Abstract

This article presents a research approach to revenue management based on customer value. Through an integration of transaction-focused capacity control and customer relationship management, customer-value-based revenue management aims at both utilising capacity efficiently and establishing profitable customer relationships. Therefore, customer value is considered when controlling the availability or price of booking classes. The strategic, tactical, and operational activities of customer-value-based revenue management are examined. Simulation studies are used to illustrate the benefits of the approach, compared to transaction-based revenue management. Finally, some concluding remarks are made and the outlook for future research is considered.

Similar content being viewed by others

PROBLEM STATEMENT AND RESEARCH DESIGN

The concept of transaction-based revenue management

The efficient use of limited, inflexible and perishable capacity, such as passenger seats, hotel rooms or cargo space on transport vehicles, is a prevalent success factor for service providers (Anderson and Wilson, 2003), particularly when facing uncertain and heterogeneous demand. The acceptance of lower-value booking requests, which arrive early in the booking period may prevent sufficient capacity from being available for later booking requests of higher value (revenue displacement). Conversely, declining early booking requests too often may result in idle capacity at the time of service provision (revenue loss). Revenue management aims at utilising capacity efficiently through appropriately controlling the acceptance of early booking requests. Therefore, the expected demand in the booking period must be projected. The available capacity must then be allocated to different booking classes with regard to expected demand and revenue obtained from the different booking classes. According to the specific allocation, booking control governs the availability of different booking classes (quantity-based approach) or the dynamic booking-class price (price-based approach). Such revenue management is applied in a growing number of quite different industries, including airlines, car rental agencies and cruise ship operators.

Shortcomings of transaction-based revenue management and the state of the art

Allocation and booking control in revenue management are based mostly on short-term willingness-to-pay (that is booking-class revenue) and not on the customers’ long-term value for the service provider (Kuhlmann, 2004). Hence, prospective customers (low current, but high potential future contributions) and reference customers (not necessarily high own but high induced contributions of other customers) are declined mostly when capacity starts to run out. The state of the art has recognised the problem, but has, so far, provided only insufficient approaches for a solution. Either different revenue management strategies (Noone et al, 2003) or value classes (Esse, 2003) for various customer segments are suggested. However, both approaches fail to specify the methods for classifying customers in the booking process and the calculation of contingents assigned to the different value classes. For casino hotels, a decision rule has been developed, which compares customer value in the gambling area with the opportunity costs of occupying a room (Hendler and Hendler, 2004). Apart from the above-mentioned articles, the literature offers several other suggestions for a modification of transaction-based revenue management (Wirtz et al, 2003). However, the identification of customer value within the booking process, the integration of customer value into booking control as well as the strategic tasks of revenue management are rarely considered.

Research design

The shortcomings of transaction-based revenue management justify the integration of customer value into availability or price control. Hence, the focus of this article is on the development of a management model for capacity control, based on customer value. Accordingly, particular attention is paid to the various integration approaches of customer value in tactical planning and their incorporation into optimisation. In order to identify the activities of revenue management on strategic, tactical and operational levels, methods of transaction-based revenue management are enhanced with regard to the relationship-focused marketing paradigm. The model is evaluated by means of simulations. The following section introduces the concept of customer value and the conceptual model of customer-value-based revenue management. The necessary activities at different management levels are then described, after which the results of a prototypical implementation are presented. Finally, some conclusions are drawn and possibilities for future research are considered.

CONCEPTUAL MODEL OF CUSTOMER-VALUE-BASED REVENUE MANAGEMENT

Concept of customer value with regard to capacity control

The incorporation of customer value into management decisions is motivated by empirical findings confirming that the value of the customer base (customer equity) contributes positively to shareholder value (Berger et al, 2006). At its simplest, it can be calculated as the discounted sum of all projected contribution margins of a customer, while more complex approaches conceive it as a manifold construct (Gupta et al, 2006). In transaction-based revenue management, booking requests are assessed through the direct and present value contribution (that is, the booking-class revenue), whereas in customer-value-based revenue management, both direct and indirect as well as present and future value contributions should be considered. In this article, customer value is regarded as the potential future benefit provided by a customer to a firm over a defined period of time (Gupta et al, 2006). The present and future value contributions that the service provider regards as being relevant, for example, expected contribution margins or customer referrals, are referred to as determinants. These determinants are projected on the basis of indicators related to past or present, such as previous contribution margins, age and chosen distribution channels. In contrast to indicators, customer value and its determinants are usually non-observable. Customer-value-based revenue management is conceived as an approach to capacity control that enables the incorporation of customer value into booking control or pricing in order to make the limited capacity available for the most valuable customers.

Managerial activities

The activities associated with customer-value-based revenue management can be systematised according to the length of their planning horizon. In order to account for the effect of customer-value-based capacity control on the long-term success potential of the service provider, the current tactical and operational managerial perspective of revenue management must be complemented by certain strategic activities. The strategic management layer comprises an environmental analysis as well as the formulation of objectives and strategies. At the tactical level and with a medium-term horizon, tactical planning, the definition of booking classes (offer configuration), and pricing are required. Activities at the operational level are usually associated with a specific booking period. Hence, forecasting, allocating capacity to expected demand (optimisation), booking control based on optimisation (transaction control) and adapting the control to the actual state of demand and supply, all have to be taken into account. Furthermore, the calculation and analysis of performance indicators as well as the development of models for forecasting, optimisation and transaction control are activities that are conducted at the operational level (see Figure 1).

STRATEGIC MANAGEMENT ACTIVITIES

Environmental analysis

By means of an environmental analysis, external and internal factors that are relevant to capacity control are assessed. Information on customer retention costs, opportunistic customer behaviour and customer interaction and so on provide the basis for strategic and tactical revenue management decisions. The factors important to customer-value-based revenue management can be assigned to a microenvironment (that is, service provider, customer, competitor and market-related characteristics) and to a macro environment (that is, legal, technological and societal conditions). The analytical process follows the standard approach of strategic management (Narayanan and Fahey, 1987), comprising the identification of these factors, their monitoring, a prediction of changes and an evaluation of such changes.

Formulation of objectives

The short-term success and long-term success potential of service providers complement each other. Therefore, it is necessary to integrate the objectives of transaction-based revenue management that are geared towards the short-term success of a particular service provision, such as a flight or accommodation, and the objectives of customer relationship management that are geared towards long-term success potential (see Figure 2). The short-term revenue maximisation of revenue management is often operationalised through the maximisation of capacity utilisation and revenue per unit of capacity sold (Weatherford and Bodily, 1992), whereas the value of the customer base (customer equity) can be affected by the number of (current and potential) customers as well as their individual customer values (Gupta et al, 2006). Potential conflicts of objectives, such as the retention of prospective customers, for example, students, and the maximisation of short-term revenue, require a balancing of objectives, based on the environmental analysis.

Strategy development

Strategy development aims at defining an appropriate revenue management strategy for achieving the strategic objectives. The systematisation of potential strategies can be supported by a strategy framework that enables the specification of strategy options along various dimensions (see Figure 3). The first example of a strategy option characterises a service provider attempting to establish profitable customer relationships by means of high service quality and an individualised handling of customers. The second example of a strategy option focuses on the minimisation of costs resulting from service provision and customer relationship management in order to gain competitive advantages.

Strategy framework for customer-value-based revenue management (adapted from Hougaard and Bjerre, 2002).

TACTICAL MANAGEMENT ACTIVITIES

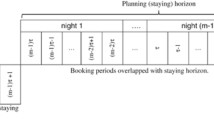

Tactical planning

Both the operational activities and tactical activities, such as offer configuration and pricing, require the definition of a control model that derives its specifications from the long-term strategies. The control model, for example, defines whether capacity control is based on quantity or price, which booking mechanism is implemented, which determinants are relevant to customer value, how risk is dealt with and which overbooking policy is applied (see Figure 4). In customer-value-based revenue management, the control model should also represent how customer value is treated in the context of capacity control.

-

One method of providing a value-based customer differentiation is to enhance transaction-based revenue management by controlling the availability or price, not just on the basis of booking classes, but on the basis of a combination of a particular customer segment and a booking class. The value of a specific combination is measured by means of value-related revenue that comprises both booking-class revenue and average customer value within the customer segment requesting this booking class. Hence, a specific booking class may be available to particular customer segments, but not be available to others.

-

Additionally, value-based overbooking can be applied. This means that customer value affects the calculation of overbooking pads, as well as the selection and compensation of customers who are rejected despite reservations, in cases of overselling (that is, more customers show up than can be accommodated). Customer values can be applied to decide on the acceptance of booking requests above the capacity level, as they reflect both the value of these additional requests and the value that may be lost due to overselling-induced rejections. Moreover, the treatment of rejected customers may be based on an ordinal prioritisation according to their customer value.

-

Corresponding to the service-level-based overbooking policy (Phillips, 2005), availability guarantees can be applied. In this case, a certain degree of availability of specific booking classes for particular customer segments has to be provided. Availability guarantees may be defined according to the average customer value within a segment and must be considered both when allocating capacity to expected demand and when controlling rejections in cases of overselling.

Offer configuration

The configuration of offers aims at a customer-oriented utilisation of capacity and at designing reference figures for forecasting and optimisation. Therefore, different offers (booking classes) are defined for a product within particular channels of distribution. Although products may differ in terms of their physical attributes, booking classes are mostly linked to non-physical characteristics, such as booking restrictions. The configurations of different product characteristics that are expected (or accepted) by customers can be identified by market research or an analysis of previous booking periods (Talluri and van Ryzin, 2004). Hence, the service provider must determine how many booking classes are defined for a product (that is, single or multi-stage differentiation), how the booking classes differ in value (that is, horizontal or vertical differentiation) and which criteria (for example, customer, booking or service-related) are applied for purposes of differentiation (Wirtz et al, 2003; Phillips, 2005). In contrast to the transaction-based approach, customer-value-based revenue management does not necessarily require a differentiation of booking classes, as it is possible to control the availability (or price) of a single booking class separately for different customer segments, according to their customer value.

Pricing

The pricing process is closely connected with the definition of booking classes. In quantity-based revenue management, predefined prices are assigned to particular booking classes. In price-based revenue management, however, upper and lower bounds for booking class prices may be defined, whereas the dynamic price within the booking period is calculated by means of optimisation. Pricing can be based on costs, competition or customers (Phillips, 2005). In revenue management, price differentiation, based, for instance, on temporal, regional, customer, quantity or service-related characteristics, is commonly applied in order to influence demand, skim consumer surplus or generate additional demand from customer segments with a lower willingness-to-pay (Phillips, 2005). Hence, in order to set prices, the service provider has to decide on the pricing basis (for example, costs, competitors, customers) as well as the stages (for example, single or multi stage) and criteria (for example, time, channel, quantity-related) of price differentiation.

OPERATIONAL MANAGEMENT ACTIVITIES

Forecasting

Forecasting provides information on the expected demand required for optimisation and transaction control. Therefore, regression and time series analyses (Weatherford et al, 2003), as well as decision trees and neural networks (Neuling et al, 2004) can be applied. In addition to the models for predicting the amount of expected demand and its distribution within the booking period, customer-value-based revenue management requires the development and application of several other models. On the basis of forecast models and available indicators, determinants of customer value for expected demand in the booking period are estimated. A segmentation model is applied to establish homogeneous customer segments that vary in the determinants of customer value. The expected demand in the booking period can then be predicted for each of these value-based segments. Finally, a valuation model is required to assign an (average) customer value to a particular segment according to the determinants. Represented as a monetary value or score, the customer values are the basis for calculating segment-specific contingents or value-related revenue of booking requests.

Optimisation

Optimisation aims at allocating capacity according to the expected demand in order to achieve both short-term efficient capacity utilisation and long-term profitable customer relationships. In order to treat particular customer segments differently according to their specific customer value, the allocation of capacity to the various booking classes, as done by transaction-based revenue management, is not sufficient. By contrast, the customer-value-based approach assigns available capacity to a combination of customer segment and booking class. This enables the provision of a lower-value booking class for prospective customers (that is, low short-term willingness-to-pay, but high customer value), although it is not available for customers with a lower customer value. The allocation of capacity to each combination of S customer segments and J booking classes is based on value-related revenue v sj comprising short-term revenue (that is, the price r j of the respective booking class j) and long-term value contributions (that is, the customer value c s of the respective customer segment s). A weighting factor αC (αC∈[0; 1]) emphasises either short or long-term value contributions, according to the applied strategy option. Value-related revenue can be calculated as an additive (customer value is a monetary value; see Formula 1) and a multiplicative combination (customer value is a score; see Formula 2). The lower the αC, the greater the extent to which booking-class revenue is modified by customer value. In the case of the customer value represented as a score, the extent of adjustment depends on the relation of the corresponding customer value to the average customer value among all S segments.

In order to illustrate the integration of value-related revenue into optimisation, Formula 3 shows an LP for the allocation of capacity, where y sj represents the contingent assigned to a combination of customer segment s and booking class j, B=(b sj ) S,J is the number of current bookings corresponding to a specific combination, m i is the capacity of the ith of I resources, and D t =(d sjt ) S,J is the expected remaining demand from booking interval t (t=T, …, 0). The element a ij represents the capacity utilisation and has a value of 1, whenever resource i is used by booking class j, and 0 otherwise.

Depending on the booking mechanism, contingents, opportunity costs of capacity utilisation (bid prices), sets of available booking classes or dynamic booking class prices are calculated through optimisation. Contingents can be derived directly from the allocation. Opportunity costs representing the decision criterion in the case of a bid-price control can be calculated by comparing the value of the remaining capacity in the case of both acceptance and decline of a booking request (Bertsimas and Popescu, 2003). The calculation of dynamic booking-class prices is based mainly on expected demand and its price sensitivity (Bitran and Caldentey, 2003). If value-based overbooking is applied, value-related revenue represents the booking-class and segment-specific value of additional bookings and therefore affects the overbooking pad assigned to a combination of customer segment and booking class. Moreover, assuming that customers (and their corresponding customer values) are lost to competitors when rejected in the case of overselling, customer value reflects the opportunity costs of rejections. Therefore, incorporating both value-related revenue and customer-value-related costs of rejections into transaction-based overbooking methods (Bertsimas and Popescu, 2003) is reasonable. Availability guarantees, by contrast, can be considered as an additional restriction in the optimisation problem. Model development for optimisation comprises the formulation of optimisation models as well as the definition of appropriate solution methods (Gosavi et al, 2002).

Transaction control

Whereas optimisation can be conducted before the booking period, transaction control must govern the availability (quantity-based approach) or the price of booking classes (price-based approach) when requests are received. Transaction control aims at achieving the optimal allocation, despite an uncertain temporal and quantity-related distribution of booking requests within the booking period. Common booking mechanisms are contingent control, bid-price control and customer-choice models. Transaction-based contingent control must be enhanced, because a booking request can only be accepted if there is still a positive contingent assigned to the combination of requested booking class and requesting customer segment. In the case of a bid-price control, it is not sufficient to compare only booking-class revenue with the opportunity costs in order to decide on the acceptance or rejection of a booking request. Instead, value-related revenue of the booking request, comprising booking-class revenue and the corresponding customer value, has to be calculated first. Afterwards, it is compared with the opportunity costs emerging from the utilisation of capacity. Thus, a booking class is only available if the value-related revenue outweighs the opportunity costs. If customer-choice models are applied, a specific set of booking classes that has been determined for the particular time of request and the requesting customer segment is available. In contrast to transaction-based revenue management, the identification of segment-specific contingents, value-related revenue, sets of booking classes or the segment-specific price of booking classes, necessitates that the requesting customer be assigned to one of the value-based segments. Hence, predicting the determinants of customer value for the requesting customer as well as classifying the customer based on these determinants by means of a classification model is required. For the prediction of determinants based on available indicators, for example, channel of distribution, time of request and booking-class characteristics chosen by the customer, forecast models are applied. The availability of indicators depends on the booking process and on the customer characteristics. Thus, an intensive exchange of information between service provider and customer, such as in the conference sector or in the context of financial services, as well as the existence of a customer history in the case of regular customers, allow for more indicators than standardised booking requests, such as in online flight booking.

Adaptation

Adaptation entails adjusting forecasting, optimisation or transaction control during the booking period. These adjustments may be triggered by the observed booking progress as well as price or capacity changes. If contingent control is applied, the contingent assigned to a combination of a particular customer segment and a booking class must be reduced whenever a booking request is accepted. In the event of a deviation of the forecasted from the current booking profile, or the occurrence of external factors, such as short-term promotional activities or capacity changes, contingents, opportunity costs, sets of booking classes or dynamic prices may have to be re-optimised. In addition to the adaptation required for transaction-based revenue management, a completed booking may provide additional indicators, because customer-choice behaviour may have been observed or a customer may have been identified as regular. In the case of contingent control, customer re-classification, based on all available indicators, may change the availability of contingents for future requests.

Analysis

The analysis of performance indicators provides the basis for the monitoring and improvement of capacity control. In transaction-based revenue management, the load factor (or occupancy) and – provided that variable costs are negligible – the (absolute) revenue per unit of capacity sold, are considered as relevant performance indicators (Talluri and van Ryzin, 2004). In customer-value-based revenue management, value-related revenue enables the incorporation of relationship-focused objectives. Corresponding to the value-related revenue used for controlling booking requests, value-related revenue used for analysis combines transaction revenue from accepted bookings with the customer value of accepted customers and weighs both components appropriately by means of a factor αA. Depending on this weighting factor, both short-term success (high weighting of transaction revenue) and long-term success potential (high weighting of customer values) can be represented. In order to estimate the effect of capacity control in isolation, value-related revenue earned should be measured in relation to ex-post optimal revenue, or to the revenue in the event of trivial first-come-first-serve control (fcfs). The so-called revenue opportunity metric combines these two ratio figures and represents the exploitation of additional revenue potential derived from the deployment of capacity control (Phillips, 2005). In addition to measuring the achievement of the formulated objectives by means of the mentioned performance indicators, the feasibility of the models applied for forecasting, optimisation and transaction control, as well as the deployed information systems and procedures should be assessed (Desinano et al, 2006).

RESULTS OF A PROTOTYPICAL IMPLEMENTATION

In order to analyse the performance of value-based revenue management in different application scenarios, simulation studies were conducted. These simulations are based on a small network with two legs, a higher and a lower-value booking class for each possible connection, as well as a higher and a lower-value customer segment. Bid-price control, based on a mathematical programming approach (Bertsimas and Popescu, 2003) was applied. The average correlation between customer value (that is, requesting customer segment) and willingness-to-pay (that is, requested booking class) is represented by r (r∈[−1;1]), where r=1 represents the basic assumption of transaction-based revenue management, that high-value customers always request high-value booking classes. However, r=−1 may occur in the presence of prospective or reference customers. At r=0, the expected demand for a booking class is generated equally by both customer segments. Three methods of control were applied according to the weighting of short and long-term revenue: strongly transaction-based (αC=1), hybrid (αC=0, 5) and strongly customer-value-based (αC=0). In order to measure the performance of the methods applied, value-related revenue with different weighting factors was used. With αA=1, only short-term revenue (success, meaning revenue of all accepted booking requests) is taken into account, whereas αA=0 counts only long-term revenue (success potential, meaning the value of those customers whose booking requests have been accepted). αA=0, 5 represents a hybrid measure and considers the uncertainty of long-term customer values, because customers whose booking requests have been accepted may not necessarily be loyal and generate revenue as predicted. Moreover, in order to evaluate the performance of booking control in isolation, revenue was measured in relation to the ex-post optimal solution (that is, the optimal allocation of capacity to the observed booking requests), to a trivial fcfs control and based on the revenue opportunity metric.

The analysis of transaction and customer-value-related revenue in several scenarios, differentiated according to the correlation between customer value and willingness-to-pay, shows that both customer-value-based and hybrid capacity control lead to lower short-term success, but to higher long-term success potential, if customer value and willingness-to-pay correlate non-positively. The (sole) customer-value-based approach is outperformed marginally by the hybrid approach. Other studies indicate that in cases of high demand, late-arriving booking requests of higher value, and substantial difference in customer values, the additional value-related revenue derived from customer-value-based control, compared to trivial fcfs control, as well as the exploitation of additional revenue potential, increase. By contrast, varying the ratio between booking class revenue, and between booking class revenue and customer value, as well as varying the deviation of assumed and real correlation between customer value and willingness-to-pay, does not exert a notable impact on the above-mentioned performance indicators when controlling booking requests based on value-related revenue.

The simulation studies suggest that the additional benefit of customer-value-based revenue management over the transaction-based approach depends on several factors. Particularly in the case of a non-positive correlation of customer value and willingness-to-pay, only customer-value-based capacity control is able to establish relationships with valuable customers, as it enables the availability of lower-value booking classes for customers with a low willingness-to-pay, but high customer value, for example, prospective or reference customers. Furthermore, the relationship between short and long-term as well as direct and indirect revenue affects the assessment of capacity control methods. Thus, in application areas characterised by long-term, individual customer relationships, for example, business-to-business relationships in cargo and conference services, a customer-value-based approach is more useful than in application areas characterised by short-term, standardised customer relationships, for example, in the case of low-cost carriers. Similarly, a customer-value-based approach is appropriate if indirect revenue not reflected in the booking-class price is substantial, such as for cruises and casino hotels. Finally, customer-value-based revenue management assumes an effect of capacity control on customer loyalty, that is, customers are committed if their booking requests are accepted, and lost to competitors if their booking requests are declined. Conversely, if capacity control exerts only a marginal effect on customer loyalty, a transaction-based approach should be preferred.

CONCLUSION AND OUTLOOK FOR FUTURE RESEARCH

Transaction-based revenue management commonly applied in different industries does not enable both efficient capacity utilisation and the establishment of profitable customer relationships. Customer-value-based revenue management represents an integrated approach for overcoming this deficiency. The results of prototypical simulation studies indicate that the traditional approach is outperformed with regard to the development of long-term success potential, particularly when willingness-to-pay and customer value do not correlate positively, such as in case of prospective or reference customers with whom the service provider should establish long-term profitable relationships. In the event of a positive correlation, however, customer-value and transaction-based capacity control lead to comparable results. Service providers should select customer characteristics relevant for decisions on the availability or price of booking classes according to the business environment and should formulate the interaction process appropriately in order to provide indicators for predicting such customer characteristics. Furthermore, measures of market communication must be applied in order to reduce or justify observable customer differentiation and, therefore, to reduce perceptions of unfairness as well as undesirable strategic behaviour on the part of customers.

Among other related issues, research remains to be done on the identification of appropriate indicators and models for predicting customer value, which are necessary for capacity control. For complex customer-value-based optimisation models, efficient solution techniques, such as on the basis of evolutionary algorithms, are necessary. Moreover, the applicability of the conceptual model with regard to the customer perceptions of fairness and strategic behaviour should be evaluated empirically.

Given the prevailing importance of capacity control and customer relationship management, research on customer-value-based revenue management can provide useful findings on the competitive capabilities of service providers.

References

Anderson, C. K. and Wilson, J. G. (2003) Wait or buy? The strategic consumer – Pricing and profit implications. Journal of the Operational Research Society 54 (3): 299–306.

Berger, P. D., Eechambadi, N., George, M., Lehmann, D. R., Rizley, R. and Venkatesan, R. (2006) From customer lifetime value to shareholder value – Theory, empirical evidence, and issues for future research. Journal of Service Research 9 (2): 156–167.

Bertsimas, D. and Popescu, I. (2003) Revenue management in a dynamic network environment. Transportation Science 37 (3): 257–277.

Bitran, G. and Caldentey, R. (2003) An overview of pricing models for revenue management. Manufacturing & Service Operations Management 5 (3): 203–229.

Desinano, P., Minuti, M. S. and Schiaffella, E. (2006) Controlling the yield management process in the hospitality business. In: F. Sfodera, (ed.) The Spread of Yield Management Practices – The Need for Systematic Approaches. Heidelberg, Germany: Physica, pp. 65–79.

Esse, T. (2003) Securing the value of customer value management. Journal of Revenue & Pricing Management 2 (2): 166–171.

Gosavi, A., Bandla, N. and Das, T. K. (2002) A reinforcement learning approach to a single leg airline revenue management problem with multiple fare classes and overbooking. IIE Transactions 34 (9): 729–742.

Gupta, S. et al (2006) Modeling customer lifetime value. Journal of Service Research 9 (2): 139–155.

Hendler, R. and Hendler, F. (2004) Revenue management in fabulous Las Vegas – Combining customer relationship management and revenue management to maximise profitability. Journal of Revenue & Pricing Management 3 (1): 73–79.

Hougaard, S. and Bjerre, M. (2002) Strategic Relationship Marketing. Berlin: Springer.

Kuhlmann, R. (2004) Why is revenue management not working? Journal of Revenue & Pricing Management 2 (4): 378–387.

Narayanan, V. K. and Fahey, L. (1987) Environmental analysis for strategy formulation. In: W.R. King and D.I. Cleland (eds.) Strategic Planning and Management Handbook. New York: Van Nostrand Reinhold, pp. 147–176.

Neuling, R., Riedel, S. and Kalka, K.-U. (2004) New approaches to origin and destination and no-show forecasting – Excavating the passenger name records treasure. Journal of Revenue & Pricing Management 3 (1): 62–72.

Noone, B. M., Kimes, S. E. and Renaghan, L. M. (2003) Integrating customer relationship management and revenue management – A hotel perspective. Journal of Revenue & Pricing Management 2 (1): 7–21.

Phillips, R. L. (2005) Pricing and Revenue Optimization. Stanford, CA: Stanford University Press.

Talluri, K. and van Ryzin, G. (2004) The Theory and Practice of Revenue Management. Berlin: Springer.

Weatherford, L. R. and Bodily, S. E. (1992) A taxonomy and research overview of perishable-asset revenue management – Yield management, pricing, and overbooking. Operations Research 40 (5): 831–844.

Weatherford, L. R., Gentry, T. W. and Wilamowski, B. (2003) Neural network forecasting for airlines – A comparative analysis. Journal of Revenue & Pricing Management 1 (4): 319–331.

Wirtz, J., Kimes, S. E., Pheng Theng, J. H. and Patterson, P. (2003) Revenue management – Resolving potential customer conflicts. Journal of Revenue & Pricing Management 2 (3): 216–226.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

von Martens, T., Hilbert, A. Customer-value-based revenue management. J Revenue Pricing Manag 10, 87–98 (2011). https://doi.org/10.1057/rpm.2009.15

Received:

Revised:

Published:

Issue Date:

DOI: https://doi.org/10.1057/rpm.2009.15