challenges and future research directions on crowdfunding in China.

You have full access to this open access chapter, Download chapter PDF

Similar content being viewed by others

Keywords

- China

- Reward crowdfunding

- Donation crowdfunding

- Equity crowdfunding

- Loan-based crowdfunding

- Market development

- Regulation

Introduction

Crowdfunding is the practice of funding a project or venture by raising small amounts of money from the public via the Internet. Since the establishment of the first crowdfunding platform (“Demohour”) in China in 2011, crowdfunding has gained substantial popularity in the country. However, the growth of crowdfunding in China is still at early stage compared to other markets and overall market potential.

The development of crowdfunding in China can be divided into three stages. First, a “Rudimentary stage” (2011–2013), when the number of platforms and the scale of fundraising was small, and the number of crowdfunding platforms grew slowly. Second, a “Hyper-growth stage” (2014–2015), when the number of platforms and the scale of fundraising began to increase rapidly, and when the scale of transactions expanded rapidly. And, most recently, a third “Cautious development stage” (2016–present), where due to the stricter supervision of alternative finance, the number of platforms has decreased and so did the volumes of funds raised. Most of the crowdfunding platforms were waiting for the official regulatory policy before restarting/expanding their business. Accordingly, the growth rate of the crowdfunding industry has been slowed down.

Based on past developments, the Chinese crowdfunding market has carried out some favourable explorations in crowdfunding practice. Specifically, crowdfunding project initiators have found out the power of social network interaction in boosting crowdfunding success. Some integrated crowdfunding platforms have been transferred into vertical platforms in order to strengthen competitive advantages. For example, some comprehensive crowdfunding platforms have transformed into specialized crowdfunding platforms. And, furthermore, Chinese crowdfunding practitioners have started to explore ways to educate the public and potential investors.

In term of market size and market balance, despite being the largest in the world (Ziegler et al. 2019), the Chinese crowdfunding industry exhibits slower growth rates. The slower growth rate is mainly subject to the following problems: Firstly, the policy and legal environment of crowdfunding in China are still immature and under development, and there are still some frictions between the crowdfunding innovation and profit models and the current laws and regulations (e.g. Lin 2017; You 2017). Secondly, the Chinese-style crowdfunding credit system lacks a degree of credibility. Thirdly, intellectual property in crowdfunding projects is insufficiently protected. Lastly, Chinese society in general has limited understanding of crowdfunding and there are many misunderstandings about its use and associated risks and benefits. Accordingly, if the above problems can be solved, the Chinese crowdfunding industry is expected to achieve and regain rapid development in a standardized, regulated, and healthy way.

The purpose of the current chapter is thus to review the landscape of the crowdfunding industry in China, with a focus on providing meaningful insights from this unique and important market. We first provide extensive descriptions of different crowdfunding models in China. Based on that, we then generate context insights in different models respectively. Next, the current regulations of different crowdfunding models in China is presented and discussed. Then, through an extensive literature review, main crowdfunding research related to the Chinese market are exhibited and summarized. Finally, this chapter highlights the implications for practice and research, as well as mentioning potential future research directions.

Volumes by Models and Context Insights

As crowdfunding has different operating models, it is necessary to take all the main crowdfunding models into consideration in order to properly capture the comprehensive crowdfunding landscape in China. In this section, we report data and analysis for the four main crowdfunding models (reward-based, equity-based, loan-based, and donation-based) in China and then provide special insights of each model respectively.

Reward-Based Crowdfunding

Reward-based crowdfunding is identified as individuals contributing comparatively small amounts of money to crowdfunding projects in return for different kinds of non-monetary reward (e.g. physical products, services), while accepting a certain degree of risk of non-delivery on campaign promises (Shneor and Munim 2019). Reward-based crowdfunding is the best-known crowdfunding model in China.

According to the China Crowdfunding Industry Development Research (Yuan and Chen 2018), there were 90 operating reward-based crowdfunding platforms in mainland China. Geographically, these reward-based crowdfunding platforms are operating in 20 provincial-level administrative regions across the country. Most of the platforms are established in the coastal areas which have better financial conditions and entrepreneurial culture. Compared to the coastal areas, only a few platforms are established in the northeast, northwest, and southwest of China. Specifically, there are 26 reward-based crowdfunding platforms in Beijing followed by Guangdong (12), Zhejiang (11), Jiangsu (7), Shandong (7), and Shanghai (6). The platforms in the coastal area capture 77% of all reward-based crowdfunding platforms in mainland China.

In 2017, 18,209 reward-based crowdfunding projects were successfully online. Among the online projects, 13,927 projects got successfully funded by the end of their fundraising periods. The success rate is 76.48%. The sum of the fundraising targets of all successful projects is RMB 2.09 billion (approx. USD 0.3 billion). Eventually, the successful projects have raised RMB 9.743 billion (approx. USD 1.38 billion) in total, which is approximately 4.5 times higher than the expected funding amount. The total backer number of successful projects is approximately 23 million (Yuan and Chen 2018).

Among the successful projects, 4144 projects got funded in the range of RMB 50,000–100,000 (approx. USD 7106–14,211) followed by RMB 10,000–50,000 (approx. USD 1421–7106) (3967 projects), RMB 1000–10,000 (approx. USD 142–1421) (2600 projects) and less than RMB 1000 (approx. USD 142) (647 projects). The projects within the top four fundraising ranges are 11,358 which account for 81.57% of all the successful projects. There were only 208 projects that were successfully funded with an amount of more than RMB 1 million (approx. USD 0.14 million).

Reward-based crowdfunding projects in mainland China can be classified into seven main categories: technology, film, and television, agriculture, tourism, music, publishing and games. Technology, agriculture, and music are the top three categories for reward-based crowdfunding in China by number of campaigns. Technology ranked first with 3558 online projects, followed by agriculture with 3351 online projects, and music ranked third with 806 online projects. Projects from the top three categories account for 42% of the total number of online projects.

Insights on Reward-Based Crowdfunding

As the best-known crowdfunding model, reward-based crowdfunding in China has some unique characteristics. First, Chinese reward-based crowdfunding supporters are more “realistic” compared with the supporter in other mature crowdfunding markets (e.g. the U.S. crowdfunding market). Most of the Chinese backers invest their money in the projects in order to buy future products. Besides that, they tend to be less interested in participating in co-creation processes (Yuan and Chen 2018). In this sense, they behave more like consumers than like supporters. Accordingly, reward-based crowdfunding can be considered as equal to pure product pre-selling in China.

In addition, reward-based crowdfunding has been used as an online marketing/market testing channel by Chinese e-commerce giants (e.g. Alibaba, JD). These corporations’ participation in crowdfunding is not for fundraising but for launching their own products, increasing product awareness, and finding potential consumers.

Lastly, different from other reward-based crowdfunding markets, no commission fees are charged by most Chinese reward-based crowdfunding platforms. Instead, platforms get their income and profits from online marketing and advertising services.

Equity-Based Crowdfunding

In terms of equity-based crowdfunding, individuals invest money in purchasing offerings of private company securities with an expectation of receiving monetary rewards in the future. Equity-based crowdfunding is a game of capital markets. Therefore, it is subjected to financial regulations (Ahlers et al. 2015).

By the end of 2017, there were 89 equity-based crowdfunding platforms operating in mainland China. Geographically, among the 34 provincial-level administrative regions, equity-based crowdfunding platforms only cover 13 regions. Like the distribution of reward-based crowdfunding, most equity-based platforms are located in economically developed areas, while few platforms are established in the northeast, northwest, and southwest part of China. Specifically, 29 equity-based crowdfunding platforms are based in Beijing followed by Guangdong (24), Shanghai (15), Zhejiang (8), and Sichuan (4). The platforms in the above area capture 90% of all equity-based crowdfunding platforms in mainland China.

According to the China Crowdfunding Industry Development Research (Yuan and Chen 2018), 1053 equity-based crowdfunding projects were successfully online in 2017. Among the online projects, 745 projects got successfully funded by the end of their fundraising periods. The success rate is 70.75%. The successful projects have raised RMB 3.361 billion (approx. USD 0.48 billion) in total. In terms of categories, equity-based crowdfunding projects in mainland China can be classified into eight main categories: technology, physical stores, film and television, agriculture, tourism, music, publishing, and games. Projects from the eight main categories account for 77% of the total number of online projects. Among the eight categories, physical store, technology, and film and television are the top three categories by the number of projects. The physical store ranked top with 562 online projects, followed by technology with 137 online projects and film and television ranked third with 85 online projects.

In 2017, the total number of successful projects’ backers was 41,900. Most of the successful projects are with a small number of investors. Specifically, 63% of all the successful projects had less than 60 investors. 93% of all the successful projects had less than 160 investors. Relatively few projects had many investors. Here, only 44 projects had more than 160 investors, which account for 7% of all the successful projects. In terms of total fundraising amount, 42% of all the successful projects had a total fundraising amount of less than RMB 1 million (approx. USD 0.14 million); 91% of all the successful projects had a total fundraising amount of less than RMB 10 million (approx. USD 1.4 million), while only 69 projects have successfully raised more than RMB 10 million (approx. USD 1.4 million) through equity crowdfunding, which account for 9% of all successful projects.

Insights on Equity-Based Crowdfunding

Equity-based crowdfunding has not yet been legalized in China. Equity-based crowdfunding in China refers to “Internet non-public equity financing”. As public offering in China is under extremely strong supervision by the government, equity-based crowdfunding in China can only be executed in the form of private offering (Hu and Yang 2014). As a private offering, “equity-based crowdfunding” in China is strictly controlled and supervised by the China Securities Regulatory Commission (CSRC), China Banking Regulatory Commission (CBRC), China Insurance Regulatory Commission (CIRC), and the People’s Bank of China (Huang et.al. 2018).

The development of equity-based crowdfunding in China suffers from perceived uncertainty, void of legalization, and strict investor threshold. Therefore, in terms of investor numbers, equity-based crowdfunding is the least popular crowdfunding model when compared to the other models (reward-based, loan-based, and donation-based).

Loan-Based Crowdfunding

Loan-based crowdfunding is also known as online Peer to Peer (P2P) lending. P2P lending is the practice of lending money to individuals or businesses through online platforms while matching lenders with borrowers, which is repaid with interest added (Mamonov and Malaga 2018). For lenders, loan-based crowdfunding platforms usually offer better interest rates than standard commercial banks.

According to an annual P2P lending report (WDZJ 2018), by the end of 2017, there were 1931 P2P lending platforms operating in mainland China. Geographically, 410 P2P lending platforms were based in Guangdong followed by Beijing (376), Shanghai (261), and Zhejiang (233). The P2P lending platforms in the top four areas capture 66% of all P2P platforms in mainland China. The total volume of transactions of P2P lending in mainland China has reached RMB 2805 billion (approx. USD 400.33 billion) in 2017 with an overall profit ratio of 9.45%. The number of investors and borrowers in the P2P industry in 2017 were approximately 17 million and 23 million respectively. The average lending period was 9.16 months in 2017.

The loan balance (e.g. remaining amount to be paid) of P2P loans is also increasing. By the end of 2017, the overall loan balance of the P2P lending industry in mainland China has reached RMB 1225 billion (approx. USD 160.56 billion). Geographically, Beijing, Shanghai, and Guangdong ranked the top three regions in terms of loan balance with the total volume of RMB 439 billion (approx. USD 62.39 billion), RMB 325 billion (approx. USD 46.19 billion), and RMB 227 billion (approx. USD 32.26 billion) respectively. The top three regions accounted for 81% of the total loan balance volume in 2017. Zhejiang, Jiangsu, and Sichuan ranked third to sixth with the loan balances of RMB 106 billion (approx. USD 15.06 billion), RMB 38 billion (approx. USD 5.4 billion), and RMB 13 billion (approx. USD 1.85 billion) respectively (WDZJ 2018).

In China, loan-based crowdfunding is the only model which has institutional participation. Institutional investors engage and collaborate with P2P lending platforms. By the end of 2017, 212 P2P lending platforms received investment from state-owned companies. 153 P2P lending platforms received investments from venture capital. 126 P2P platforms received investment from publicly listed companies and 15 P2P lending platforms received funds from banks (WDZJ 2018).

Insights on Loan-Based Crowdfunding

Loan-based crowdfunding (online P2P lending) in China has its unique characteristics. First, providing supply chain financial service through loan-based crowdfunding has been a new trend in the loan-based crowdfunding market of China. The Supply chain financial service connects various parties (buyer, seller, and financing institution) in a transaction organically to lower financing costs and improve business efficiency. There were 118 online P2P lending platforms providing supply chain financial services in 2017 (WDZJ 2018).

Second, mergers and acquisitions among platforms are popular in the loan-based crowdfunding market of China. It makes the market more and more concentrated. For large platforms, the concentration process can further consolidate the platforms’ business capabilities and increase their competitiveness. For small and medium-sized platforms, the market concentration strategy gives them a way to survive under conditions of fierce competition.

Last, to expand influence, some Chinese P2P lending platforms (e.g. China Rapid Finance, Hexindai, PPdai) choose to get on overseas listings in the U.S. Some mature Chinese P2P lending platforms (e.g. Dianrong, Lufax) have opened overseas branches to offer P2P lending services in southeast Asia to increase scale and profits.

Donation-Based Crowdfunding

Donation-based crowdfunding is usually used for funding social causes, NGOs, and charity projects. Through donation-based crowdfunding, individuals donate money to support social causes, charitable projects, or persons with no expectation of receiving tangible rewards in return, while enjoying intangible benefits such as the feeling of self-fulfilment and mental satisfaction.

Specifically, there were 12 donation-based crowdfunding platforms operating in mainland China by the end of 2017 and 9513 donation-based projects were successfully launched on these platforms. Different from other crowdfunding models, donation-based crowdfunding in China follows the “keep it all” principle. This means that there will be no unsuccessful projects (unless no funds are raised at all). Here, fundraisers set funding goals and keep the entire amount raised regardless of whether they meet their goals or not (Tomczak and Brem 2013). In 2017, total fundraising target was expected to be about RMB 1.90 billion (approx. USD 0.27 billion) and the actual total fundraising amount was about RMB 401 million (approx. USD 56.99 million). Among all related projects, 6467 have raised less than RMB 10,000 (approx. USD 1421) and 1711 projects have raised amounts in the range of RMB 10,000–50,000 (approx. USD 1421–7105). In other words, 86% of all the donation-based projects (8178) have raised less than RMB 50,000 (approx. USD 7105) and only 1335 projects got funded with more than RMB 50,000 (approx. USD 7105) (Yuan and Chen 2018).

In 2017, the total backer number of all the projects was 15.98 million. Specifically, 3839 projects had between 100 and 500 supporters, 1689 projects had between 50 and 100 supporters, and 1538 projects had less than 50 supporters. Overall 74% of all the donation-based projects (7066) had less than 500 supporters (Yuan and Chen 2018).

Insights on Donation-Based Crowdfunding

Donation-based crowdfunding industry in China is still in its initial stage of development. Specifically, in terms of platform numbers, there were only 12 donation-based crowdfunding platforms in mainland China, which is substantially a lower number of platforms when compared with the total number of platforms operating in all crowdfunding models. In 2017, the total fundraising amount of donation-based crowdfunding in China was RMB 401 million (approx. USD 56.99 million). This sum was far from enough to mitigate the huge supply gap of public welfare (Yuan and Chen 2018).

In addition, donation-based crowdfunding platforms in China are not charitable organizations but private-owned companies. Therefore, they need to pay their own daily expenses by charging commission fees or advertising fees. Because of the charity nature of donation-based crowdfunding, whether charging fees can be applied as the revenue source of donation-based crowdfunding in China is questionable.

Lastly, donation-based crowdfunding in China is usually used to solve individual cases/help individuals rather than to organizational initiatives. This means that offering help to needed groups through donation-based crowdfunding is still under exploration and development in China.

Regardless of crowdfunding model operated, as elsewhere, platforms are subjected to differing regulatory requirements. In the following section we explore the current state of crowdfunding regulation in China.

Current Regulation

Because of the lack of specific regulations for supervising crowdfunding, the Chinese crowdfunding market has grown rapidly since its emergence in 2011. However, perceived substantial risks challenge all crowdfunding participants (investors, project initiators, and crowdfunding platforms) in China (Zhu and Hu 2019). To promote a more secure environment for developing the crowdfunding industry, the Chinese crowdfunding market supervision is based on two core principles: separate supervision and information disclosure.

In term of separate supervision, the equity-based crowdfunding is mainly regulated by the China Securities Regulation Commission (CSRC). The loan-based crowdfunding must be carried out under the supervision of the China Banking and Insurance Regulatory Commission (CBRC) and the People’s Bank of China. In opposite, the donation-based crowdfunding and the reward-based crowdfunding are not included in the financial supervision system because they are not providing financial products and services. In addition, the Ministry of Industry and Information Technology (MIIT), the National Development and Reform Commission (NDRC), and other related ministries and commissions are required to participate in the supervision of cybersecurity and credit information system (Yuan and Chen 2018).

The crowdfunding platform is the main body for crowdfunding practices. The supervision of crowdfunding platforms is based on information disclosure. Since the crowdfunding platform is an intermediary between investors and project initiators it is required to establish a systematic and institutionalized information disclosure system in order to mitigate information asymmetry between these parties. Based on the two core principles, the central government of China has issued a series of policy announcements to regulate the operations of different crowdfunding models.

Reward-Based Crowdfunding Regulation in China

Reward-based crowdfunding is considered as product pre-selling in China. Under this viewpoint, the supporters of reward-based crowdfunding are the “consumers” and the project developers of reward-based crowdfunding are the “sellers”. The reward-based crowdfunding platform acts like an online trading intermediary. The regulation of reward-based crowdfunding should be the same as the ones used to supervise online B2C marketplaces. In general, it is subject to the supervision of the “State Administration for Industry and Commerce of the People’s Republic of China”. The “Law of the People’s Republic of China on the Protection of Consumer Rights and Interests” and the “Administrative Measures for Online Trading” are applied to the regulating process of reward-based crowdfunding.

Specifically, as “consumers”, the rights of reward-based crowdfunding supporters are under the protection of the “Law of the People’s Republic of China on the Protection of Consumer Rights and Interests” and the “Administrative Measures for Online Trading”. As “sellers”, project developers should take related legal obligations. As “online trading intermediaries”, crowdfunding platforms should take legal responsibilities related to the infringement of consumer rights caused by the products or services provided on the platforms. In addition, the “State Administration for Industry and Commerce of the People’s Republic of China” may impose administrative penalties in cases of misconduct by platforms.

However, reward-based crowdfunding cannot be equally treated as general online consumption according to the concept at its core, as backers also accept a certain degree of risk of non-delivery on campaign promises (Shneor and Munim 2019). This leads some to suggest that it should be regarded as investing behaviour rather than pure consumption. Therefore, supervision may also be different. The backers of crowdfunding projects should have self-awareness of the risks and share the risks with project developers in order to achieve their mutual ambitions in a relatively high information asymmetryenvironment. If crowdfunding participants’ rights and interests are infringed, they should be able to take legal action to defend their rights. Therefore, reward-based crowdfunding platforms should only serve as information intermediaries and not as credit intermediaries, and under such conditions they will also not assume any responsibility.

To sum up, based on different understandings of reward-based crowdfunding, there is still controversy on how to protect the rights and interests of reward-based crowdfunding participants in China.

Equity-Based Crowdfunding Regulation in China

Among the four models of crowdfunding, the regulation of equity crowdfunding is the most complicated. Due to current legislation void, genuine equity crowdfunding has not been officially accepted and carried out in China. The Chinese government has announced a series of legal provisions to manage the equity crowdfunding market in a quasi-regulated manner. The legislation remains unfinished and the ongoing legislation progress is as follows:

-

On December 18, 2014, the Securities Association of China (SAC) issued the “Private Equity Crowdfunding Administrative Measures (Trial Version)”. This is the first officially issued equity crowdfunding regulation. However, this trial version has no legal effect.

-

On July 18, 2015, the People’s Bank of China and other nine ministries issued the “Guiding Opinions on Promoting the Healthy Development of Internet Finance (Guiding Opinion)”. In this “Guiding Opinion”, equity crowdfunding is officially defined as the activities of public small-amount equity financing through the Internet. Publicity and small amount are two basic principles of equity crowdfunding. The equity crowdfunding platform is an information intermediary rather than a credit intermediary and equity crowdfunding is officially supervised by China Securities Regulation Commission (CSRC).

-

On August 7, 2015, the CSRC issued the “Notice of the General Office of the China Securities Regulatory Commission on Conducting Special Inspections of Institutions Engaging in Equity Financing via the Internet”. According to this notice, no organization or individual may carry out equity crowdfunding activities in China without the approval of the CSRC. In addition, it is stipulated that “equity crowdfunding” refers specifically to “public equity crowdfunding”, while the existing “private equity crowdfunding” will be replaced by “private equity financing”, and the maximum number of investors that can participate in an equity crowdfunding project is 200.

-

On August 10, 2015, the SAC issued the “Measures for the Administration of Over-the-Counter Securities Business Recordation”. In accordance with the measures, equity crowdfunding in China has been officially divided into two categories: “public offering (equity crowdfunding)” and “private offering (online non-public equity financing)”.

-

On August 17, 2016, the CSRC issued the “Interim Measures for the Administration of the Business Activities of Online Lending Information Intermediary Institutions”. It is stipulated that the P2P platforms cannot be engaged in equity crowdfunding business.

-

On April 14, 2016, the CSRC issued the “Implementation Plan for Special Rectification on Risks in Equity Crowdfunding” in order to get prepared to rectify the existing problems in Chinese equity crowdfunding market.

-

On December 1, 2018, Li Zhibin, director of the SFC’s Office for Combating Illegal Securities Futures, revealed that the CSRC is currently developing and improving the “Measures for the Pilot Administration of Equity Crowdfunding” at the third China New Financial Summit Forum.

Loan-Based Crowdfunding Regulation in China

China has the world’s largestP2P lending market. However, this immature market is still suffering from some inherent risks such as the lack of credit and risk controls, the lack of industry standards, and regulation challenges.

At the national regulatory level, China Banking Regulatory Commission (CBRC), and other related departments have officially established a “1 + 3 supervision system” to monitor, manage, and mitigate inherent risks in Chinese P2P market (Huang 2018). Specifically, the “1 + 3 supervision system” refers to “one method plus three guidelines” which is mainly composed of the following regulatory documents:

-

“Interim Measures for the Administration of Online Lending Intermediary Institutions’ Business Activities” (Issued by the CBRC on 17 August 2016)

-

“Guideline on the Administration of Recordation and Registration of Online Lending Intermediary Institutions” (Issued by the CBRC, Ministry of Industry and Information Technology and State Administration of Industry and Commerce on 28 November 2016)

-

“Guideline on the Custodian Business for Online Lending Funds” (Issued by the CBRC on 22 February 2017)

-

“Guideline on Information Disclosure of Online Lending Intermediary Institutions’ Business Activities” (Issued by the CBRC on 24 August 2017)

Besides, the National Internet Finance Association (NIFA) has also issued several rules and standards on the information disclosures and self-regulation of Chinese P2P market in 2016.

At the local regulatory level, being supplements, some developed regions (e.g. Beijing, Shanghai) have begun to develop self-regulatory frameworks and associations by taking regional variations into consideration. Self-regulation is effective in reducing the regulatory burden and cost, eliminating the information asymmetry between the market and the regulatory authority and improving market standardization.

Donation-Based Crowdfunding Regulation in China

In China, public fundraising for charitable purposes is mainly related to the “Charity Law of the People’s Republic of China”. According to this law, there are clear regulations on charitable organizations using the Internet and other platforms to conduct public fundraising. Organizations or individuals that do not have the qualification for public fundraising may not use public fundraising.

Most donation-based crowdfunding projects in China are created by individuals who are facing difficulties. These troubled individuals use crowdfunding as the channel to seek help from the greater society. Fundraising activities for certain troubled individuals are guided by self-interest. Therefore, donation-based crowdfunding in China is not charitable fundraising but social assistance and may not apply to the “Charity Law of the People’s Republic of China”.

On July 20, 2017, the Ministry of Civil Affairs announced the “Basic Specifications for the Internet-based Public Fundraising Platform for Charity Organizations” and the “Basic Management Regulations for the Internet-based Public Fundraising Platform for Charity Organizations” to manage donation-based crowdfunding market. Donation-based crowdfunding is officially distinguished from charityfundraising.

According to the specifications and regulations, project developers should take full responsibilities of the authenticity of the provided information. Donation-based crowdfunding platform should strengthen project information review and disclosure, inform potential donors on the potential risks of the projects, and clarify the traceability of responsibility. In addition, donation-based crowdfunding platforms should disclose platform operation information to the public at least every six months.

Review of Key Research Done in China

Though the first Chinese crowdfunding platform “Demohour” went online in 2011, most Chinese crowdfunding platforms were launched after 2014 (Yuan and Chen 2018). Since then, the crowdfunding concept has been recognized in China in both research and practice with researchers starting to investigate this phenomenon within the Chinese market. In order to summarize the findings of such research, we conducted a literature review. Generally, we found out that the crowdfunding research focused on the Chinese market is still limited in scope compared to the ones based on Western market data. Specifically, our main findings are summarized as follows:

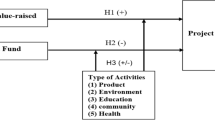

First, most of the existing Chinese crowdfunding studies are focused on investigating the success factors of crowdfunding. These mostly rely on the signalling theory and Elaboration Likelihood Model (e.g. Zheng et al. 2016; Bi et al. 2017), which were frequently adopted as the main theoretical foundations. Based on the data collected from the key players of Chinese crowdfunding market (e.g. JD Crowdfunding; Demohour; Zhongchou), Chinese crowdfunding literature reveals that social capital (Shahab et al. 2019; Kang et al. 2017; Chen et al. 2018), trust and commitment (Zheng et al. 2016; Zhao et al. 2017; Liang et al. 2019), campaign characteristics (Du and Wang 2016; Du et al. 2019; Zhao and Vinig 2017), campaign quality (Xu et al. 2016; Yuan et al. 2016; Shahab et al. 2019; Chen et al. 2018; Zhang et al. 2017; Bi et al. 2017), as well as backer and initiator interaction (Wang et al. 2018; Xie et al. 2019) are positively associated with crowdfunding success in China.

Second, many studies explore the current status of crowdfunding in China compared to the one in other countries. In general, the degree of development of crowdfunding markets in developed countries is higher than that of developing countries (Rau 2018). However, as an emerging market, the volume of the Chinese crowdfunding market grows rapidly and has become the largest crowdfunding market in the world (Ziegler et al. 2018). Compared with the Western crowdfunding markets, the Chinese crowdfunding market has its unique characteristics. Specifically, in terms of reward-based crowdfunding, the Chinese contributors are more realistic compared to the ones in Western markets. Specifically, their motivations to contribute are mainly generated by receiving the rewards but not by helping to further develop the business ideas (Yuan and Chen 2018). In addition, the Chinese crowdfunding market is controlled by several key players (Yuan and Chen 2018). The performance of the key players (e.g. Taobao Crowdfunding, JD Crowdfunding) counts for most of the market share in China (Huang et al. 2018). As a latecomer of the crowdfunding market, the legal framework related to the regulation of the Chinese crowdfunding market is immature which hinders its further development (Yuan and Chen 2018). Specifically, this immature legal framework has brought problems such as fraud, illegal fundraising, and money laundering (Huang et al. 2018). As a result, the growth rate of the Chinese crowdfunding market has been slowed down as legal frameworks are being revisited (Chirisa and Mukarwi 2018).

Third, crowdfunding has proved to be a feasible tool in supporting creative industries and sustainable projects in China (Sun and Meng 2015). Two-thirds of the reward-based crowdfunding projects in the Chinese market are related to creative industries such as film, music, publication, animation, design, and games (Sun and Meng 2015). Besides, crowdfunding is also used to support sustainable campaigns in China (Lam and Law 2016). The success of sustainable crowdfunding projects is closely associated with public opinion and brand effect in the Chinse market (Chen et al. 2018).

Implications for Research and Practice

Theoretical Implications

Based on the review of the key Chinese crowdfunding literature, we found that existing research has provided valuable insights for understanding the Chinese crowdfunding market. However, the limitations of the current literature indicate several future research directions as well.

First, most of the existing Chinese crowdfunding literature are replicative studies. These replicate previous crowdfunding studies by using the Chinese data in order to test the validation of previous findings in non-Chinese crowdfunding market (e.g. Zheng et al. 2017). Future research could generate more special outputs by taking unique Chinese cultural factors and market characteristics into consideration. For instance, “Guanxi” is a special element of Chinese culture, which has been embedded in the daily practices of the Chinese business community (Chung and Hamilton 2001). It should be beneficial to enrich the Chinese crowdfunding literature by investigating the impact of “Guanxi” on Chinese crowdfunding practices (Zhao and Vinig 2019). Besides, the Chinese crowdfunding market has strong connections to several Chinese Internet giants (e.g. Alibaba, JD, and Tencent) (Yang and Zhang 2016). It would be interesting to explore the influences of these Internet giants on the formation and development of the Chinese crowdfunding market, and their relations with crowdfunding platforms.

Second, in terms of research perspectives, most of the existing literature aims to explore the success factors of crowdfunding in the Chinese market by analysing real market data from the platforms. The signalling theory and Elaboration Likelihood Model are mostly adopted by Chinese crowdfunding literature (e.g. Zheng et al. 2016; Bi et al. 2017). Besides, the total amount of research related to equity crowdfunding and loan-based crowdfunding is smaller compared to the research associated with reward-based and donation-based crowdfunding. To generate more meaningful insights, future research could try to analyse the Chinese crowdfunding market from other perspectives by applying alternative theoretical frames (Huang et al. 2018). In addition, more research on equity-based crowdfunding and loan-based crowdfunding should be generated.

Practical Implications

This chapter also provides several practical implications for Chinese crowdfunding practitioners, contributors, and regulators.

First, Chinese investors tend to rely on personal relationships to help make investment decisions as the Chinese business is relation-based. The personal relationship is used as substitutes for formal institutional support (Xin and Pearce 1996). In terms of the Chinese crowdfunding market, project initiators’ social capital levels should be closely associated with crowdfunding success (Shahab et al. 2019). Therefore, Chinese crowdfunding practitioners should pay attention to their social capital accumulation by interacting with potential contributors to create personal trust and take full advantage of the power of social capital to promote projects within their target audiences.

Second, Chinese crowdfunding contributors are more pragmatic compared to the ones in the Western markets (Yuan and Chen 2018). Specifically, they contribute for getting the rewards, rather than being parts of the process of the project “co-creation” (Yuan and Chen 2018). Therefore, it is beneficial for Chinese crowdfunding campaign initiators to pay more attention to the design and delivery of the crowdfunding rewards. For instance, compared with the other campaigns, the campaigns with clear descriptions, well-designed reward prototypes, and determined delivery time are expected to have higher probabilities to get successful fundraising.

Third, it is of great importance for the regulators to strengthen the regulative framework to guarantee the healthy development of the equity-based and loan-based crowdfunding models in China. The regulative framework should be designed within the existing Chinese legislation system and cultural background (Hu and Yang 2014). Under the established framework, specific principles and regulations need to be promulgated to provide adequate supervision of the whole crowdfunding market and offer timely information disclosures to market participants. In addition, the development of Chinese loan-based crowdfunding market has been greatly impeded by fraud caused by the lack of nationwide credit rating systems (Wei 2015). Therefore, a comprehensive credit rating system should be established to support the development of the Chinese loan-based crowdfunding market.

Lastly, for promoting crowdfunding industry in China, it is also important to create a close integration between social media sites, digital payment systems, and crowdfunding platforms to create a seamless, convenient, and efficient process for information sharing and transactions.

Conclusion

In conclusion, given the uniqueness of culture, regulation, and social systems in China, the concept of Chinese crowdfunding could be considered as a combination of Chinese unique characteristics and general crowdfunding principles (Funk 2019). In this chapter, we introduce and discuss the crowdfunding phenomena in China concretely from the perspectives of different stakeholders (platforms, fundraisers, funders, and regulators) and crowdfunding models (reward-based, equity-based, loan-based, and donation-based). Generally, the Chinese crowdfunding market has developed rapidly and has become the world’s largest crowdfunding market (Ziegler et al. 2018). However, we also find out that there are some problems in the Chinese crowdfunding market, such as underdeveloped regulatory system and personal credit system (Chirisa and Mukarwi 2018). These problems will limit the further development of the Chinese crowdfunding market. To solve these problems, specific solutions have been proposed in this chapter. Practically, this chapter can be used as prescriptive guidelines for Chinese crowdfunding stakeholders to enhance and improve market performance. In addition, we also point out some meaningful research topics for researchers to explore the Chinese crowdfunding phenomena further.

References

Ahlers, G. K. C., Cumming, D., Günther, C., et al. (2015). Signaling in Equity Crowdfunding. Entrepreneurship Theory and Practice, 39(4), 955–980.

Bi, S., Liu, Z., & Usman, K. (2017). The Influence of Online Information on Investing Decisions of Reward-based Crowdfunding. Journal of Business Research, 71, 10–18.

Chen, J., Chen, L., Chen, J., et al. (2018). Mechanism and Policy Combination of Technical Sustainable Entrepreneurship Crowdfunding in China: A System Dynamics Analysis. Journal of Cleaner Production, 177, 610–620.

Chirisa, I., & Mukarwi, L. (2018). A Comparative Analysis of Africa and Chinese Crowdfunding Markets. In U. G. Benna & A. U. Benna (Eds.), Crowdfunding and Sustainable Urban Development in Emerging Economies (pp. 147–163). Hershey, PA: IGI Global.

Chung, W. K., & Hamilton, G. G. (2001). Social Logic as Business Logic: Guanxi, Trustworthiness, and the Embeddedness of Chinese Business Practices. In R. Appelbaum, W. Felstiner, & V. Gessner (Eds.), Rules and Networks: The Legal Culture of Global Business Transactions (Vol. 1, pp. 325–346). Portland, OR: Hart Publishing.

Du, Z., Li, M., & Wang, K. (2019). “The more options, the better?” Investigating the Impact of the Number of Options on Backers’ Decisions in Reward-based Crowdfunding Projects. Information & Management, 56(3), 429–444.

Du, Z., & Wang, K. (2016). Choice Schema Design of Crowdfunding Campaigns: An Exploratory Study. Paper Presented at the 20th Pacific Asia Conference on Information Systems, Chiayi, Taiwan, June 27.

Funk, A. S. (2019). Crowdfunding in China: A New Institutional Economics Approach (1st ed.). Cham: Springer International Publishing.

Hu, T. L., & Yang, D. (2014). The People’s Funding of China: Legal Developments of Equity Crowdfunding-Progress, Proposals, and Prospects. University of Cincinnati Law Review, 83(2), 445–476.

Huang, R. H. (2018). Online P2P Lending and Regulatory Responses in China: Opportunities and Challenges. European Business Organization Law Review, 19(1), 63–92.

Huang, Z., Chiu Candy, L., Mo, S., et al. (2018). The Nature of Crowdfunding in China: Initial Evidence. Asia Pacific Journal of Innovation and Entrepreneurship, 12(3), 300–322.

Kang, L., Jiang, Q., & Tan, C.-H. (2017). Remarkable Advocates: An Investigation of Geographic Distance and Social Capital for Crowdfunding. Information & Management, 54(3), 336–348.

Lam, P. T. I., & Law, A. O. K. (2016). Crowdfunding for Renewable and Sustainable Energy Projects: An Exploratory Case Study Approach. Renewable and Sustainable Energy Reviews, 60, 11–20.

Liang, T.-P., Wu, S. P.-J., & Huang, C.-c. (2019). Why Funders Invest in Crowdfunding Projects: Role of Trust from the Dual-process Perspective. Information & Management, 56(1), 70–84.

Lin, L. (2017). Managing the Risks of Equity Crowdfunding: Lessons from China. Journal of Corporate Law Studies, 17(2), 327–366.

Mamonov, S., & Malaga, R. (2018). Success Factors in Title III Equity Crowdfunding in the United States. Electronic Commerce Research and Applications, 27, 65–73.

Rau, P. R. (2018). Law, Trust, and the Development of Crowdfunding. Retrieved June 1, 2019, from https://ssrn.com/abstract=2989056.

Shahab, Y., Ye, Z., Riaz, Y., et al. (2019). Individual’s Financial Investment Decision-making in Reward-based Crowdfunding: Evidence from China. Applied Economics Letters, 26(4), 261–266.

Shneor, R., & Munim, Z. H. (2019). Reward Crowdfunding Contribution as Planned Behaviour: An Extended Framework. Journal of Business Research, 103, 56–70.

Sun, X., & Meng, Q. (2015). Puzzles about the “Crowdfunding” in Cultural Industry and Its Ecological Countermeasures. Open Journal of Social Sciences, 3(7), 7–14.

Tomczak, A., & Brem, A. (2013). A Conceptualized Investment Model of Crowdfunding. Venture Capital, 15(4), 335–359.

Wang, N., Li, Q., Liang, H., et al. (2018). Understanding the Importance of Interaction Between Creators and Backers in Crowdfunding Success. Electronic Commerce Research and Applications, 27, 106–117.

WDZJ. (2018). 2017 Annual Chinese P2P lending Industry Report. Retrieved June 1, 2019, from https://osscdn.wdzj.com/upload/2017wdnb.pdf.

Wei, S. (2015). Internet Lending in China: Status Quo, Potential Risks and Regulatory Options. Computer Law & Security Review, 31(6), 793–809.

Xie, K., Liu, Z., Chen, L., et al. (2019). Success Factors and Complex Dynamics of Crowdfunding: An Empirical Research on Taobao Platform in China. Electronic Markets, 29(2), 187–199.

Xin, K. K., & Pearce, J. L. (1996). Guanxi: Connections As Substitutes for Formal Institutional Support. Academy of Management Journal, 39(6), 1641–1658.

Xu, B., Zheng, H., Xu, Y., et al. (2016). Configurational Paths to Sponsor Satisfaction in Crowdfunding. Journal of Business Research, 69(2), 915–927.

Yang, D., & Zhang, X. (2016). Review of the Domestic Crowdfunding Industry Development. Journal of Service Science and Management, 9(1), 45–49.

You, C. (2017). Recent Development of FinTech Regulation in China: A Focus on the New Regulatory Regime for the P2P Lending (Loan-based Crowdfunding) Market. Capital Markets Law Journal, 13(1), 85–115.

Yuan, H., Lau, R. Y. K., & Xu, W. (2016). The Determinants of Crowdfunding Success: A Semantic Text Analytics Approach. Decision Support Systems, 91, 67–76.

Yuan, Y., & Chen, L. (2018). China Crowdfunding Industry Development Research (1st ed.). Shang Hai Jiao Tong University Press.

Zhang, W., Yan, X., & Chen, Y. (2017). Configurational Path to Financing Performance of Crowdfunding Projects Using Fuzzy Set Qualitative Comparative Analysis. Engineering Economics, 28(1), 25–34.

Zhao, L., & Vinig, T. (2017). Hedonic Value and Crowdfunding Project Performance: A Propensity Score Matching-Based Analysis. Review of Behavioral Finance, 9(2), 169–186.

Zhao, L., & Vinig, T. (2019). Guanxi, Trust and Reward-based Crowdfunding Success: A Chinese Case. Chinese Management Studies. Forthcoming.

Zhao, Q., Chen, C.-D., Wang, J.-L., et al. (2017). Determinants of Backers’ Funding Intention in Crowdfunding: Social Exchange Theory and Regulatory Focus. Telematics and Informatics, 34(1), 370–384.

Zheng, H., Hung, J.-L., Qi, Z., et al. (2016). The Role of Trust Management in Reward-based Crowdfunding. Online Information Review, 40(1), 97–118.

Zheng, H., Xu, B., Wang, T., et al. (2017). Project Implementation Success in Reward-Based Crowdfunding: An Empirical Study. International Journal of Electronic Commerce, 21(3), 424–448.

Zhu, C. C., & Hu, J. (2019). Internet Financial Regulation and Law Analysis of China. In S.-B. Tsai, C.-H. Shen, H. Song, & B. Niu (Eds.), Green Finance for Sustainable Global Growth (pp. 173–192). Hershey, PA: IGI Global.

Ziegler, T., Johanson, D., Zhang, B., Ben, S., Wang, W., Mammadova, L., Hao, R., et al. (2018). The 3rd Asia Pacific Region Alternative Finance Industry Report. Cambridge: The Cambridge Centre for Alternative Finance.

Ziegler, T., Shneor, R., Wenzlaff, K., Odorović, A., Johanson, D., Hao, R., & Ryll, L. (2019). Shifting Paradigms: The 4th Annual European Alternative Finance Report. Cambridge: The Cambridge Centre for Alternative Finance.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Open Access This chapter is licensed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license and indicate if changes were made.

The images or other third party material in this chapter are included in the chapter’s Creative Commons license, unless indicated otherwise in a credit line to the material. If material is not included in the chapter’s Creative Commons license and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder.

Copyright information

© 2020 The Author(s)

About this chapter

Cite this chapter

Zhao, L., Li, Y. (2020). Crowdfunding in China: Turmoil of Global Leadership. In: Shneor, R., Zhao, L., Flåten, BT. (eds) Advances in Crowdfunding. Palgrave Macmillan, Cham. https://doi.org/10.1007/978-3-030-46309-0_12

Download citation

DOI: https://doi.org/10.1007/978-3-030-46309-0_12

Published:

Publisher Name: Palgrave Macmillan, Cham

Print ISBN: 978-3-030-46308-3

Online ISBN: 978-3-030-46309-0

eBook Packages: Business and ManagementBusiness and Management (R0)