Abstract

The study examines the feedback effect of innovation outcomes on access to finance, as an extension to the existing literature which suggests financial access drives firms to innovate. The study applies the theory of planned behaviors integrated with the signaling theory to evaluate financial access of Vietnamese firms in connection to their innovation with a particular focus on planned innovation activities—innovation activities that started out with an entrepreneurial intention to innovate. Applying the multilevel mixed-effects logistic (MELOGIT) regression for panel and the two-stage probit model within the conditional mixed process (CMP) to the data on Vietnamese small and medium firms, for the period 2005–2015, the study shows that firms with innovation outcomes appear to have better access to finance. More interestingly, the effect is stronger for planned innovation. These findings assert the signaling role of planned innovation to potential lenders on a comprehensive resource commitment guiding the innovation activity to success. The study offers interdisciplinary arguments from both financial risk perspective and theory of planned behavior integrated with the signaling view.

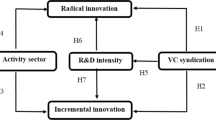

(Source: authors’ own calculation)

(Source: authors’ own calculation)

Similar content being viewed by others

Notes

Small value of labor cost relatively to revenue results in small percentage which is rounded down to zero. This explains the minimum value of zero for labor cost.

The exogenous variables predict innovative activity include R&D over assets, proportion of machine over asset, and percentage top management by woman whilst these variables have little relation to the outcome variable.

Our robustness tests confirm that overall bank access is also positive toward innovation and planned innovation across innovation types. Results are to be provided upon request.

References

Aghion, P., Bond, S., Klemm, A., & Marinescu, I. (2004). Technology and financial structure: Are innovative firms different? Journal of the European Economic Association, 2(2–3), 277–288.

Ajzen, I. (1991). The theory of planned behavior. Organization Behavior and Human Decision, 50(2), 179–211.

Alam, P., & Walton, K. S. (1995). Information asymmetry and valuation effects of debt financing. Journal of Financial Review, 30(2), 289–311.

Almeida, H., Park, S. Y., Subrahmanyam, M. G., & Wolfenzon, D. (2011). The structure and formation of business groups: Evidence from Korean chaebols. Journal of Financial Economics, 99(2), 447–475.

Asiedu, E., Freeman, J. A., & Nti-Addae, A. (2012). Access to credit by small businesses: How relevant are race, ethnicity, and gender? Journal American Economic Review, 102(3), 532–537.

Atanassov, J., & Liu, X. (2020). Can corporate income tax cuts stimulate innovation? Journal of Financial and Quantitative Analysis, 55(5), 1415–1465.

Audretsch, D. B., Kuratko, D. F., & Link, A. N. (2016). Dynamic entrepreneurship and technology-based innovation. Journal of Evolutionary Economics, 26(3), 603–620.

Ayyagari, M., Demirgüç-Kunt, A., & Maksimovic, V. (2011). Firm innovation in emerging markets: The role of finance, governance, and competition. Journal of Financial Quantitative Analysis, 46(6), 1545–1580.

Beck, T., & Demirguc-Kunt. (2006). Small and medium-size enterprises: Access to finance as a growth constraint. Journal of Banking Finance, 30(11), 2931–2943.

Beck, T., Demirgüç-Kunt, A., Laeven, L., & Maksimovic, V. (2006). The determinants of financing obstacles. Journal of International Money and Finance, 25(6), 932–952.

Beck, T., Demirgüç-Kunt, A., & Maksimovic, V. (2008). Financing patterns around the world: Are small firms different? Journal of Financial Economics, 89(3), 467–487.

Beck, T., Demirgüç-Kunt, A., & Pería, M. S. M. (2011). Bank financing for SMEs: Evidence across countries and bank ownership types. Journal of Financial Services Research, 39(1–2), 35–54.

Bird, B. (1988). Implementing entrepreneurial ideas: The case for intention. Journal of Academy of Management Review, 13(3), 442–453.

Bougheas, S. (2004). Internal vs external financing of R&D. Small Business Economics, 22(1), 11–17.

Boyd, N. G., & Vozikis, G. S. (1994). The influence of self-efficacy on the development of entrepreneurial intentions and actions. Journal of Entrepreneurship Theory Practice, 18(4), 63–77.

Brandt, K., Rand, J., Sharma, S., Tarp, F., & Trifkovic, N. (2016). Characteristics of the Vietnamese business environment: Evidence from a SME survey in 2015. Retrieved from https://www.wider.unu.edu/sites/default/files/SME2015-report-English.pdf.

Bui, T. Q., & Do, A. V. P. (2022). Does technological inclusion reduce financial constraints on small and medium sized enterprises? The case of Vietnam. Finance Research Letters, 47(1), 102534.

Bun, M. J., & Harrison, T. D. (2019). OLS and IV estimation of regression models including endogenous interaction terms. Econometric Reviews, 38(7), 814–827.

Byiers, B., Rand, J., Tarp, F., & Bentzen, J. (2010). Credit demand in Mozambican manufacturing. Journal of International Development: THe Journal of the Development Studies Association, 22(1), 37–55.

Castellacci, F., Oguguo, P. C., & Freitas, I. M. B. (2022). Quality of pro-market national institutions and firms’ decision to invest in R&D: Evidence from developing and transition economies. Eurasian Business Review, 12(1), 35–57.

Coad, A., & Rao, R. (2008). Innovation and firm growth in high-tech sectors: A quantile regression approach. Research Policy, 37(4), 633–648.

Darnihamedani, P., & Hessels, J. (2016). Human capital as a driver of innovation among necessity-based entrepreneurs. International Review of Entrepreneurship, 14(1), 1–23.

Daskalakis, N., & Psillaki, M. (2008). Do country or firm factors explain capital structure? Evidence from SMEs in France and Greece. Applied Financial Economics, 18(2), 87–97.

De Mel, S., McKenzie, D., & Woodruff, C. (2009). Are women more credit constrained? Experimental evidence on gender and microenterprise returns. American Economic Journal: Applied Economics, 1(3), 1–32.

Demirguc-Kunt, A., Klapper, L., & Singer, D. (2013). Financial inclusion and legal discrimination against women: evidence from developing countries. Policy Research Working Papers, 6416.World Bank.

Dinh, H. T. (2014). Light manufacturing in Vietnam: Creating jobs and prosperity in a middle-income economy. Policy Research Working Papers, 6598. World Bank.

Dosi, G., Piva, M., Virgillito, M. E., & Vivarelli, M. (2021). Embodied and disembodied technological change: The sectoral patterns of job-creation and job-destruction. Research Policy, 50, 104199.

Fagerberg, J., Mowery, D. C., & Nelson, R. R. (2005). The Oxford handbook of innovation. Oxford University Press.

Farhi, E., & Tirole, J. (2012). Bubbly liquidity. The Review of Economic Studies, 79(2), 678–706.

Fombang, M. S., & Adjasi, C. K. (2018). Access to finance and firm innovation. Journal of Financial Economic Policy, 10(1), 73–94.

Freel, M. S. (2007). Are small innovators credit rationed? Small Business Economics, 28(1), 23–35.

Fu, X., Mohnen, P., & Zanello, G. (2018). Innovation and productivity in formal and informal firms in Ghana. Technological Forecasting Social Change, 131, 315–325.

Goel, R. K., & Nelson, M. A. (2022). Employment effects of R&D and process innovation: Evidence from small and medium-sized firms in emerging markets. Eurasian Business Review, 12, 97–123.

Gorodnichenko, Y., & Schnitzer, M. (2013). Financial constraints and innovation: Why poor countries don’t catch up. Journal of the European Economic Association, 11(5), 1115–1152.

Gu, F. (2005). Innovation, future earnings, and market efficiency. Journal of Accounting, Auditing Finance, 20(4), 385–418.

Gu, F., & Lev, B. (2004). The information content of royalty income. Accounting Horizons, 18(1), 1–12.

Gunday, G., Ulusoy, G., Kilic, K., & Alpkan, L. (2011). Effects of innovation types on firm performance. International Journal of Production Economics, 133(2), 662–676.

Hainz, C., & Nabokin, T. (2019). Access to credit and its determinants: A comparison of survey-based measures. Economics of Transition Institutional Change, 27(4), 1031–1067.

Hall, B. H. (2002). The financing of research and development. Oxford Review of Economic Policy, 18(1), 35–51.

Hall, B. H., Lotti, F., & Mairesse, J. (2009). Innovation and productivity in SMEs: Empirical evidence for Italy. Small Business Economics, 33(1), 13–33.

Hall, G. C., Hutchinson, P. J., & Michaelas, N. (2004). Determinants of the capital structures of European SMEs. Journal of Business Finance & Accounting, 31(5–6), 711–728.

Häussler, C., Harhoff, D., & Müller, E. (2012). To be financed or not…—The role of patents for venture capital-financing. ZEW discussion papers 09–-03, ZEW—Leibniz Centre for European Economic Research.

Kinghan, C., Newman, C., & O’Toole, C. (2020). Capital allocation, credit access, and firm growth. Micro, small, and medium enterprises in Vietnam (pp. 41–62). Oxford University Press.

Leland, H. E., & Pyle, D. H. (1977). Informational asymmetries, financial structure, and financial intermediation. Journal of Finance, 32(2), 371–387.

Lesaffre, E., & Spiessens, B. (2002). On the effect of the number of quadrature points in a logistic random effects model: An example. Journal of the Royal Statistical Society, 50(3), 325–335.

Levine, R. (2005). Finance and growth: Theory and evidence. Handbook of Economic Growth, 1(1), 865–934.

Mac an Bhaird, C., & Lucey, B. (2010). Determinants of capital structure in Irish SMEs. Small Business Economics, 35(3), 357–375.

Mateev, M., Poutziouris, P., & Ivanov, K. (2013). On the determinants of SME capital structure in Central and Eastern Europe: A dynamic panel analysis. Research in International Business and Finance, 27(1), 28–51.

Mazzucato, M. (2013). Financing innovation: Creative destruction vs. destructive creation. Industrial Corporate Change, 22(4), 851–867.

Meuleman, M., & De Maeseneire, W. (2012). Do R&D subsidies affect SMEs’ access to external financing? Research Policy, 41(3), 580–591.

Mina, A., Lahr, H., & Hughes, A. (2013). The demand and supply of external finance for innovative firms. Industrial Corporate Change, 22(4), 869–901.

Nguyen, S. K., Vo, X. V., & Vo, T. M. T. (2020). Innovative strategies and corporate profitability: The positive resources dependence from political network. Heliyon, 6(4), e03788.

OECD. (2009). Innovation in firms: A microeconomic perspective. Retrieved from the link https://www.oecd.org/berlin/44120491.pdf.

OECD. (2021). SME and entrepreneurship policy in Vietnam. Retrieved from the link https://www.oecd.org/publications/sme-and-entrepreneurship-policy-in-viet-nam-30c79519-en.htm.

Olivari, J. (2016). Entrepreneurial traits and firm innovation. Eurasian Business Review, 6(3), 339–360.

Osano, H. M., & Koine, P. W. (2016). Role of foreign direct investment on technology transfer and economic growth in Kenya: A case of the energy sector. Journal of Innovation Entrepreneurship, 5(1), 1–25.

Pham, T. T. T., Nguyen, K. S., Nguyen, H. H., Nguyen, L. T., & Vo, V. X. (2021). Dynamic entrepreneurship, planned innovation, and firm profitability: Evidence from a Southeast Asian country. Heliyon, 7(7), e07599.

Pellegrino, G., & Piva, M. (2020). Innovation, industry and firm age: Are there new knowledge production functions? Eurasian Business Review, 10(1), 65–95.

Piza, C., & de Moura, M. J. S. B. (2016). The effect of a land titling programme on households’ access to credit. Journal of Development Effectiveness, 8(1), 129–155.

Rand, J. (2007). Credit constraints and determinants of the cost of capital in Vietnamese manufacturing. Small Business Economics, 29(1–2), 1–13.

Roodman, D. (2011). Fitting fully observed recursive mixed-process models with CMP. The Stata Journal, 11(2), 159–206.

Rostamkalaei, A., & Freel, M. (2016). The cost of growth: Small firms and the pricing of bank loans. Small Business Economics, 46(2), 255–272.

Roy, R., & Cohen, S. K. (2017). Stock of downstream complementary assets as a catalyst for product innovation during technological change in the US machine tool industry. Strategic Management Journal, 38(6), 1253–1267.

Schumpeter, J. (1934). The theory of economic development: An inquiry into profits, capital, credit, interest, and the business cycle. Harvard University Press.

Slater, S. F., Mohr, J. J., & Sengupta, S. (2014). Radical product innovation capability: Literature review, synthesis, and illustrative research propositions. Journal of Product Innovation Management, 31(3), 552–566.

Spence, M. (2002). Signaling in retrospect and the informational structure of markets. American Economic Review, 92(3), 434–459.

Szewczyk, S. H., Tsetsekos, G. P., & Zantout, Z. (1996). The valuation of corporate R&D expenditures: Evidence from investment opportunities and free cash flow. Journal Financial Management, 25(1), 105–110.

Takalo, T., & Tanayama, T. (2010). Adverse selection and financing of innovation: Is there a need for R&D subsidies? Journal of Technology Transfer, 35(1), 16–41.

Thi Khanh Cao, N. (2019). What factors determine whether small and medium enterprises obtain credit from the formal credit market? The case of Vietnam. Asian Economic Journal, 33(2), 191–213.

Tirole, J. (2010). The theory of corporate finance. Princeton University Press.

Tran, T. Q. G., & Vu, T. T. A. (2020). Vietnam: The dilemma of bringing global financial standards to a socialist market economy. In E. Jones (Ed.), The political economy of bank regulation in developing countries: Risk and reputation (pp. 305–326). Oxford University Press.

Vella, F., & Verbeek, M. (1998). Whose wages do unions raise? A dynamic model of unionism and wage rate determination for young men. Journal of Applied Econometrics, 13(2), 163–183.

Watson, R., & Wilson, N. (2002). Small and medium size enterprise financing: A note on some of the empirical implications of a pecking order. Journal of Business Finance & Accounting, 29(3–4), 557–578.

Wellalage, N. H., Locke, S., & Samujh, H. (2020). Firm bribery and credit access: Evidence from Indian SMEs. Small Business Economics, 55(1), 283–304.

WorldBank. (2019). Vietnam: Strengthening banking sector soundness and development. World Bank. Retrieve from http://documents.worldbank.org/curated/en/504361561514781366/pdf/Project-Information-DocumentPID-Vietnam-Strengthening-Banking-Sector-Soundness-and-Development-P171375.pdf.

Wright, R. E., Palmer, J. C., & Perkins, D. (2004). Types of product innovations and small business performance in hostile and benign environments. Journal of Small Business Strategy, 15(2), 33–44.

Wu, B., Wan, Z., & Levinthal, D. A. (2014). Complementary assets as pipes and prisms: Innovation incentives and trajectory choices. Strategic Management Journal, 35(9), 1257–1278.

Yoshino, N., & Taghizadeh-Hesary, F. (2018). The role of SMEs in Asia and their difficulties in accessing finance. ADBI Working Paper Series, 911. Retrieve from https://www.adb.org/sites/default/files/publication/474576/adbi-wp911.pdf.

Funding

This research is funded by the Vietnam National Foundation for Science and Technology Development (NAFOSTED) [502.01- 2016.21].

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

We would like to declare that there is no competing interests and funding.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Pham, T.T.T., Nguyen, T.V.H., Nguyen, S.K. et al. Does planned innovation promote financial access? Evidence from Vietnamese SMEs. Eurasian Bus Rev 13, 281–307 (2023). https://doi.org/10.1007/s40821-023-00238-3

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40821-023-00238-3