Abstract

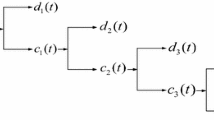

In this paper, a hybrid approach consisting of pigeon-inspired optimization (PIO) and extreme learning machine (ELM) based on wavelet packet analysis (WPA) is presented for predicting bulk commodity futures prices. Firstly, WPA is applied to decompose the original futures prices into a set of lower-frequency subseries. Secondly, the PIO algorithm is used to optimize the parameters of ELM and then the optimized ELM is utilized to forecast the subseries. Finally, we adopt the hybrid method to calculate the final forecasting outcomes of futures prices. In order to further test the predictive ability of the hybrid forecasting model on bulk commodity futures prices, we use the prices of West Texas Intermediate crude oil futures and Chicago Board of Trade soybean futures to make one-step, two-step and four-step ahead predictions. In comparison with complete ensemble empirical mode decomposition with adaptive noise, empirical mode decomposition and singular spectrum analysis, WPA is the most suitable for decomposing bulk commodity futures prices. The experimental outcomes show that the hybrid WPA-PIO-ELM model has better performance on horizontal precision, directional precision and robustness.

Similar content being viewed by others

References

Chi G T, Li Z J. Forecast model of stock index futures prices based on small sample. ICIC Express Lett Part B Appl Int J Res Surv, 2014, 5: 657–662

Wang C Y. Forecast on price of agricultural futures in China based on ARIMA model. Asian Agr Res, 2016, 8: 9–12

Darekar A, Reddy A. Predicting market price of soybean in major india studies through ARIMA model. Soc Sci Electron Publishing, 2017, 30: 73–76

Xu W C, Zhou H B, Cheng N, et al. Internet of vehicles in big data era. IEEE/CAA J Autom Sin, 2018, 5: 19–35

Mazouchi M, Naghibi-Sistani M B, Sani S K H. A novel distributed optimal adaptive control algorithm for nonlinear multi-agent differential graphical games. IEEE/CAA J Autom Sin, 2018, 5: 331–341

Zhang Y H, Shen X, Shen T L. A survey on online learning and optimization for spark advance control of SI engines. Sci China Inf Sci, 2018, 61: 070201

Li H T, Zhao G D, Meng M, et al. A survey on applications of semi-tensor product method in engineering. Sci China Inf Sci, 2018, 61: 010202

Baruník J, Malinská B. Forecasting the term structure of crude oil futures prices with neural networks. Appl Energy, 2016, 164: 366–379

Hu J W S, Hu Y C, Lin R R W. Applying neural networks to prices prediction of crude oil futures. Math Probl Eng, 2012, 2012: 1–12

Zhang X M, Han Q L, Zeng Z. Hierarchical type stability criteria for delayed neural networks via canonical bessellegendre inequalities. IEEE Trans Cybern, 2018, 48: 1660–1671

Zhang Y, He J, Yin T F. Research on petroleum price prediction based on SVM. Comput Simul, 2012, 29: 375–377

Zhang J L, Zhang Y J, Zhang L. A novel hybrid method for crude oil price forecasting. Energy Econ, 2015, 49: 649–659

Das S P, Padhy S. A novel hybrid model using teaching-learning-based optimization and a support vector machine for commodity futures index forecasting. Int J Mach Learn Cyber, 2018, 9: 97–111

Ela A A A E, Abido M A, Spea S R. Differential evolution algorithm for optimal reactive power dispatch. Electric Power Syst Res, 2011, 81: 458–464

Zhang D F, Duan H B, Yang Y J. Active disturbance rejection control for small unmanned helicopters via Levy flight-based pigeon-inspired optimization. Aircraft Eng Aerospace Tech, 2017, 89: 946–952

Chen H H, Chen M, Chiu C C. The integration of artificial neural networks and text mining to forecast gold futures prices. Commun Stat-Simul Comput, 2016, 45: 1213–1225

Dou R, Duan H B. Pigeon inspired optimization approach to model prediction control for unmanned air vehicles. Aircraft Eng Aerospace Tech, 2016, 88: 108–116

Pang B, Liu M, Zhang X, et al. A novel approach framework based on statistics for reconstruction and heartrate estimation from PPG with heavy motion artifacts. Sci China Inf Sci, 2018, 61: 022312

Sun S L, Wang S Y, Zhang G W, et al. A decomposition-clustering-ensemble learning approach for solar radiation forecasting. Sol Energy, 2018, 163: 189–199

Liu H, Mi X W, Li Y F. Comparison of two new intelligent wind speed forecasting approaches based on wavelet packet decomposition, complete ensemble empirical mode decomposition with adaptive noise and artificial neural networks. Energy Convers Manag, 2018, 155: 188–200

Jiang F, He J Q, Zeng Z G, et al. A decomposition-optimization-ensemble learning approach for electricity price forecasting (in Chinese). Sci Sin Inform, 2018, 48: 1300–1315

Wang D Y, Yue C Q, Wei S, et al. Performance analysis of four decomposition-ensemble models for one-day-ahead agricultural commodity futures price forecasting. Algorithms, 2017, 10: 108

Wang Y, Qi C, Li M F. Prediction of commodity prices based on SSA-ELM. Syst Eng-Theory Pract, 2017, 37: 2004–2014

Lu H F. Price forecasting of stock index futures based on a new hybrid EMD-RBF neural network model. Agro Food Ind Hi Tech, 2017, 28: 1744–1747

Wang J, Li X. A combined neural network model for commodity price forecasting with SSA. Soft Comput, 2018, 22: 5323–5333

Huang G B, Zhu Q Y, Siew C K. Extreme learning machine: theory and applications. Neurocomputing, 2006, 70: 489–501

Duan H B, Qiao P X. Pigeon-inspired optimization: a new swarm intelligence optimizer for air robot path planning. Int J Intel Comput Cyber, 2014, 7: 24–37

Diebold F X, Mariano R S. Comparing predictive accuracy. J Business Economic Stat, 2002, 20: 134–144

Pesaran M H, Timmermann A. A simple nonparametric test of predictive performance. J Business Economic Stat, 1992, 10: 461–465

Helske J, Luukko P. Ensemble empirical mode decomposition (EEMD) and its complete variant (CEEMDAN). Int J Public Health, 2016, 60: 1–9

Author information

Authors and Affiliations

Corresponding authors

Rights and permissions

About this article

Cite this article

Jiang, F., He, J. & Zeng, Z. Pigeon-inspired optimization and extreme learning machine via wavelet packet analysis for predicting bulk commodity futures prices. Sci. China Inf. Sci. 62, 70204 (2019). https://doi.org/10.1007/s11432-018-9714-5

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s11432-018-9714-5