-

PDF

- Split View

-

Views

-

Cite

Cite

Ryan D Edwards, Commentary: Work, well-being, and a new calling for countercyclical policy, International Journal of Epidemiology, Volume 34, Issue 6, December 2005, Pages 1222–1225, https://doi.org/10.1093/ije/dyi142

Close - Share Icon Share

The question of how human well-being is affected by business cycles is an age-old focus in economics. Starting with the dawn of the modern welfare state early in the 20th century, economists following in the tradition of John Maynard Keynes1 advocated activist countercyclical economic policies: increases in spending or decreases in taxes that are implemented during economic downturns in order to dampen business cycles. The stagflation of the 1970s and the Lucas critique2 marked the beginning of a sea change in thinking about countercyclical policy. Lucas showed why good-intentioned countercyclical policy might be rendered ineffective at best and inflationary at worst by forward-looking rational individuals who adapt to government policymaking.

As a result of this feasibility argument, activist countercyclical policy largely fell out of favour in the United States. New policies took neoclassical emphases on fostering price stability, improving incentives to work and save, and increasing the potential for long-run growth. There is much to be said about the beneficial impacts of such policies in the long run, but incentivizing work necessarily tilts the fiscal policy in the procyclical direction, i.e. increasing spending during times that are already good, although that was probably never the original intent. For example, the Earned Income Tax Credit (EITC), which has grown to $30 billion per year and now exceeds traditional welfare payments by $5 billion, is essentially a wage subsidy for low-income working families with children. It is thus inherently procyclical in that those families must work to qualify for it. Welfare reform during the late 1990s, which radically recharacterized federal poverty assistance as temporary support and retraining rather than open-ended income support, probably represents the height of this reorientation of policy.

To be sure, countercyclical policy is in practice far from dead. Today, unemployment insurance and the progressivity of the federal income tax still remain key examples of what are called automatic fiscal stabilizers, which is net government spending that is naturally countercyclical. Combined, these currently help to offset perhaps 8% of macroeconomic shocks to income, roughly the same as in the 1960s.3 In recent years we have also seen broad-based tax refund checks from the US Treasury and historically low federal funds rates set by the Federal Reserve in response to the downturn of 2001.

But during the last 20 years, the fiscal landscape has definitely shifted away from emphasizing traditional stimulus and support policies and towards increasingly rewarding work, which many economists view as either previously disincentivized or inherently good, perhaps due to positive spillover effects. A pervasive view in academic macroeconomics today is that the welfare benefits of incentivizing work in this way far exceed the gains from traditional countercyclical policies.4 So the arguments against discretionary countercyclical policy are now 2-fold: not only is it unlikely to work, it is unlikely to be worth it even if it did work.

The new paper by José A Tapia Granados,5 ‘Increasing Mortality During the Expansions of the US Economy, 1900–1996,’ like others in the important and increasingly vibrant subfield of interdisciplinary research on economic fluctuations and health,6–9 gives macroeconomists much to think about. The basic finding of the paper is that mortality, a fundamental measure of the inverse of human well-being, rises significantly during periods of economic expansion and falls significantly during recessions. In a very real sense, this result turns both neoclassical and traditional Keynesian perspectives on their heads. If more employment and income result in increased mortality, then incentivizing work may have the unintended consequence of raising mortality. Leaving aside the effect of incentives; however, at least programs like the EITC compensate individuals to some degree for heightened mortality risk. Countercyclical government spending may ameliorate economic hardship during recessions, but it cannot address procyclical mortality and might even compound the pain by requiring higher taxes during times of prosperity. It is worrisome that a key component of well-being might paradoxically decline as a result of traditional policies intended to increase well-being.

This finding raises three critical questions. First, why is this happening? Second, how big or important is this effect in a relative sense? And third, what are the policy implications? I consider each of these in turn.

Although at odds with economic theory in its simplest form, the insight that increases in income and work may not always be positively associated with health is not novel, of course. Historians, epidemiologists, demographers, and development economists have recognized that there are adverse health consequences associated with economic growth, especially rapid growth during the course of development.10 But in an industrialized country like the United States, during most of the 20th century, such an association is less immediately clear, if not seemingly backward. In cross-sectional data and short panels, health and wealth are positively related.11 Over longer periods of time; however, it is more common for researchers to find much weaker associations between income and life spans or mortality, if any at all, while technology appears to play a much more prominent role.12,13

Tapia Granados models the change in log mortality rates in the United States between 1900 and 1996 as a constant plus a linear effect of either the change in log income or the change in the log unemployment rate. This functional form allows the constant term to pick up much of the long-term temporal change in log mortality, which is consistent with the remarkably steady exponential decline in US age-specific mortality rates since 1900.14 Tapia Granados then shows that what is left over, the temporary fluctuations in mortality, appear to be linked to other cyclical phenomena. Using ordinary least squares, he finds negative and significant effects of income or unemployment on total mortality. On an average, 1% faster GDP growth is associated with 0.25% higher age-adjusted mortality. Tapia Granados deals obliquely with the issue of whether third variables or endogenous feedbacks from health back into income may bias his results or their robustness. A more direct assessment of these concerns might test whether instrumental variables that isolate the effect of income on health produce different results. The consistency of the current findings with others in the literature15 suggests such concerns may be overblown.

To improve understanding of the causal mechanisms, Tapia Granados examines mortality by major causes of death, among subgroups identified by age, sex, and race, and during specific time periods. Results on causes of death fit well with the established literature and offer a coherent story.6,8,15 Procyclical traffic accidents play a central role; cardiovascular and infectious disease, perhaps reflecting job stresses and close physical proximity to other workers, are also procyclical; and deaths from cirrhosis of the liver, suggesting procyclical alcohol abuse, are another important part. Effects are strongest for working-age Americans, which is consistent with the idea of a vital role for work-related risks. Effects are also large for black females, after 1970, which may reflect patterns of increasing labour force participation and greater vulnerability to work-related risks.

Altogether, these results are theoretically plausible and interesting. They suggest that work-related health risks increase during economic expansions, increasing mortality and decreasing well-being. There are many lingering questions surrounding the precise pathways and incidence of procyclical mortality, but these cannot be answered using the aggregate data examined in the study and must instead be left for future efforts.

The second question concerns the relative size of the negative impact of growth or working on health. For individuals who actually experience procyclical mortality, the costs are catastrophic, of course. We also wish to know how large these costs are when averaged across the entire population. I approach this question in three ways: (i) by comparing procyclical fluctuations in mortality with its long-term trend; (ii) by comparing mortality fluctuations associated with growth to total annual mortality fluctuations; and (iii) by comparing a simple calculation of the economic cost of mortality fluctuations with annual consumption, a standard baseline in macroeconomics.

Since 1900 age-adjusted death rates have declined ∼1% per year on average.16 Real annual GDP growth has averaged a little under 3.5% with a standard deviation of ∼5% since 1929. Measured after 1947, average growth remained roughly unchanged while the SD has been more like 2.5%. Based on the average coefficient found by Tapia Granados, ∼0.25, a positive shock to GDP growth of 1 SD is thus associated with an increase in mortality of between 0.6 and 0.9% depending on the era, or between 60 and 90% of the average annual decrease in mortality.

That sounds like a large impact, but how does it compare with the SD in the change in log mortality? Over the entire sample interval, which includes the influenza epidemic of 1918, I find that number to be fairly large, ∼4.8%. But since 1947, the SD in the percentage decline in mortality has been more like 1.8%, falling slightly to 1.7% after 1970. If we compared the smallest of these three numbers, 1.7, with the translated effect of a SD shock in GDP, 0.6–0.9, we might conclude that economic cycles explain somewhere between a third and a half of recent annual fluctuations in mortality. If we used the 4.8% figure, that share would be considerably smaller—between a 10th and a 20th. Viewed this way, the data suggest that although economic cycles have an important effect on mortality, a large component of annual fluctuations in mortality is not explained by economic cycles.

For a completely different perspective on the relative importance of procyclical mortality, we can attempt to quantify the welfare losses associated with higher mortality during good times. In economics, this is done by translating the value of mortality reductions into dollars, either by examining explicit market transactions or through inferring or querying individuals' willingness to pay for reductions of mortality risk. These studies typically produce a fairly wide range of estimates, but a commonly used central estimate is $2 million per fatality prevented in 1990.17

To proceed with this back-of-the-envelope calculation, we combine our estimate of the value of a statistical life with the actual mortality data in that year and with our estimate of the effect of cyclical GDP growth on mortality. The age-adjusted mortality rate in the United States in 1990 was 9188 deaths per million.16 An increase in that rate of 0.6–0.9%, our estimated range of the effect of a 1 SD shock to GDP, would be 55–83 deaths per million. At $2 million per death, the costs of these cyclically induced deaths amount to between $110 and $166 per person. Relative to per capita consumption in 1990, which was $15 350, the costs of procyclical mortality are between 0.7 and 1.1%.

Although they may sound small, these figures are actually fairly large relative to many estimates of the welfare costs of business cycles. One eminent economist places the latter at only 0.05% of consumption; while estimates vary, no studies have conclusively shown this figure to be unreasonably small.4 Further, as already noted, these costs of mortality are borne disproportionately by those who die. There may be large differences in incidence across groups, such as those found among black women by Tapia Granados.5 This would inflate average costs even more for groups most at-risk.

We can conclude that procyclical mortality is important when compared either with the average rate of mortality decline or with average consumption. However, it is not an overwhelmingly large portion of annual variability in mortality. But overall, it is apparent that the costs of procyclical mortality are considerable, and they suggest a possible role for policy.

Since procyclical mortality seems to be important, the next and final question is naturally, what can be done about it? Although we require a better understanding of the microeconomic pathways of the phenomenon in order to inform policy, we can explore the range of possible implications given our current knowledge.

If a large part of the story is traffic accidents, then we are probably dealing with a traditional economic externality. By recklessly rushing to work or by driving a delivery truck all night to meet a deadline, individuals are probably not factoring in the external social costs of recklessness. Traffic deaths would then be suboptimally high. Researchers have studied these kinds of externalities in great detail, and there is a wide array of traditional solutions available, such as taxes that raise private costs to meet social costs. Policies incentivizing employers to expand telecommuting options or to offer flexible working hours could also help reduce traffic fatalities, as would improvements in public transportation infrastructure. Similar arguments apply if air pollution is a major culprit.

For other pathways, such as work-related stress, it is less clear what could be done. If stress and poor health are simply by-products of heated economic activity, that is a real conundrum for the policy. Economists are of course intimately familiar with work disincentives, but they are usually engaged in identifying and reducing them, not implementing or increasing them, as might seem initially appropriate under these circumstances. France's recent experience with the 35 h workweek highlights the inherent difficulties with policies that aim to reduce the intensity of work or to spread it more evenly across the population. Economic stagnation is a high price to pay for anything, let alone the mere possibility of gains in healthiness. In fact, while taxes on labour and other work disincentives vary widely across OECD countries, procyclical mortality apparently does not,8 suggesting little role for traditional work disincentives in promoting healthy work.

Rather than overt work disincentives, policies should probably target health while working instead of working itself. These might include mandated minimum vacation time or family leave, restrictions on overtime, or annual physicals for employees. But there may be considerable cross-country variation in such policies already, without any clear differences in procyclical mortality. Policies that incentivize work, such as the EITC, probably also incentivize unhealthiness, but they also at least partially compensate individuals for heightened risks to their health from working. While the EITC increases the financial rewards to working, new policies could incentivize work by offering additional health care instead of money.

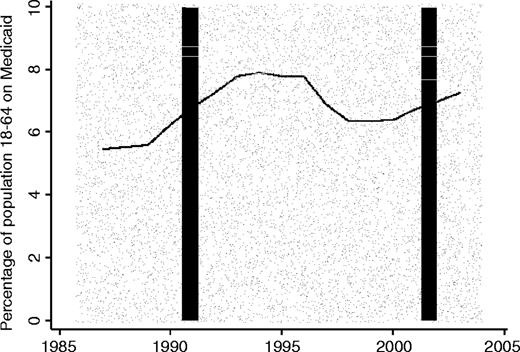

In the United States, poor health care coverage among workers may explain some component of procyclical mortality. According to Census Bureau statistics, Americans without any health care coverage number almost 45 million, 35 million of whom are of working age. Medicaid, which provides basic care for the poor and medically needy, covers only 13 million or ∼7% of the 180 million Americans of working age, because they earn too much to qualify. Since it is means-tested Medicaid is also countercyclical, as shown in Figure 1, which plots the share of the working-age population covered by Medicaid since 1987. (Part of the decline in coverage after 1996 may be associated with welfare reform, although that was not intended at the time.) The extent to which procyclical mortality may be driven by lack of access to care remains unclear, but this evidence suggests that creating an EITC-style medical benefit for the working poor could be effective in reducing it.

Workers' Medicaid coverage rose after recent recessions but fell during the economic expansion of the 1990s. Source: US Census Bureau, March Current Population Surveys, 1988–2004

If risky or careless behaviour is a key element of the story, however, it is not clear that increased health coverage would help much. Excessive smoking or drinking or increased intake of fast food, which may underlie increased mortality from cardiovascular disease and cirrhosis of the liver, may be very difficult to quell by any means. It is hard to imagine political support for procyclical taxes on alcohol, tobacco, and hamburgers. It is even harder to support an adult analogue of the school lunch program that is neither means-tested nor optional. The fact is that recent human demographic history is replete with examples of excesses-induced mortality that is rarely reined in by anything short of totalitarianism. If this pathway is the key, procyclical mortality may be an unfortunate side-effect of some fundamental human myopia.

While much work clearly remains to be done, especially on the microeconomic pathways that will better inform policy, the bottom line is that interdisciplinary work such as offered here by Tapia Granados recasts old policy debates. His findings suggest that we should reassess traditional views of countercyclical policy with a broader focus on general human well-being rather than economic well-being alone. These findings support an entirely new calling for cyclical policy: the amelioration of procyclical mortality, an economically significant side-effect of good times that is relatively large compared with the trends in overall well-being.

References

Lucas RE. Econometric policy evaluation: A Critique.

Auerbach AJ, Feenberg D. The significance of federal taxes as automatic stabilizers.

Tapia Granados JA. Increasing mortality during the expansions of the US economy, 1900–1996.

Gerdtham UG, Ruhm CJ. Deaths rise in good economic times: evidence from the OECD. NBER Working Paper No. 9357,

Laporte A. Do economic cycles have a permanent effect on population health? Revisiting the Brenner hypothesis.

Szreter S. Economic growth, disruption, deprivation, disease, and death: On the importance of the politics of public health for development.

Smith JP. Healthy bodies and thick wallets: the dual relation between health and economic status.

Deaton A, Paxson C. Mortality, income, and income inequality over time in Britain and the United States. In Wise DA (ed), Perspectives on the Economics of Aging. Chicago: University of Chicago Press,

Preston SH. The changing relationship between mortality and level of economic development.

Board of Trustees, Federal Old-Age and Survivors Insurance and Disability Insurance Trust Funds.