Impact on green finance and environmental regulation on carbon emissions: evidence from China

- Institute of Quantitative Economics, Huaqiao University, Xiamen, China

Introduction: Achieving peak carbon dioxide emissions and carbon neutrality is an extensive and profound systematic economic and social change. Through market-oriented financial means, green finance has moved forward the effective governance port, curbed polluting investment and promoted technological progress such as green low-carbon, energy conservation and environmental protection, which has become a powerful starting point to support the practice of low-carbon development.

Methods: Based on the panel data of 30 provinces in China (except Tibet, Hongkong, Macau and Taiwan Province) from 2004 to 2021, this paper calculates the development level of green finance in China provinces by using entropy weight method, and on this basis, uses mathematical statistical model to verify the impact of green finance and its sub-dimensions on carbon emissions and the regulatory effect of heterogeneous environmental regulation tools.

Results: The results show that the development of green finance has a significant inhibitory effect on carbon emissions during the investigation period, and there is a time lag effect. After a series of robustness tests and considering endogenous problems, this conclusion still holds. From the results of heterogeneity analysis, the carbon emission reduction effect of green credit is the most obvious, and the impact of green finance on carbon emission is slightly different in different regions. Besides, Command-controlled environmental regulation tools and public participation environmental regulation tools play a positive regulatory role in the transmission path of green finance’s impact on carbon emissions, but market-driven environmental regulation tools cannot effectively enhance the carbon emission reduction effect of green finance development.

Discussion: The research results of this paper provide a basis for the government to formulate flexible, accurate, reasonable and appropriate green financial policies, help to strengthen the exchange and cooperation between regions in reducing carbon and fixing carbon, and actively and steadily promote China’s goal of “peak carbon dioxide emissions, carbon neutrality”.

1 Introduction

Since the reform and opening up, China’s economic construction has made great achievements, created the China miracle in the history of human economic development, and made China contribution to the world’s economic development. However, the rapid economic growth is at the cost of resource consumption, environmental pollution and ecological degradation. The long-term development mode of extensive economic has made environmental problems such as resource and environmental constraints and ecological degradation more and more prominent, and various environmental pollution and ecological destruction have occurred frequently. China has become the largest energy consumption and carbon emission country in the world (Lin, 2022). The report “Global Environmental Performance Index 2020″shows that China’s environmental performance ranking is in a relatively low position among more than 180 countries participating in the ranking, and the environmental quality scores of methane intensity, carbon dioxide intensity and nitrogen oxide intensity are low (Latif, 2022). With the consensus of green and low-carbon development in the world, how to effectively deal with the increasingly severe carbon emission pressure and achieve the goal of “double carbon” as scheduled has become an urgent practical problem to be studied. The development of green economy needs a lot of capital investment, and financial resources can only meet 10%–15% of it (Zhang et al., 2021). Faced with such a huge demand for carbon reduction funds and the pressure of economic transformation, green finance has become an inevitable choice to conform to this trend.

Green finance, also known as “environmental finance” or “low-carbon finance”, is a variety of institutional arrangements and financial services to promote the development of low-carbon economy, and plays an active role in guiding the rational allocation of resources, promoting the ecological development of traditional industries and the development of new green ecological industries. Taking green credit as an example, the differentiated reward and punishment of credit costs for green enterprises and polluting enterprises has released an incentive or warning signal to related enterprises, which has enabled similar enterprises to spontaneously adjust their development models and transform to green. At the same time, the “green signal” transmitted by green finance through the design of market mechanism plays a role in mobilizing social capital, guiding social capital to lay out green industries and providing necessary capital demand for ecological environment governance. Therefore, with the increasingly severe situation of carbon emission in China, green finance has become an important way to promote the construction of ecological civilization and win the battle of pollution prevention and control, and it is the key support and effective grasper to achieve the goal of “double carbon”.

So, does the development of green finance really help to reduce carbon emissions? The research on this issue is undoubtedly of great significance in realizing the goal of “double carbon”, constructing the institutional guarantee for low-carbon development and promoting the green transformation of development mode.

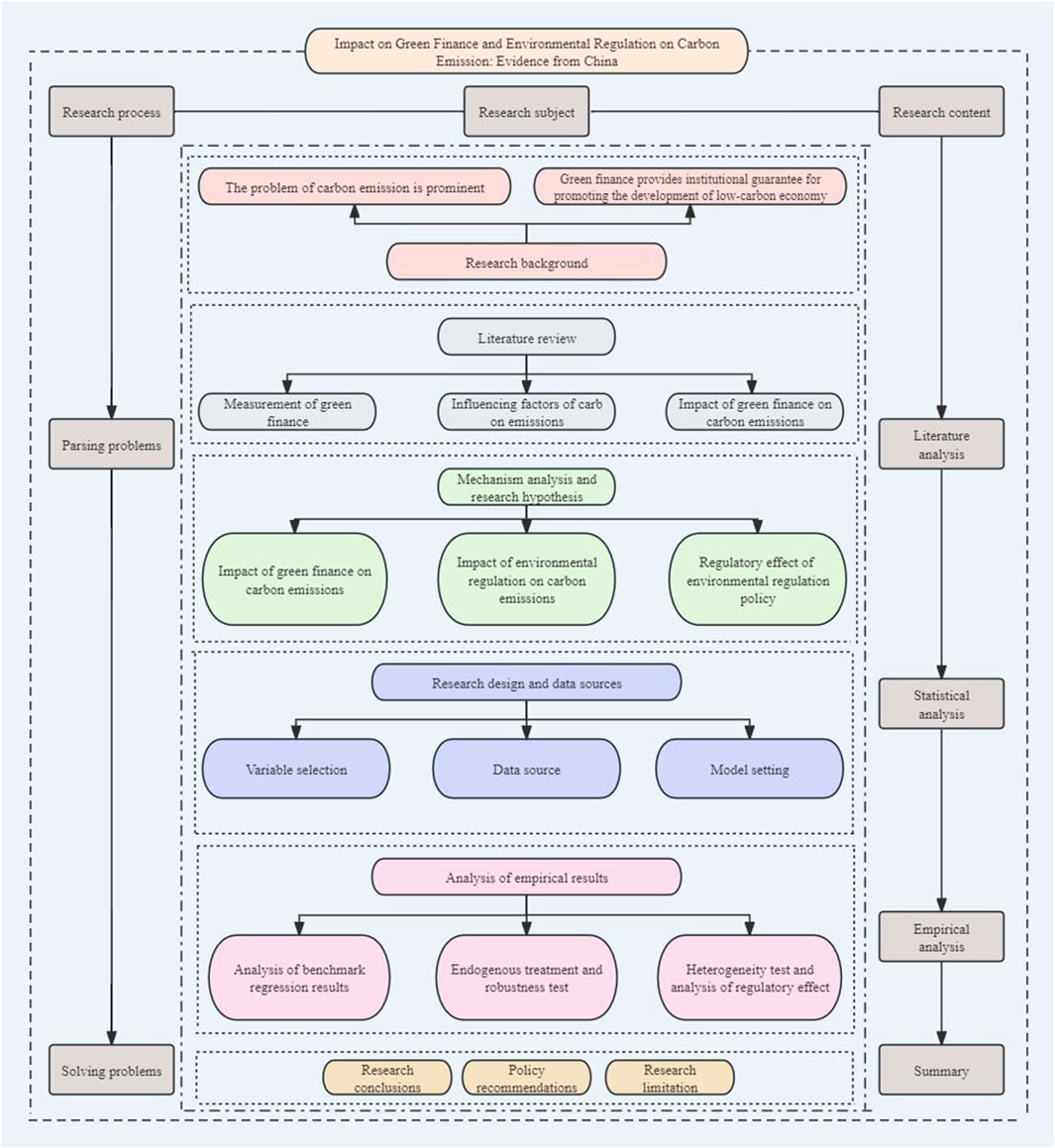

The rest of the article is arranged as follows: the second chapter provides a literature review on the measurement and evaluation of green finance, the influencing factors of carbon emissions and the relationship between green finance, environmental regulation and carbon emissions; the third chapter puts forward the research hypothesis of this paper, combs the influence path of green finance on carbon emissions and what role environmental regulation policy plays in this process; the fourth chapter describes the data and methods used in this paper; the fifth chapter uses a series of mathematical statistical models to verify the carbon emission reduction effect of green finance and the regulatory effect of environmental regulation; the sixth chapter summarizes the full text, provides corresponding policy suggestions, and expounds the research limitations and future prospects. See Figure 1 for an overview of the article.

2 Literature review

Looking at the relevant literature at home and abroad, the research related to the theme of this paper can be roughly divided into the following aspects.

2.1 Measurement and evaluation of green finance

The existing literature has conducted extensive and in-depth research on the measurement of the development level of green finance from both macro and internal mechanisms, and most scholars adopt the method of multiple indexes weighting to measure it. For example, Clark et al. (2018), Yin et al. (2022), and Meo et al. (2022) selected the development indicators of green finance from four areas: green credit, green securities, green insurance and carbon finance, and found that green finance could not be effectively linked with industrial structure adjustment, ecological environment protection and economic development, and the degree of green finance was not high, which restricted the coordinated development of green finance and economic growth, resulting in the insignificant supporting role of green finance for economic growth. Lv et al. (2021) constructed the evaluation index system of green finance from five dimensions: green credit, green securities, green insurance, green investment and carbon finance. By using Dagum’s Gini coefficient decomposition method, nuclear density estimation, Markov chain and spatial Markov chain, it was found that the overall development index of green finance in China showed an upward trend, but the overall level was not high, and the regional gap was gradually narrowing.

2.2 Research on the influencing factors of carbon emissions

Most of the existing literatures use LMDI exponential decomposition method and STIRPAT model to study the influencing factors of carbon emissions. For example, the level of economic growth, energy intensity, energy structure, industrial structure, foreign direct investment and technological innovation are the main factors that affect carbon emissions (Muhammad et al., 2013; Qin et al., 2022; Liu et al., 2023). Yu et al. (2019) and Zhang et al. (2022) pointed out that using a stricter but properly designed environmental regulation tool will promote regulated enterprises to dynamically adjust their internal resource allocation under the background of changing constraints, improve the efficiency of green technology innovation, and partially or even completely offset the cost of complying with environmental regulation, thus improving the market competitiveness of enterprises and solving the regional environmental pollution problem.

2.3 Research on the relationship between green finance, environmental regulation and carbon emissions

Academic circles have done a lot of theoretical discussion and empirical analysis, but there are still great differences between the existing conclusions. There is no agreement on what role green financial development plays in carbon emissions. The implementation of green financial policy guides capital to support green projects such as environmental protection industry and clean energy by reducing financing costs, relaxing quota restrictions and increasing financial leverage, thus promoting environmental protection transformation and technological upgrading of enterprises and reducing carbon emissions. However, some scholars hold the opposite view, such as Huang and Tian (2023), Kant et al. (2021) and Hou et al. (2022), indicating that the development of green finance may increase carbon dioxide emissions by expanding the production scale of enterprises and promoting consumption. In addition, the existing research has not reached an agreement on whether the environmental regulatory tools have the effect of carbon emission reduction, and the “strong Porter hypothesis” and “weak Porter hypothesis” coexist. Most scholars believe that environmental regulation obeys the effect of “innovation compensation”, that is, the reverse effect of the policy itself promotes the transformation and upgrading of industrial structure, makes production factors flow to less polluting industries and eliminates backward production capacity. At the same time, some scholars believe that there is a “cost retrogression effect” in environmental regulation tools. Due to additional energy conservation and emission reduction and increased pollution control costs, enterprises and other production entities urgently need to adjust their production scale, which will reduce their productivity and market competitiveness to a certain extent.

To sum up, the existing literature has done a lot of useful research on measuring the development level of green finance in China, identifying the influencing factors of high carbon emissions and exploring the relationship between green finance, environmental regulation and carbon emissions, which provides ideas for reference and method enlightenment for this paper. However, the existing literature lacks attention to the nonlinear relationship between green finance and carbon emissions. At the same time, there are few documents from the perspective of heterogeneous environmental regulation policies to explore its regulatory effect in the process of carbon emission reduction of green finance.

The contribution of this paper is as follows. (1). According to the connotation and purpose of green finance, this paper constructs an evaluation index system of green finance development index from four dimensions: green credit, green securities, green insurance and green investment, and quantitatively evaluates the development level of green finance in China in multiple dimensions, thus more comprehensively reflecting the influence of green finance and its sub-dimensions on carbon emissions; (2). When combing the channel mechanism of green finance’s impact on carbon emissions, the paper innovatively takes heterogeneous environmental regulation tools as regulatory variables and brings them into the analysis framework, so as to identify the effective channels for green finance to play the role of carbon emission reduction in China at this stage, further enriching the research content of green finance and providing useful reference for further optimizing the combination of environmental regulation tools; (3). Most of the existing studies focus on the static, dynamic and spatial spillover effects of green finance development on carbon emissions, and there is little research on whether there is a time lag effect between them. In this paper, the lagging period of green finance index is included in the model analysis, and the long-term relationship between green finance development and carbon emissions is discussed. (4). The paper clearly compares the differences of carbon emission reduction effects of green finance in different regions of China, expands the depth of research in this field, and provides an empirical basis for maintaining the consistency and stability of green financial policies, which is conducive to finding the starting point of green finance and accelerating the realization of “peak carbon dioxide emissions and carbon neutrality”.

3 Mechanism analysis and research hypothesis

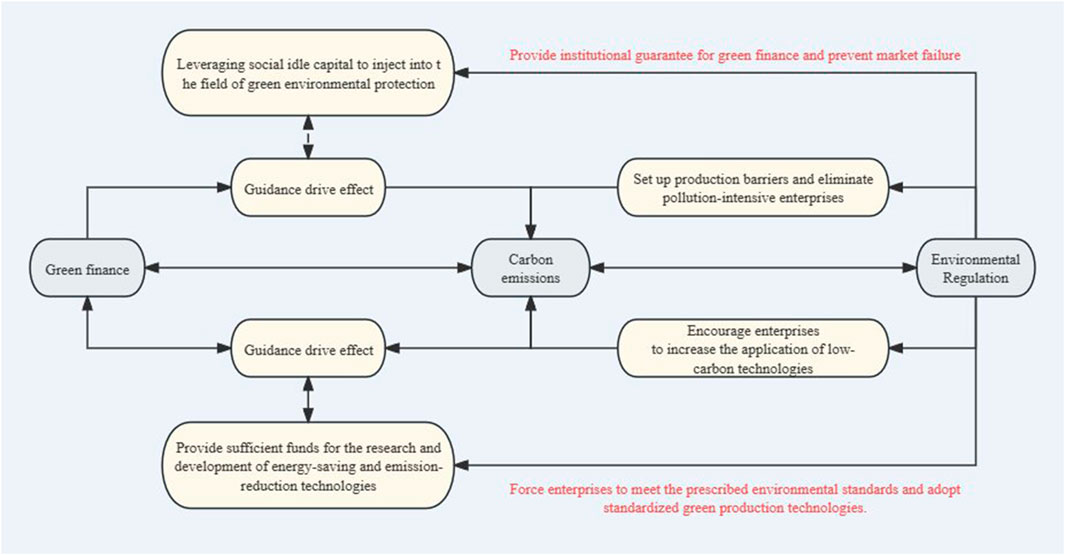

Based on the existing literature research and sustainable development theory, combined with the nature of green finance, this paper studies the influence mechanism of green finance on carbon emissions and the effect of environmental regulation policies. The specific theoretical logic framework is shown in Figure 2.

3.1 The impact of green finance on carbon emissions

3.1.1 Guidance drive effect

Green finance, as a new finance aimed at coping with climate change, improving ecological environment and efficiently utilizing resources, covers energy conservation, environmental protection, clean energy, green transportation, green agriculture, etc. By developing green credit, green bonds, setting up green development funds and other forms, it can leverage social idle capital to inject into the green environmental protection field, thus having a substantial impact on the “carbon reduction” activities (Chang et al., 2024; Yan et al., 2023a). Specifically, the environmental governance of enterprises usually has the characteristics of long period, high cost, high risk and high uncertainty, which leads to the traditional financial involvement, which hinders the promotion of carbon emission reduction to some extent (Zhao et al., 2023). Green finance can help economic growth by exerting “savings mobilization”, and provide long-term and low-cost green financial capital for enterprises by using financial policies such as credit tilt and interest rate floating, and provide sufficient financial guarantee for carbon emission reduction, thus reasonably matching the risks and benefits of carbon reduction for enterprises (He et al., 2022; Chi et al., 2023). At the same time, as a top-down policy tool, green finance is not only reflected in the fact that financial institutions represented by banks are constantly raising the loan threshold of “three high” enterprises, restricting their interest-bearing debt financing and new investment, but also in the fact that it has an impact on the investment logic of market investment by setting up a weather vane of primary capital market, thus guiding social funds to flow from “three high” enterprises to green enterprises, further compressing the living space of enterprises with high energy consumption, high pollution and high emissions, and effectively promoting (Zhang et al., 2022; Wang et al., 2023). In addition, green finance integrates the development concept of low-carbon and environmental protection into the financial field, guides financial institutions to directly participate in environmental governance, and provides diversified, multi-level and flexible fund allocation, especially focusing on supporting the green transformation of infrastructure, projects in the field of clean energy and the development of energy-saving and environmental protection industries, so as to reduce carbon emissions and accelerate the development of green economy. However, it is worth noting that the policy formulation, product innovation and market cultivation of green finance need to be explored and practiced repeatedly to gradually show the effect, so as to effectively guide more funds to withdraw from the “two high and one surplus” field and flow to the “two low” field, and finally curb the carbon emissions generated by production activities and consumption behavior.

3.1.2 Technological innovation effect

As an important tool to coordinate the opposition between economic growth and environmental protection, green technological innovation plays an irreplaceable role in the green transformation of national economy (Xu et al., 2020; Lee et al., 2022). The first premise of technological progress is the effective investment of capital. Green finance, as a new financial model that gives consideration to both ecological environment protection and traditional financial activities, complements the shortcomings of the capital chain of clean production departments by exerting the financial functions of capital allocation, risk diversification and external incentives and constraints, and provides sufficient financial guarantee for the research and development of energy-saving and emission-reduction technologies, thereby improving carbon emission efficiency and reducing unnecessary carbon emissions (Han et al., 2022). Specifically, with the gradual improvement and maturity of the green financial system, green finance can develop diversified underlying assets for different environmental rights and interests, such as carbon trading, emission trading and water rights trading, thus broadening financing channels and breaking the capital bottleneck of technology research and development of different types of enterprises (Lv et al., 2023; Xu et al., 2023). At the same time, the continuous enrichment of financial products such as green securities and green bonds can not only meet different investment needs, but also reduce the threat to the company’s technological innovation caused by “black swan” time and market fluctuation, and disperse the risk of technological research and development of enterprises, thus reducing the pressure of green management of enterprises. In addition, with the continuous improvement of corporate environmental information disclosure mechanism, ESG evaluation index will become a new investment criterion in the financial market, and different audit mechanisms and standards will be established for different green industries, which will cause banks and securities institutions to urge listed companies to disclose detailed and complete environmental information, especially carbon emissions and carbon footprint information of polluting enterprises, and to evaluate the green qualification of loan enterprises (Huang et al., 2023a; Xiong et al., 2023; Zeng et al., 2023). This will force polluting enterprises to increase technology research and development in order to obtain credit funds, promote the green transformation of enterprise production methods, and reduce the carbon dioxide emissions generated by daily production activities (Guo et al., 2022).

Based on the above analysis, the article puts forward the following assumptions:

Hypothesis 1:. Developing green finance can inhibit carbon emissions. However, due to factors such as policy lag, there is a time lag in the carbon emission reduction of green finance.

3.2 Influence of environmental regulation on carbon emissions

With a series of problems, such as resource overdraft, ecological degradation and serious environmental pollution, brought about by extensive economic growth model, the ecological pressure in China has faced the environmental bearing limit. In order to achieve sustainable economic development and alleviate the negative effects of environmental pollution, the government has formulated relevant laws and regulations to implement the main responsibility of corporate environmental governance. Therefore, environmental regulation has become an important tool to promote the goal of “double carbon” and an important means to balance the relationship between economic development and ecological environmental protection (Wen et al., 2022; Liang and Song, 2022). Using a stricter but properly designed environmental regulation tool can effectively promote the regulated enterprises to dynamically adjust the internal resource allocation of enterprises under the background of changing constraints, improve the efficiency of green technology innovation, and partially or completely offset the cost of complying with environmental regulation, so as to improve the market competitiveness of enterprises and solve the regional environmental pollution problem (Zhong et al., 2015; Luo et al., 2023). Specifically, on the one hand, environmental regulation will set up barriers in increasing the capital required by pollution-intensive enterprises, improving the difficulty of commercial operation and stricter regulatory standards, so that market enterprises can realize the survival of the fittest, promote the upgrading of industrial structure and reduce carbon emissions (Pei et al., 2019). On the other hand, environmental regulation is conducive to low-emission enterprises to obtain support from policies and funds, and to achieve the sustainability of production and operation by improving the level of production technology and expanding their own production scale while increasing the investment and application of low-carbon technology innovation (Zhou et al., 2023).

Since the reform and opening-up, China is gradually building a “trinity” environmental regulation system with administrative orders, market incentives and public participation. The administrative imperative environmental regulation tool mainly relies on the rigid constraints of relevant administrative regulations, and compellingly requires enterprises and other market entities to control production and pollution discharge, thus promoting environmental improvement (Li et al., 2022). Market-driven environmental regulation is designed by the administrative subject according to the “polluter pays” principle, aiming at guiding enterprises to flexibly adjust the factor structure according to their own production and operation conditions by relying on the market regulation mechanism and collecting market means such as sewage charges, so as to reduce pollutant emissions (Qu et al., 2022). For public participation in environmental regulation tools, it comes from the pressure of individuals and social organizations on market operators such as enterprises. In the environmental governance system of “government-enterprise-public”, media communication, public opinion pressure and public action will have a strong sense of oppression on environmental damage. According to the stakeholder theory, public participation in monitoring the pollution discharge behavior of enterprises will force enterprises to optimize their production behavior in advance and increase capital investment to introduce or develop green technologies, so as to realize the transformation from “end pollution control” to “source control” and promote the development of carbon emission reduction (Huang et al., 2023b).

Based on the above analysis, the article puts forward the following assumptions:

Hypothesis 2:. Environmental regulatory policies can strengthen the inhibition of green finance on carbon emissions, and the regulatory effects of different types of environmental regulatory tools may be heterogeneous.

3.3 Regulatory effect of environmental regulation policy

Green finance can accelerate industrial low-carbon transformation and reduce carbon emissions by guiding the allocation of financial resources, increasing financing channels for enterprises, transmitting green development signals, and stimulating enterprises’ green technology research and development power (Jiang et al., 2022; Zhang et al., 2023). However, due to the early introduction of green finance in China, a perfect legal system has not yet been formed. In order to break through this dilemma, it is urgent to strengthen the guarantee of green financial system and prevent the emergence of market failure. Green finance emphasizes that production and operation activities should follow the laws of eco-economy, save resources and energy, and reduce ecological environmental pollution, which inevitably requires enterprises to use various green technologies such as eco-technology, pollution control and prevention, and recycling to promote process innovation, management optimization, and equipment upgrading, and form an industrial green supply chain, thereby reducing carbon emissions in the production process. However, in this process, the long research and development cycle of green innovation technology, high investment cost, uncertainty of rate of return on capital and other factors are very likely to induce enterprises to take lower-cost and inefficient “green washing” and terminal treatment to cover up the negative environmental externalities of production activities, thus failing to truly reduce the carbon emissions of enterprises.

Therefore, environmental regulatory tools can provide institutional guarantee in the process of green finance affecting carbon emissions and strengthen the effect of carbon emission reduction. Specifically, firstly, environmental regulation, as policy support, can directly improve the efficiency of fund allocation of green finance, build a green capital flow carrier, and form a new model of environmental protection policy system and green finance to support low-carbon development, thus guiding social idle capital to flow into the field of green production and breaking the limitation of single green investment (Cui et al., 2022; Yan et al., 2023b). Second, with the continuous improvement of the environmental regulatory policy system, the government will force enterprises to meet the specified environmental standards or immediately shut down for rectification, so that they will no longer choose terminal treatment technologies that are easy to imitate and low-cost to avoid administrative punishment, and will force enterprises to adopt standardized green production technologies, speed up the development of new energy, green innovation and green industrial structure transformation, and then control carbon dioxide emissions from the source (Tong et al., 2022; Li et al., 2023).

Based on the above analysis, the article puts forward the following assumptions:

Hypothesis 3. Environmental regulatory policies may have a regulatory effect in the process of green finance affecting carbon emissions.

4 Research design and data sources

4.1 Variable selection

4.1.1 Explained variable

Carbon dioxide emissions mainly come from the respiration of animals, plants and microorganisms in nature, the early decomposition of carbonate minerals and the burning of fossil fuels by human beings. However, in the actual measurement process, due to the inaccuracy of the estimation model, the calculation error of carbon emission factors, the unavailability of original data and the existence of unknown carbon sources, it is easy to cause errors in the estimation of carbon emissions from carbon sources.

In order to obtain more accurate data of carbon emissions, this paper considers the following aspects: (1) Carbon dioxide emissions mainly come from the energy consumption in the process of thermal power generation and heating in the process of terminal consumption and energy processing conversion, and other energy processing conversion processes (such as coal preparation, coking, oil refining and coal-to-liquid production, gas making, natural gas liquefaction, etc.) and transportation and distribution losses are not considered; (2) There are great differences in energy consumption structure and application degree of energy-saving and emission-reduction technologies in different regions of China, which leads to great differences in carbon emission factors of electricity and heat in different regions. In order to calculate the carbon dioxide emissions of regional electricity and heat more accurately, 17 energy varieties with relatively stable emission factors, such as raw coal, cleaned coal, other washed coal, briquette, coke, coke oven gas, other gas, other coking products, crude oil, gasoline, kerosene, diesel oil, fuel oil and natural gas, are selected for indirect calculation. (3) Regional power includes both local thermal power generation and external power supply. Therefore, in the process of calculating the carbon emissions of regional power, the carbon emissions transferred from other provinces (autonomous regions and municipalities) should be deducted after calculating the carbon emissions transferred from this province (autonomous regions and municipalities) according to the principle of production place.

In view of this, this paper uses the practices of Wang and Geng (2015), Song et al. (2021), and Wang et al. (2021), for reference, and combines the characteristics of China’s regional energy statistics to calculate the regional carbon emissions. The calculation formula is shown in Eq 1:

Among them,

It should be noted that the conversion coefficient of standard quantity of energy consumption in the process of terminal energy consumption, thermal power generation and heating and the conversion coefficient of standard quantity of electric power transferred in and out of regions are all expressed as the ratio of standard quantity to physical quantity of certain energy consumption, that is, as shown in Eqs 2–6:

4.1.2 Core explanatory variable

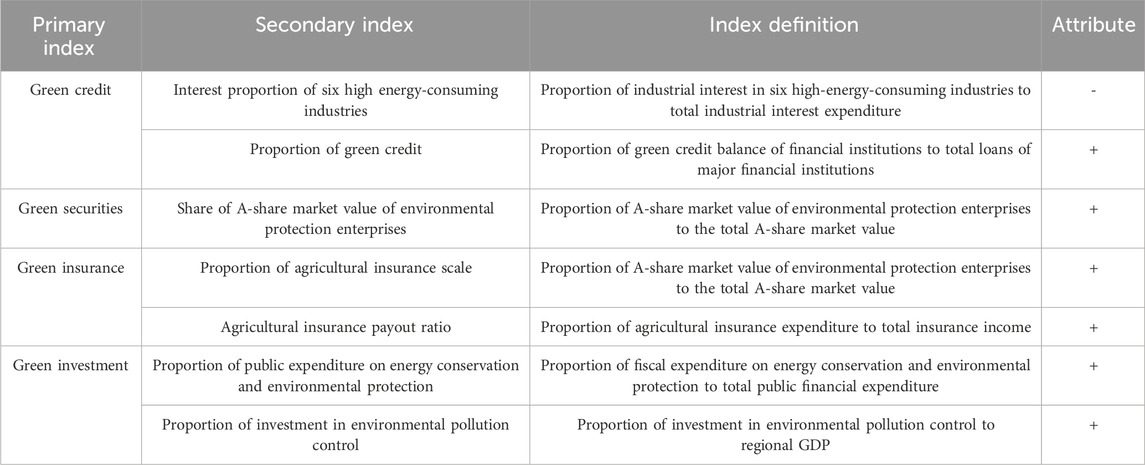

Green finance. As a financial model committed to green and sustainable development, it can not only effectively coordinate the relationship between ecology and finance, but also guide the optimal allocation of capital, environmental resources and social resources. In 2016, seven departments, including the People’s Bank of China and the China Securities Regulatory Commission, jointly issued the Guiding Opinions on Building a Green Financial System, requiring financial instruments such as green credit, green bonds, green insurance and green stock index and related policies to support the development of green and low-carbon economy. In view of this, based on the completeness of indicator setting and the availability of data, this paper draws lessons from the practices of Chen et al. (2021), Feng et al. (2023), and Lin et al. (2023), and constructs the evaluation index system of China’s green financial development level from the four dimensions of green credit, green securities, green insurance and green investment. The specific indicators are shown in Table 1.

In the process of constructing the green financial development index, the difference in the distribution of the weights of each subdivision index will directly affect the reliability and accuracy of the evaluation results. Entropy weight method objectively weights the indicators by the amount of information provided by the observed values of each indicator, which better avoids the result error caused by human factors. Therefore, this paper uses entropy weight method to weight the internal indicators of each dimension, and the specific calculation steps are as follows:

(1) The forward and reverse indicators are dimensionless. The treatment method is as follows:

Among them,

(2) Construct an evaluation matrix. Assume that the dimension of the M-year green financial index of a province to be measured contains n indicators

Where m represents the number of evaluation indicators and n represents the number of years of evaluation indicators.

(3) Calculate the entropy value of the j index. Considering that it needs to be logarithmized when calculating the information entropy, in order to avoid the situation that the standardized index value is zero, this paper refers to the practice of Zhang et al. (2014), and only shifts the initial standardized data by 0.01 unit to the right, then the information entropy

(4) Calculate the coefficient of difference of the j index:

(5) Calculate the weight

(6) Calculate the development index of green finance in i province:

4.1.3 Mechanism variables

Environmental regulation. At present, there is no uniform regulation on the measurement of environmental regulation in academic circles. Some scholars measure the level of environmental regulation by using indicators such as the control effect of industrial “three wastes”, the investment in environmental pollution control and the comprehensive index of environmental regulation. Based on the availability of data and the integrity of indicators, this paper further divides environmental regulation tools into command-controlled environmental regulation, market-driven environmental regulation and public-participation environmental regulation with reference to the practices of Xiao et al. (2021), Chen et al. (2022) and Zhang et al. (2023). Among them, command-controlled environmental regulations are laws and regulations formulated by legislative or administrative departments, which directly affect polluters to make environmentally friendly choices, and are mainly reflected in the pollutant discharge and disposal of enterprises due to regulatory standards. Therefore, this paper selects the proportion of “three simultaneities” environmental protection investment in each province (autonomous region and municipality) to the regional GDP to characterize it; Market-driven environmental regulation aims to guide enterprises’ pollutant discharge behavior with the help of market signals, so that the overall pollution situation of society tends to be controlled and optimized, which is mainly reflected in encouraging economic entities to reduce their own pollutant discharge level through tradable pollutant discharge permits or pollutant discharge taxes and fees. Therefore, this paper selects the proportion of sewage collection, pollution control investment and resource tax in local fiscal revenue in various provinces (autonomous regions and municipalities) to measure; The core idea of public-participation environmental regulation is that the public and non-profit environmental protection organizations can complain to the relevant departments or disclose the pollution behavior of enterprises by public opinion, which will exert supervision pressure on polluting enterprises, so that enterprises can take the initiative to assume social responsibility for environmental protection. Therefore, this paper selects the sum of letters from the public on environmental issues in various provinces (autonomous regions and municipalities), the number of visiting batches and the number of environmental protection news releases reported by party and government organs as proxy variables.

4.1.4 Control variable

In order to minimize the error caused by the omission of important variables to the causal inference of the model, this paper selects the following control variables according to the research perspective of existing literature: economic development level. Environmental Kuznets Curve (EKC) shows that the relationship between economic growth and carbon emissions is inverted U-shaped, and higher GDP growth in the short term means more carbon dioxide emissions. In view of this, this paper refers to the practice of Zhao et al. (2022), and chooses the per capita GDP value after logarithmic processing to measure it; Urbanization rate. The improvement of urbanization level will accelerate the agglomeration of factors and industries, improve the utilization efficiency and scientific and technological level of public facilities, improve production efficiency, increase the utilization of clean energy, and thus reduce carbon emissions. In view of this, this paper refers to the practice of Li et al. (2023a), and chooses the proportion of urban population to the total population to represent it; Foreign direct investment. Foreign direct investment can transfer industries with high energy consumption and high emissions to China, resulting in a “pollution paradise” effect. But at the same time, the green technology introduction and technology spillover it brings will have a “pollution halo” effect. In view of this, this paper refers to the practice of Li et al. (2023b), and selects the actual utilization of foreign direct investment and the investment amount converted according to the average exchange rate of RMB against the US dollar over the years to represent it; Industrialization degree. The promotion of industrialization will inevitably generate huge demand for labor, materials, investment and other resources, thus aggravating the level of carbon emissions pollution. In view of this, this paper refers to the practice of Hu et al. (2023), and selects the proportion of the added value of the secondary industry in GDP to measure it; Government intervention degree. The government’s intervention in the financial market tends to distort the bank’s credit behavior and crowd out green enterprises with long R&D cycle and low short-term return rate, thus increasing carbon dioxide emissions. In view of this, this paper refers to the practice of Wu et al. (2024), and adopts the proportion of expenditure in local government budget to GDP.

4.2 Model setting

In order to verify the above research hypothesis and mechanism, this part uses mathematical statistical model to verify it. According to the definition and selection of explained variables, core explanatory variables and control variables, the following benchmark econometric models are constructed:

In Eq 15, the subscripts i and t denote individuals and years respectively,

Considering that there may be a nonlinear relationship between green finance and carbon emissions, this paper brings the square term

In addition, in order to verify the regulatory effect of environmental regulation tools in the process of green finance affecting carbon emissions, this paper sets the following econometric equation:

Among them,

4.3 Data source

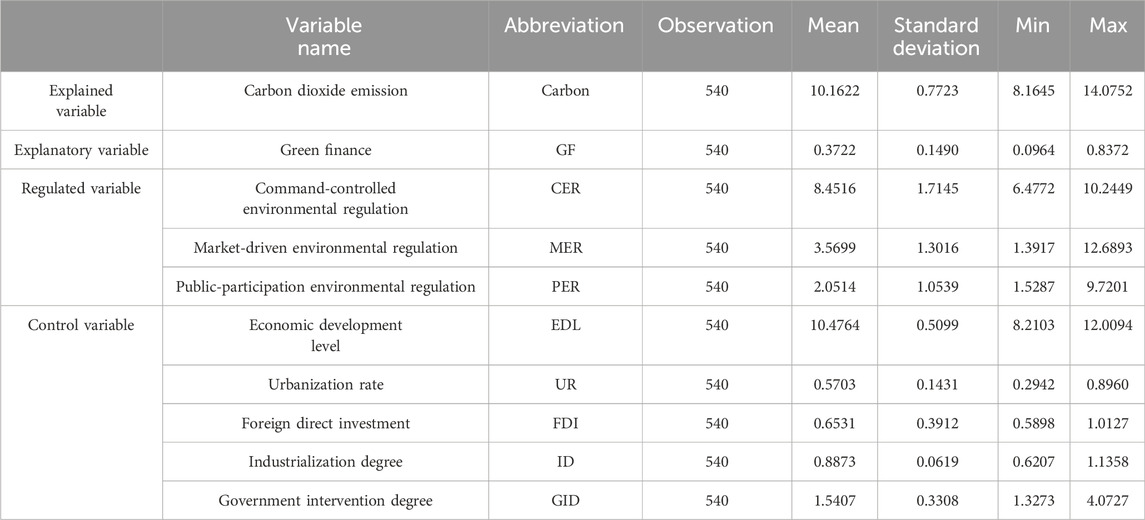

According to the principle of data availability, this paper selects the panel data of 30 provinces in China from 2004 to 2021 (except Tibet, Hong Kong, Macao and Taiwan) as the research sample. The original data of all variables mainly come from China Statistical Yearbook, China Energy Statistical Yearbook, China Industrial Statistical Yearbook, China Environmental Statistical Yearbook, China Insurance Yearbook, China Carbon Accounting (CEADs) database, Easy Professional Superior (EPS) database and statistical yearbooks of various provinces and cities. For a few missing values, LaGrange interpolation polynomial is used to complete them. The definitions and statistical characteristics of main variables are shown in the Table 2. From the statistical results, we can find that the average value of green finance is 0.3722 and the standard deviation is 0.1490, which indicates that there is no big difference in the development level of green finance among different provinces. However, the standard deviation of carbon emissions reached 0.7723, and the difference between the maximum value and the minimum value was 5.9107, indicating that there was an obvious gap in carbon emissions among provinces.

5 Analysis of empirical results

5.1 Variable correlation test

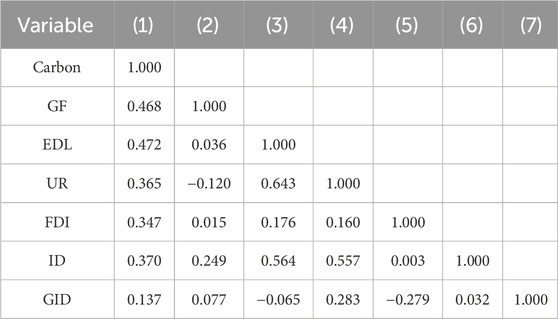

Before establishing the model for empirical analysis, it is necessary to test the correlation of each variable first, so as to avoid the deviation of the estimation of the model due to the high correlation between variables. In this paper, Pearson correlation coefficient and variance expansion factor are used to judge the correlation between variables, and the test results are shown in the Table 3. It is not difficult to see that there is a certain degree of correlation between the variables, but the values are all less than 0.7, which does not constitute a strong correlation.

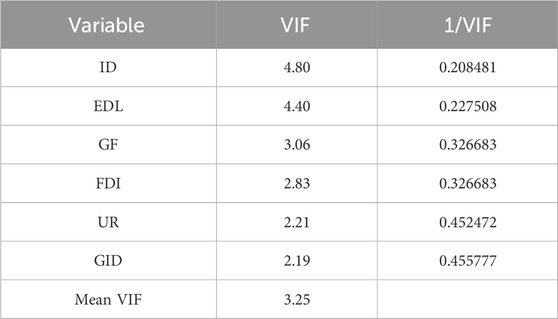

Besides, in the process of verifying the carbon emission reduction effect of green finance, this paper selects more control variables in order to obtain unbiased estimation as much as possible. In order to prevent multicollinearity from making variable significance and parameter estimation lose practical significance, it is necessary to carry out multicollinearity test. According to the test results in Table 4, the largest variance expansion factor is 4.80 of the industrialization degree (ID), and the average variance expansion factor is 3.25. The VIF of the other variables is also less than the critical standard of 10. Therefore, it can be concluded that there is no multicollinearity problem in the econometric model constructed in this paper, and the next regression analysis can be carried out.

5.2 Analysis of benchmark regression results

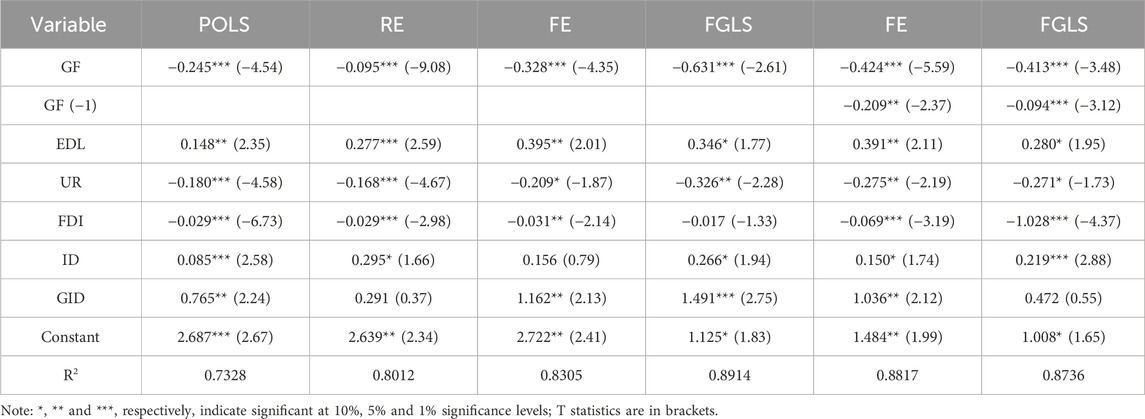

The commonly used panel fitting models include the pooled ordinary least square method (POLS), random effects model (RE), and fixed effects model (FE). The specific model that is most suitable for the sample data in this article needs to be distinguished using F-test, LM test, and Hausman test. The test results show that the F statistic of likelihood ratio test is 25.66, and that of Hausman test is 46.08, both of which are significant at 1% significance level. Based on this, this paper adopts two-way fixed effect model as the benchmark regression model for subsequent empirical test, namely, fixed individual effect and time effect. At the same time, in order to eliminate the interference of heteroscedasticity, sequence correlation, and cross-sectional correlation on the regression results, the article mainly uses Driscoll-Kraay standard error to address it, and uses feasible generalized least squares (FGLS) for auxiliary verification. The specific estimated results are shown in Table 5.

Considering the robustness of the model, this paper still reports the estimation results of POLS and RE models. It can be seen from the Table 5 that the average estimation coefficient of green finance is -0.328 and is significant at the significance level of 1%, which indicates that green finance has a significant inhibitory effect on carbon emissions. The possible reasons behind it are as follows: on the one hand, the development of green finance has a “subsidy effect” on environmental protection technology innovation, that is, it provides diversified risk compensation and guarantee mechanisms for green technology innovation by giving play to risk management functions, and the driver also realizes low-carbon transformation. At the same time, under the guidance of green development, financial institutions will provide financing facilities for enterprises that adopt cleaner production technologies, save energy and reduce emissions, promote the transfer and reorganization of production factors such as capital, labor and technology, and alleviate the mismatch of resources, thus accelerating the green transformation and upgrading of enterprises and making it possible to decouple carbon emissions from economic growth; On the other hand, the development of green finance has a “crowding-out effect” through the pricing of financial products, that is, financial institutions increase the financing cost of high-emission enterprises by incorporating the environmental cost of carbon emissions into the prices of financial products, forcing them to upgrade their production processes or withdraw from the market. According to the results of green finance index, the fitting coefficients of GF and GF (-1) are -0.424 and -0.209, respectively, and they have passed the 1% and 5% level significance tests, indicating that the rapid development of green finance is an important means to reduce pollution and carbon, but the carbon emission reduction effect of green finance has obvious time lag effect, and after considering heteroscedasticity, autocorrelation and cross-section correlation, FGLS estimation is made. This conclusion is similar to the research results of Zhang et al. (2023) and Lin et al. (2023), that is, with the deepening influence of economic factors such as economic development level and urbanization, the effect of green finance on carbon emissions is limited. The possible reasons are as follows: First, China’s green finance started late, and there are some problems in the development process, such as unclear path plan and vague objectives, and most of the relevant policy documents are principled and programmatic documents, lacking specific and effective implementation measures, which makes the supply of green finance unable to accurately correspond to the development needs of low-carbon economy, thus leading financial institutions to fail to capture the capital demand generated by carbon emission reduction in time, which hinders the progress of green transformation and development of enterprises; Second, green financial projects usually take a long time to implement and have obvious positive externalities, which leads to high risks and cannot provide matching high returns. In order to realize the low-carbon economy, a large number of enterprises enter the new energy market in a short time, which leads to the decline of core competitiveness and low profit rate of new energy enterprises, and often faces practical difficulties such as the extension of financing projects, the oversaturation of the market and the difficulty in realizing products. Finally, the carbon emission reduction effect of green finance will be reflected after a certain period of time.

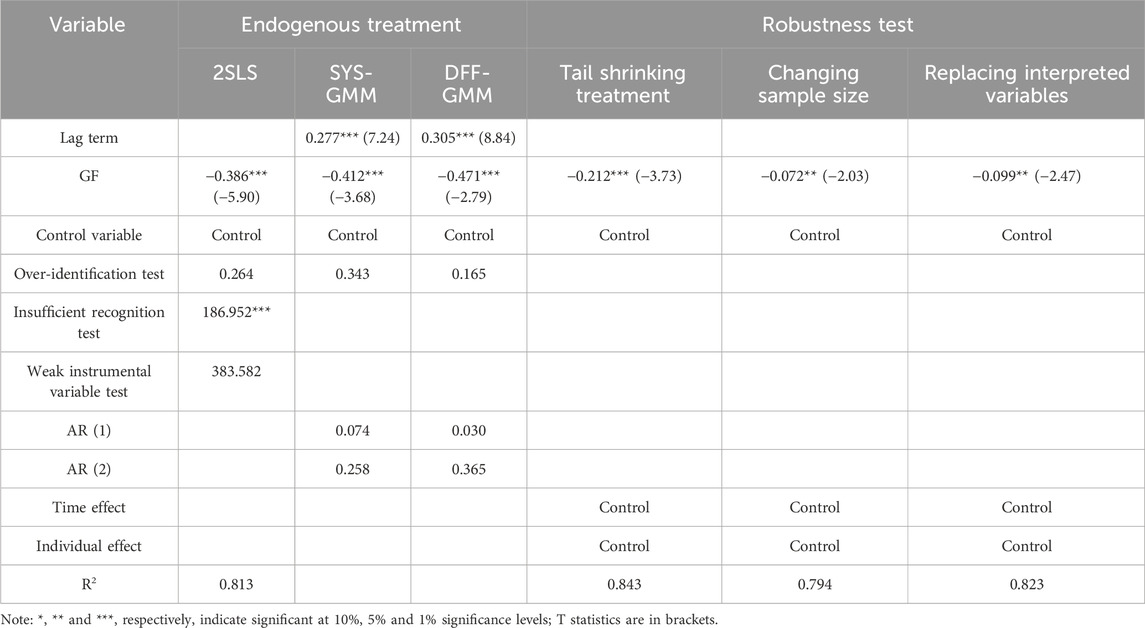

5.3 Endogenous treatment

Usually, endogenous problems involve omission of important variables, measurement deviation and mutual causality. Although in this paper, when considering the relationship between green finance and carbon emissions, more control variables are selected to alleviate the endogenous problems caused by missing variables and measurement errors, the model setting is still threatened by the mutual causal endogenous problems between them. In view of this, considering the rigor of the conclusion, this paper chooses the following two ways to eliminate the possible endogenous problems: one is to refer to the practice of Xie et al. (2023), using the product of the lag term (GF (-1)) and the difference term (ΔGF) of green finance as a tool variable for two-stage least squares estimation (2SLS); Secondly, the lag term of the explained variable is included in the model, and a dynamic panel model is constructed to fit the data. On the basis of differential generalized moment estimation, Blundell and Bond improved the system generalized moment estimation method (SYS-GMM), which made up the deficiency of differential GMM (Blundell et al., 1998). At the same time, because the two-step SYS-GMM is easy to cause the parameter values to be seriously underestimated in small samples, and then the variables are too significant, WC-robust estimation method is used to correct this. The specific results are shown in Table 6.

As can be seen from Table 6, each model has passed the unrecognizable test, weak instrumental variable test and over-identification test, and it shows that the carbon emission reduction effect of green finance still exists after considering endogenous problems, and even the estimation coefficient has increased. Therefore, after eliminating the possible endogenous problems, the impact of green finance on carbon emissions still supports the conclusions in the benchmark regression analysis. In addition, the estimation results of SYS-GMM and DFF-GMM models also show that the lag term of the explained variables is significantly positive, indicating that the current carbon emissions will be affected by the total carbon emissions in the previous period, and there is a typical inertia effect.

5.4 Robustness test

In order to verify the robustness and reliability of the benchmark regression estimation results, this paper uses the following three methods to verify:

First, tail-shrinking treatment. In order to prevent outliers from causing errors in regression results, such as economic shocks or major natural disasters during the epidemic period, all kinds of enterprises are faced with huge competitive risks, prolonged financing projects, over-saturation of the market and difficulties in realizing products. Therefore, all continuous variables are truncated by 1% up and down, and then re-estimated by fixed effect model.

Second, change the sample size. Because Chinese municipalities (Beijing, Tianjin, Shanghai, Chongqing) enjoy central policy support and tax preference in financial development, and local financial institutions store larger transaction data and customer information, which is heterogeneous with other provinces, this paper excludes them and re-estimates them by using fixed effect model.

Third, replace the explained variables. The input-output process of energy is complex. Taking industrial production as an example, the production of raw materials such as cement, lime and glass will also produce carbon emissions. Therefore, there may be a certain measurement error between the carbon emissions calculated based on fossil energy consumption and the actual carbon emissions in the region, which will have a certain impact on the model estimation results. In view of this, this paper replaces the explained variable with the carbon emissions of provinces published by China Carbon Accounting Database (CEADs), and re-estimates the model.

From the robustness results (Table 6), all three methods show that green finance has a significant inhibitory effect on carbon emissions, and the level of significance has not changed significantly, which fully shows that the benchmark regression results are reliable and robust, that is, there is an obvious negative relationship between green finance and carbon emissions.

5.5 Further analysis

5.5.1 Heterogeneity test

5.5.1.1 Heterogeneity test of green finance fractal dimension

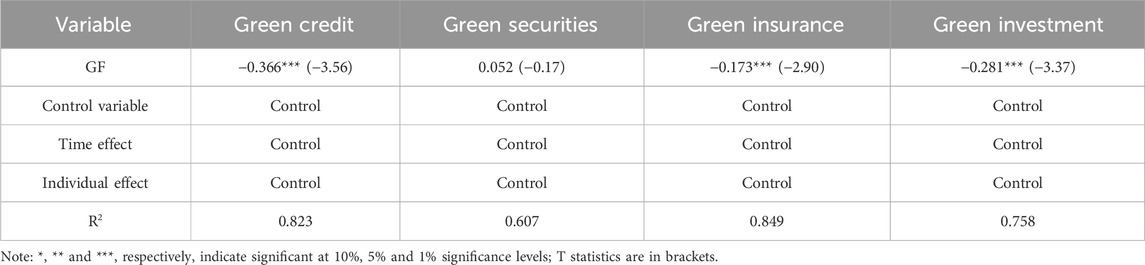

The development of green finance is not monotonous and independent, but towards green credit, green insurance, green securities and green investment, so it is necessary to analyze the structural effects of green finance on carbon emissions. It is not difficult to find from Table 7 that green credit, green insurance and green investment have obvious inhibitory effects on carbon emissions at a significant level of 1%, with coefficients of -0.366, -0.173 and -0.281 respectively. However, the carbon emission reduction effect of green securities has not passed the significant test. With the continuous release of relevant policies such as Statistical System of Green Credit and Key Evaluation Indicators of Green Credit Implementation, China’s green credit market system has been gradually improved. Therefore, in the process of developing green finance, we can quickly and reasonably allocate funds to areas such as environmental protection, energy conservation and emission reduction, meet the financing needs of environmental protection enterprises, and innovate green products and services. At the same time, by reducing the credit line for enterprises with high pollution, high emission and high energy consumption, the “three high” enterprises are forced to accelerate the green transformation and reduce carbon emissions. In addition, the carbon emission reduction effect of green securities has not yet appeared, which may be due to the short official issuance time of green securities in China, a series of obstacles such as small overall issuance scale, imperfect system and time delay in signal transmission in the securities market.

5.5.1.2 Heterogeneity test of sub-regions

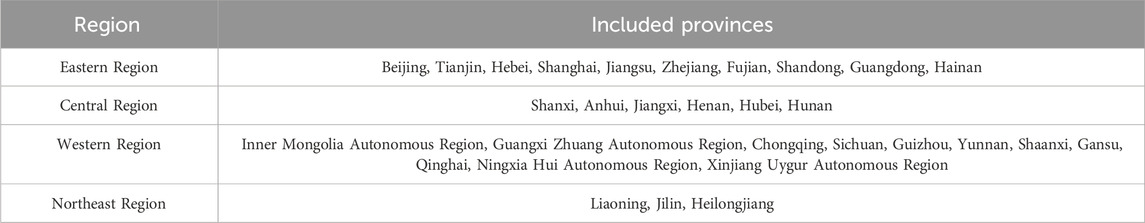

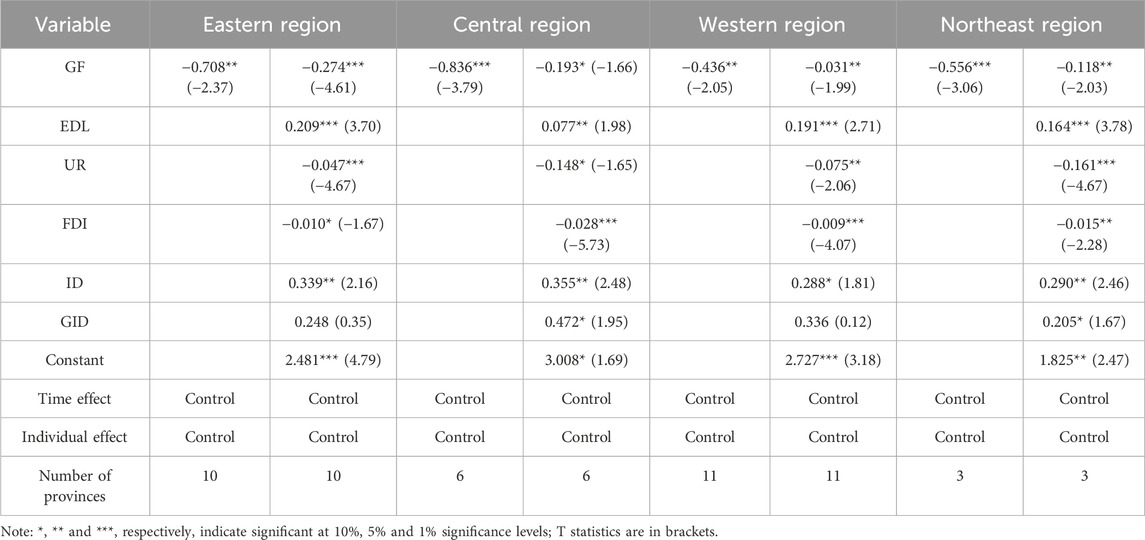

Because the sample involves 30 provinces in China (except Tibet, Hong Kong, Macao and Taiwan), the regional span is large, and there are differences in green financial reform and innovation policies, resource endowments, location advantages, economic development levels and other factors among provinces, resulting in certain heterogeneity in their respective green financial development levels and industrial ecological environment levels. At the same time, with the continuous acceleration of urbanization, the carbon emissions between neighboring provinces are spatially dependent. In view of this, referring to the research results of China Physical Geography and Guo et al. (2023), this paper divides the geographical region of China into eastern region, central region, western region and northeast region, so as to further investigate the differences in the impact of green finance on carbon emissions. Among them, each region contains provinces as shown in the table 8.

From Table 9, it can be found that whether control variables are added or not, green finance in different regions has a significant inhibitory effect on carbon emissions, but the difference is that the effect is slightly different. Among them, the effect of green finance in the eastern region is the most obvious, and the regression coefficient is -0.274. The reason is that, because of its targeted marketing function and its natural green attribute, green finance can not only reduce the moral hazard and adverse selection caused by information asymmetry, but also provide sufficient funds for green business activities accurately but conditionally, promote high-quality production factors to flow into environmental protection projects and guide the green transformation of traditional industries. Beijing, Tianjin, the Yangtze River Delta and other regions are rich in natural resources and geographical advantages, and the level of green finance is far ahead of other regions. There are many kinds of green financial instruments, which make the production of various industries have financial guarantee, and efficient, low-carbon and green business models are widely selected, thus promoting the green development of industries and reducing carbon dioxide emissions. However, in order to promote the economic development of the western region, China has put forward a series of policies focusing on the strategy of “developing the western region” and encouraged some industries in the eastern region to move to the west, which to some extent strengthened the proportion of heavy and chemical industries in the western region and increased the total carbon emissions in the western region. In addition, the dilemma of “economy-environment” zero-sum game leads to the neglect of the development of green finance in the western region with low industrial level and far from the technological frontier, which leads to the lack of first-Mover advantage in promoting carbon emission reduction.

5.5.2 Analysis of regulatory effect

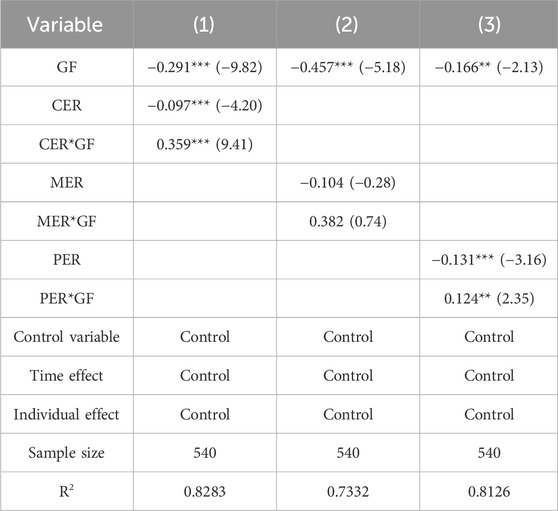

In order to reveal whether the environmental regulation policy plays a regulatory role in the process of green finance affecting carbon emissions, based on the above equation and its related principles, the benchmark regression model is used for fitting calculation. The specific inspection results are shown in Table 10.

It is not difficult to see from the Table 10 that both the command-and-control environmental regulation tools and the public participation environmental regulation tools have a significant negative impact on carbon emissions, and their fitting coefficients are -0.097 and -0.131, respectively, and they have passed the significance test at 1% level. At the same time, the product of these two kinds of environmental regulation tools and green finance index has a significant positive impact on carbon emissions, which shows that command-and-control environmental regulation and public participation environmental regulation have a positive regulatory effect on the carbon emission reduction effect of green finance. For command-and-control environmental regulation tools, the strengthening of its regulation will directly reduce the production scale of high-emission enterprises, and financial institutions will also reduce their financial support and even force them to withdraw from the market. As for the tools of public participation in environmental regulation, the pressure and supervision of the public on the production activities of enterprises will continue to increase with the enhancement of environmental awareness, which will directly reverse the low-cost green-washing and end-treatment behaviors of enterprises and reduce carbon emissions. Therefore, these two kinds of environmental regulation tools both restrain carbon emissions to a certain extent, worsen the financing environment of high-emission enterprises, reduce their production scale and even force them to invest in green low-carbon technologies, realize the green transformation of production methods and strengthen the carbon emission reduction effect of green financial development.

In addition, market-driven environmental regulation tools have not significantly inhibited carbon emissions, and have not shown a regulatory effect on the carbon emission reduction effect of green finance. The reason may be that the market-driven environmental regulation tools rely on the market regulation mechanism. Once the market mechanism is not perfect, especially the carbon emission trading license market is not mature and the environmental tax rates are inconsistent in different places, the market-driven environmental regulation tools cannot promote technological innovation, but may breed the phenomenon of “environmental rent-seeking” and increase the environmental governance burden of enterprises. At the same time, financial institutions’ loans to enterprises are mainly based on the quality of their mortgaged assets, rather than the green degree of their production methods. In addition, there is no effective linkage between themselves and environmental protection departments, and they cannot obtain relevant environmental punishment information in time, which leads to the failure of market-driven environmental regulation tools to effectively enhance the carbon emission reduction effect of green financial development.

6 Conclusion and policy recommendations

6.1 Conclusion

By systematically combing the related theories of green finance and environmental regulation affecting carbon emissions, as well as the regulatory effect mechanism of heterogeneous environmental regulation, the evaluation index system of China provincial green finance development index is constructed, and the green finance level of 30 provinces in China from 2004 to 2021 is calculated and evaluated by entropy weight method. Then, a series of mathematical statistical models are used to verify the relationship among green finance, environmental regulation and carbon emissions. This paper obtained several results. First, the development of green finance has a significant inhibitory effect on carbon emissions, and there is a certain time lag effect. This conclusion still holds after a series of robustness tests and endogenous treatment. Second, from the results of regional heterogeneity, with its unique geographical advantages and economic characteristics, the carbon emission reduction effect of green finance is more prominent in the eastern region. This conclusion is similar to that of Bao et al. (2022) and Wu et al. (2023), and both indicate the particularity of the western region in the process of industrialization and modernization in China, which is hindered by the serious solidification of urban structure. From the sub-dimension of green financial development, green credit, green investment and green insurance all have carbon emission reduction effects, but the only difference is that the inhibition effect is slightly different. Third, command-controlled environmental regulation tools and public participation environmental regulation tools have a positive regulatory effect on the carbon emission reduction effect of green finance, while market-driven environmental regulation tools cannot effectively enhance the carbon emission reduction effect of green finance development.

6.2 Policy recommendations

In view of this, this paper puts forward the following policy suggestions:

(1) Attach great importance to the construction of green financial policy system and improve the inclusiveness, coverage and accuracy of financial services. First of all, the government should gradually establish and improve laws and regulations related to green finance, establish green financial standards from the legislative level, simplify green financing processes, and rationalize green financing procedures, so as to give full play to the financial subsidies and incentives for low-carbon projects and promote the diversified development of green financial instruments. Secondly, we should specify different standards according to different production projects, strictly control the financial support for high-pollution and high-emission industries, and increase the transaction costs of high-energy-consuming enterprises. Thirdly, further improve the green financial supervision system, form a standardized and transparent information disclosure system for green financial supervision and corporate environmental pollution, increase penalties for environmental pollution violations, and improve the return rate of green finance. Finally, accelerating the improvement of the characteristic service standards, general basic standards and credit rating standards of green financial products. At the same time, enterprises rely on the platform of professional institutions to strengthen the integration and upgrading of financial technology and digital technology, increase their application in environmental information disclosure and information sharing, and give play to the role of risk dispersion of green finance.

(2) Carry out the regional development strategy and implement differentiated green financial policies. In view of the differences in economic development level, industrial structure, resource endowment and other factors among provinces in China, governments at all levels should implement regional development strategies and implement differentiated green financial policies and environmental regulatory measures according to the actual regional development. As far as the eastern region is concerned, while strengthening financial support for the green environmental protection industry, it should also expand the cross-regional green financial reform and innovation pilot, realize the cross-regional flow of green financial resources, and give full play to the radiation-driven role of the pilot areas. For the central and western regions, we should pay more attention to the formation of the concept of green finance, expand the coverage of green finance business, strengthen its integration with traditional industries such as agriculture, tourism and energy, and give full play to the carbon emission reduction effect of green finance. The central people’s government should also give full play to the role of macro-allocation, rationally distribute and dynamically allocate resources according to the actual situation of the region, and ensure the steady development of green economy in various regions on the basis of maximizing the efficiency of capital utilization. At the same time, the government can promote the green financial reform and innovation policy to all parts of the country, thus promoting the construction of a green financial system. In addition, commercial banks are encouraged to increase the scale of green credit, increase the investment in credit funds for green and clean industries (environmental protection, new energy and new materials), and at the same time reduce the funds flowing to the “two high” industries and strengthen the supervision of the use of funds.

(3) Innovate green financial products and services to improve the supply efficiency of green finance. Diversified green financial instruments provide investors with more choices to participate in financial transactions, improve market liquidity and reduce environmental risks. Guide financial institutions to support the green transformation and upgrading of small and micro enterprises, appropriately lower the financing threshold, innovatively launch diversified green credit products such as “chain loan”, “green leaf loan”, “e-commerce loan” and “family farm loan”, broaden the financing channels for green enterprises and marginalized people, and effectively revitalize “carbon assets”. At the same time, promote the application of green credit points and establish personal carbon accounts to stimulate green consumption, change the endogenous motivation of poverty alleviation, and achieve the dual goals of poverty reduction and ecological civilization. In addition, financial institutions should focus on strengthening financing support for new energy, low-carbon environmental protection and other strategic emerging industries, and promote technological transformation of enterprises and industrial optimization and upgrading, so as to shorten the effective time of carbon emission reduction effect and weaken the lag effect of green finance carbon emission reduction effect.

(4) Strengthen the synergistic effect of environmental regulation and green finance, and continuously improve the optimal combination and innovation of various environmental regulation tools. Any environmental regulatory tool has its own advantages and limitations. There is no optimal regulatory policy that can reduce carbon emissions and achieve green industrial development. It is necessary to adopt a comprehensive regulatory tool that integrates standards and regulatory policies, fiscal and taxation policies, voluntary agreements, information tools and technology research and development policies. According to the actual situation in different regions, the government can introduce detailed preventive measures, improve the level of law enforcement team, and avoid inefficient environmental protection behaviors that interfere with the normal operation and production of enterprises and inhibit their enthusiasm for production on the grounds of strengthening pollution control. At the same time, we should safeguard the right of independent production and management of enterprises, strive to create a fair competitive market environment, optimize the business environment, and encourage enterprises to change their environmental governance from “end governance” to “front prevention” to minimize the efficiency loss of administrative environmental governance.

6.3 Research limitation

Although this paper provides some enlightenment for the government’s decision making and research in the field of carbon emission reduction and green finance, it still has some limitations. Firstly, due to the availability of data, this paper uses provincial data to discuss the impact of the development level of green finance on carbon emissions in China from 2004 to 2021. Future research can explore the impact of green financial development level on corporate carbon emissions by adjusting research methods and perspectives. Secondly, from the research area, as the vanguard of actively promoting the integration of green finance and green industry, the green finance reform and innovation experimental zone has played an important role in promoting the effective transformation of ecological resources. Therefore, in the future, the green financial reform and innovation pilot zone can be included in the research framework, so as to draw more profound conclusions. Finally, the global principal component analysis (GPCA) can be considered for the measurement of green financial index in future research. GPCA is an analysis of panel data, which can reflect the dynamic changes of research objects, and it is objectively weighted according to the correlation between indicators, thus enhancing the desirability of indicators’ calculation results.

Data availability statement

Publicly available datasets were analyzed in this study. This data can be found here: The datasets used or analysed during the current study are available from the corresponding author on reasonable request.

Author contributions

XG: Writing–original draft. JY: Writing–original draft, Writing–review and editing. YS: Writing–review and editing. XZ: Writing–review and editing.

Funding

The author(s) declare that no financial support was received for the research, authorship, and/or publication of this article.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Bao, J., and He, M. L. (2022). Does green credit promote green sustainable development in regional economies? — Empirical evidence from 280 cities in China. PLoS ONE 17 (11), e0277569. doi:10.1371/journal.pone.0277569

Blundell, R., and Bond, S. (1998). Initial conditions and moment restrictions in dynamic panel data models. J. Econ. 1, 115–143. doi:10.1016/S0304-4076(98)00009-8

Chang, K. W., Luo, D., Dong, Y. Z., and Xiong, C. (2024). The impact of green finance policy on green innovation performance: Evidence from Chinese heavily polluting enterprises. J. Environ. Manage. 352 (14), 119961. doi:10.1016/j.jenvman.2023.119961

Chen, X., and Chen, Z. (2021). Can green finance development reduce carbon emissions? Empirical evidence from 30 Chinese provinces. Sustainability 13, 12137. doi:10.3390/su132112137

Chen, Z. L., Niu, X. Y., Gao, X. F., and Chen, H. H. (2022). How does environmental regulation affect green innovation? A perspective from the heterogeneity in environmental regulations and pollutants. Front. Energy Res. 10. doi:10.3389/fenrg.2022.885525

Chi, Y., and Yang, Y. (2023). Green finance and green transition by enterprises: an exploration of market-oriented governance mechanisms. Borsa Istanb. Rev. 23 (3), 628–646. doi:10.1016/j.bir.2023.01.003

Clark, R., Reed, J., and Terry, S. (2018). Bridging funding gaps for climate and sustainable development: pitfalls, progress and potential of private finance. Land Use Policy 71, 335–346. doi:10.1016/j.landusepol.2017.12.013

Cui, X. L., Elahi, E., Khalid, Z., and Xu, B. (2022). Environmental regulation, manufacturing technological progress and pollution emissions: empirical evidence from China. Sustainability 14 (23), 16258. doi:10.3390/su142316258

Feng, L., and Sun, Z. (2023). The impact of green finance pilot policy on carbon intensity in Chinese cities—based on the synthetic control method. Sustainability 15, 11571. doi:10.3390/su151511571

Guo, F., Yang, S. G., and Ren, Y. (2022). Digital economy, green technology innovation and carbon emissions —— empirical evidence from China city. J. Shaanxi Normal Univ. Philosophy Soc. Sci. Ed. 51 (3), 45–60. doi:10.15983/j.cnki.sxss.2022.0507

Guo, X. Y., Yang, J. Y., Shen, Y., and Zhang, X. W. (2023). Prediction of agricultural carbon emissions in China based on a GA-ELM model. Front. Energy Res. 11, 1245820. doi:10.3389/fenrg.2023.1245820

Han, S. Y., Zhang, Z. Q., and Yang, S. Y. (2022). Green finance and corporate green innovation: based on China's green finance reform and innovation pilot policy. J. Environ. public health 22, 1–12. doi:10.1155/2022/1833377

He, L., Zhong, T. Y., and Gan, S. D. (2022). Green finance and corporate environmental responsibility: evidence from heavily polluting listed enterprises in China. Environ. Sci. Pollut. Res. Int. 29 (49), 74081–74096. doi:10.1007/s11356-022-21065-5

Hou, H., Chen, M. N., and Zhang, M. H. (2022). Study on high energy-consuming industrial agglomeration, green finance, and carbon emission. Environ. Sci. Pollut. Res. Int. 30 (11), 29300–29320. doi:10.1007/s11356-022-24228-6

Hu, J., and Zhang, H. (2023). Has green finance optimized the industrial structure in China? Environ. Sci. Pollut. Res. 30 (12), 32926–32941. doi:10.1007/s11356-022-24514-3

Huang, H. Y., Mbanyele, W., Wang, F. R., Zhang, C. X., and Zhao, X. (2023a). Nudging corporate environmental responsibility through green finance? Quasi-natural experimental evidence from China. J. Bus. Res. 167, 114147. doi:10.1016/j.jbusres.2023.114147

Huang, X. L., and Tian, P. (2023). How does heterogeneous environmental regulation affect net carbon emissions: Spatial and threshold analysis for China. J. Environ. Manage. 350, 117161. doi:10.1016/j.jenvman.2022.117161

Huang, Y. J., Bai, F. P., Shang, M. T., and Liang, B. H. (2023b). Catalyst or stumbling block: do green finance policies affect digital transformation of heavily polluting enterprises? Environ. Sci. Pollut. Res. Int. 30 (38), 89036–89048. doi:10.1007/s11356-023-28650-2

Jiang, Y. J., Wu, Q. R., Brenya, R., and Wang, K. (2022). Environmental decentralization, environmental regulation, and green technology innovation: evidence based on China. Environ. Sci. Pollut. Res. Int. 30 (10), 28305–28320. doi:10.1007/s11356-022-23935-4

Kant, A. (2021). Practical vitality of green bonds and economic benefits. Rev. Bus. Econ. Stud. 9 (1), 62–83. doi:10.26794/2308-944X-2021-9-1-62-83

Latif, N. (2022). Comprehensive environmental performance index (CEPI): an intuitive indicator to evaluate the environmental quality over time. Environ. Res. Commun. 4 (7). doi:10.1088/2515-7620/ac8338

Lee, C. C., Yuan, Y., and Wen, H. W. (2022). Can digital economy alleviate CO2 emissions in the transport sector? Evidence from provincial panel data in China. Nat. Resour. Forum 46 (3), 289–310. doi:10.1111/1477-8947.12258

Li, G., and Wen, H. W. (2023). The low-carbon effect of pursuing the honor of civilization? A quasi-experiment in Chinese cities. Econ. Analysis Policy 78, 343–357. doi:10.1016/j.eap.2023.03.014

Li, M., Hu, J., Liu, P., and Chen, J. (2023a). How can digital finance boost enterprises’ high-quality development? evidence from China. Environ. Sci. Pollut. Res. 30, 88876–88890. doi:10.1007/s11356-023-28519-4

Li, S. N., Lin, Z. Z., and Liang, D. Z. (2022). Threshold effect of two-way FDI synergy on regional green technology innovation under heterogeneous environmental regulation: evidence from China’s provincial panel data. Systems 10 (6), 230. doi:10.3390/systems10060230

Li, X. Q., Zheng, Z. J., Shi, D. Q., Han, X. f., and Zhao, M. Z. (2023b). New urbanization and carbon emissions intensity reduction: mechanisms and spatial spillover effects. Sci. total Environ. 905, 167172. doi:10.1016/j.scitotenv.2023.167172

Liang, J. H., and Song, X. W. (2022). Can green finance improve carbon emission efficiency? Evidence from China. Front. Environ. Sci. 10, 955403. doi:10.3389/fenvs.2022.955403

Lin, B. Q. (2022). High-quality economic growth in China in the process of carbon neutralization. J. Econ. Res. 57 (1), 56–71.

Lin, M. X., and Xiao, Y. B. (2023). Research on the measurement and mechanism of green finance promoting high-quality economic development. J. Contemp. Econ. Sci. 45 (3), 101–113. doi:10.20069/j.cnki.DJKX.202303008

Lin, Z., Wang, H., Li, W., and Chen, M. (2023). Impact of green finance on carbon emissions based on a two-stage LMDI decomposition method. Sustainability 15, 12808. doi:10.3390/su151712808

Liu, M. Z., Yang, X. T., Wen, J. X., Wang, H., Feng, Y., Lu, J., et al. (2023). Drivers of China's carbon dioxide emissions: based on the combination model of structural decomposition analysis and input-output subsystem method. Environ. Impact Assess. Rev. 100, 107043. doi:10.1016/j.eiar.2023.107043

Luo, G. Y., Guo, J. T., Yang, F. Y., and Wang, C. Y. (2023). Environmental regulation, green innovation and high-quality development of enterprise: evidence from China. J. Clean. Prod. 418, 138112. doi:10.1016/j.jclepro.2023.138112

Lv, C. C., Bian, B. C., Lee, C. C., and He, Z. W. (2021). Regional gap and the trend of green finance development in China. Energy Econ. 102, 105476. doi:10.1016/j.eneco.2021.105476

Lv, W., Zhang, Z., and Zhang, X. R. (2023). The role of green finance in reducing agricultural non-point source pollution—an empirical analysis from China. Front. Sustain. Food Syst. 7. doi:10.3389/fsufs.2023.1199417

Meo, M. S., and Karim, M. (2022). The role of green finance in reducing CO2 emissions: an empirical analysis. Borsa Istanb. Rev. 1, 169–178. doi:10.1016/J.BIR.2021.03.002

Muhammad, S., Qazi, M. A. H., Aviral, K. T., and Nuno, C. L. (2013). Economic growth, energy consumption, financial development, international trade and CO2 emissions in Indonesia. Renew. Sustain. Energy Rev. 25, 109–121. doi:10.1016/j.rser.2013.04.009

Pei, Y., Zhu, Y. M., Liu, S. X., Wang, X. C., and Cao, J. J. (2019). Environmental regulation and carbon emission: the mediation effect of technical efficiency. J. Clean. Prod. 236, 117599. doi:10.1016/j.jclepro.2019.07.074

Qin, J. H., and Gong, N. J. (2022). The estimation of the carbon dioxide emission and driving factors in China based on machine learning methods. Sustain. Prod. Consum. 33, 218–229. doi:10.1016/j.spc.2022.06.027

Qu, F., Xu, L., and Chen, Y. F. (2022). Can market-based environmental regulation promote green technology innovation? Evidence from China. Front. Environ. Sci. 9, 823536. doi:10.3389/fenvs.2021.823536

Song, Z. G. (2021). Economic growth and carbon emissions: estimation of a panel threshold model for the transition process in China. J. Clean. Prod. 278, 123773. doi:10.1016/j.jclepro.2020.123773

Tong, L., Chiappetta, J. C. J., Samira, B., Najam, H., and Abbas, J. (2022). Role of environmental regulations, green finance, and investment in green technologies in green total factor productivity: empirical evidence from Asian region. J. Clean. Prod. 380 (2), 134930. doi:10.1016/j.jclepro.2022.134930

Wang, Q., and Zhang, F. Y. (2021). The effects of trade openness on decoupling carbon emissions from economic growth – evidence from 182 countries. J. Clean. Prod. 279, 123838. doi:10.1016/j.jclepro.2020.123838

Wang, T. Y., Umar, M., Li, M. G., and Shan, S. (2023). Green finance and clean taxes are the ways to curb carbon emissions: an OECD experience. Energy Econ. 124, 106842. doi:10.1016/j.eneco.2023.106842

Wang, Z. H., and Geng, L. W. (2015). Carbon emissions calculation from municipal solid waste and the influencing factors analysis in China. J. Clean. Prod. 104, 177–184. doi:10.1016/j.jclepro.2015.05.062