Abstract

Risk attitudes other than risk aversion (e.g. prudence and temperance) are becoming important both in theoretical and empirical work. While the literature has mainly focused its attention on the intensity of such risk attitudes (e.g. the concepts of absolute prudence and absolute temperance), I consider here an alternative approach related to the direction of these attitudes (i.e. the sign of the successive derivatives of the utility function).

Similar content being viewed by others

Introduction

In the 18th century, without using terms such as risk aversion, marginal utility or concavity, which are so familiar today, Bernoulli and Cramer had already anticipated the notion of risk aversion. While the link between risk aversion and the concavity of the utility function (u(x), i.e. utility of wealth) was regularly re-examined since then,Footnote 1 it is not before the mid-sixties that the notions of absolute (−(u″/u′)) and relative (−x(u″/u′)) risk aversion were firmly established.Footnote 2 As is well known, Arrow and PrattFootnote 3 made independently a central contribution about these definitions. Indeed they not only analysed the properties of these notions but they also made assumptions about their behaviour that are still widely used today.

For our purpose, it is important to distinguish Bernoulli's approach (and subsequent ones) from that of Arrow and Pratt. Bernoulli defined an attitude “risk aversion” that could be contrasted later on with other ones such as risk neutrality and risk loving. In a terminology that I sometimes use Bernoulli discusses a direction. Building upon Bernoulli's results Arrow and Pratt consider the intensity of such an attitude. They not only want to know if a decision maker (D.M.) is risk averse: their purpose is mainly to determine when and to which extent a D.M. is more risk averse than his neighbour.

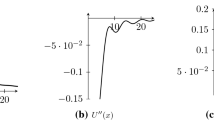

If one looks at the papers posterior to Arrow's and Pratt's contributions, it seems pretty obvious that they mainly focused on intensities of attitudes beyond risk aversion such as absolute (or relative) prudence and absolute temperance. For instance, through his well-known contribution on precautionary savings, KimballFootnote 4 defined the coefficient of absolute prudence (−u‴/u″ where u‴ stands for the third derivative of u) and made the assumption that it is decreasing in wealth (D.A.P).Footnote 5 Combining this assumption with that of decreasing absolute risk aversion (D.A.R.A.) the way was opened for the analysis of the very rich concepts of properness, standardness and risk vulnerability of the utility function.Footnote 6

Relatively to this important literature the current paper partly steps back a pace. Essentially, I’ll apply to Bernoulli's “directions” what Kimball and followers did to Arrow–Pratt's intensities.

To pursue this goal this paper is organised as follows. I’ll first indicate why it is interesting to pay attention to the sign of higher order derivatives of the utility function (beyond the second order). Then in the next section I’ll contrast two ways of interpreting these signs and I’ll explain why one dominates the other. Finally in the third section I’ll discuss some potentially interesting extensions of the existing body of literature.

Why?

There are at least three main reasons that justify the interest for the interpretation of higher order derivatives of u.

The first one is immediate and related to the discussion in the introduction. The absolute intensities of risk aversion, prudence, temperance are all ratios of higher order derivatives of u (of different order).Footnote 7 When exogenous shocks occur—such as for example an increase in wealth—the behaviour of the ratio is more difficult to interpret than that of each of its constituents, the numerator and the denominator.

Hence by having an interpretation of the constituents and of their behaviour one can obtain a better understanding and a better evaluation of assumptions made about the behaviour of absolute intensities.

An illustration of this fact can be found in Eeckhoudt and Schlesinger.Footnote 8 Consider for example the exponential utility that is characterised by a constant absolute risk aversion (CARA). When wealth increases, its numerator (−u″)—which is related to the pain induced by the presence of a zero-mean risk—decreases iff u‴>0 (a third order effect). At the same time at higher wealth u′ is also smaller under u″<0 (a second order effect). It just happens for the exponential utility that the numerator and the denominator of absolute risk aversion decrease at the same rate yielding the CARA assumption.

Using similar arguments it can be shown that the quadratic utility, which exhibits increasing absolute risk aversion (IARA) (a property usually considered as undesirable), is more attractive than one could expect. Indeed for this function u‴=0 so that the numerator of the absolute risk aversion coefficient is constant when wealth increases. This means that under the quadratic utility the pain induced by a zero-mean risk is constant at all wealth levels. The property of IARA then simply results from the fall in u′ under increasing wealth.

It is also worth stressing that the attention paid to higher order risk attitudes surprisingly leads to a much better interpretation of the coefficients of relative risk aversion, relative prudence and relative temperance. The reader is referred to Danthine and Donaldson, Eeckhoudt et al., Chiu et al., and Eeckhoudt and SchlesingerFootnote 9 for details about this relationship.

These simple examples illustrate a more general fact: the analysis of higher order risk attitudes (i.e. “directions”) is useful to better understand the properties of absolute or relative “intensities” as well as the results they induce in models of choice or of market equilibrium.

The second reason that justifies interest in higher order risk attitudes is linked to their relationship with higher order moments of a distribution. Indeed many papers in finance, economics and operations research suggest to pay attention not only to the mean and variance of a risk faced by a D.M. but also to its skewness, kurtosis, … that is its higher order moments. Then a well-known approximation of the expected utility of the D.M. yields:

where  is a zero mean risk while

is a zero mean risk while  ,

,  and

and  stand respectively for the variance, the skewness and the kurtosis of this risk.Footnote 10

stand respectively for the variance, the skewness and the kurtosis of this risk.Footnote 10

Equation (1) suggests that the impact, for example of skewness (kurtosis), on expected utility is linked to the sign and level of derivatives of u of equivalent order (third for skewness, fourth for kurtosis).

This interpretation—which is correct to some limited extent—has raised much debate (see e.g. Brockett and Kahane)Footnote 11 and we come back to it in the last section. Nevertheless we can already see that an appropriate interpretation of the sign of the successive derivatives of (u (n))Footnote 12 is a natural complement to the role of moments in the characterisation of a risk.

The third and final reason for paying attention to derivatives of u beyond the second order is the recent explosion in the number of papers in different fields that refer explicitly to the sign of u‴. For a very long time (from the late sixties to the mid-2000s), the sign of u‴ was linked to only one model of choice under risk: that of saving. However, now the sign of the third derivative of u plays a central role in a variety of fields. Let us mention for example: bargaining (White), bidding in auctions (Eso and White),Footnote 13 public goods (Bramoullé and Treich),Footnote 14 auditing (Fagart and Sinclair-Desgagné),Footnote 15 discounting (Gollier and Weitzman),Footnote 16 sustainable development (Gollier),Footnote 17 and managerial motivations (Kocabiyikoglu and Popescu).Footnote 18 All these examples suggest that higher order derivatives of u may be as important as higher order intensities in comparative statics models.

How?

I now show that there are essentially two ways to look at the interpretation of the sign of u (n). The first one, which was dominant for a long time, consists in paying attention to a comparative statics exercise and then to show the role played by u (n) in the solution of this exercise. The best example of this approach is given by Kimball's analysis (1990) of precautionary savings and their link with prudence (u‴>0). To define temperance, Kimball also examines another choice problem: the optimal composition of a portfolio in the presence of a background risk. He shows that u⁗<0 (temperance) is necessary to obtain—in accordance with intuition—that the presence of the background risk induces less risk taking in the composition of the portfolio.

While this approach—which links the interpretation of the sign of u (n) to a decision problem—has been very useful and has led to important developments it is not without difficulties since it introduces into the analysis some specificities associated with the decision problem. To illustrate this fact let me take two examples:

-

a)

Kimball linked u‴>0 to the existence of precautionary savings when a zero mean risk (a second order effect) is added to an otherwise sure future income. However, if we consider that the future risk corresponds to a first order stochastic deterioration in the future income prospects (i.e. a higher unemployment probability) then the existence of precautionary savings is guided by the sign of u″! Hence the link between prudence and precautionary savings collapses as soon as the change in future risk is not of the second order!Footnote 19

-

b)

Instead of analysing precautionary saving, let's consider for a while the self-protection decision. In Eeckhoudt and GollierFootnote 20 it is shown that—contrarily to what everyday language suggests—prudence (u‴>0) induces a lower investment in prevention. Again this result can be used to interpret the role of the sign of u‴ but it is frail. Indeed the model used in Eeckhoudt and Gollier21 assumes that the effort to reduce the probability of loss and its impact on this probability are contemporaneous. Although many real world situations correspond to this assumption, it may also be the case that the effort is made in the current time period while its effects take place in the future. This is the case for example when health or environmental risks are considered. Indeed in such cases the current decisions are likely to have an impact in a rather distant future. A recent paper by MenegattiFootnote 21 suggests that in those situations prudence and prevention may be reconciled.

Another very interesting paper that uses a comparative statics approach to look at higher order risk attitudes is Jindapon and NeilsonFootnote 22 and we come back to it later on in the last section.

Although much is to be learned from the link between prudence and precautionary savings, or between prudence and prevention, it seems difficult to build a general interpretation of the notion of prudence (or of any higher order risk attitude) on a comparative statics exercise because the specificities of this exercise interact with the interpretation of the higher order risk attitude.

We now turn to an alternative approach for the interpretation of the sign of u n that was initiated in fact by Bernoulli1 and pursued by Rothschild and Stiglitz.Footnote 23 In these papers one starts with a general preference, which is model free (i.e. not necessarily linked to the expected utility model)Footnote 24 and context free (not linked to a specific problem). For instance, Bernoulli postulates that D.M.s like to diversify and shows that this attitude can be explained when the utility function exhibits decreasing marginal utility.Footnote 25

Rothschild and StiglitzFootnote 26 assume that D.M.s like a mean preserving contraction of the risk (which is a generalisation of the notion of diversification) and then indicate that under Expected Utility (E.U.) such an attitude induces concavity of u. Similar developments for higher order risk attitudes are done by Menezes et al. Footnote 27 for the third order, by Menezes and WangFootnote 28 for the fourth order and by Eeckhoudt et al. Footnote 29 for the first four orders.

In two successive papers (Eeckhoudt and Schlesinger and Eeckhoudt et al.),Footnote 30 one starts with the assumption that D.M.s “like to combine good with bad”Footnote 31 and it is then shown that under E.U. all the successive derivatives of u alternate in sign starting with u″<0. When this alternance holds up to infinity one obtains the concept of “mixed risk aversion” discussed in Caballé and Pomansky,Footnote 32 sometimes termed also “completely monotone utility” (e.g. Pratt and Zeckhauser).Footnote 33

While the reader is referred to the two original papers for details, I give here a very short presentation that will be useful to discuss risk loving attitudes in the last section.

Consider a binary lottery L with two equally likely outcomes x and x+k (k>0) and two zero mean risk  and

and  with

with  being a mean preserving contraction of

being a mean preserving contraction of  .Footnote 34 If the D.M. prefers to combine good with bad one has: B

.Footnote 34 If the D.M. prefers to combine good with bad one has: B

A where B and A are given by:

A where B and A are given by:

Under E.U., B

A implies:

A implies:

or

For this to be true for all k, it is necessary and sufficient that:

Since  is a mean preserving spread of

is a mean preserving spread of  this occurs iff u′ is convex, that is iff u‴>0 (downside risk aversion or prudence).

this occurs iff u′ is convex, that is iff u‴>0 (downside risk aversion or prudence).

To go to higher orders one follows the same procedure with  representing an “n

th order increase in risk” of

representing an “n

th order increase in risk” of  (see Ekern)Footnote 35 and one obtains in this way an interpretation of the sign of the (n+1)th derivative of u without reference to a specific choice problem.

(see Ekern)Footnote 35 and one obtains in this way an interpretation of the sign of the (n+1)th derivative of u without reference to a specific choice problem.

It is obvious that the approach based on comparative statics exercises that was discussed at the beginning of this section has been extremely useful to motivate the interest for risk attitudes beyond risk aversion and to produce a lot of intuitive results. While I partly contributed to this approach I am presently convinced that the alternative presentation based on model and context free preferences is more satisfactory and more general.

I now indicate some ways in which the results obtained so far about the direction of higher order risk attitudes can be extended.

What's next?

I consider in turn and rather briefly some extensions that are feasible and possibly promising.

Experiments

In Eeckhoudt and SchlesingerFootnote 36, it is regularly mentioned that the approach lends itself easily to experimental evidence because of the simplicity of the lotteries that are used.

We were blessed in this respect. In a very short time period, already quite a few experiments have been conducted about risk aversion, prudence and temperance (or a subset of these risk attitudes)Footnote 37 and for reasons that I’ll indicate when I look at (mixed) risk loving attitudes I think there is still much more room for further experimental research on these topics.

Moments and preferences

As indicated in the second section the sign of the n th order derivative of u is often interpreted as a preference towards the n th order moment of a risk. Such a relationship has been criticised on statistical grounds by Brockett and Kahane12 but there exists little discussion in terms of preference.

Usually to show that risk aversion is not equivalent to a dislike for an increase in variance with constant mean, counter examples are used. Such a counter example can be found in Rothschild and Stiglitz27 in a long footnote at the end of the paper but it is not very intuitive. On the contrary, the counter example given by IngersollFootnote 38 is very interesting from our point of view.

Let us consider two lotteries:

They have the same mean (2) and S has a higher variance. However, if a risk averse D.M. has a utility function  , it is immediately observed that he prefers S

Footnote 39 so that risk aversion is NOT a dislike for variance at a constant mean.

, it is immediately observed that he prefers S

Footnote 39 so that risk aversion is NOT a dislike for variance at a constant mean.

Our analysis of higher order risk attitudes enables us to generalise this analysis. Indeed we know that for a prudent D.M., B is preferred to A with B and A defined by:

where  is a zero mean risk and k is positive.

is a zero mean risk and k is positive.

Now we can deteriorate B into B′:

where  is a mean preserving spread of

is a mean preserving spread of  . Of course B′ has the same mean as B and A and a larger variance.

. Of course B′ has the same mean as B and A and a larger variance.

Under risk aversion E[u(B′)]<E[u(B)] but since E[u(B)]>E[u(A)] one may still have:

when the deterioration of  into

into  is not too important.

is not too important.

One understands in this way why risk aversion is not aversion to variance at a constant mean. In our discussion the D.M. is so prudent that B is much preferred to A. Then the increase in variance induced by the transition to B′ is not able to reverse his preference. This phenomenon is of course at work in Ingersoll's counter example because  exhibits prudence. Our analysis simply generalises this example and suggests how and why it can be extended to higher orders.

exhibits prudence. Our analysis simply generalises this example and suggests how and why it can be extended to higher orders.

Non-E.U. models

Since our approach is initially model free, one might wonder what it implies in non-expected utility models such as Yaari's dual theory or prospect theory.

To the best of my knowledge, there exists so far only one paper on these topics (Meier and Ruger)Footnote 40 and it reveals—among other things—that the analysis outside the expected utility hypothesis is not easy (see also the comments at the end of the experimental paper by Deck and Schlesinger).Footnote 41 Clearly there is still much room for research in this direction even though it will not be easy.

Risk lovers

Although risk lovers exist and play an important role, textbooks and research papers are mostly silent about them probably because in comparative statics models risk loving leads to corner solutions. Since the preference for combining good with bad induces risk aversion (u″<0) and then the alternating sign of the successive derivatives of u (“mixed risk aversion”) it seems natural to extrapolate that a preference for combining good with good should imply risk loving.

It is easy to show that this is the case (Crainich et al.).Footnote 42 More surprisingly, however, one also obtains that risk lovers are prudent (u‴>0) so that the behaviour of prudence is shared by risk averters and risk lovers who will all develop precautionary savings. Going to further orders it appears that combining good with good induces successive derivatives of u, which are all positive and such a behaviour may be termed “mixed risk loving” by analogy with “mixed risk aversion”. Hence (mixed) risk lovers are intemperant contrarily to what is obtained under mixed risk aversion. In fact mixed risk lovers agree with mixed risk averters on the signs of odd derivatives of u and disagree for even ones.

It is worth noticing that these theoretical predictions seem confirmed by the experimental studies (see section “Experiments”) from which it appears that prudence is more widespread than risk aversion and temperance. Although this result is perfectly in line with the theoretical model one might then wonder why not all respondents are prudent since this attitude is shared by both risk lovers and by risk averters. One potential explanation is that D.M.s do not consistently stick to one type of preference: in some cases they may want to combine good with good and in other circumstances shift to the opposite preference. Of course the stability of these preferences inside an experiment remains a question for future research.

On the intensity of higher order attitudes

The first indexes proposed for the intensities, for example, of prudence and temperance, resulted from comparative statics exercises described at the beginning of the second section. They generated the two well-known indexes of absolute prudence (−u‴/u″) and temperance (−u⁗/u‴) that are often used. Besides—following Chiu and Denuit and EeckhoudtFootnote 43—such absolute coefficients can be given an interpretation outside any specific choice problem and in this way they remain in line with the Arrow–Pratt interpretation of the index of absolute risk aversion.

Notice finally that the absolute coefficients for the third and fourth order can be extended to any order through the ratio −u (n)/u (n−1).

Recently—using also a comparative statics exercise—Jindapon and Neilson23 have shown that an alternative set of absolute indices for an n th order risk attitude could be given by (−1)n+1(−u (n)/u′). Again a more general interpretation of such coefficients—relying mostly on RossFootnote 44, concept of stronger risk aversion (1981)—can be found in various papers (Modica and Scarsini, Crainich and Eeckhoudt, Li, and Denuit and Eeckhoudt).Footnote 45

This line of research has been pursued by Keenan and Snow.Footnote 46 In a first paperFootnote 47 they identify S=(u‴/u′)−3/2(u″/u′)2 as a local measure of the intensity of downside risk aversion that has the desirable property of being increasing with monotonic downside risk averse transformation of utility. In a second paperFootnote 48 they characterise greater downside risk aversion in the large and show that a larger S is a sufficient condition (and not necessary and sufficient condition) for a utility function to be more downside risk averse.

It seems pretty obvious that more research is necessary to better understand the links between the two set of absolute coefficients, being aware besides that coefficients between the two ones presented so far might also make sense and be useful. Nevertheless, for the time being, I tend to think that absolute coefficients such as −u (n)/u (n−1) remain the more promising ones for a very simple reason that I have understood only very recently. One strength of the absolute coefficient of risk aversion (−(u‴/u″)) is that it is linked to the relative coefficient (−x(u‴/u″)) of risk aversion, which has a very nice interpretation. When one goes to higher orders, it is possible to obtain and interpret relative coefficients such as −x(u (n)/u (n−1)) and to use them to analyse risky choices.Footnote 49

Since these relative coefficients play an important role in many problems of choice or of market equilibrium, the fact that they can be interpreted from the absolute equivalent coefficients (−u (n)/u (n−1)) is a good argument in favour of such coefficients.

To the best of my knowledge there exists so far no relative equivalent to absolute coefficients such as (−1)n+1(−u (n)/u′).

Conclusion

In their very influential paper, Rothschild and Stiglitz27 had established a link between a statistical concept (a mean preserving change in risk) and a preference (risk aversion represented by the concavity of the utility function). In the present paper this line of research was pursued in order to consider risk attitudes beyond risk aversion and to relate them to other statistical concepts appearing under the general heading of “n th order increase in risk”.

Besides their own interest, those results yield new interpretations of the coefficients of absolute or relative risk attitudes. It is of course premature to assess the impact these results will have for the future research in the economics of risk. Nevertheless—despite the fact that many of the results are recent—they have already induced new theoretical and experimental research.

Notes

2 For a lively account of such developments, see Borch (1990).

3 As usual u′ and u″ stand for the first and second derivatives of u with respect to wealth (x).

4 Arrow (1965) and Pratt (1964).

6 On this see also Eeckhoudt-Kimball (1992).

7 Well-known contributions in this approach are Kimball (1992), Gollier and Pratt (1996) and Pratt and Zeckhauser (1987). See also Gollier (2001) for a synthesis.

8 For instance, the ratio for temperance is defined by −u⁗/u‴ where u⁗ is the fourth derivative of u.

Since

is a zero mean risk,

is a zero mean risk,  and

and  .

. stands for the nth derivative of n whenever u exceeds 4.

stands for the nth derivative of n whenever u exceeds 4.For further developments on these topics see Eeckhoudt and Schlesinger (2008).

For an interesting discussion of the model-free approach see Cohen (1995).

Keep in mind Bernoulli doesn’t use today's vocabulary. Instead he implicitly works with a logarithmic utility.

The preference for “combining good with bad” is very much linked to the attitude of correlation aversion (see Epstein and Tanny (1980) and Denuit and Rey (2010)).

Mean preserving contractions or spreads are defined in Rothschild and Stiglitz (1970).

Let me quote some of them I know: Deck and Schlesinger (2010), Noussair et al. (2011), Ebert and Wiesen (2011) and Meier and Ruger (2010).

Other risk averters with another concave utility might prefer R: there is no unanimity towards one of the lotteries in the class of risk averse D.M's.

see e.g. Danthine and Donaldson12, Eeckhoudt and Schlesinger15, Eeckhoudt et al.,13 Chiu et al.,14 and Denuit and Rey.

References

Arrow, K. (1965) Aspects of the Theory of Risk-bearing, Helsinki: Yrjš Jahnsson Foundation.

Bernoulli, D. (1738) ‘Specimen theoriae novae de mensura sortis’, Comentarii Academiae Scientiarum Petropolitanae 5: 175–192, Translated by L. Sommer (1954), Econometrica, 22: 23–36.

Borch, K. (1990) Economics of Insurance, Amsterdam: North-Holland.

Bramoullé, Y. and Treich, N. (2009) ‘Can uncertainty alleviate the commons problem?’ Journal of the European Economic Association 7 (5): 1042–1067.

Brockett, P. and Kahane, Y. (1992) ‘Risk, return, skewness and preference’, Management Science 38 (6): 851–866.

Caballé, J. and Pomansky, A. (1996) ‘Mixed risk aversion’, Journal of Economic Theory 71 (2): 485–513.

Chiu, H. (2005) ‘Skewness preference, risk aversion, and the precedence relations on stochastic changes’, Management Science 51 (12): 1816–1828.

Chiu, H., Eeckhoudt, L. and Rey, B. (2010) ‘On relative and partial risk attitudes: Theory and implications’, Economic Theory, advance online publication, 23 July 2010, doi: 10.1007/s00199-010-0557-7.

Cohen, M. (1995) ‘Risk aversion concepts in expected and non-expected utility models’, Geneva Papers on Risk and Insurance Theory 20 (1): 73–91.

Crainich, D. and Eeckhoudt, L. (2008) ‘On the intensity of downside risk aversion’, The Journal of Risk and Uncertainty 36 (3): 267–276.

Crainich, D., Eeckhoudt, L. and Trannoy, A. (2011) About (mixed) risk lovers (or: are we all prudent?) LEM Working Paper.

Cramer, H. (1728) ‘Specimen theoriae novae de mensura sortis’, Comentarii Academiae Scientiarum Petropolitanae 5: 175–192, Translated by L. Sommer (1954), Econometrica, 22: 23–36.

Danthine, J.-P. and Donaldson, J. (2005) Intermediate Financial Theory, London: Academic Press.

Deck, C. and Schlesinger, H. (2010) ‘Exploring higher order risk effects’, Review of Economic Studies 77 (4): 1403–1420.

Denuit, M. and Eeckhoudt, L. (2010a) ‘A general index of absolute risk attitude’, Management Science 56 (4): 712–715.

Denuit, M. and Eeckhoudt, L. (2010b) ‘Stronger measures of higher-order risk attitudes’, Journal of Economic Theory 145 (5): 2027–2036.

Denuit, M. and Rey, B. (2010) ‘Prudence, temperance, edginess and higher degree risk apportionment as decreasing correlation aversion’, Mathematical Social Sciences 60 (2): 137–143.

Ebert, S. and Wiesen, D. (2011) ‘Testing for prudence and skewness seeking’, Management Science 57 (7): 1334–1349.

Eeckhoudt, L., Etner, J. and Schroyen, F. (2009) ‘The values of relative risk aversion and prudence: A context-free interpretation’, Mathematical Social Sciences 58 (1): 1–7.

Eeckhoudt, L. and Gollier, C. (2005) ‘The impact of prudence on optimal prevention’, Economic Theory 26 (4): 989–994.

Eeckhoudt, L., Gollier, C. and Schneider, T. (1995) ‘Risk aversion, prudence and temperance: A unified approach’, Economics Letters 48 (3–4): 331–336.

Eeckhoudt, L. and Kimball, M. (1992) ‘Background risk, prudence and the demand for insurance’, in G. Dionne (ed.) Contributions to Insurance Economics, Boston, Dordrecht, London: Kluwer Academic Publisher, p. 524.

Eeckhoudt, L. and Schlesinger, H. (2006) ‘Putting risk in its proper place’, American Economic Review 96 (1): 280–289.

Eeckhoudt, L. and Schlesinger, H. (2008) ‘Changes in risk and the demand for saving’, Journal of Monetary Economics 55 (7): 1329–1336.

Eeckhoudt, L. and Schlesinger, H. (2009) ‘On the utility premium of Friedman and Savage’, Economics Letters 105 (1): 46–48.

Eeckhoudt, L., Schlesinger, H. and Tsetlin, I. (2009) ‘Apportioning of risks via stochastic dominance’, Journal of Economic Theory 144 (3): 994–1003.

Ekern, S. (1980) ‘Increasing Nth degree risk’, Economic Letters 6 (4): 329–333.

Epstein, L. and Tanny, S. (1980) ‘Increasing generalized correlation: A definition and some economic consequences’, The Canadian Journal of Economics 13 (1): 16–34.

Eso, P. and White, L. (2004) ‘Precautionary bidding in auctions’, Econometrica 72 (1): 77–92.

Fagart, M.-C. and Sinclair-Desgagné, B. (2007) ‘Ranking contingent monitoring systems’, Management Science 53 (9): 1501–1509.

Gollier, C. (2001) The Economics of Risk and Time, Cambridge: MIT Press.

Gollier, C. (2011) Pricing the Planet's Future: The Economics of Discounting in an Uncertain World, London: Princeton University Press.

Gollier, C. and Pratt, J. (1996) ‘Risk vulnerability and the tempering effect of background. Risk’, Econometrica 64 (5): 1109–1124.

Gollier, C. and Weitzman, M. (2010) ‘How should the distant future be discounted when discount rates are uncertain?’ Economic Letters 107 (3): 350–353.

Ingersoll, J. (1987) Theory of Financial Decision Making, Savage, Maryland: Rowman and Littlefield Publishers, p. 474.

Jindapon, P. and Neilson, W. (2007) ‘Higher-order generalizations of Arrow–Pratt and Ross risk aversion: A comparative statics approach’, Journal of Economic Theory 136 (1): 719–728.

Keenan, D. and Snow, A. (2002) ‘Greater downside risk aversion’, The Journal of Risk and Uncertainty 24 (3): 267–277.

Keenan, D. and Snow, A. (2009) ‘Greater downside risk aversion in the large’, Journal of Economic Theory 144 (3): 1092–1101.

Kimball, M. (1990) ‘Precautionary saving in the small and in the large’, Econometrica 58 (1): 53–73.

Kimball, M. (1992) ‘Precautionary motives for holding assets’, in P. Newman, M. Milgate et and J. Eatwell (eds.) The New Palgrave Dictionary of Money and Finance. Vol. 3, London: The Macmillan Press Limited, pp. 158–161.

Kocabiyikoglu, A. and Popescu, I. (2007) ‘Managerial motivation dynamics and incentives’, Management Science 53 (5): 834–848.

Li, J. (2010) ‘Comparative higher-degree Ross risk aversion’, Insurance: Mathematics and Economics 45 (3): 333–336.

Menegatti, M. (2009) ‘Optimal prevention and prudence in a two period model’, Mathematical Social Science 58 (2): 393–397.

Menezes, C., Geiss, C. and Tressler, J. (1980) ‘Increasing downside risk’, American Economic Review 70 (5): 921–932.

Menezes, C. and Wang, H. (2005) ‘Increasing outer risk’, Journal of Mathematical Economics 41 (4): 875–886.

Meier, J. and Ruger, M. (2009) ‘Reference-dependent risk preferences of higher orders’, Mimeo, University of Augsburg.

Meier, J. and Ruger, M. (2010) ‘Experimental evidence on higher-order risk preferences?’ Mimeo, University of Augsburg.

Modica, S. and Scarsini, M. (2005) ‘A note on comparative downside risk aversion’, Journal of Economic Theory 122 (1): 267–271.

Noussair, C., Trautmann, S. and van de Kuilen, G. (2011) Higher order risk attitudes, demographics, and financial decisions, Working Paper, University of Tilburg.

Pratt, J. (1964) ‘Risk aversion in the small and in the large’, Econometrica 32 (1–2): 122–136.

Pratt, J. and Zeckhauser, R. (1987) ‘Proper risk aversion’, Econometrica 55 (1): 143–154.

Ross, S. (1981) ‘Some stronger measures of risk aversion in the small and in the large with applications’, Econometrica 48 (3): 621–638.

Rothschild, M. and Stiglitz, J. (1970) ‘Increasing risk I: A definition’, Journal of Economic Theory 2 (3): 225–243.

Rothschild, M. and Stiglitz, J. (1971) ‘Increasing risk II: Its economic consequences’, Journal of Economic Theory 3 (1): 66–84.

White, L. (2008) ‘Prudence in bargaining: The effect of uncertainty on bargaining outcomes’, Games and Economic Behavior 62 (1): 211–231.

Acknowledgements

I express my gratitude to a referee whose very careful reading of the first version has led to many improvements in the manuscript.

Author information

Authors and Affiliations

Additional information

This paper was prepared for the 23 Geneva Risk Economics lecture delivered at the 38 Seminar of the European Group of Risk and Insurance Economists (EGRIE) in Vienna in 2011.

1 Bernoulli (1738) and Cramer (1728).

Rights and permissions

About this article

Cite this article

Eeckhoudt, L. Beyond Risk Aversion: Why, How and What's Next?. Geneva Risk Insur Rev 37, 141–155 (2012). https://doi.org/10.1057/grir.2012.1

Published:

Issue Date:

DOI: https://doi.org/10.1057/grir.2012.1

is a zero mean risk,

is a zero mean risk,  and

and  .

. stands for the nth derivative of n whenever u exceeds 4.

stands for the nth derivative of n whenever u exceeds 4.