Abstract

This study explores the impacts of user adaptation and its antecedents, including perceived usefulness, self-efficacy, and subjective norm on continuance intention towards mobile banking. Based on (1) extended expectation-confirmation model, (2) adaptive structuration theory for individuals, and (3) decomposed theory of planned behavior, and by incorporating user adaptation and trust perspectives, this study proposes and validates a research model by using convenient and snowball sampling techniques, face-to-face survey with a sample of 523 consumers of large banks in Vietnam. The partial least squares structural equation modeling SmartPLS 4.0 software is employed for data analysis. The research findings reveal that (1) except for subjective norm, perceived usefulness, satisfaction, adaptation, and self-efficacy significantly impact continuance intention; (2) trust moderates the relationship between adaptation and continuance intention. Theoretical and managerial implications are provided to broaden the information technology continuance literature, suggesting how banks should sustain strong relationships with mobile banking customers.

Similar content being viewed by others

Introduction

As a result of the rapid growth of information technology (IT) systems, internet-mobile communications and smartphones, mobile commerce (m-commerce) is experiencing a huge breakthrough. Mobile banking (m-banking), or MB for short, is now exceptionally popular in the m-commerce sector (Lee et al., 2023; Naruetharadhol et al., 2021; Ngai and Gunasekaran, 2007; Tiwari et al., 2006). Financial institutions and banks (hereafter banks) provide their customers with ubiquitous services such as transferring money, online payment, financial transactions, and checking account balances by using installed m-banking applications on smartphones, anytime and anywhere. Mobile banking services have gradually attracted individual users and are expected to become corporate customers’ primary payment channels (Khoa, 2021).

MB refers to a host of banking services performed by users through specific bank applications installed on their smartphones (Shaikh and Karjaluoto, 2015; Tang, 2019). It is different from Internet banking (IB) in that users can access the service through MB applications (or platforms) on mobile devices, while IB services are only accessible through web browsers (Filotto et al., 2021). Meanwhile, online banking is an umbrella term that is often used interchangeably with IB to distinguish it from traditional banks (Khan et al., 2022).

M-bank services bring benefits for both the customers and the banks. While m-banking benefits banks by reducing their operating costs, expanding new services, and improving service quality (Foroughi et al., 2019), it enables customers to do banking services with greater convenience, at suitable times and places, prompt information and interaction (Abbasi et al., 2022; Shao et al., 2019).

Juniper research estimated that m-banking users would increase drastically over the next 5 years and the growth rate is predicted to be 53%, with the number of users reaching over 4.2 billion in 2026, up from 2.1 billion in 2021 (Smith, 2021). Statista reported that the worldwide transaction value in digital payment is expected to reach US$9.47tn in 2023, up from US$8.38tn in 2022, and projected to be US$14.79tn by 2027, with an average annual growth rate of 11.79%. China and the United States are the two best performers from the five largest digital banking service markets, followed by the United Kingdom, Japan, and Germany (Statista, 2022).

With its number of banking consumers exceeding 600 million, the Southeast Asia region (SEA) is expected to be the fourth-largest economy globally. The digital transaction volume will more than double by 2030, with an estimated annual growth rate of 15.7% (Vo and Dinh, 2021). Statista figures have also shown that the country’s transaction value in the digital payments segment is estimated to be US$17.5bn in 2022 and US$40.52bn by 2027.

PricewaterhouseCoopers (PwC) also described that Vietnam, as the second best of the rising e-economies of SEA, has enormous potential for digital banking and digital economy (PwC, 2018). Prior scholars have studied m-banking from various perspectives and theoretical frameworks. For example, Tiwari et al. (2006) studied m-banking strategy and how mobile technologies affect customer behavior in banks. Based on the technology acceptance model (TAM) (Davis et al., 1989; Mohammadi, 2014) examined the influences of user perceptions and attitudes to intention toward using mobile banking. Susanto et al. (2016) applied the expected-confirmation model (ECM) (Bhattacherjee, 2001) to examine the post-consumption phase of smartphone banking. Hsiao et al. (2016) utilized the unified theory of acceptance and use of technology (UTAUT) (Venkatesh et al., 2003) to investigate how the millennial generation adopted mobile banking services and an extended version of UTAUT. Khoa (2021), based on the theory of privacy calculus, focuses on the impacts of user data disclosure tradeoff on trust and loyalty in m-banking services. Thus, the literature is incoherent, and its findings are mixed in that the studies applied a variety of constructs and theoretical frameworks to suit a specific research objective and service context (Ashique Ali and Subramanian, 2022; Poromatikul et al., 2020; Shaikh and Karjaluoto, 2015). Despite its benefits and dissemination, the level of m-banking adoption is not up to the expectation, and its development is still in a nascent stage, customers are reluctant to accept, and even have resistance to innovative banking services (Chaouali et al., 2019; Foroughi et al., 2019; Khoa, 2021; Thakur and Srivastava, 2013). While a considerable number of studies examined m-banking adoption, there is limited research on continuance intention (Naruetharadhol et al., 2021; Poromatikul et al., 2020). Moreover, there is a complete lack of empirical research on the impacts of user adaptation, an indispensable behavior in IT usage (Nguyen and Ha, 2022), on continuance intention in m-banking service settings, and surprisingly, up to now very little research has been carried out on mobile banking in Vietnam context (Ashique Ali and Subramanian, 2022; Franque et al., 2021; Ha et al., 2022; Shaikh and Karjaluoto, 2015; Yan et al., 2021). Likewise, trust is considered as an antecedent or outcome construct in many studies on continuance intention in mobile banking (Franque et al., 2021; Kourouthanassis et al., 2015; Shaikh et al., 2023), there are quite a few studies on trust as a moderator.

Recognizing these gaps in IT continuance literature, this study attempts to apply the ECM, decomposed theory of planned behavior (DTPB) (Taylor and Todd, 1995), and adaptive structuration theory for individuals (ASTI) (Schmitz et al., 2016) and integrates with trust perspective to investigate user continuance intention to use m-banking in Vietnam context. This research seeks to answer three questions: (1) What are the determinants of user behavioral adaptation, and user continuance intention to use m-banking? (2) How do these determinants affect user adaptation, and lead to continuance intention? And (3) How does user trust moderate the impact of adaptation and satisfaction on continuance intention?

The study contributes to IT continuance literature in multiple ways. First, this study is the first to integrate three theoretical frameworks ECM, DTPB, and ASTI, and user adaptation and trust perspectives to provide a novel extended ECM model to predict user CI in a mobile banking setting. Second, the model is a pioneer in assessing the moderating role of trust in two important relationships between SA and CI, and ADP and CI. The connection between SA and CI has enriched the literature with the importance of user adaptation and trust in the formation of continuance intention. Third, this study is among the first to utilize DTPB to decompose its monolithic belief structures of normative belief (SN) and control belief (SE) (Taylor and Todd, 1995) and evaluate how these decomposed factors affect directly CI and user adaptation, leading to CI in the emerging context of Vietnam (Nguyen and Ha, 2022).

The study has been structured as follows. The theoretical background review and hypotheses development are presented in the next section. This is followed by the methodology in Section 3. The key findings from the data analysis of this research are in Section 4. A detailed discussion of the findings, implications, and finally directions for future research are positioned in the last section.

Literature review and hypotheses development

Mobile banking service

According to Barnes and Corbitt (2003), the first m-banking application was deployed for users in Europe to make bill payments and check their account balance, as early as 1990. Barnes and Corbitt (2003) determined “m-banking as a channel whereby the customer interacts with a bank via a mobile device” (p.3). Tiwari et al. (2006) claimed that m-banking is the cornerstone of mobile commerce and is seen as the availability of banking- and financial-related services via smartphones. The scholars stated that “mobile banking refers to provision and availment of bank-related financial services with the help of mobile telecommunication devices” (Tiwari et al., 2006). The study by Ngai and Gunasekaran (2007) argued that mobile banking and payments were the most popular mobile commerce applications that support financial activities. As explained by Yuan et al. (2016), “m-banking means that users adopt mobile terminals such as cell phones to access payment services including account inquiry, transference, and bill payment” (p.20). Shaikh and Karjaluoto (2015) posited that m-banking was a type of mobile commerce that was an essential business model based on the mobile application service system. Researchers use interchangeable terms to refer to mobile banking, including mobile banking, mobile payments, mobile transfers, mobile finance, and smartphone banking (Ashique Ali and Subramanian, 2022; Shaikh and Karjaluoto, 2015; Susanto et al., 2016). These terminologies are targeted services of various studies; while they are slightly different in features (e.g., money transaction), they combine to form the family of m-banking services. One of the most popular m-banking services is mobile payment. Mobile payment is a set of financial services performed by installing an application on a smartphone, for customers to pay sellers (e.g., bank, corporate, individual) for products, services, and bills.

Continuance intention and expectation-confirmation model

Continuance intention

The term “IS continuation” refers to the user’s decision to continue using the information system (IS) after initial acceptance (Bhattacherjee and Barfar, 2011). Bhattacherjee (2001) defined IS continuance intention as a user’s intention to continue to use an IS, and continuance could happen just after acceptance (first usage) to distinguish between the two concepts of behavioral acceptance and continuance (Bhattacherjee and Lin, 2015). Nabavi et al. (2016) described it as the user’s post-adoption behavioral patterns, which included both continuation intention (CI) and continuance usage (CU).

The majority of the IS literature over the past two decades has focused on user adoption and initial usage of IS (Nabavi et al., 2016; Susanto et al., 2016). In contrast to the number of studies on initial adoption, continuation intention has attracted comparatively little attention (Hong et al., 2017). There is a shift in focus from user adoption to the continued use of individual behavior at the post-adoption stage. (Bhattacherjee and Lin, 2015; Tam et al., 2020; Yan et al., 2021). As a result, research on IT continuance has increased rapidly in recent years and spread to various contexts (Franque et al., 2021), such as continuance intention in mobile information systems (e.g., mobile payment), social network systems (e.g., social networking) (Sullivan and Koh, 2019) and electronic business information systems (e.g., mobile commerce) (Gao et al., 2015).

Yan et al. (2021) posited that the three theories that researchers use frequently to explain CI are the technology acceptance model (TAM) (Davis et al., 1989), expectation-confirmation theory (ECT) (Oliver, 1980), and IS continuance model or expectation-confirmation model (ECM) (Bhattacherjee, 2001). TAM was initially used to predict the possibility of new IS, assuming the influence of perceived ease of use and the perception of usefulness on attitude toward technology acceptance (Davis et al., 1989). An expansion of the ECT and TAM is the ECM that has posited that after initial adoption, a user’s satisfaction with the technology and assessment of the system’s value may develop, leading him/her to use the technology (Bhattacherjee and Lin, 2015).

Expectation-confirmation model

Rooted on the ECT, Bhattacherjee (2001) has suggested the expectation-confirmation model to predict user IS continuance intention. While ECT has been extensively utilized in consumer behavior to examine user satisfaction, repurchase behavior, and service marketing as a whole (Yuan et al., 2016), ECM is the foundation of a post-acceptance model used in IS literature to investigate the impacts of user perceptions and expectation in technology continuance (Bhattacherjee, 2001). The ECM has posited that confirmation from a previous use of technology substantially influences satisfaction and perceived usefulness (PU), which were strong determinants of CI. Confirmation refers to the agreement between the IT product’s actual and expected performance. ECM has discussed the distinction between the initial adoption and continuance behavior of IT products/services (Sreelakshmi and Prathap, 2020). According to ECM, consumers may have expectations before using items. After using these items, they assess the performance to gauge their satisfaction and continuance intention. Scholars have argued that other important factors have a direct or indirect impact on the continuation intention (Nguyen and Ha, 2022).

The ECM has been used in research to analyze users’ continuous use of IS contexts such as ride-hailing (Malik and Rao, 2019); food delivery services (Ramos, 2022), and mobile payment (Purohit et al., 2022; Sasongko et al., 2022). Thanks to ECM’s capability to examine continuation intention in the context of mobile apps and financial services, the model is used in this study to predict users’ continuance intention in the m-banking context.

Confirmation and PU are the factors that determine whether customers are satisfied with the IT. In many contexts, such as those involving the internet, information systems, and m-commerce, PU is a significant predictor of behavioral intention (Nabavi et al., 2016). Furthermore, confirmation may be used to express the perceived usefulness of IS, particularly when the users’ first perception of usefulness is not definite since they are unsure of what to expect from utilizing the IS.

Prior studies identify various antecedents of CI, which are divided into four basic categories: technological, psychological, social, and behavioral factors (Yan et al., 2021). Poromatikul et al. (2020) studied the post-adoption of m-banking and found that continued usage is strengthened by satisfaction, perceived usefulness, trust, and confirmation.

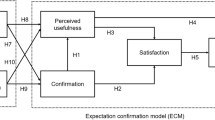

As this study is grounded in ECM, our research model has inherited the original ECM’s five factors (i.e., confirmation, perceived usefulness, satisfaction, and continuance intention) and its generic hypotheses. Based on the ECM and the aforementioned prior published studies (Ha et al., 2022; Tam et al., 2020; Yuan et al., 2016), this research proposes the following hypotheses:

H1: Users’ satisfaction is positively associated with continuance intention to use m-banking.

H2: Perceived usefulness is positively associated with continuance intention to use m-banking.

H3: Perceived usefulness is positively associated with users’ satisfaction.

H4: Confirmation is positively associated with users’ satisfaction.

H5: Confirmation is positively associated with the perceived usefulness of m-banking.

Decomposed theory of planned behavior

The work by Taylor and Todd (1995) applies the TPB to technological innovations by decomposing its monolithic or unidimensional belief structures into a set of multidimensional constructs that explain user behaviors in various IT-enabled contexts (p.140). While TPB (Ajzen, 1991) includes unidimensional belief structures, including attitudes, subjective norm (SN), and perceived behavioral control (PBC) (e.g., self-efficacy), decomposed TPB disintegrates these structures into multidimensional contextual variables. According to DTPB, (1) behavioral belief or TPB’s attitude is fragmented into three factors compatibility, complexity, and relative advantage; (2) normative belief is a subjective norm; (3) control beliefs are divided into the efficacy and facilitating conditions. Researchers have largely employed DTPB to predict user pre-adoptive (i.e., adoption) and post-adoptive usage of IT-enabled services in numerous settings. Rodríguez Del Bosque and Herrero Crespo (2011) have investigated users’ acceptance of e-commerce. While Lau and Kwok (2007) investigated how e-government strategies impact small and medium enterprises (SMEs), Ajjan et al. (2014) inspected employees’ continued usage of a company’s instant messaging applications. Regarding the app-based business context, researchers have studied the associations of SN, PBC with CI on m-commerce acceptance (Khoi et al., 2018), the impacts of PU and SN on user satisfaction and continued usage intention towards ride-hailing applications (Joia and Altieri, 2018). In mobile banking, a few researchers have applied DTPB (Souiden et al., 2021), for example, Zhou (2014) examined continuance usage. Thus, the DTPB’s application can enlighten the behavioral usage and intention in the mobile banking setting. Three DTPB’s belief structures are prospective determinants of customer behavioral adaptation and continuance usage (Taylor and Todd, 1995).

Subjective norm

TPB and DTPB view subjective norm (SN) as a key social determinant encouraging user intention to specific actions (Bhattacherjee and Lin, 2015; Mouakket, 2015). SN is denoted as the perceived external pressures (e.g., from important people) on whether to conduct a specific action in a certain situation (Lee and Kim, 2021). In our study, the subjective norm is regarded as recommendations, guidance, or opinions from key persons (i.e., colleagues, friends, or family members) for users to use mobile banking (Mohammadi, 2015). The influence of SN on user behavioral intention has been recognized by previous studies, including Fu and Juan (2017) in transportation service, Liébana-Cabanillas et al. (2015) in m-payment, Marinkovic and Kalinic (2017) in e-shopping, Zhao and Bacao (2020) in food-delivery services, and (Hamilton et al., 2021) for e-health services. The more the customers accept suggestions, the more likely it is that they will decide to use mobile applications. Recently, the importance of the associations between SN and satisfaction, behavioral intention, and actual use of m-application services has been reported in fintech and mobile banking studies (Daragmeh et al., 2021). Hence, the study suggests two following hypotheses:

H8: Subjective norm is positively associated with continuance intention to use m-banking.

H10: Subjective norm is positively associated with behavioral adaptation to m-banking.

Self-efficacy

According to the DTPB, facilitating conditions and self-efficacy (SE) that are distinct from a user control belief, influence both behavioral intention and actual usage behavior. Bandura (2010) explained SE as users’ beliefs in their abilities to act effectively and stated that self-efficacy judges “how people feel, think and behave” (p. 1). A prior study by Gupta et al. (2020) examined user SE and its significant impact on behavioral intention in Internet banking and payment. While Thakur (2018) denoted that SE is linked to continuance intention in m-commerce, Kang and Lee (2015) posited that SE is a determinant of CI towards online services. In e-learning, Rekha et al. (2023) argued that SE impacts users’ behavioral usage activities. For the ride-hailing service, while Malik and Rao (2019) examined the linkage between SE and continuance intention, Nguyen and Ha (2022) advanced to study further how SE influences user behavioral adaptation and continuance intention. Thus, we hypothesize the following hypotheses:

H7: Self-efficacy is positively associated with continuance intention to use m-banking.

H11: Self-efficacy is positively associated with behavioral adaptation to m-banking.

IT adaptation and adaptive structuration theory for individuals

There are various definitions of IT adaptation (Nguyen and Ha, 2022), such as reinvention (Rogers, 1983), mutual adaptation (Leonard-Barton, 1988), appropriation (DeSanctis and Poole, 1994), post-adoption (Jasperson et al., 2005), and so on. Researchers claim that technological adaptation refers to modifications and changes made once a new technology is installed in a specific organizational context (Orlikowski, 2000). Leonard-Barton (1988) stated that adaptation is mutual adaptation because of that technology features and users’ behaviors need to adapt to each other simultaneously and efficiently. Rogers (1983) argued that users could continue to use IT when the spread of an IT reaches the confirmation phase as it is adopted. IT implementation literature (Jasperson et al., 2005) has classified the process into six phases (i.e., initiation, adoption, adaptation, acceptance, usage, and incorporation). Amongst these phases, adaptation is considered to be one in which users perform actions on the IT to assimilate it appropriately into their workplace.

According to Ha et al. (2022), there is a prevailing framework for exploring IT adaptation that involves a pair of theories including adaptive structuration theory (AST) (DeSanctis and Poole, 1994) and adaptive structuration theory for individual (ATSI) (Schmitz et al., 2016). The difference between the two theories is that while the AST is generally applied to study organizational and group adaptation, the ASTI is applied at the individual level. In contrast, the commonality is that both theories defined the adaptation process as a consequence of a “structure episode”, the mutual interaction between IT and the user’s task in the workplace. The adaptation process has three characteristic input blocks, including technological, task, and personal characteristics, that create the output of better decision outcomes (DeSanctis and Poole, 1994; Schmitz et al., 2016). Accordingly, when implementing IT into group or individual activities, users try, modify, and adapt the IT to achieve better outputs or make decisions. Additionally, the task-technology fit (Goodhue and Thompson, 1995) considered IT utilization as an integrated concept having three adaptive elements (i.e., technology, task, and individual actions with both). Inspired by TTF, Barki et al. (2007) formed the Information System Use-Related Activity Model (ISURA) that defined individual adaptation as a combination of three factors including interaction, task-technology adaptation, and self-adaptation. Furthermore, according to Beaudry and Pinsonneault (2005), user adaptation is coping behaviors that are employees’ efforts relevant to technology, work, and personal factors. Thus, IT adaptation is explained as user behaviors that show how people use and change technology, how decisions are made, how well they perform, and whether they continue working with the IT (Barki et al., 2007; Beaudry and Pinsonneault, 2005; Nguyen and Ha, 2022). Considering prior seminal research, this article has defined user adaptations as activities performed by users that adjust the features of m-banking applications and practices of doing banking to meet their preferences, necessities, and circumstances. Therefore, behavioral adaptation for a mobile banking service can increase customer satisfaction and encourage customers to keep using it in the future.

Even though studies have identified IT adaptation as a determinant in post-adoptive behavior or continuation, research on this topic has not yet been completed. (Bhattacherjee and Barfar, 2011; Nguyen and Ha, 2021). Very few researches confirm the impact of user adaptation on CI and investigate it in the context of mobile banking. To address this gap, this study intends to investigate the correlations of behavioral adaptation with user satisfaction and continuance by hypothesizing the following:

H6: Behavioural adaptation is positively associated with continuance intention to use m-banking.

H12: Behavioural adaptation is positively associated with user satisfaction.

In addition, the construct of perceived compatibility towards a specific behavior is considered comparable to expected performance or PU (Taylor and Todd, 1995; Venkatesh et al., 2003). Thus, it is the user’s perceived usefulness of the m-banking app characteristics and its service advantages over traditional financial payment methods that combine to encourage users to utilize the m-banking service (Susanto et al., 2016). Based on these theories and the aforementioned argument, we propose the following:

H9: Perceived usefulness is positively associated with behavioral adaptation to m-banking.

Trust

Trust is studied in many different contexts and has various definitions, reflecting the meaningful nature of trust (Soleimani, 2022). One of the most acceptable definitions in the marketing and information technology literature of trust is proposed by Mayer et al. (1995), who claim that trust is understood as “the willingness of a party to be vulnerable to the actions of another party based on the expectation that the other will perform a particular action important to the trustor, irrespective of the ability to monitor or control that other party” (Mayer et al., 1995). In the e-commerce environment, researchers argued that trust helps users to overcome their perception of risk and unwillingness, and users are likely to conduct the following actions: accepting recommendations from e-commerce vendors, sharing information online, and, most importantly, purchasing from e-commerce applications (McKnight et al., 2002). Trust is seen as consisting of three belief components, including ability, integrity, and benevolence.

While ability means that m-commerce providers have the knowledge and skills to accomplish their duties, integrity means that they will maintain their commitments and not betray the consumers, and benevolence means that online commerce businesses prioritize and care for their consumers’ benefits, not just their own. In mobile payment, scholars have claimed that trust is the faith that encourages online buyers to become willingly susceptible to the m-payment providers after realizing the characteristics of the payment from which they are dealing (Al-Adwan et al., 2020). Another point is that in m-commerce, while Wei et al. (2009) denoted that trust is a belief in the safety of using m-commerce, Sasongko et al. (2022) referred to trust as the willingness of users to take risks caused by the transactions of another party (e.g., a bank), believing in the expectation that the bank will take beneficial action in favor of the bank users. Researchers also posited trust as an essential direct influencer of continuance intention in the online shopping context and mobile payment settings (Poromatikul et al., 2020).

Drawing on prior studies, in our study, trust is the belief that enables users to engage in m-banking service voluntarily, while considering its susceptible mutual features. Trust likely reduces the user’s perception of risk and reluctance and encourages user initial usage (i.e., pre-adoption), enables users to make use of m-banking services and leads to continuance usage (Gao et al., 2015; Nguyen and Ha, 2021). While trust is inspected as a contingent factor in limited contexts such as human resources (Zhou et al., 2022), online hospitality (Han et al., 2022), and e-government (Lee and Kim, 2022), very few explored its moderating role in the financial sector such as mobile banking (Ashique Ali and Subramanian, 2022). For e-wallet services, Senali et al. (2022) have investigated the role of trust as a moderator in the interactions between users’ perceptions of the service (e.g. perceived usefulness) on intentions to use. Chong et al. (2023) have investigated the moderating effect of trust on CI in the e-commerce context in Malaysia. As such, based on previous studies, we propose the following:

H13: Trust moderates the relationships between adaptation and users’ continuance intention in using m-banking.

H14: Trust moderates the relationships between satisfaction and users’ continuance intention in using m-banking.

Thus, based on the above theoretical references, the research model including theoretical hypotheses is presented in Fig. 1.

Methodology

Data collection and sample

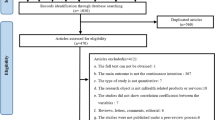

Our research involves a questionnaire-based survey conducted with m-banking service customers in Hanoi, Ho Chi Minh City, and Danang, the three busiest megacities of Vietnam (World Population Review, 2022). The m-banking respondents were selected from Vietcombank, Vietinbank, and Techcombank, which are ranked the largest banks in the country (Vietnam Credit, 2021). The selection was based on the following three criteria suggested by Shaikh et al. (2023): (1) being a mobile banking account holder, (2) being a mobile banking account holder, (2) having downloaded an m-banking app, and (3) having experience in using at least one m-banking service, such as bill payment and money transfers. The pre-test for questionnaire items was also carried out using group discussions with twenty (n = 20) bank officials, experts in financial, and banking and management information system sectors, and m-banking users. The purpose of the pre-test was to gauge if any items used unfamiliar language or wording in the questionnaire (Colton and Covert, 2007).

The questionnaire was finalized with three parts, including (1) a screening questions part and a brief explanation of mobile banking services (as suggested by the pre-test), (2) the second part comprised 30 observed items, and (3) items designed to gather the participants’ demographic details. A total of 700 questionnaires were distributed using convenience and snowball sampling approaches, which were considered appropriate methods given the context of our research model regarding a novel e-service (i.e., mobile banking) and the challenge of limited business data availability of an emerging market such as Vietnam (Calder et al., 1981; Sarstedt et al., 2017). The data was collected between January and June 2022, primarily through face-to-face interviews, as numerous respondents suggested on the day of the interview that they could respond later using various electronic media.

Of the 700 questionnaires delivered, 523 were completed and valid, which accounted for 74.7%. Face-to-face interviews and online responses accounted for 69% and 31%, respectively. To reduce response bias, a group of interviewers who were senior banking and financial management students were trained on survey skills (e.g., keeping the questionnaire’s order, not rephrasing questions) before undertaking the interviews. The respondents were informed during the recruitment process that the interview was voluntary, and their responses were treated with confidentiality. The respondents were asked to tick the consent box before an interview. All respondents were between the ages of 18 and 65. Men comprise 49% of respondents, and women comprise 51%. While students accounted for 17%, officers and other professionals who were m-banking users accounted for 55% and 28%, respectively. The majority of MB users received a monthly income of $335 to $1250, but students received less than $335 per month. Table 1 presents a summary of respondents’ profiles, including gender, age, occupation, position, and monthly income.

The study sample size is 523, which is larger than “ten times the largest number of structural paths directed at a particular latent construct in the model” (Henseler et al., 2009). As presented in Fig. 1, our research model consists of five paths (from PU, SA, ADP, SN, and SE) that connect to the dependent variable of CI, suggesting that several samples of above fifty should be used. Therefore, our study’s total of 523 responses fulfills the PLS-SEM minimum sample size condition (Ha et al., 2023; Hair et al., 2019; Shmueli et al., 2019).

Measurement Scale

This study measures items using a Likert scale with seven points ranging from strongly disagree (1) to strongly agree (7). The seven-point Likert scale is considered a measurement with a relatively high degree of precision and simplicity (Nunnally, 1978). Measurements from earlier literature were obtained and appropriately adjusted to ensure content validity (Trochim et al., 2016).

The scales for CI and confirmation are each measured using three items. The CI scale is modified from Bhattacherjee (2001) and Baabdullah et al. (2019), while the confirmation scales are altered from Susanto et al. (2016). The scales for PU, SE, subjective norm SN, and ADP are measured in four items for each construct. PU is adapted from Davis et al. (1989) and Baabdullah et al. (2019), and SE is taken from Taylor and Todd (1995) and Susanto et al. (2016). The SN scale is modified from Bhattacherjee and Lin (2015) and Park et al. (2019). The scale for trust is adapted from Gefen et al. (2003) and Gao et al. (2015). The measures for ADP were taken by Nguyen and Ha (2022) and Barki et al. (2007).

Empirical analysis and results

Evaluating outer model

A potential issue in a survey sample is identified as common method variance (CMV) bias. Harman’s single-factor test is used because it is appropriate for testing CMV (Podsakoff et al., 2012). The findings show that the single factor is 22.067% of the variance, which is far less than 50%. Thus, in our findings, CMB does not appear to be a concern (Podsakoff et al., 2012). In addition, we conducted a comprehensive collinearity analysis using SmartPLS to calculate the variance inflation factor (VIF) (Becker et al., 2015). The results indicate that all VIF values are lower than the recommended threshold of 3, suggesting that CMV bias is not an issue in our study (Kock, 2017).

Subsequently, we used SmartPLS 4 for our data analysis. Table 2 presents the calculations of the outer model assessments, including the outer loadings, Cronbach’s alpha, composite reliability (CR), rho_A, rho_C, and average variance extracted (AVE). During the reliability assessment, an indicator (PU3) was removed as its value was lower than the cut-off point of 0.7 (Hair et al., 2019). Moreover, as shown in Table 2, all CR values range from 0.703 (TR) to 0.832 (SE), which is greater than the required value of 0.70 (Hair et al., 2019; Jöreskog, 1971). This suggests that all constructs meet the consistent reliability requirement.

This study uses the heterotrait–monotrait ratio of correlations (HTMT) to assess discriminant validity, ensuring that HTMT values should be below 0.85 (Hair et al., 2019; Kline, 2015). All AVEs results range from 0.527 (TR) to 0.693 (CI), indicating that convergent validity has been achieved. Therefore, as the test displays that all HTMT values are less than 0.85, this demonstrates that discriminant validity has been gained and that the constructs of the research’s model are reliable and valid. The results can be found in Table 3.

Evaluating inner model

Following the confirmation of the external model’s quality, the internal model is evaluated. During this step, the hypothesized direct and moderating relationships were examined, as well as the model’s accuracy and predicting strengths were calculated (Dawson, 2019). The recommended subsampling of 5000 for bootstrapping was used and its results are described subsequently.

First, the variance inflation factor (VIF) or collinearity was checked and all values were below 3, ensuring that the multicollinearity issue of the inner model was resolved (Hair et al., 2017). Next, standard assessment criteria were evaluated to determine the significance of path coefficients. The criteria include the coefficient of determination (R-squared), t-statistics, and p-value (Hair et al., 2014). Figure 2 depicts the path coefficients and R-squared for all variables. As Fig. 2 shows, R2 (CI) = 0.243, R2 (ADP) = 0.096, and R2 (SA) = 0.222. According to (Hair et al., 2019), the higher the R-squared value, the stronger the explanatory power of the inner model, and the endogenous constructs are more predictable. After this, the PLSpredict was additionally computed to assess the predictive power of the model (Ringle et al., 2022).

Table 4 presents the model’s quality criteria from the bootstrapping calculation results. As illustrated in Table 4, except for the direct link SN-CI (H8), all relationships are statistically confirmed as all of the p-values are less than 0.05. The predictive performance calculation procedure was carried out with a holdout sample-based and cross-validation coefficient k = 10. Accordingly, the structural model’s predictive performance was established since the Q-square predicted values of PU, SA, ADP, and CI were all greater than zero (Shmueli et al., 2019).

Evaluation moderating effects

Trust is theorized to have a moderating role in the relationships between the link ADP-CI (H6) and the link SA-CI (H1). The data analysis has found that while TR has a significant positive effect (β = 0.133, ρ = 0.002) on the relationship of ADP-CI (H13 was supported), it has an insignificant effect on the link of SA-CI (ρ = 0.104) (H14 is not supported). Accordingly, the support of H13 shows that the effect of TR on CI depends on ADP. As shown in Fig. 3, the slope of the line, depicting the moderating effect of TR on the relationship between ADP and CI, is greater for a higher TR as compared to a lower TR. Therefore, the higher the TR value, the stronger the relationship between ADP and CI and vice versa. This finding provides empirical evidence that unveils a moderating effect of TR on the association of ADP and CI.

Discussions and implications

Discussions

This study has developed an innovative model to predict the intention to continue using mobile banking apps in Vietnam, based on three theoretical frameworks: ECM, ASTI, and DTPB, and the perspective of trust. The study’s extended expectation-confirmation model includes four factors: PU, CON, SA, and CI, and incorporates two variables from DTPB (SN and SE), one from ASTI (ADP), and the perspective of trust. Except for the direct association SN – CI (H8) and the moderating link of TR on SA-CI, all the hypotheses were confirmed (H1 to H7, H9 to H13). The study found that user adaption was an important driver of CI, and trust played a moderating role in the relationship between behavioral adaptation and CI.

The study found that user adaptation statistically affects continuance intention. The finding is consistent with previous research (Ha et al., 2022), indicating that “intention to reuse” is contextually associated with actual usage. IT adaptation, supported by perceived usefulness, self-efficacy, and subjective norm, has impacted continuance intention to use mobile banking. This means that mobile banking providers must offer digital banking services that are more advantageous in terms of functional features, convenience, and comparable prices than traditional services. Applications must also be simple to use to support user confidence. In summary, users are encouraged by influencers with their IT abilities to adapt to mobile banking by modifying and tailoring the application’s functionalities. Once adopted, users are driven to continue using the platform.

The study also found that PU, CON, SA, SN, and SE are all positively related to CI, which is consistent with prior empirical research (Chiu et al., 2021; Gupta et al., 2020; Lu et al., 2017; Yuan et al., 2016). User satisfaction during the adaptation process is a significant element fostering users’ continuance intention of mobile banking. The study indicates that only SE has a positive impact on CI, while SN does not. The study also suggests that social influence is less appropriate when individuals decide whether to continue using the banking application. Therefore, banks must appropriately strategize to enhance customers’ self-efficacy in mobile banking.

The study evaluated the moderating effects of trust on the relationships between IT adaptation and user satisfaction and continuance intention of m-banking settings. The findings confirm that trust plays a moderating role in the link of ADP-CI, while no evidence trust moderates the link of SA-CI. The study suggests that once trusted, users will begin to adjust their behavior and improve their intention to continue using the mobile banking application (Foroughi et al., 2019; Yuan et al., 2016).

Contrary to our expectations, this study did not find any evidence that trust has moderated the link of SA-CI (H14 is not supported). While numerous earlier research studies have confirmed a positive association between trust and SA (Sharma and Sharma, 2019) and the moderating role of trust on SA-CI (Kourouthanassis et al., 2015), an important finding of the current study does not support this moderating effect. Unlike Zhou et al. (2018), who asserted that trust moderates the link between satisfaction and CI negatively in online payment platforms in China, users’ trust in our study’s findings surprisingly has no moderating effects on the relationship between user satisfaction and continuance intention to use mobile banking. This discrepancy may be because the impact of trust on customers’ perceptions and behaviors will change over time (Grayson and Ambler, 1999). Thus, trust may not have an impact on the SA-CI relationship when customers have adapted and are satisfied with the service. In other words, customer satisfaction and adaptation to mobile banking services significantly impact their intention to continue using it and are not moderated by their belief like trust. In addition, this conclusion also confirmed that the ECM is an extensively robust model for explaining IS continuance intention (Franque et al., 2020).

Theoretical contribution

The study provides three theoretical contributions by filling considerable gaps in IT continuance literature. First, this study is the first to integrate three theoretical frameworks, namely, ECM, DTPB, and ASTI, and user adaptation and trust perspectives to provide an innovative extended ECM model to predict user CI in a mobile banking setting. While these three theories have been regarded as foundational frameworks for measuring outcome behavioral changes and performance (e.g., post-adoptive behavior) (DeLone and McLean, 2016; Tam et al., 2020; Yan et al., 2021), earlier research has been reluctant to combine these theories and their key variables, thus providing little evidence on how these factors affect CI. The findings reaffirm all the model’s hypotheses, yet not the direct impact of SN on CI in m-banking. Therefore, the research model validated by this study can be considered a theoretical base model for predicting continuance intention in m-commerce and similar settings.

Second, our model is a pioneer for assessing the moderating role of trust in two relatively new relationships between SA-CI, and ADP-CI. While behavioral adaptation and trust have been recognized as substantial influencers to continuance intention and user satisfaction (Franque et al., 2020; Nguyen and Ha, 2021), few or no studies have ever explored the moderator of trust on these two links. The fact that the results confirm that trust has moderated the effect of adaptation to CI but has not moderated the connection between SA and CI has enriched the IT continuance literature with the importance of IT adaptation and trust.

Third and last, the study extends the limited research on understanding SN, SE, and its determining impact on user adaptation CI in m-banking services. This study is amongst the first to utilize DTPB to decompose its monolithic belief structures of normative belief (SN) and control belief (SE) (Taylor and Todd, 1995) as well as evaluate how these decomposed factors directly affect CI and user adaptation, leading to CI (Nguyen and Ha, 2022).

Managerial implications

The research results also bring to mobile banking service providers various practical managerial implications. First, a detailed knowledge of the elements that influence users’ intentions to continue using mobile banking can assist service providers in identifying factors that influence mobile banking use. According to the findings, IT adaptation is the best predictor of user CI, followed by PU, SE, and SA. Therefore, the facilitating adaptation process of the m-banking application is very important for banks to shape their users’ intention to continue using the app. Vietnamese banking managers should provide customizable and personalized services that fit different customer needs. Secondly, the study finds that perceived usefulness has substantial effects on continued usage intention. This suggests mobile banking providers need to introduce an accessible, convenient, beneficial, and easy-to-use mobile banking system. Third, the results show that trust has a moderated role in the relationship between adaptation and continuance intention. Therefore, financial service providers should develop customer confidence that mobile banking is safe and risk-free and that customers are protected when performing transactions. Additionally, the study’s findings might be essential for banks to retain their current m-banking customers. Fourth and finally, this study has some important implications for government regulators. It can help regulators recognize m-banking users’ involvement in platform governance. Many stakeholders, including users, must be involved in developing laws and regulations for the m-banking service industry. The banking policymakers must provide and enforce laws to ensure that m-banking service frameworks are advantageous, convenient, innovative, trustworthy, and easily adaptable (Kandpal, 2023; Poromatikul et al., 2020). In addition, m-banking institutions must invest significant investments in banking technology infrastructures and mobile banking platform functions and features to assist the adaptation process and eventually fulfill customers’ needs (Kandpal, 2020). Additionally, it is essential for banking regulators in Vietnam, an emerging country, to actively support and facilitate m-banking by establishing policies and guidelines that ensure the implementation of robust safety measures. It will provide a secure regulatory environment for mobile banking providers and customers to utilize the service confidently.

Conclusion

The fast growth of m-banking services in society affects both banks and customers. Especially, it alarms m-bank service providers about competitiveness, customer retention, and keeping up with market growth. This is because customers of banks, both online and conventional, are willing to utilize the new mobile banking form and its services routinely. On the other hand, mobile banks rely more on maintaining users to compete in the digital marketplace. Bank management seeks direction in figuring out how to maintain customers and enhance their services.

This study set out to explore the influence of adaptation, satisfaction, and their antecedents on the continuance usage intention to use mobile banking. We also examined the moderating role of trust on the influences of adaptation and satisfaction on continuance intention. The findings of this study demonstrate that user adaptation plays an eminent role in influencing continuance use intention. The results of this research not only contribute to the continuance intention literature in an m-banking context, but they also provide valuable information to enable banks and their managers to understand the factors that may motivate m-banking users to continue to use this system.

The findings present an extensive and detailed examination of users’ adaptation and the variables that influence their continuance intention using m-banking. Bank management and policymakers are seeking in-depth understanding and solutions to leverage the mobile banking market, as well as firms’ capability to enable customer adaptation and usage. For banks, achieving the goal of retaining customers who have adapted to the m-banking apps is a sustainable success. The findings address the lack of mobile banking literature by providing a research model and validating its theoretical hypotheses in the Vietnamese mobile banking sector for platform-based services. The associations between essential factors, including customers’ perceived usefulness, subjective norm, self-efficacy, adaptation, and trust with their continued usage are confirmed. The study findings would certainly promote mobile banks in Vietnam and other emerging economies, in Southeast Asia and worldwide.

Limitations and future research

The study has some unavoidable limitations that should be addressed in future studies. First, we only focused on customers’ use of m-banking applications in Vietnam, a developing country in Asia. While our findings serve as a guide for countries with similar contexts to Vietnam, future research could expand on m-banking use in developed countries’ contexts to improve the study’s generalization. Second, this research has yet to include individual technological and innovation characteristics that are potential factors for user behavior research in the “customer-focused” period (DeLone and McLean, 2016) within the IT-enabled services context. Future studies should consider individual innovativeness and how this factor influences users’ CI.

Data availability

All data generated or analyzed during this study are included in this published article and its supplementary file.

References

Abbasi GA, Sandran T, Ganesan Y, Iranmanesh M (2022) Go cashless! Determinants of continuance intention to use E-wallet apps: A hybrid approach using PLS-SEM and fsQCA. Technol Soc 68(1):101937. https://doi.org/10.1016/j.techsoc.2022.101937

Ajjan H, Hartshorne R, Cao Y, Rodriguez M (2014) Continuance use intention of enterprise instant messaging: a knowledge management perspective. Behav Inf Technol 33(7):678–692. https://doi.org/10.1080/0144929X.2014.886722

Ajzen I (1991) The theory of planned behavior. Organ Behav Hum Decis Process 50(2):179–211. https://doi.org/10.1016/0749-5978(91)90020-T

Al-Adwan AS, Kokash H, Adwan AA, Alhorani A, Yaseen H (2020) Building customer loyalty in online shopping: the role of online trust, online satisfaction and electronic word of mouth. Int J Electron Mark Retail 11(3):278–306. https://doi.org/10.1504/IJEMR.2020.108132

Ashique Ali KA, Subramanian R (2022) Current status of research on mobile banking: an analysis of literature. J Bus Perspect 28(1):7–18. https://doi.org/10.1177/09722629211073268

Baabdullah AM, Alalwan AA, Rana NP, Kizgin H, Patil P (2019) Consumer use of mobile banking (M-Banking) in Saudi Arabia: towards an integrated model. Int J Inf Manag 44(1):38–52

Bandura A (2010) Self-efficacy. In: The corsini encyclopedia of psychology. John Wiley & Sons, Inc

Barki H, Titah R, Boffo C (2007) Information system use–related activity: an expanded behavioral conceptualization of individual-level information system use. Inf Syst Res 18(2):173–192. https://doi.org/10.1287/isre.1070.0122

Barnes SJ, Corbitt B (2003) Mobile banking: concept and potential. Int J Mob Commun 1(3):273–288. https://doi.org/10.1504/IJMC.2003.003494

Beaudry A, Pinsonneault A (2005) Understanding user responses to information technology: a coping model of user adaptation. MIS Q 29(3):493–524. https://doi.org/10.2307/25148693

Becker J-M, Ringle CM, Sarstedt M, Völckner F (2015) How collinearity affects mixture regression results. Mark Lett 26(4):643–659. https://doi.org/10.1007/s11002-014-9299-9

Bhattacherjee A (2001) Understanding information systems continuance: an expectation-confirmation model. MIS Q 25(3):351–370. https://doi.org/10.2307/3250921

Bhattacherjee A, Barfar A (2011) Information technology continuance research: current state and future directions. Asia Pac J Inf Syst 21(2):1–18

Bhattacherjee A, Lin C-P (2015) A unified model of IT continuance: three complementary perspectives and crossover effects. Eur J Inf Syst 24(4):364–373. https://doi.org/10.1057/ejis.2013.36

Calder BJ, Phillips LW, Tybout AM (1981) Designing research for application. J Consum Res 8(2):197–207. https://doi.org/10.1086/208856

Chaouali W, Lunardo R, Yahia IB, Cyr D, Triki A (2019) Design aesthetics as drivers of value in mobile banking: does customer happiness matter? Int J Bank Mark 38(1):219–241. https://doi.org/10.1108/IJBM-03-2019-0100

Chiu W, Cho H, Chi CG (2021) Consumers’ continuance intention to use fitness and health apps: an integration of the expectation–confirmation model and investment model. Inf Technol People 34(3):978–998. https://doi.org/10.1108/ITP-09-2019-0463

Chong HX, Hashim AH, Osman S, Lau JL, Aw EC-X (2023) The future of e-commerce? Understanding livestreaming commerce continuance usage. Int J Retail Distrib Manag 51(1):1–20. https://doi.org/10.1108/IJRDM-01-2022-0007

Colton D, & Covert RW (2007). Designing and constructing instruments for social research and evaluation. John Wiley & Sons

Daragmeh A, Lentner C, Sági J (2021) FinTech payments in the era of COVID-19: Factors influencing behavioral intentions of “Generation X” in Hungary to use mobile payment. J Behav Exp Financ 32(1):100574. https://doi.org/10.1016/j.jbef.2021.100574

Davis FD, Bagozzi RP, Warshaw PR (1989) User acceptance of computer technology: a comparison of two theoretical models. Manag Sci 35(8):982–1003. https://doi.org/10.1287/mnsc.35.8.982

Dawson C (2019). A-Z of digital research methods. Routledge

DeLone WH, McLean ER (2016) Information systems success measurement. Found Trends Inf Syst 2(1):1–116. https://doi.org/10.1561/2900000005

DeSanctis G, Poole MS (1994) Capturing the complexity in advanced technology use: adaptive structuration theory. Organ Sci 5(2):121–147. https://doi.org/10.1287/orsc.5.2.121

Filotto U, Caratelli M, Fornezza F (2021) Shaping the digital transformation of the retail banking industry. Empirical evidence from Italy. Eur Manag J 39(3):366–375. https://doi.org/10.1016/j.emj.2020.08.004

Foroughi B, Iranmanesh M, Hyun SS (2019) Understanding the determinants of mobile banking continuance usage intention. J Enterp Inf Manag 32(6):1015–1033. https://doi.org/10.1108/JEIM-10-2018-0237

Franque FB, Oliveira T, Tam C (2021) Understanding the factors of mobile payment continuance intention: empirical test in an African context. Heliyon 7(8):07807. https://doi.org/10.1016/j.heliyon.2021.e07807

Franque FB, Oliveira T, Tam C, Santini FdO (2020) A meta-analysis of the quantitative studies in continuance intention to use an information system. Internet Res 31(1):123–158. https://doi.org/10.1108/INTR-03-2019-0103

Fu X, Juan Z (2017) Understanding public transit use behavior: integration of the theory of planned behavior and the customer satisfaction theory. Transportation 44(5):1021–1042. https://doi.org/10.1007/s11116-016-9692-8

Gao L, Waechter KA, Bai X (2015) Understanding consumers’ continuance intention towards mobile purchase: a theoretical framework and empirical study – a case of China. Comput Hum Behav 53(1):249–262. https://doi.org/10.1016/j.chb.2015.07.014

Gefen D, Karahanna E, Straub DW (2003) Trust and TAM in online shopping: an integrated model. MIS Q 27(1):51–90. https://doi.org/10.2307/30036519

Goodhue DL, Thompson RL (1995) Task-technology fit and individual performance. MIS Q 19(2):213–236. https://doi.org/10.2307/249689

Grayson K, Ambler T (1999) The dark side of long-term relationships in marketing services. J Mark Res 36(1):132–141. https://doi.org/10.1177/002224379903600111

Gupta A, Yousaf A, Mishra A (2020) How pre-adoption expectancies shape post-adoption continuance intentions: an extended expectation-confirmation model. Int J Inf Manag 52(1):102094. https://doi.org/10.1016/j.ijinfomgt.2020.102094

Ha M-T, Nguyen G-D, Doan B-S (2023) Understanding the mediating effect of switching costs on service value, quality, satisfaction, and loyalty. Humanit Soc Sci Commun 10(1):288. https://doi.org/10.1057/s41599-023-01797-6

Ha M-T, Nguyen G-D, Nguyen M-L, Tran A-C (2022) Understanding the influence of user adaptation on the continuance intention towards ride-hailing services: the perspective of management support. J Glob Bus Adv 15(1):39–62. https://doi.org/10.1504/JGBA.2022.127208

Hair JF, Hult GTM, Ringle CM, Sarstedt M (2017) A primer on partial least squares structural equation modeling (PLS-SEM). Sage publications, Thousand Oaks

Hair JF, Risher JJ, Sarstedt M, Ringle CM (2019) When to use and how to report the results of PLS-SEM. Eur Bus Rev 31(1):2–24. https://doi.org/10.1108/EBR-11-2018-0203

Hair JF, Sarstedt M, Hopkins L, Kuppelwieser V (2014) Partial least squares structural equation modeling (PLS-SEM). Eur Bus Rev 26(2):106–121. https://doi.org/10.1108/EBR-10-2013-0128

Hamilton K, Keech JJ, Peden AE, Hagger MS (2021) Changing driver behavior during floods: Testing a novel e-health intervention using implementation imagery. Saf Sci 136(1):105141. https://doi.org/10.1016/j.ssci.2020.105141

Han W, Liu W, Xie J, & Zhang S (2022). Social support to mitigate perceived risk: moderating effect of trust. Current Issues in Tourism, 1-16. https://doi.org/10.1080/13683500.2022.2070457

Henseler J, Ringle CM, & Sinkovics RR (2009). The use of partial least squares path modeling in international marketing. In: Sinkovics RR & Ghauri PN (eds.). New Challenges to International Marketing (Vol. 20, pp. 277–319). Emerald Group Publishing Limited. https://doi.org/10.1108/S1474-7979(2009)0000020014

Hong J-C, Lin P-H, Hsieh P-C (2017) The effect of consumer innovativeness on perceived value and continuance intention to use smartwatch. Comput Hum Behav 67(1):264–272. https://doi.org/10.1016/j.chb.2016.11.001

Hsiao C-H, Chang J-J, Tang K-Y (2016) Exploring the influential factors in continuance usage of mobile social Apps: satisfaction, habit, and customer value perspectives. Telemat Inform 33(2):342–355. https://doi.org/10.1016/j.tele.2015.08.014

Jasperson JS, Carter PE, Zmud RW (2005) A comprehensive conceptualization of post-adoptive behaviors associated with information technology enabled work systems. MIS Q 29(3):525–557. https://doi.org/10.2307/25148694

Joia LA, Altieri D (2018) Antecedents of continued use intention of e-hailing apps from the passengers’ perspective. J High Technol Manag Res 29(2):204–215. https://doi.org/10.1016/j.hitech.2018.09.006

Jöreskog KG (1971) Statistical analysis of sets of congeneric tests. Psychometrika 36(2):109–133. https://doi.org/10.1007/BF02291393

Kandpal V (2020) Reaching sustainable development goals: bringing financial inclusion to reality in India. J Public Aff 20(4):e2277. https://doi.org/10.1002/pa.2277

Kandpal V (2023). Dimensions of financial inclusion in India: a qualitative analysis of bankers perspective. Qualitative Research in Financial Markets, ahead-of-print(ahead-of-print). https://doi.org/10.1108/QRFM-04-2022-0072

Kang YJ, Lee WJ (2015) Self-customization of online service environments by users and its effect on their continuance intention. Serv Bus 9(2):321–342. https://doi.org/10.1007/s11628-014-0229-y

Khan IU, Hameed Z, Khan SN, Khan SU, Khan MT (2022) Exploring the effects of culture on acceptance of online banking: a comparative study of Pakistan and turkey by using the extended UTAUT model. J internet Commer 21(2):183–216. https://doi.org/10.1080/15332861.2021.1882749

Khoa BT (2021) The Impact of the personal data disclosure’s tradeoff on the trust and attitude loyalty in mobile banking services. J Promot Manag 27(4):585–608. https://doi.org/10.1080/10496491.2020.1838028

Khoi NH, Tuu HH, Olsen SO (2018) The role of perceived values in explaining Vietnamese consumers’ attitude and intention to adopt mobile commerce. Asia Pac J Mark Logist 30(4):1112–1134. https://doi.org/10.1108/APJML-11-2017-0301

Kline RB (2015) Principles and practice of structural equation modeling. The Guilford Press, NY

Kock N (2017). Common Method Bias: A Full Collinearity Assessment Method for PLS-SEM. In H Latan & R Noonan (eds.), Partial Least Squares Path Modeling: Basic Concepts, Methodological Issues and Applications (pp. 245–257). Springer International Publishing. https://doi.org/10.1007/978-3-319-64069-3_11

Kourouthanassis P, Lekakos G, Gerakis V (2015) Should I stay or should I go? The moderating effect of self-image congruity and trust on social networking continued use. Behav Inf Technol 34(2):190–203. https://doi.org/10.1080/0144929X.2014.948489

Lau AS, Kwok VW (2007) How e-government strategies influence e-commerce adoption by SMEs. Electron Gov, Int J 4(1):20–42. https://doi.org/10.1504/EG.2007.012177

Lee H, Kim J (2022) Factors affecting rumor believability in the context of COVID-19: the moderating roles of government trust and health literacy. J Appl Commun Res 50(6):613–631. https://doi.org/10.1080/00909882.2022.2141069

Lee J-C, Tang Y, Jiang S (2023) Understanding continuance intention of artificial intelligence (AI)-enabled mobile banking applications: an extension of AI characteristics to an expectation confirmation model. Humanit Soc Sci Commun 10(1):333. https://doi.org/10.1057/s41599-023-01845-1

Lee S, Kim BG (2021) User, system, and social related factors affecting perceived usefulness for continuance usage intention of mobile apps. Int J Mob Commun 19(2):190–217. https://doi.org/10.1504/ijmc.2021.113457

Leonard-Barton DA (1988) Implementation as mutual adaptation of technology and organization. Res Policy 17(5):251–267. https://doi.org/10.1142/9789814295505_0019

Liébana-Cabanillas F, Ramos de Luna I, Montoro-Ríos FJ (2015) User behaviour in QR mobile payment system: the QR Payment Acceptance Model. Technol Anal Strateg Manag 27(9):1031–1049. https://doi.org/10.1080/09537325.2015.1047757

Lu J, Yu C-S, Liu C, Wei J (2017) Comparison of mobile shopping continuance intention between China and USA from an espoused cultural perspective. Comput Hum Behav 75:130–146. https://doi.org/10.1016/j.chb.2017.05.002

Malik G, Rao AS (2019) Extended expectation-confirmation model to predict continued usage of ODR/ride hailing apps: role of perceived value and self-efficacy. Inf Technol Tour 21(4):461–482. https://doi.org/10.1007/s40558-019-00152-3

Marinkovic V, Kalinic Z (2017) Antecedents of customer satisfaction in mobile commerce: exploring the moderating effect of customization. Online Inf Rev 41(2):138–154

Mayer RC, Davis JH, Schoorman FD (1995) An integrative model of organizational trust. Acad Manag Rev 20(3):709–734. https://doi.org/10.5465/amr.1995.9508080335

McKnight DH, Choudhury V, Kacmar C (2002) Developing and validating trust measures for e-commerce: an integrative typology. Inf Syst Res 13(3):334–359. https://doi.org/10.1287/isre.13.3.334.81

Mohammadi H (2014) Investigating users’ perspectives on e-learning: an integration of TAM and IS success model. Comput Hum Behav 45:359–374. https://doi.org/10.1016/j.chb.2014.07.044

Mohammadi H (2015) A study of mobile banking usage in Iran. Int J Bank Mark 33(6):733–759. https://doi.org/10.1108/IJBM-08-2014-0114

Mouakket S (2015) Factors influencing continuance intention to use social network sites: the Facebook case. Comput Hum Behav 53:102–110. https://doi.org/10.1016/j.chb.2015.06.045

Nabavi A, Taghavi-Fard MT, Hanafizadeh P, Taghva MR (2016) Information technology continuance intention: a systematic literature review. Int J E-Bus Res (IJEBR) 12(1):58–95. https://doi.org/10.4018/IJEBR.2016010104

Naruetharadhol P, Ketkaew C, Hongkanchanapong N, Thaniswannasri P, Uengkusolmongkol T, Prasomthong S, Gebsombut N (2021) Factors affecting sustainable intention to use mobile banking services. SAGE Open 11(3):21582440211029925. https://doi.org/10.1177/2158244021102992

Ngai EWT, Gunasekaran A (2007) A review for mobile commerce research and applications. Decis Support Syst 43(1):3–15. https://doi.org/10.1016/j.dss.2005.05.003

Nguyen DG, Ha M-T (2022) What makes users continue to want to use the digital platform? Evidence from the ride-hailing service platform in Vietnam. SAGE Open 12(1):18. https://doi.org/10.1177/21582440211069146

Nguyen G-D, Ha M-T (2021) The role of user adaptation and trust in understanding continuance intention towards mobile shopping: an extended expectation-confirmation model. Cogent Bus Manag 8(1):1980248. https://doi.org/10.1080/23311975.2021.1980248

Nunnally JC (1978). Psychometric Theory (2nd ed). McGraw-Hill

Oliver RL (1980) A cognitive model of the antecedents and consequences of satisfaction decisions. J Mark Res 17(4):460–469. https://doi.org/10.1177/002224378001700405

Orlikowski WJ (2000) Using technology and constituting structures: a practice lens for studying technology in organizations. Organ Sci 11(4):404–428. https://doi.org/10.1287/orsc.11.4.404.14600

Park J, Ahn J, Thavisay T, Ren T (2019) Examining the role of anxiety and social influence in multi-benefits of mobile payment service. J Retail Consum Serv 47(1):140–149. https://doi.org/10.1016/j.jretconser.2018.11.015

Podsakoff PM, MacKenzie SB, Podsakoff NP (2012) Sources of method bias in social science research and recommendations on how to control it. Annu Rev Psychol 63(1):539–569. https://doi.org/10.1037/0021-9010.88.5.879

Poromatikul C, De Maeyer P, Leelapanyalert K, Zaby S (2020) Drivers of continuance intention with mobile banking apps. Int J Bank Mark 38(1):242–262. https://doi.org/10.1108/IJBM-08-2018-0224

Purohit S, Arora R, Paul J (2022) The bright side of online consumer behavior: Continuance intention for mobile payments. J Consum Behav 21(3):523–542. https://doi.org/10.1002/cb.2017

PwC. (2018). The Future of ASEAN-Viet Nam Perspective. PwC Viet Nam offices. Retrieved 02.02 from https://www.pwc.com/vn/en/publications/2018/pwc-vietnam-future-of-asean-vietnam-perspective.pdf

Ramos K (2022) Factors influencing customers’ continuance usage intention of food delivery apps during COVID-19 quarantine in Mexico. Br Food J 124(3):833–852. https://doi.org/10.1108/BFJ-01-2021-0020

Rekha IS, Shetty J, Basri S (2023) Students’ continuance intention to use MOOCs: empirical evidence from India. Educ Inf Technol 28(4):4265–4286. https://doi.org/10.1007/s10639-022-11308-w

Ringle CM, Wende S, Becker J-M (2022) SmartPLS 4. SmartPLS GmbH. In, Oststeinbek

Rodríguez Del Bosque I, Herrero Crespo Á (2011) How do internet surfers become online buyers? An integrative model of e-commerce acceptance. Behav Inf Technol 30(2):161–180. https://doi.org/10.1080/01449291003656362

Rogers EM (1983) Diffutions of innovations. Free Press

Sarstedt M, Bengart P, Shaltoni AM, Lehmann S (2017) The use of sampling methods in advertising research: a gap between theory and practice. Int J Advertising 37(4):650–663. https://doi.org/10.1080/02650487.2017.1348329

Sasongko DT, Handayani PW, Satria R (2022) Analysis of factors affecting continuance use intention of the electronic money application in Indonesia. Proc Comput Sci 197(1):42–50. https://doi.org/10.1016/j.procs.2021.12.116

Schmitz KW, Teng JT, Webb KJ (2016) Capturing the complexity of malleable IT use: adaptive structuration theory for individuals. MIS Q 40(3):663–686. https://doi.org/10.25300/MISQ/2016/40.3.07

Senali MG, Iranmanesh M, Ismail FN, Rahim NFA, Khoshkam M, & Mirzaei M (2022). Determinants of intention to use e-wallet: personal innovativeness and propensity to trust as moderators. Iny J Hum Comput Interact, 1-13. https://doi.org/10.1080/10447318.2022.2076309

Shaikh AA, Alamoudi H, Alharthi M, Glavee-Geo R (2023) Advances in mobile financial services: a review of the literature and future research directions. Int J Bank Mark 41(1):1–33. https://doi.org/10.1108/IJBM-06-2021-0230

Shaikh AA, Karjaluoto H (2015) Mobile banking adoption: a literature review. Telemat Inform 32(1):129–142. https://doi.org/10.1016/j.tele.2014.05.003

Shao Z, Zhang L, Li X, Guo Y (2019) Antecedents of trust and continuance intention in mobile payment platforms: the moderating effect of gender. Electron Commer Res Appl 33(1):100823. https://doi.org/10.1016/j.elerap.2018.100823

Sharma SK, Sharma M (2019) Examining the role of trust and quality dimensions in the actual usage of mobile banking services: an empirical investigation. Int J Inf Manag 44(1):65–75. https://doi.org/10.1016/j.ijinfomgt.2018.09.013

Shmueli G, Sarstedt M, Hair JF, Cheah J-H, Ting H, Vaithilingam S, Ringle CM (2019) Predictive model assessment in PLS-SEM: guidelines for using PLSpredict. Eur J Mark 53(11):2322–2347. https://doi.org/10.1108/EJM-02-2019-0189

Smith S (2021). Over half of global population to use digital banking in 2026; driven by banking digital transformation. Retrieved from https://www.juniperresearch.com/press/over-half-global-population-digital-banking

Soleimani M (2022) Buyers’ trust and mistrust in e-commerce platforms: a synthesizing literature review. Inf Syst e-Bus Manag 20(1):57–78. https://doi.org/10.1007/s10257-021-00545-0

Souiden N, Ladhari R, Chaouali W (2021) Mobile banking adoption: a systematic review. Int J Bank Mark 39(2):214–241. https://doi.org/10.1108/IJBM-04-2020-0182

Sreelakshmi C, Prathap SK (2020) Continuance adoption of mobile-based payments in Covid-19 context: an integrated framework of health belief model and expectation confirmation model. Int J Pervasive Comput Commun 16(4):351–369. https://doi.org/10.1108/IJPCC-06-2020-0069

Statista. (2022). Digital Payments - Worldwide. Statista. https://www.statista.com/outlook/dmo/fintech/digital-payments/worldwide

Sullivan YW, Koh CE (2019) Social media enablers and inhibitors: understanding their relationships in a social networking site context. Int J Inf Manag 49(1):170–189. https://doi.org/10.1016/j.ijinfomgt.2019.03.014

Susanto A, Chang Y, Ha Y (2016) Determinants of continuance intention to use the smartphone banking services: an extension to the expectation-confirmation model. Ind Manag Data Syst 116(3):508–525. https://doi.org/10.1108/IMDS-05-2015-0195

Tam C, Santos D, Oliveira T (2020) Exploring the influential factors of continuance intention to use mobile Apps: extending the expectation confirmation model. Inf Syst Front 22(1):243–257. https://doi.org/10.1007/s10796-018-9864-5

Tang AK (2019) A systematic literature review and analysis on mobile apps in m-commerce: Implications for future research. Electron Commer Res Appl 37:100885

Taylor S, Todd PA (1995) Understanding information technology usage: a test of competing models. Inf Syst Res 6(2):144–176. https://doi.org/10.1287/isre.6.2.144

Thakur R (2018) The role of self-efficacy and customer satisfaction in driving loyalty to the mobile shopping application. Int J Retail Distrib Manag 46(3):283–303. https://doi.org/10.1108/IJRDM-11-2016-0214

Thakur R, Srivastava M (2013) Customer usage intention of mobile commerce in India: an empirical study. J Indian Bus Res 5(1):52–72. https://doi.org/10.1108/17554191311303385

Tiwari R, Buse S, & Herstatt C (2006). Mobile banking as business strategy: Impact of mobile technologies on customer behaviour and its implications for banks. 2006 Technology Management for the Global Future-PICMET 2006 Conference

Trochim W, Donnelly J, & Arora K (2016). Research methods: the essential knowledge base (2nd ed.) Cengage Learning. Retrieved 17 April from http://www.cengage.co.uk/books/9781133954774/

Venkatesh V, Morris MG, Davis GB, Davis FD (2003) User acceptance of information technology: Toward a unified view. MIS Q 27(3):425–478. https://doi.org/10.2307/30036540

Vietnam Credit. (2021). TOP 10 LARGEST BANKS IN VIETNAM 2021. Vietnam Credit. Retrieved from http://vietnamcredit.com.vn/news/top-10-largest-banks-in-vietnam-2021_14418

Vo LT, & Dinh HH (2021). Payments 2025 and beyond: Evolution to revolution: Six macro trends shaping the future of payments in Vietnam. PriceWaterHouse. https://www.pwc.com/vn/en/payments-2025-and-beyond.html

Wei TT, Marthandan G, Yee‐Loong Chong A, Ooi KB, Arumugam S (2009) What drives Malaysian m‐commerce adoption? An empirical analysis. Ind Manag Data Syst 109(3):370–388. https://doi.org/10.1108/02635570910939399

World Population Review. (2022). Population of Cities in Vietnam. Retrieved from https://worldpopulationreview.com/countries/cities/vietnam

Yan M, Filieri R, Gorton M (2021) Continuance intention of online technologies: a systematic literature review. Int J Inf Manag 58(1):102315. https://doi.org/10.1016/j.ijinfomgt.2021.102315

Yuan S, Liu Y, Yao R, Liu J (2016) An investigation of users’ continuance intention towards mobile banking in China. Inf Dev 32(1):20–34. https://doi.org/10.1177/0266666914522140

Zhao Y, Bacao F (2020) What factors determining customer continuingly using food delivery apps during 2019 novel coronavirus pandemic period? Int J Hosp Manag 91(1):102683. https://doi.org/10.1016/j.ijhm.2020.102683

Zhou, G, Gul, R, & Tufail, M (2022). Does servant leadership stimulate work engagement? The moderating role of trust in the leader. Front Psychol, 13. https://www.ncbi.nlm.nih.gov/pmc/articles/PMC9295928/

Zhou T (2014) Examining continuance usage of mobile Internet services from the perspective of resistance to change. Inf Dev 30(1):22–31. https://doi.org/10.1177/0266666912468762

Zhou W, Tsiga Z, Li B, Zheng S, Jiang S (2018) What influence users’ e-finance continuance intention? The moderating role of trust. Ind Manag Data Syst 118(8):1647–1670. https://doi.org/10.1108/IMDS-12-2017-0602

Author information

Authors and Affiliations

Contributions

Conceptualization: T-HTD and G-DN; Methodology: G-DN and T-HTD; Analysis and investigation: G-DN; Writing-original drafting: T-HTD; Writing-review and editing: T-HTD and G-DN; Validation: G-DN; Resources: T-HTD; Supervision: G-DN.

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Ethical approval

The research adhered to the following instructions: (1) all participants were explained about the study and its procedures before taking the survey; (2) the research uses a simple questionnaire that collects non-identifiable data about participants (i.e., without name, address, or affiliation); (3) the research maintained absolute confidentiality of the obtained data; and (4) the questionnaire and methodology of this study have been evaluated as appropriate by the author’s institution. However, this type of research does not require ethical approval as it does not contain sensitive or private information. Ethical approval was therefore not provided, and the author’s institution did not issue an ethical number.

Informed consent

The authors sought and obtained Informed consent before and throughout the data collection process. The participants were informed that their participation was voluntary and that all information was treated with confidentiality and anonymity. Moreover, this research did not collect identifying details such as names, addresses, or affiliations. The participants were also made aware of their right to withdraw from the survey at any time, and they were asked to check the consent box before completing the survey.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary information

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Nguyen, GD., Dao, TH.T. Factors influencing continuance intention to use mobile banking: an extended expectation-confirmation model with moderating role of trust. Humanit Soc Sci Commun 11, 276 (2024). https://doi.org/10.1057/s41599-024-02778-z

Received:

Accepted:

Published:

DOI: https://doi.org/10.1057/s41599-024-02778-z