Abstract

Background

Buprenorphine-naloxone is an essential part of the response to opioid poisoning rates in North America. Manipulating market exclusivity is a strategy manufacturers use to increase profitability, as evidenced by Suboxone in the USA.

Objective

To investigate excess costs of buprenorphine-naloxone due to unmerited market exclusivity (no legal patent or data protection) in Canada.

Methods

Using controlled interrupted time-series, this study examined changes in the cost of buprenorphine-naloxone before and after the first generics were listed on public formularies. Methadone cost was the control. Public data from the Canadian Institute of Health Information in British Columbia, Manitoba, and Saskatchewan were used. All buprenorphine-naloxone and methadone claims (2010–2019) accepted for payment by the provincial drug plan/programme were collected. Primary outcome was mean cost per mg of buprenorphine-naloxone after the first listing of generics.

Results

Mean cost per mg of buprenorphine-naloxone before the first listing of generics was $1.21 CAD in British Columbia, $1.27 CAD in Manitoba, and $0.85 CAD in Saskatchewan. Following the introduction of generics, the cost per mg decreased by $0.22 CAD (95% CI − 0.33 to − 0.10; p = 0.0014) in British Columbia, $0.36 CAD (95% CI − 0.58 to − 0.13; p = 0.004) in Manitoba, and $0.27 CAD (95% CI − 0.50 to − 0.05; p = 0.03) in Saskatchewan. Mean cost per mg decreased by $0.26 CAD (95% CI − 0.38 to − 0.13; p = 0.0004) after a third generic was introduced in British Columbia. Excess costs to public formularies during the 4- to 5-year period prior to the listing of generics were $1,992,558 CAD in British Columbia, $80,876 CAD in Manitoba, and $4130 CAD in Saskatchewan. If buprenorphine-naloxone cost $0.61 CAD (mean cost after the third generic entered) instead of $1.21 CAD per mg during the pre-generics period, public payers in British Columbia could have saved $5,016,220 CAD between 2011 and 2015.

Conclusions

Unmerited 6 years of market exclusivity for brand-name buprenorphine-naloxone in Canada resulted in substantial excess costs. There is an urgent need to implement policies that can help reduce costs for high-priority drugs in Canada.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

In this interrupted time-series analysis, the first listing of generic buprenorphine-naloxone significantly decreased the cost of the drug by $0.22/mg in British Columbia, $0.36/mg in Manitoba, and $0.27/mg in Saskatchewan. |

These findings indicate the need for policies to help reduce costs for high-priority drugs in Canada, especially those deemed an essential response to major public health issues like the drug poisoning crisis. |

1 Introduction

Buprenorphine is considered first-line therapy for opioid use disorder in the USA and Canada [1, 2]. Its use is associated with a 3.3-fold reduction in overdose mortality and it is considered an essential component to address the rising rates of opioid poisonings [1, 3]. Although the first formulation was approved in the USA in 2002 and in Canada in 2007, buprenorphine-naloxone, a combination product, remains underutilised [4, 5]. Besides multiple health system barriers to evidence-based opioid use disorder care [6], this underutilisation may be partly explained by a lack of generic competition resulting in several years of contestable market exclusivity, where the brand-name version of the drug, Suboxone®, held a monopoly [7,8,9].

Generic competition is used as a strategy to decrease the cost of drugs for governments and patients and to increase access to life-saving therapies [10]. To increase generic competition in Canada, the Pan-Canadian Pharmaceutical Alliance effected a tiered-pricing framework on April 1, 2014, that sets the maximum allowable list price of generic drugs in all jurisdictions in the country [10, 11]. The first generic drug can be listed at a maximum of 75–85% the brand price, the second at a maximum of 50% the brand price, and any additional generic drugs at no more than 25–35% the brand price [10]. However, drug manufacturers use a combination of strategies to delay generic competition and extend periods of brand-name market exclusivity and associated revenues [9]. These include patent “evergreening”, reformulation, or “product hopping”, where manufacturers slightly tweak the original formulation or delivery mechanism and then heavily market the new version of the drug [12]. The manufacturer of Suboxone was fined US$1.4 billion in one of the largest settlements in opioid history for using these tactics in the USA [13]. These anti-competitive schemes delayed the entry of buprenorphine-naloxone generics in the USA and cost payers an estimated $703 million (37%) more per year, according to Suboxone’s 2017 sales figures [14, 15]. In 2016 alone, the excess cost to the country’s Medicaid programme was $203 million [14].

Delayed access to generics and associated high drug costs are a major challenge in Canada across therapeutic areas and represent a compelling example of the competing priorities of industry profit-making versus public health priorities of ensuring equitable access to life-saving drugs [16]. Our previous research shows the Suboxone tablet had 6 years of market exclusivity, despite no patent or data protection [9]. Market exclusivity was likely afforded by a lack of generic competition, which can sometimes happen in smaller markets like Canada, especially when the path to reimbursement appears complicated because of several differences across provinces [17]. Our primary objective for this study was to investigate the excess costs resulting from this lack of generic competition by measuring changes in the cost of buprenorphine-naloxone following the listing of generic versions in provincial formularies in Canada. During the period of interest, buprenorphine without naloxone (brand name Subutex®) had very limited availability through a federal special access programme for clinical situations when naloxone was considered to be contraindicated, such as during pregnancy [18]. As such, Subutex was not considered for this analysis.

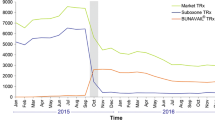

Health Canada approved the brand-name version of buprenorphine-naloxone, Suboxone, on May 18, 2007 (Table 1) [19, 20]. It was listed on public formularies in each province in 2010. Health Canada approved the first generic, by Mylan, on July 4, 2013. The second and third generics, by PMS and Teva, were approved on May 7, 2014, and April 18, 2016, respectively. In all three provinces, the first two generics (Mylan and PMS) were listed on public formularies on the same date in 2015. The third generic (Teva) was listed on public formularies in 2018.

2 Methods

We conducted a controlled interrupted time-series analysis using publicly available data from the Canadian Institute of Health Information to determine the effect of the introduction of generics on the mean cost per mg of buprenorphine-naloxone (brand and generic) in three Canadian provinces. Informed consent was not required because all data were deidentified and publicly available. This study followed the Consolidated Health Economic Evaluation Reporting Standards (CHEERS) [21].

2.1 Data Sources

We obtained quarterly data from the Canadian Institute of Health Information’s National Prescription Drug Utilization Information System, which collects drug utilisation and cost data from public drug programmes [22]. We obtained 2010–2019 data on the mean quarterly cost per mg for all prescription claims for buprenorphine-naloxone and methadone paid for by the public drug plan/programme in British Columbia, Manitoba, and Saskatchewan. Other provinces had limited (< 10%) coverage of non-seniors data and were therefore not obtained for analysis. Collectively, these three provinces represent approximately 20% of the Canadian population [23]. Cost per mg was calculated as the total prescription cost accepted for payment by the public formulary divided by the total mg accepted. Total mg accepted was the total quantity of a chemical (e.g., number of tablets) multiplied by the strength (e.g., mg per tablet) for all claims for which the public plan/programme accepted at least a portion of the cost, either towards a deduction (if applicable) or for reimbursement. The list of public plans/programmes included in each province is outlined in Appendix A. The primary outcome of this study was mean cost per mg accepted for payment by the public formulary of total (brand and generic) buprenorphine-naloxone after the first listing of generics. The secondary outcome of this study was excess cost spent on buprenorphine-naloxone during the pre-generics period. This was defined as the difference between the hypothetical spend on buprenorphine-naloxone (brand and generic) in the pre-generics period (calculated using the mean cost per mg observed after the first introduction of generics) and the actual spend on buprenorphine-naloxone in the pre-generics period (i.e., brand only) [14, 24, 25].

2.2 Statistical Analysis

To determine the association of the introduction of generic buprenorphine with the primary outcome, we estimated an interrupted time-series specification that captured both the changes in levels and the trends for the cost per mg of the drug [26]. As observations may have been correlated over time, we used segmented regression with autocorrelated residuals with cost per mg as the outcome and incorporated an autoregressive of order 1 for residuals model structure [26]. Two intervention dates were defined as the quarter closest to when: (1) the first generic drug appeared on formulary in each province and (2) all three generic drugs appeared on formulary. We used the cost per mg of methadone, the other primary pharmacotherapy for opioid use disorder that did not have coincident changes in brand and generic availabilities and coverage, as the control outcome to strengthen causal inference [27]. We performed analyses separately for each province. In exploratory analyses, we used the cost of the brand (instead of total brand and generic cost) as the outcome. All tests were 2-sided with statistical significance set at p < 0.05 and conducted using SAS 9.4 statistical software.

3 Results

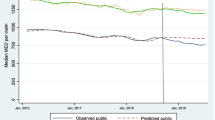

In each of the provinces, the mean cost per mg of buprenorphine-naloxone decreased following the first listing of generic buprenorphine-naloxone (Fig. 1). This cost reduction ranged from 18–21% across provinces. When the first two generics were introduced in 2015, the mean cost per mg of buprenorphine-naloxone dropped significantly by $0.22 (95% CI − 0.33 to − 0.10; p = 0.0014) in British Columbia, by $0.36 (95% CI − 0.58 to − 0.13; p = 0.004) in Manitoba, and by $0.27 (95% CI − 0.50 to − 0.05; p = 0.03) in Saskatchewan (Table 2).

When the third generic was introduced in 2018, the mean cost per mg decreased by an additional $0.26 (95% CI − 0.38 to − 0.13; p = 0.0004) in British Columbia, but cost reductions were not significant in Manitoba (β = − 0.19; 95% CI − 0.42 to 0.05; p = 0.13) or Saskatchewan (β = − 0.17; 95% CI − 0.41 to 0.07; p = 0.18). Prior to the introduction of generics, the quarterly mean cost per mg of Suboxone was $1.03 (95% CI 0.89–1.17) in British Columbia, $1.52 (95% CI 1.23–1.80) in Manitoba, and $0.85 (95% CI 0.61–1.10) in Saskatchewan. In exploratory analyses, the mean cost per mg of Suboxone decreased significantly by $0.37 (95% CI − 0.59 to − 0.15; p = 0.003) after the listing of three generics in British Columbia and by $0.33 (95% CI − 0.63 to − 0.03; p = 0.04) after the first listing of generics in Manitoba (Appendix B).

Total formulary spending on buprenorphine-naloxone prior to generic entry in 2015 was $9,948,343 in British Columbia, $442,642 in Manitoba, and $23,507 in Saskatchewan (Table 3). Applying the mean cost per mg observed in the first interruption period (i.e., when two generics were available) to the total number of mg accepted by public plan/programmes in the pre-generics period, we estimated an excess spend of $1,992,558 in British Columbia, $80,876 in Manitoba, and $4130 in Saskatchewan when only the brand-name drug was available. After the introduction of a third generic in British Columbia in 2018, the mean cost per mg was roughly half ($0.61) its cost pre-generics ($1.21). If buprenorphine-naloxone cost $0.61 instead of $1.21 per mg during the pre-generics period, public payers in British Columbia could have saved an estimated $5,016,220 between 2011 and 2015. There were no significant changes in the mean cost per mg of methadone, our control, following either of the two interruptions periods in each province (Fig. 1).

4 Discussion

In one of the first Canadian studies using controlled interrupted time-series analysis to determine the cost effects of generic competition, we found the introduction of generics in 2015 significantly reduced the mean cost per mg of buprenorphine-naloxone in each province by $0.22 to $0.36 per mg. Buprenorphine-naloxone cost on mean 21–25% higher during the pre-generics period compared to the period when two generics were available. This amounted to an excess cost of roughly $4000 to $2 million depending on provincial utilisation. Assuming a mean stabilisation dose of buprenorphine-naloxone 8–12 mg per day as outlined in the National Opioid Use Disorder Guideline contemporaneous with the study period [28], the excess costs could have been used to treat an additional 472–708 patients in British Columbia, 18–27 patients in Manitoba, and 1–2 patients in Saskatchewan annually.

Our results are consistent with previous studies in the USA and Europe, where authors observed a significant reduction in the cost of buprenorphine following the entry of generics [14, 24, 29, 30] Roberts et al found a 24% reduction in total buprenorphine-naloxone prescription spending following the introduction of generics in 2013, using a large private insurance database in the USA [29]. Authors attributed the reduction, in part, to wider use of lower-cost generics. Haffajee et al used the 37% price reduction attributable to entry of generic buprenorphine-naloxone tablets in the USA in 2011 to calculate a hypothetical annual cost savings of $703 million had generic versions of Suboxone film been available [14]. Price reductions following the introduction of generics are partly due to the increased market competition, which in Canada, is stimulated by the national tiered-pricing framework for generic drugs [10, 11, 31, 32]. The maximum allowable price for a generic drug starts at 75% of the brand price and decreases as more generics enter the market (50% and 25% with two and three generics, respectively) [11]. For many generic manufacturers, the cost of production is only about 2–3% of the price of the brand-name drug, therefore, even at 25% of the price of the brand-name drug, generic manufacturers stand to reap substantial profits [11]. With the national tiered-pricing framework, provincial formularies, like that in British Columbia, may choose to cover only up to the cost of the generic version of the drug [33]. Results from a Freedom of Information request into the drug’s historical pricing in British Columbia confirmed that the province adhered to this framework, where its Low Cost Alternative programme only partially covered the brand-name drug once generic versions were available [33]. The province’s formulary covered the total cost of suboxone’s 2 mg/0.5 mg tablet in the pre-generics period at $2.88. When the first two generics entered in 2015, they were priced at 50% the cost of the brand ($1.44), equalling the amount covered by the provincial formulary. Once the third generic entered in 2018, the price of generics dropped to $0.72 and only 25% of the cost of the brand-name drug was covered.

Even though there were three generics available as of 2018 and the brand-name was only covered up to 25% by the provincial formulary, 59% (14,961) of British Columbia’s active beneficiaries in 2018 were treated with the brand-name drug. That same year, 66% ($6,342,349) of the province’s total prescription spend on buprenorphine-naloxone in 2018 was on the brand. Our results are similar to findings from Barenie et al, where even after generic buprenorphine-naloxone tablets were introduced in 2013 in the USA, spending on brand-name formulations (tablet and film) of the drug was still 5.2 times greater than spending on generic formulations from 2013–2018 [30]. Previous research suggests this may be due to the inherent brand recognition and familiarity from both patients and physicians resulting from several years of market exclusivity, branded educational programmes sanctioned by the Health Canada, promotional activities from the brand-name manufacturer, and a lack of promotional activities from generic manufacturers [34, 35]. Although the tiered-pricing framework is meant to incentivise generic manufacturers to challenge patents and accelerate market entry [10], even without patent protection, generic versions of buprenorphine-naloxone were not approved in Canada until 2013, 6 years after Suboxone’s approval [9]. Moreover, generic versions of buprenorphine-naloxone were not listed on provincial formularies until 2015, affording the brand-name drug 5 years of sole public coverage in British Columbia, Manitoba, and Saskatchewan. Zhang et al examined 189 drug markets across 9 provincial drug plan/programmes in Canada and found that, although the tiered-pricing framework was successful at promoting generic competition in small markets, it did not accelerate competition in large markets [10]. This suggests Canada needs additional policies to enhance generic competition and identify other means for reducing costs of and increasing access to pharmaceuticals that are of high public interest.

5 Limitations

Although data from the Canadian Institute for Health Information are accurate and comprehensive, these data only contain information on the cost to the public formulary in each province and do not include prescriptions paid by private plans or out of pocket [22]. Accounting for private insurance and out-of-pocket costs would result in a higher excess spend due to the unmerited market exclusivity for Suboxone. In addition, the total cost and number of milligrams accepted through prescription claims was aggregated by province and quarter. Quarterly aggregation meant we had to define our intervention date as the closest quarter to the date when generics were introduced, which may have affected the accuracy of our results. In accordance with the Institute’s privacy policy, in cases where the number of patients was less than five but greater than zero, that number along with other associated values were suppressed to ensure confidentiality. As a result, Saskatchewan data were suppressed in 2012 and 2014, which likely underestimated the excess spend on buprenorphine-naloxone in the pre-generics period. Despite this, our results in Saskatchewan are consistent with the other provinces. Finally, because of the lack of available data in other provinces, our analyses were restricted to three provinces. However, we found consistent results across these three provinces. Additional studies could also confirm our findings in other provinces and consider implications for two recently approved buprenorphine-containing formulations (Probuphine and Sublocade) that have market exclusivity through patent protections until 2023 and 2035, respectively [9].

6 Conclusion

Buprenorphine-containing products are important elements of opioid use disorder treatment and a cornerstone of medical responses to the Canadian drug poisoning crisis [5, 36]. Our study demonstrated how delays in access to generic drugs resulted in excess costs to public payers. The significant reduction in cost following the introduction of generic buprenorphine-naloxone demonstrates that there is an urgent need to identify policies to further promote generic competition. We also argue for lowering pharmaceutical costs in general, including high-priority drugs as represented by those deemed essential in response to the drug poisoning crisis. There is opportunity to implement and test any relevant policies to support increased accessibility for Sublocade, a newer buprenorphine-containing product used to treat opioid use disorder with contestable patent protection until 2035.

References

Centre for Addiction and Mental Health. Opioid agonist therapy: a synthesis of Canadian guidelines for treating opioid use disorder. 2021.

Health and Human Services Department. Practice guidelines for the administration of buprenorphine for treating opioid use disorder. Fed Reg. 2021;86:22439–40.

Sordo L, Barrio G, Bravo MJ, Indave BI, Degenhardt L, Wiessing L, et al. Mortality risk during and after opioid substitution treatment: systematic review and meta-analysis of cohort studies. BMJ. 2017;357:1550. https://doi.org/10.1136/bmj.j1550.

Health Canada. Surveillance of opioid- and stimulant-related harms in Canada. 2021.

Ahamad K, Kerr T, Nolan S, Wood E. Moving towards improved access for evidence-based opioid addiction care in British Columbia. 2016.

Mackey K, Veazie S, Anderson J, Bourne D, Peterson K. Barriers and facilitators to the use of medications for opioid use disorder: a rapid review. J Gen Intern Med. 2020;35:954–63. https://doi.org/10.1007/s11606-020-06257-4.

Kanavos P, Costa-Font J, Seeley E. Competition in off-patent drug markets: Issues, regulation and evidence. Econ Policy. 2008;23:500–44. https://doi.org/10.1111/j.1468-0327.2008.00207.x.

Lexchin J. Market exclusivity time for top selling originator drugs in Canada: a cohort study. Value Health. 2017;20:1139–42. https://doi.org/10.1016/j.jval.2017.05.004.

Sud A, McGee M, Mintzes B, Herder M. Permissive regulation: a critical review of the regulatory history of buprenorphine formulations in Canada. Int J Drug Policy. 2022;105:103749. https://doi.org/10.1016/j.drugpo.2022.103749.

Zhang W, Sun H, Guh DP, Lynd LD, Hollis A, Grootendorst P, et al. The impact of tiered-pricing framework on generic entry in Canada. Int J Health Policy Manag. 2020. https://doi.org/10.34172/ijhpm.2020.215.

Hollis A. Generic drugs in Canada: an examination of tiered pricing. CMAJ. 2015;187:1033–4. https://doi.org/10.1503/cmaj.150395.

Gupta R, Morten CJ, Zhu AY, Ramachandran R, Shah ND, Ross JS. Approvals and timing of new formulations of novel drugs approved by the US food and drug administration between 1995 and 2010 and followed through 2021. JAMA Health Forum. 2022;3:e221096–e221096. https://doi.org/10.1001/jamahealthforum.2022.1096.

The United States Department of Justice. Justice Department Obtains $1.4 Billion from Reckitt Benckiser Group in Largest Recovery in a Case Concerning an Opioid Drug in United States History 2019. https://www.justice.gov/opa/pr/justice-department-obtains-14-billion-reckitt-benckiser-group-largest-recovery-case (accessed March 22, 2022).

Haffajee RL, Frank RG. Generic drug policy and suboxone to treat opioid use disorder. J Law Med Ethics. 2019;47:43–53. https://doi.org/10.1177/1073110519898042.

Clemans-Cope L, Epstein M, Kenney GM. Rapid Growth in Medicaid Spending on Medications to Treat Opioid Use Disorder and Overdose 2017. https://www.urban.org/sites/default/files/publication/91521/2001386-rapid-growth-in-medicaid-spending-on-medications-to-treat-opioid-use-disorder-and-overdose_3.pdf (accessed June 21, 2022).

Grootendorst P. Brand drug companies impeding generic drug company access to product samples: estimated prevalence and impact on drug costs. J Gen Med. 2022;18:10–20. https://doi.org/10.1177/17411343211035168.

Roberts EA, Herder M, Hollis A. Fair pricing of “old” orphan drugs: considerations for Canada’s orphan drug policy. CMAJ. 2015;187:422–5. https://doi.org/10.1503/cmaj.140308.

Ordean A, Wong S, Graves L. No. 349-substance use in pregnancy. J Obstet Gynaecol Can. 2017;39:922–37. https://doi.org/10.1016/j.jogc.2017.04.028.

Health Canada. Drug Product Database: Access the database. Drug Product Database: Access the Database 2015. https://www.canada.ca/en/health-canada/services/drugs-health-products/drug-products/drug-product-database.html (accessed March 22, 2022).

Health Canada. Notice of Compliance search 2010. https://health-products.canada.ca/noc-ac/newSearch-nouvelleRecherche.do (accessed June 20, 2022).

Consolidated Health Economic Evaluation Reporting Standards 2022 (CHEERS 2022) Statement: Updated Reporting Guidance for Health Economic Evaluations n.d. https://www.equator-network.org/reporting-guidelines/cheers/ (accessed June 30, 2022).

Canadian Institute for Health Information. National Prescription Drug Utilization Information System metadata n.d.

Government of Canada, Statistics Canada. Population estimates, quarterly 2022.

Chapman SR, Aladul MI, Fitzpatrick RW. Lost cost savings to the NHS in England due to the delayed entry of multiple generic low-dose transdermal buprenorphine: a case scenario analysis. BMJ Open. 2019;9:26817. https://doi.org/10.1136/bmjopen-2018-026817.

Lexchin J. The effect of generic competition on the price of brand-name drugs. Health Policy. 2004;68:47–54. https://doi.org/10.1016/j.healthpol.2003.07.007.

Wagner AK, Soumerai SB, Zhang F, Ross-Degnan D. Segmented regression analysis of interrupted time series studies in medication use research. J Clin Pharm Ther. 2002;27:299–309. https://doi.org/10.1046/j.1365-2710.2002.00430.x.

Linden A, Adams JL. Applying a propensity score-based weighting model to interrupted time series data: improving causal inference in programme evaluation. J Eval Clin Pract. 2011;17:1231–8. https://doi.org/10.1111/j.1365-2753.2010.01504.x.

The CIHR Canadian Research Initiative in Substance Misuse. CRISM national guideline for the clinical management of opioid use disorder. 2018.

Roberts AW, Saloner B, Dusetzina SB. Buprenorphine use and spending for opioid use disorder treatment: trends from 2003 to 2015. Psychiatr Serv. 2018;69:832–5. https://doi.org/10.1176/appi.ps.201700315.

Barenie RE, Sinha MS, Kesselheim AS. Factors affecting buprenorphine utilization and spending in Medicaid, 2002–2018. Value Health. 2021;24:182–7. https://doi.org/10.1016/j.jval.2020.04.1840.

Wouters OJ, Kanavos PG, McKEE M. Comparing generic drug markets in Europe and the United States: prices, volumes, and spending. Milbank Q. 2017;95:554–601. https://doi.org/10.1111/1468-0009.12279.

Frank RG, Salkever DS. Generic entry and the pricing of pharmaceuticals. J Econ Manag Strategy. 1997;6:75–90. https://doi.org/10.1111/j.1430-9134.1997.00075.x.

Government of British Columbia. Low Cost Alternative (LCA) Program 2021. https://www2.gov.bc.ca/gov/content/health/practitioner-professional-resources/pharmacare/prescribers/how-pharmacare-covers-drugs-in-the-low-cost-alternative-lca-program (accessed June 2, 2022).

Howard JN, Harris I, Frank G, Kiptanui Z, Qian J, Hansen R. Influencers of generic drug utilization: a systematic review. Res Social Adm Pharm. 2018;14:619–27. https://doi.org/10.1016/j.sapharm.2017.08.001.

Sud A, Strang M, Buchman DZ, Spithoff S, Upshur REG, Webster F, et al. How the suboxone education programme presented as a solution to risks in the Canadian opioid crisis: a critical discourse analysis. BMJ Open. 2022;12:59561. https://doi.org/10.1136/bmjopen-2021-059561.

Fiscella K, Wakeman SE, Beletsky L. Buprenorphine deregulation and mainstreaming treatment for opioid use disorder: X the X Waiver. JAMA Psychiat. 2019;76:229–30. https://doi.org/10.1001/jamapsychiatry.2018.3685.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Funding

This work was supported by the Substance Use and Abuse Program, Health Canada (grant number 1920-HQ-000031).

Conflict of interest

The authors have no conflicts of interest to declare.

Role of the funder/sponsor

The funder had no role in the design and conduct of the study; collection, management, analysis, and interpretation of the data; preparation, review, or approval of the manuscript; and decision to submit the manuscript for publication.

Ethics approval

Not applicable.

Consent to participate

Not applicable.

Consent for publication (from patients/participants)

Not applicable.

Availability of data and material

All data sources are available publicly through the Canadian Institute for Health Information or Health Canada.

Code availability

Available upon request.

Authors contributions

RM and MM had full access to all of the data in the study and take responsibility for the integrity of the data and the accuracy of the data analysis. Concept and design: All authors. Acquisition, analysis, or interpretation of data: All authors. Drafting of the manuscript: All authors. Critical revision of the manuscript for important intellectual content: All authors. Statistical analysis: RM, MM. Obtained funding: Sud. Administrative, technical, or material support: All authors. Supervision: Sud.

Electronic supplementary material

Below is the link to the electronic supplementary material.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License, which permits any non-commercial use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by-nc/4.0/.

About this article

Cite this article

McGee, M., Chiu, K., Moineddin, R. et al. The Impact of Suboxone’s Market Exclusivity on Cost of Opioid Use Disorder Treatment. Appl Health Econ Health Policy 21, 501–510 (2023). https://doi.org/10.1007/s40258-022-00787-0

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40258-022-00787-0