- EAER>

- Journal Archive>

- Contents>

- articleView

Contents

Citation

Article View

East Asian Economic Review Vol. 21, No. 4, 2017. pp. 343-384.

DOI https://dx.doi.org/10.11644/KIEP.EAER.2017.21.4.334

Number of citation : 23Quantifying the Comprehensive and Progressive Agreement for Trans-Pacific Partnership

|

Ciuriak Consulting Inc. C.D. Howe Institute Centre for International Governance Innovation (CIGI) BKP Development Research & Consulting GmbH |

|

|

Infinite-Sum Modeling Inc. |

|

|

Ciuriak Consulting Inc. |

Abstract

We assess the outcomes for the negotiating parties in the Trans-Pacific Partnership if the remaining eleven parties go ahead with the agreement as negotiated without the United States, as compared to the outcomes under the original twelve-member agreement signed in October 2016. We find that the eleven-party agreement, now renamed as the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), is a much smaller deal than the twelve-party one, but that some parties do better without the United States in the deal, in particular those in the Western Hemisphere – Canada, Mexico, Chile, and Peru. For the politically relevant medium term, the United States stands to be less well-off outside the TPP than inside. Since provisional deals can be in place for a long time, the results of this study suggest that the eleven parties are better off to implement the CPTPP, leaving aside the controversial governance elements, the implications of which for national interests are unclear and which, in any event, may be substantially affected by parallel bilateral negotiations between individual CPTPP parties and the United States.

JEL Classification: F02, F13, F15

Keywords

Trans-Pacific Partnership, TPP, CPTPP, United States, CGE Modelling

I. INTRODUCTION

Following the withdrawal by the Trump Administration of the United States from the Trans-Pacific Partnership (TPP) agreement, the other eleven TPP parties (“the Eleven”) entered into negotiations to implement the agreement largely as negotiated, but without the United States. Agreement on the core elements of a revised TPP – renamed the Comprehensive Progressive Agreement for Trans-Pacific Partnership (CPTPP) – was reached on the margins of the Asia-Pacific Economic Cooperation (APEC) summit in Da Nang in November 2017.

The original TPP aspired to rewrite the ground rules of international commerce for the 21st Century, modelled on the US economic governance regime. The CPTPP preserves the original text of the TPP agreed in October 2016, but suspends a number of provisions and leaves open a number of specific issues to be resolved.

The suspended provisions impact on the CPTPP regime in the following areas:

• Express shipments;

• Investment (in particular, the investor-state dispute settlement or ISDS mechanism);

• The intellectual property (IP) property rights regime, in particular measures covering, inter alia:

▪ patentable subject matter,

▪ patent term restoration,

▪ protection of undisclosed data for pharmaceutical approvals,

▪ extended term of protection for data used to developed biologic medicines,

▪ technological protection measures (TPMs) and rights management information (RMI), and

▪ copyright extension;

• Resolution of telecommunications disputes.

The issues that remain outstanding for further negotiations (with the CPTPP Member requiring modifications in parentheses) include:

▪ State-owned enterprises (Malaysia);

▪ Services and investment non-conforming measures (Brunei Darussalam);

▪ Dispute settlement trade sanctions (Vietnam); and

▪ Cultural exception (Canada)

This paper assesses the quantitative implications of the CPTPP going forward. The CPTPP policy shock consists of the liberalization commitments made by the parties in the original TPP for tariffs and non-tariff barriers (NTBs) in goods and services and foreign direct investment (FDI). These commitments are evaluated against the OECD’s Trade Facilitation Index (TFI), Services Trade Restrictiveness Index (STRI), and Foreign Direct Investment Restrictiveness Index (FDIR) for goods trade, cross-border services trade, and investment, respectively. For goods trade, we take into account the impacts of rules of origin (ROOs) in terms of a less-than-full rate of preferences utilization, but assume a high rate of utilization to reflect a key TPP outcome, namely ROOs regionalization. For services trade, we take account of the value of binding commitments. The services estimates now constitute an upper bound depending on the extent of derogations from the final TPP text originally negotiated, if and when the CPTPP is implemented.

The CPTPP is simulated on a dynamic version of the Global Trade Analysis Project’s (GTAP) computable general equilibrium (CGE) model that incorporates FDI by introducing a foreign-owned representative firm into each GTAP region-sector. FDI responds in tandem with domestic investment to changes in expected rates of return (RORs) in each region-sector due to trade liberalization and reductions in NTBs facing investment. To bring out the relative contribution of the CPTPP’s various quantifiable elements, we simulate the shocks on a sequential basis for each policy measure, such that the marginal effect of each set of measures is brought out.

The rest of this paper is organized as follows: section 2 sets out some basic background on the TPP economies; section 3 provides an overview of the quantitative modeling; section 4 describes the policy shock; section 5 sets out the results; and section 6 provides a discussion and draws conclusions.

II. BACKGROUND

1. The TPP Economies … and the United States

The original twelve TPP signatories were Australia, Brunei, Canada, Chile, Japan, Malaysia, Mexico, New Zealand, Peru, Singapore, the United States, and Vietnam. They are all APEC members and have a combined population of close to 825 million, a combined GDP of just under US$30 trillion,1 imports of goods of over US$4.7 trillion,2 and imports of commercial services of approximately US$1.1 trillion.3 The CPTPP generates about one-third of the total GDP generated by the TPP12, accounts for about 60% of the population of the TPP12 region, and has an average per capita income about one-third of the US level, measured at market exchange rates.

A similar calculus applies in terms of the CPTPP’s role as a market for imports and a source of outward FDI. As shown in Table 2, the CPTPP accounts for 14.7% of global goods imports, almost 13% of global services imports, and 14.3% of global goods and services imports combined. Table 3 shows that the CPTPP accounts for about 14.4% of global FDI stocks, inward and outward, and is comprised, on net terms, of outward investors.

1)Estimated 2017 population and GDP from IMF (October 2017).

2)Merchandise imports, 2015 from

3)Services imports, 2015 from WTO (n.d.).

III. FRAMEWORK FOR QUANTITATIVE ANALYSIS

1. The GTAP-FDI Model

To model the TPP, we use a recursive dynamic version of the standard GTAP CGE model, adapted to incorporate FDI (Ciuriak and Xiao, 2014, provide a description of the way FDI is incorporated in the model).

CGE models integrate a number of accounts to provide a complete description of an economy:

▪ The standard national income and expenditure accounts;

▪ A breakdown of industry by sector that reflects inter-sectoral input-output links, which take into account internationally-sourced intermediate goods and services (in all, the GTAP dataset allows for the representation of up to 57 sectors, 43 of which are goods);

▪ A production function for each sector that combines sector-specific inputs of capital, skilled and unskilled labour, and intermediate inputs; and

▪ A trade account that models the international linkages for each sector of the economy.

The model generates results for national account aggregates, industry output and prices, factor inputs and prices, and trade flows. For a technical description of the GTAP model, see Hertel (1997); for a discussion of the degree of confidence in CGE estimates, see Hertel et al. (2003).

On the production side, the model evaluates efficiency gains from the reallocation of factors of production across sectors. In the first stage (“nest”), land, labour (skilled and unskilled), and capital substitute for one another to generate domestic value-added by sector; intermediate inputs, which include imported inputs, substitute for domestic value-added in the second stage.

Given that we use a dynamic model, both labour and capital respond to changes in factor returns. Labour responds to changes in the wage rate according to an estimated long-run elasticity equal to one. Capital supply responds to changes in the ROR on capital; the investment response is based on the Monash capital model (Dixon and Rimmer, 1998). Both labour and capital are mobile across all sectors within a country. Capital is also mobile internationally.

On the demand side, an aggregate Cobb-Douglas utility function allocates expenditures to private consumption, government spending, and savings so as to maximize per capita aggregate utility. Following a shock, such as the CPTPP, the changes in consumption are allocated across these three aggregates based on their income shares in each region.

Private household demand responds to changes in prices and income. This latter effect reflects the fact that consumption of particular types of goods, such as luxury goods, increases more with higher income than does consumption of other goods, such as staple food products.4 Notably, changes in trade protection result in changes not only in the prices of intermediate production goods, but also in the prices of consumer goods, which induces demand responses.

The trade module assumes imperfect substitution based on product differentiation across regions. The key parameter determining the scale of impacts on trade from a tariff shock is the elasticity of substitution – a high substitution elasticity generates relatively large trade impacts for a given size of tariff shock. Note that the GTAP sectors reflect relatively large aggregates of individual products; accordingly, substitution elasticities are lower than they would be for product categories that are defined more narrowly and, thus, are more substitutable for each other.

Economic welfare is based on equivalent variation: the lump sum payment at pre-shock prices without the shock that leaves households as well off as in the post-shock economy.

We use a perfect competition specification of the GTAP model. Some models incorporate imperfect competition for industrial goods sectors, introducing price mark-ups that represent monopolistic pure profits in equilibrium. These price mark-ups are reduced by intensified competition under trade liberalization, generating additional welfare gains.5 Several recent models incorporate heterogeneous firms features, which generate productivity gains from reallocation of market shares to more productive firms under trade liberalization.6 As it is problematic to combine all these features in one model while retaining a reasonable degree of product and regional disaggregation, no single modelling exercise can be considered definitive; a suite of studies is required to hone in on the likely impacts (see, e.g., Narayanan et al., 2015).

2. Implementation

We use the recently-updated GTAP V9 database with a base year of 2011. For the simulations, we adopt a 33-product group aggregation, featuring 11 agricultural and food sectors, 4 other primary sectors, 10 industrial sectors, and 8 services sectors. The regional disaggregation used for the model features 40 economies and/or regions designed to model the various mega-regional trade agreements. We report the results for the CPTPP economies, the United States, China, India, Korea, Taiwan, Other APEC, the EU28, and the rest of the world (ROW). Tables 4 and 5 provide the breakdown for sectors and regions.

The CPTPP is assumed to be implemented in 2018, the same as was assumed for the TPP12 in Ciuriak et al. (2016b). We first simulate the GTAP database forward to 2035, using GTAP dynamic database tools, which draw on available macroeconomic data (IMF World Economic Outlook for the near term and projections from Fouré et al., 2012, for the out years).

The policy shocks – tariff reductions, the effect of ROOs on preference utilization, NTBs on services, and NTBs on investment – are implemented on this projected base in a dynamic process whereby changes in the ROR on capital induce investment and changes in wage rates induce labour force participation changes. The shocks are simulated sequentially, allowing us to identify the impacts by policy measure. The results reported are changes relative to the baseline at 2018, 2025, and 2035. The 2035 results may be interpreted as a permanent change in the level of trade and economic output, once full equilibrium has been restored following the policy shocks.

3. Closures

In CGE simulations, the number of endogenous variables is limited; the others must be set exogenously by assumption, thus defining the “closure” of the model. CGE models can be simulated with various alternative closures; the choice influences the results significantly.7

Under the GTAP model’s default

In the GTAP-FDI model, investment adjusts to changes in the ROR; similarly, we allow labour supply to adjust to changes in wages. As a result, the TPP generates “endowment” effects: that is, the supply of labour and capital changes based on changes in returns to labour and capital. For both labour and capital, the supply elasticity is set at one; for labour supply, this assumption is based on estimates of long-run labour supply from the literature;10 for capital supply, the assumption is based on regressions of the investment response to a change in ROR using firm-level data.

As regards GTAP’s

4)Household demand is modelled using a Constant Difference of Elasticities function, which captures the fact that the structure of household demand changes as income increases (i.e., in technical terms, it is “non-homothetic”).

5)See

6)These include

7)

8)This is sometimes described as reflecting a medium-term time horizon in which labour supply is “sticky.”

9)The closure rule in which the ROR to capital is fixed is sometimes described as reflecting longer-run “steady-state” growth conditions. For an example of the use of the labour market closure rule, under which the wage rate is fixed, see

10)See

11)

IV. THE CPTPP POLICY SHOCK

1. Tariffs

Tariff reduction/elimination is based on the original TPP schedules and technical summaries released by the parties. The shocks follow those in Ciuriak et al. (2016b). There are several general points to be borne in mind.

First, the precise extent to which the CPTPP liberalization schedules improve upon existing free trade agreement (FTA) commitments could not be taken fully into account in this analysis due to resource constraints. Significant improvements that have been flagged by governments in their technical summaries are incorporated – for example, the CPTPP improves upon the market access commitments made by Japan on beef to countries with which it has existing FTAs that provide lesser market access (Australia, Mexico, and Peru). Otherwise, we do not attempt to identify marginal additional improvements under the CPTPP compared to existing agreements. The CPTPP does clean up the spaghetti bowl of FTAs in the Asia-Pacific to some extent, but our simulations do not fully capture this; this is largely housekeeping, however, and should not materially impact the assessment.

Second, as regards the time path of the liberalization schedules, the CPTPP’s schedules are highly complex and differentiated by individual products and countries, which makes it impractical to attempt to capture the phase-outs in detail. We review the tariff elimination schedules to identify the overall timeframes for phase-outs applied for different product groups and construct stylized straight-line elimination schedules accordingly. We note that, at the high level of aggregation at which CGE simulations are run and given the changing composition of trade, especially in the later stages of the implementation period, the trade weights for the individual tariff lines will, in any event, change (and probably quite significantly). We provide read-outs of the impacts at years 8 (2025) and 18 (2035) of the CPTPP implementation period; these are, in our view, reasonable estimates of the medium- and longer-term impacts.

Third, we do not take into account the trailing bits of liberalization that extend beyond 2035. Changing economic conditions make impact estimates that far in the future highly uncertain and such commitments are of limited relevance to either policy or business.

Fourth, as regards the value of the managed trade concessions in the agricultural sector, we assume full quota utilization with physical quantities converted to values based on unit values in trade in the relevant product groups. Given uncertainties about quota utilization and the fluctuations in unit prices from year to year and across countries, these impact estimates are subject to some degree of uncertainty.

2. Preference Utilization

Preferences for industrial products are not fully utilized due to ROOs compliance costs. We assume that agricultural products face negligible ROOs costs and are mostly traded by large agri-business firms with adequate administrative capacity. Accordingly, we assume 100% preference utilization and impose no charge for this use. For textiles and clothing and autos, we assume a high utilization rate of 90% due to the size of the tariff savings and the likelihood that supply chains would be adjusted to take full advantage of the CPTPP (there is evidence that factories were already being shifted into Vietnam to take advantage of the TPP for exports to the United States). For other industrial sectors, we assume 80% preference utilization to reflect the regionalization of ROOs, a significant negotiating achievement. We phase in the utilization rate from 60% in the first year by 5% per year to reflect adjustment to the regime.

We incorporate no charge for utilizing preferences into the simulations, since the assumption of preference underutilization based on empirical evidence concerning observed utilization rates already includes the trade effects of ROOs costs. We consider that the Armington specification of the model, which allows for differing unit costs of traded goods, already addresses the welfare costs of trade diversion (in terms of sourcing imports from higher-cost TPP-region sources).

3. Goods Sector NTBs

The overall assessment of the TPP’s impact on goods trade NTBs in Ciuriak et al. (2016b) was that it was below the level that is meaningful for a macroeconomic analysis, particularly given the advances made in the WTO’s Trade Facilitation Agreement. We incorporate no general goods trade facilitation shock for the CPTPP analysis

4. Services Sector NTBs

We develop the liberalization shock for services NTBs by coding the CPTPP against the cross-border services trade components of the CPTPP parties’ STRI developed by the OECD (Geloso Grosso et al., 2015). We also take into account the extent of squeezing “water” out of the bindings in the General Agreement on Trade in Services (GATS) by comparing CPTPP bindings to the parties’ scores in the corresponding GATS Trade Restrictiveness Index (GTRI) developed by Miroudot and Pertel (2015) and/or in existing bilateral FTAs.

In developing the CPTPP policy shock for services, we proceed as follows:

▪ NTBs, as quantified by gravity-model-based analysis, implicitly reflect both the effect of actual restrictions and of “water”, as measured by the difference between the GTRI and the STRI (that is, the difference between bound commitments and applied practice).

▪ On the basis of regression analysis of the effect of bindings (Ciuriak and Lysenko, 2016), we assume that actual market restrictions, as measured by the STRI, have twice the restrictive power as an equivalent amount of “water”.

▪ Accordingly, we adopt the following simple formula: Total NTB = α(STRI + 0.5*Water), where α is a coefficient that scales the index-based measure to the ad valorem equivalent (AVE) of a country’s sector-specific NTBs developed for GTAP sectors by Fontagné et al. (2016). We assume that only 25% of these measured AVEs correspond to the barriers to services trade itemized in the OECD’s STRI/GTRI framework and thus actionable under the CPTPP. This assumption is consistent with the general conclusion obtained from the Berden et al. (2009) survey of NTBs goods and services, that 50% could in principle be removed i.e., that they were “actionable”; and the Francois et al. (2013) assessment that an ambitious FTA could reduce trans-Atlantic barriers by 50% of actionable barriers (i.e., by 25% of the total observed barriers).

5. Barriers to FDI

For FDI, we build in a liberalization shock based on cross-referencing the CPTPP’s measures to the OECD’s FDIR index for CPTPP members. Given the presence of numerous bilateral investment agreements within the region, the marginal impact of new bindings attributable to the CPTPP is not likely to be of major significance and a specific quantification of the value of bindings was not included.

6. Other Issues

We do not explicitly model the impact of IP measures, for several reasons. First, IP measures work very differently than trade liberalization. Where trade liberalization increases competition and reduces prices, increased IP protection does the opposite.12 The benefit from IP protection is increased research and development and increased innovation, which are manifest in additional product varieties. The conventional modelling framework for FTA analysis is not equipped to analyze IP issues, as it does not reflect the impact of IP protection on asset values (Ciuriak, 2017). The impact on any individual economy of increased IP protection is thus an open empirical question. Innovation could be inhibited in some jurisdictions depending on whether disincentives outweigh incentives (Ciuriak and Curtis, 2015). From a financial flow perspective, the direct benefits of increased IP protection in the CPTPP would be heavily skewed to the countries with the largest stocks of IP (e.g., Japan). Taking these flows and the enhanced values of the companies’ intangible assets (and hence their market capitalization) into account could materially impact the distributional impact of the CPTPP across the various parties.

Government procurement is also not modelled. Since most procurement is done through commercial presence (“Modality 2” in government procurement; see Cernat and Kutlina-Dimitrova, 2015), rather than on a cross-border basis (“Modality 1”) and since Modality 2 already benefits fully from national treatment rules under WTO commitments, the CPTPP’s impact here is likely to be small in any event. Accordingly, unlike for IP, the failure to explicitly model procurement will not materially affect the overall CPTPP impacts.

7. Summary of Shocks Between CPTPP Parties

Table 6 summarizes the tariff shock. The table may be read as follows: the countries listed in the columns face the percentage tariff reduction offered by the countries in the top row. Thus, for example, Australia faces a reduction of the weighted average tariff by Canada of 0.293%. This low figures reflects the fact that 75.6% of Canada’s applied most-favoured nation (MFN) tariff lines are already at zero, the main areas where Canada liberalizes for the most part exclude the high-tariff sectors (dairy and poultry), and Canada imports little from Australia in sectors where tariff cuts are significant (automotive and textiles and apparel). As can be seen, two of the parties – Chile which has an FTA with with every other CPTPP member, and Singapore, which operates under effectively unilateral free trade for goods – have no tariff shock. Few of the bilateral relationships feature significant tariff reductions.

Table 7 summarizes the services liberalization shock.

This table provides the change in the trade cost equivalent (TCE) derived by multiplying the percentage reduction in the region-sector NTBs times the corresponding region sector AVE measure of services trade barriers. This TCE reduction is expressed as a trade technology (AMS) shock in the GTAP modelling framework.

Table 8 provides the weighted average shock to the “phantom tax” in each CPTPP region.

12)For a discussion of the interaction between trade rules and innovation, see

V. RESULTS

1. Trade Impacts

The CPTPP generates 2.40% in additional intra-regional exports, only two-fifths of the TPP12’s impact in level terms (US$17.34 billion at 2017 prices for the CPTPP vs. US$56.3 billion for the TPP12), but larger in percentage terms. The larger percentage gain reflects the removal of the large baseline level of US trade with the other TPP parties. Taking into account trade deflection, total exports of CPTPP parties to the world rise by 0.22% (about US$12.27 billion at 2017 prices).

As a trade deal, the CPTPP improves upon the TPP12 for the Eastern Pacific parties (Mexico, Canada, Peru, and Chile), as these countries avoid erosion of existing preferences in the US market, while they pick up market share in the Western Pacific from the United States. It also improves upon the TPP12 for Singapore, which avoids preference erosion in its Asian markets from US export gains in those markets. Apart from the United States, which flips from gains to losses under the CPTPP, Vietnam and Japan see the biggest discount of gains, because they stood to gain the most in the US market under the TPP12. Third parties are less negatively hit by the CPTPP than by the TPP12. The EU28, Other APEC, and China experience the largest reduction of negative impact.

2. Impacts on GDP and Economic Welfare

For the CPTPP as a group, the simulations suggest that real GDP will rise by about 0.075% generating economic welfare benefits of about US$13.47 billion by 2035. These gains are smaller in absolute terms, but about the same in percentage terms, compared to the gains under the TPP12. It must be mentioned here that the difference in welfare effects does not take into account any differences in the non-quantified measures – including in particular IP – that might emerge under a provisional CPTPP compared to the full package of the TPP12 as negotiated.

We observe that the GDP percentage gain, in real terms, is about one-quarter the size of the two-way trade percentage gain in real terms, which is a reasonable ratio in light of earlier literature on this issue (the rule of thumb suggests a ratio of around 20%). However, the welfare gain is large in value terms relative to the total trade gain (welfare gains of US$13.5 billion vs. gains in terms of two-way trade of about US$25.4 billion); this reflects terms of trade improvements for the CPTPP. Given the size of the CPTPP region relative to the world, a non-negligible impact on terms of trade is plausible. Overall, the simulation results generate broadly reasonable ratios.

The impact on real GDP and welfare follows the pattern of trade impacts, with Australia, Mexico, Canada, Chile, and Peru improving their outcomes in the CPTPP compared to the TPP12. The United States has a relatively large flip on welfare going from +US$8.4 billion under the TPP12 to almost –US$2 billion under the CPTPP, consistent with the flip on real GDP from 0.038% to -0.008%.

3. Sources of the Impacts

Table 12 provides a decomposition of the impacts in 2035 by policy: tariff reduction and ROOs; reduction of services NTBs; and easing of FDI restrictions. For the CPTPP, the major gains in welfare come from tariff reduction net of ROOs costs (about US$1.4 billion), supplemented by services liberalization (about US$1.8 billion), and FDI liberalization (about US$1.6 billion). Most of the gains in services and FDI are attributable to the binding of existing market access and, thus, due to a reduction of uncertainty.

One of the notable features of FDI liberalization is that the reallocation of capital to more profitable applications within the CPTPP frees up capital for net investment in third parties. The model simulation suggests all regions would in fact benefit from the FDI liberalization measures (this is a feature present in both the CPTPP and TPP12).

4. Sectoral Impacts

Table 13 sets out the CPTPP sectoral impacts. In terms of intra-TPP exports, automotive products (US$3.6 billion) stand out in the case of goods exports, and business services (US$576 million) in the case of services exports. The large gains that Vietnam stood to make in textiles and apparel under the TPP12 through enhanced access to the US market are washed out in the CPTPP. However, after automotive products, textiles and apparel (US$3.2 billion) see the largest gains in intra-TPP exports. Other sectors that will palpably feel an intra-TPP expansion of exports include machinery and equipment (US$1.8 billion) and leather products (US$1.6 billion). In the agri-foods area, beef (US$891 million), processed foods (US$715 million), and fruit and vegetables (US$267 million) make notable gains.

VI. DISCUSSION AND CONCLUSIONS

The original TPP12 agreement promised to be a relatively modest deal when evaluated in traditional terms of trade, jobs, and growth. As noted in Ciuriak et al. (2016b), this reflected a number of factors:

▪ Apart from sensitive sectors, tariffs are already low in Asia-Pacific trade.

▪ Sensitive sectors successfully resisted significant liberalization.

▪ Preferences will not be fully utilized and utilization of preferences generates administrative costs for firms, which detract from the trade gains.

▪ The TPP as negotiated had little impact on goods trade costs, as it did not improve upon the WTO Trade Facilitation Agreement and had few sector-specific facilitating measures.

▪ Services market access was minimally impacted by the terms of the agreement – the TPP’s main role was to improve upon bindings under the GATS – and then only by half the membership.

▪ FDI in most sectors is welcomed by all countries to start with and there is an extensive existing web of bilateral investment treaties in place, many of which already feature such mechanisms as ISDS.

The CPTPP promises still lower gains due to the withdrawal of the biggest economy among the twelve original signatories. Nonetheless, it does promise gains: for the CPTPP as a group, the simulations suggest that real GDP will rise by about 0.075% generating economic welfare benefits by close to US$13.5 billion by 2035. Moreover, the CPTPP would improve upon the current trade regime prevailing in the Asia-Pacific region, not least because it would go a long way to clearing up the “spaghetti bowl” of existing bilateral agreements in the region.

The United States forfeits, in the first instance, the gains it stood to make under the TPP12 and incurs losses from preference erosion. This is not likely to be the final bottom line for the United States and the CPTPP. The Trump Administration has indicated its preference for one-on-one negotiations, where it holds the whip hand, being the larger economy with the larger market. The provisional implementation of a CPTPP would undoubtedly be followed by a US announcement of its intent to open bilateral trade negotiations with at least some of the Eleven.

Whether countries would take up the offer, and whether the United States would in reality improve upon the TPP12 outcome through bilateral negotiations, are open questions. In the latter regard, it is important to note that the United States already negotiated the TPP12 on a bilateral basis – including, for example, the ROOs for the automotive sector in the TPP12, which have been rejected by the Trump Administration and which were negotiated bilaterally between the United States and Japan and presented to the rest of the membership as a fait accompli. This point is underscored by the fact that all trade deals, regional or multilateral, ultimately involve one-on-one bargaining among the main parties on the key points – for example, China’s accession to the WTO involved a one-on-one negotiation between China and the United States, where the latter held all the cards. In any event, replicating or improving upon the TPP12 outcome would involve significant time and resources and the CPTPP could serve as the basis for Asia-Pacific trade for a considerable window in time.

For the remaining CPTPP parties, the implications of going ahead without the United States vary. For the four parties in the Americas (Canada, Mexico, Chile, and Peru), US withdrawal actually promises, in the first instance, to expand the gains from the CPTPP. This reflects the fact all four have FTAs in force with the United States and do not experience preference erosion in their key US markets under the CPTPP, while making additional preferential trade gains at US expense in Asian markets. Within the CPTPP group, no country stands to benefit more from US withdrawal than Mexico. It increases its welfare gain from about US$1,138 million to about about US$2.6 billion. Third parties also benefit from US withdrawal from the TPP since they experience less erosion of their competitive position in both the US and the CPTPP markets.

How to handle the automotive sector under a CPTPP would be a major issue, however. The TPP12 featured a significant lowering of the overall amount of regional value content (RVC) required for an automotive product to qualify for TPP preferences compared to the North American Free Trade Agreement (NAFTA) standard of 62.5% for automobiles and light trucks. As noted, this measure was agreed in a bilateral between the United States and Japan and whether it would make sense to apply in a CPTPP context, given the Trump Administration’s rejection of this negotiated outcome and indications that higher RVC would be demanded, is thus a wide-open question. Deciding a provisional regime for automotive ROOs would be one of the major elements of negotiating implementation of the CPTPP.

An important caveat concerning reliance on the results reported here for policy considerations is that the available quantitative tools are inadequate to assess the impacts of the TPP as an instrument of systemic regulation and asset value protection for the knowledge-based economy (KBE). A KBE works on different principles than the industrial economy. It is based on amassing asset portfolios and data and exploiting the associated rents, not on moving inventory. The network externalities and “winner-take-most” economics of the KBE raise difficult and different questions about competition than those that are contemplated in the CPTPP governance model, which extends comprehensive protection to established assets and thus established market positions, including by creating a general freedom to operate that allows firms to optimize their mode of engagement with the global economy. The wealth effects of the CPTPP are likely to be heavily skewed to the countries with the largest stocks of intangible assets to protect.

A second important caveat is that, in many of the controversial governance areas, the situation is unsettled. The CPTPP’s ISDS mechanism is clearly inferior to that which was developed by the European Union and Canada for their Comprehensive Economic and Trade Agreement (CETA) – and the CETA mechanism itself is still not carved in stone. Further, recent US Supreme Court decisions affecting the US regime for IP protection (e.g., in

As regards the overall scale of the impacts reported in this study, there is inevitably some degree of sensitivity to the assumptions underlying the simulations. Generally, trade impacts are higher with larger trade elasticities (specifically the elasticities of substitution); and the real GDP gains are higher for a given trade shock the stronger the supply side response of the economy to the incentives created by trade liberalization. For the CPTPP simulation, the real GDP impacts across all regions average about 27% of the size of the change in real two-way trade. This is broadly in line with historical experience regarding the productivity gains generated by increased openness (the standard rule of thumb suggests a ratio of about 20%). The simulations rely on the standard GTAP elasticities of substitution, which were recently updated and represent an internationally recognized benchmark for empirical analysis. Nonetheless, given that CGE simulations of trade agreements typically generate lower estimates of bilateral trade gains than reported in gravity model studies, the trade and real GDP impacts may be considered to be conservative estimates.

Bearing in mind these caveats, this study concludes that, for the politically relevant medium term, the United States stands to be less well-off without the TPP12 than with the CPTPP in force. Measured using traditional metrics, this expected discount is small, but not insignificant for many US stakeholders. An alternative perspective on the impact of modern trade agreements that emphasizes their impact on asset prices – treating the TPP as an “asset value protection agreement” rather than an FTA – suggests the expected discount for the United States might be substantially greater (Ciuriak, 2017). For the eleven CPTPP parties, the study suggests that the gains remain significant and in some cases greater than under the TPP12. Accordingly, if there is a real option for the Eleven to suspend the controversial issues while proceeding with the conventional trade liberalization agenda on a provisional basis, the Eleven should seize it.

Tables & Figures

Table 1.

Income and Population, Estimated 2017, CPTPP and the United States

Source: IMF (October 2017).

Table 2.

Global Imports, CPTPP Parties and the United States, 2015, Current US$ Millions

Source:

Table 3.

Inward and Outward Investment, CPTPP Parties and the United States, 2015, Current US$ Millions

Note: Negative figures for outward flows reflect net disinvestment from abroad.

Source:

Table 4.

Sectors in the Modelling Framework

Source: Compiled by the authors.

Table 5.

Regions in the Modelling Framework

Note: Brunei is part of Rest of Southeast Asia.

Source: Compiled by the authors.

Table 6.

Summary of the Trade-Weighted Tariff Shock, by Dyad

Source: Calculations by the study team. Note that the Australia-Peru FTA announced at the APEC meetings in Da Nang in November 2017 is not reflected and the liberalization pursuant to that FTA is treated as due to the CPTPP.

Table 7.

Summary of the Services Shock: % Change in Trade-Weighted TCE, by Dyad

Source: Calculations by the study team.

Table 8.

Percentage Reduction in the Phantom Tax on FDI by CPTPP Region

Source: Calculations by the study team.

Table 9.

Trade Impacts: Exports to TPP Partners and to the World, 2035

Table 9.

Continued

Note: TPP totals do not include Brunei. Further, the original model data, which are in USD at 2011 prices, are converted to 2017 USD using the change in the US GDP deflator over the period (10.25% over the period in IMF, October 2017).

Exports are valued using GTAP code VXW, a valuation which includes transport margins, while the corresponding sum of sectoral exports in

Source: Calculations by the authors. The TPP12 estimates are revised versions of the results reported in

Table 10.

Trade Impacts: Imports from TPP Partners and from the World, 2035

Note: Imports are valued using GTAP code VSW, a valuation which includes transport margins while the corresponding sum of sectoral imports in

Source: Calculations by the authors.

Table 11.

GDP and Economic Welfare Impacts of the TPP and CPTPP

Note: Welfare is measured as equivalent variation. See also notes to

Source: Calculations by the authors.

Table 12.

Decomposition of CPTPP Impacts by Policy, Cumulated Change in 2035

Source: Calculations by the authors.

Table 13.

CPTPP Regional Sectoral Impacts 2035

Source: Calculations by the authors. See also notes to

APPENDIX: TECHNICAL DESCRIPTION OF THE GTAP-FDI MODEL

The distinguishing feature of the GTAP-FDI model is that there are two investors for each sector and each region: one domestic investor and one foreign investor. By contrast, the GTAP database has only one composite investor for each region-sector. To disaggregate the original GTAP investment-related variables, we proceed as follows.

Based on firm-level data from Standard & Poor’s Capital IQ database, we assign listed firms to GTAP sectors. We extract information on gross operating surplus, rate of return and depreciation rate for earch firms in the sample. We then generate initial estimates of the capital stock, the value of depreciation and the level of investment through the equations described in Figures A1 and A2. These values are then aggregated to construct corresponding values for a representative firm corresponding to the GTAP sector classification.

These initial levels are not, however, consistent with the levels of capital, depreciation and investment for the aggregate single representative firm in the GTAP database. To preserve the consistency of the GTAP database, we scale the initial estimates of the values of the capital stock, depreciation and investment for the domestic and foreign-owned representative firms such that the sum is consistent with the values in the GTAP database.

The second step is to disaggregate each GTAP sector (the representative firm) into domestic-owned and foreign-owned firms. We firstly utilize the FDI and FAS data (Lakatos et al., 2011) to estimate the share of foreign owned capital in each GTAP sector in each region. For the input structure of the domestic and foreign-owned firms, we use the FDIR (FDI restrictiveness index) data from OECD and build a gravity model to estimate the potential growth in FDI when removing FDIR. Combined with the investment theory in the model, we estimate the phantom tax and its corresponding income (payment on capital) of the two types of firms. For the rest of the input structures of the two types of firms we assume they have the same technology with the original representative firm. Then we use these shares to split the original representative firm into domestic and foreign owned representative firm.

These procedures are described in Figure A1. The derivation of the equations in Figure A1 is given in Figure A2.

To construct the foreign affiliate sales (FAS) matrix  we start with the FAS data in Lakatos et al. (2011). This FAS dataset has three dimensions: sectors, host countries and source countries. We sum across source countries to get the overall sales of foreign affiliates in sector j and host country h. Then, we divide this by the total domestic sales of products in host country h

we start with the FAS data in Lakatos et al. (2011). This FAS dataset has three dimensions: sectors, host countries and source countries. We sum across source countries to get the overall sales of foreign affiliates in sector j and host country h. Then, we divide this by the total domestic sales of products in host country h  to estimate the penetration rates of foreign firms (FAS/TS) in each sector and region. This penetration ratio is then used to allocate sales in the GTAP database to the representative domestic and foreign-owned firms.

to estimate the penetration rates of foreign firms (FAS/TS) in each sector and region. This penetration ratio is then used to allocate sales in the GTAP database to the representative domestic and foreign-owned firms.

Similarly, the FDI matrix  sourced from Fukui and Lakatos (2012) also has three dimensions. We sum across source countries, then divide by the capital stock matrix (

sourced from Fukui and Lakatos (2012) also has three dimensions. We sum across source countries, then divide by the capital stock matrix (

Fukui and Lakatos (2012) argue that FAS data provide better information about the operations of foreign affiliates than data on international flow of funds. So, to integrate the FAS dataset, we apply the following regression model to estimate the FDI/VKB ratios:

where

We take the average of the fitted ratio from (E2.1) and the actual FDI/VKB ratios (excluding outliers) to get the final estimated share of capital stock that is owned by foreign investors. Then we use these ratios to split the capital stock matrix (

For the investment matrix  we assume that firms owned by domestic and foreign investors have the same depreciation rate. Provisionally, we also assume they have the same capital growth rate, although this is a restrictive assumption since we know that foreign investment has been growing more rapidly than overall investment. Using Equation (E1.2) in section 1,

we assume that firms owned by domestic and foreign investors have the same depreciation rate. Provisionally, we also assume they have the same capital growth rate, although this is a restrictive assumption since we know that foreign investment has been growing more rapidly than overall investment. Using Equation (E1.2) in section 1,

Next, we apply the concept of a “phantom tax” to break down the gross operating surplus of a given region-sector into gross operating surplus for domestic and foreign owned capital  as shown in Figure A3. A phantom tax restricts entry of FDI but does not result in the collection of revenue. Intuitively, the phantom tax restricts the entry of FDI notwithstanding higher returns to foreign capital. With the removal of the phantom tax, foreign capital has an incentive to take advantage of the higher returns by increasing investment, thus expanding the FDI stock.

as shown in Figure A3. A phantom tax restricts entry of FDI but does not result in the collection of revenue. Intuitively, the phantom tax restricts the entry of FDI notwithstanding higher returns to foreign capital. With the removal of the phantom tax, foreign capital has an incentive to take advantage of the higher returns by increasing investment, thus expanding the FDI stock.

We start with the FDI restrictiveness matrix, then quantify the effect on FDI of the restrictions-that is we determine by how much the share of FDI in the regionsector capital stock would increase if we remove all barriers. We then use these results to estimate the phantom tax applying to FDI in each region-sector. We assume that the phantom tax creates a wedge between the rates of return of domestic versus foreign-owned capital; this allows us to then derive the gross operating surplus matrix

To estimate by how much the FDI stock will increase if we remove all FDI barriers, we use the following gravity-like econometric specification:

where

In this econometric exercise, we use all the 44 regions in the OECD dataset, and extract the data of the corresponding 44 regions from the full GTAP v8 database. So the sample size is 110,352 (i.e., 57*44*44). The regression results show that the elasticity of FDI stocks with respect to the FDI restrictiveness index (

For example, if Australia remove all the barriers of FDI in electricity sector (FDI restrictiveness index =0.175), it would lead to a 38.5% increase in the FDI stock in that sector.

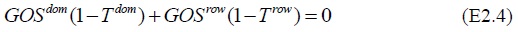

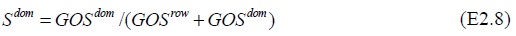

In calibrating the model, we assume that the initial phantom tax rates have been set so as to equalize the after-tax return from reallocating a unit of capital from domestic producers to foreign producers, while simultaneously collecting no net revenue. That is, for given values for

where

By solving (E2.3) and (E2.4), we have

We substitute (E2.5) and (E2.6) into (E2.9) to get

From above, we calculate the  can thus be determined.

can thus be determined.

Next, to derive the expression linking a change in the level of the phantom tax (τrow) to a change in FDI, consistent with the calculation where the change in FDI was linked to a change in the FDI restrictiveness index.

Proceeding by way of example, in the previous section we determined that full elimination of FDI restrictions would result in a 38.5% increase in FDI in Australia’s electricity sector. Assuming an elasticity of capital supply with respect to the rate of tax of 0.3 on a provisional basis,14 this implies the elimination of FDI restrictions is equivalent to an effective tax cut of about 128% (=38.5%/0.3). With this information in hand, the system of equations above generates both the phantom tax and the respective RORs for the domestic and foreign-owned sectors (recall: the wedge in RORs between domestic and foreign-owned capital emerges due to the presence of restrictions on FDI).

In the Australian electricity sector, the real gross return on foreign capital is calculated to be about 19%, and on domestic capital about 7.8%. These estimates are consistent with a phantom tax on foreign capital of about 56% and a negative phantom tax (i.e., a subsidy) of 6.6% on domestic capital.

To see this, recall that (

Thus, (.19 * (1-0.562))/(.078 * (1+.066)) = 1

The elimination of the phantom tax implies that the expression

Finally, from the VKB determined above, the foreign-owned Australian electricity capital stock is about 3,500mn USD. Given the 19% gross rate of return for foreign-owned capital determined by the procedure above, we obtain the GOS for foreign-owned capital of about 665mn USD.

The Investment Function

In the Monash investment function, the growth rate of capital (and hence the level of investment) is determined by investors’ willingness to supply increased capital to industry

where

are the capital stocks in end and start of period of sector j in region r;

are the capital stocks in end and start of period of sector j in region r;

Figure A3 shows the diagrammatical relationship between the growth in capital stock (

This equation may be understood as follows. For industry

Also we know the following dynamic linkage between capital stock and investment:

where D is the depreciation rate of the physical capital stock. Thus we can derive the investment of sector j in region r.

Regression Results for FDI on FDI Restrictiveness Index

OLS, using observations 1-110352 (n = 88952)

Missing or incomplete observations dropped: 21400

Dependent variable: l_FDIS

13)To simplify the notation here, we omit the subscripts denoting sectors and regions.

14)This estimate is drawn from the MONASH model.

Appendix Tables & Figures

Figure A1.

The Procedure in Creating Investment Matrices

Figure A2.

Derivation of the Equations in Figure 1

Figure A3.

Capital-supply Function in MONASH

.

.

References

-

Balistreri, E. J. and T. F. Rutherford. 2013. Computing General Equilibrium Theories of Monopolistic Competition and Heterogeneous Firms. In Dixon, P. B. and D. W. Jorgenson. (eds.)

Handbook of Computable General Equilibrium Modeling . Amsterdam: Elsevier. pp. 1513-1570. - Berden, K. G., Francois, J., Thelle, M., Wymenga, P. and S. Tamminen. 2009. Non-Tariff Measures in EU-US Trade and Investment: An Economic Analysis. Report to the European Commission. Rotterdam: ECORYS.

-

Cernat, L. and Z. Kutlina-Dimitrova. 2015. International Public Procurement: From Scant Facts to Hard Data.

European Commission DG Trade Chief Economist Note , no. 1. - Ciuriak, D. 2017. A New Name for Modern Trade Deals: Asset Value Protection Agreements. Published online: Centre for International Governance Innovation.

- Ciuriak, D. and D. Lysenko. 2016. Quantifying Services-Trade Liberalization: The Impact of Binding Commitments. Better in than Out? Canada and the Trans-Pacific Partnership, Technical Paper. Toronto: C. D. Howe Institute.

- Ciuriak, D. and J. Xiao. 2014. The Trans-Pacific Partnership: Evaluating the ‘Landing Zone’ for Negotiations. Ciuriak Consulting Working Paper.

-

Ciuriak, D. and J. Curtis. 2015. Trade and Innovation: Key Challenges and Canada’s Policy Options. In Tapp, S., Van Assche, A. and R. Wolfe. (eds.)

Redesigning Canadian Trade Policies for New Global Realities . Montreal: IRPP. Volume VI. -

Ciuriak, D. and S. Chen. 2008. Preliminary Assessment of the Economic Impacts of a Canada -Korea Free Trade Agreement. In Ciuriak, D. (ed.)

Trade Policy Research 2007 . Ottawa: Foreign Affairs and International Trade Canada. pp. 187-234. - Ciuriak, D., Dadkhah, A. and J. Xiao. 2016a. Better In than Out? Canada and the Trans-Pacific Partnership. C.D. Howe E-Brief.

- Ciuriak, D., Dadkhah, A. and J. Xiao. 2016b. Taking the Measure of the TPP as Negotiated. Ciuriak Consulting Working Paper.

- Dade, C. and D. Ciuriak, with Dadkhah, A. and J. Xiao. 2017. The Art of the Trade Deal: Quantifying the Benefits of a TPP Without the United States. Calgary: Canada West Foundation.

- Dixon, P. B. and M. T. Rimmer. 1998. Forecasting and Policy Analysis with a Dynamic CGE Model of Australia. Working Papers, no. op-90. Melbourne: Centre of Policy Studies/ IMPACT Centre.

- Dixon, P. B., Jerie, M. and M. T. Rimmer. 2013. Deriving the Armington, Krugman and Melitz Models of Trade. Paper Presented at the 23rd Pacific Conference of the Regional Science Association International (RSAI). Bandung, Indonesia. July.

-

Evers, M. Mooij, R. D. and D. Van Vuuren. 2008. “The Wage Elasticity of Labour Supply: A Synthesis of Empirical Estimates,”

De Economist , vol. 156, no. 1, pp. 25-43.

- Fontagné, L., Mitaritonna, C. and J. E. Signoret. 2016. Estimated Tariff Equivalents of Services NTMs. CEPII Working Papers, no. 2016-20.

- Fouré, J., Bénassy-Quéré, A. and L. Fontagné. 2012. The Great Shift: Macroeconomic Projections for the World Economy at the 2050 Horizon. CEPII Working Papers, no. 2012-03.

-

Francois, J. and L. Baughman. 2005.

Impact of imports from China on U.S. Employment . Washington, DC: The National Retail Federation. - Francois, J., Manchin, M., Norberg, H., Pindyuk, O. and P. Tomberger. 2013. Reducing Transatlantic Barriers to Trade and Investment: An Economic Assessment. Report to the European Commission. London: Centre for Economic Policy Research (CEPR).

- Fukui, T. and C. Lakatos. 2012. A Global Database of Foreign Affiliate Sales. Office of Economics Working Paper, no. 2012-08A. U.S. International Trade Commission.

- Geloso Grosso, M., Gonzales, F., Miroudot, S., Nordås, H. K., Rouzet, D. and A. Ueno. 2015. Services Trade Restrictiveness Index (STRI): Scoring and Weighting Methodology. OECD Trade Policy Papers, no. 177.

-

Gilbert, J. P. 2004. GTAP Model Analysis: Simulating the Effect of a Korea-U.S. FTA Using Computable General Equilibrium Techniques. In Choi, I. and J. J. Schott. (eds.)

Free Trade Between Korea and the United States? . Washington, DC: Institute for International Economics. Appendix B, pp. 89-118. -

Ham, J. C. and K. Reilly. 2013. “Implicit Contracts, Life Cycle Labor Supply, and Intertemporal Substitution,”

International Economic Review , vol. 54, no. 4, pp. 1133-1158.

-

Hertel, T. (ed.). 1997.

Global Trade Analysis: Modeling and Applications . Cambridge, UK: Cambridge University Press. - Hertel, T., Hummels, D., Ivanic, M. and R. Keeney. 2003. How Confident Can We Be in CGE-Based Assessments of Free Trade Agreements?. GTAP Working Paper, no. 26.

-

International Monetary Fund (IMF). October 2016.

World Economic Outlook Database . <http://www.imf.org/external/pubs/ft/weo/2016/02/weodata/index.aspx > (accessed June 1, 2017) -

International Monetary Fund (IMF). April 2017.

World Economic Outlook Database . <http://www.imf.org/external /pubs/ft/weo/2017/01/weodata/index.aspx > (accessed June 1, 2017) -

International Trade Centre (ITC). 2015.

Trade Map . <http://www.trademap.org/Index.aspx > (accessed June 1, 2017) - Itakura, K. and K. Oyamada. 2013. Incorporating firm heterogeneity into the GTAP Model. Paper presented at the 16th Annual Conference on Global Economic Analysis. Shanghai, China. June.

- Lakatos, C., Walmsley, T. L. and T. Chappuis. 2011. A Global Multi-sector Multi-region Foreign Direct Investment Database for GTAP. GTAP Research Memorandum, no. 18.

- Miroudot, S. and K. Pertel. 2015. Water in the GATS: Methodology and Results. OECD Trade Policy Papers, no. 185.

- Narayanan, B. G., Ciuriak, D. and H. V. Singh. 2015. Quantifying the Mega-regional Trade Agreements: A Review of the Models. Discussion Paper. Winnipeg: International Institute for Sustainable Development.

- Oyamada, K. 2013. Parameterization of Applied General Equilibrium Models with Flexible Trade Specifications Based on the Armington, Krugman, and Melitz Models. IDE Discussion Paper, no. 380. Chiba: Institute of Developing Economies.

- Roson, R. 2006. Introducing Imperfect Competition in CGE Models: Technical Aspects and Implications. Fondazione Eni Enrico Mattei, Nota Di Lavoro, no. 3.2006.

- Roson, R. and K. Oyamada. 2014. Introducing Melitz-Style Firm Heterogeneity in CGE Models: Technical Aspects and Implications. Working Paper, no. 04/WP/2014. Venice: Department of Economics, Ca’ Foscari, University of Venice.

- United Nations Conference on Trade and Development (UNCTAD). 2016. World Investment Report 2016, Investor Nationality: Policy Challenges. Geneva: United Nations.

-

World Trade Organization (WTO). n.d. Time Series. Statistics Database. <

http://stat.wto.org/StatisticalProgram/WSDBStatProgramHome.aspx?Language=E > (accessed June 1, 2017) -

Zhai, F. 2008. “Armington Meets Melitz: Introducing Firm Heterogeneity in a Global CGE Model of Trade,”

Journal of Economic Integration , vol. 23, no. 3, pp. 575-604.