Abstract

The primary goal sought by the Bank of International Settlements and its committee on banking supervision (BCBS) is to make banks safer entities while maintaining a “level playing field.” However, the question of whether this objective can be attained through enforcing capital requirements is still debatable due to the controversy surrounding the impact of regulatory standards, in particular, the Basel I and II accords on crises that occurred soon after the frameworks were introduced. While the impact of the latter remains controversial in the U.S. due to its effective implementation date, we observe that the newly introduced capital requirements could have played a role in the buildup to the subprime crisis. These results have direct policy implications with regard to ongoing revisions to Basel III, in particular the standardized approach for credit risk.

Similar content being viewed by others

References and notes

Blasko, M. and Sinkey, J. (2006) Bank Asset Structure, Real-estate Lending, and Risk-taking. The Quarterly Review of Economics and Finance 46: 53–81.

Bernanke, B. S. and Blinder, A. S. (1992) The Federal Funds Rate and the Channels of Monetary Transmission. American Economic Review 82: 901–922.

Koehn, M. and Santomero, A. M. (1980) Regulation of Bank Capital and Portfolio Risk. Journal of Finance 35(5): 1235–1244.

Kim, D. and Santomero, A. M. (1988) Risk in Banking and Capital Regulation. Journal of Finance 35: 1219–1233.

Gennotte, G. and Pyle, D. (1991) Capital Controls and Bank Risk. Journal of Banking and Finance 15(4-5): 805–824.

Blum, J. (1999) Do Capital Adequacy Requirements Reduce Risks in Banking? Journal of Banking and Finance 23: 755–771.

Montgomery, H. (2005) the effect of the basel accord on bank portfolios in japan. Journal of Japanese International Economies 19(I): 24–36.

Furlong, F.T. and Keely, M.C. (1987) Bank capital regulation and asset risk. Economic Review. Federal Reserve Bank of San Francisco Spring: 1–23.

Furlong, F. T. and Keely, M. C. (1989) Capital Regulation and Bank Risk-Taking: A note. Journal of Banking and Finance 13: 883–891.

Keely, M. and Furlong, F. (1990) A Reexamination of MeanVariance Analysis of Bank Capital Regulation. Journal of Banking and Finance 14: 69–84.

Shrieves, R. E. and Dahl, D. (1992) The Relationship Between Risk and Capital in Commercial Banks. Journal of Banking and Finance 16: 439–457.

Calem, P. and Rob, R. (1999) The Impact of Capital-Based Regulation on Bank Risk-Taking. The Journal of Financial Intermediation 8: 317–352.

Blum, J. M. (2008) Why ‘Basel II’ May Need a Leverage Ratio Restriction. Journal of Banking and Finance 32: 1699–1707.

Syron, R.F. (1991) Are we experiencing a credit crunch? New England Economic Review July/August: 3–10.

Bernanke, B. S. and Lown, C. S. (1991) The Credit Crunch. Brookings Papers on Economic Activity 2: 205–247.

Hyun, J.-S. and Rhee, B.-K. (2011) Bank Capital Regulation and Credit Supply. Journal of Banking and Finance 35: 323–330.

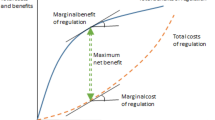

Caruana, J. (2014). How much capital is enough? Speech at IESE Business School conference on ‘Challenges for the future of banking: regulation, supervision and the structure of banking’ London, 26 November. http://www.bis.org/speeches/sp141216.pdf.

Moore, R.R. (1992) The Role of Bank Capital in Bank Loan Growth: Market and Accounting Measures. Federal Reserve Bank of Dallas Financial Industry Studies. Working Paper no. 92-3.

Baer, H. and McElravey, J. (1993) Capital Adequacy and the Growth of U.S. Banks. Federal Reserve Bank of Chicago. Working Paper no. 92-11.

Hall, B. J. (1993) How Has the Basel Accord Affected Bank Portfolios? Journal of the Japanese and International Economies 7: 408–440.

Leverage is not to be confused with the traditional corporate finance definition of Debt/Equity. In fact both “capital” measures differ mainly in their denominator: the leverage ratio uses unweighted assets whereas the capital ratio uses risk-weighted-assets.

Gilbert, R.A. (2006) Keep the Leverage Ratio for Large Banks to Limit the Competitive Effects of Implementing Basel II Capital Requirements. Networks Financial Institute at Indiana State University. Working Paper no. 2006-PB-01.

Moosa, I. A. (2010) Basel II as a Casualty of the Global Financial Crisis. Journal of Banking Regulation 11: 95–114.

Berger, A. N., DeYoung, R., Flannery, M. J., Lee, D. and Oztekin, O. (2008) How Do Large Banking Organizations Manage Their Capital Ratios? Journal of Financial Services Research 34(2): 123–149.

Close estimates of 9.7 and 11.9 per cent were obtained by Demirguc-Kunt et al. 24 for each ratio using a sample of OECD countries.

Demirguc-Kunt, A., Detragiache, E. and Merrouche, O. (2010) bank capital lessons from the financial crisis. Journal of Money, Credit and Banking 45(6): 1–32.

Chami, R. and Cosimano, T. (2010) Monetary Policy with a Touch of Basel. Journal of Economics and Business 62: 161–175.

Beatty, A. and Liao, S. (2011) Do Delays in Expected Loss Recognition Affect Banks’ Willingness to Lend? Journal of Accounting and Economics 52: 1–20.

Berger, A. and Bouwman, C. (2013) How Does Capital Affect Bank Performance During Financial Crises? Journal of Financial Economics 109(1): 146176.

Berger, A. N. and Udell, G. F. (1994) Did Risk-Based Capital Allocate Bank Credit and Cause a ‘Credit Crunch’ in the United States? Journal of Money, Credit and Banking 26(3): 585–628.

Also known as Reports of Condition and Income taken from the Federal Financial Institutions Examination Council (FFIEC). The FDIC covers all types of U.S. domiciled deposit-taking institutions. According to its online statistics, it insured 6,660 member banks as of July 8, 2014.

BCBS (2015). Revisions to the standardised approach for credit risk. http://www.bis.org/bcbs/publ/d347.pdf.

Woo, D. (2003) In search of ‘capital crunch’: Supply factors behind the credit slowdown in Japan. Journal of Money, Credit and Banking 35(6): 1019–1038. (Part 1).

Flannery, M. and Rangan, K. (2008) What Caused the Bank Capital Build-up of the 1990s? Review of Finance 12: 391–429.

Avery, R. B. and Berger, A. N. (1991) Risk-Based Capital and Deposit Insurance Reform. Journal of Banking and Finance 15: 847–874.

Hancock, D. and Wilcox, J. A. (1994) Bank capital and the credit crunch: The roles of risk-weighted and unweighted capital regulations. Journal of the American Real Estate and Urban Economics Association 22(I): 59–94.

Shrieves, R. E. and Dahl, D. (1995) Regulation, Recession, and Bank Lending Behavior: The 1990 Credit Crunch. Journal of Financial Services Research 9: 5–30.

Jones, D. (2000) Emerging Problems with the Basel Capital Accord: Regulatory Capital Arbitrage and Related Issues. Journal of Banking and Finance 24: 35–58.

Herring, R. J. (2007) The Rocky Road to Implementation of Basel II in the United States. Atlantic Economic Journal 411: 1–36.

FDIC (2005) Letter from the Director. Supervisory Insights, Winter 2(2): 1–40.

The latter became informally known as Basel 1A.

Blundell-Wignall, A. and Atkinson, P. (2009) Origins of the Financial Crisis and Requirements for Reform. Journal of Asian Economics 20(5): 546–548.

Watanabe, W. (2007) Prudential Regulation and the ‘Credit Crunch’: Evidence from Japan. Journal of Money, Credit and Banking 39(2-3): 639–666.

Another potentially important change was the credit enhancement due to securitization which effectively set the risk-weight for RMBSs to 20 per cent, lower than that of its individual loan components.

Note that the changes directly impact users of the Standardized or IRB approaches as banks could always be relied on to try to game the regulatory system in order to save on capital.40 As such, any incentive arising from the decrease in risk-weights will have been factored in one approach or the other.

Blundell-Wignall, A. and Atkinson, P. (2010) Thinking Beyond Basel III: Necessary Solutions for Capital and Liquidity. OECD Journal: Financial Market Trends 2010(1): 1–23.

Barajas, A., Chami, R. and Cosimano, T. (2004) Did the Basel Accord Cause a Credit Slowdown in Latin America? Economia Fall 2004: 135–183.

Loutskina, E. and Strahan, P. E. (2009) Securitization and the Declining Impact of Bank Finance on Loan Supply: Evidence from Mortgage Originations. The Journal of Finance 64(2): 861–890.

Ivashina, V. and Scharfstein, D. (2010) Bank lending during the financial crisis of 2008. Journal of Financial Economics 97: 319–338.

Cornett, M., McNutt, J., Strahan, P. and Tehranian, H. (2011) Liquidity risk management and credit supply in the financial crisis. Journal of Financial Economics 101: 297–312.

We discarded B&U’s SHARE variable due to multi-collinearity. We also replace the CRRAT variable with a more relevant variable for our setting. Finally, we keep TOTRAT for our robustness tests as one striking feature we observed in B&U is the systematic opposite and inconsistent signs between T1RAT and TOTRAT. This is a permanent feature of their model whether the coefficients are significant or not and was not commented on by B&U. This property, which arises due to the high correlation between the two variables, makes it difficult to compare with the effects of capital reported elsewhere.

Peek, J. and Rosengren, E. (1992) The capital crunch in New England. Federal Reserve Bank of Boston New England Economic Review 21–31.

At that time, the FDIC had not setup the new 35% risk-weight category in their Call Reports.

Although it is more common nowadays to use GDP, our choice of GNP is strictly in line with B&U. In our framework, both variables yield similar results.

Peek, J. and Rosengren, E. (1994) Bank Real Estate Lending and the New England Capital Crunch. Real Estate Economics 22(1): 33–58.

Peek, J. and Rosengren, E. (1995) Bank Regulation and the Credit Crunch. Journal of Banking and Finance, 19(3–4): 679–692.

Ghosh, S. (2008) Revisiting the Credit Crunch of 1990s: An Empirical Evidence. European Journal of Economics, Finance and Administrative Sciences 13: 1–10.

Mian, A. and Sufi, A. (2009) The consequences of mortgage credit expansion: Evidence from the U.S. mortgage default crisis. The Quarterly Journal of Economics November(I): 1449–1497.

All seasonal variables are equal because by construction it happens that we have the same number of quarters belonging to each seasonal group.

Note that 30YR Treasuries were still discontinued at the start of our control period. Therefore, duration and interest rates were not available for this maturity in order to replicate B&U’s SLOPE variables. Instead of extrapolating from past or future values, we take a more solid approach by using the second closest maturity posted by the FED, the 20YR bond. We do the same for 10YR and 5YR Treasuries and our results are not sensitive to either specification.

Andelman, D. A. (2005). A mixed welcome back for the 30 year bond. http://www.forbes.com/2005/08/04/treasury-bonds-funds-cx_daa_0804andelman.html.

Leamer, E. and Leonard, H. (1983) Reporting the Fragility of Regression Estimates. Review of Economics and Statistics 65: 307–317.

Learner, E. (1985) Lets Take the Con Out of Econometrics. American Economic Review 37: 31–43.

Despite the unwanted effects that the number of parameters could have on the model specification, we control for a wide range of exogenous factors in order to deal with omitted variable bias.

Levine, R. E. and Renelt, D. (1992) A Sensitivity Analysis of Cross-Country Growth Regressions. American Economic Review 82: 942–963.

Otherwise, the explanatory power in those variables would be absorbed by the intercept and would never show shown as significant as underlined.

Gambacorta, L. and Marques-Ibanez, D. (2011) The Bank Lending Channel Lessons From the Crisis. ECB: Economic Policy 26(66): 135–182.

Ediz, T., Michael, I. and Perraudin, W. (1998) Capital Regulation and UK Banks’ Behaviour. Financial Stability Review 5: 46–54.

Nichols, M. W., Hendrickson, J. M. and Griffith, K. (2011) Was the Financial Crisis the Result of Ineffective Policy and Too Much Regulation? An Empirical Investigation. Journal of Banking Regulation 12(3): 236–251.

One author used a less conservative estimate of 10 per cent

15 Statistical significance is set as follows throughout the table: * \(p<0.05, **p<0.01, ***p<0.001\)

We do the same with NPFRAT by re-defining the variable as non-performing assets. Our results remain unchanged.

This also supports our previous decision not to include both capital ratios in the model as with B&U.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Cathcart, L., El-Jahel, L. & Jabbour, R. Basel II: an engine without brakes. J Bank Regul 18, 359–374 (2017). https://doi.org/10.1057/s41261-016-0003-2

Published:

Issue Date:

DOI: https://doi.org/10.1057/s41261-016-0003-2