Abstract

Prior studies on Malaysia mainly looked at the cointegration relationship and causality nexus of the tourism sector. In addition to these apects, in this article, we look at the statistical and economic significance of tourism in Malaysia. We explore the short-run and long-run effects of tourism on output per worker in Malaysia using the sample period 1975–2012 where we estimate the respective elasticity coefficients. Given that the data on tourism receipts reported by the World Bank (2013) are only for 1995–2011 at the time of study, we use an exponential trend function based on the available data for tourism receipts as best fit to approximate the missing data. Subsequently, using the data from 1975–2012 and the augmented Solow (1956) model in which tourism receipts (% GDP) is included as a shift variable and hence a proxy for tourism development, we examine the cointegration, elasticity coefficients and causation using the ARDL bounds (Pesaran et al. 2001) and the Toda and Yamamoto (1995) non Granger causality procedure, respectively. The results show that tourism has a lagged marginal negative effect (\(-\)0.06 %) in the short run and a positive and statistically significant effect in the long-run (+0.26 %). The causality nexus show a bi-directional causation between tourism and capital per worker which supports the notion that tourism and investment activities are mutually reinforcing; and a unidirectional causation from output per worker to capital per worker indicating that economic growth spurs capital accumulation and productivity. Although our findings are not unique due to data constraints, the results nevertheless reveal that tourism has a long-run momentous effect on the economic growth of Malaysia and is a catalyst for boosting investment activities. In this regard, policy focus can be directed towards enhancing tourism infrastructure including technology integration and management, creating more visitor confidence in the global tourism markets, exploiting the major sources of tourism markets with socially desirable and economically beneficial tourist products, and exploring niche markets for tourism expansion which can include links with foreign direct investment.

Similar content being viewed by others

1 Introduction

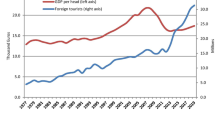

Malaysia is one of the top ten tourist destination in the world and among the leading countries (with China) in the Asia region (UNWTO 2013). Undoubtedly, only second to manufacturing, tourism sector is one of the major sources of foreign currency earning in Malaysia. Among the top ten inbound tourism for Malaysia in 2012, Singapore has the bulk of the market share (52.0 %) followed by Indonesia (9.5 %), China (6.2 %), Thailand (5.1 %), Brunei Darussalam (5.0 %), India (2.8 %), Philippines (2.0 %), Australia (2.0 %), Japan (1.9 %), and the United Kingdom (1.6 %) (Ministry of Tourism 2013).

In the bid to boost the sector, the Government of Malaysia has included tourism as one of the key economic sectors in its Third Industrial Master Plan 2006–2020 and declared 2014 as Visit Malaysia year. The national tourism policy of Malaysia further aims to develop the tourism industry into a key revenue earner. Malaysia has thus adopted measures in further promoting the tourism sector which is likely to have an impact in the long run. Measures adopted include interalia the removal and reduction of foreign equity restriction, providing tax incentives and offering loans at low interest rates. Further tax incentives are also provided to priority sectors such as hotel accommodation. In addition to this, Malaysia’s trade in services commitment at the multilateral front in the World Trade Organization (WTO) has also had significant impact on its tourism sector. Under the general agreement on trade in services (GATS) commitment, Malaysia has made significant commitments which includes the hotel tourist resort and restaurant services including entry permitted on joint-venture basis, travel agency and tour services.

Given these developments and the pertinent role that tourism plays in the Malaysian economy, we explore the plausible effects of international tourism on economic growth in the short-run and the long-run. Notably, prior studies (Salleh et al. 2008; Loganathan et al. 2008; Norsiah and Saad 2010; Tang and Tan 2013; among others) only looked at the causality nexus and therefore did not examine the economic significance of tourism earnings in the short-run and the long-run. Subsequently, within the caveats, the article moves beyond the statistical significance and quantifies the effect by estimating the elasticity coefficient of tourism earnings over the period 1975–2012. Whilst putting the tourism sector at the core of the discussion, one of the goals of the article is to contribute to the emerging dialogues on sustainable development and growth of Malaysia.

We advance our study using the Solow (1956) growth framework which is augmented with tourism earnings/receipts (as a percent of the gross domestic product—GDP) with insights from the pioneers of and contemporary literature on growth (Schumpeter 1933; Domar 1952, 1961; Harrod 1959; Romer 1990; Acemoglu 2009). Briefly, we find that tourism earnings contribute about 0.26 % to the economic growth in the long-run. However, there is a marginal lagged-negative effect from tourism (about \(-\)0.05 %) in the short-run. The causality results confirm a bi-directional causation between tourism and capital per worker and a unidirectional causation from output per worker to capital per worker, indicating that investment is doubly supported by tourism earnings. It is important to note a 1 % increase in tourism receipts will result in an increase of roughly 0.26 % of output per worker in the long run. On the same token, the resultant economic growth and the possible growth in tourism earnings will support capital accumulation and greater investment activities which will have positive externalities. The findings from this article are expected to be of benefit to policy makers in the sense that some quantifiable effects are presented with respect to tourism and economic growth duly adding value to the tourism and development dialogues. The balance of the paper is set out as follows. A brief literature survey is provided in Sect. 2. In Sect. 3, the framework, method and data are discussed. Section 4 presents the results, and finally, conclusion follows in Sect. 5.

2 Literature survey

2.1 Tourism

The literature on tourism development and its consequent impact on growth and development process dates back to the pioneering work of Sheldon (1997) which later on spurred a plethora of studies in this direction. The discussion on tourism and growth nexus often revolves around the direction of causality and the tourism-led-growth (TLG) hypothesis. According to Payne and Mervar (2010), the nexus between tourism and economic growth have two aspects. First, the economic growth led tourism hypothesis which is a consequence of effective government policies and institutions, adequate investment in both physical and human capital, and stability in international tourism which duly supports the tourism infrastructure and the sector as a whole. Second, the tourism-led growth hypothesis assumes tourism as an engine of growth which is expected to create positive externalities in the economy.

A number of studies have looked at the tourism-growth nexus, at country-specific and cross-country level. For instance, in a study, Durbarry (2004) explore the impact of tourism on Mauritius where he used real gross domestic investment (% GDP) as a proxy for investment, secondary school enrolment as a proxy for human capital, and disaggregated exports such as sugar, manufactured exports and tourism receipts, and find that tourism contributes about 0.8% to growth in the long-run. Nowak et al. (2007) study the Spanish economy and show that tourism exports when used to finance imports of capital goods has a growth enhancing effect. Khalil et al. (2007) examine the causal relationship between tourism earnings and GDP growth for Pakistan using annual data for the period 1960–2005 and find evidence of cointegration and a bi-directional causation between tourism earnings and economic growth.

Lee and Chang (2008) use a heterogeneous panel cointegration technique for OECD (Organization for Economic Co-operation and Development) and non-OECD countries. They find that tourism has a larger impact on GDP in non-OECD countries than in the OECD countries. Brida et al. (2008) investigate the plausible causal relationships betweentourism expenditure, real exchange rate and economic growth on a quarterly data in Mexico using the Johansen cointegration technique. Their results confirm the TLG hypothesis and show a unidirectional causation from tourism to real GDP. Fayissa et al. (2008) use a panel of 42 African countries within the conventional neoclassical framework to explore the potential contributions of tourism to growth. Their results show evidence of tourism receipts having a positive contribution to the current level of output and economic growth of the selected SSA countries. Payne and Mervar (2010) investigate the tourism-growth nexus in Croatia using quarterly data from 2000 to 2008 and the Toda and Yamamoto (1995) non-Granger causality approach to identify the causal relationship between tourism receipts, real GDP and real exchange rate. Their findings indicate a unidirectional causality from GDP to tourism receipts, and from GDP to real effective exchange rate duly supporting that economic growth drives tourism in the economy. Arslanturk et al. (2011) examine the causal link between tourism receipts and GDP for Turkey using annual time series data from 1968 to 2006 and find tourism receipts have positive effects on GDP in early 1980s. Obadiah et al. (2012) examine the relationship between tourism development and economic growth for Kenya using ARDL estimation technique. Their results indicate a unidirectional causality from tourism development to economic growth. On the contrary, Kumar (2013a) finds a unidirectional causation from economic growth (measured by output per worker) to tourism receipts in Kenya. Hye and Khan (2013) study tourism demand for Pakistan using ARDL approach and rolling windows bounds testing approach using annual time series data from 1971 to 2008. Their findings confirm the presence of a long run relationship between tourism earnings and economic growth. Eeckels et al. (2012) examine the relationship between cyclical components of Greek GDP and international tourism demand using annual data from 1976 to 2004. Their findings support the tourism-led economic growth hypothesis for Greece economy.

Furthermore, Holzner (2010) explore the Dutch disease effect of tourism with a sample of 134 countries and finds that there is no significant danger of beach (Dutch) disease effect and that tourism dependent countries benefit from higher economic growth as a result of tourism. Seetanah (2011) uses a panel of 19 island economies and the generalized method of moments (GMM) technique over the period 1990–2007 within the conventional augmented Solow growth model to examine the contribution of tourism to growth. He finds tourism significantly contributes to economic growth and that there is a plausible bi-directional causality between tourism and growth. In another study, Seetanah et al. (2011) study 40 African countries over the period 1990–2006 and find, inter alia, a bi-causal and reinforcing relationship between tourism and output. Chang et al. (2012) use instrument variable (IV) estimation in a panel threshold model to investigate the importance of tourism specialization in economic development of 159 countries and find a positive relationship between growth and tourism. Tang and Abosedra (2014) use panel data of 24 countries in the Middle East and North African region and find that that energy consumption and tourism significantly contribute to the economic growth of countries in the region.

Very few studies examine the long-run elasticity coefficients of tourism in developing countries. Nevertheless, having some quantifiable estimates of tourism sector contribution to economic growth is vital for policy discussion. For instances, in case of a small island economy of Fiji, Kumar and Kumar (2012) and Kumar and Kumar (2013a) show that elasticity coefficient is 0.23 % and 0.12 %, respectively. The variation in the elasticity coefficients are mainly due to the sample size and the model specification, as the latter includes other variables such as urbanization besides tourism and technology; in case of Kenya, the estimated elasticity is 0.08 % (Kumar 2013a); and in case of Vietnam, the elasticity is close to 0.03 % (Kumar 2013b). In all these studies, the authors use the ARDL bounds procedure and the augmented Solow framework to estimate the long-run elasticity coefficients of tourism.

In many instances, the TLG hypothesis is unequivocally accepted. However, there are few studies which have noted contrary views. For instances, Oh (2005) examines the causal relationship between tourism and economic expansion for Korea by using the Engle and Granger two-stage approach and a bi-variate Vector Autoregression (VAR) model, and shows there is no long-run equilibrium relationship between tourism and output, and only the evidence of a unidirectional causality from output to tourism. Ozturk and Acaravci (2009) and Katircioglu (2009) investigate the TLG hypothesis in Turkey and find no evidence of any cointegration relationship between international tourism and economic growth. Similarly, Kumar et al. (2011) examine the impact of tourism and remittances on per worker output in a small island economy of Vanuatu using the ARDL procedure and find that tourism (measured by the number of annual visitor arrivals) although positive (0.02 %), is not statistically significant.

2.2 Recent Studies: tourism-growth nexus in Malaysia

A number of studies focusing on Malaysia have come forth over the recent years which look at different aspects of tourism within the context of economics and development. For instances, Lim and McAleer (2002) investigate the long run relationship in Australia focusing on tourists demand from Malaysia over the period of 1975–1996, and find that real income is not cointegrated with Malaysian tourists arrival to Australia. Tan et al. (2002) examine the stability of inbound tourism demand models for Indonesia and Malaysia in the pre-formation and post-formation of tourism development organizations. Using basic determinants model and Wald test, this study explores the importance of marketing implications for tourism industries for Indonesia and Malaysia. Their results indicate that relative prices have dominant effect on marketing strategies for tourism industries for both countries.

Moreover, Salleh et al. (2008) investigate the long run and short run relationship for tourism demand to Malaysia from 7 Asian countries using annual time series data from 1970 to 2004 using the ARDL bounds approach. Their results show tourism price, traveling cost, substitute price and income has direct link with Asian tourist arrivals both in the long run and short run. Loganathan et al. (2008) use annual time series data from 1980 to 2007 to identify the effects of CPI and GDP on international tourism demand to Malaysia using the Johansen-Juselius (JJ) cointegration procedure and Granger causality tests, and show that long run relationship exists between the variables.

In addition, Kadir and Karim (2009) explore demand for tourism in Malaysia from the UK and the US using the VECM (vector error correction mechanism) approach and find that Malaysian economic growth causes increase in demand for the UK and the US tourist arrivals. Mazumder et al. (2009) examine the contribution from tourism sector by estimating the multiplier effects using the input-output analysis. Among other things, they find that each Ringgit (local currency) increase of tourist expenditure results in 0.35 Ringgit increase in household income.

In recent studies, Norsiah and Saad (2010) use a sample data from 1994–2004 to examine international tourism receipts and real economic growth in Malaysia and find that the two are significantly cointegrated and that real economic growth causes tourism earnings. Hanafiah and Harun (2010) use gravity model using income, price, exchange rate, CPI, distance, population and economic crisis to determine tourism demand for Malaysia from Australia, Hong Kong, Indonesia, UK, Thailand, Taiwan and China and show, interalia that an increasing number of tourist arrivals is influenced by population growth and distance and the latter two factors have an adverse effect on tourism demand to Malaysia.

Habibi and Abbsasinejad (2011) use dynamic panel estimation technique with 19 European countries to identify the impact of the of tourism demand to Malaysia over the period from 1998 to 2007. The findings reveal that word-of-mouth influences tourism demand for Malaysia from European countries. Loganathan et al. (2012) employs quarterly time series data on tourist arrival from ASEAN (Association of South East Asian Nations) to Malaysia over the periods 1995–2009 and forecast future tourism demand based on the seasonal ARIMA (autoregressive integrated moving average) approach. They find that seasonality model does not offer any valuable insights in forecasting tourism demand for Malaysia from the ASEAN countries.

Tang (2011) and more recently, Tang and Tan (2013) re-assess the stability of the TLG hypothesis using the combined cointegration technique in Malaysia with respect of 12 different tourism markets using monthly datasets from 1995 (January) until 2009 (February), out of which only 8 (Japan, Singapore, UK, Taiwan, USA, Thailand, Australia, and Germany) contribute significantly to the Malaysian growth while the other 4 (Korea, Indonesia, Brunei and China) show lesser impact despite the fact that these four countries are among the top tourism market for Malaysia. However, the basis for choosing all the 12 countries in the analysis is not explained and therefore including more than 12 countries which are source of tourism for Malaysia is likely to give greater insights and perhaps alter the balance of the outcome in terms of up-market and low-market source of tourists to Malaysia.

3 Model, sample data and method

3.1 Framework and model

We use the conventional Cobb-Douglas type production function within the augmented Solow framework (Solow 1956). The extended Solow model is often used to explore the plausibility of various economic factors affecting growth (Kumar and Kumar 2012, 2013b; Kumar 2013a, b, c; Kumar et al. 2014), where factors besides capital and labor are treated as shift variables (Rao 2010). Starting with the conventional model:

where \(\alpha \) and \(\beta \) are capital and labor shares respectively and \(\alpha +\beta = 1\), thus assuming constant returns to scale. Hence, the per worker output (\(y_{t}\)) equation is defined as:

where \(A\) = stock of technology and \(k\) = capital per worker. The Solow model assumes that the evolution of technology is given by:

where \(A_{0}\) is the initial stock of knowledge and \(T\) is time.

Augmenting the model with tourism, we define the stock of technology as:

where tur refers to tourism receipts as a percent of GDP and is a proxy for tourism,

Subsequently,

and

The above can be formulated as:

where \({\varDelta } L\) denotes the partial differential of logs of respective variables, and the intercept term, \(g\), is the TFP, compactly defined.

3.2 Data

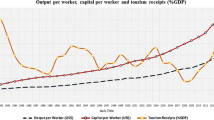

The data for GDP at constant 2005 prices and gross fixed capital formation (at constant 2005 prices) is available for 1960–2012 from the World Bank Indicators and the Global Development Finance database (World Bank 2013). However, data on tourism receipts (in current US$) is only available from 1995–2011 in the database (Fig. 1). Therefore, to ensure a consistent sample size, we used the exponential trend formula to compute the data for the required periods. In other words, we plot the data for tourism receipts over the period 1995–2011 (Fig. 1), and determined the best trend fit equation, which is then used to build the data for previous periods. In what follows, we use the equation \(TUR_{t} = 3.3592e^{0.1074x}\) to estimate the tourism receipts for 1975–1994, and 2012, where, \(TUR_{t}\) denotes the estimated tourism receipts (in billions of US$ at current prices) in a given year, \(t\), and \(x\) denotes the number of periods from 1995 onwards. Hence, \(t = \{1995, 1996, \ldots , 2011\}\) corresponds to \(x = \{1, 2, \ldots , 17\}\). Consequently \(x = \{0, -1, \ldots , -19\}\), corresponds to \(t = \{1994, 1993, \ldots , 1975\}\). The sample used in the analysis is from 1975–2012.

Tourism receipts (Current US$ in billions). Source: World Bank (2013)

In regards to capital stock (\(K_{t}\)), we use the perpetual inventory method, where gross fixed capital formation is used as a proxy for investment (\(I_{t}\)). Data for gross fixed capital formation and GDP is available from 1960–2012. Hence, the capital stock in the current period, \(t\) is defined as \(K_{t} = (1-\delta )K_{t-1}+ I_{t}\). The initial capital, \(K_{0}\) is defined as 1.01 times the 1960 GDP (constant 2005 US$) and the depreciation rate, \(\delta \) is 0.12. The initial capital and the depreciation rate are arbitrarily chosen as long as the capital per worker exhibit diminishing returns to scale over time and the capital share obtained are realistic (positive and less than one) and reasonably coincide with the stylized values (Bosworth and Collins 2008). The labour stock, \(L_{t}\) equals the percentage of population that are employed in each year based on the average employment ratio data available from 1991–2012. In this case, the average employment rate is 0.59. Finally, the tourism receipts (current US$) is divided by the GDP (in current US$), as a percent, to proxy for tourism. A complete data set is provided in the appendix. The data used in the analysis are duly transformed into natural logarithms to minimize errors and also compute elasticity coefficients. The descriptive statistics and the correlation matrix are provided in Table 1. As noted from the correlation matrix, the log of tourism earnings (% GDP) (Ltur), capital per worker (Lk) and output per worker (Ly) are strongly positively correlated.

Next, we use the autoregressive distributed lag (ARDL) procedure developed by Pesaran et al. (2001) to test the existence of a long-run relationship between output per worker, capital per worker, and tourism. The ARDL approach is used because it is relatively simple and recommended for small sample size (Ghatak and Siddiki 2001; Pesaran et al. 2001). To examine the cointegration based on the computed F-statistics, it is recommended to use the critical bounds from Narayan (2005) which are specifically constructed for a small sample size.Footnote 1 Although, one may not test for unit roots and proceed to investigate cointegration thereby overlooking the order of integration, we emphasize the need to conduct the unit root tests for a couple of reasons. First, to ensure that the series are indeed I(0) and/or I(1) in order to apply the ARDL bounds procedure instead of other approaches such as the ordinary least squares (OLS) method which is not recommended for variables in the presence of unit root; and second, examining the unit root provides information on the maximum lags that can be used when performing the Toda and Yamamoto (1995) non-Granger causality procedure. Therefore, we use the augmented Dickey-Fuller (ADF), Phillips-Perron (PP) and Kwiatkowski-Phillips-Schmidt-Shin (KPSS) tests to examine the time series properties of the variables and compute the unit root statistics.

4 Results

In this section, we examine and present the results at various stages of the analysis. In what follows, Sect. 4.1 examines the stationarity of the series by computing the unit root statistics; Sect. 4.2 presents the cointegration results; Sect. 4.3 examines the diagnostics; Sect. 4.4 discusses the short-run and long-run results; and Sect. 4.5 presents the causality nexus.

4.1 Unit root and structural breaks

Based on these standard tests, we conclude that all variables are stationary at most in their first differences (Table 2) duly confirming the maximum order of I(1). Furthermore, since the presence of structural breaks can influence the computed F-statistics from the bounds procedure, it is important to control for these breaks, where possible. Although, we agree that there can be more than one break in the series, we control for only a single break in the series by using the relatively simple test of Perron (1997). As noted from Table 3, the respective series structural breaks are noted in 1988 (Lk), 1991 (Ly) 1997 (\({\varDelta }Lk\)), 1998 (Ltur and \({\varDelta }Ly\)) and 2001 (\({\varDelta }Ltur\)). In retrospect, these periods indicates some significant structural shifts in the economy. For instances, 1988 was the start off period for Malaysia as it shifted from the traditional agriculture and resource based economy to manufactured goods with a focus on export-oriented outlook; in 1997 Asian Financial crisis—decline in foreign direct investment and increase in capital outflow as a result of speculative short-selling of Malaysian currency; in 1991, the economy came up with Vision 2020 with the focus on becoming a self-sufficient industrialized nation by 2020; it was in 1991 that the controversial positive program, the New Economic Policy (NEP) was ostensibly ended; and in 2001, the central bank launched a Financial Sector Master plan to revamp the finance sector following the Asian Financial crisis, with emphasis on Islamic Banking. Subsequently, we set the break periods in the respective series to one to identify break in each series and then use the cumulative structural (\(CumStruc_{t}\)) break, which is a dummy variable indicating the periodic breaks for the entire series as a single variable and compute the bounds statistics. This information is important when computing the bounds F-statistics and estimating the short-run and long-run relationship (see Eqs. 8–10).

4.2 Cointegration

Since we do not have information about the direction of the long-run relationship between output per worker (Ly), capital per worker (Lk) and tourism (Ltur), we specify the following three ARDL equations to investigate the long-run cointegration:

In examining the cointegration relationship, there are two steps involved: First, Eqs. (8)–(10) is estimated separately using the OLS technique. Second, the existence of a long-run relationship is traced for each equation by imposing a restriction on all estimated coefficients of lagged level variables equating to zero. Hence, in essence, bounds test is based on the F-statistics (or Wald statistics) with the null hypothesis of no cointegration (\(H_0 :\beta _{i1} =\beta _{i2} =\beta _{i3} =0\)) against the alternative hypothesis of existence of long-run cointegration (\(H_1 :\beta _{i1} \ne 0;\beta _{i2} \ne 0;\beta _{i3} \ne 0\)). If the computed F-statistics falls above the upper critical bound, then the null hypothesis of no cointegration is rejected at the given levels of significance. Alternatively, if the test statistics falls below the lower bounds, then the null hypothesis of no cointegraiton is accepted at the given level of significance. In case when the F-statistics falls within the upper and lower bounds, the outcome is inconclusive. Given that the sample used in the analysis are from 1975–2012 (n = 38), the computed F-statistics can be compared against the computed bounds from Narayan (2005) for n = 35 and n = 40. Noting the dummy variable \(CumStruc_{t} = 1\) for 1988, 1991, 1997, 1998, and 2001, we used this variable to control for structural breaks and compute the respective bounds F-statistics. We also include unrestricted constant (\(C\)) and unrestricted trend (\(T\)) variables, respectively. As noted, for n = 35, the lower bound I(0), is 7.6430 and the upper bound I(1), is 9.0630; and for n = 40, I(0) is 7.5270, and I(1) is 8.8030. Notably, the computed F-statistics (F = 18.7196) when Ly is treated as dependent variable with the full sample of n = 38 is higher than the upper bounds for n = 35 and n = 40, duly confirming the presence of a long run relationship at 1 % level of significance and the existence of a single cointegrating vector (Table 4).

4.3 Diagnostics

After establishing the presence of a long-run cointegration, we proceed to estimate the long-run and short-run results.Footnote 2 Before examining the results, we examine the diagnostic tests from the lag estimates of the ARDL regression results.Footnote 3 These include: Lagrange multiplier test of residual serial correlation (\(\chi ^{2}_{\mathrm{sc}}\)); Ramsey’s RESET test using the square of the fitted values for correct functional form (\(\chi ^{2}_{\mathrm{ff}}\)); normality test based on the test of skewness and kurtosis of residuals (\(\chi ^{2}_{\mathrm{n}}\)); and heteroscedasticity test based on the regression of squared residuals on squared fitted values (\(\chi ^{2}_{\mathrm{hc}}\)). The results are reported in Table 5. In what follows, we find that the diagnostic test rejects the acceptance of the null hypothesis of the presence of serial correlation (\(\chi ^{2}_{sc }= 1.2999: F(1, 20) = 0.7950\)), functional form biasness (\(\chi ^{2}_{ff =} 0.0163: F(1, 20) = 0.0096\)), normality biasness (\(\chi ^{2}_{n }= 0.1973\)) and heteroscedasticity (\(\chi ^{2}_{hc}= 0.7611: F(1, 32) = 0.7327\)) at 1 % level of significance. Moreover, the CUSUM and CUSUM of squares (CUSUMQ) figures are examined to determine the stability of the parameters of the model (Fig. 2a, b). As noted from Fig. 2a, there is a slight instability in the years 2007 and 2008, which could have been due to financial crisis and the SARS pandemic. Nevertheless, the CUSUMQ plot shows relatively evidence of parameter stability in the model.

4.4 Short-run and long-run

4.4.1 Short-run

The short-run results (Table 6: panel b) indicate a mixed contribution from capital per worker. The coefficients of the capital per worker are statistically significant at 1 % level and is about 1.47 % (\({\varDelta } Lk_{t}=1.4691\)) in the current period and \(-\)1.18 % (\({\varDelta } Lk_{t-1}=-1.1767\)) in the lag-one (\(t-1\)) period, respectively. Nevertheless, the net effect is positive and about 0.29 %. Interestingly, we note that tourism has a marginal lagged (\(t-2\)) negative contribution of about 0.06 % (\({\varDelta } Ltur_{t-2}=-0.0593\)) which is significant at 5 % level of statistical significance. The net negative effect from tourism in the short-run is plausible when income from tourism does not immediately translates or enters into investment and productive activities, which in large part can be due to the lower average length of stay of tourists and lower spending per day resulting in low yield earnings in the sector. We also note the structural changes (breaks) have a lagged (\(t-2\)) negative effect in the short-run. As noted, the coefficient of the lagged \((t-2\)) cumulative structural changes is statistically significant at 10 % level and decreases the output per worker by a factor of 0.02 (\(CumStruc_{t-2}=-0.0179\)) implying the marginal, however negative and delayed response from structural factors in the short-run. The error correction term (\(ECT_{t-1} = -0.3092\)), which measures the speed at which prior deviations from equilibrium are corrected, has correct (negative) sign and is significant at 1 % level of statistical significance duly indicating a relatively speedy convergence to long-run equilibrium, i.e., roughly 31 % of the previous period deviations are corrected in the current period.

4.4.2 Long-run

In the long-run (Table 6: panel a), we note that the capital share is 0.63 (Lk = 0.6282), which is statistically significant at the 1 % level. However, the capital share is slightly larger than the stylized value of one-third (Ertur and Koch 2007; Rao 2007). This is plausible when: (a) the capital and labor inputs tend to grow at relatively similar rates; (b) an economy is predominantly developing and hence a large number of self-employed persons earn income from both capital and their own labour (Gollin 2002) thus making it difficult to obtain meaningful measures of income shares; and (c) the quality of data and the sample size which also makes it difficult to compute capital stock (Bosworth and Collins 2008) that can perfectly exhibit decreasing returns to scale and thus conform to a desirable steady-state convergence. We concur to all these reasons in case of this study. The coefficient of tourism (Ltur = 0.2552), which is significant at 5 % level of statistical significance indicates that a 1 % increase in tourism earnings, ceteris paribus, results in about 0.26 % increase in the output per worker in the long-run. Therefore, the estimated elasticity coefficient for tourism in Malaysia is 0.26. Similar to the short-run effects, the structural factors (denoted by the cumulative structural breaks in the series), have long-run negative effects at 10 % level of statistical significance (\(CumStruc_{t}=-0.0496; \; CumStruc_{t-1}=-0.0424;\; CumStruc_{t-2}=-0.0579\)). On average, the structural breaks decreases the long-run output per worker by a factor of 0.02 per periods.

4.5 The Toda-Yamamoto (T-Y) approach to Granger non-causality

Next, to give further merit to the cointegration results and the estimations of short-run and long-run results, the Granger causality test using the Toda and Yamamoto (1995) approach is carried out. This approach is suitable when the economic series are either integrated of different orders, not cointegrated, or both. In these cases, the error-correction model (ECM) cannot be applied for Granger causality tests and the standard (pair-wise) Granger causality test may not give robust results unless all the variables are ensured to be I(0) through first and/or second order differencing. Hence, Toda and Yamamoto (1995) provides a reliable method to test for the presence of non-causality, irrespective of whether the variables are I(0), I(1) or I(2), not cointegrated or cointegrated of an arbitrary order. Moreover, using this procedure, one can also examine the ‘combined’ or the conjoint effects of the parameters (excluded variables) on the target variable (Kumar and Kumar 2013b; Kumar 2013a, b). In order to carry out the Granger non-causality test, the model is presented in the following vector autoregression (VAR) system:

where the series are defined in (11)–(13). The null hypothesis of no-causality is rejected when the p-values falls within the conventional 1–10 % of level of significance. Hence, in (11), Granger causality from \(Lk_{t}\) to \(Ly_{t}\), and \(Ltur_{t}\) to \(Ly_{t}\) implies \(\eta _{1i} \ne 0\forall i\) and \(\phi _{1i} \ne 0\forall i, \delta _{1i} \ne 0\forall i\), respectively. Similarly, in (12), \(Ly_{t}\) and Ltur Granger causes \(Lk_{t}\) if \(\theta _{1i} \ne 0\forall i\), and \(\vartheta _{1i} \ne 0\forall i\), respectively; from (13) \(Ly_{t}, Lk_{t}\) Granger causes \(Ltur_{t}\) if \(\varphi _{1i} \ne 0\forall i\), and \(\mu _{1i} \ne 0\forall i\), respectively. From the unit root results (Table 2) where the maximum order of integration is 1 (\(d_{max = }1\)), and the optimal lag length chosen from ARDL VAR estimation using the Akaike information and Schwarz Bayesian criteria is 3 (\(k = 3\)). Hence, the maximum lags that can be used to carry out the non-causality tests is 4 (\(d_{max} + k \le 4\)). This implies that when examining the causality, appropriate lags that can be chosen should not exceed 4. Importantly, in conducting the causality tests, it is important to examine the properties of inverse roots of the AR (auto-regressive) characteristics polynomial diagram. It order to obtain a robust causality result (based on the chi-square and p-values), the inverse roots should lie within the positive and the negative unity. Where the inverse roots lie outside the unit boundaries, this can be corrected by including appropriate lags and/or trend variable as instruments (exogenous variable) in the VAR equation. We ensure the AR inverse roots are within the positive/negative unit boundary before proceeding to the causality assessment. For our purpose, we used the lag-length of 1 to examine the causality results.Footnote 4 The results of the causality tests are presented in Table 7.

In what follows, we note the acceptance of causality in case of a unidirectional causation from output per worker to capital per worker (\(Ly \rightarrow Lk\)) at 1 % level of statistical significance (\(\chi ^{2} = 19.2032\)), and a bi-directional causation from capital per worker to tourism earnings (\(Lk \leftarrow \rightarrow Ltur\)) at 10 % level of statistical significance (\(\chi ^{2} = 3.6734\)) (Table 7). The bi-directional causation indicates that tourism earnings and capital productivity (and investment activities) are mutually reinforcing. This implies that tourism earnings spur capital accumulation which duly supports the tourism sector in Malaysia. Moreover, the unidirectional causation from output per worker to capital per worker (capital productivity and investment) indicates that economic growth supports and/or attracts and incentivizes capital investment which duly supports tourism sector development. Finally, the combined causation/conjoint effect, which we denote as the interaction between the two excluded variables, indicate that output per worker and tourism earnings duly support capital per worker (capital productivity) (\(Ly \times Ltur \rightarrow Lk\)) at 1 % level of statistical significance (\(\chi ^{2} = 28.0014\)), where the dominant causation is coming from the output per worker (economic growth).

5 Conclusion

In this article, we look at the short-run and long-run effects of tourism earnings in the economy of Malaysia over the period 1975–2012 using the augmented Solow framework and the ARDL bounds procedure. Our results indicate that tourism has a positive and momentous long-run effect on the economic growth in Malaysia. In other words, ceteris paribus, a 1 % increase in tourism receipts (as a percent of GDP) will result in roughly 0.26 % increase in economic growth. Moreover, we note that tourism in the short-run has a lagged marginal negative effect, i.e. 0.06 %. The causality assessment revealed a bi-directional causation between capital per worker and tourism receipts, and a unidirectional causation from output per worker to capital per worker. Some contributions of this paper are in order. Although, there are different types of studies being done with respect to Malaysian economy, there is no study done thus far that explores the tourism elasticity. Therefore, to modestly fill this lacuna, we follow a similar method and approach used in other country-specific studies (Kumar and Kumar 2012, 2013a; Kumar et al. 2011; Kumar 2013a, b), and find a long-run cointegration between output per worker, capital per worker and tourism earnings. We stress that the importance of quantifying the effects tourism is expected to facilitate ongoing policy dialogues in the light of tourism development and also spur more research and refined methods in estimating the statistical and economic significance of tourism in Malaysia and other countries.

Moreover, prior studies (Kadir and Karim 2009; Norsiah and Saad 2010) find that economic growth caused tourism earnings in Malaysia. By incorporating capital accumulation in the model (which implicitly includes investment), our study reveals that tourism and capital accumulation are mutually reinforcing. In other words, tourism earnings also support capital formation and investment activities which duly supports tourism infrastructure development. In light of the results from causality nexus, we argue tourism and economic growth conjointly propels investment activities in Malaysia which is likely to support sustainable growth and development. In this regard, tourism can be considered as a source of (foreign direct) investment and catalyst to promoting long-run growth.

Notably, we find that tourism in the short-run has a lagged marginal negative effect. This may be due to the low yield from tourism activities in the short-run. In other words, there is plausibility that tourism earnings are not deployed immediately into investment and other productive activities which could be due to the earnings being saved or accumulated for longer-term high return projects. However, some caveats to the results are in order. First, using the augmented Solow approach is somewhat controversial since it is often argued that the model is applicable in the case of developed and closed economies and a relatively old model. In addition, data limitations, i.e. data for capital stock and labor stock (not force) is not available publicly and hence need to be constructed using economically and econometrically reasonable assumptions such as that (a) capital share need to coincide with the stylized values, (b) capital per worker need to exhibit diminishing returns to scale, and (c) depreciation rate and initial capital stock is arbitrarily determined in the economy. Second, the estimated long-run capital share in our results is slightly higher than one-third due to above assumptions and the justifications given earlier in the results section (c.f. Bosworth and Collins 2008; Gollin 2002). Third, the availability of consistent data on tourism receipts for Malaysia (and for many other developing countries for that matter) is not easily available in authoritative sources such as World Bank (2013) database and therefore we have used the exponential trend function as the best fit to approximate data for periods 1975–1994 and hence resulting in the empirical outcome to be not unique. Moreover, one can also use other numerical techniques such as advanced spline curve fitting procedures to approximate the data. We leave for further research. In additionFootnote 5, we did not use the ARMA (auto-regressive moving average) model for estimation since we find that the exponential trend function exhibit the actual data relatively well and the goal is to do a backward estimation whereas ARMA model in most cases are useful tool for forecasting and forward estimation of data points. Moreover, in our study, although the polynomial trend function show a relatively high \(\hbox {R}^{2}\) (0.93) than the exponential function (0.87), we use the latter because the polynomial trend function is a quadratic function and gives a higher backward estimates of the data points as we move backward in time (pre-1995 periods), which is somewhat difficult to justify as tourism earning and visitor arrivals in Malaysia took momentum from the year 1995 onwards. Forth, there is a plausibility of more than one structural break in each series which can be captured using the relatively advanced econometric techniques such as two-period break test of Lee and Strazicich (2003), and/or the recently developed technique by Narayan and Popp (2013). Fifth, explicitly controlling for the effects of financial crisis and the SARS pandemic can further extend the model and plausibly provide better results. Nevertheless, against these limitations, the empirical study quantifies the short-run and long-run effects in Malaysia and argues that tourism earnings and investment (capital accumulation) are mutually reinforcing.

In light of the results and within the caveats highlighted above, we recommend the need to consider the regulatory requirements in relation to foreign direct investment in the tourism sector. In other words, the regulatory environment need to be supportive of tourism related investment activities so long as the investments are socially and economically welfare enhancing and pro-growth. Subsequently, having a pro-tourism regulatory requirement in place will ensure investor confidence in the sector which is expected to yield greater benefits in the long-run. In addition, some other aspects that will support tourism sector development includes improving support services specific to the tourism sector such as the developments in information and communications technology (ICT) and call center service operations, and targeted marketing of niche and key areas of tourism which includes medical, academic, nature based, and other types of socially desirable and economically beneficial tourism activities. From a research viewpoint, we propose that different methods, approaches and perspectives can be explored to examine the benefits of tourism in Malaysia in order to facilitate sector specific policy level dialogues towards sustainable growth and development of the economy.

Notes

The critical bounds of Pesaran et al. (2001) however are suitable in cases when the sample size exceeds 80.

Note that we drop the trend (\(T)\) variable in the short-run and long-run estimate since trend variable in this instance is not statistically significant, and therefore excluding \(T\) improves the results and the diagnostics.

The ARDL lag estimation results are not included here to conserve space. We only provide the diagnostic tests in order to ascertain the robustness of the long-run and short-run results.

Since the maximum lag-length required for causality assessment is 4, we examined all possible lags up to 4 and found that lag-length of 1 gives the desired results while ensuring that the AR inverse roots are within the positive and negative unity.

In response to a reviewers comment.

References

Acemoglu, D.: Introduction to Modern Economic Growth. Princeton University Press, U.S.A (2009)

Arslanturk, Y., Balcilar, M., Azdemir, Z.A.: Time-varying linkages between tourism receipts and economic growth in small open economy. Econ. Model. 28, 664–671 (2011)

Bosworth, B., Collins, S.M.: Accounting for growth: comparing China and India. J. Econ. Perspect. 22, 45–66 (2008)

Brida, J.G., Carrera, E.S., Risso, W.A.: Tourism’s impact on long-run Mexican economic growth. Econ. Bull. 3, 1–8 (2008)

Tang, C.F.: Is the tourism-led growth hypothesis valid for Malaysia? A view from disaggregated tourism markets. Int. J. Tour. Res. 13(2011), 97–101 (2011)

Chang, C.-L., Khamkaew, T., Mcleer, M.: IV Estimation of a panel threshold model of tourism specialization and economic development. Tour. Econ. 18, 5–41 (2012)

Domar, E.D.: Economic growth: an econometric approach. Am. Econ. Rev. 42, 479–495 (1952)

Domar, E.D.: On the measurement of technological change. Econ. J. 71, 709–702 (1961)

Durbarry, R.: Tourism and economic growth: the case of Mauritius. Tour. Econ. 10, 389–401 (2004)

Eeckels, B., Filis, G., Leon, C.: Tourism income and economic growth in Greece: empirical evidence from their cyclical components. Tour. Econ. 18, 817–834 (2012)

Ertur, C., Koch, W.: Growth, technological interdependence and spatial externalities: theory and evidence. J. Appl. Econ. 22, 1033–1062 (2007)

Fayissa, B., Nsiah, C., Tadasse, B.: Impact of tourism on economic growth and development in Africa. Tour. Econ. 14, 807–818 (2008)

Ghatak, S., Siddiki, J.: The use of ARDL approach in estimating virtual exchange rates in India. J. Appl. Stat. 28, 573–583 (2001)

Gollin, D.: Getting income shares right. J. Polit. Econ. 110, 458–474 (2002)

Habibi, F., Abbsasinejad, H.: Dynamic panel data analysis of European tourism demand in Malaysia. Iran. Econ. Rev. 55, 27–41 (2011)

Hanafiah, M.H.M., Harun, M.F.M.: Tourism demand in Malaysia: a cross-sectional pool time-series analysis. Int. J. Trade Econ. Financ. 1, 80–83 (2010)

Harrod, R.F.: Domar and dynamic economics. Econ. J. 69, 451–464 (1959)

Holzner, M.: Tourism and economic development: the beach disease? Tour. Manag. 32, 922–933 (2010)

Hye, Q.M.A., Khan, R.E.A.: Tourism-led growth hypothesis: a case study of Pakistan. Asia Pac. J. Tour. Res. 18, 303–313 (2013)

Kadir, N., Karim, A.M.Z.: Demand for tourism in Malaysia by UK and US tourists: a cointegration and error correction model. In: Matias, Á., Nijkamp, P., Sarmento, M. (eds.) Advances in Tourism Economics. Physica-Verlag, Sarmento (2009). doi:10.1007/978-3-7908-2124-6_4

Katircioglu, S.T.: Revisiting the tourism-led-growth hypothesis for Turkey using the bounds test and Johansen approach for cointegration. Tour. Manag. 30, 17–20 (2009)

Khalil, S., Mehmood, K.K., Waliullah, K.: Role of tourism in economic growth: empirical evidence from Pakistan economy. Pak. Dev. Rev. 46, 985–995 (2007)

Kumar, R.R., Kumar, R.: Exploring the nexus between information and communications technology, tourism and growth in Fiji. Tour. Econ. 18, 359–371 (2012)

Kumar, R.R., Kumar, R.: Effects of energy consumption on per worker output: A study of Kenya and South Africa. Energy Policy 62, 1187–1193 (2013b)

Kumar, R.R., Kumar, R.: Exploring the developments in urbanisation, aid dependency, sectoral shifts and services sector expansion in Fiji: a modern growth perspective. Glob. Bus. Econ. Rev. 15, 371–395 (2013a)

Kumar, R.R., Naidu, V., Kumar, R.: Exploring the nexus between trade, visitor arrivals, remittances and income in the Pacific: a study of Vanuatu. Œconomica 7, 199–218 (2011)

Kumar, R.R., Stauverman, P.J., Patel, A., Kumar, R.D.: Exploring the effects of energy consumption on output per worker: A study of Albania, Bulgaria, Hungary and Romania. Energy Policy 69, 575–585 (2014)

Kumar, R.R.: Exploring the nexus between tourism, remittances and growth in Kenya. Qual. Quant. 48, 1573–1588 (2013a). doi:10.1007/s11135-013-9853-1

Kumar, R.R.: Exploring the role of technology, tourism and financial development: an empirical study of Vietnam. Qual. Quant. http://link.springer.com/article/10.1007%2Fs11135-013-9930-5 (2013b)

Kumar, R.R.: Remittances and economic growth: a study of Guyana. Econ. Syst. 37, 462–472 (2013c)

Lee, C.C., Chang, C.P.: Tourism development and economic growth: a closer look at panels. Tour. Manag. 29, 180–192 (2008)

Lee, J., Strazicich, M.C.: Minimum Lagrange multiplier unit root test with two structural breaks. Rev. Econ. Stat. 85, 1082–1089 (2003)

Lim, C., McAleer, M.: A cointegration analysis of annual tourism demand by Malaysia for Malaysia. Math. Comput. Simul. 59, 197–205 (2002)

Loganathan, N., Ibrahim, Y., Harun, M.: The contribution of tourism development, policy and strategic alliances to economic growth: the case of Malaysia. TOURISMOS 3, 83–98 (2008)

Loganathan, N., Subramaniam, T., Kogid, M.: Is ‘Malaysia truly Asia’? forecasting tourism demand from ASEAN using SARIMA approach. TOURISMOS 7, 367–381 (2012)

MacKinnon, J.G.: Numerical distribution functions for unit root and cointegration tests. J. Appl. Econom. 11, 601–618 (1996)

Mazumder, M.N.H., Ahmed, E.M., Al-Amin, A.Q.: Does tourism contribute significantly to the malaysian economy? Multiplier analysis using I-O technique. Int. J. Bus. Manag. 4, 146–159 (2009)

Ministry of Tourism (MOT): Media Release—Malaysia receives a record 25 million tourist arrivals last year. MOT Malaysia. http://corporate.tourism.gov.my/mediacentre.asp?page=news_desk&news_id=763 (2013). Accessed 25 Dec 2013

Narayan, P.K., Popp, S.: Size and power properties of structural break unit root tests. Appl. Econ. 45, 721–728 (2013)

Narayan, P.K.: The saving and investment nexus in China: evidence from co-integration tests. Appl. Econ. 37, 1979–1990 (2005)

Norsiah, K., Saad, A.: Tourism and economic growth in Malaysia: evidence from multivariate causality tests. The First Seminar On: Entrepreneurship and Societal Development in ASEAN, pp. 1–9. ISE-SODA 2010, Bayview (2010). ISBN 983-2078-36-4

Nowak, J.Q., Sahli, M., Cortes-Jimenez, I.: Tourism, capital good imports and economic growth: theory and evidence for Spain. Tour. Econ. 13, 515–536 (2007)

Obadiah, N.K., Odhiambo, N.M., Njuguna, J.M.: Tourism and economic growth in Kenya: an empirical investigation. Int. Bus. Econ. Res. J. 11, 517–528 (2012)

Oh, C.O.: The contribution of tourism development to economic growth in the Korean economy. Tour. Manag. 26, 39–44 (2005)

Ozturk, I., Acaravci, A.: On the causality between tourism growth and economic growth: empirical evidence from Turkey. Transylv. Rev. Adm. Sci. 25E, 73–81 (2009)

Payne, J.E., Mervar, A.: The tourism-growth nexus in Croatia. Tour. Econ. 19, 1089–1094 (2010)

Perron, P.: Further evidence on breaking trend functions in macroeconomic variables. J. Econom. 80, 355–385 (1997)

Pesaran, M.H., Shin, Y., Smith, R.: Bounds testing approaches to the analysis of level relationships. J. Appl. Econom. 16, 289–326 (2001)

Rao, B.B.: Estimates of the steady state growth rates for selected Asian countries with an extended Solow Model. Econ. Model. 27, 46–53 (2010)

Rao, B.B.: Estimating short and long-run relationships: a guide for the applied economist. Appl. Econ. 39, 1613–1625 (2007)

Romer, P.M.: Endogenous technological change. J. Polit. Econ. 98, 71–102 (1990)

Salleh, N.H.M., Law, S.K., Ramachandran, S., Noor, Z.M.: Asia tourism demand for Malaysia: a bound test approach. Contemp. Manag. Res. 4, 351–368 (2008)

Schumpeter, J.: The common sense econometrics. Econometrica 1, 5–12 (1933)

Seetanah, B.: Assessing the dynamic economic impact of tourism for island economies. Ann. Tour. Res. 38, 291–308 (2011)

Seetanah, B., Padachi, K., Rojid, S.: Tourism and economic growth: african evidence from panel vector autoregressive framework. Working Paper No 2011/33, UNU-WIDER (2011)

Sheldon, P.: Tourism Information Technologies. CAB, Oxford (1997)

Solow, R.M.: A contribution to the theory of economic growth. Quart. J. Econ. 70, 65–94 (1956)

Tan, A.Y.F., McCahon, C., Miller, J.: Stability of inbound tourism demand models for Indonesia and Malaysia: the pre-and postformation of tourism development organizations. J. Hosp. Tour. Res. 26, 361–378 (2002)

Tang, C.F., Abosedra, S.: The impacts of tourism, energy consumption and political instability on economic growth in the MENA countries. Energy Policy 68, 458–464 (2014)

Tang, C.F., Tan, E.C.: How stable is the tourism-led growth hypothesis in Malaysia? Evidence from disaggregated tourism markets. Tour. Manag. 37, 52–57 (2013)

Toda, H.Y., Yamamoto, T.: Statistical inferences in vector autoregressions with possibly integrated process. J. Econom. 66, 225–250 (1995)

UNWTO: UNWTO 25th CAP-CSA AND UNWTO Conference on Sustainable Tourism and Development 12–14 April 2013, Hyderabad, India (2013)

World Bank: World Development Indicators and Global Development Finance. World Bank, Washington D.C. (2013)

Author information

Authors and Affiliations

Corresponding author

Appendix

Rights and permissions

About this article

Cite this article

Kumar, R.R., Loganathan, N., Patel, A. et al. Nexus between tourism earnings and economic growth: a study of Malaysia. Qual Quant 49, 1101–1120 (2015). https://doi.org/10.1007/s11135-014-0037-4

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11135-014-0037-4