Abstract

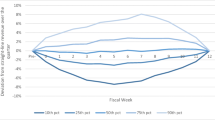

This study investigates investors' reactions to revenue and expense surprises around preliminary earnings announcements. Results show that investors value more highly a dollar of revenue surprise than a dollar of expense surprise. Results further show that these differential market reactions to revenue and expense surprises vary systematically for growth versus value firms and depend on (a) the proportion of variable to total costs, (b) the relative persistence of sales and expenses, and (c) the proportion of operating to total expenses. Results highlight the importance of interpreting the earnings surprise in the context of its sources—e.g. surprise in revenues or in total expenses.

Similar content being viewed by others

References

Bagella, M., L. Becchetti and A. Carpentieri. (2000). “The First Shall Be Last. Size and Value Strategy Premia at the London Stock Exchange.” Journal of Banking and Finance 24, 893-919.

Ballester, M., J. Livnat and C. Seethamraju. (1998). “Individual-Firm Style Loadings, Unrecorded Economic Assets and Systematic Risk.” Journal of Accounting, Auditing and Finance 13, 275-296.

Bagnoli, M., S. Kallapur and S. G. Watts. (2001). “Top Line and Bottom Line Forecasts: A Comparison of Internet Firms During and After the Bubble.” Working Paper, Purdue University.

Bartov, E., D. Givoly and C. Hayn. (2002). “The Rewards to Meeting or Beating Earnings Expectations.” Journal of Accounting and Economics 33, 173-204.

Basu, S. (1977). “The Investment Performance of Common Stocks in Relation to Their Price-Earnings Ratios: A Test of the Efficient Market Hypothesis.” Journal of Finance 32, 663-682.

Bauman, S. W. and R. E. Miller. (1997). “Investor Expectations and the Performance of Value Stocks Versus GrowthStocks-Why Value Stocks Outperform GrowthStocks.” Journal of Portfolio Management 23, 57-68.

Chow, V. K. and H. M. Hulburt. (2000). “Value, Size and Portfolio Efficiency-The Value Effect Obtains Across BothLarge and Small-Stock Portfolios.” Journal of Portfolio Management 26, 78-89.

Chan, L. K. C., Y. Hamao and J. Lakonishok. (1991). “Fundamentals and Stock Returns in Japan.” Journal of Finance 46, 1739-1764.

Daniel, K. and S. Titman. (1998). “Characteristics or Covariances.” Journal of Portfolio Management 24, 24-33.

Davis, J. L. (1994). “The Cross-Section of Realized Stock Returns: The Pre-COMPUSTAT Evidence.” Journal of Finance 49, 1579-1593.

Davis, J. L., E. Fama and K. R. French. (2000). “Characteristics, Covariances and Average Returns.” Journal of Finance 55, 389-406.

DeBondt, W. F. M. and R. Thaler. (1985). “Does the Stock Market Overreact?” Journal of Finance 40, 793-805.

DeBondt, W. F. M. and R. H. Thaler. (1987). “Further Evidence on Investor Overreaction and Stock Market Seasonality.” Journal of Finance 42, 557-581.

Degeorge, F., J. Patel and R. Zeckhauser. (1999). “Earnings Management to Exceed Thresholds.” Journal of Business 72, 1-33.

Easton, P. D. and M. E. Zmijewski. (1989). “Cross-Sectional Variations in the Stock Market Response to Accounting Earnings Pronouncements.” Journal of Accounting and Economics 11, 117-141.

Ertimur, Y. and J. Livnat. (2002). “Confirming or Conflicting Sales and Earning Signals: Differential Returns for Growthand Value Companies.” Journal of Portfolio Management 28, 45-56.

Fama, E. and K. R. French. (1992). “The Cross-section of Expected Stock Returns.” Journal of Finance 47, 427-465.

Fama, E. F. and K. R. French. (1995). “Size and Book-To-Market Factors in Earnings and Returns.” Journal of Finance 50, 131-155.

Fama, E. F. and K. R. French. (1996). “Multifactor Explanation of Asset Pricing Anomalies.” Journal of Finance 51, 55-84.

Fama, E. F. and K. R. French. (1998). “Value versus Growth: The International Evidence.” Journal of Finance 53, 1975-1999.

Graham, B. and D. Dodd. (1934). Security Analysis. New York: McGraw-Hill.

Hackel, K. S., J. Livnat and A. Rai. (1994). “Free CashFlow: Small Cap Anomaly.” Financial Analysts Journal September-October, 33-42.

Hackel, K. S., J. Livnat and A. Rai. (2000). “A Free CashFlow Investment Anomaly.” Journal of Accounting, Auditing and Finance 15, 1-24.

Hand, J. R. M. (2000). “Profits, Losses, and the Non-Linear Pricing of Internet Stocks.” Unpublished Manuscript, University of NorthCarolina

Hopwood, W. and J. McKeown. (1985). “The Incremental Information Content of Interim Expenses over Interim Sales.” Journal of Accounting Research 23, 161-174.

Hoskin, R. E., J. S. Hughes, W. E. Ricks, and L. D. Brown. (1986). “Evidence on the Incremental Information Content of Additional Firm Disclosures Made Concurrently withEarnings/Discussion.” Journal of Accounting Research 24, 1-36.

Jaffe, J., D. B. Keim and R. Westerfield. (1989). “Earnings Yields, Market Values, and Stock Returns.” Journal of Finance 44, 135-148.

Keim, D. B. (1985). “Dividend Yields and Stock Returns: Implications of Abnormal January Returns.” Journal of Financial Economic 14, 473-489.

Kothari, S. P. (2001). “Capital Markets Research in Accounting.” Journal of Accounting and Economic 31, 105-231.

La Porta, R., J. Lakonishok, A. Schleifer and R. W. Vishny. (1997). “Good News For Value Stocks: Further Evidence on Market Efficiency.” Journal of Finance 52, 859-874.

Lakonishok, J., A. Schleifer, and R. W. Vishny. (1994). “Contrarian Investment, Extrapolation, and Risk.” Journal of Finance 49, 1541-1578.

Latane, H. A., D. L. Tuttle and C. P. Jones. (1969). “E/P Ratios V. Changes In Earnings.” Financial Analyst Journal 25, 117-120.

Lev, B. (1989). “On the Usefulness of Earnings and Earnings Research: Lessons and Directions from Two Decades of Empirical Research.” Journal of Accounting Research 27, 153-201.

Lipe, R. C. (1986). “The Information Contained in the Components of Earnings.” Journal of Accounting Research 24, 37-68.

Rai, A. (1996). “Differential Price Reaction to the Earnings Announcements of Glamour and Value firms.” Ph.D. Dissertation, New York University.

Rees, L. and K. Sivaramakrishnan. (2001). “Valuation Implications of Revenue Forecasts.” Unpublished Manuscript, Texas A&M University.

Rosenberg, B., K. Reid, and R. Lanstein. (1984). “Persuasive View of Market Inefficiency.” Journal of Portfolio Management 11, 9-17.

Swaminathan, S. and J. Weintrop. (1991). “The Information Content of Earnings, Revenues, and Expenses.” Journal of Accounting Research 29, 418-427.

Wilson, G. P. (1986). “The Relative Information Content of Accruals and Cash Flows—Combined Evidence at the Earnings Announcement and Annual Report Release Day.” Journal of Accounting Research 24, 165-200.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Ertimur, Y., Livnat, J. & Martikainen, M. Differential Market Reactions to Revenue and Expense Surprises. Review of Accounting Studies 8, 185–211 (2003). https://doi.org/10.1023/A:1024409311267

Issue Date:

DOI: https://doi.org/10.1023/A:1024409311267